Global Medical Injection Molding Market

Market Size in USD Billion

CAGR :

%

USD

24.17 Billion

USD

35.52 Billion

2025

2033

USD

24.17 Billion

USD

35.52 Billion

2025

2033

| 2026 –2033 | |

| USD 24.17 Billion | |

| USD 35.52 Billion | |

|

|

|

|

Medical Injection Moulding Market Size

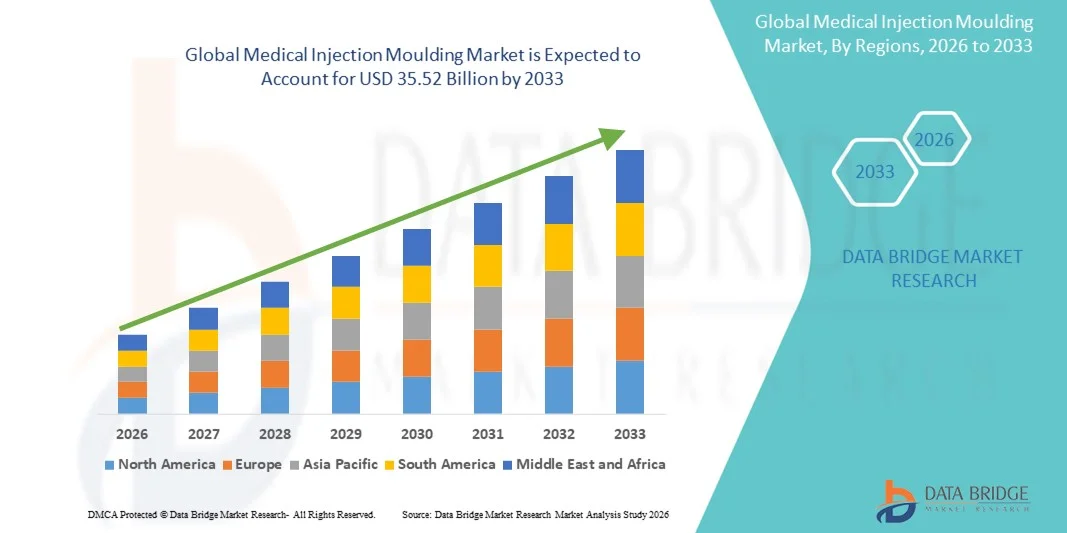

- The global medical injection moulding market size was valued at USD 24.17 billion in 2025 and is expected to reach USD 35.52 billion by 2033, at a CAGR of 4.93% during the forecast period

- The market growth is largely fueled by the increasing demand for precision-engineered medical components such as syringes, diagnostic device parts, surgical instruments, and other healthcare products, driven by rising healthcare expenditure, technological advancements in materials, and the growing prevalence of chronic diseases worldwide

- Furthermore, ongoing innovation in biocompatible polymers, higher adoption of automated and efficient manufacturing processes, and stringent regulatory standards for medical device quality are prompting manufacturers to expand capacity and invest in advanced injection moulding solutions. These converging factors are accelerating the uptake of medical injection moulding technologies, thereby significantly boosting the industry’s growth

Medical Injection Moulding Market Analysis

- Medical injection moulding, used for producing high-precision components such as syringes, diagnostic device parts, surgical instruments, and implantable products, is becoming increasingly vital in the healthcare manufacturing ecosystem due to its ability to deliver sterile, repeatable, and cost-efficient production at scale for both disposable and durable medical devices

- The escalating demand for medical injection moulded components is primarily fueled by rising global healthcare expenditure, growing chronic disease prevalence, and the increasing shift toward minimally invasive procedures, along with a strong industry preference for high-accuracy, contamination-controlled manufacturing technologies

- North America dominated the medical injection moulding market with the largest revenue share of 38.4% in 2025, supported by advanced healthcare infrastructure, strong regulatory compliance requirements, and early adoption of automated moulding technologies, with the U.S. experiencing substantial demand growth driven by innovation in diagnostics, drug delivery, and surgical device manufacturing

- Asia-Pacific is expected to be the fastest-growing region in the medical injection moulding market during the forecast period due to rapid expansion of medical device production, rising investments in healthcare manufacturing capabilities, and cost-efficient large-scale production in countries such as China and India, capturing an increasing regional share year-on-year

- Plastic segment dominated the medical injection moulding market with a share of 55.7% in 2025, driven by its widespread use in disposable medical products, diagnostic housings, and fluid-management components, supported by the availability of advanced medical-grade polymers that enable high performance, biocompatibility, and manufacturing flexibility

Report Scope and Medical Injection Moulding Market Segmentation

|

Attributes |

Medical Injection Moulding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Medical Injection Moulding Market Trends

Accelerated Shift Toward Micro-Injection and High-Precision Moulding

- A significant and accelerating trend in the global medical injection moulding market is the growing shift toward micro-injection moulding and ultra-precision manufacturing, driven by the rising demand for miniaturized medical devices, wearables, implantables, and advanced diagnostic components requiring extremely tight tolerances and contamination-controlled production

- For instance, Westfall Technik and Accumold have expanded their micro-moulding capabilities to support micro-catheters, microfluidic components, and intricate drug-delivery parts that cannot be produced using conventional moulding processes. Similarly, companies such as Phillips-Medisize specialize in precision moulding for complex medical assemblies used in connected inhalers and autoinjectors

- AI-enabled process optimization and machine-learning-driven quality control are emerging within injection moulding systems to enhance defect detection, improve process repeatability, and reduce waste. For instance, leading equipment manufacturers such as Engel and Arburg integrate AI-driven process monitoring to automatically correct deviations in melt flow, cavity pressure, and cooling cycles during moulding. Furthermore, IoT-enabled moulding machines offer real-time performance analytics and predictive maintenance capabilities for medically regulated environments

- The seamless integration of moulding operations with automated assembly lines and clean-room robotics facilitates greater efficiency for high-volume medical device manufacturing. Through a single digital interface, manufacturers can connect moulding equipment with vision inspection, sterilization tracking, and packaging modules to streamline production workflow

- This trend toward miniaturized, intelligent, and automated medical injection moulding processes is fundamentally reshaping expectations for medical device production. Consequently, companies such as Proto Labs and Spectrum Plastics Group are investing heavily in advanced moulding cells capable of micro-feature replication and automated quality verification needed for next-generation medical devices

- The demand for medical injection moulding solutions offering automation, precision, and digital integration is growing rapidly across diagnostic, surgical, and drug-delivery segments, as manufacturers increasingly prioritize scalability, accuracy, and regulatory compliance in device production

Medical Injection Moulding Market Dynamics

Driver

Growing Need Due to Rising Healthcare Demand and Device Miniaturization

- The increasing prevalence of chronic diseases, rising healthcare expenditure, and global demand for high-precision medical components are significant drivers of the growing adoption of medical injection moulding across the medical device manufacturing ecosystem

- For instance, in 2025, GW Plastics (now Nolato) expanded its clean-room injection moulding capacity to support growing demand for drug-delivery components and minimally invasive surgical products. Such strategies by key companies are expected to drive the medical injection moulding industry growth during the forecast period

- As healthcare providers and OEMs seek advanced components for diagnostics, drug-delivery, and microfluidics, injection moulding offers high repeatability, sterile production, and the ability to produce complex geometries that traditional manufacturing methods cannot achieve

- Furthermore, the increasing shift toward interconnected medical devices, wearable health technologies, and disposable components is making injection moulding a central manufacturing method, offering seamless production scalability and compatibility with advanced medical-grade polymers and specialty materials

- The convenience of high-volume production, clean-room compatibility, and the ability to integrate features such as microchannels, fine-tolerance mechanisms, and embedded components are key factors propelling the uptake of injection-moulded parts in both low-risk and high-risk medical device categories. The trend toward automation and digitalized moulding systems further accelerates market adoption

Restraint/Challenge

Skin Irritation Issues and Regulatory Compliance Hurdle

- Concerns surrounding stringent regulatory compliance, validation protocols, and material approval requirements pose significant challenges to broader market expansion, as medical injection moulded components must meet strict standards related to biocompatibility, sterility, and long-term patient safety

- For instance, delays caused by regulatory audits, material certification processes, or design-for-manufacturability issues can hinder time-to-market for new medical products relying on injection-moulded parts

- Addressing these compliance challenges through robust documentation practices, validated production processes, and continuous quality monitoring is essential for building trust among medical device OEMs. Companies such as Phillips-Medisize and Nypro emphasize their regulatory expertise and validation capabilities to assure customers of consistent quality. In addition, the high capital cost of clean-room facilities, advanced moulding machinery, and precision tooling can be a barrier for smaller manufacturers or companies operating in cost-sensitive markets

- While equipment and material costs are gradually declining, the perceived complexity of regulatory-driven production can still hinder adoption among emerging medical device startups, particularly those lacking expertise in ISO 13485, FDA requirements, or global material compliance

- Overcoming these challenges through improved training, investment in regulatory-compliant infrastructure, and wider access to cost-efficient moulding technologies will be vital for sustained long-term market growth

Medical Injection Moulding Market Scope

The market is segmented on the basis of system, class, and material.

- By System

On the basis of system, the medical injection moulding market is segmented into hot runner and cold runner. The hot runner segment dominated the market with the largest revenue share in 2025, driven by its ability to reduce material waste, accelerate cycle times, and support high-precision production essential for large-volume medical components. Manufacturers heavily rely on hot runner systems for producing consistent, contamination-free parts used in diagnostics, drug delivery, and surgical consumables. Their compatibility with advanced polymers and suitability for automated clean-room environments further enhances adoption across major medical device companies. The growing complexity of medical designs and increasing regulatory requirements for precision and sterility continue to strengthen the dominance of hot runner systems in global production.

The cold runner segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand from small-batch, prototype, and customized medical device manufacturing. Cold runner systems offer lower initial tooling costs, making them a preferred choice for emerging OEMs and development of new medical components. Their ability to process shear-sensitive and specialty polymers, including biodegradable and bioresorbable materials, further supports growth. Flexibility in design modifications and ease of maintenance make cold runner systems ideal for rapid innovation cycles. As medical markets expand into personalized devices and low-volume applications, cold runner moulding is expected to grow rapidly.

- By Class

On the basis of class, the medical injection moulding market is segmented into Class I, Class II, and Class III medical devices. The Class I segment dominated the market with the largest revenue share in 2025, driven by high-volume production of disposable and low-risk medical products such as connectors, syringes, caps, housings, and consumable diagnostic items. These devices benefit from shorter regulatory approval timelines, allowing manufacturers to scale efficiently and meet rising global healthcare demand. Growth in point-of-care testing, public health initiatives, and home-healthcare services continues to increase the consumption of Class I injection-moulded products. The combination of large-scale usage, low complexity, and wide global distribution cements Class I as the dominant segment in the medical injection moulding market.

The Class II segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing demand for advanced diagnostics, drug-delivery devices, and minimally invasive surgical instruments. These devices require higher precision, biocompatibility, and durability—attributes that advanced injection moulding technologies effectively deliver. Rising adoption of wearables and connected medical devices further fuels the need for specialized moulded components. Increasing investments in R&D and a shift toward sophisticated mid-risk medical products are expanding manufacturing opportunities. As healthcare systems worldwide move toward more technologically advanced and patient-centric solutions, Class II device production is expected to accelerate significantly.

- By Material

On the basis of material, the medical injection moulding market is segmented into plastic and metal. The plastic segment dominated the market with the largest market revenue share of 55.7% in 2025, driven by its extensive use in disposable and semi-durable medical devices across diagnostic, therapeutic, and fluid-management applications. Medical-grade polymers such as polypropylene, polycarbonate, and silicone offer superior biocompatibility, sterilizability, and design flexibility, making them essential for modern healthcare products. Rapid advancements in polymer technology, including antimicrobial and transparent variants, further expand application potential. The global shift toward single-use devices and high-volume production reinforces plastic moulding as the dominant material category in medical manufacturing.

The metal segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for high-strength, miniaturized components used in orthopedic tools, dental implants, and surgical instruments. Metal injection moulding enables the production of complex geometries with excellent mechanical properties, offering a cost-effective alternative to traditional machining. Increasing adoption of minimally invasive surgical procedures drives the need for durable and highly precise metal components. Advancements in titanium, stainless steel, and cobalt-chromium processing further expand the role of metal moulding in high-risk medical devices. As healthcare innovation progresses toward more robust and long-lasting solutions, the metal segment is expected to grow rapidly.

Medical Injection Moulding Market Regional Analysis

- North America dominated the medical injection moulding market with the largest revenue share of 38.4% in 2025, supported by advanced healthcare infrastructure, strong regulatory compliance requirements, and early adoption of automated moulding technologies

- The region’s medical manufacturers prioritize accuracy, biocompatibility, and scalability, driving the uptake of injection-moulded parts across diagnostics, drug-delivery systems, and minimally invasive surgical instruments

- Furthermore, rising investments in automated production technologies, stringent regulatory standards, and the shift toward cost-efficient mass manufacturing continue to reinforce North America’s leadership in the global medical injection moulding landscape

U.S. Medical Injection Moulding Market Insight

The U.S. medical injection moulding market captured the largest revenue share in North America in 2025, fueled by the strong presence of medical device manufacturers and high demand for precision-moulded components in diagnostics, drug-delivery, and surgical instruments. Manufacturers prioritize automated and high-throughput production to meet regulatory standards and large-scale healthcare requirements. The growing adoption of single-use devices and minimally invasive tools further drives market growth. In addition, the integration of advanced polymers and clean-room production systems supports the manufacture of complex, high-quality medical parts. Rising investments in R&D and innovation by leading OEMs continue to propel the U.S. market. Furthermore, regulatory compliance and technological advancements make the country a hub for cutting-edge injection-moulded medical devices.

Europe Medical Injection Moulding Market Insight

The Europe medical injection moulding market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent medical device regulations and the increasing demand for high-precision, biocompatible components. Rising healthcare expenditure, aging populations, and urbanization are fostering adoption of injection-moulded parts for diagnostics, drug delivery, and surgical applications. Manufacturers in Germany, France, and Italy are investing in automated production systems and advanced polymer technologies to meet evolving standards. European OEMs increasingly integrate medical-grade injection moulded components into both new medical devices and retrofit applications. Sustainability initiatives and energy-efficient production processes also encourage growth. The region’s emphasis on innovation and quality reinforces Europe’s strong position in the global market.

U.K. Medical Injection Moulding Market Insight

The U.K. medical injection moulding market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising healthcare infrastructure investments and a strong focus on domestic medical device manufacturing. The growing prevalence of chronic diseases and demand for disposable and miniaturized medical components support market expansion. In addition, government initiatives to boost local medical manufacturing and adoption of advanced polymer and metal injection-moulding technologies are encouraging growth. The U.K.’s well-established supply chain, robust e-commerce, and manufacturing ecosystem further promote the production and distribution of high-quality moulded medical components. Rising awareness of regulatory compliance and product safety enhances the preference for locally produced, precision-engineered medical parts.

Germany Medical Injection Moulding Market Insight

The Germany medical injection moulding market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, strong industrial base, and increasing demand for high-performance and sustainable medical components. The country’s emphasis on innovation, precision engineering, and environmentally conscious manufacturing supports adoption of automated injection-moulding solutions. German manufacturers are integrating metal and plastic moulded components into advanced surgical devices, implants, and diagnostic tools. The focus on quality, durability, and biocompatibility drives market growth. Furthermore, collaborations between OEMs and technology providers accelerate the development of next-generation medical components. Growing preference for high-precision and customized solutions reinforces Germany’s leadership in the European market.

Asia-Pacific Medical Injection Moulding Market Insight

The Asia-Pacific medical injection moulding market is poised to grow at the fastest CAGR during the forecast period, driven by increasing healthcare expenditure, rapid urbanization, and rising demand for advanced medical devices in countries such as China, India, and Japan. Growing adoption of disposable medical devices, drug-delivery systems, and diagnostic components is fueling market expansion. The region is emerging as a manufacturing hub for injection-moulded medical components due to cost-effective production, availability of skilled labor, and government support for healthcare infrastructure. Rising investment in clean-room facilities and adoption of modern polymer and metal moulding technologies further enhance growth. In addition, expanding medical device exports from APAC to global markets contribute to the market’s rapid growth trajectory.

Japan Medical Injection Moulding Market Insight

The Japan medical injection moulding market is gaining momentum due to the country’s advanced healthcare ecosystem, high demand for minimally invasive and wearable devices, and emphasis on precision manufacturing. Increasing adoption of clean-room production, automated moulding systems, and advanced polymers supports high-quality production of diagnostic, drug-delivery, and surgical components. The country’s aging population and demand for easier-to-use, safe medical devices further drive market growth. Integration of IoT-enabled medical devices and connected healthcare solutions is enhancing adoption of injection-moulded components. Government support for healthcare innovation and strong domestic OEM presence contribute to steady market expansion. Rising focus on quality, biocompatibility, and durability reinforces Japan’s position as a key market in the Asia-Pacific region.

India Medical Injection Moulding Market Insight

The India medical injection moulding market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding healthcare infrastructure, and high adoption of cost-effective, precision-moulded components. India is emerging as a major hub for manufacturing disposable medical devices, diagnostic components, and drug-delivery systems. Government initiatives promoting medical device manufacturing and smart hospital infrastructure support market growth. The availability of affordable materials, skilled workforce, and domestic injection-moulding manufacturers further propel adoption. In addition, growing exports of injection-moulded medical components to global markets enhance revenue potential. Rising demand for single-use devices, minimally invasive tools, and healthcare innovation continues to drive India’s market growth.

Medical Injection Moulding Market Share

The Medical Injection Moulding industry is primarily led by well-established companies, including:

- C&J Industries (U.S.)

- HTI Plastics (U.S.)

- AMS Micromedical LLC (U.S.)

- Currier Plastics Inc. (U.S.)

- Proto Labs, Inc. (U.S.)

- Johnson Precision Inc. (U.S.)

- Metro Mold & Design (U.S.)

- Harbec (U.S.)

- Milacron (Hillenbrand Inc.) (U.S.)

- All Plastics (U.S.)

- Biomerics LLC (U.S.)

- The Rodon Group (U.S.)

- EVCO Plastics (U.S.)

- Tessy Plastics (U.S.)

- Formplast GmbH (Germany)

- H&K Müller GmbH & Co. KG (Germany)

- ENGEL Austria GmbH (Austria)

- Phillips Medisize (U.S.)

- Freudenberg Medical (Germany)

- West Pharmaceutical Services, Inc. (U.S.)

What are the Recent Developments in Global Medical Injection Moulding Market?

- In November 2025, Vance Street Capital announced the acquisition of Injectech, expanding its VSC Medical Molding platform with enhanced precision injection molding and fluid management solutions for medical devices and life sciences. The deal combines Injectech’s custom injection‑molded fluid‑control components with VSC’s precision molding and tooling capabilities to broaden medical device manufacturing offerings globally

- In October 2025, ROSTI Integrated Manufacturing Solutions partnered with IDC at MedTec China 2025 to highlight cutting‑edge medical device design and manufacturing capabilities, including advanced injection molding, optical molding, and precision assembly solutions targeting dynamic medical markets

- In July 2025, Europlaz, a UK‑based contract manufacturer specializing in medical injection molding, announced it successfully passed an FDA inspection and is scaling up production through expanded cleanroom capabilities to serve medtech customers, strengthening its foothold in the U.S. and global markets

- In April 2025, C&J Industries announced a major expansion of its medical‑grade plastic injection molding operations, including a new ISO Class 7/8 cleanroom and additional molding presses to increase production of medical device components. This expansion supports high‑precision molding for disposable and durable medical products

- In February 2023, Austrian machinery maker ENGEL delivered two of the largest injection molding machines ever built to a customer in North America, marking a milestone in high‑capacity moulding equipment deployment. The duo machines have an 8,000‑tonne clamping force each and are designed for high‑volume production, demonstrating sustained industrial scale‑up of injection moulding technology that can support complex components including potential medical device tooling requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.