Global Lipid Disorder Treatment Market

Market Size in USD Billion

CAGR :

%

USD

30.96 Billion

USD

56.29 Billion

2025

2033

USD

30.96 Billion

USD

56.29 Billion

2025

2033

| 2026 –2033 | |

| USD 30.96 Billion | |

| USD 56.29 Billion | |

|

|

|

|

Lipid Disorder Treatment Market Size

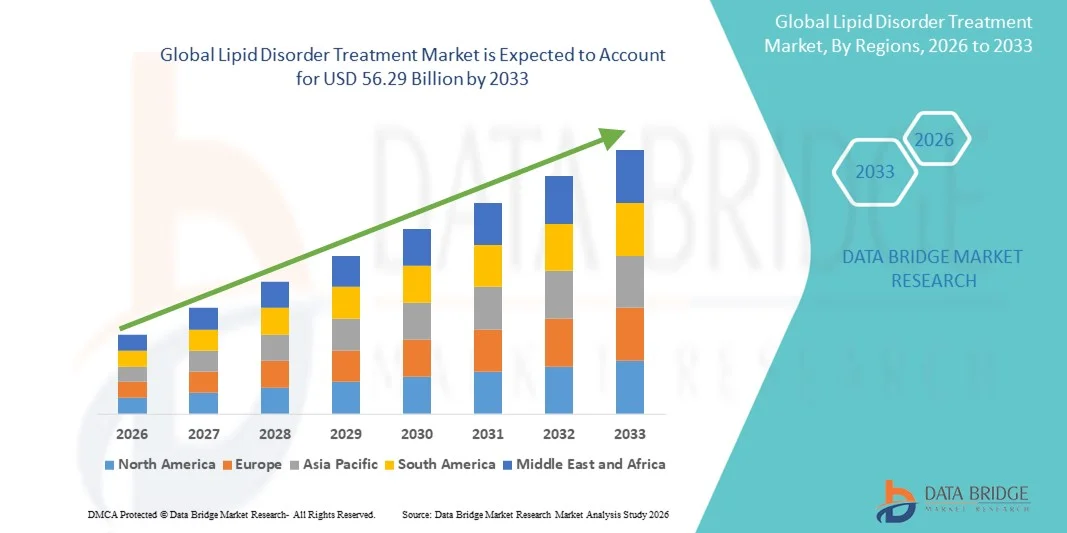

- The global lipid disorder treatment market size was valued at USD 30.96 billion in 2025 and is expected to reach USD 56.29 billion by 2033, at a CAGR of 6.87% during the forecast period

- The market growth is largely fueled by the rising prevalence of lipid abnormalities increasing cardiovascular disease risk worldwide, and continuous innovations in lipid‑lowering therapies such as statins, PCSK9 inhibitors, and emerging modalities that improve patient outcomes

- Furthermore, growing awareness of heart health, broader treatment adoption, and personalized therapeutic approaches are driving demand for effective lipid disorder management across both developed and emerging markets. These converging factors are accelerating uptake of advanced treatment solutions, thereby significantly boosting the industry’s growth

Lipid Disorder Treatment Market Analysi

- Lipid disorder treatments, including statins such as Atorvastatin, Rosuvastatin, Simvastatin, Fluvastatin, and Pravastatin, are increasingly vital for managing high cholesterol and triglyceride levels, reducing cardiovascular risks, and improving long-term heart health outcomes across both developed and emerging markets

- The escalating demand for lipid disorder treatments is primarily fueled by the rising prevalence of cardiovascular diseases, growing awareness of heart health, and increasing adoption of advanced therapies that offer improved efficacy and safety profiles compared to traditional medications

- North America dominated the lipid disorder treatment market with the largest revenue share of 38.9% in 2025, driven by high healthcare expenditure, early adoption of innovative therapies, and strong presence of key pharmaceutical companies, with the U.S. experiencing substantial growth in prescription and over-the-counter lipid-lowering medications

- Asia-Pacific is expected to be the fastest-growing region in the lipid disorder treatment market during the forecast period due to increasing prevalence of lifestyle-related disorders, expanding healthcare infrastructure, and rising accessibility to modern lipid-lowering therapies

- Atorvastatin segment dominated the lipid disorder treatment market with a market share of 42.3% in 2025, driven by its proven efficacy, established clinical guidelines, and widespread physician preference for managing high cholesterol and cardiovascular risk

Report Scope and Lipid Disorder Treatment Market Segmentation

|

Attributes |

Lipid Disorder Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Lipid Disorder Treatment Market Trends

Emerging Personalized Therapies and Digital Health Integration

- A significant and accelerating trend in the global lipid disorder treatment market is the increasing adoption of personalized lipid-lowering therapies and digital health tools, enabling tailored treatment plans based on patient genetics, lifestyle, and cholesterol profiles

- For instance, some clinics now use genetic testing to identify high-risk patients for statin therapy, while digital platforms track medication adherence and lipid profile improvements, helping optimize treatment outcomes

- Integration of mobile health apps with wearable devices enables patients to monitor cholesterol levels, receive medication reminders, and share real-time data with healthcare providers, improving patient engagement and adherence

- Pharmaceutical companies are increasingly collaborating with digital health startups to offer telemedicine solutions, allowing patients to receive consultations, prescriptions, and therapy adjustments remotely, creating a more connected treatment ecosystem

- This trend towards personalized, digitally enabled, and data-driven lipid disorder management is reshaping patient expectations and care strategies. Consequently, companies such as Amgen and Pfizer are exploring digital adherence tools alongside advanced therapies to enhance patient outcomes

- The demand for lipid-lowering treatments that incorporate personalized approaches and digital health support is growing rapidly across both developed and emerging markets as patients and physicians prioritize efficacy, convenience, and long-term cardiovascular risk reduction

- Rising interest in combination therapies that target multiple lipid parameters simultaneously is further driving innovation, offering enhanced treatment efficacy for patients with complex lipid disorders

- Integration of AI-powered predictive analytics in lipid disorder management platforms is helping physicians forecast patient risk, optimize therapy, and reduce cardiovascular events, creating new value in treatment delivery

Lipid Disorder Treatment Market Dynamics

Driver

Rising Prevalence of Cardiovascular Diseases and Awareness

- The increasing prevalence of cardiovascular diseases and associated lipid disorders, coupled with rising patient awareness about cholesterol management, is a key driver for the growing demand for lipid-lowering therapies

- For instance, in April 2025, a U.S. cardiology clinic introduced a digital statin management program, aiming to monitor and optimize treatment for patients with high LDL cholesterol, which highlights efforts to improve therapy adherence and outcomes

- As patients and physicians recognize the link between lipid levels and heart disease risk, there is increased adoption of advanced therapies such as statins, PCSK9 inhibitors, and combination treatments for effective cholesterol control

- Furthermore, government health initiatives, awareness campaigns, and preventive cardiovascular programs are encouraging routine lipid screening and early intervention, driving market growth

- The convenience of oral therapies, injectable biologics, and online prescription services are further facilitating access to lipid disorder treatments across both urban and rural regions, promoting widespread adoption

- Expanding geriatric population with higher cardiovascular risk is boosting demand for long-term lipid management solutions, creating a substantial growth opportunity

- Increasing insurance coverage and reimbursement programs in developed and emerging countries are making advanced lipid-lowering therapies more accessible, further driving market expansion

Restraint/Challenge

Adverse Effects and High Treatment Costs

- Concerns surrounding side effects of lipid-lowering therapies, such as muscle pain, liver enzyme elevation, or gastrointestinal issues, pose a significant challenge to broader market uptake

- For instance, reports of statin-induced myopathy or intolerance have led some patients to discontinue therapy, impacting overall adherence and limiting market growth potential

- Addressing these adverse effects through alternative therapies, dose adjustments, and regular monitoring is crucial for improving patient compliance. In addition, the relatively high cost of advanced therapies such as PCSK9 inhibitors compared to generic statins can be a barrier for patients in developing regions or with limited insurance coverage

- While generic statins have reduced treatment costs, premium biologics and combination therapies still carry a higher price tag, limiting adoption among price-sensitive populations

- Overcoming these challenges through safer therapies, patient education, and reimbursement programs will be vital for sustained growth of the lipid disorder treatment market

- Limited awareness in rural and underserved regions regarding lipid disorders and preventive care can hinder early diagnosis and treatment initiation, restraining market penetration

- Stringent regulatory approvals and clinical trial requirements for new lipid-lowering therapies increase development timelines and costs, posing challenges for market entrants and innovation

Lipid Disorder Treatment Market Scope

The market is segmented on the basis of product, indication, and distribution channel.

- By Product

On the basis of product, the global lipid disorder treatment market is segmented into atorvastatin, fluvastatin, rosuvastatin, simvastatin, pravastatin, and other products. The atorvastatin segment dominated the market with the largest revenue share of 42.3% in 2025, driven by its strong clinical efficacy in lowering LDL cholesterol and its widespread prescription across both primary and secondary prevention of cardiovascular diseases. Atorvastatin is commonly recommended due to its proven long-term safety profile and availability in both branded and generic forms, making it accessible across diverse patient populations. Physicians frequently prefer atorvastatin for patients with moderate to severe hypercholesterolemia owing to its dose flexibility and effectiveness. In addition, its broad regulatory approvals and inclusion in standard treatment guidelines support high prescription volumes. The extensive availability through retail and hospital pharmacies further strengthens its dominant position. These factors collectively contribute to atorvastatin’s continued leadership in the product segment.

The rosuvastatin segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its superior potency and ability to achieve aggressive LDL reduction at lower doses. Rosuvastatin is increasingly prescribed for high-risk patients, including those with diabetes and established cardiovascular disease, due to its favorable lipid-modifying profile. Growing clinical evidence supporting its effectiveness in reducing cardiovascular events is driving adoption. Furthermore, the rising diagnosis of familial hypercholesterolemia is boosting demand for high-intensity statin therapies such as rosuvastatin. Expanding generic availability is improving affordability, particularly in emerging markets. These factors are accelerating the growth trajectory of the rosuvastatin segment.

- By Indication

On the basis of indication, the market is segmented into familial combined hyperlipidemia, familial defective apolipoprotein B-100, familial dysbetalipoproteinemia, familial hypertriglyceridemia, heterozygous familial hypercholesterolemia, and other indications. The familial combined hyperlipidemia segment dominated the market in 2025, owing to its high prevalence among inherited lipid disorders and its strong association with premature cardiovascular disease. Patients with this condition often require long-term lipid-lowering therapy, contributing to sustained drug demand. The condition frequently remains underdiagnosed until adulthood, leading to chronic treatment needs once identified. Physicians commonly prescribe statins as first-line therapy, reinforcing high prescription volumes. Increasing screening and awareness programs are improving diagnosis rates. As a result, this indication continues to generate substantial revenue for the market.

The heterozygous familial hypercholesterolemia segment is anticipated to grow at the fastest rate during the forecast period, driven by rising genetic testing and improved disease awareness. Early diagnosis initiatives and cascade screening among family members are increasing the identified patient population. Patients with this condition often require intensive lipid-lowering regimens, including high-potency statins and combination therapies. Advances in personalized medicine and guideline-driven treatment protocols are supporting faster adoption. In addition, growing access to specialized lipid clinics is improving disease management. These factors collectively contribute to the rapid growth of this indication segment.

- By Distribution Channel

On the basis of distribution channel, the lipid disorder treatment market is segmented into retail pharmacies, hospital pharmacies, and online pharmacies. The retail pharmacies segment dominated the market with the largest revenue share in 2025, driven by their widespread presence and ease of access for chronic disease patients. Lipid disorder treatments are typically long-term therapies, and retail pharmacies play a key role in repeat prescription fulfillment. Strong pharmacist-patient interaction supports medication adherence and continuity of care. The availability of both branded and generic statins further strengthens retail pharmacy sales. In addition, insurance reimbursement and prescription refills are more conveniently managed through retail outlets. These factors collectively reinforce the dominance of retail pharmacies.

The online pharmacies segment is expected to register the fastest growth from 2026 to 2033, fueled by increasing digital health adoption and growing patient preference for home delivery services. Online platforms offer convenience, competitive pricing, and discreet access to chronic medications. The expansion of e-prescriptions and telemedicine consultations is supporting online drug purchases. Rising smartphone penetration and improved logistics infrastructure are further accelerating adoption. Patients managing long-term lipid disorders increasingly rely on subscription-based medication services. As a result, online pharmacies are emerging as a rapidly expanding distribution channel.

Lipid Disorder Treatment Market Regional Analysis

- North America dominated the lipid disorder treatment market with the largest revenue share of 38.9% in 2025, driven by high healthcare expenditure, early adoption of innovative therapies, and strong presence of key pharmaceutical companies, with the U.S. experiencing substantial growth in prescription and over-the-counter lipid-lowering medications

- Patients and healthcare providers in the region place significant emphasis on early diagnosis, preventive care, and long-term lipid management, supported by routine screening programs and strong adherence to clinical treatment guidelines

- This widespread adoption is further supported by high healthcare spending, broad insurance coverage, strong presence of leading pharmaceutical companies, and increasing awareness of heart health, establishing lipid disorder treatments as a core component of chronic disease management across the region

U.S. Lipid Disorder Treatment Market Insight

The U.S. lipid disorder treatment market captured the largest revenue share within North America in 2025, fueled by the high prevalence of cardiovascular diseases and widespread cholesterol screening programs. Patients and healthcare providers strongly prioritize preventive cardiology and long-term lipid management through statins and advanced therapies. The growing adoption of guideline-driven treatment protocols, along with strong insurance coverage and reimbursement frameworks, continues to propel market growth. Moreover, the presence of leading pharmaceutical companies and rapid uptake of innovative lipid-lowering drugs are significantly contributing to the market’s expansion.

Europe Lipid Disorder Treatment Market Insight

The Europe lipid disorder treatment market is projected to expand at a substantial CAGR during the forecast period, primarily driven by aging populations and increasing focus on preventive cardiovascular care. Rising awareness of cholesterol management, supported by government-led health initiatives, is fostering higher diagnosis and treatment rates. European healthcare systems emphasize early intervention and long-term disease management, driving sustained demand for lipid-lowering therapies. Growth is observed across hospital-based treatment, outpatient care, and retail pharmacy channels, supported by strong regulatory oversight and standardized treatment guidelines.

U.K. Lipid Disorder Treatment Market Insight

The U.K. lipid disorder treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing incidence of lifestyle-related disorders and strong adoption of preventive healthcare practices. National screening programs and NHS-backed cardiovascular risk assessments are encouraging early diagnosis and treatment initiation. Growing patient awareness regarding cholesterol control and heart health is boosting demand for statins and combination therapies. In addition, the expansion of digital health services and e-prescriptions is supporting improved treatment accessibility and adherence.

Germany Lipid Disorder Treatment Market Insight

The Germany lipid disorder treatment market is expected to expand at a considerable CAGR, fueled by a well-established healthcare infrastructure and high emphasis on evidence-based cardiovascular care. Germany’s strong focus on early diagnosis, preventive medicine, and long-term disease monitoring supports consistent demand for lipid-lowering therapies. The presence of leading pharmaceutical manufacturers and research institutions promotes rapid adoption of advanced treatment options. In addition, rising awareness of genetic lipid disorders and increased specialist care are contributing to market growth.

Asia-Pacific Lipid Disorder Treatment Market Insight

The Asia-Pacific lipid disorder treatment market is poised to grow at the fastest CAGR during the forecast period, driven by rising urbanization, changing dietary habits, and increasing prevalence of cardiovascular risk factors. Improving healthcare access and expanding middle-class populations are accelerating diagnosis and treatment rates across major economies. Government initiatives promoting preventive healthcare and chronic disease management are supporting market expansion. Furthermore, increasing availability of affordable generic statins is improving treatment penetration across the region.

Japan Lipid Disorder Treatment Market Insight

The Japan lipid disorder treatment market is gaining momentum due to the country’s aging population and high incidence of age-related cardiovascular conditions. Preventive healthcare is deeply embedded in Japan’s medical system, encouraging routine lipid screening and early intervention. Strong physician adherence to clinical guidelines supports steady demand for statins and advanced lipid-lowering therapies. Moreover, Japan’s emphasis on precision medicine and patient compliance is enhancing long-term treatment outcomes in both hospital and outpatient settings.

India Lipid Disorder Treatment Market Insight

The India lipid disorder treatment market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rising cardiovascular disease burden, rapid urbanization, and growing health awareness. Increasing adoption of routine health check-ups and expanding access to affordable generic medications are driving market growth. India’s large patient population and improving healthcare infrastructure support strong demand across retail and hospital pharmacies. In addition, government initiatives targeting non-communicable diseases and preventive care are further accelerating the adoption of lipid disorder treatments.

Lipid Disorder Treatment Market Share

The Lipid Disorder Treatment industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Merck & Co., Inc. (U.S.)

- Sanofi (France)

- Amgen Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Amarin Corporation plc (Ireland)

- Esperion Therapeutics, Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- AbbVie Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Viatris Inc. (U.S.)

- Glenmark Pharmaceuticals Ltd. (India)

- Cipla Ltd. (India)

- Lupin Limited (India)

- Emcure Pharmaceuticals Ltd. (India)

- Torrent Pharmaceuticals Ltd. (India)

- Abbott (U.S.)

What are the Recent Developments in Global Lipid Disorder Treatment Market?

- In December 2025, the U.S. FDA approved Lerodalcibep-liga (Lerochol), a once-monthly PCSK9 inhibitor for adults with hypercholesterolemia, including heterozygous familial hypercholesterolemia (HeFH), marking a shift toward long-acting LDL-C control in high-risk patients. This approval supports improved adherence with sustained LDL-C reduction and underscores industry focus on convenience-oriented therapies

- In November 2025, Arrowhead Pharmaceuticals received FDA approval for Redemplo (plozasiran), a siRNA therapy to significantly reduce triglycerides in adults with familial chylomicronemia syndrome, making it only the second approved U.S. treatment for this rare lipid disorder and expanding options for severe triglyceride management

- In August 2025, Novartis reported positive Phase IV V-DIFFERENCE study results for Leqvio (inclisiran), showing significantly greater early achievement of LDL-C goals and reduced muscle-related side effects when added to optimized lipid-lowering therapy, reinforcing its clinical role beyond first-line statin therapy

- In July 2025, an experimental CRISPR-Cas9 gene-editing therapy (CTX310™) safely and substantially reduced LDL and triglycerides in a first-in-human trial, pointing to a potential one-time genetic approach to lipid disorders that could dramatically change long-term management if confirmed in larger studies

- In April 2025, AstraZeneca’s novel oral PCSK9 inhibitor AZD0780 demonstrated major LDL-C reductions in a Phase 2b PURSUIT trial, indicating that oral PCSK9 inhibitors could become an effective complement to standard statin therapy pending further development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.