Market Analysis and Insights : Global Insuretech Market

Market Analysis and Insights : Global Insuretech Market

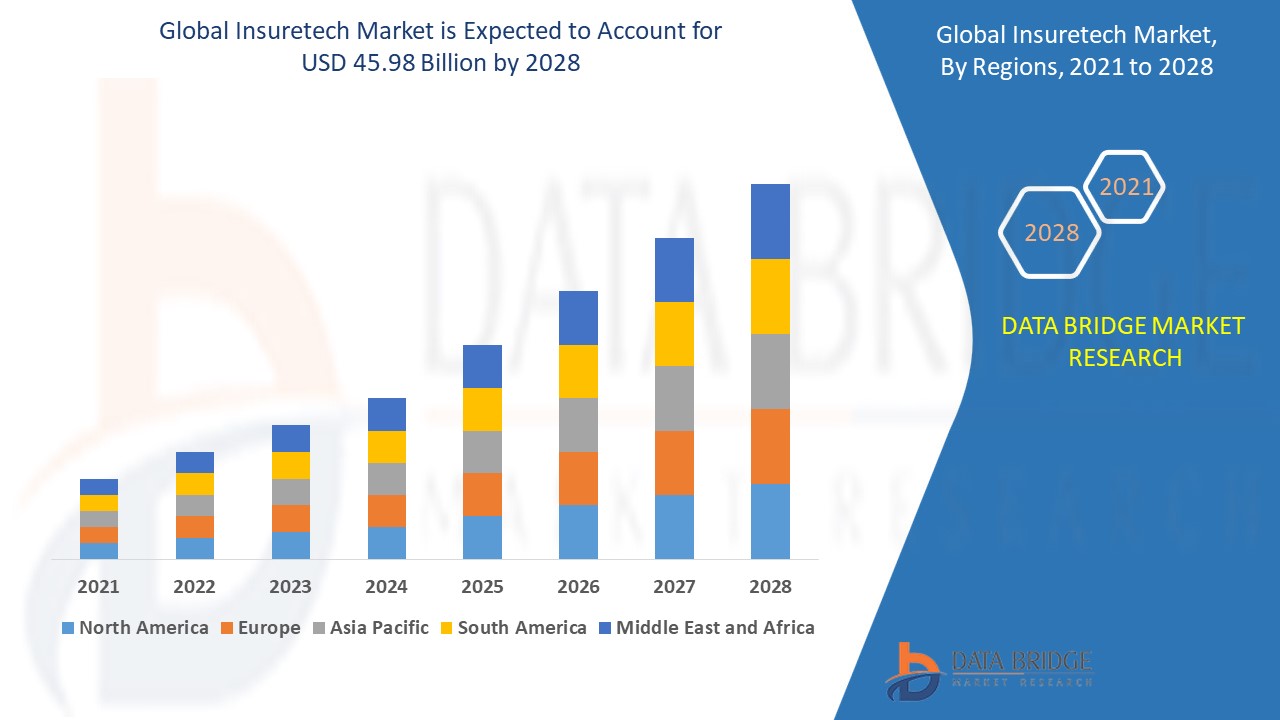

The insuretech market is expected to witness market growth at a rate of 42.4% in the forecast period of 2021 to 2028 and is expected to reach USD 45.98 billion by 2028. Data Bridge Market Research report on insuretech market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The simplification of the claims processes is escalating the growth of insuretech market.

Insurtech is a shirt form of the term insurance technology, which refers to a wide category of constantly changing technologies used in the insurance sector. It includes every technology that is utilized by an insurance company to increase the efficiency of its operations. It is defined as the subdivision of fintech that is new technology introduced to improve the operations and bottom line for finance companies.

The rise in the need for digitization of insurance services across the globe, acts as one of the major factors driving the growth of insuretech market. The rise in the emphasis by insurance companies on improving communication with their clients and capabilities to implement automation processes and the increase in use of these solutions as these companies utilize technology innovations specifically designed to enhance the efficiency of the existing insurance industry model, accelerate the insuretech market growth. The utilizations of new streams of information from the internet-enabled devices by these solutions in order to price premiums in accordance with the observed behavior and the increase in use of the insuretech solutions by businesses to discover avenues that large insurance companies have less incentive to achieve such as ultra-customized policies and social insurance further influence the insuretech market. Additionally, increasing use of applications to pull dissimilar policies into one platform, urbanization and digitization, increasing investments in research and development activities and surge in investments positively affect the insuretech market. Furthermore, the integration of artificial intelligence with the purpose of efficiently handling the tasks of agents and discovering the accurate mix of policies extends profitable opportunities to the insuretech market players in the forecast period of 2021 to 2028.

On the other hand, the rise in the concerns regarding the privacy and data security is expected to obstruct the insuretech market growth. The issue with financial uncertainty is projected to challenge the insuretech market in the forecast period of 2021-2028.

This insuretech market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on insuretech market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Insuretech Market Scope and Market Size

The insuretech market is segmented on the basis of type, service, technology and end-use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the insuretech market is segmented into auto, business, health, home, specialty, travel and others.

- On the basis of service, the insuretech market is segmented into consulting, support and maintenance and managed services.

- On the basis of technology, the insuretech market is segmented into blockchain, cloud computing, iot, machine learning, robo advisory and others.

- On the basis of end-use, the insuretech market is segmented into automotive, BFSI, government, healthcare, manufacturing, retail, transportation and others.

Global Insuretech Market Country Level Analysis

The insuretech market is analyzed and market size, volume information is provided by country, type, service, technology and end-use as referenced above.

The countries covered in the global insuretech market report are the U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates insuretech market because of the increase in the adoption of insuretech solutions because of the surge in the spending of customers in the area of insurance-related products and presence of technology providers with the region. Asia-Pacific is expected to witness fastest growth in the forecast period of 2021-2028 due to the presence of numerous emerging economies and financial hubs in Singapore, India and Hong Kong, high penetration of internet users and growing adoption of cloud technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Insuretech Market Share Analysis

The insuretech market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to insuretech market.

The major players covered in the insuretech market report are Damco Group, DXC Technology Company, Insurance Technology Services, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov, Inc., Wipro Limited, ZhongAn Online P&C Insurance, Nationwide Mutual Insurance Company, Policybazaar Insurance Brokers Private Limited, Clover Health, ACKO Technology & Services Pvt Ltd, Moonshot Insurance, Sureify Labs, Inc., Oscar Insurance, Anorak Technologies Ltd, Bdeo Technologies, Earnix Ltd, Planck Resolution LTD among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.