Global Imidacloprid Market

Market Size in USD Billion

CAGR :

%

USD

1.12 Billion

USD

1.85 Billion

2024

2032

USD

1.12 Billion

USD

1.85 Billion

2024

2032

| 2025 –2032 | |

| USD 1.12 Billion | |

| USD 1.85 Billion | |

|

|

|

|

What is the Global Imidacloprid Market Size and Growth Rate?

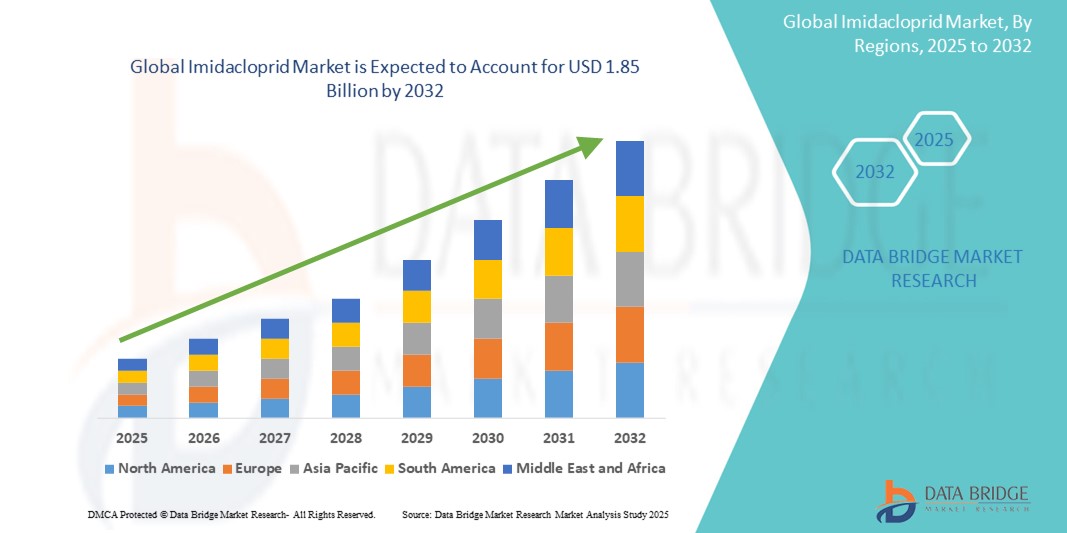

- The global imidacloprid market size was valued at USD 1.12 billion in 2024 and is expected to reach USD 1.85 billion by 2032, at a CAGR of6.40% during the forecast period

- Market expansion is driven by increasing adoption of systemic insecticides in modern agriculture, along with the rising need to protect high-value crops against destructive pests

- In addition, growing emphasis on enhancing agricultural productivity and reducing yield loss due to pest infestations is contributing to the accelerated uptake of Imidacloprid-based products, propelling overall industry growth

What are the Major Takeaways of Imidacloprid Market?

- Imidacloprid, a neonicotinoid insecticide, is widely used in agriculture for seed treatment, soil application, and foliar spray, offering effective protection against sucking insects such as aphids, whiteflies, and termites

- The rising demand for sustainable crop protection solutions, combined with the cost-efficiency and broad-spectrum control offered by imidacloprid, is significantly strengthening its market position

- Increased global efforts to secure food supply chains and rising awareness among farmers about crop protection are further enhancing market adoption across both developing and developed regions

- Asia-Pacific dominated the Imidacloprid market with the largest revenue share of 41.6% in 2024, driven by- high agricultural activity, increasing pest outbreaks, and rising awareness about crop protection solutions across major economies such as China, India, and Southeast Asian nations

- South America Imidacloprid market is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032, fueled by increasing adoption of commercial farming practices and high pest pressure in crops such as soybeans, maize, and sugarcane

- The agriculture segment dominated the market with the largest revenue share of 51.6% in 2024, driven by the increasing use of Imidacloprid to control sucking pests in major food crops such as rice, maize, and wheat

Report Scope and Imidacloprid Market Segmentation

|

Attributes |

Imidacloprid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Imidacloprid Market?

“Growing Demand for Systemic and Long-Lasting Pest Control Solutions”

- A key trend shaping the global Imidacloprid market is the increasing demand for systemic insecticides that offer long-lasting and broad-spectrum pest control, especially in high-value and food security-sensitive crops such as rice, cotton, and vegetables

- Imidacloprid’s versatility across multiple application methods—including seed treatment, foliar spray, and soil drenching—makes it highly preferred in integrated pest management (IPM) systems

- For instance, Bayer CropScience has expanded the usage of its Imidacloprid-based products across Asia-Pacific, promoting higher yields and longer-lasting pest protection. These solutions provide residual efficacy, protecting plants during their vulnerable early growth stages

- The trend is further driven by climate change impacts, which are intensifying pest pressures, making farmers seek efficient and longer-acting crop protection chemicals such as Imidacloprid

- In addition, the compatibility of Imidacloprid with other agrochemicals makes it suitable for tank-mix applications, further boosting its adoption across conventional and modern farming methods

- This shift toward systemic and sustainable pest control is expected to reshape global crop protection strategies, positioning Imidacloprid as a central input in modern agricultural practices

What are the Key Drivers of Imidacloprid Market?

- The rising global food demand, shrinking arable land, and the need for higher crop yields are major drivers boosting the use of Imidacloprid-based insecticides in agriculture

- For instance, in June 2023, Shandong Weifang Rainbow Chemical Co. expanded production capacity of its Imidacloprid line to meet growing demand from Southeast Asian and African markets

- Imidacloprid's broad efficacy against piercing-sucking pests, along with its low application rate and cost-effectiveness, make it an attractive option for farmers worldwide

- In addition, its low toxicity to mammals and beneficial insects, when used correctly, enhances its appeal amid increasing regulatory scrutiny on crop protection chemicals

- The insecticide’s ability to be systemically absorbed by plants, providing protection from the inside out, ensures consistent pest control even in hard-to-reach areas, further propelling its global demand

Which Factor is challenging the Growth of the Imidacloprid Market?

- One major challenge is the growing regulatory restrictions and environmental concerns associated with neonicotinoid insecticides such as Imidacloprid, especially their potential impact on pollinators such as bees

- For instance, in 2018, the European Union imposed a near-total ban on outdoor use of Imidacloprid due to risks to bee populations, prompting other regions to reevaluate its usage.

- These restrictions have led to increased scrutiny and research into safer alternatives, thereby putting pressure on manufacturers to innovate and reformulate their offerings

- Moreover, pest resistance due to overuse, particularly in crops such as rice and cotton, is emerging as a technical barrier, necessitating crop rotation and combination with other modes of action

- To mitigate these challenges, companies are focusing on precision agriculture practices, recommending responsible usage, and investing in next-generation insecticides to complement or replace Imidacloprid

- Navigating regulatory pressures and environmental safety demands will be critical for sustaining Imidacloprid's market position in the long term

How is the Imidacloprid Market Segmented?

The market is segmented on the basis of application, crop type, formulation type, and distribution channel.

- By Application

On the basis of application, the imidacloprid market is segmented into agriculture, horticulture, forestry, and landscaping. The agriculture segment dominated the market with the largest revenue share of 51.6% in 2024, driven by the increasing use of Imidacloprid to control sucking pests in major food crops such as rice, maize, and wheat. The segment’s growth is further supported by the global push to boost crop productivity and minimize pest-related losses in large-scale farming.

The horticulture segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the rising demand for high-value fruits and vegetables and the increasing use of systemic insecticides to maintain crop quality. Growing urban farming and greenhouse cultivation trends are also expected to contribute significantly to segment growth.

- By Crop Type

Based on crop type, the market is segmented into field crops, fruit crops, vegetable crops, and ornamental plants. The field crops segment held the largest market revenue share in 2024 at 48.9%, attributed to the widespread application of Imidacloprid in cereal and grain production, especially in pest-prone regions across Asia-Pacific and Latin America.

The vegetable crops segment is anticipated to register the fastest growth rate during the forecast period due to rising consumer preference for pesticide-protected produce, especially in greenhouse and organic farming settings. The increased emphasis on crop yield and quality is further driving the demand for precision pest control in vegetable farming.

- By Formulation Type

On the basis of formulation type, the market is segmented into granular, liquid, wettable powder, and emulsifiable concentrate. The liquid segment accounted for the largest market revenue share in 2024 at 42.3%, due to its ease of use, fast absorption, and effectiveness across foliar spray and soil drenching applications. Liquid formulations are widely favored in commercial agriculture owing to their high efficacy and reduced labor input.

The granular segment is projected to witness the fastest CAGR from 2025 to 2032, largely driven by its increasing usage in seed treatments and soil application, especially in regions with mechanized farming practices. Granular Imidacloprid formulations are also preferred for their longer residual effect and reduced environmental exposure.

- By Distribution Channel

The Imidacloprid market is segmented by distribution channel into online, retail, wholesale, and direct sales. The wholesale segment held the dominant market share of 39.7% in 2024, owing to its extensive reach among agricultural cooperatives, large-scale distributors, and government procurement schemes. Wholesale distribution ensures efficient supply to rural and semi-urban farming communities, where bulk purchasing is common.

The online segment is expected to register the fastest growth during the forecast period, driven by the growing penetration of e-commerce platforms and digital agro-input marketplaces. Farmers are increasingly relying on online platforms for price transparency, doorstep delivery, and access to a broader range of crop protection products.

Which Region Holds the Largest Share of the Imidacloprid Market?

- Asia-Pacific dominated the imidacloprid market with the largest revenue share of 41.6% in 2024, driven by- high agricultural activity, increasing pest outbreaks, and rising awareness about crop protection solutions across major economies such as China, India, and Southeast Asian nations

- The region’s heavy reliance on agriculture for economic sustenance, combined with favorable government policies supporting the use of agrochemicals, significantly boosts the demand for Imidacloprid

- In addition, the presence of a robust manufacturing base, cost-effective labor, and increasing adoption of modern farming practices further support the dominance of Asia-Pacific in the global Imidacloprid market

China Imidacloprid Market Insight

The China imidacloprid market held the largest revenue share of 58% in 2024 within the Asia-Pacific region, fueled by rapid urbanization, rising food security concerns, and government-driven initiatives to boost crop yields. China’s expanding middle class and demand for higher-quality produce have driven increased usage of advanced insecticides. Domestic manufacturers are ramping up production and exports of Imidacloprid, making the country a major global hub for supply and consumption.

India Imidacloprid Market Insight

The India imidacloprid market is expected to witness the fastest CAGR during the forecast period, driven by the country’s large agricultural sector, pest-resilient crop strategies, and the increasing adoption of hybrid seeds. Government subsidies and awareness programs promoting integrated pest management are further supporting Imidacloprid penetration. The growing use of seed treatment and soil applications across staple crops such as cotton and sugarcane is also fueling market growth.

Japan Imidacloprid Market Insight

The Japan imidacloprid market is expanding steadily, backed by the country’s technologically advanced farming systems and preference for precision agriculture. Japanese farmers emphasize crop quality and sustainability, driving demand for low-dosage, high-efficacy insecticides such as Imidacloprid. Stringent environmental regulations also promote the use of targeted applications and innovative formulations, positioning Imidacloprid as a compliant yet powerful solution.

Which Region is the Fastest Growing Region in the Imidacloprid Market?

South America imidacloprid market is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032, fueled by increasing adoption of commercial farming practices and high pest pressure in crops such as soybeans, maize, and sugarcane. Countries such as Brazil and Argentina are investing in crop protection products to meet export demands and improve farm productivity. Furthermore, favorable climate conditions for pest proliferation and the rising use of seed treatment technologies are accelerating the demand for systemic insecticides such as Imidacloprid. The region also benefits from flexible regulatory frameworks and growing foreign investment in agri-inputs.

Brazil Imidacloprid Market Insight

The Brazil imidacloprid market leads in Latin America, accounting for over 63% of the regional revenue share in 2024, driven by the country’s position as a global agricultural powerhouse. Imidacloprid plays a key role in pest control strategies for soy, corn, and sugarcane crops. Brazil’s continuous efforts to increase yield per hectare and combat resistant pests are key growth drivers, supported by both domestic and multinational agrochemical firms.

Which are the Top Companies in Imidacloprid Market?

The imidacloprid industry is primarily led by well-established companies, including:

- Bayer (Germany)

- Syngenta (Switzerland)

- Corteva Agriscience (U.S.)

- FMC Corporation (U.S.)

- ADAMA Agricultural Solutions (Israel)

- Sumitomo Chemical (Japan)

- Lanxess (Germany)

- Hanfeng Evergreen (Canada)

- Nufarm (Australia)

- ChemChina (China)

- Nihon Nohyaku (Japan)

- Jiangshan Chemical (China)

- Guangdong Techand (China)

- Wynca Chemical (China)

- UPL Limited (India)

- Excel Crop Care (India)

- Rallis India (India)

- Atul Ltd (India)

- Punjab Chemicals Crop Protection (India)

- Nanjing Red Sun (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.