Global Pulse Market

Market Size in USD Billion

CAGR :

%

USD

11.87 Billion

USD

18.92 Billion

2024

2032

USD

11.87 Billion

USD

18.92 Billion

2024

2032

| 2025 –2032 | |

| USD 11.87 Billion | |

| USD 18.92 Billion | |

|

|

|

|

Pulse Market Size

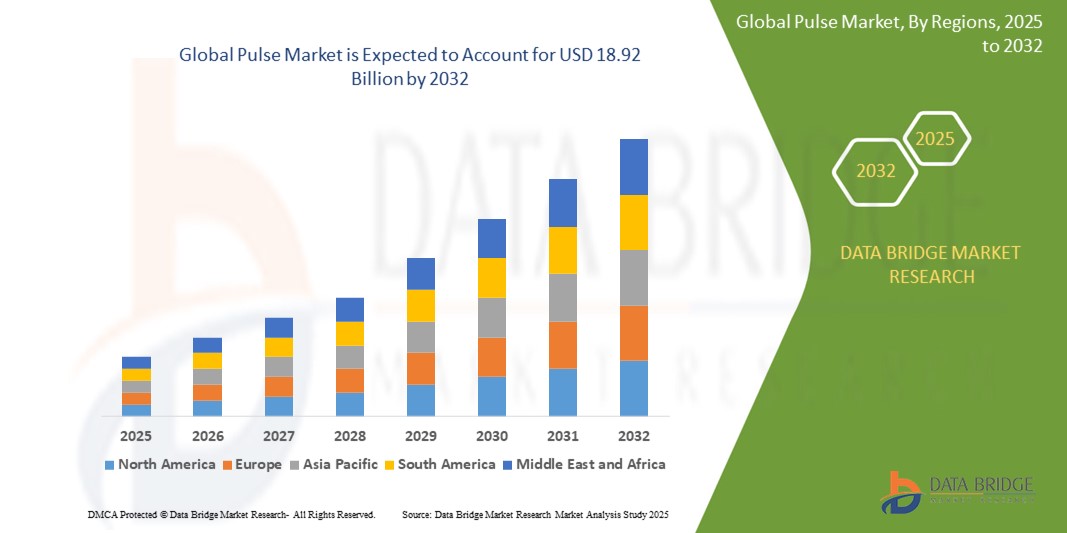

- The global pulse market size was valued at USD 11.87 billion in 2024 and is expected to reach USD 18.92 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of plant-based nutrition, rising health consciousness, and the growing popularity of vegetarian and vegan diets across both developed and emerging economies

- Furthermore, the demand for high-protein, gluten-free, and clean-label food products is positioning pulses as a preferred ingredient across diverse food applications including snacks, meat alternatives, and functional foods. These converging factors are accelerating the adoption of pulse-based products, thereby significantly boosting the industry's growth

Pulse Market Analysis

- Pulses are nutrient-dense legumes such as chickpeas, lentils, and mung beans, widely consumed for their high protein, fiber, and micronutrient content. They play a critical role in food security, sustainability, and healthy eating, making them essential in both traditional diets and modern food innovations

- The escalating demand for pulses is driven by the global shift toward plant-based protein sources, increased prevalence of lifestyle-related health issues, and a growing need for affordable, shelf-stable, and sustainable food solutions

- Asia-Pacific dominated the pulse market with a share of 33.9% in 2024, due to high consumption rates across the region, where pulses serve as daily dietary staples

- North America is expected to be the fastest growing region in the pulse market during the forecast period due to surging demand for plant-based protein, functional foods, and gluten-free alternatives

- Chickpeas segment dominated the market with a market share of 28.9% in 2024, due to their widespread consumption across both traditional and contemporary cuisines and their nutritional density rich in protein, fiber, and essential vitamins. Chickpeas are a staple in several regions, particularly in the Middle East, South Asia, and Mediterranean countries, and their growing incorporation in ready-to-eat meals and plant-based diets has significantly strengthened their market position. Their versatility in various applications, including canned products, hummus, salads, and baked snacks, further drives consumer demand

Report Scope and Pulse Market Segmentation

|

Attributes |

Pulse Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pulse Market Trends

“Growing Demand for Plant-Based Protein Alternatives”

- The global pulses market is expanding rapidly, driven by heightened consumer interest in plant-based protein alternatives—a trend powered by health awareness, environmental sustainability, and the shift to vegetarian and flexitarian diets. Pulses such as lentils, chickpeas, peas, and beans are increasingly utilized in meat substitutes, vegan meal kits, and high-protein snack bars due to their rich protein, fiber, and micronutrient content

- For instance, major food and ingredient companies such as Cargill Inc. and Archer Daniels Midland (ADM) have significantly increased their investment in pulse-based product lines, capitalizing on demand from food producers and retailers seeking to offer gluten-free, allergen-friendly, and sustainable protein-rich foods

- The foodservice and ready-to-eat segments are witnessing strong growth as pulses are integrated into a wider range of prepared meals, snacks, and beverages

- Consumer demand for clean-label and functional foods is speeding up the development of pulse-derived flours, protein isolates, and fiber ingredients suited for health-conscious markets

- Pulses’ low environmental impact and nitrogen-fixing abilities are attracting sustainability-oriented consumers and aligning with policy goals for eco-friendly agriculture

- Emerging markets, particularly in Asia-Pacific and India, are seeing government-led initiatives to boost pulse production and adoption, further accelerating global demand growth

Pulse Market Dynamics

Driver

“Increasing Health Awareness”

- Health awareness is one of the core drivers of pulse market growth, as consumers seek out foods rich in plant-based protein, dietary fiber, and minerals to support heart health, weight management, and overall wellness

- For instance, the United Nations Food and Agriculture Organization (FAO) and industry marketing campaigns have spotlighted the health benefits of pulses, reinforcing their role in diets targeting reduced cholesterol, blood sugar control, and improved digestive health—prompting increased supermarket shelf space and product launches worldwide

- Pulse-based foods appeal to consumers with special dietary needs, such as gluten intolerance or vegetarianism, further widening the addressable market

- Pulses’ versatility in traditional and contemporary recipes makes them desirable as staple ingredients in diverse cuisines

- The rise of fitness culture, sports nutrition, and “clean eating” trends has brought pulses into focus as a functional and practical source of natural nutrition. Growing educational efforts and public health messaging are reinforcing the importance of pulses in daily diets, sustaining consumer demand

Restraint/Challenge

“Infrastructure and Supply Chain Issues”

- The global pulse market faces constraints from inconsistent infrastructure, fragmented supply chains, post-harvest losses, storage limitations, and volatility in international trade

- For instance, in India—the world’s largest pulse consumer—regular supply bottlenecks and logistics challenges have prompted government interventions such as seed distribution programs and support for high-yield pulse varieties to stabilize production and reduce dependency on imports

- Many producing countries lack adequate cold storage, drying, and bulk handling facilities, which leads to spoilage or loss of crop value

- Price volatility due to weather events, export restrictions, and market concentration among a few major players (such as Cargill, ADM, B&G Foods) can lead to sudden shortages or surpluses

- Smallholder farmers, especially across Africa and South Asia, often lack access to efficient market networks, quality seeds, and credit, further limiting reliable supply and consistency. Addressing these challenges requires coordinated investment in logistics, storage, and processing as well as international collaboration on research, trade, and standards

Pulse Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the pulse market is segmented into chickpeas, kaspa peas, lentils, pigeon peas, fava beans, black gram, mung beans, and others. The chickpeas segment dominated the largest market revenue share 28.9% in 2024, primarily due to their widespread consumption across both traditional and contemporary cuisines and their nutritional density rich in protein, fiber, and essential vitamins. Chickpeas are a staple in several regions, particularly in the Middle East, South Asia, and Mediterranean countries, and their growing incorporation in ready-to-eat meals and plant-based diets has significantly strengthened their market position. Their versatility in various applications, including canned products, hummus, salads, and baked snacks, further drives consumer demand.

The mung beans segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising health awareness and increasing use in functional foods and plant-based protein products. Mung beans are gaining popularity due to their easily digestible protein, antioxidant content, and suitability for gluten-free and vegan diets. Their growing use in sprouted form, soups, noodles, and even dairy alternatives is enhancing their demand among health-conscious urban populations globally.

- By End User

On the basis of end user, the pulse market is segmented into home use, snack food industry, flour industry, and others. The home use segment held the largest market revenue share in 2024, supported by the continued reliance on pulses as an affordable, protein-rich food staple in households across emerging and developed economies. Pulses are widely used in everyday cooking, especially in vegetarian diets, due to their high satiety value and versatility in a range of traditional recipes. This segment benefits from increased awareness about balanced nutrition and the importance of plant-based protein in daily diets.

The snack food industry segment is expected to register the fastest growth rate from 2025 to 2032, driven by rising demand for high-protein, clean-label, and gluten-free snacking options. The expansion of health-oriented snack innovations using pulse flours and whole pulses in chips, crackers, roasted snacks, and extruded products is contributing to this surge. Consumer preference for minimally processed and allergen-free ingredients has positioned pulses as an ideal base for creating healthy and sustainable snack alternatives.

Pulse Market Regional Analysis

- Asia-Pacific dominated the pulse market with the largest revenue share of 33.9% in 2024, driven by high consumption rates across the region, where pulses serve as daily dietary staples

- Rising population, rapid urbanization, and increasing focus on plant-based nutrition are fueling demand across food processing and retail sectors

- Supportive government initiatives promoting pulse cultivation, improved supply chain infrastructure, and increasing health awareness are further contributing to market expansion across the region

India Pulse Market Insight

India leads the regional market due to its dominant production and consumption of pulses, particularly chickpeas, lentils, and pigeon peas. The cultural significance of pulses in daily meals, coupled with government incentives and public distribution systems, continues to sustain demand. Urbanization and the shift toward packaged and ready-to-cook formats are further driving investment in pulse processing and branded retail offerings, while e-commerce growth is enabling greater access to premium and organic varieties.

China Pulse Market Insight

China’s pulse market is expanding rapidly, supported by rising consumer interest in health and nutrition, particularly in relation to plant-based protein. Pulses are being incorporated into a variety of formats including soups, snacks, and meat substitutes, catering to a growing middle-class population seeking healthy food alternatives. Government focus on diversifying imports and improving domestic yield through advanced agricultural practices is reinforcing supply-side strength, while demand is propelled by evolving consumer habits and an expanding processed food industry.

Europe Pulse Market Insight

Europe is projected to witness significant growth in the pulse market over the forecast period, driven by increasing consumer inclination toward sustainable, plant-based food alternatives. Pulses are gaining traction across various applications such as meat analogues, vegan ready meals, and protein-enriched bakery products. Regulatory frameworks encouraging organic and sustainable farming practices are providing a favorable backdrop for pulse production. Moreover, growing consumer preference for allergen-free, high-fiber, and non-GMO ingredients is accelerating innovation in the food processing sector, contributing to broader adoption of pulse-based ingredients across both retail and foodservice channels.

U.K. Pulse Market Insight

The U.K. pulse market is gaining momentum due to rising awareness around plant-forward diets, particularly among younger and health-conscious consumers. Pulses are increasingly featured in meal kits, snacks, and convenience products marketed as high-protein and low-fat. The government’s support for reducing meat consumption and promoting sustainable agriculture aligns well with the growing demand for pulses. Major retailers and food brands are expanding their legume-based product portfolios to cater to the evolving preferences of flexitarian and vegan consumers.

Germany Pulse Market Insight

Germany’s pulse market continues to grow steadily, backed by strong consumer interest in sustainable, nutrient-dense foods. Pulses are being integrated into a wide range of food innovations including plant-based meats, fortified cereals, and clean-label packaged meals. The country's mature organic food sector and its emphasis on food transparency have made pulses a preferred ingredient among environmentally and health-conscious shoppers. Technological advancements in pulse milling and protein extraction are further enabling the development of novel food products in the German market.

North America Pulse Market Insight

North America is expected to register the fastest CAGR in the pulse market from 2025 to 2032, driven by surging demand for plant-based protein, functional foods, and gluten-free alternatives. The rising trend of clean eating and minimal processing is pushing manufacturers to incorporate pulses into health-oriented snacks, protein bars, and dairy alternatives. Consumers are increasingly turning to lentils, chickpeas, and black gram for their nutritional benefits, including high protein, fiber, and micronutrient content. In parallel, government-backed programs promoting pulse production and sustainable agriculture practices are strengthening supply chains and boosting farmer participation in legume cultivation.

U.S. Pulse Market Insight

The U.S. holds the largest share in the North American pulse market, with growth fueled by the rising popularity of products such as hummus, chickpea snacks, lentil pasta, and pulse-based flours. The demand for clean-label, high-protein, and plant-based food products is being met through widespread innovation in the processed food and alternative protein industries. Federal programs under the USDA, aimed at promoting pulse consumption in schools and public health campaigns, are creating additional avenues for growth. Moreover, increasing investments by major food brands and startups in legume-based formulations are enhancing market penetration across retail and foodservice sectors.

Pulse Market Share

The pulse industry is primarily led by well-established companies, including:

- B&G Foods, Inc. (U.S.)

- La Milanaise (Canada)

- Adani Group (India)

- Cargill, Incorporated (U.S.)

- The Kraft Heinz Company (U.S.)

- ADM (U.S.)

- NHC Foods Ltd (U.K.)

- Ingredion (U.S.)

- AGT Food and Ingredients Inc. (Canada)

- Broadgrain (Canada)

- The Scoular Company (U.S.)

- Blue Ribbon (U.S.)

- SunOpta (Canada)

- Batory Foods (U.S.)

- USA Pulses (U.S.)

Latest Developments in Global Pulse Market

- In October 2024, Merchant Gourmet, a leading brand in pulses and grains, announced the launch of a new range of ready-to-eat, drain-free bean pouches, set to be available at Sainsbury’s, Waitrose, and Ocado. The company highlighted that this new offering comes in response to the growing consumer demand for pulses and beans, with the prepared beans and peas category in the UK valued at nearly USD 1.09 billion, showing double-digit growth in prepared beans at 11% and a remarkable 23% growth in chickpeas

- In February 2024, DS Group, a prominent multi-business corporation and leading FMCG conglomerate, released a new television commercial for Pass Pass Pulse, the nation’s favorite hard-boiled candy. The commercial reiterates the brand's foundational message, "Pran Jaaye Par Pulse Na Jaaye," featuring actors Saurabh Shukla and Abhishek Banerjee, who embody the essence of this message

- In March 2023, Adani Walmir, an FMCG company, announced that its Fortune Pulses brand has introduced nine varieties of natural pulses into its product line. This move aims to strengthen its market presence in the Northern and Eastern regions of India

- In November 2022, Uralchem Innovation, a subsidiary of Uralchem based in Russia, launched a pilot plant dedicated to the production of pea isolate. This isolate, derived from yellow peas, serves as a refined natural vegetable protein with a wide range of applications in the food industry

- In October 2021, InnovoPro, an Israeli foodtech company specializing in chickpea protein concentrate, introduced a texturized vegetable protein (TVP) made from chickpeas. This product is designed to help food manufacturers enhance their meat analogue offerings, including burgers, nuggets, and meatballs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pulse Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pulse Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pulse Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.