Global Inulin Market

Market Size in USD Billion

CAGR :

%

USD

1.77 Billion

USD

3.16 Billion

2024

2032

USD

1.77 Billion

USD

3.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.77 Billion | |

| USD 3.16 Billion | |

|

|

|

|

Inulin Market Size

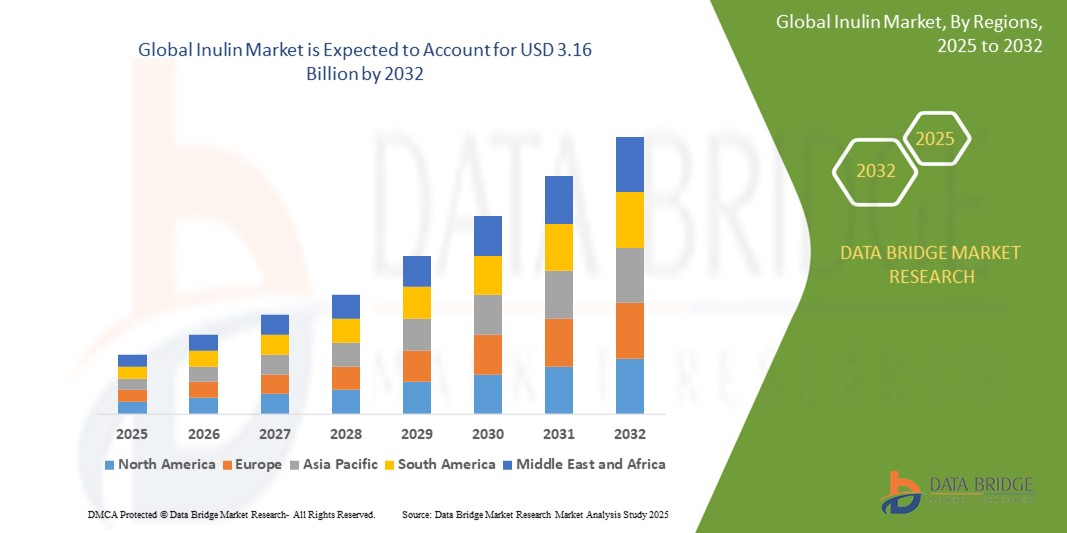

- The global inulin market size was valued at USD 1.77 billion in 2024 and is expected to reach USD 3.16 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of gut health, rising demand for natural and functional ingredients in food and beverages, and growing adoption of prebiotics in dietary supplements and pharmaceuticals

- The shift toward healthier lifestyles and the preference for clean-label, plant-based ingredients are further accelerating the demand for inulin, positioning it as a key ingredient in modern nutrition and wellness solutions

Inulin Market Analysis

- Inulin, a plant-based prebiotic fiber, is increasingly vital in promoting gut health, enhancing digestion, and supporting overall wellness, making it a critical component in food, beverage, and pharmaceutical applications

- The surge in demand for inulin is fueled by growing consumer focus on preventive healthcare, rising popularity of functional foods, and the increasing incorporation of prebiotics in infant formula and dietary supplements

- Europe dominated the inulin market with the largest revenue share of 42.5% in 2024, driven by strong consumer awareness of health and wellness, a well-established food and beverage industry, and the presence of major inulin manufacturers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rising disposable incomes, increasing urbanization, and growing demand for functional foods and dietary supplements

- The chicory inulin segment held the largest market revenue share of 62.5% in 2024, driven by its widespread availability, cost-effectiveness, and high inulin content, making it a preferred choice for food and beverage manufacturers

Report Scope and Inulin Market Segmentation

|

Attributes |

Inulin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Inulin Market Trends

“Increasing Integration of Functional and Clean-Label Ingredients”

- The global inulin market is experiencing a notable trend toward the integration of functional and clean-label ingredients in food and beverage products

- Inulin, a prebiotic dietary fiber, is increasingly valued for its ability to enhance gut health, improve digestion, and serve as a low-calorie sugar or fat substitute, aligning with consumer demand for healthier, natural products

- Advanced processing techniques are enabling manufacturers to incorporate inulin into a wide range of applications, such as dairy, bakery, and functional beverages, without compromising taste or texture

- For instance, companies such as Beneo and Sensus are developing inulin-based solutions that enhance the nutritional profile of products such as yogurts, cereal bars, and plant-based alternatives, catering to health-conscious consumers

- This trend is boosting the appeal of inulin in both consumer and industrial applications, particularly in functional foods and dietary supplements

- Data analytics is also being used to study consumer preferences and optimize inulin formulations for specific dietary needs, such as low-sugar or vegan products

Inulin Market Dynamics

Driver

“Rising Demand for Functional Foods and Prebiotic Ingredients”

- Growing consumer awareness of gut health and the benefits of dietary fibers is a key driver for the global inulin market

- Inulin’s prebiotic properties, which promote beneficial gut bacteria, are increasing its demand in functional foods, dietary supplements, and clinical nutrition

- Regulatory support, such as the European Commission’s approval of health claims for chicory-derived inulin, is encouraging its adoption in food and beverage applications

- The rise of plant-based and vegan diets, coupled with advancements in food processing technologies, is enabling broader use of inulin in products such as dairy alternatives, infant formula, and meat substitutes

- Manufacturers are increasingly incorporating inulin as a standard ingredient to meet consumer expectations for healthier, fiber-rich products with clean-label credentials

Restraint/Challenge

“High Production Costs and Limited Raw Material Availability”

- The high cost of extracting and processing inulin, particularly from sources such as agave and Jerusalem artichoke, poses a significant barrier to market growth, especially in cost-sensitive regions

- The extraction process requires specialized equipment and expertise, increasing production costs and impacting affordability for some manufacturers and consumers

- Limited availability of raw materials, such as chicory roots in certain regions, and fluctuations in supply due to seasonal or climatic factors can lead to market volatility

- In addition, competition from alternative prebiotic fibers, such as fructooligosaccharides (FOS) and oligofructose, presents a challenge to inulin’s market share

- Regulatory complexities surrounding organic certifications and varying standards for functional ingredients across countries can further complicate market expansion for inulin manufacturers

Inulin Market Scope

The market is segmented on the basis of source, form, nature, application, and end use.

- By Source

On the basis of source, the global inulin market is segmented into agave inulin, chicory inulin, and Jerusalem artichoke. The chicory inulin segment held the largest market revenue share of 62.5% in 2024, driven by its widespread availability, cost-effectiveness, and high inulin content, making it a preferred choice for food and beverage manufacturers. Chicory root is extensively used due to its prebiotic properties and suitability for various applications.

The Jerusalem artichoke segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for natural and organic sources of inulin. Its rising popularity in health-conscious markets, particularly in Europe and Asia-Pacific, is fueled by its sustainability and compatibility with clean-label products.

- By Form

On the basis of form, the global inulin market is segmented into powder and liquid. The powder segment accounted for the largest market revenue share of 68.5% in 2024, owing to its ease of handling, longer shelf life, and versatility in applications such as food and beverage, dietary supplements, and pharmaceuticals. Powdered inulin is widely used in functional foods and bakery products due to its ability to act as a fat replacer and fiber enhancer.

The liquid segment is anticipated to experience the fastest growth rate of 16.8% from 2025 to 2032, driven by its increasing use in beverages, infant formula, and liquid dietary supplements. Liquid inulin offers better solubility and ease of incorporation into liquid-based products, catering to growing consumer demand for convenient and functional beverages.

- By Nature

On the basis of nature, the global inulin market is segmented into organic and conventional. The conventional segment held the largest market revenue share of 73.5% in 2024, attributed to its cost-effectiveness and widespread use in large-scale food production. Conventional inulin is widely adopted in processed foods and beverages due to its availability and lower price point.

The organic segment is expected to witness robust growth from 2025 to 2032, driven by rising consumer preference for organic and clean-label products. Increasing awareness of health, sustainability, and environmental concerns is boosting demand for organic inulin, particularly in Europe and North America.

- By Application

On the basis of application, the global inulin market is segmented into food and beverage, dietary supplements, pharmaceuticals, meat products, and others. The food and beverage segment accounted for the largest market revenue share of 58.5% in 2024, driven by the growing use of inulin as a prebiotic fiber, fat replacer, and texture enhancer in products such as dairy, bakery, and functional beverages. Its ability to improve gut health and meet clean-label demands fuels its adoption.

The dietary supplements segment is anticipated to experience the fastest growth from 2025 to 2032. Rising consumer awareness of gut health, immunity, and digestive wellness, particularly in Asia-Pacific, is driving demand for inulin-based supplements. The trend toward preventive healthcare and natural ingredients further accelerates this segment’s growth.

- By End Use

On the basis of end use, the global inulin market is segmented into clinical nutrition, dietary supplements, functional food and beverages, dairy products, infant formula, breakfast cereals and cereal bars, meat products, and animal nutrition. The functional food and beverages segment dominated the market with a revenue share of 42.5% in 2024, driven by the increasing incorporation of inulin in products such as yogurt, energy bars, and fortified beverages to enhance nutritional value and appeal to health-conscious consumers.

The infant formula segment is expected to witness rapid growth of 18.4% from 2025 to 2032, fueled by growing awareness of inulin’s prebiotic benefits in supporting infant gut health. The rising demand for premium and functional infant nutrition products, particularly in Asia-Pacific, is a key driver of this segment’s growth

Inulin Market Regional Analysis

- Europe dominates the global inulin market with the largest revenue share in 2024, driven by a well-established food and beverage industry and increasing demand for natural, functional ingredients

- Consumers prioritize inulin for its prebiotic properties, digestive health benefits, and use as a natural sweetener, particularly in regions with high health-conscious populations

- Growth is supported by advancements in extraction technologies, rising demand for organic and clean-label products, and expanding applications in dietary supplements, functional foods, and pharmaceuticals

U.S. Inulin Market Insight

The U.S. expected to witness the fastest growth rate in the inulin market fueled by strong demand for functional foods and dietary supplements. Growing consumer awareness of gut health and the benefits of prebiotics drives market expansion. The trend toward clean-label and plant-based products, along with increasing use in infant formula and dairy products, further boosts growth. Both domestic production and imports of chicory-based inulin support a robust market ecosystem.

Europe Inulin Market Insight

The Europe inulin market holds the largest global share with a revenue share of 38.5% in 2024, supported by stringent regulations promoting natural and health-focused ingredients. Consumers seek inulin for its role in improving gut health and enhancing food texture while maintaining low caloric content. Growth is prominent in functional foods, dairy products, and dietary supplements, with countries such as Germany and France showing significant adoption due to rising health awareness and sustainable food trends.

U.K. Inulin Market Insight

The U.K. market for inulin is expected to witness rapid growth, driven by increasing demand for prebiotic ingredients in functional foods and beverages. Consumers prioritize digestive health and natural sweeteners, boosting inulin use in dairy, cereals, and dietary supplements. Evolving regulations supporting health claims and clean-label products influence consumer preferences, encouraging wider adoption across food and beverage sectors.

Germany Inulin Market Insight

Germany is expected to witness significant growth in the inulin market, attributed to its advanced food processing industry and high consumer focus on health and wellness. German consumers prefer inulin for its prebiotic benefits and versatility in low-sugar and high-fiber products. The integration of inulin in premium functional foods, dairy, and dietary supplements, along with strong domestic production, supports sustained market growth.

Asia-Pacific Inulin Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rising health awareness, expanding food and beverage industries, and increasing disposable incomes in countries such as China, India, and Japan. Growing demand for prebiotics, functional foods, and infant formula fuels inulin adoption. Government initiatives promoting healthy diets and sustainable ingredients further encourage the use of inulin across applications.

Japan Inulin Market Insight

Japan’s inulin market is expected to witness rapid growth, due to strong consumer preference for high-quality, health-focused ingredients that support digestive health and overall wellness. The presence of major food and beverage manufacturers and the integration of inulin in functional foods, dairy, and dietary supplements accelerate market penetration. Rising interest in clean-label and prebiotic products also contributes to growth.

China Inulin Market Insight

China holds the largest share of the Asia-Pacific inulin market, propelled by rapid urbanization, increasing health consciousness, and growing demand for functional foods and dietary supplements. The country’s expanding middle class and focus on preventive healthcare support inulin adoption. Strong domestic production capabilities, particularly for chicory and agave-based inulin, and competitive pricing enhance market accessibility.

Inulin Market Share

The inulin industry is primarily led by well-established companies, including:

- Xylem Analytics Germany Sales GmbH & Co. KG. (U.S.)

- Baolingbao Biology Co. Ltd. (China)

- Meiji Holdings Co., Ltd. (Japan)

- Roquette Frères (France)

- Royal FrieslandCampina (Netherlands)

- Ingredion (U.S.)

- COSUCRA (Belgium)

- Ingredion Incorporated (U.S.)

- Cargill, Incorporated (U.S.)

- BENEO (Germany)

- Dingxi Longhai Dairy Co., Ltd. (China)

- Shandong Baolingbao Biotechnology Co. LTD (China)

- Ciranda, Inc. (U.S.)

- The Green Labs LLC (U.S.)

- Orafti (Belgium)

What are the Recent Developments in Global Inulin Market?

- In April 2024, BENEO GmbH introduced a new line of Orafti® Inulin products with enhanced solubility, specifically designed for beverage applications. These prebiotic-rich ingredients improve texture and health benefits while maintaining taste integrity, addressing the rising demand for functional drinks. The launch underscores BENEO’s commitment to innovation, supporting gut health and natural ingredient preferences in the global inulin market

- In March 2024, Cosucra Groupe Warcoing SA partnered with a major European dairy manufacturer to integrate chicory root inulin into a new range of low-sugar yogurts. This collaboration enhances the nutritional profile of dairy products, leveraging inulin’s prebiotic benefits to support gut health. The initiative aligns with growing consumer demand for clean-label and functional foods, reinforcing Cosucra’s commitment to sustainable nutrition

- In March 2022, Sensus announced plans to expand chicory root fiber (inulin) production, responding to the growing demand for natural prebiotics in plant-based foods and supplements. This initiative aligns with Cosun’s Unlock 25 strategy, which focuses on sustainability and capacity expansion. Chicory root fiber enhances taste and texture in plant-based products, while also supporting gut health and immune function. Sensus aims to increase availability, helping food manufacturers create better-for-you products

- In December 2021, BENEO announced a multi-million investment program to expand prebiotic chicory root fiber production at its Pemuco, Chile, and Oreye, Belgium facilities. The initiative aims to increase production capacity by more than 40%, addressing rising global demand for chicory root fiber inulin. The expansion supports sustainable nutrition trends, reinforcing BENEO’s commitment to gut health and functional food innovation. Work on both sites began in 2022, with additional refinery upgrades planned to enhance energy efficiency and carbon neutrality

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Inulin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Inulin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Inulin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.