Global Lifting Equipment Market

Market Size in USD Billion

CAGR :

%

USD

77.58 Billion

USD

112.89 Billion

2024

2032

USD

77.58 Billion

USD

112.89 Billion

2024

2032

| 2025 –2032 | |

| USD 77.58 Billion | |

| USD 112.89 Billion | |

|

|

|

|

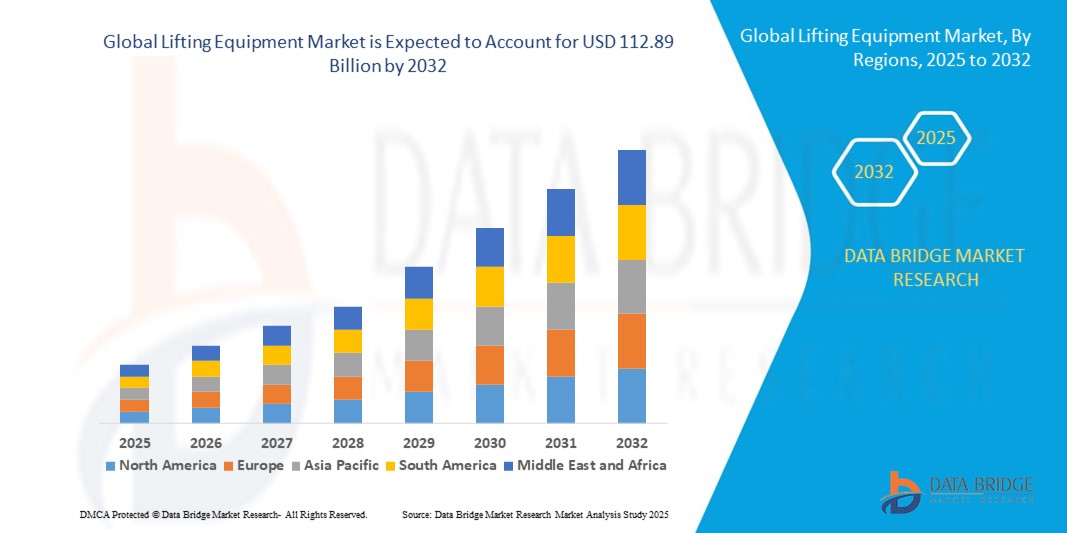

What is the Global Lifting Equipment Market Size and Growth Rate?

- The global lifting equipment market size was valued at USD 77.58 billion in 2024 and is expected to reach USD 112.89 billion by 2032, at a CAGR of 4.80% during the forecast period

- The global lifting equipment market is witnessing steady growth driven by increasing industrialization and construction activities globally. Technological advancements such as IoT integration and automation are enhancing the efficiency and safety of lifting equipment. Key players are focusing on innovation and strategic partnerships to gain a competitive edge in the market. However, stringent regulations regarding safety standards pose a challenge to market growth

What are the Major Takeaways of Lifting Equipment Market?

- The rise in the construction industry along with the swift industrialization is one of the major factors driving the growth of global lifting equipment market. These trucks are popular for being powerful, user-friendly, economical, and easy to maintain. They are usually utilized in several industrial tasks owing to their unique features

- North America dominated the lifting equipment market with the largest revenue share of 36.14% in 2024, driven by robust construction activity, expanding manufacturing output, and significant investments in warehouse automation

- Asia-Pacific (APAC) region is projected to record the fastest CAGR of 10.7% from 2025 to 2032, driven by rapid industrialization, infrastructure expansion, and the growth of manufacturing hubs in countries such as China, India, and Vietnam

- The Forklifts segment dominated the market with the largest revenue share of 36.8% in 2024, driven by their versatility in handling various load sizes, ease of operation, and wide applicability across warehouses, manufacturing facilities, and construction sites

Report Scope and Lifting Equipment Market Segmentation

|

Attributes |

Lifting Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Lifting Equipment Market?

Integration of IoT, Telematics, and Automation

- A major emerging trend in the global lifting equipment market is the integration of IoT-enabled monitoring systems, telematics, and automated control features to improve safety, efficiency, and predictive maintenance capabilities

- For instance, Konecranes offers Smart Features such as sway control, load impact monitoring, and remote diagnostics, allowing operators to track equipment health and performance in real time. Similarly, Komatsu integrates KOMTRAX telematics to optimize usage patterns and minimize downtime

- IoT connectivity enables monitoring of load capacity, operational hours, and environmental conditions, reducing the risk of overloads and enhancing operational planning. Jungheinrich AG has introduced automated warehouse cranes with energy recovery systems and remote troubleshooting

- Automation allows for precision lifting, reduced human error, and consistent performance in high-risk environments such as ports, construction sites, and heavy manufacturing plants

- Companies such as Toyota Industries Corporation are incorporating AI-driven analytics with lifting machinery to predict maintenance needs and improve lifecycle management

- This shift towards intelligent, data-driven lifting equipment is boosting safety compliance, reducing operational interruptions, and enhancing overall productivity across industries worldwide

What are the Key Drivers of Lifting Equipment Market?

- Growing demand for material handling efficiency in industries such as construction, logistics, manufacturing, and shipping is a primary driver for lifting equipment adoption

- For instance, in May 2024, Haulotte Group launched its latest range of electric scissor lifts with enhanced load capacity and extended battery life, supporting sustainable operations in urban construction projects

- Rapid infrastructure development in emerging economies, especially in Asia-Pacific, is fueling the need for cranes, forklifts, and hoists capable of handling heavy loads efficiently

- Expansion of e-commerce and warehousing is creating demand for automated lifting solutions to speed up order fulfillment and reduce labor dependency

- Increased workplace safety regulations are pushing companies to adopt modern lifting machines equipped with load monitoring, stability control, and fail-safe braking systems

- The combination of industrial growth, safety standards, and technological upgrades is driving global demand for advanced lifting equipment

Which Factor is challenging the Growth of the Lifting Equipment Market?

- One major challenge is the high initial investment for technologically advanced lifting equipment, which can deter adoption in small-scale businesses or cost-sensitive markets

- For instance, automated cranes with IoT and AI capabilities can be significantly more expensive than traditional lifting systems, limiting penetration in developing regions

- Operational challenges such as equipment downtime due to harsh working conditions, overloading, or inadequate maintenance can impact productivity and increase repair costs

- Shortage of skilled operators and technicians trained to handle automated and telematics-equipped lifting machines further slows adoption

- Companies such as Konecranes and PALFINGER AG are addressing these challenges by offering flexible leasing programs, modular designs, and operator training packages

- Overcoming these hurdles will require cost optimization, durability enhancements, and workforce upskilling to maximize the benefits of next-generation lifting equipment

How is the Lifting Equipment Market Segmented?

The market is segmented on the basis of type, mechanism, and application.

- By Type

On the basis of type, the lifting equipment market is segmented into Lifts, Pallet Trucks, Forklifts, Hoists, Stackers, and Robotic Arms. The Forklifts segment dominated the market with the largest revenue share of 36.8% in 2024, driven by their versatility in handling various load sizes, ease of operation, and wide applicability across warehouses, manufacturing facilities, and construction sites. Their capability to operate in confined spaces while providing high load-lifting efficiency has solidified their role as an essential material handling solution in multiple industries.

The Robotic Arms segment is projected to witness the fastest growth rate from 2025 to 2032, owing to increasing automation in manufacturing and logistics, along with advancements in AI-powered load-handling systems that enhance precision, safety, and productivity.

- By Mechanism

On the basis of mechanism, the market is segmented into Electrical, Magnetic, Hydraulic, Pneumatic, and Scissor Lifts. The Hydraulic segment accounted for the largest market share of 41.2% in 2024, supported by their high load-bearing capacity, durability, and adaptability for both stationary and mobile lifting applications. Their widespread use in construction, heavy manufacturing, and shipbuilding sectors makes them indispensable for large-scale lifting tasks.

The Electrical segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the shift toward energy-efficient, low-maintenance, and environmentally friendly lifting systems, especially in indoor and automated operations.

- By Application

On the basis of application, the lifting equipment market is segmented into Construction, Shipping Dockyards and Warehouses, Manufacturing Industry, and Process Industry. The Construction segment held the largest revenue share of 39.5% in 2024, driven by rapid urbanization, infrastructure development projects, and the demand for high-capacity lifting solutions for building materials and heavy components. The need for safe and efficient load handling in high-rise construction and large-scale engineering projects further contributes to this dominance.

The Shipping Dockyards and Warehouses segment is anticipated to witness the fastest growth from 2025 to 2032, owing to the expansion of global trade, increasing container traffic, and the adoption of automated cargo-handling systems that enhance throughput and reduce manual labor dependency.

Which Region Holds the Largest Share of the Lifting Equipment Market?

- North America dominated the lifting equipment market with the largest revenue share of 36.14% in 2024, driven by robust construction activity, expanding manufacturing output, and significant investments in warehouse automation

- The region’s strong presence of major equipment manufacturers, combined with technological advancements in automated and electric lifting systems, is fueling market growth

- Supportive safety regulations, a skilled operator workforce, and the rapid adoption of Industry 4.0 solutions position North America as a global leader in lifting equipment adoption

U.S. Lifting Equipment Market Insight

The U.S. captured the largest share within North America, supported by high infrastructure spending, large-scale industrial expansion, and the rapid rise of e-commerce-driven warehousing. The country’s advanced logistics sector, coupled with growing adoption of autonomous forklifts and robotic lifting arms, is driving demand. Ongoing investments in safety upgrades, load efficiency, and high-capacity lifting solutions further strengthen market growth. In addition, increasing replacement of older, fuel-based equipment with energy-efficient electric models is shaping the country’s competitive advantage.

Europe Lifting Equipment Market Insight

Europe is projected to grow at a healthy CAGR during the forecast period, supported by modernization of manufacturing facilities and the rapid growth of the renewable energy sector. Countries such as Germany and the U.K. are investing in advanced lifting solutions for wind turbine assembly, aerospace production, and port automation. The push for sustainability and compliance with strict workplace safety regulations is accelerating the adoption of electric and hybrid lifting equipment across industries.

U.K. Lifting Equipment Market Insight

The U.K. market is set to grow steadily, supported by investments in infrastructure development, warehouse automation, and offshore renewable energy projects. The logistics and e-commerce boom is increasing demand for compact, high-efficiency forklifts and automated stacker systems. Adoption of low-emission and battery-powered lifting solutions is becoming more prevalent, aligning with the country’s carbon-reduction targets and environmental standards.

Germany Lifting Equipment Market Insight

Germany’s market growth is influenced by its position as a leading manufacturing hub and exporter of high-precision lifting machinery. With strong demand from automotive production lines, industrial plants, and logistics hubs, the country continues to set quality benchmarks in the sector. Its robust R&D ecosystem fosters the development of advanced lifting technologies that improve operational safety, reduce downtime, and enhance load-handling accuracy.

Which Region is the Fastest Growing Region in the Lifting Equipment Market?

Asia-Pacific (APAC) region is projected to record the fastest CAGR of 10.7% from 2025 to 2032, driven by rapid industrialization, infrastructure expansion, and the growth of manufacturing hubs in countries such as China, India, and Vietnam. The rise in smart factories, coupled with significant port expansion projects and warehouse automation in Southeast Asia, is boosting demand for advanced lifting systems. Competitive manufacturing costs and rising export-oriented production are further fueling equipment adoption.

Japan Lifting Equipment Market Insight

Japan’s market is driven by its advanced engineering capabilities and demand for precision lifting solutions in automotive manufacturing, shipbuilding, and renewable energy projects. While its domestic market size is smaller compared to China, Japanese manufacturers play a critical role in supplying high-quality, automated lifting equipment globally. The country’s expertise in robotics and mechatronics is advancing the development of intelligent load-handling systems.

China Lifting Equipment Market Insight

China held the largest market share in APAC in 2024, supported by large-scale industrial expansion, aggressive infrastructure development, and government-backed manufacturing modernization programs. The country’s dominance in global trade and logistics has fueled demand for port cranes, automated warehouse lifts, and high-capacity forklifts. Competitive pricing from local manufacturers, along with rapid adoption of electric and autonomous lifting systems, continues to strengthen China’s leadership in the regional market.

Which are the Top Companies in Lifting Equipment Market?

The lifting equipment industry is primarily led by well-established companies, including:

- Anhui Heli Co., Ltd. (China)

- HAULOTTE GROUP (France)

- Ingersoll Rand (U.S.)

- SSAB (Sweden)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- Hyster-Yale Materials Handling, Inc. (U.S.)

- PALFINGER AG (Austria)

- Cargotec Corporation (Finland)

- Columbus McKinnon Corporation (U.S.)

- TOYOTA INDUSTRIES CORPORATION (Japan)

- KITO CORPORATION (Japan)

- XCMG Group (China)

- Linamar (Canada)

- Terex Corporation (U.S.)

- Jungheinrich AG (Germany)

- Liebherr (Germany)

- Konecranes (Finland)

- The Manitowoc Company, Inc. (U.S.)

- Tadano Ltd. (Japan)

- Crown Equipment Corporation (U.S.)

- Mammoet (Netherlands)

- Komatsu Ltd. (Japan)

- MITSUBISHI LOGISNEXT CO., LTD (Japan)

What are the Recent Developments in Global Lifting Equipment Market?

- In January 2022, Terex Ecotec, a subsidiary of U.S.-based Terex Corporation and part of the Terex Materials Processing business, announced the launch of a new track-mounted high-speed shredder designed for medium-scale producers seeking precise and consistent output. This launch strengthens the company’s product portfolio and expands its reach in the materials processing market

- In December 2021, Kion Group AG officially inaugurated its asymmetric lift truck plant in Jinan, China, with the first forklift rolling off the production line, while also laying the foundation stone for a new material handling equipment facility adjacent to it. These developments highlight Kion’s commitment to expanding its manufacturing capabilities in the Asia-Pacific region

- In May 2021, Toyota Industries formed a strategic partnership with Third Wave Automation to develop next-generation autonomous material handling solutions. This collaboration marks a step forward in advancing automation and efficiency in warehouse operations

- In July 2020, Terex Cranes welcomed RET Utilaje from Romania into its dealer network, granting the company rights to sell Terex’s rough terrain cranes across the country, including popular models such as the RT35 and RT1045. This partnership enhances Terex’s sales and service footprint in Eastern Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lifting Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lifting Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lifting Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.