Global Kosher Food Market

Market Size in USD Billion

CAGR :

%

USD

22.07 Billion

USD

29.52 Billion

2024

2032

USD

22.07 Billion

USD

29.52 Billion

2024

2032

| 2025 –2032 | |

| USD 22.07 Billion | |

| USD 29.52 Billion | |

|

|

|

|

What is the Global Kosher Food Market Size and Growth Rate?

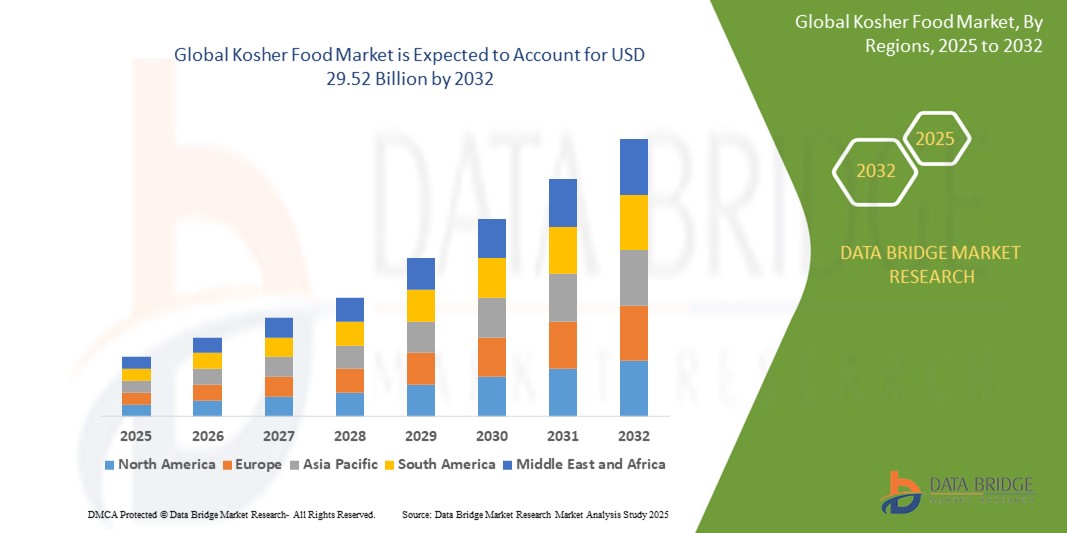

- The global kosher food market size was valued at USD 22.07 billion in 2024 and is expected to reach USD 29.52 billion by 2032, at a CAGR of 3.70% during the forecast period

- The kosher food market is thriving with the latest technology driving its growth. Advanced processing techniques ensure strict adherence to kosher dietary laws, attracting a broader consumer base. Innovations in packaging and preservation extend shelf life while maintaining quality

- With increasing demand for kosher-certified products worldwide, the market is poised for significant expansion, reflecting evolving consumer preferences and dietary trends

What are the Major Takeaways of Kosher Food Market?

- Continual innovation in kosher-certified products, featuring alternative ingredients, flavors, and cuisines, propels market growth by appealing to diverse consumer tastes. For instance, companies are developing kosher-certified plant-based meat alternatives to meet the demands of health-conscious and environmentally aware consumers

- Similarly, the introduction of kosher-certified exotic spices and globally-inspired dishes caters to adventurous palates, expanding the market beyond traditional offerings and attracting new consumers

- North America dominated the kosher food market with the largest revenue share of 34.87% in 2024, driven by rising health consciousness, increasing demand for food transparency, and the cultural prevalence of kosher certifications

- Asia-Pacific Kosher Food market is poised to grow at the fastest CAGR of 7.41% from 2025 to 2032, supported by growing health awareness, western dietary influence, and expanding Jewish communities

- The seafood segment dominated the kosher food market with the largest revenue share of 36.5% in 2024, attributed to rising demand for certified kosher fish products that meet dietary laws, particularly in the U.S. and Israel

Report Scope and Kosher Food Market Segmentation

|

Attributes |

Kosher Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Kosher Food Market?

“Rising Demand for Plant-Based and Vegan Kosher Products”

- A prominent trend in the kosher food market is the increasing consumer demand for plant-based and vegan-friendly kosher options, driven by health, ethical, and environmental concerns

- Kosher consumers are actively seeking products that align with both religious dietary laws and lifestyle choices, such as veganism, gluten-free, and allergen-free diets—creating strong crossover demand for certified plant-based kosher foods

- For instance, in February 2024, Impossible Foods received kosher certification for its plant-based sausage and meatballs, expanding its appeal to religious and health-conscious buyers across North America

- Many kosher food companies are launching meat alternatives, non-dairy desserts, and plant-based snacks that comply with kosher pareve requirements, making them suitable for consumption with both meat and dairy meals

- Startups and established players alike are innovating with ingredients such as pea protein, soy isolates, and oat-based dairy substitutes while maintaining kosher supervision and certification

- This convergence of kosher and plant-based eating is reshaping product development and retail strategy, with a growing number of supermarkets and foodservice outlets offering dual-labeled products to attract a wider consumer base

What are the Key Drivers of Kosher Food Market?

- The growing demand for clean-label, safe, and ethically produced foods is a major driver of the kosher food market, with kosher certification increasingly viewed as a mark of food quality and religious compliance

- In March 2024, Blommer Chocolate Company expanded its kosher-certified product line in the U.S., highlighting the trend of mainstream brands tapping into the kosher segment to reach wider health and religious markets

- Rising awareness among non-Jewish consumers about the perceived benefits of kosher foods—such as stricter hygiene, animal welfare standards, and rigorous inspections—is expanding the consumer base beyond traditional users

- Moreover, increasing numbers of Muslim and vegan consumers are purchasing kosher products due to overlapping dietary standards, especially in North America and parts of Europe

- Supermarket chains and food service providers are also stocking more kosher-certified items to serve diverse consumer segments, boosting visibility and availability across regions

- These shifts underscore how kosher certification has evolved from a religious necessity to a mainstream quality assurance symbol, driving the market across both religious and secular demographics

Which Factor is challenging the Growth of the Kosher Food Market?

- A major challenge in the kosher food market is the perception of high cost and complex certification processes, which can deter smaller food manufacturers and price-sensitive consumers

- For instance, Eden Foods reported delays in product expansion due to complexities in obtaining multi-tiered kosher certification for new organic offerings in 2023, impacting time-to-market

- The strict requirements for kosher processing, segregation, and supervision can lead to higher operational costs and limit scalability, especially for companies in emerging markets with limited certification infrastructure

- In addition, consumer confusion over various kosher labels and trust in certifications (e.g., Orthodox Union vs. local certifiers) may reduce confidence or preference for specific brands

- Misinformation or lack of awareness among secular buyers may also hinder full understanding of the benefits of kosher compliance, impacting potential market growth

- Overcoming these challenges through streamlined certification, transparent labeling, and educational campaigns about the value and rigor of kosher standards will be crucial for expanding adoption and acceptance worldwide

How is the Kosher Food Market Segmented?

The market is segmented on the basis of type, application, and distribution channel.

- By Type

On the basis of type, the kosher food market is segmented into buckwheat, seafood, lamb, pulses, and others. The seafood segment dominated the kosher food market with the largest revenue share of 36.5% in 2024, attributed to rising demand for certified kosher fish products that meet dietary laws, particularly in the U.S. and Israel. Strict rabbinical supervision ensures compliance, boosting consumer trust and retail expansion. In addition, frozen and canned kosher seafood is gaining popularity due to convenience and shelf stability.

The pulses segment is expected to witness the fastest growth rate of 20.1% from 2025 to 2032, fueled by a growing health-conscious consumer base seeking high-protein, plant-based kosher alternatives. Pulses such as lentils and chickpeas are increasingly used in snacks, ready-to-eat meals, and kosher-certified vegan dishes, which align with both sustainability and religious preferences.

- By Application

On the basis of application, the kosher food market is segmented into culinary products, snacks and savory, bakery and confectionery products, beverages, meat, and dietary supplements. The bakery and confectionery products segment held the largest revenue share of 33.8% in 2024, driven by the widespread consumption of kosher-certified baked goods and sweets during religious observances and daily meals. Popularity of kosher certifications among mainstream brands such as Oreos and Chips Ahoy has significantly increased shelf presence and consumer demand globally.

The dietary supplements segment is anticipated to register the fastest CAGR from 2025 to 2032, propelled by the expanding use of kosher-certified vitamins, herbal extracts, and nutraceuticals. This growth is influenced by both observant Jewish populations and non-Jewish health-conscious consumers who perceive kosher certification as a mark of purity and safety.

- By Distribution Channel

On the basis of distribution channel, the kosher food market is segmented into supermarkets and hypermarkets, grocery stores, and online stores. The supermarkets and hypermarkets segment dominated the market with the highest revenue share of 48.9% in 2024, as these retail formats offer a wide range of kosher-certified products under one roof. Strategic shelf placement and in-store promotions further fuel customer awareness and convenience.

The online stores segment is projected to witness the fastest CAGR during the forecast period (2025–2032), owing to the increasing preference for digital grocery shopping, home delivery, and greater product accessibility in remote or underserved areas. Platforms such as Amazon and kosher-specific e-commerce sites are expanding kosher food offerings, often including filters for certifications and dietary restrictions.

Which Region Holds the Largest Share of the Kosher Food Market?

- North America dominated the kosher food market with the largest revenue share of 34.87% in 2024, driven by rising health consciousness, increasing demand for food transparency, and the cultural prevalence of kosher certifications

- The region benefits from a strong Jewish population, rising vegan and vegetarian dietary trends, and consumers who associate kosher labels with quality and safety

- The presence of key kosher food manufacturers, along with the expansion of kosher-certified offerings in mainstream supermarkets and foodservice chains, reinforces market dominance

U.S. Kosher Food Market Insight

The U.S. kosher food market dominated the North American share in 2024, led by the demand for cleaner labels, ethical sourcing, and allergen-friendly foods. Beyond religious adherence, kosher products are being chosen by diverse demographics for their perceived quality and rigorous inspection processes. Strong retail penetration, especially in urban areas, and continuous innovation by major food brands such as Manischewitz, Empire Kosher, and Nestlé U.S., further fuel market growth.

Europe Kosher Food Market Insight

The Europe kosher food market is projected to grow at a steady CAGR over the forecast period, driven by increasing cultural diversity and awareness of dietary certifications. Demand is particularly rising in Western European countries where consumers seek transparency in food ingredients and trust kosher labels for purity and hygiene. Growth is supported by regulatory encouragement for food labeling and an expanding Jewish diaspora, along with new product lines from bakery and snack manufacturers.

U.K. Kosher Food Market Insight

The U.K. kosher food market is expected to grow at a notable pace, supported by a blend of religious consumption and health-driven food choices. Consumers are increasingly exploring kosher-certified items for their perceived cleanliness, ethical processing, and high production standards. E-commerce platforms and supermarket chains such as Tesco and Sainsbury's are actively expanding their kosher product offerings to meet growing demand.

Germany Kosher Food Market Insight

The Germany Kosher Food market is expected to expand at a considerable CAGR, fueled by rising multiculturalism and food quality awareness. Health-conscious consumers, including non-Jewish buyers, are drawn to kosher products for their inspection rigor and minimal use of artificial additives. Increasing kosher certification of packaged goods and awareness campaigns are strengthening the market footprint across both retail and HORECA segments.

Which Region is the Fastest Growing Region in the Kosher Food Market?

Asia-Pacific kosher food market is poised to grow at the fastest CAGR of 7.41% from 2025 to 2032, supported by growing health awareness, western dietary influence, and expanding Jewish communities. Countries such as India, China, and Japan are witnessing increased demand for specialty food products, including kosher-certified items, often aligned with organic and halal alternatives. Rising disposable income, rapid urbanization, and the surge in premium product categories across retail outlets drive the region’s rapid expansion.

Japan Kosher Food Market Insight

The Japan kosher food market is gaining traction, driven by the growing demand for clean-label, allergen-free, and minimally processed food products. Kosher certification is increasingly viewed as a mark of quality and safety, especially among health-conscious consumers and those with dietary restrictions. Retailers and specialty food importers are expanding kosher selections in response to evolving consumer preferences and rising culinary tourism.

China Kosher Food Market Insight

The China kosher food market held the largest revenue share in Asia-Pacific in 2024, propelled by growing middle-class demand for premium food and international standards. Consumers perceive kosher-certified food as safer and more reliable, aligning with national pushes toward food safety and regulation. Local manufacturers are also investing in kosher certification to expand exports and meet rising domestic demand across grocery stores and online platforms.

Which are the Top Companies in kosher food Market?

The kosher food industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Blommer Chocolate Company (U.S.)

- Brooklyn Cookie Company LLC (U.S.)

- Eden Foods (U.S.)

- Ice Chips Candy LLC (U.S.)

- Nestlé S.A. (Switzerland)

- Empire Kosher Poultry, LLC (U.S.)

- Unilever (U.K.)

- General Mills (U.S.)

- Cargill, Incorporated (U.S.)

- Conagra Foodservice, Inc. (U.S.)

- Dairy Farmers of America, Inc. (U.S.)

- PepsiCo (U.S.)

- Hain Celestial (U.S.)

- Agrana (Austria)

- Kayco (U.S.)

- Kellanova (U.S.)

- The Kraft Heinz Company (U.S.)

- F Industries LTD (India)

What are the Recent Developments in Global Kosher Food Market?

- In March 2023, Cargill introduced Diamond Crystal Fine Kosher Salt, designed to enhance the flavor of fried foods and seasonings. By tapping into the growing demand for kosher-certified products, this move underscores Cargill's dedication to quality and flavor excellence. This launch strengthens Cargill’s market position by aligning with evolving consumer preferences for kosher and premium culinary ingredients

- In March 2022, Prairie Street Prime expanded its kosher meat delivery services to include regions such as Palm Beach, New York City, and Beverly Hills, California. The company aims to provide high-quality kosher beef directly to consumers seeking convenience and authenticity. This initiative highlights Prairie Street Prime’s commitment to accessible premium kosher offerings in major metropolitan markets

- In January 2022, KU Chabad partnered with Allen Fieldhouse to launch a full-service kosher deli during weekday basketball games. The menu included glatt kosher options such as all-beef hot dogs and smoked pastrami on rye, catering to kosher-observing fans. This collaboration marks a significant step in increasing the availability of kosher food in mainstream entertainment venues

- In January 2021, NSF Certification Ireland Limited, a subsidiary of NSF, announced the acquisition of Global Trust Certification Limited, an Ireland-based seafood certification and auditing firm. This move enhances NSF’s global portfolio in food certification services. The acquisition strategically boosts NSF's global reach and strengthens its position in the kosher and broader food certification market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Kosher Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Kosher Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Kosher Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.