Global Industrial Margarine Market

Market Size in USD Billion

CAGR :

%

USD

2.91 Billion

USD

4.13 Billion

2024

2032

USD

2.91 Billion

USD

4.13 Billion

2024

2032

| 2025 –2032 | |

| USD 2.91 Billion | |

| USD 4.13 Billion | |

|

|

|

|

Industrial Margarine Market Size

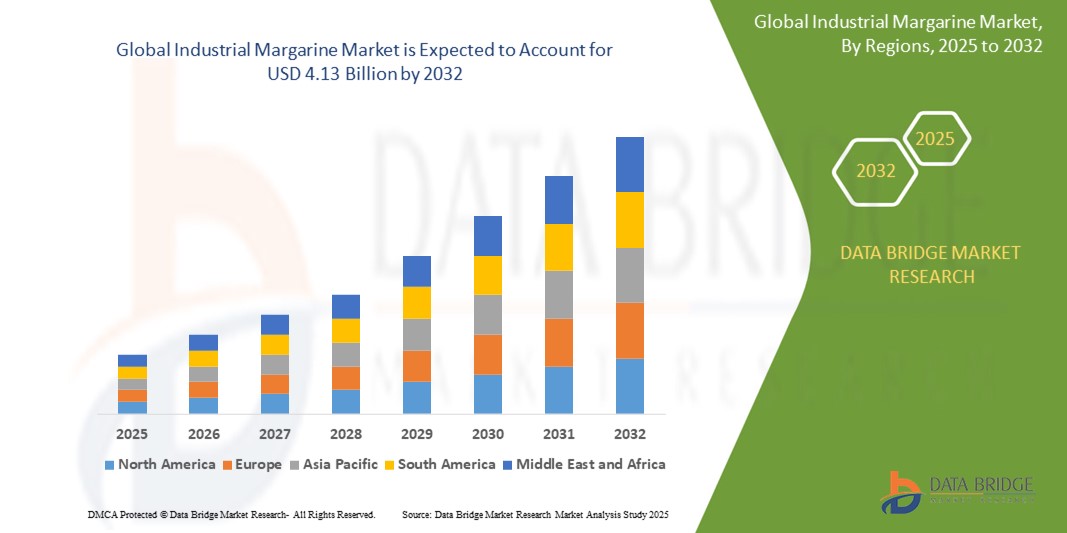

- The global industrial margarine market size was valued at USD 2.91 billion in 2024 and is expected to reach USD 4.13 billion by 2032, at a CAGR of 4.50% during the forecast period

- This growth is driven by factors such as rising demand in the bakery and confectionery sectors, cost-effectiveness compared to butter, longer shelf life, and growing consumer preference for plant-based and trans-fat-free alternatives

Industrial Margarine Market Analysis

- Industrial margarine is a key ingredient used in the production of bakery, confectionery, and convenience food products, offering texture, flavor, and shelf-life stability. It serves as a cost-effective alternative to butter in large-scale food manufacturing

- The demand for industrial margarine is significantly driven by the growing bakery and processed food sectors, increasing preference for plant-based products, and its longer shelf life compared to dairy-based alternatives

- North America is expected to dominate the industrial margarine market with largest market share of 35.1%, due to growing consumer shift toward allergen-free, non-GMO products and the increasing adoption of vegan and plant-based diets. As consumers become more health-conscious, there is a surging demand for margarine alternatives that cater to dietary restrictions and preferences, such as dairy-free and non-GMO options

- Asia-Pacific is expected to be the fastest growing region in the industrial margarine market during the forecast period due to rapid urbanization, rising disposable incomes, and growing demand for convenient and affordable food products

- Commercial segment is expected to dominate the market with a largest market share of 83.3% due to the extensive use of margarine in the food industry. Margarine is a key ingredient in various processed foods, including bakery items, snacks, and ready-to-eat meals, where it provides texture, flavor, and shelf stability. Its cost-effectiveness compared to butter and its versatility in cooking, baking, and frying, make it a preferred choice for food manufacturers

Report Scope and Industrial Margarine Market Segmentation

|

Attributes |

Industrial Margarine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Margarine Market Trends

“Clean Label and Plant-Based Trends Shaping the Future of Industrial Margarine”

- One prominent trend in the global industrial margarine market is the rising consumer preference for clean label, non-GMO, and plant-based margarine products in response to growing health and sustainability concerns

- Manufacturers are reformulating margarine to eliminate artificial additives, reduce trans fats, and incorporate natural ingredients, aligning with consumer demand for transparency and healthier food options

- For instance, leading food companies are launching vegan margarine made from plant oils like sunflower, canola, and coconut, catering to the expanding vegan and flexitarian populations, particularly in Europe and North America

- This trend is significantly shaping product innovation, expanding the market for functional and specialty margarines, and reinforcing the shift toward sustainable and health-conscious food manufacturing

Industrial Margarine Market Dynamics

Driver

“Rising Demand from Bakery and Processed Food Industries”

- The increasing consumption of baked goods, confectionery, and convenience foods is a major driver of growth in the global industrial margarine market. Margarine is widely used in these applications due to its cost-effectiveness, extended shelf life, and functional properties such as texture enhancement and flavor stability

- As consumer lifestyles shift toward convenience and ready-to-eat products, food manufacturers are scaling up production, leading to a higher demand for margarine as a key ingredient in industrial food processing

For instance,

- According to the American Bakers Association, the baking industry in the U.S. alone contributes over USD 150 billion to the economy, indicating the scale and demand for baking ingredients like margarine

- As a result of this growing demand from large-scale food processing industries, the industrial margarine market is witnessing consistent growth globally, especially in regions with expanding bakery and food manufacturing sectors

Opportunity

“Product Innovation in Plant-Based and Functional Margarine”

- The shift toward plant-based diets and clean-label ingredients presents a significant market opportunity for innovation in industrial margarine. Manufacturers are focusing on developing margarine products that are non-dairy, trans-fat-free, and enriched with health-promoting ingredients such as omega-3s, vitamins, and natural antioxidants

- This growing consumer demand for healthier and more sustainable food options opens doors for product differentiation and premiumization within the margarine category

For instance,

- In recent years, companies like Upfield and Conagra Brands have expanded their portfolios to include plant-based and organic margarine products, capitalizing on the rising trend of vegan and flexitarian diets, especially in North America and Europe

- These innovations not only cater to health-conscious consumers but also allow manufacturers to enter new market segments and increase profit margins, making plant-based and functional margarine a high-potential growth area within the global industrial margarine market

Restraint/Challenge

“Health Concerns and Regulatory Restrictions on Trans Fats”

- The presence of partially hydrogenated oils (PHOs), a major source of trans fats in margarine, has led to increasing health concerns and stringent regulatory actions globally, posing a significant challenge to the industrial margarine market

- Several countries have implemented or are in the process of enforcing strict regulations or complete bans on trans fats, pushing manufacturers to reformulate products, which can increase production costs and affect product texture and taste

For instance,

- In January 2021, the World Health Organization (WHO) reiterated its call for the global elimination of industrially produced trans fats by 2023, and countries like the U.S., Canada, and several in the EU have already enacted full or partial bans on PHOs in food products

- Consequently, complying with evolving regulatory frameworks while maintaining product quality and affordability presents a major challenge for margarine producers, particularly in regions with strict health standards and growing consumer scrutiny

Industrial Margarine Market Scope

The market is segmented on the basis of type, form, source, and application

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Source |

|

|

By Application |

|

In 2025, the commercial is projected to dominate the market with a largest share in application segment

The commercial segment is expected to dominate the industrial margarine market with the largest share of 83.3% due to the extensive use of margarine in the food industry. Margarine is a key ingredient in various processed foods, including bakery items, snacks, and ready-to-eat meals, where it provides texture, flavor, and shelf stability. Its cost-effectiveness compared to butter and its versatility in cooking, baking, and frying, make it a preferred choice for food manufacturers

The hard margarine is expected to account for the largest share during the forecast period in form segment

In 2025, the hard margarine segment is expected to dominate the market with the largest market share of 52% due to its widespread use in baking and food production. Hard margarine is known for its stable texture and high melting point and ideal for creating flaky pastries, cakes, and other baked goods. Its long shelf life and cost-effectiveness make it a preferred choice for both commercial kitchens and households

Industrial Margarine Market Regional Analysis

“North America Holds the Largest Share in the Industrial Margarine Market”

- North America dominates the industrial margarine market with largest market share of 35.1%, driven by strong demand in the bakery, food processing, and convenience food industries, as well as a high adoption rate of margarine as a cost-effective and versatile ingredient

- The U.S. holds a significant share of approximately 23%, due to the growing popularity of margarine in both commercial food production and household consumption, alongside the demand for healthier, trans-fat-free, and plant-based margarine alternatives

- The region benefits from well-established food manufacturing infrastructure, a highly competitive retail environment, and continuous product innovations by leading margarine producers, making it a key market for industrial margarine

- In addition, consumer trends toward healthier eating, the rise of veganism, and increasing awareness of the benefits of plant-based margarine options contribute to the market's growth across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Industrial Margarine Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the industrial margarine market, driven by rapid urbanization, increasing disposable incomes, and changing food consumption patterns in emerging markets

- Countries such as China, India, and Japan are emerging as key markets due to the rising demand for convenience foods, snacks, and bakery products, which are significant consumers of margarine

- China, with its large population and growing middle class, is seeing increased demand for affordable and convenient food products, which is driving the adoption of margarine in food manufacturing. The country is also witnessing significant investments in food processing technologies, enhancing margarine production capabilities

- India, with its rising disposable incomes and urbanization, is experiencing a surge in demand for industrial margarine, particularly in the bakery and confectionery sectors. Meanwhile, Japan's advanced food manufacturing technologies and increasing preference for healthier alternatives are boosting the consumption of margarine

Industrial Margarine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill Incorporated (U.S.)

- Bunge Limited (U.S.)

- Wilmar International Ltd. (Singapore)

- Unilever (UK/Netherlands)

- Royal FrieslandCampina N.V. (Netherlands)

- Conagra Brands Inc. (U.S.)

- Kerry Group (Ireland)

- Barry Callebaut (Switzerland)

- Orkla ASA (Norway)

- AAK AB (Sweden)

- Fuji Oil Co. Ltd. (Japan)

- Puratos (Belgium)

- Vandemoortele (Belgium)

- Richardson International Limited (Canada)

- Remia C.V. (Netherlands)

- Currimjee Group (Mauritius)

- MUEZ-Hest India Pvt. Ltd. (India)

- S.A. Aigremont N.V. (Belgium)

- NMGK Group (Russia)

- EFKO Group (Russia)

Latest Developments in Global Industrial Margarine Market

- In February 2025, BlueBand, a trademark of the Flora Food Group, launched an economy-sized margarine pack aimed at supporting the growth of food MSMEs (Micro, Small, and Medium Enterprises). The brand also introduced the "BlueBand Professional UMKM Star #AhlinyaRasaSukses" program, alongside the release of BlueBand Master Cake Margarine 500g, providing cost-effective, high-quality solutions for food businesses. This initiative highlights the growing trend in the global industrial margarine market of offering affordable, high-quality products tailored to meet the needs of small and medium-sized food enterprises

- In March 2024, Wilmar Africa unveiled its latest culinary innovation, "Fortune Spread & Fortune All Purpose Margarine," alongside the opening of a state-of-the-art factory dedicated to the efficient and high-quality production of this new product. This strategic move underscores the growing demand for versatile and premium margarine products in the global industrial margarine market. Wilmar Africa’s investment in advanced manufacturing capabilities aligns with the increasing consumer preference for high-quality, multi-purpose margarine options, catering to both household and foodservice sectors

- In March 2022, ADEKA launched a new line of plant-based products under the Deli-PLANTS brand, designed to provide consumers with "Delicious Plant-Based Foods" for their dining tables. These products were introduced under the RISU BRAND, with a focus on enhancing taste and convenience for the professional use markets. This launch highlights the growing trend in the global industrial margarine market toward plant-based and vegan alternatives, responding to the increasing consumer demand for healthier and more sustainable food options

- In March 2022, Charalambides Christis launched its latest range of margarine products under the slogan "Our Margarine," designed to elevate culinary experiences with delicious recipes that appeal to both adults and children, fostering moments of enjoyment. This product launch reflects the ongoing innovation within the global industrial margarine market, as companies strive to meet diverse consumer tastes and preferences. By offering a versatile product that enhances culinary experiences, Charalambides Christis is tapping into the growing demand for high-quality, multi-functional margarine options in both household and foodservice applications

- In September 2022, the Federal Ministry of Health in Nigeria issued a public advisory urging citizens to discontinue the use of margarine due to its high trans-fat content. Dr. Salma Anas Ibrahim, Director of Family Health at the Ministry, linked the rising incidence of heart disease in the country to the consumption of unhealthy fats, including those found in margarine. This advisory underscores the growing global focus on health and wellness, with increasing scrutiny on the nutritional content of food products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Margarine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Margarine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Margarine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.