Global Insulated Cooler Market

Market Size in USD Million

CAGR :

%

USD

797.25 Million

USD

1,369.83 Million

2024

2032

USD

797.25 Million

USD

1,369.83 Million

2024

2032

| 2025 –2032 | |

| USD 797.25 Million | |

| USD 1,369.83 Million | |

|

|

|

|

Insulated Cooler Market Size

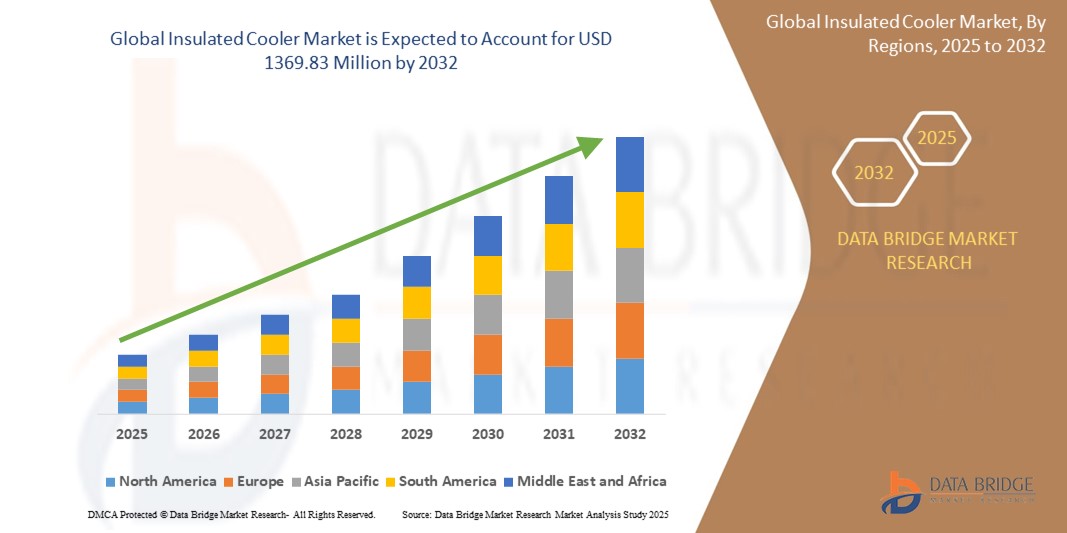

- The global insulated cooler market size was valued at USD 797.25 million in 2024 and is expected to reach USD 1369.83 million by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is largely fuelled by the rising demand for portable food and beverage storage solutions across outdoor recreational activities such as camping, picnics, and fishing, coupled with the growing popularity of road trips and tailgating culture

- In addition, the increasing need for cold chain logistics in food delivery, pharmaceuticals, and e-commerce sectors is accelerating the adoption of insulated coolers in both consumer and commercial applications

Insulated Cooler Market Analysis

- The insulated cooler market is undergoing rapid innovation in product design and material technology, with manufacturers focusing on lightweight, durable, and high-performance coolers offering extended ice retention

- Market players are expanding their product lines with smart coolers integrated with Bluetooth speakers, solar-powered charging ports, and temperature control features, catering to tech-savvy consumers seeking convenience and functionality

- North America dominated the insulated cooler market with the largest revenue share of 39.8% in 2024, fuelled by a high rate of outdoor recreational activities and the strong presence of leading cooler manufacturers

- Asia-Pacific region is expected to witness the highest growth rate in the global insulated cooler market, driven by increasing participation in outdoor recreational activities, rising disposable incomes, and growing awareness regarding food preservation and hygiene during travel

- The hard cooler segment dominated the market in 2024, owing to its robust structure, longer cooling duration, and suitability for rugged outdoor use. These coolers are preferred for long trips, fishing, hunting, and tailgating due to their durability and ability to retain ice for several days

Report Scope and Insulated Cooler Market Segmentation

|

Attributes |

Insulated Cooler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Rising Demand for Eco-Friendly, Sustainable Insulated Coolers Growing Use in Pharmaceutical Cold Chain and Vaccine Transport |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insulated Cooler Market Trends

“Rising Demand for Multi-Functional and Smart Coolers”

- Consumers are increasingly seeking coolers with integrated features such as Bluetooth speakers, USB charging ports, solar power, and LED lights for enhanced outdoor convenience

- The demand is largely fueled by millennials and Gen Z, who prefer innovative, tech-driven products for leisure and travel

- Multi-functional coolers are becoming popular for activities such as tailgating, camping, and beach outings where entertainment and utility are both desired

- The integration of smart features also supports commercial applications, including food delivery and mobile vending where temperature control and power access are crucial

- For instance, Coolest Cooler, with built-in blender and speaker, and GoSun Chillest, with solar power and refrigeration, reflect the market's shift toward all-in-one cooler systems

Insulated Cooler Market Dynamics

Driver

“Growing Popularity of Outdoor Recreational Activities”

- A significant rise in outdoor leisure pursuits such as hiking, camping, and road-tripping has increased the demand for reliable, portable cooling solutions

- Insulated coolers are essential for maintaining the freshness and safety of food and beverages during extended outdoor activities

- Higher disposable income, particularly in urban areas and developing nations, is driving the purchase of recreational gear, including premium coolers

- Retail and e-commerce platforms are boosting access to advanced and specialized coolers that cater to niche outdoor needs

- For instance, In 2023, the U.S. outdoor recreation industry crossed USD 1 trillion in value, reflecting growing investment in outdoor equipment such as insulated coolers

Restraint/Challenge

“High Cost of Premium Coolers and Limited Product Differentiation”

- Advanced coolers with high insulation efficiency and added tech features come at a premium price, limiting adoption in cost-sensitive regions

- Many coolers across brands offer similar cooling capabilities, which makes it difficult for consumers to distinguish products beyond branding

- In developing countries, lower purchasing power leads consumers to opt for generic or local alternatives with basic insulation

- The saturation of look-alike products in the market dilutes brand loyalty and places pressure on global leaders to constantly innovate

- For instance, While YETI coolers dominate the high-end U.S. market, they face increasing competition from budget brands in Asia offering similar performance at lower costs

Insulated Cooler Market Scope

The insulated cooler market is segmented into four notable segments based on capacity, product, carrying method, and material type.

• By Capacity

On the basis of capacity, the insulated cooler market is segmented into below 25 quart, 26–75 quart, 76–150 quart, and above 150 quart. The 26–75 quart segment held the largest market revenue share in 2024, driven by its optimal size for recreational use, including picnics, road trips, and camping. This capacity offers a balance between portability and storage volume, making it ideal for small groups and families. The segment continues to gain popularity due to its compatibility with vehicle storage, ease of handling, and efficient temperature retention for day-long use.

The above 150 quart segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand from commercial and professional users such as catering services, event organizers, and fishermen. This size segment is particularly valued for its ability to store larger volumes of perishables and ice for extended durations.

• By Product

On the basis of product, the market is segmented into hard coolers and soft coolers. The hard cooler segment dominated the market in 2024, owing to its robust structure, longer cooling duration, and suitability for rugged outdoor use. These coolers are preferred for long trips, fishing, hunting, and tailgating due to their durability and ability to retain ice for several days.

The soft cooler segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its lightweight design, compact storage capability, and popularity among urban users for short outings, daily use, and portability during travel or office commutes.

• By Carrying Method

Based on carrying method, the insulated cooler market is segmented into side handles, lid handle, shoulder strap, and wheel. The side handle segment led the market in 2024, favored for its balanced grip and two-person carrying ease, especially for medium and large coolers. Side handles are widely integrated into most cooler designs due to their utility and simplicity.

The wheel segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for mobility and convenience. Wheeled coolers are ideal for beaches, campsites, and events, reducing manual strain and supporting easy transport across various terrains.

• By Material Type

On the basis of material type, the market is segmented into plastic, metal, fabrics, and rubber. The plastic segment captured the largest market share in 2024, driven by its lightweight, cost-effective, and durable properties, making it a top choice for both hard and soft coolers. Plastic-based coolers offer a good balance of insulation and impact resistance for everyday use.

The fabric segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing demand for soft coolers. Fabrics such as polyester and nylon provide flexibility, are easy to clean, and are suitable for collapsible or foldable cooler designs, making them ideal for casual and short-term applications.

Insulated Cooler Market Regional Analysis

- North America dominated the insulated cooler market with the largest revenue share of 39.8% in 2024, fuelled by a high rate of outdoor recreational activities and the strong presence of leading cooler manufacturers.

- Consumers in this region are increasingly adopting insulated coolers for camping, fishing, tailgating, and sporting events, with demand supported by growing awareness of food safety and temperature control.

- The market is further driven by the popularity of premium hard-sided coolers and innovations in ice retention technology, with robust e-commerce networks facilitating widespread product availability.

U.S. Insulated Cooler Market Insight

The U.S. insulated cooler market held the highest share of 82% in 2024 within North America, owing to the country’s well-established outdoor culture and consumer spending on leisure gear. The demand for coolers that can retain ice for extended durations is boosting sales, especially for high-capacity and wheeled variants. Product launches by key brands tailored for U.S. consumers—such as Yeti and Igloo—along with customized solutions for fishing, hunting, and off-road adventures, are reinforcing market dominance.

Europe Insulated Cooler Market Insight

The Europe insulated cooler market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising interest in sustainable travel, road trips, and nature tourism. Increasing demand for lightweight, compact, and eco-friendly coolers is shaping product development. The trend towards mobile lifestyles, including van living and car camping, is also supporting the adoption of soft-sided and multi-use coolers across the region.

U.K. Insulated Cooler Market Insight

The U.K. insulated cooler market is expected to witness the fastest growth rate from 2025 to 2032, with consumers increasingly participating in outdoor picnics, hiking, and festivals. The need for portable and reusable cold storage solutions is expanding, especially among environmentally conscious consumers. Strong retail penetration and the presence of camping and outdoor specialty stores are also enhancing market accessibility and product variety.

Germany Insulated Cooler Market Insight

The Germany insulated cooler market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising environmental awareness and a strong focus on product quality and performance. Demand for BPA-free, recyclable, and high-performance materials is rising. Germany’s affinity for organized camping, family outings, and sports events is also fueling demand for both soft and hard coolers, particularly those with high durability and long-lasting ice retention.

Asia-Pacific Insulated Cooler Market Insight

The Asia-Pacific insulated cooler market is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing middle-class population, increasing disposable incomes, and rapid urbanization. Countries such as China, India, and Australia are witnessing a surge in outdoor leisure activities, and insulated coolers are becoming a lifestyle accessory for domestic travel and weekend outings. In addition, the region’s strong manufacturing base and export capabilities are expanding access to affordable, high-quality products.

Japan Insulated Cooler Market Insight

The Japan’s insulated cooler market is expected to witness the fastest growth rate from 2025 to 2032, due to a growing preference for compact and high-quality coolers for bento storage, camping, and seasonal festivals. Consumers in Japan value space-saving, multifunctional, and minimalistic cooler designs. The integration of advanced insulation technologies and the use of sleek, eco-conscious materials appeal to the country’s design-sensitive population, further supporting market growth.

China Insulated Cooler Market Insight

The China accounted for the largest revenue share in the Asia-Pacific insulated cooler market in 2024, supported by its strong manufacturing infrastructure and increasing consumer spending on outdoor lifestyle products. The shift toward health-conscious travel, picnics, and vehicle-based tourism is driving market demand. Local brands are introducing competitively priced and customizable coolers, further strengthening China’s position as both a manufacturing hub and a major consumer market.

Insulated Cooler Market Share

The Insulated Cooler industry is primarily led by well-established companies, including:

- American Outdoors (U.S.)

- Bison Coolers (U.S.)

- Engel Coolers (U.S.)

- Grizzly Coolers (U.S.)

- Igloo Products Corp. (U.S.)

- Pelican Products, Inc. (U.S.)

- POLAR BEAR COOLERS (U.S.)

- Rubbermaid (U.S.)

- STANLEY (U.S.)

- The Coleman Company, Inc. (U.S.)

- YETI COOLERS, LLC. (U.S.)

- Koolatron (Canada)

- Pinnacle (India)

- Cordova Outdoors (U.S.)

- Rugged Road Outdoors. (U.S.)

- Kelty (U.S.)

Latest Developments in Global Insulated Cooler Market

- In April 2023, Oyster introduced a product innovation by launching the Tempo cooler, featuring a patented integrated vacuum insulation system made from recyclable aluminum and chemical-free silica. This development is aimed at delivering superior thermal efficiency while aligning with sustainability goals. The use of eco-friendly materials positions the brand to attract environmentally conscious consumers, potentially reshaping industry standards in sustainable cooler design.

- In 2023, Coleman rolled out a new line of high-performance insulated coolers, specifically designed to cater to demanding outdoor activities such as camping, fishing, and tailgating. This product expansion enhances their portfolio in the recreational segment, offering increased durability and cooling performance. The launch is expected to strengthen Coleman's market presence and address the growing consumer need for versatile, rugged cooler solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Insulated Cooler Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Insulated Cooler Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Insulated Cooler Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.