Global Insulin Glargine Market

Market Size in USD Billion

CAGR :

%

USD

7.46 Billion

USD

12.54 Billion

2025

2033

USD

7.46 Billion

USD

12.54 Billion

2025

2033

| 2026 –2033 | |

| USD 7.46 Billion | |

| USD 12.54 Billion | |

|

|

|

|

Insulin Glargine Market Size

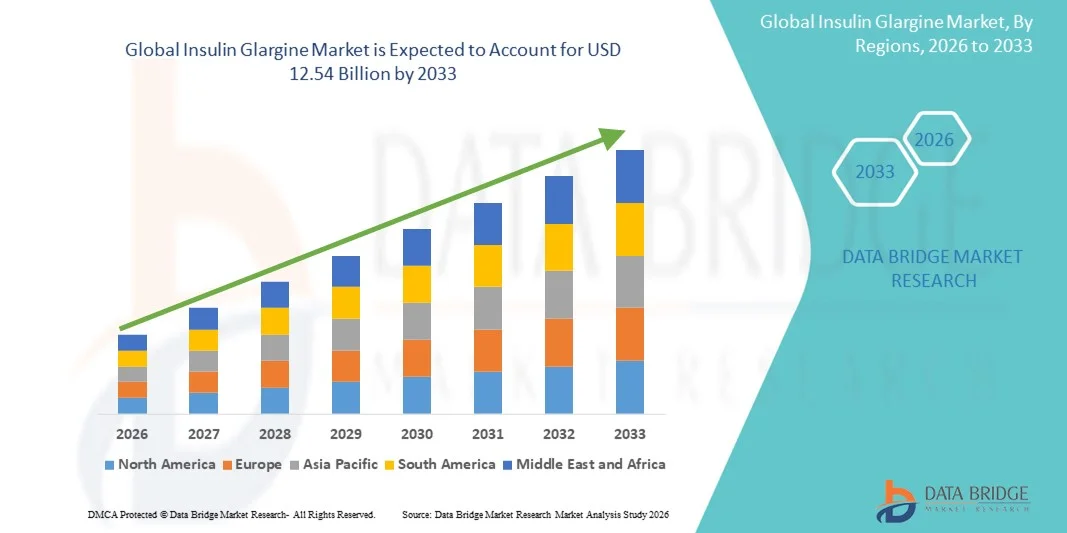

- The global insulin glargine market size was valued at USD 7.46 billion in 2025 and is expected to reach USD 12.54 billion by 2033, at a CAGR of 6.70% during the forecast period

- The market growth is primarily driven by the increasing prevalence of diabetes worldwide, coupled with rising awareness of the benefits of long-acting insulin analogs in maintaining stable blood glucose levels

- Moreover, advancements in insulin delivery devices, patient-friendly formulations, and government initiatives to improve diabetes care are enhancing accessibility and adoption of insulin glargine, thereby reinforcing its position as a preferred long-acting insulin therapy. These factors collectively are propelling the market expansion and adoption across global healthcare settings

Insulin Glargine Market Analysis

- Insulin glargine, a long-acting basal insulin analog, plays a crucial role in managing blood glucose levels in patients with type 1 and type 2 diabetes, offering steady insulin release and reducing the risk of hypoglycemia compared to intermediate-acting insulins

- The rising prevalence of diabetes, increasing awareness of diabetes management, and growing adoption of advanced insulin therapies are the primary factors driving demand for insulin glargine worldwide

- North America dominated the insulin glargine market with the largest revenue share of 37.9% in 2025, supported by well-established healthcare infrastructure, high patient awareness, and reimbursement policies facilitating access to long-acting insulin therapies, with the U.S. witnessing significant growth due to increased diabetes prevalence and widespread adoption of innovative insulin delivery systems

- Asia-Pacific is expected to be the fastest growing region in the insulin glargine market during the forecast period due to rising diabetes incidence, expanding healthcare access, and increasing government initiatives for diabetes care

- Long-acting insulin segment dominated the insulin glargine market with a market share of 54.8% in 2025, driven by its prolonged glucose control and reduced injection frequency, which improves patient compliance

Report Scope and Insulin Glargine Market Segmentation

|

Attributes |

Insulin Glargine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Insulin Glargine Market Trends

Rising Adoption of Digital Diabetes Management Solutions

- A notable trend in the global insulin glargine market is the increasing integration with digital diabetes management platforms and mobile health applications, enabling real-time monitoring of glucose levels and insulin dosing

- For instance, connected insulin pens and smart monitoring devices allow patients to track insulin glargine usage, receive automated reminders, and share data with healthcare providers for better treatment adherence

- Such digital solutions help optimize glycemic control, reduce dosing errors, and enhance patient engagement, making insulin glargine therapy more effective and personalized

- The integration of insulin glargine therapy with telemedicine platforms enables physicians to remotely adjust treatment plans and monitor patient outcomes, improving accessibility for patients in both urban and rural areas

- This trend towards connected, data-driven diabetes care is reshaping patient expectations for insulin therapy, with companies such as Novo Nordisk and Sanofi investing in smart delivery systems and digital support tools

- The growing demand for insulin glargine solutions that provide real-time insights, dose tracking, and seamless integration with digital health platforms is rising rapidly across global healthcare settings

- Personalized insulin titration programs powered by AI and patient data analytics are emerging, allowing more precise dosing schedules and improved patient adherence

- Collaborative initiatives between pharmaceutical companies and tech firms are increasing, aiming to develop ecosystem-based solutions combining insulin glargine therapy with digital coaching and remote monitoring tools

Insulin Glargine Market Dynamics

Driver

Increasing Prevalence of Diabetes and Awareness of Long-acting Insulin Benefits

- The rising global incidence of diabetes, combined with growing awareness about the advantages of long-acting insulin analogs, is a key driver for insulin glargine market expansion

- For instance, health organizations and campaigns promoting diabetes management and preventive care are boosting patient adoption of insulin glargine therapy worldwide

- Long-acting insulin glargine helps maintain stable blood glucose levels, reduce hypoglycemia risks, and improve patient adherence, increasing its preference over intermediate-acting insulins

- The expanding patient pool, higher diagnosis rates, and increasing physician recommendation of basal insulin analogs are driving consistent market demand

- In addition, improvements in insulin delivery devices, such as prefilled pens and connected pens, further enhance convenience and encourage adoption among patients

- Increasing collaborations between insulin manufacturers and digital health platforms are enhancing patient engagement and monitoring, supporting broader adoption

- Government initiatives promoting diabetes care and subsidizing insulin therapy are contributing to higher accessibility and usage of insulin glargine in various regions

Restraint/Challenge

High Treatment Costs and Access Barriers in Emerging Markets

- The relatively high cost of insulin glargine therapy compared to human insulin and affordability issues in emerging markets pose a significant challenge to market growth

- For instance, patients in low- and middle-income countries may face difficulties accessing long-acting insulin due to price constraints or limited reimbursement coverage

- Inadequate healthcare infrastructure and lack of patient education on proper insulin usage further limit market penetration in certain regions

- These barriers can result in delayed treatment initiation or suboptimal dosing, negatively impacting overall patient outcomes and market expansion

- Overcoming these challenges requires strategies such as the introduction of biosimilar insulin glargine, patient assistance programs, and government initiatives to improve accessibility and reduce treatment costs

- Limited physician familiarity with newer insulin analogs in some regions can hinder prescription rates and slow market growth

- Supply chain disruptions and cold chain dependency for insulin storage pose logistical challenges, affecting availability and consistent patient access in remote areas

Insulin Glargine Market Scope

The market is segmented on the basis of type, application, and distribution channel.

- By Type

On the basis of type, the insulin glargine market is segmented into fast-acting insulin, intermediate-acting insulin, and long-acting insulin. The long-acting insulin segment dominated the market with the largest revenue share of 54.8% in 2025, owing to its ability to maintain stable blood glucose levels over extended periods and reduce the risk of hypoglycemia. Long-acting insulin glargine is preferred by both patients and physicians for basal insulin therapy, providing consistent glucose control and enhancing treatment adherence. Its convenience of once-daily dosing and suitability for combination with other insulin types further strengthen its market position. The widespread clinical preference, ongoing physician recommendations, and patient familiarity with long-acting insulin contribute to sustained dominance in the market. In addition, increasing adoption in hospital and outpatient settings ensures broad market penetration.

The fast-acting insulin segment is expected to witness the fastest growth during the forecast period due to rising demand for flexible mealtime glucose management and combination therapies with long-acting insulin. Fast-acting insulin analogs are increasingly used alongside insulin glargine in basal-bolus regimens, offering rapid postprandial glucose control. Technological advancements in delivery devices, such as prefilled pens and smart injection systems, are enhancing convenience and accuracy, boosting adoption. Patient preference for flexible dosing schedules and integration with digital diabetes management platforms also drives the growth of fast-acting insulin. Furthermore, clinical guidelines promoting individualized therapy regimens support its rapid uptake in emerging and developed markets.

- By Application

On the basis of application, the insulin glargine market is segmented into treatment of type 2 diabetes and treatment of type 1 diabetes. The type 2 diabetes treatment segment dominated the market in 2025 due to the significantly larger patient population affected by type 2 diabetes worldwide. Insulin glargine is commonly prescribed for type 2 diabetes patients who require basal insulin therapy to achieve stable glycemic control when oral hypoglycemic agents are insufficient. The dominance is supported by rising awareness, increasing healthcare access, and strong physician preference for basal insulin therapy in type 2 diabetes. The growing prevalence of lifestyle-related diabetes and government initiatives for diabetes care further reinforce this segment's market share. Moreover, ease of administration, patient adherence, and compatibility with other antidiabetic therapies make insulin glargine a preferred choice.

The type 1 diabetes treatment segment is expected to witness the fastest growth from 2026 to 2033 due to increasing diagnosis rates, improved access to insulin therapy, and growing awareness of the benefits of basal-bolus regimens. Insulin glargine is essential for type 1 diabetes patients as a basal insulin, often combined with rapid-acting insulins for comprehensive glucose management. Advances in patient education, continuous glucose monitoring integration, and digital insulin delivery devices support faster adoption. In addition, rising healthcare expenditure and government programs for type 1 diabetes management are expanding patient access to insulin glargine therapy.

- By Distribution Channel

On the basis of distribution channel, the insulin glargine market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the market in 2025 due to structured diabetes treatment programs, physician prescriptions, and established hospital supply chains. Hospitals remain the primary channel for initiating and monitoring insulin therapy, especially for patients requiring intensive management or education on insulin use. The dominance is further supported by patient trust in hospital-administered therapies and reimbursement policies that favor hospital dispensing. Hospitals also offer integrated follow-up care, ensuring adherence and optimized therapy outcomes, which reinforces the segment's market share.

The online pharmacy segment is expected to witness the fastest CAGR during the forecast period, driven by increasing e-commerce penetration, patient convenience, and home delivery services. Online platforms provide easy access to insulin glargine, especially in remote or underserved areas, and often offer subscription-based services, reminders, and digital support for dosing and storage. The growth of telemedicine and digital health initiatives further accelerates online pharmacy adoption. In addition, competitive pricing, promotional offers, and integration with patient management apps are enhancing the attractiveness of this channel for consumers globally.

Insulin Glargine Market Regional Analysis

- North America dominated the insulin glargine market with the largest revenue share of 37.9% in 2025, supported by well-established healthcare infrastructure, high patient awareness, and reimbursement policies facilitating access to long-acting insulin therapies

- Patients and healthcare providers in the region prioritize consistent glucose control, reduced risk of hypoglycemia, and the convenience of once-daily dosing, making insulin glargine a preferred choice for both type 1 and type 2 diabetes management

- The strong presence of key pharmaceutical players, reimbursement policies, and government initiatives supporting diabetes care further reinforce market adoption, ensuring easy access to insulin glargine across hospitals, retail pharmacies, and outpatient clinics

U.S. Insulin Glargine Market Insight

The U.S. insulin glargine market captured the largest revenue share of 82% in 2025 within North America, driven by the high prevalence of diabetes and increasing adoption of long-acting insulin therapies. Patients and healthcare providers are prioritizing stable glucose control, reduced hypoglycemia risk, and once-daily dosing convenience. The growing awareness of advanced insulin delivery devices, such as prefilled pens and connected smart pens, further propels market adoption. In addition, robust healthcare infrastructure, favorable reimbursement policies, and strong presence of leading pharmaceutical players support widespread access to insulin glargine therapy across hospitals, retail pharmacies, and outpatient clinics.

Europe Insulin Glargine Market Insight

The Europe insulin glargine market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising diabetes prevalence and increasing healthcare expenditure. Patients in Europe are seeking reliable long-acting insulin therapies for both type 1 and type 2 diabetes management, complemented by digital health initiatives and advanced insulin delivery devices. Government programs promoting diabetes awareness, combined with urbanization and access to modern healthcare facilities, are fostering insulin glargine adoption. The market is witnessing significant growth across hospital and retail pharmacy channels, with therapy being incorporated into both new and ongoing diabetes management protocols.

U.K. Insulin Glargine Market Insight

The U.K. insulin glargine market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising diabetes incidence and increased patient awareness of basal insulin benefits. Concerns about effective glycemic control and reducing hypoglycemia risks are encouraging physicians and patients to prefer insulin glargine over intermediate-acting insulins. The country’s robust healthcare infrastructure, strong physician networks, and widespread availability of digital diabetes management tools are expected to continue driving market growth. The retail pharmacy and hospital pharmacy channels play a key role in enhancing therapy accessibility.

Germany Insulin Glargine Market Insight

The Germany insulin glargine market is expected to expand at a considerable CAGR during the forecast period, driven by growing awareness of diabetes management and the benefits of long-acting insulin therapy. Germany’s well-established healthcare system, high patient education levels, and focus on preventive care promote insulin glargine adoption, particularly for type 2 diabetes. Integration with digital health platforms and connected insulin pens is becoming increasingly prevalent, offering improved adherence and therapy monitoring. Patients and healthcare providers increasingly prefer insulin glargine for consistent glucose control and convenience, aligning with local clinical guidelines and patient expectations.

Asia-Pacific Insulin Glargine Market Insight

The Asia-Pacific insulin glargine market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising diabetes prevalence, increasing healthcare access, and growing awareness of long-acting insulin benefits in countries such as China, India, and Japan. The region’s rapid urbanization, expanding middle-class population, and government initiatives supporting diabetes care are accelerating insulin glargine adoption. Moreover, increasing affordability of insulin therapies and rising penetration of hospital and retail pharmacy networks are enabling wider patient access across both urban and semi-urban areas.

Japan Insulin Glargine Market Insight

The Japan insulin glargine market is gaining momentum due to high diabetes awareness, increasing adoption of basal-bolus regimens, and a strong focus on preventive care. The Japanese healthcare system emphasizes patient adherence, and the availability of advanced delivery devices, including prefilled and smart pens, supports therapy uptake. Integration with digital diabetes monitoring platforms allows remote tracking of glucose levels and dosing, further encouraging adoption. The aging population and rising incidence of type 2 diabetes are expected to drive demand for convenient, reliable insulin therapies across hospitals and retail pharmacy channels.

India Insulin Glargine Market Insight

The India insulin glargine market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising diabetes prevalence, expanding healthcare access, and increased awareness of long-acting insulin therapy benefits. India’s growing middle-class population, urbanization, and government initiatives for diabetes care are key factors driving adoption. The availability of affordable biosimilar insulin glargine, alongside digital health platforms and pharmacy networks, enhances accessibility for a larger patient base. Hospitals, retail pharmacies, and online pharmacies are increasingly becoming preferred channels for insulin glargine distribution, supporting the market’s growth trajectory.

Insulin Glargine Market Share

The Insulin Glargine industry is primarily led by well-established companies, including:

- Sanofi (France)

- Eli Lilly and Company (U.S.)

- Novo Nordisk A/S (Denmark)

- Biocon Limited (India)

- Viatris Inc. (U.S.)

- Gan & Lee Pharmaceuticals (China)

- Geropharm JSC (Russia)

- Boehringer Ingelheim International GmbH (Germany)

- United Laboratories (China)

- Tonghua Dongbao Pharmaceutical Co., Ltd. (China)

- Wockhardt Ltd (India)

- LGM Pharma (U.S.)

- Trumac Healthcare (India)

- ADOCIA SA (France)

- Lupin Ltd (India)

- Cipla Inc. (India)

- Pfizer Inc. (U.S.)

- Endocrine Technologies, Inc. (U.S.)

- Sekisui Diagnostics LLC (U.S.)

What are the Recent Developments in Global Insulin Glargine Market?

- In October 2025, Biocon Biologics expanded its partnership with nonprofit Civica to manufacture a private-label insulin glargine, which Civica will sell in the U.S. under its own brand. Under this deal, Civica will commercialize the Biocon-made insulin under Civica’s label (and in California under the “CalRx” brand), using Biocon’s existing FDA approval

- In September 2025, a study published in BMJ Open reported that the entry of insulin glargine biosimilars led to an average 21.6% reduction in Lantus prices across 28 European countries between 2013–2023, significantly improving affordability

- In March 2023, Eli Lilly announced a 70% price cut for several of its insulin products and capped out-of-pocket insulin costs at USD 35 per month, along with launching Rezvoglar at just USD 92 for a five‑pack of KwikPens, which is about a 78% discount compared to Lantus

- In November 2022, the FDA approved Rezvoglar® (insulin glargine aglr) from Eli Lilly as the second interchangeable biosimilar to Lantus. Rezvoglar had already been approved as a biosimilar in December 2021, but this interchangeability status lets pharmacists substitute it such as a generic, increasing market competitiveness

- In July 2021, Viatris and Biocon Biologics received FDA approval for Semglee® (insulin glargine yfgn) as the first interchangeable biosimilar to Lantus® in the U.S., allowing pharmacists to substitute it without a physician’s permission. This was a landmark decision because “interchangeable” biosimilars must meet a higher standard than just “biosimilar,” ensuring safety and efficacy when switching back and forth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.