Global Laundry Detergents Market

Market Size in USD Billion

CAGR :

%

USD

66.33 Billion

USD

98.76 Billion

2024

2032

USD

66.33 Billion

USD

98.76 Billion

2024

2032

| 2025 –2032 | |

| USD 66.33 Billion | |

| USD 98.76 Billion | |

|

|

|

|

Laundry Detergent Market Size

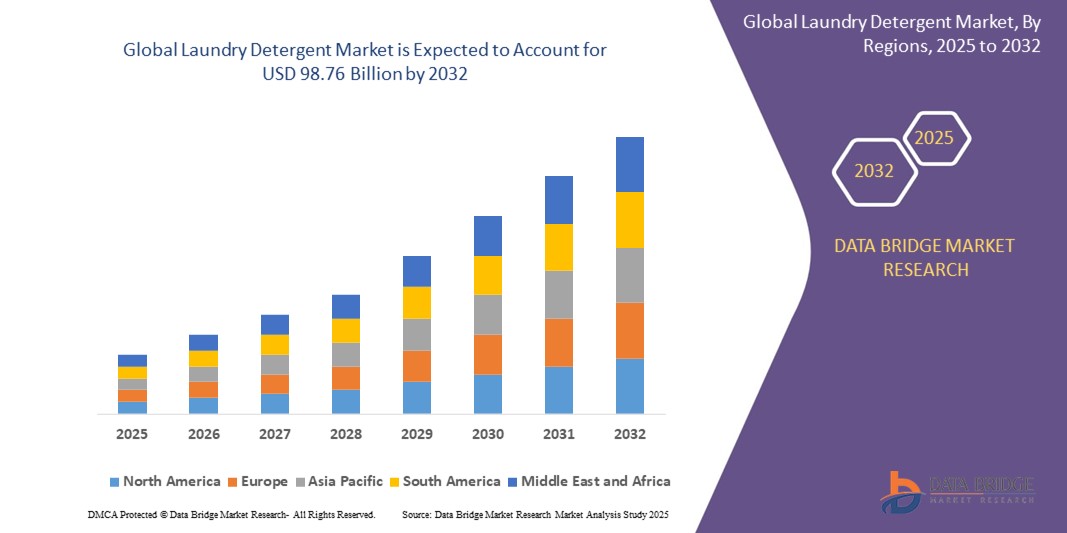

- The global laundry detergent market size was valued at USD 66.33 billion in 2024 and is expected to reach USD 98.76 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the rising demand for effective and sustainable cleaning solutions, growing urban populations, and increasing household disposable incomes

- The growing penetration of washing machines in emerging economies, supported by improved electricity access and rising living standards, is significantly contributing to the increased demand for laundry detergents across these regions

Laundry Detergent Market Analysis

- The market is witnessing a shift toward eco-friendly and concentrated detergent formulations, which appeal to environmentally conscious consumers and reduce packaging waste

- Expansion in online retail channels and brand innovation in fragrances, stain-removal technologies, and fabric care enhancements continue to drive global adoption of both liquid and powder detergent formats across residential and commercial sectors

- North America dominated the laundry detergent market with the largest revenue share in 2024, fueled by established consumption patterns, high product availability, and increasing interest in eco-friendly and skin-sensitive formulations

- Asia-Pacific region is expected to witness the highest growth rate in the global laundry detergent market, driven by rapid urbanization, rising disposable incomes, and the growing penetration of washing machines across emerging economies such as India, China, and Southeast Asian nations

- The liquid detergents segment dominated the market with the largest market revenue share in 2024, driven by its ease of use in both hand and machine washing, as well as its suitability for cold water cleaning. The growing preference for convenience and efficient stain removal has made liquid formats a top choice for urban households. In addition, the rise in the use of high-efficiency washing machines further supports the demand for low-sudsing liquid detergents

Report Scope and Laundry Detergent Market Segmentation

|

Attributes |

Laundry Detergent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Premium, Multifunctional Detergents • Expansion of E-Commerce and Direct-To-Consumer Sales |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laundry Detergent Market Trends

“Demand for Eco-Friendly and Sustainable Laundry Products”

- Consumers are increasingly seeking laundry detergents made from biodegradable and plant-based ingredients to minimize environmental harm

- There is growing demand for phosphate-free, non-toxic formulations that are safe for both users and aquatic ecosystems

- Brands such as Seventh Generation and Method have gained significant market traction by offering green alternatives and transparent labeling

- Concentrated and refillable laundry products are gaining popularity for their reduced packaging needs and lower carbon footprint

- Retailers and e-commerce platforms are promoting sustainable packaging, such as recyclable cardboard boxes and refill pouches, to attract eco-conscious buyers

- For instance, in 2023, Unilever’s Persil Eco Power Bars were launched in several European markets, emphasizing plastic-free packaging and concentrated plant-based cleaning agents

Laundry Detergent Market Dynamics

Driver

“Growing Urbanization and Increased Access to Washing Machines”

- Urban expansion is increasing the demand for convenient and time-saving laundry solutions, such as automatic detergents

- The middle-class population boom in developing nations is accelerating washing machine ownership

- Machine-compatible formats such as liquid and pod detergents are seeing higher adoption due to ease of use

- Dual-income families with busy lifestyles are prioritizing convenience and efficiency in home care routines

- Rising appliance sales in countries such as India, Vietnam, and the Philippines are directly boosting detergent consumption

- For instance, according to LG Electronics, washing machine sales in India rose by over 15% in 2023, reflecting increased appliance penetration in tier-2 and tier-3 cities

Restraint/Challenge

“Price Sensitivity and Prevalence of Local/Unbranded Products in Developing Regions”

- Many consumers in emerging markets prefer cheaper, unbranded detergent products due to tight household budgets

- Premium detergents with added features face slow adoption in low-income regions because of high pricing

- Sachet-sized and bulk packs offered by local players dominate shelves due to affordability and accessibility

- Multinational brands struggle to balance product innovation with cost-competitiveness in price-sensitive markets

- Lack of brand loyalty and emphasis on basic cleaning needs limit market share growth for global detergent giants

- For instance, in rural Bangladesh, local detergent brands such as Jet and Chaka account for a majority of market sales due to lower price points and widespread availability compared to international labels

Laundry Detergent Market Scope

The market is segmented on the basis of product, component, application, and distribution channel.

• By Product

On the basis of product, the laundry detergent market is segmented into powder detergents, liquid detergents, fabric softeners, detergent tablets, and others. The liquid detergents segment dominated the market with the largest market revenue share in 2024, driven by its ease of use in both hand and machine washing, as well as its suitability for cold water cleaning. The growing preference for convenience and efficient stain removal has made liquid formats a top choice for urban households. In addition, the rise in the use of high-efficiency washing machines further supports the demand for low-sudsing liquid detergents.

The detergent tablets segment is expected to witness a fastest growth rate from 2025 to 2032, fueled by their pre-measured, no-mess format that offers a perfect dosage every wash. Tablets are gaining popularity in developed markets due to their compact packaging and growing interest in sustainable laundry solutions that reduce water and chemical waste.

• By Component

On the basis of component, the laundry detergent market is segmented into builders, bleach, enzymes, and others. The builders segment captured the largest revenue share in 2024, as they play a vital role in softening hard water, enhancing detergent effectiveness, and improving soil suspension. Builders are commonly used in both liquid and powder formulations, offering improved performance across diverse washing conditions.

The bleach segment is expected to witness a fastest growth rate from 2025 to 2032, due to its strong oxidizing properties, which help in whitening and disinfecting fabrics. Enzymes, known for their stain-fighting capabilities, are increasingly used in premium products for removing tough organic stains such as grease, food, and blood. The demand for multifunctional enzyme blends is growing, particularly in concentrated and low-temperature wash detergents that offer energy savings without compromising cleaning performance.

• By Application

On the basis of application, the laundry detergent market is segmented into household and industrial or institutional. The household segment dominated the market in 2024, supported by the widespread use of washing machines and a growing preference for specialty detergents catering to sensitive skin, baby clothes, or fabric-specific care. Urbanization and improved living standards have driven detergent consumption, particularly in middle-income and developing regions.

The industrial or institutional segment is expected to witness a fastest growth rate from 2025 to 2032, due to increasing hygiene regulations and the expansion of commercial laundry services. The rising focus on infection control and fabric longevity in hospitals and hotels is also fuelling the need for high-performance institutional detergents.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline distribution channels. The offline segment held the largest market revenue share in 2024, driven by the strong presence of supermarkets, hypermarkets, and local convenience stores that offer consumers easy access to a variety of detergent brands and pack sizes. In-store promotions and the ability to physically compare products further reinforce offline sales.

The online distribution channel is expected to witness a fastest growth rate from 2025 to 2032, propelled by increasing digital literacy, mobile commerce adoption, and evolving consumer preferences for doorstep delivery. Subscription models and eco-friendly, refillable packaging options offered through e-commerce platforms are gaining popularity, especially among environmentally conscious consumers seeking convenience and sustainability.

Laundry Detergent Market Regional Analysis

• North America dominated the laundry detergent market with the largest revenue share in 2024, fueled by established consumption patterns, high product availability, and increasing interest in eco-friendly and skin-sensitive formulations

• Consumers in this region prioritize performance and brand loyalty, particularly in liquid detergents, while growing demand for hypoallergenic and baby-safe options is shaping new product development

• The region also benefits from advanced retail infrastructure and widespread adoption of automatic washing machines, sustaining detergent usage across both urban and suburban households

U.S. Laundry Detergent Market Insight

The U.S. laundry detergent market accounted for the largest revenue share within North America in 2024, driven by high levels of product innovation and consumer preference for premium detergents. Brands are focusing on concentrated formulas and sustainable packaging to meet evolving expectations. The popularity of liquid and pod formats continues to rise due to their convenience, especially among busy households. E-commerce platforms are also playing a key role in product accessibility and subscription-based sales growth.

Europe Laundry Detergent Market Insight

The Europe laundry detergent market is expected to witness a fastest growth rate from 2025 to 2032, supported by increasing demand for eco-labeled and biodegradable formulations. Stringent environmental regulations across the region have encouraged manufacturers to reduce chemical content and adopt green chemistry practices. Powder detergents remain popular in parts of Central and Eastern Europe, while Western Europe sees strong growth in concentrated liquids and tablets.

Germany Laundry Detergent Market Insight

The Germany laundry detergent market is expected to witness a fastest growth rate from 2025 to 2032, driven by strong consumer awareness about sustainability, product safety, and allergen-free ingredients. The presence of leading European manufacturers, combined with high household appliance penetration, supports a robust market. Brands are also emphasizing dermatologically tested and fragrance-free options to cater to sensitive skin needs.

U.K. Laundry Detergent Market Insight

The U.K. laundry detergent market is expected to witness a fastest growth rate from 2025 to 2032, driven by increasing demand for eco-friendly and hypoallergenic formulations. British consumers are highly conscious of sustainability, prompting a shift toward biodegradable ingredients and plastic-free or recyclable packaging. The rise of compact, high-efficiency washing machines is also influencing detergent preferences, with a notable uptick in demand for concentrated liquids and detergent pods. In addition, private-label and subscription-based detergent brands are gaining popularity, offering both cost-effectiveness and convenience in online and offline channels.

Asia-Pacific Laundry Detergent Market Insight

The Asia-Pacific laundry detergent market is expected to witness a fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing middle-class population, and rising awareness about hygiene. Expanding retail channels and increased washing machine ownership are boosting sales of modern detergent formats in countries such as China, India, and Indonesia. Brands are increasingly localizing product offerings to match regional fabric types and washing habits.

China Laundry Detergent Market Insight

The China dominated the Asia-Pacific laundry detergent market in 2024, owing to its large consumer base, strong domestic production, and evolving consumer preferences. The market is shifting toward higher-quality liquid detergents and eco-friendly innovations. Strong e-commerce infrastructure and digital campaigns by leading brands are further accelerating product reach.

Japan Laundry Detergent Market Insight

The Japan laundry detergent market is expected to witness a fastest growth rate from 2025 to 2032, supported by consumer preferences for mild, skin-friendly, and scent-enhanced products. Compact living spaces and environmental consciousness drive the popularity of concentrated liquids and refill packs. Japanese brands emphasize innovation in packaging and ingredients, with multifunctional detergents offering fabric care and antibacterial properties gaining traction.

Laundry Detergent Market Share

The Laundry Detergent industry is primarily led by well-established companies, including:

- Unilever (Netherlands)

- Henkel AG & Co. KGaA (Germany)

- Church & Dwight Co., Inc. (U.S.)

- Procter & Gamble (U.S.)

- Lion Corporation (Japan)

- Kao Corporation (Japan)

- method products, pbc. (U.S.)

- Carroll Company (U.S.)

- Colgate-Palmolive Company (U.S.)

- Johnson & Johnson Private Limited (U.S.)

- Reckitt Benckiser Group plc (U.K.)

- Amway India Enterprises Pvt. Ltd. (India)

- ALPHA CHEMICAL (U.S.)

- General Organics, Inc. (U.S.)

- Clean Bubbles (U.S.)

- NIRMA (India)

- BASF SE (Germany)

- DuPont (U.S.)

- Akzo Nobel N.V. (Netherlands)

Latest Developments in Global Laundry Detergent Market

- In June 2024, Whirlpool India announced a strategic partnership with Hindustan Unilever to revolutionize the laundry experience in India. This collaboration aims to integrate Whirlpool’s cutting-edge washing machines with Hindustan Unilever’s extensive range of detergents, enhancing overall laundry performance. The partnership emphasizes innovation and customer satisfaction, with a vision to transform how consumers manage laundry by merging advanced technology with high-quality cleaning products for superior results

- In May 2022, Procter & Gamble (P&G) made a significant investment of USD 2.51 billion to expand its liquid detergent production capabilities in Hyderabad, India. This strategic move aims to bolster P&G’s presence in the growing Indian detergent market. By establishing a state-of-the-art manufacturing facility, the company intends to meet increasing consumer demand for high-quality liquid detergents, further solidifying its position in the competitive landscape

- In May 2022, Breeze, a prominent brand under Unilever PLC, launched a new product, Breeze Detergent, featuring a thinner formula designed for convenience and effectiveness. The product comes in a 500ml bottle, which can be mixed with 2.5 liters of water, allowing consumers to achieve over 60 washes. This innovative packaging and formulation reflect Breeze’s commitment to providing cost-effective and practical laundry solutions to consumers

- In January 2022, Henkel announced its strategic decision to consolidate its laundry, home care, and beauty care divisions into a single entity called Henkel Consumer Brands by early 2023. This merger aims to enhance operational efficiency and create a unified platform for consumers. By leveraging combined resources, Henkel seeks to improve customer service and streamline its infrastructure, ultimately providing a more integrated shopping experience for consumers

- In June 2021, Tide, a leading laundry detergent brand from Procter & Gamble, announced a unique initiative to design cleaning products specifically for space applications. The company signed a Space Act Agreement with NASA, exploring the development of innovative cleaning solutions tailored for astronauts. This collaboration represents a ground-breaking approach to addressing the challenges of hygiene in space environments, showcasing Tide’s commitment to innovation beyond Earth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.