Global Instant Tea Premix Market

Market Size in USD Billion

CAGR :

%

USD

2.11 Billion

USD

3.57 Billion

2024

2032

USD

2.11 Billion

USD

3.57 Billion

2024

2032

| 2025 –2032 | |

| USD 2.11 Billion | |

| USD 3.57 Billion | |

|

|

|

|

Instant Tea Premix Market Size

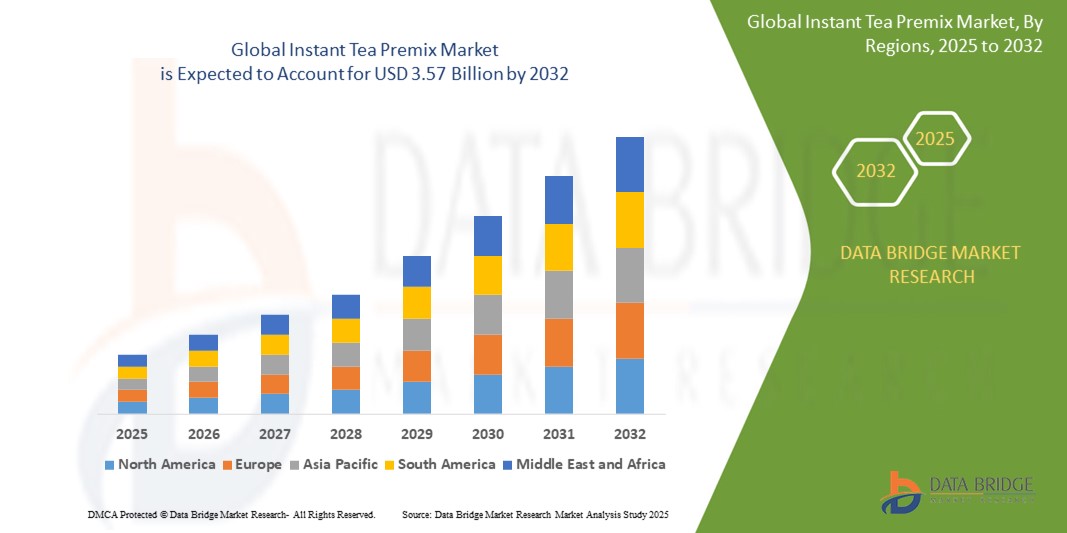

- The global instant tea premix market size was valued at USD 2.11 billion in 2024 and is expected to reach USD 3.57 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is primarily driven by the increasing demand for convenient, ready-to-drink tea solutions, rising consumer preference for flavored and health-oriented beverages, and the growing popularity of on-the-go consumption

- In addition, the expansion of e-commerce platforms and increasing urbanization are boosting the adoption of instant tea premixes, particularly in residential and commercial settings, further accelerating market growth

Instant Tea Premix Market Analysis

- Instant tea premixes, offering quick preparation and a variety of flavors, are becoming essential in modern beverage consumption due to their convenience, portability, and ability to cater to diverse consumer tastes

- The rising demand for instant tea premixes is fueled by busy lifestyles, growing health consciousness, and a preference for innovative tea flavors, such as cardamom, ginger, and masala

- Asia-Pacific dominated the instant tea premix market with the largest revenue share of 42.5% in 2024, driven by a strong tea-drinking culture, high population density, and increasing disposable incomes in countries such as India and China

- North America is expected to be the fastest-growing region during the forecast period due to rising consumer interest in specialty beverages, health-focused products, and the growing influence of global food trends

- The cardamom tea premix segment dominated the largest market revenue share of 30% in 2024, driven by its distinct aromatic flavor, digestive benefits, and consumer preference for refreshing, health-oriented beverages. Cardamom’s antioxidant and anti-inflammatory properties further enhance its appeal

Report Scope and Instant Tea Premix Market Segmentation

|

Attributes |

Instant Tea Premix Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Instant Tea Premix Market Trends

“Increasing Integration of Health-Focused Ingredients and Eco-Friendly Packaging”

- The global instant tea premix market is experiencing a significant trend toward incorporating health-focused ingredients, such as green tea extracts, herbal blends, and low-calorie or sugar-free options, to cater to health-conscious consumers

- These products are enriched with vitamins, antioxidants, and functional ingredients such as ginger and cardamom, which are marketed for benefits such as improved metabolism, immunity, and weight management

- Companies are leveraging advanced technologies, such as AI-driven consumer analytics, to develop personalized flavor profiles and innovative blends tailored to regional preferences, enhancing consumer appeal

- There is a growing emphasis on eco-friendly and sustainable packaging, with brands adopting recyclable materials and subscription-based models to improve brand loyalty and reduce environmental impact

- The rise of e-commerce platforms and digital marketing strategies, including influencer collaborations, is further boosting market visibility and accessibility, particularly for premium and organic tea premixes

- This trend is enhancing the value proposition of instant tea premixes, making them more appealing to both residential consumers and commercial sectors such as offices and cafes

Instant Tea Premix Market Dynamics

Driver

“Rising Demand for Convenient and Ready-to-Drink Beverages”

- Increasing consumer demand for convenient, ready-to-drink tea solutions, driven by busy lifestyles and urbanization, is a major driver for the global instant tea premix market

- Instant tea premixes offer quick preparation by simply adding hot water, making them ideal for on-the-go consumption in residential and commercial settings, such as offices, restaurants, and vending machines

- The growing popularity of tea as a healthful beverage, coupled with the availability of diverse flavors such as cardamom, masala, and lemon grass, is fueling market growth

- The proliferation of e-commerce and advancements in distribution channels, such as hypermarkets/supermarkets and online stores, are enhancing product accessibility, particularly in the Asia-Pacific region, which dominates the market

- Manufacturers are increasingly offering premixes in various forms and types to meet diverse consumer preferences and cultural tea-drinking traditions

Restraint/Challenge

“High Production Costs and Raw Material Price Volatility”

- The high initial costs associated with producing instant tea premixes, including sourcing quality tea extracts, flavorings, and packaging, can be a significant barrier, particularly for small-scale manufacturers in emerging markets

- Fluctuations in raw material prices, driven by factors such as supply chain disruptions, political instability, and rising fuel costs, increase production costs and impact pricing strategies, potentially deterring cost-sensitive consumers

- Data security and regulatory compliance concerns related to consumer data collected through e-commerce platforms and subscription services pose challenges, as companies must adhere to varying regional data protection laws

- The fragmented regulatory landscape across countries, particularly regarding food safety and labeling standards, complicates operations for global manufacturers and may limit market expansion

- Competition from traditional tea brewing methods and the rising popularity of coffee in some regions could hinder the growth of the instant tea premix market, especially where tea culture is less prevalent

Instant Tea Premix market Scope

The market is segmented on the basis of product, application, form, nature, type, and sales channel.

- By Product

On the basis of product, the global instant tea premix market is segmented into cardamom tea premix, ginger tea premix, masala tea premix, lemon tea premix, plain tea premix, and lemon grass tea premix. The cardamom tea premix segment dominated the largest market revenue share of 30% in 2024, driven by its distinct aromatic flavor, digestive benefits, and consumer preference for refreshing, health-oriented beverages. Cardamom’s antioxidant and anti-inflammatory properties further enhance its appeal.

The lemon grass tea premix segment is expected to witness the fastest growth rate of 7.4% from 2025 to 2032, fueled by increasing consumer demand for herbal and wellness-focused beverages. It’s refreshing taste and perceived health benefits, such as stress relief and immune system support, drive adoption, particularly in health-conscious markets.

- By Application

On the basis of application, the global instant tea premix market is segmented into residential and commercial. The commercial segment dominated the market with a revenue share of approximately 60% in 2024, driven by the widespread use of instant tea premixes in offices, cafes, and restaurants due to their convenience, quick preparation, and ability to cater to diverse consumer tastes.

The residential segment is anticipated to experience robust growth from 2025 to 2032, propelled by increasing consumer preference for convenient, ready-to-drink beverages at home, especially among busy households and health-conscious individuals seeking quick, flavorful tea options.

- By Form

On the basis of form, the global instant tea premix market is segmented into powder, paste, and granules. The powder segment held the largest market revenue share of 50% in 2023, attributed to its ease of preparation, long shelf life, and ability to incorporate diverse flavors and functional ingredients, catering to consumer demand for hassle-free tea options.

The paste segment is expected to witness the fastest growth rate of 7.7% from 2025 to 2032, driven by its versatility in blending with milk or water and its appeal in markets seeking premium, customizable tea experiences with enhanced flavor profiles.

- By Nature

On the basis of nature, the global instant tea premix market is segmented into organic tea premixes and conventional tea premixes. The conventional tea premixes segment dominated with a market revenue share of 70% in 2024, owing to their widespread availability, lower cost, and established consumer base in both developed and emerging markets.

The organic tea premixes segment is anticipated to witness significant growth from 2025 to 2032, driven by rising consumer awareness of health and wellness, preference for natural and chemical-free products, and willingness to pay a premium for sustainably sourced ingredients.

- By Type

On the basis of type, the global instant tea premix market is segmented into no sugar tea premixes and with sugar tea premixes. The with sugar tea premixes segment held the largest market revenue share of 65% in 2024, driven by consumer preference for sweetened, ready-to-drink tea options that align with traditional tea-drinking cultures, particularly in Asia-Pacific.

The no sugar tea premixes segment is expected to witness rapid growth of 7.5% from 2025 to 2032, fueled by increasing health consciousness, rising demand for low-calorie beverages, and growing awareness of obesity-related health issues among consumers globally.

- By Sales Channel

On the basis of sales channel, the global instant tea premix market is segmented into hypermarket/supermarket, convenience store, drug stores, specialty stores, traditional grocery store, and online stores. The hypermarket/supermarket segment dominated with a market revenue share of 40% in 2024, driven by their extensive product availability, competitive pricing, and widespread presence in urban and semi-urban areas.

The online stores segment is anticipated to witness the fastest growth from 2025 to 2032, propelled by the increasing penetration of e-commerce platforms, convenience of home delivery, and growing consumer preference for exploring diverse flavors and brands online.

Instant Tea Premix Market Regional Analysis

- Asia-Pacific dominated the instant tea premix market with the largest revenue share of 42.5% in 2024, driven by a strong tea-drinking culture, high population density, and increasing disposable incomes in countries such as India and China

- North America is expected to be the fastest-growing region during the forecast period due to rising consumer interest in specialty beverages, health-focused products, and the growing influence of global food trends

U.S. Instant Tea Premix Market Insight

The U.S. instant tea premix market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer preference for health-oriented beverages offering benefits such as antioxidants and low calories. The trend toward customization, with flavors such as cardamom and ginger, and increasing adoption of organic premixes drive market expansion. The availability of instant tea premixes in supermarkets, hypermarkets, and online stores, combined with a focus on no-sugar options, supports sustained growth.

Europe Instant Tea Premix Market Insight

The European instant tea premix market is expected to witness significant growth, driven by a strong tea culture and increasing demand for convenient beverage solutions. Consumers prioritize premixes that offer health benefits, such as ginger and lemongrass, for their digestive and wellness properties. Growth is prominent in both residential and commercial applications, with countries such as Germany and the U.K. showing notable uptake due to rising health consciousness and urban lifestyles.

U.K. Instant Tea Premix Market Insight

The U.K. market for instant tea premixes is expected to witness rapid growth, driven by demand for convenient and health-focused beverages in urban settings. Increased interest in flavors such as masala and lemon tea, along with rising awareness of organic and no-sugar options, encourages adoption. Evolving consumer preferences for ready-to-drink beverages and the expansion of online sales channels further boost market growth.

Germany Instant Tea Premix Market Insight

Germany is expected to witness significant growth in the instant tea premix market, attributed to its strong beverage consumption culture and focus on health and wellness. Consumers prefer technologically advanced premixes, such as organic and no-sugar variants, that align with health-conscious trends. The integration of instant tea premixes in commercial settings and the availability of diverse flavors such as cardamom and ginger through specialty stores and e-commerce platforms support sustained market growth

Asia-Pacific Instant Tea Premix Market Insight

The Asia-Pacific region dominates the global instant tea premix market, driven by a strong tea culture, expanding beverage industry, and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of health benefits, such as antioxidants in green tea premixes, and demand for convenient, ready-to-drink options boost market growth. Government initiatives promoting healthier beverage choices and the availability of diverse sales channels, including hypermarkets and online stores, further enhance market penetration.

Japan Instant Tea Premix Market Insight

Japan’s instant tea premix market is expected to witness rapid growth due to strong consumer preference for high-quality, health-oriented premixes that enhance convenience and wellness. The presence of major beverage manufacturers and the integration of premixes in both OEM and aftermarket channels accelerate market growth. Rising demand for organic and no-sugar variants, particularly in flavors such as lemon grass and plain tea, contributes to market expansion.

China Instant Tea Premix Market Insight

China holds the largest share of the Asia-Pacific instant tea premix market, propelled by rapid urbanization, increasing beverage consumption, and growing demand for convenient and health-focused solutions. The country’s expanding middle class and focus on innovative flavors, such as masala and ginger, support the adoption of instant tea premixes. Strong domestic manufacturing capabilities and competitive pricing, along with widespread availability through e-commerce and hypermarkets, enhance market accessibility.

Instant Tea Premix Market Share

The instant tea premix industry is primarily led by well-established companies, including:

- Unilever (U.K)

- Gourmesso (U.S)

- Harney & Sons Fine Teas (U.S)

- Dualit (U.K)

- Nestlé SA (Switzerland)

- Ippodo Tea Co. Ltd. (China)

- Tranquini (U.S)

- Chillbev (U.S)

- Phi Drinks, Inc.(U.S)

- BevNet (U.S)

- ITO EN LTD. (Japan)

- The Republic of Tea (U.S)

- Dunkin Brands Inc. (U.S)

- Wagh Bakri Tea Group (India)

- Keurig Green Mountain, Inc. (U.S)

What are the Recent Developments in Global Instant Tea Premix Market?

- In May 2025, R&M Trading LLC issued an allergy alert and voluntary recall for its R&M Refresher Instant Milk Tea powder products due to the presence of undeclared milk. Although the ingredient list mentioned Whey and Caseinate under the Non-Dairy Creamer section, it failed to explicitly state that these components are milk-derived, posing a serious risk to individuals with milk allergies. The affected products were sold on Amazon between November 2024 and May 2025 in various flavors, including Brown Sugar, Matcha, Taro, and Honeydew. No illnesses were reported, but the incident underscores the critical need for transparent labeling to ensure consumer safety

- In January 2025, a market report on the instant tea premix sector emphasized a sustained push by industry players toward product innovation and strategic partnerships to strengthen market positioning. The report also spotlighted the rising adoption of sustainable packaging and ethically sourced tea leaves, reflecting a broader industry shift toward corporate social responsibility (CSR) and environmental stewardship. These trends align with evolving consumer expectations for transparency, eco-consciousness, and functional beverage solutions, driving companies to integrate green practices into both product development and supply chain strategies

- In March 2024, Wagh Bakri Tea Group launched two new varieties of its instant tea, Wagh Bakri Instant Saffron Tea and Wagh Bakri Instant Express Tea. This product launch strengthened the company's instant premix collection, which already included flavors such as Masala, Elaichi, Ginger, and Lemongrass. This move reflects the company's commitment to providing a wide range of flavors to cater to diverse consumer preferences while offering the convenience of instant preparation

- In March 2024, Assam’s tea industry entered a new era with the commercial production of green-leaf tea powder, marking a significant step toward product innovation and diversification. This initiative also introduced five distinct flavors of tea tablets, crafted from the same powdered base, offering consumers convenient, ready-to-use formats that preserve the essence of Assam’s rich tea heritage. These developments reflect a broader strategy to modernize traditional tea offerings, cater to evolving consumer preferences, and tap into health-conscious and on-the-go markets. The move underscores Assam’s commitment to value addition and global competitiveness in the tea sector

- In November 2023, Tata Consumer Products Limited launched Tata Tea Gold Care, a health-forward instant tea premix designed to blend Ayurvedic wellness with modern convenience. This ready-to-drink tea is fortified with essential vitamins—D, B6, B9, and B12—and enriched with natural ingredients such as ginger, tulsi, cardamom, brahmi, and mulethi, known for their immunity-boosting and digestive benefits. The product caters to growing consumer demand for functional beverages that support daily vitality while offering the ease of instant preparation. This launch reflects a broader industry shift toward nutritional innovation in everyday beverages

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INSTANT TEA PREMIX MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL INSTANT TEA PREMIX MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL INSTANT TEA PREMIX MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRODUCTION CAPACITY OF KEY MANUFACTURERES

9 BRAND OUTLOOK

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10 GLOBAL INSTANT TEA PREMIX MARKET, BY TYPE , (2022-2031), (USD MILLION)

10.1 OVERVIEW

10.2 PLAIN/REGULAR

10.3 FLAVOUR

10.3.1 FLAVOUR, BY TYPE

10.3.1.1. CARDAMOM TEA

10.3.1.2. GINGER TEA

10.3.1.3. MASALA TEA

10.3.1.4. SAFFRON TEA

10.3.1.5. LEMONGRASS TEA

10.3.1.6. HERBAL TEA

10.3.1.7. OTHERS

11 GLOBAL INSTANT TEA PREMIX MARKET, BY FORM , (2022-2031), (USD MILLION)

11.1 OVERVIEW

11.2 POWDER

11.3 GRANULES

12 GLOBAL INSTANT TEA PREMIX MARKET, BY NATURE, (2022-2031), (USD MILLION)

12.1 OVERVIEW

12.2 ORGANIC

12.3 CONVENTIONAL

13 GLOBAL INSTANT TEA PREMIX MARKET, BY CATEGORY, (2022-2031), (USD MILLION)

13.1 OVERVIEW

13.2 SUGAR-FREE

13.3 WITH SUGAR

14 GLOBAL INSTANT TEA PREMIX MARKET, BY SALES CHANNEL, (2022-2031), (USD MILLION)

14.1 OVERVIEW

14.2 ONLINE

14.2.1 ONLINE, BY SALES CHANNEL

14.2.1.1. COMPANY OWN WENSITE

14.2.1.2. 3RD PARTY WEBSITE

14.3 OFFLINE

14.3.1 OFFLINE, BY SALES CHANNEL

14.3.1.1. HYPERMARKET/SUPERMARKET

14.3.1.2. CONVENIENCE STORE

14.3.1.3. SPECIALTY STORES

14.3.1.4. TRADITIONAL GROCERY STORE

15 GLOBAL INSTANT TEA PREMIX MARKET, BY END USER, (2022-2031), (USD MILLION)

15.1 OVERVIEW

15.2 RESIDENTIAL USERS

15.2.1 RESIDENTIAL USERS, BY TYPE

15.2.1.1. PLAIN/REGULAR

15.2.1.2. FLAVOUR

15.3 COMMERCIAL USERS

15.3.1 COMMERCIAL USERS, BY END USER

15.3.1.1. OFFICES AND WORKPLACES

15.3.1.2. HOTELS AND RESTAURANTS

15.3.1.3. CAFES AND COFFEE SHOPS

15.3.1.4. CANTEENS AND VENDING MACHINES

15.3.1.5. EVENT AND CATERING SERVICES

15.3.2 COMMERCIAL USERS, BY TYPE

15.3.2.1. PLAIN/REGULAR

15.3.2.2. FLAVOUR

15.4 TRAVEL AND TOURISM SECTOR

15.4.1 TRAVEL AND TOURISM SECTOR, BY END USER

15.4.1.1. AIRLINES AND RAILWAYS

15.4.1.2. TRAVEL LOUNGES

15.4.2 TRAVEL AND TOURISM SECTOR, BY TYPE

15.4.2.1. PLAIN/REGULAR

15.4.2.2. FLAVOUR

15.5 OTHERS

15.5.1 RESIDENTIAL USERS, BY TYPE

15.5.1.1. PLAIN/REGULAR

15.5.1.2. FLAVOUR

16 GLOBAL INSTANT TEA PREMIX MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS & PARTNERSHIP

16.8 REGULATORY CHANGES

17 GLOBAL INSTANT TEA PREMIX MARKET, BY GEOGRAPHY

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 U.K.

17.2.3 ITALY

17.2.4 FRANCE

17.2.5 SPAIN

17.2.6 SWITZERLAND

17.2.7 NETHERLANDS

17.2.8 BELGIUM

17.2.9 RUSSIA

17.2.10 TURKEY

17.2.11 REST OF EUROPE

17.3 ASIA-PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 SINGAPORE

17.3.7 THAILAND

17.3.8 INDONESIA

17.3.9 MALAYSIA

17.3.10 PHILIPPINES

17.3.11 REST OF ASIA-PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 UAE

17.5.3 SAUDI ARABIA

17.5.4 KUWAIT

17.5.5 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL INSTANT TEA PREMIX MARKET, SWOT & DBMR ANALYSIS

19 GLOBAL INSTANT TEA PREMIX MARKET, COMPANY PROFILES

19.1 INTERNATIONAL COFFEE & TEA, LLC

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHICAL PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 UNILEVER

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHICAL PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 GOURMESSO

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHICAL PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 ONQANET TECHNOLOGIES PVT LTD

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHICAL PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 HARNEY & SONS FINE TEAS

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHICAL PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 CHAICHAI BY GIRNAR

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHICAL PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENTS

19.7 NESTLÉ

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHICAL PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENTS

19.8 TATA CONSUMER PRODUCTS LIMITED

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHICAL PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENTS

19.9 WAGH BAKRI TEA GROUP

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHICAL PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENTS

19.1 ITO EN

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHICAL PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENTS

19.11 SUNSHINE TEAHOUSE PRIVATE LIMITED

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHICAL PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENTS

19.12 SOCIETY TEA

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHICAL PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENTS

19.13 VENDING UPDATES INDIA PVT. LTD.

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHICAL PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENTS

19.14 SENSO FOODS PRIVATE LIMITED

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHICAL PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENTS

19.15 DHONDHEENAA PVT LTD

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHICAL PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENTS

19.16 SAMAARA

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHICAL PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENTS

19.17 NARASU'S COFFEE COMPANY

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHICAL PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENTS

19.18 NEEL BEVERAGES

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 GEOGRAPHICAL PRESENCE

19.18.4 PRODUCT PORTFOLIO

19.18.5 RECENT DEVELOPMENTS

19.19 CHIA-TZA-TENG INTERNATIONAL CORP

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 GEOGRAPHICAL PRESENCE

19.19.4 PRODUCT PORTFOLIO

19.19.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 RELATED REPORTS

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Instant Tea Premix Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Instant Tea Premix Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Instant Tea Premix Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.