Global Laser Projection Market

Market Size in USD Billion

CAGR :

%

USD

17.84 Billion

USD

79.83 Billion

2024

2032

USD

17.84 Billion

USD

79.83 Billion

2024

2032

| 2025 –2032 | |

| USD 17.84 Billion | |

| USD 79.83 Billion | |

|

|

|

|

Laser Projection Market Size

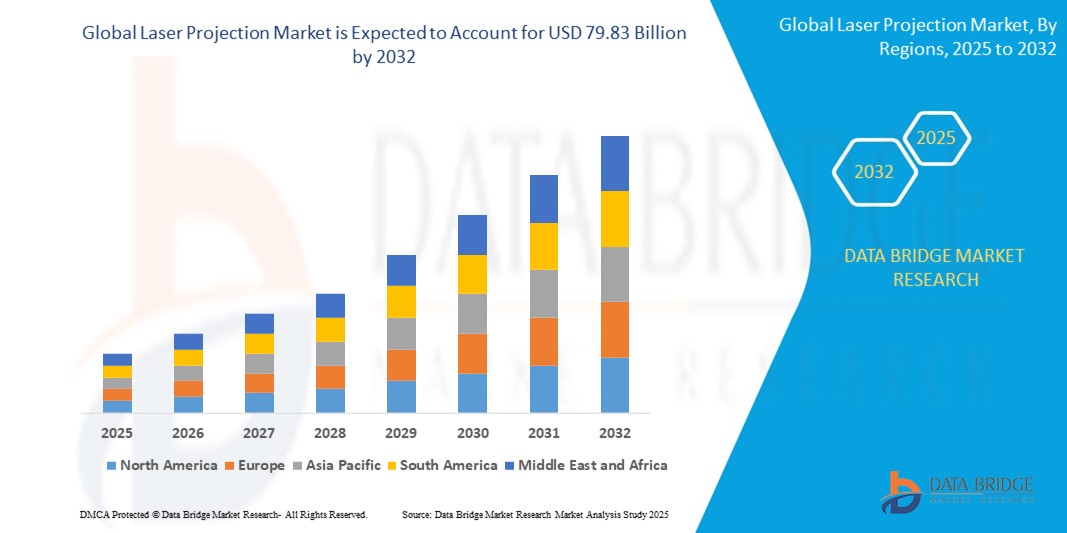

- The global laser projection market size was valued at USD 17.84 billion in 2024 and is expected to reach USD 79.83 billion by 2032, at a CAGR of 20.6% during the forecast period

- The market growth is significantly driven by the numerous advantages of laser projectors over traditional lamp-based projectors, including their longer lifespan, reduced maintenance requirements, superior brightness and color fidelity, and energy efficiency

- Rising demand for high-brightness projection solutions across various sectors such as education for interactive learning environments, corporate for presentations, and the entertainment industry including digital cinemas, theme parks, and live events, is compelling the growth of the laser projection market. The increasing adoption of 4K and 8K resolution laser projectors for enhanced viewing experiences in home theaters, simulation, and gaming applications further fuels this demand

Laser Projection Market Analysis

- The laser projection market involves the development, manufacturing, and sale of projectors that utilize laser light sources to create images. This technology is gaining increasing importance in today's environment due to its capacity to offer superior brightness, color accuracy, energy efficiency, and longevity compared to traditional lamp-based projectors

- The expanding adoption of laser projection systems is mainly attributable to the growing demand for high-quality visual experiences across various applications, an increasing focus on energy-efficient and low-maintenance display solutions, and a rising need for versatile projection capabilities in diverse settings ranging from education and business to entertainment and industrial applications

- Asia-Pacific dominates the laser projection market with a share of 36.9% in 2024 due to the region's significant demand for advanced projection technologies in large-scale venues such as stadiums, amusement parks, and public spaces

- North America is expected to be the fastest growing region in the laser projection market during the forecast period due to increasing consumer awareness and adoption of advanced projection technologies. These laser projectors offer superior brightness, longer lifespan, and lower maintenance costs compared to traditional lamp-based projectors, appealing to both commercial and residential markets

- Laser phosphor segment is expected to dominate the market with a market share of 36.2% due to its cost-effectiveness, energy efficiency, and ability to produce bright and reliable images, making it a popular choice for a wide array of applications from classrooms to conference rooms

Report Scope and Laser Projection Market Segmentation

|

Attributes |

Laser Projection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Laser Projection Market Trends

“Increasing Demand for High-Quality Visuals”

- A prominent and rapidly expanding trend in the global laser projection market is the increasing demand for higher quality visual experiences across various applications. This growing emphasis is driven by advancements in display technologies, the availability of high-resolution content, and a consumer preference for more immersive and realistic visual output in settings ranging from home theaters to large-scale events

- For instance, major companies in the laser projection industry, such as Sony and Barco, are heavily investing in and promoting high-brightness, high-resolution laser projectors with enhanced color accuracy. Sony offers advanced 4K laser projectors for home cinema and professional applications, while Barco provides high-lumen RGB laser projectors for digital cinema and large venue displays

- This heightened focus on visual quality is enabling the creation of more engaging and impactful experiences. In educational settings, high-resolution laser projectors allow for clearer display of intricate diagrams and videos. In entertainment, they contribute to a more immersive and lifelike experience in cinemas and theme park attractions. For corporate presentations and digital signage, the superior image quality of laser projection ensures impactful and easily readable visuals

- The growing recognition among end-users of the limitations of lower-resolution or less vibrant display technologies, along with the increasing availability of 4K and even 8K content, further fuels the importance of high-quality visuals as a critical component of the modern laser projection market

- Organizations across different sectors are increasingly acknowledging the potential of high-quality laser projection to enhance communication, engagement, and overall impact. This trend towards prioritizing visual fidelity is driving significant advancements and investments in the laser projection market

- The demand for sharper, brighter, and more color-accurate visuals is growing rapidly, encouraging businesses and consumers to adopt laser projection technology that can deliver these enhanced experiences, ultimately boosting the market for high-performance laser projectors

Laser Projection Market Dynamics

Driver

“High Advancements in Laser Technology”

- The increasing recognition of the crucial role of technological innovation is a significant driver for the heightened demand and expansion of the laser projection market. Continuous advancements in laser technology are leading to the development of more efficient, brighter, smaller, and more cost-effective laser light sources, which are revolutionizing the projection industry

- For instance, leading companies at the forefront of laser technology, such as Epson and Barco, consistently launch new laser projectors with improved features. Epson has developed compact and high-brightness laser projectors using advanced laser diode technology, while Barco has pioneered high-lumen RGB laser projection systems for large venues, showcasing the benefits of pure laser light sources

- As the capabilities of laser technology continue to improve, laser projectors offer significant advantages over traditional lamp-based models. These include instant on/off functionality, consistent brightness over their lifespan, reduced heat output, lower power consumption, and the elimination of lamp replacements, leading to a lower total cost of ownership and enhanced user convenience

- The increasing availability of diverse and sophisticated laser light sources, coupled with innovations in optics and imaging processing, makes laser projection an increasingly attractive option across various sectors, driving its adoption and further technological progress

- The demand for cutting-edge display solutions is growing rapidly, encouraging manufacturers to leverage high advancements in laser technology to create innovative and high-performing projectors that meet the evolving needs of the market

Restraint/Challenge

“Complex Installation Requirements”

- The presence of complex installation requirements can pose a notable challenge to the broader adoption and easier integration of certain laser projection systems within the laser projection market. The necessity for specialized knowledge, precise alignment, and specific environmental conditions for optimal performance can create hurdles for end-users, particularly in non-professional settings

- For instance, while companies such as Barco and Christie Digital Systems offer high-performance laser projectors for large venues and digital cinema, their installation often necessitates trained technicians for proper setup, calibration, and integration with existing infrastructure. Similarly, even some advanced home theater laser projectors might require specific throw distances, screen types, and light control to achieve the intended visual quality, making the installation process more involved than traditional projectors

- Addressing these complex installation challenges requires manufacturers to focus on developing more user-friendly installation features, providing comprehensive guides and support, and potentially offering professional installation services as part of their product offerings. Features such as automatic calibration, lens shift, and keystone correction can help simplify the setup process

- While the superior performance and immersive experiences offered by advanced laser projection are significant advantages, the complexity involved in their installation can deter some potential customers, especially in segments where ease of use and setup are primary considerations.

- Overcoming these challenges through innovation in installation design and offering robust support and services will be vital for ensuring the consistent growth and wider appeal of the laser projection market across various user segments

Laser Projection Market Scope

The market is segmented on the basis of product type, illumination type, resolution, and verticals.

- By Product Type

On the basis of product type, the market is segmented into laser projector and CAD laser projection system. The laser projector segment dominates the largest market revenue share of 67.5% in 2024, driven by its versatility and wide range of applications across various sectors such as education, business presentations, home entertainment, and digital signage. Their adaptability to different display needs and established presence in the market contribute to their leading position.

The CAD laser projection system segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing adoption of these systems in industries such as aerospace, automotive, and construction for precise template projection, quality control, and assembly guidance, enhancing accuracy and efficiency in manufacturing processes.

- By Illumination Type

On the basis of illumination type, the market is segmented into laser phosphor, hybrid, RGB laser, laser diode, and others. The laser phosphor segment dominates the largest market revenue share of 36.2% in 2024, driven by its cost-effectiveness, energy efficiency, and ability to produce bright and reliable images, making it a popular choice for a wide array of applications from classrooms to conference rooms.

The RGB laser segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its superior color accuracy, wider color gamut, and high brightness levels, making it increasingly preferred in applications demanding high visual quality such as digital cinema, large venue displays, and advanced simulation and visualization.

- By Resolution

On the basis of resolution, the market is segmented into XGA (1024 x 768 pixels), WXGA (1280 x 800 pixels), HD (1920 x 1080 pixels), 4K (4096 x 2160 pixels), and others. The HD (1920 x 1080 pixels) segment dominates with the largest market revenue share in 2024, driven by its established status as the standard for high-definition content, offering a good balance of visual quality and affordability, and its widespread compatibility with various media and devices.

The 4K (4096 x 2160 pixels) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing availability of 4K content, decreasing prices of 4K projectors, and increasing demand for ultra-high-resolution visuals in applications such as home theaters, professional visualization, and certain enterprise and retail settings.

- By Verticals

On the basis of verticals, the market is segmented into retail, media and entertainment, public places, enterprise, healthcare, education, industrial, and others. The education segment dominates with the largest market revenue share of 28.8% in 2024, driven by the long-standing and widespread use of projectors in classrooms and educational institutions for visual learning and presentations, with laser projectors offering benefits such as longer lifespan and reduced maintenance.

The media and entertainment segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing deployment of laser projectors in applications such as digital signage in retail and entertainment venues, immersive experiences, themed attractions, and live events, where their high brightness, vibrant colors, and flexibility in projection mapping create engaging and impactful visuals.

Laser Projection Market Regional Analysis

- Asia-Pacific dominates the laser projection market with the largest revenue share of 36.9% in 2024, driven by the region's significant demand for advanced projection technologies in large-scale venues such as stadiums, amusement parks, and public spaces

- Moreover, APAC's rapid urbanization and infrastructure development further drive the adoption of laser projectors in commercial and entertainment sectors, fueling market growth

- The region's robust manufacturing capabilities and technological advancements also contribute to its leadership in producing and deploying these cutting-edge projection systems

China Laser Projection Market Insight

China laser projection market is a significant contributor to the Asia Pacific region, which held the largest share of the global laser projection market driven by a rising demand for digital displays and increasing adoption across various sectors. Specifically within the smart home projector segment, China holds a dominant share of the global market. This indicates a strong consumer preference and market presence for laser projectors in home entertainment. The market is also seeing trends such as young consumers shifting from traditional TVs to projectors, and an increasing preference for laser projectors over traditional lamp-based models due to their enhanced performance and longevity.

Europe Laser Projection Market Insight

Europe accounts for a significant global market share in laser projection. Increased use in business settings, educational facilities, and public venues such as museums and exhibitions is driving growth, and the integration of laser projectors into sophisticated manufacturing and simulation applications is also a factor. The presence of leading projection technology manufacturers in the region supports this expansion.

U.K. Laser Projection Market Insight

U.K. laser projection market is experiencing notable expansion within Europe, likely boosted by growing adoption in the education and corporate sectors, alongside increasing use in rental and staging for events and performances. A rising need for energy-efficient and high-performing projectors is also contributing to this growth.

Germany Laser Projection Market Insight

Germany represents a substantial and expanding market for laser technology, including significant use of laser projectors across different sectors such as automotive design, simulation, and in educational and commercial installations. This is strongly supported by the country's emphasis on technological innovation and high-quality engineering.

North America Laser Projection Market Insight

North America Laser Projection market is poised to grow at the fastest CAGR of over 24% during the forecast period of 2025 to 2032, driven by increasing consumer awareness and adoption of advanced projection technologies. These laser projectors offer superior brightness, longer lifespan, and lower maintenance costs compared to traditional lamp-based projectors, appealing to both commercial and residential markets. The region's robust infrastructure for technological innovation and a strong consumer base seeking high-quality visual experiences further contribute to this anticipated growth. In addition, trends favoring large-scale digital displays in sectors such as entertainment, education, and corporate environments are driving demand for these advanced projection solutions in North America.

U.S. Laser Projection Market Insight

In the U.S., the laser display technology industry is expected to experience substantial growth due to increasing demand from the cinema, corporate, and education sectors. Hollywood's shift towards laser projection, also known as smart laser display, and the expansion of immersive entertainment venues such as theme parks and museums are significant factors driving this adoption. Government initiatives that promote energy efficiency and adherence to safety standards are also encouraging the growth of the industry. Furthermore, investments by major technology companies in augmented and virtual reality are accelerating innovation. Demand is also being fueled by corporate spending on hybrid work solutions, with companies such as Epson and Barco increasing their focus on this market. The US remains a leading region in this industry due to significant investments in research, development, and rapid technological advancements.

Laser Projection Market Share

The laser projection industry is primarily led by well-established companies, including:

- Panasonic Corporation (Japan)

- LG Electronics (South Korea)

- Xiaomi (China)

- Barco (Belgium)

- NEC Display Solutions (Japan)

- BenQ America Corp. (Taiwan)

- Delta Electronics, Inc. (Taiwan)

- Optoma (Taiwan)

- Sony Corporation (Japan)

- Seiko Epson Corporation (Japan)

- Ricoh (Japan)

- Canon Inc. (Japan)

- Christie Digital Systems USA, Inc. (U.S.)

- Dell (U.S.)

- Hitachi Digital Media Group (Japan)

- FARO Technologies, Inc. (U.S.)

- LAP GmbH (Germany)

- CASIO COMPUTER CO., LTD. (Japan)

- ViewSonic Corporation (U.S.)

- Digital Projection, Inc. (U.K.)

- VAVA (China)

- Eiki International, Inc. (Japan)

- Production Resource Group LLC (U.S.)

- Kvant Lasers SRO (Slovakia)

Latest Developments in Global Laser Projection Market

- In October 2024, PFU (EMEA) Limited's announcement of the RICOH PJ UHL3660 UST Laser Projector's addition to its smart meeting devices portfolio signifies the growing trend of incorporating ultra-short throw laser technology into products designed for collaborative environments, aiming to enhance meeting experiences with advanced visual capabilities

- In March 2021, Samsung Electronics H.K. Co., Ltd.'s launch of The Premiere 4K Smart Triple Laser Projector (Ultra Short Throw) LSP9T significantly impacted the laser projection market by showcasing the potential of ultra-short throw technology combined with cutting-edge triple laser systems to deliver a high-quality 4K viewing experience on large screens from a very short distance within homes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Laser Projection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Laser Projection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Laser Projection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.