Global Injection Devices For Biological Drugs Market

Market Size in USD Billion

CAGR :

%

USD

568.77 Billion

USD

1,124.19 Billion

2025

2033

USD

568.77 Billion

USD

1,124.19 Billion

2025

2033

| 2026 –2033 | |

| USD 568.77 Billion | |

| USD 1,124.19 Billion | |

|

|

|

|

Injection Devices for Biological Drugs Market Size

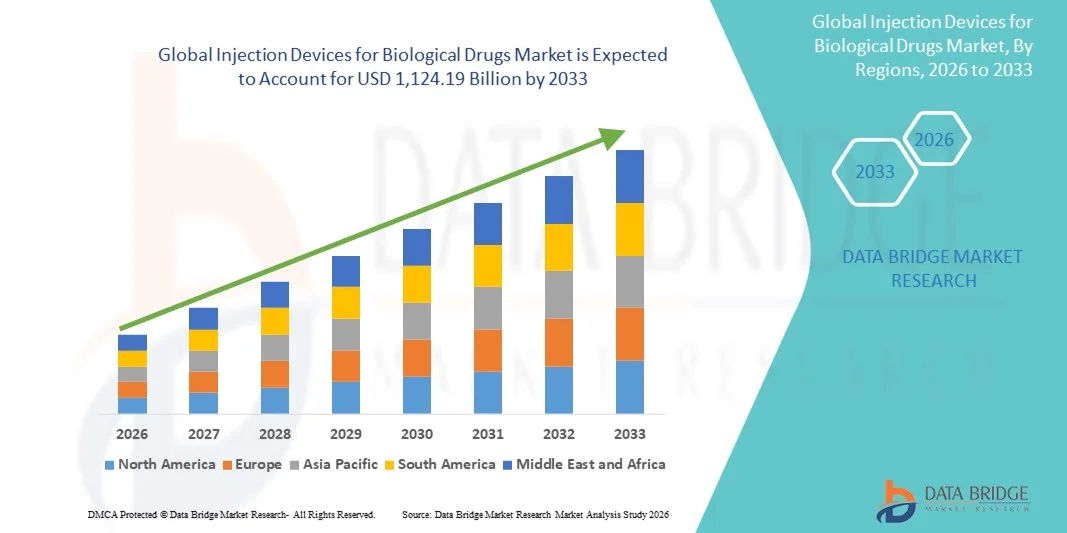

- The global injection devices for biological drugs market size was valued at USD 568.77 billion in 2025 and is expected to reach USD 1,124.19 billion by 2033, at a CAGR of 8.89% during the forecast period

- The market growth is largely fueled by the growing prevalence of chronic conditions that rely on biologic injectables, integration of smart features and rising patient preference for self‑administration. These factors are driving digitalization and innovation across both residential/homecare and clinical settings

- Furthermore, rising demand for secure, user‑friendly, and integrated injection solutions including needle‑free systems and smart injectors is establishing advanced injection devices as the preferred delivery mechanism for biological drugs. These converging factors are accelerating the uptake of injection devices, thereby significantly boosting the industry’s growth

Injection Devices for Biological Drugs Market Analysis

- Injection devices for biological drugs, including conventional injection devices and other advanced delivery systems, are increasingly vital components of modern healthcare delivery in both homecare and clinical settings due to their convenience, dosing accuracy, and ability to support self-administration of complex biologic therapies

- The escalating demand for injection devices is primarily fueled by the growing prevalence of chronic conditions such as autoimmune diseases, hormonal disorders, and orphan diseases, along with rising patient preference for safe, user-friendly, and effective self-injection solutions

- North America dominated the injection devices for biological drugs market with the largest revenue share of 42.3% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key industry players, with the U.S. experiencing substantial adoption of prefilled syringes and pen injectors in both hospitals and homecare settings, driven by innovations from established medical device companies and startups focusing on safety and connected injection technologies

- Asia-Pacific is expected to be the fastest growing region in the injection devices for biological drugs market during the forecast period due to increasing healthcare expenditures, rising prevalence of chronic diseases, and growing adoption of biologic therapies in homecare and clinical settings

- Disposable pen injectors dominated the injection devices for biological drugs market with a market share of 53.8% in 2025, driven by their ease of use, enhanced safety features, and suitability for self-administration across multiple sites of administration including skin, circulatory/musculoskeletal system, organs, and the central nervous system

Report Scope and Injection Devices for Biological Drugs Market Segmentation

|

Attributes |

Injection Devices for Biological Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Injection Devices for Biological Drugs Market Trends

Digital and Connected Injection Devices Enhancing Patient Adherence

- A significant and accelerating trend in the global injection devices market is the integration of smart, connected injection devices with mobile apps and cloud platforms, enhancing patient adherence, dosing accuracy, and real-time monitoring across both homecare and clinical settings

- For instance, smart auto-injectors for rheumatoid arthritis seamlessly connect with companion apps to track injection history, send reminders, and allow healthcare providers to monitor adherence remotely. Similarly, wearable injectors for hormone therapies can provide automated dosing logs and alerts for missed doses

- Connected injection devices enable features such as personalized dosing schedules, predictive alerts for injection errors, and monitoring of unusual injection patterns. For instance, some prefilled smart pen injectors notify both patients and clinicians if a dose is missed or administered incorrectly. Furthermore, mobile app integration allows patients to log side effects and track treatment progress with minimal manual input

- The integration of injection devices with digital platforms facilitates centralized patient management, enabling physicians and caregivers to remotely monitor multiple patients, adjust therapy plans, and provide timely intervention through a single interface

- This trend towards smarter, more intuitive, and patient-centered injection devices is fundamentally reshaping expectations for biologic therapy administration. Consequently, companies such as Ypsomed and Enable Injections are developing connected devices that include automated dose tracking and smartphone compatibility

- The demand for connected and smart injection devices is growing rapidly across both hospitals and homecare settings, as patients and healthcare providers increasingly prioritize convenience, adherence, and treatment safety

Injection Devices for Biological Drugs Market Dynamics

Driver

Growing Demand Due to Rising Chronic Disease Prevalence and Homecare Adoption

- The increasing prevalence of chronic diseases such as autoimmune disorders, hormonal deficiencies, and rare conditions, coupled with the rising trend of home-based therapy administration, is a key driver for heightened demand for injection devices

- For instance, in March 2025, Ypsomed launched a smart insulin pen platform in Europe, designed to improve adherence and allow remote monitoring by healthcare providers, driving broader adoption of self-administered biologics

- As patients and clinicians seek safer, more reliable, and user-friendly delivery methods, injection devices offer advanced features such as prefilled dosing, automated reminders, and error reduction mechanisms, providing a compelling alternative to traditional syringes

- Furthermore, the growing popularity of self-injection therapies and the desire for remote healthcare management are making connected and smart injection devices integral components of biologic therapy administration

- Ease of use, reduced hospital visits, improved patient compliance, and the ability to monitor therapy outcomes remotely are key factors propelling the adoption of injection devices across both hospitals and homecare settings

- Increasing partnerships between device manufacturers and pharmaceutical companies to co-develop therapy-specific injection systems are accelerating product adoption and customization

- Government initiatives promoting home-based healthcare and self-administration of chronic therapies are supporting market expansion, particularly in regions with aging populations

Restraint/Challenge

Device Complexity, Cost, and Regulatory Hurdles

- Concerns surrounding device complexity, patient training requirements, and regulatory compliance pose significant challenges to broader market penetration, particularly in emerging regions with limited healthcare infrastructure

- For instance, high-profile recalls of malfunctioning auto-injectors have made some patients hesitant to adopt advanced injection devices, despite their benefits in adherence and convenience

- Addressing these challenges through robust device design, intuitive user interfaces, and comprehensive patient education is crucial for building confidence. Companies such as BD and SHL emphasize their training programs and simplified injection protocols to reassure users. In addition, the relatively high cost of advanced devices compared to conventional syringes can be a barrier to adoption for price-sensitive patients or healthcare systems

- While costs are gradually decreasing, the perceived premium for connected or smart injection devices can still hinder widespread adoption, especially in regions where patients self-fund biologic therapies

- Overcoming these challenges through regulatory alignment, enhanced usability, and development of cost-effective devices will be vital for sustained market growth

- Complexity in integrating connected injection devices with hospital IT systems and ensuring cybersecurity compliance remains a technical barrier for some providers

- Limited awareness and training among patients and healthcare providers about proper use of advanced injection devices can reduce adherence and slow market penetration in certain regions

Injection Devices for Biological Drugs Market Scope

The market is segmented on the basis of type of product, application, end user, site of administration, and usability.

- By Type of Product

On the basis of type of product, the market is segmented into conventional injection devices and others. The conventional injection devices segment dominated the market with the largest revenue share in 2025. These devices include prefilled syringes, traditional auto-injectors, and pen injectors widely used in hospitals and clinics. Their dominance is driven by their long-standing adoption, reliability, and compatibility with a broad range of biologic drugs. Healthcare providers often prefer conventional devices for their ease of use, proven safety profile, and lower regulatory barriers. The segment also benefits from strong physician familiarity, well-established supply chains, and robust patient trust. Patients using chronic therapies such as insulin or autoimmune treatments often rely on conventional injection devices due to their predictable performance and ease of handling. In addition, conventional devices are cost-effective compared to newer, connected solutions, supporting adoption in emerging markets.

The others segment, which includes wearable injectors, needle-free systems, and connected smart devices, is expected to witness the fastest growth from 2026 to 2033. This growth is driven by the increasing demand for self-administration, improved adherence, and remote monitoring capabilities. Smart and wearable devices allow patients to inject biologics at home with minimal assistance, reducing hospital visits and improving convenience. These devices integrate with mobile apps and cloud platforms to track doses, provide reminders, and alert healthcare providers of missed or incorrect injections. Growing patient preference for connected healthcare solutions and technological innovations by key players are propelling this segment. Regulatory approvals for novel delivery systems and rising awareness of patient-centered care also contribute to rapid adoption.

- By Application

On the basis of application, the market is segmented into autoimmune diseases, hormonal disorders, orphan diseases, aesthetic treatment, and other clinical applications. The autoimmune diseases segment dominated the market in 2025 due to the high prevalence of conditions such as rheumatoid arthritis, psoriasis, and multiple sclerosis. Biologics are increasingly prescribed for these chronic diseases, and patients require regular, accurate injections, often at home. Healthcare providers favor reliable devices such as prefilled syringes and pen injectors to ensure dosing accuracy and reduce complications. The segment benefits from strong awareness programs and reimbursement coverage for biologics in developed countries. Advances in injection devices designed for patient convenience, such as ergonomic pens, have further strengthened adoption. In addition, the ongoing rise in autoimmune disorders worldwide ensures a sustained demand for reliable injection devices.

The aesthetic treatment segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing demand for cosmetic biologics such as botulinum toxins and dermal fillers. Self-administration and minimally supervised injections are gaining traction in clinics and homecare settings. Patients are increasingly adopting easy-to-use pen injectors and prefilled devices to administer aesthetic treatments safely. Technological innovations such as compact devices and precision dosing systems support rapid adoption. Rising disposable incomes and increased awareness of cosmetic procedures are further fueling growth. Market players are investing in patient education programs to promote safe self-administration and expand the user base.

- By End User

On the basis of end user, the market is segmented into hospitals and clinics, home care settings, and others. The hospitals and clinics segment dominated the market with the largest revenue share in 2025 due to high patient throughput and the need for controlled administration of biologics. Hospitals often prefer conventional devices because of staff familiarity, reliable dosing, and proven safety. Chronic disease management programs in clinics also support repeated usage of prefilled syringes and pen injectors. The segment benefits from bulk procurement, robust distribution networks, and clinical oversight for treatment adherence. Hospitals and clinics also lead in administering complex therapies that require healthcare professional supervision. In addition, established physician recommendations for conventional devices reinforce market dominance.

The home care settings segment is expected to witness the fastest growth from 2026 to 2033, fueled by patient preference for self-injection and convenience. Technological innovations, including smart pen injectors and wearable devices, support remote monitoring and adherence tracking. Rising chronic disease prevalence and decentralization of healthcare delivery accelerate home use. Patients increasingly seek user-friendly devices with minimal training requirements to avoid hospital visits. Supportive reimbursement policies and patient education programs also contribute to growth. The increasing integration of connected devices with telemedicine platforms further drives adoption in homecare environments.

- By Site of Administration

On the basis of site of administration, the market is segmented into skin, circulatory/musculoskeletal system, organs, and central nervous system. The skin administration segment dominated the market in 2025, as subcutaneous injections are commonly used for biologics such as insulin, monoclonal antibodies, and vaccines. Subcutaneous delivery allows easier self-administration, improving patient adherence. The segment benefits from safety, minimal invasiveness, and reduced complications compared to intramuscular or intravenous routes. Prefilled syringes, pen injectors, and auto-injectors are widely used for skin administration, providing consistent dosing. Patients prefer subcutaneous devices for homecare due to comfort and ease of handling. Healthcare providers recommend this route for chronic conditions to simplify therapy management.

The circulatory/musculoskeletal system segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for intravenous biologics for autoimmune disorders and enzyme replacement therapies. Hospitals and specialty clinics are increasingly adopting devices that facilitate targeted delivery to joints or systemic circulation. Wearable injectors and advanced IV-compatible devices support precision dosing and reduced administration errors. Innovations in minimally invasive injection systems also drive adoption. Increasing prevalence of musculoskeletal disorders and supportive reimbursement programs fuel market expansion. Market players are focusing on devices that enhance convenience, safety, and efficacy for this route.

- By Usability

On the basis of usability, the market is segmented into reusable pen injectors and disposable pen injectors. The disposable pen injectors segment dominated the market with the largest revenue of 53.8% share in 2025 due to ease of use, safety, and suitability for self-administration. Disposable devices reduce the risk of contamination, require minimal training, and are compatible with multiple biologic therapies. High adoption in both homecare and clinical settings drives growth. Patients appreciate convenience and single-use reliability, while healthcare providers value infection control. Prefilled disposable pens are widely used for chronic therapies such as insulin, autoimmune biologics, and hormone treatments. Cost-effectiveness and accessibility contribute to the segment’s sustained dominance.

The reusable pen injectors segment is expected to witness the fastest growth from 2026 to 2033, fueled by cost-efficiency and environmental sustainability. Patients can use the same device with replaceable cartridges, reducing long-term therapy costs. Advances in ergonomic design, digital integration, and dose memory features enhance convenience and adherence. Increasing adoption in chronic therapies and patient preference for personalized injection solutions contribute to rapid growth. Manufacturers are innovating to improve safety, durability, and user experience. Regulatory approvals for reusable devices in emerging markets further drive adoption.

Injection Devices for Biological Drugs Market Regional Analysis

- North America dominated the injection devices for biological drugs market with the largest revenue share of 42.3% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key industry players

- Patients and healthcare providers in the region highly value the convenience, safety features, and adherence support offered by prefilled syringes, auto-injectors, and smart pen injectors for homecare and clinical use

- This widespread adoption is further supported by strong patient awareness, robust reimbursement policies, and a technologically inclined population, establishing injection devices as the preferred solution for both hospitals, clinics, and homecare settings

U.S. Injection Devices for Biological Drugs Market Insight

The U.S. injection devices market captured the largest revenue share of 79% in 2025 within North America, fueled by the high prevalence of chronic diseases and the increasing trend of self-administration of biologic therapies. Patients are prioritizing devices that enhance treatment adherence, reduce hospital visits, and provide safe, accurate dosing. The growing adoption of smart pen injectors and prefilled syringes, combined with mobile app integration for dose tracking and remote monitoring, further propels the market. Moreover, partnerships between device manufacturers and pharmaceutical companies are accelerating the development of therapy-specific devices, driving adoption. Regulatory support for home-based therapy and patient education programs significantly contribute to market growth. The U.S. emphasis on digital healthcare solutions and connected devices continues to strengthen the market’s expansion.

Europe Injection Devices Market Insight

The Europe injection devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing autoimmune and rare disease prevalence, as well as supportive reimbursement policies. Rising awareness of self-administration and homecare therapy adoption fosters demand for safe and easy-to-use injection devices. European healthcare providers are adopting connected auto-injectors and prefilled syringes to improve patient compliance and treatment outcomes. The growth of chronic disease management programs and hospital initiatives promoting patient-centric care further boost market penetration. In addition, the increasing incorporation of injection devices in both new healthcare setups and treatment protocols contributes to sustained adoption. Countries across Europe are witnessing expansion across hospitals, clinics, and homecare segments.

U.K. Injection Devices Market Insight

The U.K. injection devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising chronic and rare disease prevalence and a strong focus on patient-centric therapies. Concerns regarding treatment adherence and hospital resource optimization encourage healthcare providers and patients to adopt prefilled syringes, pen injectors, and wearable devices. The U.K.’s robust healthcare infrastructure, combined with high patient awareness and digital healthcare initiatives, is expected to continue stimulating market growth. Moreover, telemedicine integration and home-based biologic administration programs are expanding opportunities for device adoption. The availability of user-friendly, connected devices further enhances treatment convenience. Regulatory support and reimbursement policies strengthen the market’s overall growth trajectory.

Germany Injection Devices Market Insight

The Germany injection devices market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of biologic therapies and home-based administration. Germany’s advanced healthcare infrastructure and emphasis on patient safety promote the adoption of prefilled syringes, auto-injectors, and smart pen devices. Integration of connected injection systems with hospital IT platforms and mobile applications is becoming increasingly prevalent, enhancing monitoring and adherence. The emphasis on precision, safety, and reliability aligns with local patient expectations and physician preferences. Furthermore, initiatives promoting self-administration of chronic therapies in clinics and homecare settings drive market expansion. Market players are focusing on innovative, eco-conscious, and ergonomic devices to meet Germany’s high standards.

Asia-Pacific Injection Devices Market Insight

The Asia-Pacific injection devices market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising prevalence of autoimmune and hormonal disorders, increasing healthcare spending, and growing adoption of biologic therapies in homecare settings. Rapid urbanization, rising disposable incomes, and growing awareness of self-injection therapies are fostering market growth. Moreover, government initiatives promoting digital healthcare, telemedicine, and patient-centric programs are accelerating adoption. Countries such as China, Japan, and India are witnessing technological advancements in injection devices, including wearable and connected pens. Increasing local manufacturing and affordability are making devices more accessible to a broader patient base. The region’s strong focus on chronic disease management and decentralized healthcare delivery continues to propel the market.

Japan Injection Devices Market Insight

The Japan injection devices market is gaining momentum due to high chronic disease prevalence, an aging population, and growing demand for convenient self-administration solutions. Patients and healthcare providers prioritize devices that simplify biologic therapy, improve adherence, and enable remote monitoring. The integration of connected pen injectors and wearable devices with telemedicine platforms is fueling adoption. Japan’s technology-driven healthcare ecosystem supports innovations in ergonomic, safe, and precise devices. Growing awareness of homecare treatment options and patient education programs further stimulate market growth. The adoption of advanced, connected injection devices for both residential and clinical use continues to expand in response to patient-centric care models.

India Injection Devices Market Insight

The India injection devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the increasing prevalence of chronic diseases, rapid urbanization, and growing middle-class population. Patients are increasingly adopting prefilled syringes, pen injectors, and wearable devices for home-based biologic therapy. Government initiatives promoting digital health, smart cities, and telemedicine support adoption. Affordable device options, combined with the presence of local manufacturers, make biologic therapy more accessible. The rising awareness of self-administration, coupled with growing healthcare infrastructure, is further fueling market growth. India is becoming a significant hub for biologic therapy delivery innovations, supporting regional expansion.

Injection Devices for Biological Drugs Market Share

The Injection Devices for Biological Drugs industry is primarily led by well-established companies, including:

- Baxter (U.S.)

- BD (U.S.)

- Gerresheimer AG (Germany)

- Eli Lilly and Company (U.S.)

- Pfizer Inc. (U.S.)

- SCHOTT AG (Germany)

- Sandoz International GmbH (Switzerland)

- Terumo Corporation (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Crossject SA (France)

- AptarGroup, Inc. (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Antares Pharma, Inc. (U.S.)

- Sensile Medical AG (Switzerland)

- SHL Medical AG (Switzerland)

- ApiJect Systems Corp. (U.S.)

- Ypsomed AG (Switzerland)

- Nemera (France)

- E3D Elcam Drug Delivery Devices Ltd. (Israel)

- Debiotech SA (Switzerland)

What are the Recent Developments in Global Injection Devices for Biological Drugs Market?

- In October 2025, West Pharmaceutical Services launched the West Synchrony™ Prefillable Syringe (PFS) System at CPHI Worldwide. Designed to streamline syringe selection and accelerate regulatory submission for biologics and vaccines, this system‑level solution enhances integration and reliability in drug delivery components, supporting efficient development and supply of injectable biologic therapies

- In September 2025, Apiject Systems submitted an NDA (New Drug Application) to the U.S. FDA for its innovative prefilled single-dose injection device using Blow-Fill-Seal (BFS) technology, aimed at scalable and affordable biologic drug delivery. The submission represents a key step toward regulatory approval of a new class of prefilled injection systems that combine BFS liquid packaging and precision injection molding

- In July 2025, Becton, Dickinson and Company (BD) announced the first pharma‑sponsored clinical trial using its BD Libertas™ Wearable Injector technology for subcutaneous delivery of complex biologics. This marks a key advancement in drug‑device combination products, enabling potential shifts from hospital infusions to more convenient self‑injection at home with high‑viscosity biologics, emphasizing patient‑centric treatment delivery

- In May 2025, Sandoz commercially launched PYZCHIVA® (ustekinumab) autoinjector in Europe, making it the first commercially available biosimilar ustekinumab autoinjector in the region. This launch provides a self‑administered treatment option for chronic inflammatory diseases such as plaque psoriasis and Crohn’s disease, enhancing convenience and adherence for patients requiring long‑term biologic therapy

- In October 2024, BD and Ypsomed announced a strategic collaboration to advance self‑injection systems for high‑viscosity biologics. This initiative integrates BD’s Neopak™ XtraFlow™ glass prefillable syringe with Ypsomed’s YpsoMate® 2.25 autoinjector platform, aiming to expand delivery options for biologic drugs with challenging viscosity profiles and enhance patient self‑administration capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.