Global Immunoprecipitation Market

Market Size in USD Million

CAGR :

%

USD

789.37 Million

USD

1,188.66 Million

2025

2033

USD

789.37 Million

USD

1,188.66 Million

2025

2033

| 2026 –2033 | |

| USD 789.37 Million | |

| USD 1,188.66 Million | |

|

|

|

|

Immunoprecipitation Market Size

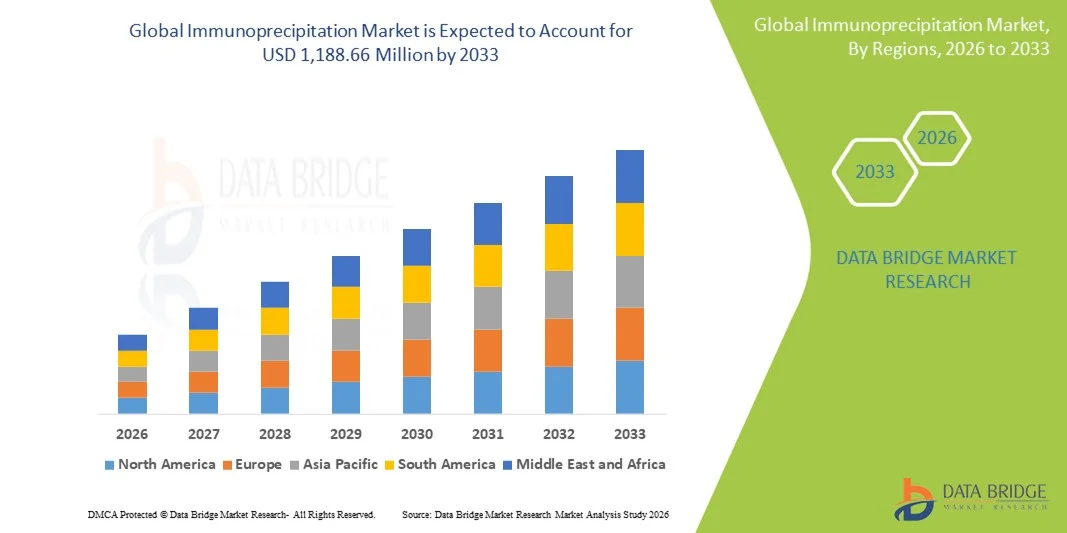

- The global immunoprecipitation market size was valued at USD 789.37 million in 2025 and is expected to reach USD 1,188.66 million by 2033, at a CAGR of 5.25% during the forecast period

- The market growth is largely fueled by the increasing adoption of proteomics and genomics research, rising investment in life-science R&D, and the expanding need for protein-interaction analysis in areas such as cancer, cardiovascular, and neurodegenerative disease studies

- Furthermore, advancements in antibodies, magnetic-bead–based kits, automation, and high-throughput platforms combined with the demand for accurate, reproducible, and sensitive protein isolation are establishing immunoprecipitation as a preferred technique in modern molecular biology. These converging factors are accelerating its uptake, thereby significantly boosting the industry’s grow

Immunoprecipitation Market Analysis

- Immunoprecipitation (IP), a key technique used to isolate and analyze specific proteins from complex biological samples, is becoming increasingly vital in proteomics, genomics, and disease-mechanism research due to its precision, versatility, and compatibility with advanced downstream analytical tools such as Western blotting and mass spectrometry

- The escalating demand for immunoprecipitation is primarily fueled by the rapid expansion of life-science research, rising prevalence of chronic and genetic diseases, and growing investment in protein-interaction studies, particularly in oncology, neurology, and personalized medicine

- North America dominated the global immunoprecipitation market with the largest revenue share of 38.5% in 2025, supported by a strong biotechnology and pharmaceutical ecosystem, high R&D expenditure, and the presence of leading technology providers, with the U.S. experiencing substantial growth driven by increasing adoption of high-throughput IP kits and advanced antibody-based platforms

- Asia-Pacific is expected to be the fastest-growing region in the immunoprecipitation market during the forecast period due to expanding biotechnology research infrastructure, increasing government funding for molecular biology, and rising adoption of proteomic tools across academic and clinical laboratories

- The kits segment dominated the immunoprecipitation market with a market share of 54.7% in 2025, driven by high repeat-purchase frequency, continuous product innovation in magnetic-bead technologies, and growing demand for high-affinity antibodies that improve accuracy and reproducibility in protein isolation workflows

Report Scope and Immunoprecipitation Market Segmentation

|

Attributes |

Immunoprecipitation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Immunoprecipitation Market Trends

Enhanced Precision Through AI-Driven Protein Analysis and Automation

- A significant and accelerating trend in the global immunoprecipitation market is the deepening integration of artificial intelligence (AI) and advanced automation platforms into protein isolation workflows, enabling researchers to achieve greater precision, consistency, and throughput in both academic and industrial laboratories

- For instance, Cytiva’s AI-enabled imaging and analysis tools now complement IP workflows by enhancing protein-band detection accuracy, while Thermo Fisher’s automated KingFisher platforms streamline magnetic-bead–based immunoprecipitation for high-volume sample processing with minimal manual intervention

- AI integration in immunoprecipitation systems enables features such as automated optimization of antibody binding conditions, improved identification of protein–protein interactions, and intelligent alerts that flag anomalies during sample preparation. For instance, machine-learning algorithms incorporated into some “smart” lab workstations can detect deviations in bead behavior or reagent viscosity and alert users before results are affected

- The seamless integration of IP workflows with digital lab-management platforms facilitates centralized control over experimental design, reagent tracking, and data output, allowing researchers to coordinate IP processes alongside Western blotting, mass spectrometry, and other molecular assays through unified interfaces

- This trend toward more intelligent, intuitive, and interconnected IP systems is fundamentally reshaping expectations for proteomic analysis accuracy and workflow efficiency. Consequently, companies such as Abcam are developing AI-assisted antibody validation tools to enhance reproducibility in immunoprecipitation experiments across diverse biological contexts

- The demand for immunoprecipitation tools that offer seamless AI and automation capabilities is growing rapidly across biotechnology, pharmaceutical, and academic research sectors, as users increasingly prioritize consistency, data quality, and high-throughput functionality

Immunoprecipitation Market Dynamics

Driver

Growing Need Due to Rising Proteomics Research and Disease Biology Studies

- The increasing prevalence of chronic, genetic, and immune-related disorders, coupled with the accelerating focus on proteomics-driven discovery research, is a significant driver for the heightened demand for immunoprecipitation techniques across global laboratories

- For instance, in April 2025, Thermo Fisher Scientific expanded its protein-interaction analysis portfolio with new magnetic-bead IP kits designed for improved sensitivity in cancer biomarker detection, and such strategies by key companies are expected to propel immunoprecipitation market growth during the forecast period

- As researchers seek deeper insights into disease pathways, cellular signaling, and therapeutic targets, immunoprecipitation provides precise isolation of proteins and complexes, offering a critical upgrade over less selective protein-capture techniques

- Furthermore, the rising popularity of multi-omics workflows and the demand for integrated research environments are making immunoprecipitation an essential component of advanced molecular biology pipelines, supporting applications across drug discovery, antibody validation, and pathway mapping

- The convenience of ready-to-use IP kits, automated magnetic-bead platforms, and the ability to analyze protein interactions with high specificity are key factors propelling the adoption of immunoprecipitation in pharmaceutical, biotechnology, and academic research settings. The trend toward miniaturized, high-throughput, and automation-friendly IP solutions further contributes to market expansion

Restraint/Challenge

Reproducibility Issues and Regulatory Compliance Hurdle

- Concerns surrounding reproducibility challenges in protein isolation, variability among antibodies, and the need for strict procedural consistency pose significant restraints to broader adoption of immunoprecipitation techniques in high-precision research environments

- For instance, high-profile reports highlighting poor antibody specificity in certain proteomic studies have made some laboratories cautious about relying on IP workflows without rigorous validation steps

- Addressing these reproducibility concerns through high-affinity antibodies, standardized reagents, and validated protocols is crucial for building confidence among researchers. Companies such as Abcam and Cell Signaling Technology emphasize their multi-step antibody validation processes to reassure users of result reliability. In addition, the relatively high cost of premium IP reagents and specialized antibodies compared with general-purpose biochemical reagents can be a barrier for smaller laboratories or budget-restricted institutions

- While prices are gradually decreasing, the perceived premium for high-quality IP consumables and automation-compatible kits can still hinder widespread adoption, especially for laboratories that do not frequently perform protein-interaction studies

- Overcoming these challenges through improved reagent consistency, researcher training on best practices, and the development of more affordable immunoprecipitation kits and validated antibody libraries will be vital for sustained market growth

Immunoprecipitation Market Scope

The market is segmented on the basis of type, product, and end-user.

- By Type

On the basis of type, the global immunoprecipitation market is segmented into individual immunoprecipitation, co-immunoprecipitation, chromatin immunoprecipitation, and rna immunoprecipitation. The Individual Immunoprecipitation segment dominated the market with the largest revenue share in 2025, driven by its essential role in isolating specific proteins using targeted antibodies across routine molecular biology workflows. Researchers widely prefer this technique because of its simplicity, versatility, and compatibility with downstream analytical methods, including Western blotting and mass spectrometry. The dominance of this segment is further reinforced by the availability of validated antibodies that enhance reproducibility and simplify experimental design. Continuous improvements in magnetic-bead chemistry and antibody specificity also fuel its strong adoption. Individual IP remains the preferred method in both academic and industrial labs due to its reliability and broad application across proteomic studies.

The Chromatin Immunoprecipitation segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for analyzing DNA–protein interactions and epigenetic modifications. ChIP is widely used in gene regulation studies, cancer research, and developmental biology, driving rapid adoption across research institutes and biotechnology companies. The strong rise of ChIP-Seq applications has significantly expanded its relevance in genome-wide regulatory mapping. Technological advancements in ChIP kits allow reduced sample input, shortened workflow time, and enhanced sensitivity. Growing interest in precision medicine and epigenetics further accelerates adoption. As a result, ChIP is becoming a central tool for biomarker discovery and transcriptional pathway analysis.

- By Product

On the basis of product, the market is segmented into kits, reagents, and accessories. The kits segment dominated the immunoprecipitation market with a market share of 54.7% in 2025, driven by their all-in-one convenience, standardization, and high reproducibility across research workflows. Kits significantly reduce protocol variability, making them the preferred choice for academic labs and biotech companies conducting high-throughput or time-sensitive studies. Their rapid adoption is further supported by the availability of specialized IP kits, including ChIP-grade and RNA-IP kits, which streamline complex applications. In addition, kits minimize hands-on time and technical errors, offering optimized buffers and validated antibodies that improve experimental success rates. The surge in epigenetics and chromatin research has amplified demand for advanced chromatin immunoprecipitation kits, further strengthening this segment’s dominance. Their compatibility with next-generation sequencing workflows (such as ChIP-seq and RIP-seq) also contributes to strong market leadership.

The reagents segment is expected to record the fastest growth rate from 2026 to 2033, supported by increasing demand for customizable and flexible IP workflows among experienced researchers. Reagents including antibodies, beads, buffers, and protein A/G resins allow scientists to tailor experimental setups more precisely than standardized kits. Growth is also fueled by the rising need for high-affinity and highly specific antibodies suitable for co-IP and RNA-IP applications as research complexity increases. Pharmaceutical and biotech companies increasingly rely on standalone reagents for large-scale studies, biomarker discovery, and protein interaction mapping, accelerating revenue expansion. As immunoprecipitation workflows integrate more with mass spectrometry and sequencing platforms, high-purity reagents become essential, contributing to robust CAGR. In addition, the introduction of premium magnetic bead–based reagents and low-background formulations enhances performance, making reagents the fastest-growing product category.

- By End-User

On the basis of end-user, the market is segmented into academic & research institutes, pharmaceutical & biotechnology companies, and contract research organizations. The Academic & Research Institutes segment dominated the immunoprecipitation market in 2025, driven by heavy utilization of IP techniques in fundamental molecular biology, proteomics, and gene-regulation research. Universities and public research laboratories conduct high volumes of protein interaction and pathway studies, making IP an essential laboratory method. Robust funding for basic science in North America, Europe, and Asia supports widespread adoption of IP reagents and kits. Academic institutions frequently engage in exploratory and discovery-driven experiments, increasing demand for reliable IP tools. The need for teaching, training, and publishing further contributes to recurring consumption. This strong and sustained usage establishes academia as the leading consumer group in the market.

The Pharmaceutical & Biotechnology Companies segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing reliance on immunoprecipitation in drug discovery, target validation, and mechanistic studies. Protein–protein interaction analysis and pathway mapping are central to therapeutic development, intensifying IP adoption within biopharma pipelines. The rise of biologics and precision therapeutics further elevates the importance of IP methods. Automation-driven IP workflows are being widely integrated to enhance throughput and reproducibility. Growing investments in proteomics, structural biology, and multi-omics platforms continue to expand demand. As biopharmaceutical companies increase outsourcing, CROs also benefit indirectly, supporting long-term market expansion.

Immunoprecipitation Market Regional Analysis

- North America dominated the global immunoprecipitation market with the largest revenue share of 38.5% in 2025, supported by a strong biotechnology and pharmaceutical ecosystem, high R&D expenditure, and the presence of leading technology providers

- Researchers in the region heavily rely on immunoprecipitation for applications such as biomarker discovery, chromatin analysis, and interaction proteomics, supporting widespread adoption of IP kits, reagents, and advanced pull-down systems

- This leadership is further reinforced by rapid uptake of technologies integrated with downstream platforms such as mass spectrometry and next-generation sequencing, which require high-quality IP-grade materials. Favorable government grants, extensive clinical research activities, and strategic investments by major biotech players strengthen market penetration and innovation

U.S. Immunoprecipitation Market Insight

The U.S. immunoprecipitation market captured the largest revenue share within North America in 2025, driven by the country’s strong concentration of academic research centers, biotech firms, and pharmaceutical leaders conducting advanced proteomic and genomic research. Increasing adoption of IP-based techniques for applications such as protein–protein interaction mapping, chromatin studies, and biomarker discovery fuels strong market penetration. The rapid uptake of precision medicine initiatives, coupled with growing drug discovery pipelines, further underscores the demand for high-quality IP kits and reagents. In addition, the increasing integration of immunoprecipitation with mass spectrometry, NGS workflows, and high-throughput platforms is significantly contributing to the market’s expansion.

Europe Immunoprecipitation Market Insight

The Europe immunoprecipitation market is projected to expand at a substantial CAGR throughout the forecast period, primarily supported by strong biotechnology research activity, government-funded molecular biology programs, and rising proteomics-focused collaborations. The region’s increasing emphasis on biomarker identification, epigenetic studies, and protein interaction research is fueling broader adoption of immunoprecipitation techniques. European laboratories are also focusing on reproducibility and high-quality data output, thereby increasing demand for standardized IP kits and automation-ready reagents. Growth is pronounced across academic, pharmaceutical, and CRO environments, where immunoprecipitation is routinely incorporated into disease mechanism studies and drug development projects.

U.K. Immunoprecipitation Market Insight

The U.K. immunoprecipitation market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s robust life sciences sector and significant emphasis on genomics and proteomics research. Rising investments in academic research infrastructure and expanding collaborations between universities and biotech enterprises are accelerating the use of immunoprecipitation techniques. The growing focus on understanding disease pathways, particularly in oncology and immunology, is driving the adoption of advanced IP solutions. In addition, strong government support for biomedical innovation and the presence of leading CROs provide further momentum to market expansion.

Germany Immunoprecipitation Market Insight

The Germany immunoprecipitation market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced research ecosystem and strong commitment to R&D across biotechnology, molecular diagnostics, and pharmaceutical sectors. German laboratories prioritize high-quality, reproducible assays, driving demand for premium IP kits, reagents, and automation-compatible consumables. The country’s emphasis on translational research and precision diagnostics is also increasing reliance on immunoprecipitation for protein isolation, chromatin mapping, and interaction studies. Germany’s established infrastructure and focus on technological innovation further support widespread adoption of IP-based workflows.

Asia-Pacific Immunoprecipitation Market Insight

The Asia-Pacific immunoprecipitation market is poised to grow at the fastest CAGR during the forecast period, driven by rapid expansion of biotechnology capabilities and rising investments in molecular biology and proteomics research across China, Japan, India, and South Korea. Increasing government support for genomic research programs and growing biotech startup ecosystems are accelerating market adoption. The region’s expanding academic research base, coupled with rising pharmaceutical R&D outsourcing, strengthens demand for IP kits, reagents, and specialized consumables. As APAC evolves into a hub for biologics production and protein science research, immunoprecipitation is becoming a core technique across both research and commercial laboratories.

Japan Immunoprecipitation Market Insight

The Japan immunoprecipitation market is gaining momentum due to the country’s leadership in advanced biomedical research, high adoption of automation, and strong emphasis on functional genomics and proteomics. Japan’s research institutions prioritize high-precision analytical techniques, driving demand for reliable IP kits and reagents for chromatin studies, protein complex analysis, and signaling pathway research. Integration of immunoprecipitation workflows with advanced imaging, mass spectrometry, and sequencing technologies is accelerating market growth. In addition, Japan’s aging population and increased focus on disease mechanism studies in oncology and neurodegenerative disorders further stimulate adoption.

India Immunoprecipitation Market Insight

The India immunoprecipitation market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid expansion of the biotechnology sector, growing academic research output, and significant government initiatives promoting life sciences and molecular diagnostics. The country’s rising focus on protein-based research, expanding CRO network, and increasing outsourcing of drug discovery activities are driving the uptake of immunoprecipitation products. Affordability improvements, growing numbers of trained researchers, and establishment of new biotech parks strengthen domestic demand. Immunoprecipitation techniques are increasingly adopted in studies related to cancer biology, infectious diseases, and epigenetics, boosting market growth.

Immunoprecipitation Market Share

The Immunoprecipitation industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific, Inc. (U.S.)

- Bio‑Rad Laboratories, Inc. (U.S.)

- Merck KGaA (Germany)

- Cell Signaling Technology, Inc. (U.S.)

- Abbkine, Inc. (U.S.)

- GeneTex, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- GenScript (China)

- Rockland Immunochemicals, Inc. (U.S.)

- Proteintech Group, Inc. (U.S.)

- Santa Cruz Biotechnology, Inc. (U.S.)

- Bethyl Laboratories, Inc. (U.S.)

- Miltenyi Biotec GmbH (Germany)

- BioLegend, Inc. (U.S.)

- Enzo Life Sciences, Inc. (U.S.)

- Creative Diagnostics (U.S.)

- Sino Biological Inc. (China)

- PerkinElme. (U.S.)

- Active Motif, Inc. (U.S.)

- New England Biolabs, Inc. (U.S.)

What are the Recent Developments in Global Immunoprecipitation Market?

- In March 2025, Thermo Fisher Scientific announced the launch of a new “Pierce Magnetic IP Kit” with enhanced sensitivity for low‑abundance proteins. This kit expands Thermo Fisher’s end‑to‑end immunoprecipitation workflow portfolio enabling better detection of scarce proteins, which is critical for proteomics and biomarker discovery

- In December 2024, Thermo Fisher launched the Dynabeads Protein A IP Kit and Magnet Starter Pack, offering a combined magnetic‑bead and buffer kit for immunoprecipitation helping labs streamline IP prep with ready-to-use reagents

- In March 2024, Bio-Rad Laboratories introduced a new set of validated primary and secondary antibodies for rare cell and circulating tumour‑cell (CTC) immunostaining a development relevant for immunoprecipitation / immuno‑assay workflows in cancer research

- In May 2023, researchers published a novel method demonstrating that magnetic beads (commonly used in IP workflows) specifically Dynabeads can function as Raman‑reporter labels for simultaneous capture and identification of biomolecules, suggesting a possible dual role (isolation + detection) in immunoaffinity assay

- In March 2022, a peer‑reviewed study published an optimized co‑immunoprecipitation protocol that improved endogenous protein enrichment and protein–protein interaction (PPI) analysis. The work reflects ongoing methodological improvements in IP workflows enabling more reliable detection of native PPIs without overexpression artefacts, which enhances the value and reliability of IP in biological research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.