Global Medical Suction Devices Market

Market Size in USD Million

CAGR :

%

USD

850.18 Million

USD

1,256.11 Million

2024

2032

USD

850.18 Million

USD

1,256.11 Million

2024

2032

| 2025 –2032 | |

| USD 850.18 Million | |

| USD 1,256.11 Million | |

|

|

|

|

Medical Suction Devices Market Size

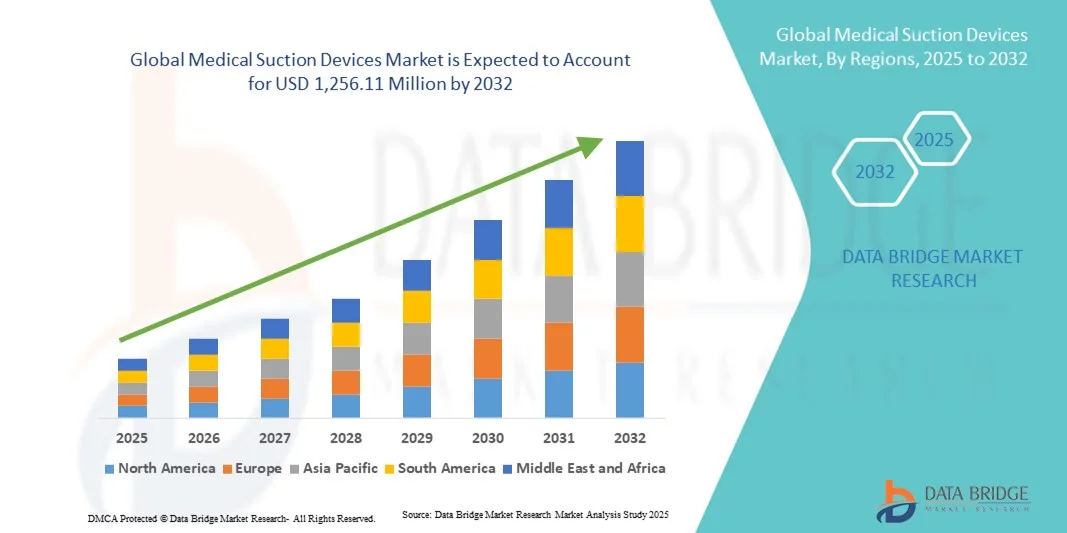

- The global medical suction devices market size was valued at USD 850.18 million in 2024 and is expected to reach USD 1,256.11 million by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely driven by the increasing prevalence of chronic and surgical conditions, coupled with rising adoption of advanced medical suction technologies in hospitals, clinics, and ambulatory care settings

- Furthermore, growing demand for minimally invasive procedures and efficient fluid management systems, along with the need for enhanced patient safety and operational efficiency, is positioning medical suction devices as an essential component in modern healthcare infrastructure. These converging factors are accelerating the adoption of medical suction solutions, thereby significantly boosting the industry's growth

Medical Suction Devices Market Analysis

- Medical suction devices, used to remove bodily fluids, secretions, or surgical debris, are increasingly essential components of modern healthcare settings in hospitals, clinics, and ambulatory care centers due to their efficiency, patient safety benefits, and compatibility with advanced surgical and procedural equipment

- The growing demand for medical suction devices is primarily driven by the rising prevalence of chronic diseases, increasing number of surgical procedures, and the need for minimally invasive and efficient fluid management solutions

- North America dominated the medical suction devices market with the largest revenue share of 39.6% in 2024, characterized by well-established healthcare infrastructure, high adoption of advanced medical devices, and strong presence of key manufacturers, with the U.S. leading in procurement of portable and hospital-grade suction units, driven by technological innovations and regulatory support

- Asia-Pacific is expected to be the fastest-growing region in the medical suction devices market during the forecast period due to expanding healthcare infrastructure, increasing hospital admissions, and rising awareness of patient care and safety standards

- Hand-held Suction Devices segment dominated the medical suction devices market with a share of around 43.4% in 2024, driven by their ease of use, flexibility in emergency and outpatient settings, and compatibility with various clinical procedures

Report Scope and Medical Suction Devices Market Segmentation

|

Attributes |

Medical Suction Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Suction Devices Market Trends

Advancements in Portability and Smart Integration

- A significant and accelerating trend in the global medical suction devices market is the growing development of portable, hand-held devices and integration with smart monitoring systems, enhancing operational efficiency and patient safety

- For instance, the Laerdal Compact Suction unit offers a lightweight, battery-operated design, allowing healthcare providers to perform suction in emergency or home care settings efficiently

- Smart integration in suction devices enables features such as automatic pressure regulation, real-time monitoring of usage, and alerting healthcare personnel about maintenance needs or abnormal fluid volumes. For instance, some Vacsafe models utilize intelligent sensors to optimize suction levels based on procedure type and patient condition

- The seamless integration of suction devices with digital hospital systems facilitates centralized monitoring and coordination, allowing clinicians to manage multiple procedures and devices via a single interface, improving workflow efficiency

- This trend towards more portable, intelligent, and connected suction systems is reshaping user expectations in healthcare, leading companies such as Medela to develop smart, battery-operated units with automated control and IoT-enabled tracking

- The demand for portable and smart-integrated suction devices is growing rapidly across hospitals, clinics, and home healthcare, as medical professionals increasingly prioritize efficiency, safety, and ease of use

Medical Suction Devices Market Dynamics

Driver

Increasing Surgical Procedures and Healthcare Infrastructure Expansion

- The rising prevalence of surgical procedures, chronic illnesses, and emergency care requirements is a significant driver for the heightened demand for medical suction devices

- For instance, in March 2024, Allied Healthcare introduced a new portable suction system for ambulatory care settings, highlighting the focus on improving accessibility and efficiency in hospitals and emergency units

- As healthcare facilities aim to enhance patient safety and procedural efficiency, suction devices provide advanced functionality such as adjustable vacuum control, portability, and compatibility with various medical procedures

- Furthermore, expanding healthcare infrastructure and investments in modern hospitals in emerging economies are increasing the adoption of advanced suction systems in surgical theaters and ICU setups

- The convenience of battery-operated portable units, ease of use in emergency situations, and ability to manage fluid removal in diverse clinical environments are key factors propelling the adoption of suction devices across hospitals, clinics, and home care setups

Restraint/Challenge

Maintenance Complexity and Regulatory Compliance Hurdles

- Concerns regarding device maintenance, sterilization requirements, and compliance with healthcare regulations pose challenges to market penetration. Suction devices require routine servicing to maintain efficiency and hygiene standards

- For instance, high-profile reports of device malfunction or contamination have made some healthcare facilities cautious in adopting certain portable or advanced suction units

- Addressing these challenges through rigorous maintenance protocols, compliance with FDA/CE standards, and provision of user training is crucial for building trust among healthcare providers. Companies such as Stryker emphasize ease of maintenance and regulatory adherence in their marketing to reassure potential buyers

- In addition, relatively high costs of advanced suction systems compared to manual or traditional devices can be a barrier for small clinics or home healthcare providers, particularly in developing regions. While basic units are affordable, features such as smart monitoring or battery-powered portability often come at a premium

- Overcoming these challenges through durable, cost-effective, and user-friendly designs, along with healthcare provider education, will be vital for sustained market growth

Medical Suction Devices Market Scope

The market is segmented on the basis of portability, type, vacuum systems, suction parts, applications, and end user.

- By Portability

On the basis of portability, the medical suction devices market is segmented into hand-held suction devices and wall-mounted suction devices. The hand-held suction devices segment dominated the market with the largest revenue share of 43.4% in 2024, driven by their portability, ease of use in emergency care, and suitability for home healthcare and ambulatory applications. Healthcare providers and first responders often prefer hand-held devices due to their lightweight design, battery operation, and ability to function in remote locations or during patient transport. The segment also benefits from increasing awareness of home-based care, aging populations, and rising chronic disease prevalence. Moreover, portable suction devices are compatible with a variety of medical procedures, including airway clearing and minor surgical interventions, enhancing their market penetration. The growing emphasis on rapid response in emergency care further strengthens the demand for hand-held devices.

The wall-mounted suction devices segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing hospital and clinic infrastructure upgrades in emerging economies. Wall-mounted units provide continuous vacuum power, higher suction efficiency, and reliability for surgical and intensive care applications. Hospitals favor wall-mounted systems for their low maintenance and long-term cost-effectiveness, as well as integration with centralized vacuum systems. Growth is also supported by stricter hospital regulations requiring fixed suction solutions for operating theaters and ICUs, ensuring safe and sterile fluid management. Advanced wall-mounted systems now offer smart monitoring and automated alerts, further boosting adoption. The segment’s expansion is accelerated by the rising number of hospitals and upgraded healthcare facilities worldwide.

- By Type

On the basis of type, the medical suction devices market is segmented into AC-powered devices, battery-powered devices, dual-powered devices, and manually operated devices. The AC-powered devices segment dominated in 2024, driven by their reliability, consistent suction performance, and widespread use in hospital and surgical environments. AC-powered units are preferred in operating rooms and ICUs due to uninterrupted power supply, ability to handle high-demand procedures, and compliance with hospital safety standards. The segment’s market dominance is further strengthened by the need for high-capacity suction during surgeries and critical care procedures. In addition, AC-powered devices support integration with other surgical equipment and monitoring systems, enhancing procedural efficiency. Hospitals also favor these devices for long-term durability and low failure rates.

The battery-powered devices segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for portable and emergency care suction solutions. Battery-operated devices are ideal for home care, ambulatory settings, and prehospital emergency scenarios. Their growing adoption is supported by technological advancements in battery life, lightweight design, and compactness, enabling healthcare professionals to provide care in remote or resource-constrained environments. These devices are increasingly used in disaster management, first-aid units, and mobile clinics. Ease of maintenance and user-friendly design further enhance their appeal in emerging markets.

- By Vacuum Systems

On the basis of vacuum systems, the medical suction devices market is segmented into manual, electrically powered, and Venturi systems. The electrically powered systems segment dominated the market in 2024, driven by high efficiency, consistent suction pressure, and suitability for continuous surgical and ICU applications. Hospitals prefer electrically powered units for critical procedures due to precise control over vacuum levels, integration with monitoring systems, and reduced manual effort. This segment also benefits from the increasing number of surgeries, emergency procedures, and critical care interventions worldwide. Electrically powered systems can handle high-volume fluid removal, reducing procedure time. Integration with smart alerts and maintenance monitoring makes them highly reliable for hospitals.

The manual vacuum systems segment is expected to witness the fastest growth from 2025 to 2032, fueled by demand in low-resource and emergency healthcare settings. Manual systems are cost-effective, require no electricity, and can be used in remote areas, ambulances, and home care scenarios. Their simplicity, reliability, and ease of maintenance make them ideal for regions with limited infrastructure, supporting the segment’s rapid adoption. Manual systems are particularly useful in prehospital and field applications where portability is critical. Their low cost also appeals to small clinics and home healthcare providers. Training and ease of operation contribute further to market expansion.

- By Suction Parts

On the basis of suction parts, the medical suction devices market is segmented into vacuum pump, bacterial filter, vacuum gauge, moisture or debris trap, suction catheter, and others. The vacuum pump segment dominated in 2024, driven by its critical role in creating the necessary suction pressure for efficient fluid removal. Vacuum pumps are integral to both portable and fixed suction systems, ensuring consistent performance during surgical procedures and emergency interventions. Their durability, precision, and compatibility with various devices contribute to the segment’s large market share. Hospitals rely on vacuum pumps for high-capacity suction, reducing procedure times and improving safety. Continuous innovation in pump efficiency further strengthens the segment’s position. Maintenance-friendly designs also enhance adoption.

The suction catheter segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing surgical interventions, airway management procedures, and rising home healthcare applications. Catheters are single-use or easily sterilizable, providing safe and efficient fluid extraction. Demand is further boosted by technological innovations in catheter design, including flexible, lightweight, and patient-friendly variants. Catheters are also critical in emergency airway management, increasing adoption in ambulances and ICU settings. Rising awareness of hygiene and infection control further supports market growth. Their versatility across applications enhances the segment’s potential.

- By Applications

On the basis of applications, the medical suction devices market is segmented into airway clearing, surgical applications, and research & diagnostics. The surgical applications segment dominated in 2024, driven by the increasing number of surgical procedures globally and the essential role of suction devices in operating rooms. Hospitals and surgical centers rely on these devices for fluid management, maintaining a clear operative field, and preventing infection during invasive procedures. The segment also benefits from rising investments in advanced surgical facilities and adoption of minimally invasive techniques. Surgical suction devices are used in a variety of specialties including cardiology, orthopedics, and general surgery. Demand is supported by hospitals seeking standardized, reliable, and high-performance equipment. Technological integration, such as automated suction control, further strengthens adoption.

The airway clearing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing respiratory disorders, emergency care needs, and home healthcare adoption. Portable suction devices for airway management are critical in ambulances, ICUs, and home settings, supporting rapid and effective intervention. Technological improvements, including compact and battery-operated units, are driving demand in this application segment. Increased awareness of chronic respiratory conditions such as COPD and sleep apnea contributes to adoption. The segment also benefits from rising training programs for caregivers and emergency responders. Integration with patient monitoring systems further enhances effectiveness.

- By End User

On the basis of end user, the medical suction devices market is segmented into hospitals and clinics, home care, prehospital care, and others. The hospitals and clinics segment dominated in 2024, driven by the presence of well-established healthcare infrastructure, high procedural volumes, and the adoption of advanced surgical and ICU equipment. Hospitals prefer reliable suction devices for critical care, surgery, and routine clinical procedures. The segment’s dominance is further reinforced by regulatory standards mandating safe and effective fluid management systems in medical facilities. Hospitals also benefit from integration of suction devices with centralized systems, enhancing operational efficiency. Training programs and maintenance services further support adoption.

The home care segment is expected to witness the fastest growth from 2025 to 2032, fueled by the rising geriatric population, prevalence of chronic diseases, and increasing awareness of home-based healthcare solutions. Hand-held and battery-operated suction devices enable caregivers to manage airway clearance and minor procedures safely at home. Advancements in user-friendly and portable designs are accelerating adoption in this segment, supporting rapid market growth. Home care adoption is also driven by cost-effectiveness and reduced hospital visits. Awareness campaigns and telehealth support enhance consumer confidence. Convenience and mobility of devices further strengthen market penetration.

Medical Suction Devices Market Regional Analysis

- North America dominated the medical suction devices market with the largest revenue share of 39.6% in 2024, characterized by well-established healthcare infrastructure, high adoption of advanced medical devices, and strong presence of key manufacturers

- Hospitals, clinics, and emergency care providers in the region prioritize reliable, high-performance suction devices to ensure patient safety, support complex surgical procedures, and enhance operational efficiency

- This dominance is further supported by strong government healthcare spending, high awareness of patient care standards, and rapid adoption of portable and smart-integrated suction devices for both hospital and home care applications

U.S. Medical Suction Devices Market Insight

The U.S. medical suction devices market captured the largest revenue share of around 40% in 2024 within North America, fueled by the presence of advanced healthcare infrastructure and high surgical procedure volumes. Hospitals and emergency care providers are increasingly adopting portable and battery-operated suction devices for ICU, operating room, and home care applications. The growing preference for efficient airway management systems and minimally invasive procedures further propels market growth. Moreover, integration with hospital monitoring systems and advanced safety features is significantly contributing to the adoption of smart suction solutions. The strong presence of key manufacturers and ongoing product innovations enhances the market’s expansion.

Europe Medical Suction Devices Market Insight

The Europe medical suction devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing surgical interventions, stringent healthcare regulations, and rising demand for advanced ICU and emergency care equipment. Investments in hospital infrastructure and adoption of portable suction devices in home care settings are fostering market growth. European healthcare providers also prioritize reliability, durability, and ease of sterilization in suction devices. The demand spans both new hospital constructions and modernization projects in existing facilities, further supporting the uptake of efficient suction systems.

U.K. Medical Suction Devices Market Insight

The U.K. medical suction devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing surgical volumes, emergency care requirements, and demand for high-quality portable suction units. The prevalence of chronic respiratory and cardiovascular conditions is encouraging hospitals, clinics, and home healthcare providers to adopt reliable suction devices. In addition, government initiatives promoting healthcare modernization and safety compliance are expected to further stimulate market growth. The preference for battery-operated and hand-held suction devices for home care is also supporting market expansion.

Germany Medical Suction Devices Market Insight

The Germany medical suction devices market is expected to expand at a considerable CAGR during the forecast period, fueled by a well-developed healthcare system, high awareness of patient safety, and growing investments in hospitals and surgical facilities. Technologically advanced hospitals are adopting electrically powered and smart-integrated suction devices for ICUs and operating theaters. The focus on hygiene, sterilization standards, and reliability promotes adoption in both hospital and home care settings. The demand for eco-friendly and energy-efficient medical suction solutions is also rising, aligning with Germany’s emphasis on sustainability.

Asia-Pacific Medical Suction Devices Market Insight

The Asia-Pacific medical suction devices market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by expanding healthcare infrastructure, rising hospital admissions, and increasing prevalence of chronic diseases in countries such as China, Japan, and India. Government initiatives supporting digitalization and modernization of hospitals are accelerating adoption. Moreover, the region’s emergence as a manufacturing hub for portable and battery-operated suction devices is enhancing affordability and accessibility. The growing trend of home healthcare, emergency care, and ambulatory services further contributes to market expansion.

Japan Medical Suction Devices Market Insight

The Japan medical suction devices market is gaining momentum due to advanced healthcare infrastructure, high-tech adoption, and an increasing number of surgical procedures. Hospitals and clinics are prioritizing battery-operated and portable suction devices for ICUs, emergency care, and home healthcare applications. The aging population is further spurring demand for easy-to-use and safe suction solutions in both residential and clinical settings. Integration with patient monitoring systems and adherence to strict hygiene standards is driving adoption. Japan’s focus on connected medical devices enhances the uptake of intelligent suction systems.

India Medical Suction Devices Market Insight

The India medical suction devices market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing hospital infrastructure, and rising awareness of patient safety. The growing prevalence of chronic diseases and emergency care needs is driving demand for portable, hand-held, and battery-operated suction devices. Government initiatives supporting smart hospitals and healthcare modernization further boost adoption. India’s expanding middle class and rising home healthcare adoption contribute to market growth. Affordable suction solutions from domestic and international manufacturers are enhancing accessibility and penetration across urban and semi-urban regions.

Medical Suction Devices Market Share

The Medical Suction Devices industry is primarily led by well-established companies, including:

- SSCOR, Inc. (U.S.)

- ATMOS MedizinTechnik GmbH & Co. KG (Germany)

- Medela (Switzerland)

- Bound Tree Medical, LLC (U.S.)

- Boehringer Laboratories, LLC (U.S.)

- MFI Medical (U.S.)

- Ohio Medical LLC (U.S.)

- Anand Medicaids (India)

- ZOLL Medical Corporation (U.S.)

- SWIK Medical Solutions (U.S.)

- LifeVac LLC (U.S.)

- Cardinal Health (U.S.)

- Qosina (U.S.)

- Triumph Medical Services (U.S.)

- Ventec Life Systems, Inc. (U.S.)

- Wellell Inc. (Taiwan)

- Ambu A/S (Denmark)

- Meril Life Sciences Pvt. Ltd. (India)

- Intersurgical Ltd. (U.K.)

What are the Recent Developments in Global Medical Suction Devices Market?

- In September 2025, LifeVac, a Long Island-based company, reported that its anti-choking device has saved nearly 5,000 lives worldwide. The device offers a non-invasive, suction-based method to clear airways during choking emergencies, with over 1,300 lives saved in 2025 alone. The company emphasizes durability and accessibility by offering lifetime devices with free replacements

- In September 2025, Olympus Corp. announced an exclusive global distribution agreement with MacroLux Medical Technology Co., Ltd. to distribute single-use urology products. This partnership aims to expand Olympus's product offerings in the urology sector

- In March 2025, Frida Baby introduced the Electric NoseFrida Pro (ENF Pro), an upgraded version of their popular manual nasal aspirator. The ENF Pro offers enhanced suction power comparable to hospital-grade neonatal aspirators and is FDA-approved. It features a soft tip for smaller noses, a more rigid tip for older children, and is dishwasher-safe for easy cleaning

- In March 2025, the U.S. Medical Research and Development Command (MRDC) announced an initiative to license innovative airway surgical devices. The goal is to fast-track the development of tools that reduce risks to patients and surgeons during complex airway surgical procedures

- In February 2025, Emboa Medical Inc., a medical device startup, announced the creation and validation of a novel catheter designed to improve the retrieval of blood clots causing strokes. The device mimics a snake's evolutionary advantage, enhancing the effectiveness of stroke treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.