Market Analysis and Insights Global Industrial Computed Tomography Market

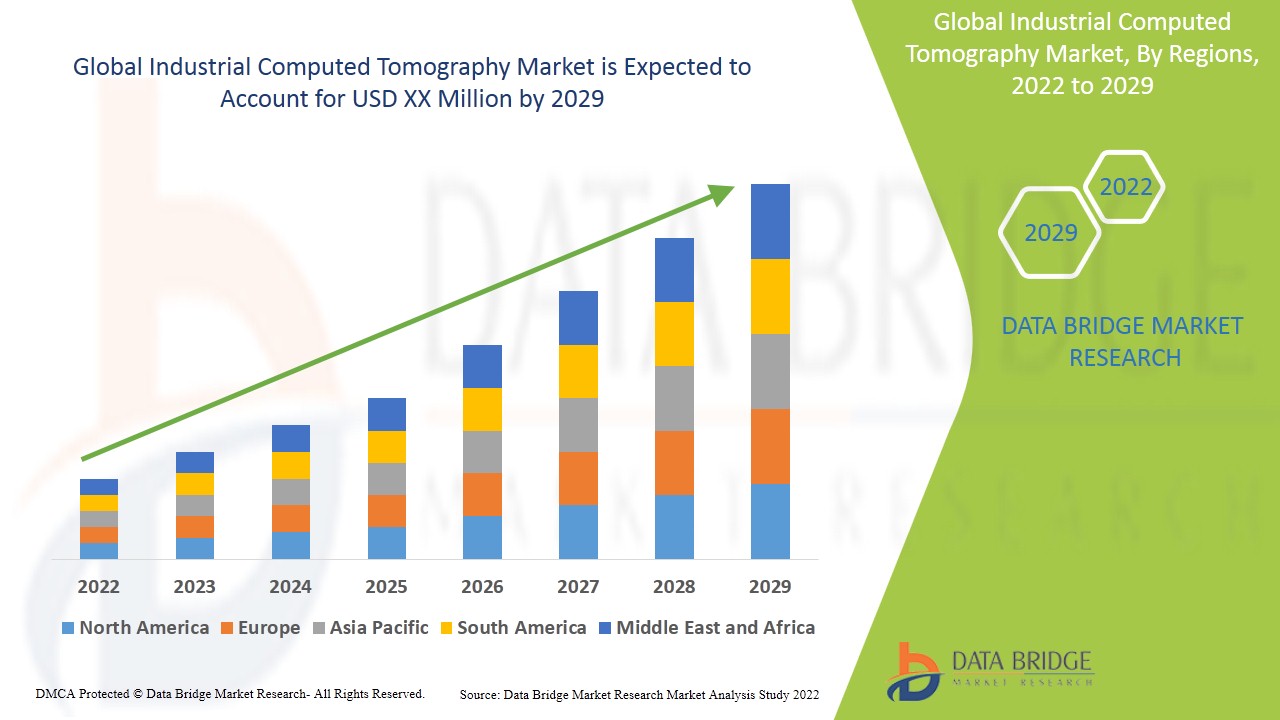

The industrial computed tomography market is expected to witness market growth at a rate of 8.30% in the forecast period of 2022 to 2029. Data Bridge Market Research report on industrial computed tomography market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rise in the utilization of additive manufacturing techniques in the production processes across industries, including aerospace, automotive, defense, and electronics amongst others is escalating the growth of industrial computed tomography market.

Industrial CT scanning is known to utilize high-powered x-rays to penetrate the internal geometries of an object, making a perfect inspection tool for high-value parts where destructive testing is financially exorbitant. Industrial CT scanners have several benefits including procuring the internal structure of an object, confirming extremely accurate internal dimensions, letting comparison to reference models, no shaded zones, compatibility with all shapes and sizes, no post-processing work and extremely high-resolution imaging.

Major factors that are expected to boost the growth of the industrial computed tomography market in the forecast period are the rise in the complexity in the design and manufacturing of components that utilize new processes, new materials, and intricate geometries that demand advanced quality control and assurance solutions. Furthermore, the increasing demand for early diagnosis is further anticipated to propel the growth of the industrial computed tomography market. Moreover, the growing inclination for minimally invasive diagnostic procedures is further estimated to cushion the growth of the industrial computed tomography market. On the other hand, the growing cost of installation is further projected to impede the growth of the industrial computed tomography market in the timeline period.

In addition, the rise in the geriatric population and the growing advantages of CT scans over other imaging modalities will further provide potential opportunities for the growth of the industrial computed tomography market in the coming years. However, the rise in the cost for maintenance might further challenge the growth of the industrial computed tomography market in the near future.

This industrial computed tomography market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the industrial computed tomography market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Global Industrial Computed Tomography Market Scope and Market Size

The industrial computed tomography market is segmented on the basis of offering, application and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them in making strategic decisions for the identification of core market applications.

- On the basis of offering, the industrial computed tomography market is segmented into equipment and services. Equipment is further sub segmented into line beam scanners and cone beam scanners.

- On the basis of application, the industrial computed tomography market is segmented into flaw detection and inspection, failure analysis, assembly analysis, dimensioning and tolerancing analysis and others.

- On the basis of vertical, the industrial computed tomography market is segmented into oil and gas, aerospace and defense, automotive, electronics and others.

Industrial Computed Tomography Market Country Level Analysis

The industrial computed tomography market is analysed, and market size insights and trends are provided by country, offering, application and vertical as referenced above.

The countries covered in the industrial computed tomography market report are the U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa (MEA) as a part of the Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the industrial computed tomography market due to the rise in the number of investments in the adoption of new and developed technologies by major industry players. Furthermore, the growing automotive and electronics industries and sturdy occurrence of prominent market players will further boost the growth of the industrial computed tomography market in the region during the forecast period. Asia-Pacific is projected to observe significant amount of growth in the industrial computed tomography market due to the rise in the adoption of industrial CT systems for testing and inspection purposes amongst several industries, including automotive, electronics, aerospace and defense. Furthermore, the growing manufacturing and production activities is further anticipated to propel the growth of the industrial computed tomography market in the region in the coming years.

The country section of the industrial computed tomography market report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as consumption volumes, production sites, and volumes, import-export analysis, price trend analysis, cost of raw materials, downstream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The industrial computed tomography market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kinds of products for the industrial computed tomography market, the impact of technology using lifeline curves, and changes in healthcare regulatory scenarios and their impact on the industrial computed tomography market. The data is available for the historic period 2010-2020.

Competitive Landscape and Industrial Computed Tomography Market Share Analysis

The industrial computed tomography market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to the industrial computed tomography market.

Some of the major players operating in the industrial computed tomography market are Nikon Metrology NV, OMRON Corporation, Baker Hughes, YXLON International, Carl Zeiss Meditech AG, Shimadzu Corporation, Koninklijke Philips N.V., SAMSUNG, General Electric Company, Rigaku Corporation, Bruker, Comet Group, Hitachi Ltd., Thermo Fisher Scientific, Neusoft Corporation, Medtronic, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Toshiba Corporation, and Siemens among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VALUE AND VOLUME

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES

5.3 PATENT ANALYSIS

5.4 GOVERNMENT POLICIES

5.5 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET ANALYSIS (QUALITATIVE AND QUANTITATIVE ANALYSIS)

6 INDUSTRY INSIGHTS

6.1 KEY PRICING STRATEGIES

6.2 KEY MARKETING STRATEGIES

6.3 INTERVIEWS WITH EQUIPMENT MANUFACTURERS

6.4 INTERVIEWS WITH SUBJECT MATTER EXPERTS

6.5 OTHER KOL SNAPSHOTS

7 REGULATORY FRAMWORK

8 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 EQUIPMENT

8.2.1 FAN-BEAM SYSTEMS

8.2.1.1. HIGH ENERGY INDUSTRIAL CT

8.2.1.1.1. 2D

8.2.1.1.1.1 MARKET VALUE (USD MILLION)

8.2.1.1.1.2 MARKET VOLUME (UNIT)

8.2.1.1.1.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.2. 3D

8.2.1.1.2.1 MARKET VALUE (USD MILLION)

8.2.1.1.2.2 MARKET VOLUME (UNIT)

8.2.1.1.2.3 AVERAGE SELLING PRICE (USD)

8.2.1.1.3. 4D

8.2.1.1.3.1 MARKET VALUE (USD MILLION)

8.2.1.1.3.2 MARKET VOLUME (UNIT)

8.2.1.1.3.3 AVERAGE SELLING PRICE (USD)

8.2.1.2. LOW ENERGY INDUSTRIAL CT

8.2.1.2.1. 2D

8.2.1.2.1.1 MARKET VALUE (USD MILLION)

8.2.1.2.1.2 MARKET VOLUME (UNIT)

8.2.1.2.1.3 AVERAGE SELLING PRICE (USD)

8.2.1.2.2. 3D

8.2.1.2.2.1 MARKET VALUE (USD MILLION)

8.2.1.2.2.2 MARKET VOLUME (UNIT)

8.2.1.2.2.3 AVERAGE SELLING PRICE (USD)

8.2.1.2.3. 4D

8.2.1.2.3.1 MARKET VALUE (USD MILLION)

8.2.1.2.3.2 MARKET VOLUME (UNIT)

8.2.1.2.3.3 AVERAGE SELLING PRICE (USD)

8.2.1.3. MINI-FOCUS INDUSTRIAL CT

8.2.1.3.1. 2D

8.2.1.3.1.1 MARKET VALUE (USD MILLION)

8.2.1.3.1.2 MARKET VOLUME (UNIT)

8.2.1.3.1.3 AVERAGE SELLING PRICE (USD)

8.2.1.3.2. 3D

8.2.1.3.2.1 MARKET VALUE (USD MILLION)

8.2.1.3.2.2 MARKET VOLUME (UNIT)

8.2.1.3.2.3 AVERAGE SELLING PRICE (USD)

8.2.1.3.3. 4D

8.2.1.3.3.1 MARKET VALUE (USD MILLION)

8.2.1.3.3.2 MARKET VOLUME (UNIT)

8.2.1.3.3.3 AVERAGE SELLING PRICE (USD)

8.2.2 CONE-BEAM SYSTEMS

8.2.2.1. HIGH ENERGY INDUSTRIAL CT

8.2.2.1.1. 2D

8.2.2.1.1.1 MARKET VALUE (USD MILLION)

8.2.2.1.1.2 MARKET VOLUME (UNIT)

8.2.2.1.1.3 AVERAGE SELLING PRICE (USD)

8.2.2.1.2. 3D

8.2.2.1.2.1 MARKET VALUE (USD MILLION)

8.2.2.1.2.2 MARKET VOLUME (UNIT)

8.2.2.1.2.3 AVERAGE SELLING PRICE (USD)

8.2.2.1.3. 4D

8.2.2.1.3.1 MARKET VALUE (USD MILLION)

8.2.2.1.3.2 MARKET VOLUME (UNIT)

8.2.2.1.3.3 AVERAGE SELLING PRICE (USD)

8.2.2.2. LOW ENERGY INDUSTRIAL CT

8.2.2.2.1. 2D

8.2.2.2.1.1 MARKET VALUE (USD MILLION)

8.2.2.2.1.2 MARKET VOLUME (UNIT)

8.2.2.2.1.3 AVERAGE SELLING PRICE (USD)

8.2.2.2.2. 3D

8.2.2.2.2.1 MARKET VALUE (USD MILLION)

8.2.2.2.2.2 MARKET VOLUME (UNIT)

8.2.2.2.2.3 AVERAGE SELLING PRICE (USD)

8.2.2.2.3. 4D

8.2.2.2.3.1 MARKET VALUE (USD MILLION)

8.2.2.2.3.2 MARKET VOLUME (UNIT)

8.2.2.2.3.3 AVERAGE SELLING PRICE (USD)

8.2.2.3. MINI-FOCUS INDUSTRIAL CT

8.2.2.3.1. 2D

8.2.2.3.1.1 MARKET VALUE (USD MILLION)

8.2.2.3.1.2 MARKET VOLUME (UNIT)

8.2.2.3.1.3 AVERAGE SELLING PRICE (USD)

8.2.2.3.2. 3D

8.2.2.3.2.1 MARKET VALUE (USD MILLION)

8.2.2.3.2.2 MARKET VOLUME (UNIT)

8.2.2.3.2.3 AVERAGE SELLING PRICE (USD)

8.2.2.3.3. 4D

8.2.2.3.3.1 MARKET VALUE (USD MILLION)

8.2.2.3.3.2 MARKET VOLUME (UNIT)

8.2.2.3.3.3 AVERAGE SELLING PRICE (USD)

8.3 SOFTWARE

8.4 SERVICES

8.4.1 ARTICLE INSPECTION

8.4.2 FAILURE ANALYSIS

8.4.3 GEOMETRIC DIMENSIONING & TOLERANCES ANALYSIS ANALYSIS

8.4.4 POROSITY & THICKNESS ANALYSIS

8.4.5 REVERSE ENGINEERING SERVICES

8.4.6 OTHERS

9 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D

9.3 3D

9.4 4D

10 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 METROLOGY

10.2.1 NOMINAL/ACTUAL COMPARISON

10.2.2 DIMENSIONAL CONTROL

10.2.3 WALL THICKNESS ANALYSIS

10.2.4 TOOL & PROCESS OPTIMIZATION

10.2.5 DEVELOPMENT & REVERSE ENGINEERING

10.3 INSPECTION

10.3.1 DEFECT ANALYSIS

10.3.2 ASSEMBLY CONTROL

10.3.3 JOINING TECHNOLOGY CONTROL

10.3.4 ELECTRONIC TESTING

10.4 ANALYSIS

10.4.1 STRUCTURAL ANALYSIS

10.4.2 IN-SITU & 4D ANALYSIS

10.4.3 ROUGHNESS ANALYSIS

10.4.4 FIBER COMPOSITE ANALYSIS

10.5 OTHER APPLICATIONS

11 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.3 AEROSPACE

11.4 BIOMEDICAL TECHNOLOGY

11.5 ELECTRONICS

11.6 CONSUMER GOODS

11.7 OIL & GAS

11.8 OTHERS

12 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY GEOGRAPHY

12.1 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.1.1. U.S INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY PRODUCT TYPE

12.1.1.1.2. U.S INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY TECHNOLOGY

12.1.1.1.3. U.S INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY APPLICATION

12.1.1.1.4. U.S INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, BY INDUSTRY

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. FRANCE

12.1.2.3. U.K.

12.1.2.4. ITALY

12.1.2.5. SPAIN

12.1.2.6. RUSSIA

12.1.2.7. TURKEY

12.1.2.8. BELGIUM

12.1.2.9. NETHERLANDS

12.1.2.10. SWITZERLAND

12.1.2.11. REST OF EUROPE

12.1.3 ASIA-PACIFIC

12.1.3.1. JAPAN

12.1.3.2. CHINA

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. AUSTRALIA

12.1.3.6. SINGAPORE

12.1.3.7. THAILAND

12.1.3.8. MALAYSIA

12.1.3.9. INDONESIA

12.1.3.10. PHILIPPINES

12.1.3.11. REST OF ASIA-PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. SAUDI ARABIA

12.1.5.3. UAE

12.1.5.4. EGYPT

12.1.5.5. ISRAEL

12.1.5.6. REST OF MIDDLE EAST AND AFRICA

12.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, SWOT AND DBMR ANALYSIS

15 GLOBAL INDUSTRIAL COMPUTED TOMOGRAPHY MARKET, COMPANY PROFILE

15.1 BAKER HUGHES COMPANY

15.1.1 COMPANY OVERVIEW

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ZEISS

15.2.1 COMPANY OVERVIEW

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 SAEC/KINETIC VISION, INC.

15.3.1 COMPANY OVERVIEW

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BLUE STAR LIMITED.

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ELEMENT MATERIALS TECHNOLOGY

15.5.1 COMPANY OVERVIEW

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 EXACT METROLOGY INC.

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 HAMAMATSU PHOTONICS K.K.

15.7.1 COMPANY OVERVIEW

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 SANYING PRECISION INSTRUMENTS CO.,LTD

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 DANDONG AOLONG RADIATIVE INSTRUMENT GROUP CO.,LTD

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 NORTH STAR IMAGING INC.

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 APPLIED TECHNICAL SERVICES, LLC

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 MICRON

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 DRTECH

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 X-SCAN.

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 SCIENSCOPE

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 EWI

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 NIKON CORPORATION

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 YXLON INTERNATIONAL

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 DIVERSE DIMENSIONS

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 EXPONENT

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 THORLABS, INC.

15.21.1 COMPANY OVERVIEW

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 OGI

15.22.1 COMPANY OVERVIEW

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 TELEDYNE DIGITAL IMAGING INC.

15.23.1 COMPANY OVERVIEW

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

15.24 ADAPTIVE ENERGY

15.24.1 COMPANY OVERVIEW

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENTS

15.25 DELPHI PRECISION IMAGING

15.25.1 COMPANY OVERVIEW

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENTS

15.26 HAVEN METROLOGY

15.26.1 COMPANY OVERVIEW

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPMENTS

15.27 AVON IMAGING

15.27.1 COMPANY OVERVIEW

15.27.2 REVENUE ANALYSIS

15.27.3 GEOGRAPHIC PRESENCE

15.27.4 PRODUCT PORTFOLIO

15.27.5 RECENT DEVELOPMENTS

15.28 ADVANCED INSPECTION SERVICES

15.28.1 COMPANY OVERVIEW

15.28.2 REVENUE ANALYSIS

15.28.3 GEOGRAPHIC PRESENCE

15.28.4 PRODUCT PORTFOLIO

15.28.5 RECENT DEVELOPMENTS

15.29 LMI TECHNOLOGIES INC.

15.29.1 COMPANY OVERVIEW

15.29.2 REVENUE ANALYSIS

15.29.3 GEOGRAPHIC PRESENCE

15.29.4 PRODUCT PORTFOLIO

15.29.5 RECENT DEVELOPMENTS

15.3 SIGRAY

15.30.1 COMPANY OVERVIEW

15.30.2 REVENUE ANALYSIS

15.30.3 GEOGRAPHIC PRESENCE

15.30.4 PRODUCT PORTFOLIO

15.30.5 RECENT DEVELOPMENTS

15.31 OMRON CORPORATION

15.31.1 COMPANY OVERVIEW

15.31.2 REVENUE ANALYSIS

15.31.3 GEOGRAPHIC PRESENCE

15.31.4 PRODUCT PORTFOLIO

15.31.5 RECENT DEVELOPMENTS

15.32 VJ GROUP, INC.

15.32.1 COMPANY OVERVIEW

15.32.2 REVENUE ANALYSIS

15.32.3 GEOGRAPHIC PRESENCE

15.32.4 PRODUCT PORTFOLIO

15.32.5 RECENT DEVELOPMENTS

15.33 SHIMADZU CORPORATION

15.33.1 COMPANY OVERVIEW

15.33.2 REVENUE ANALYSIS

15.33.3 GEOGRAPHIC PRESENCE

15.33.4 PRODUCT PORTFOLIO

15.33.5 RECENT DEVELOPMENTS

15.34 RIGAKU CORPORATION

15.34.1 COMPANY OVERVIEW

15.34.2 REVENUE ANALYSIS

15.34.3 GEOGRAPHIC PRESENCE

15.34.4 PRODUCT PORTFOLIO

15.34.5 RECENT DEVELOPMENTS

15.35 WERTH INC.

15.35.1 COMPANY OVERVIEW

15.35.2 REVENUE ANALYSIS

15.35.3 GEOGRAPHIC PRESENCE

15.35.4 PRODUCT PORTFOLIO

15.35.5 RECENT DEVELOPMENTS

16 CONCLUSION

17 QUESTIONNAIRE

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.