Global Milk Replacers Market

Market Size in USD Billion

CAGR :

%

USD

4.14 Billion

USD

7.72 Billion

2024

2032

USD

4.14 Billion

USD

7.72 Billion

2024

2032

| 2025 –2032 | |

| USD 4.14 Billion | |

| USD 7.72 Billion | |

|

|

|

|

What is the Global Milk Replacers Market Size and Growth Rate?

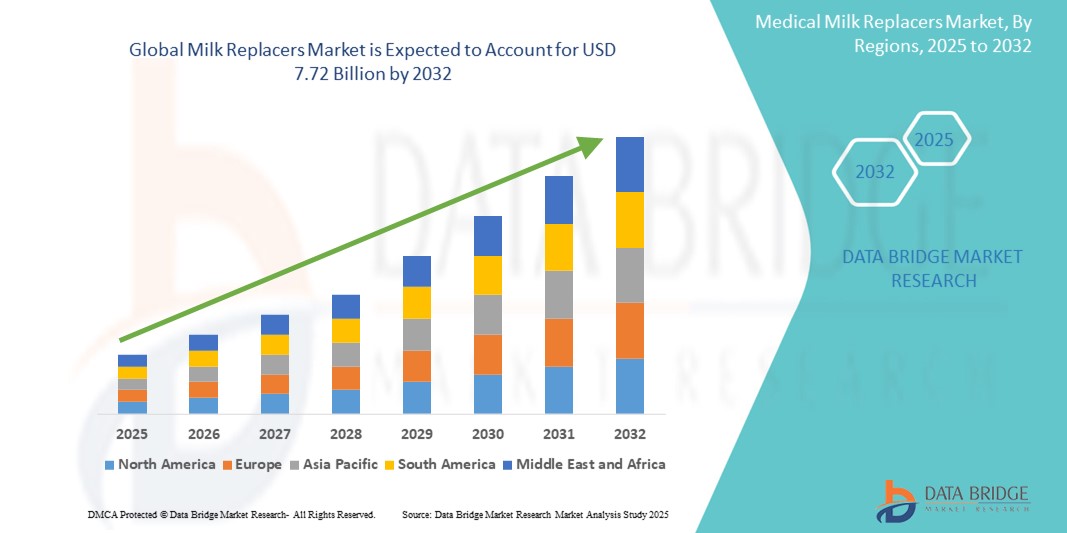

- The global milk replacers market size was valued at USD 4.14 billion in 2024 and is expected to reach USD 7.72 billion by 2032, at a CAGR of 8.10% during the forecast period

- The milk replacers plays a vital role in animal husbandry by providing essential nutrition to young animals such as calves, piglets, lambs, and foals. These substitutes provide a well-rounded combination of essential nutrients and vitamins necessary for optimal growth and development in instances where the mother's milk is inadequate or inaccessible

- Milk replacers contribute to health management in young animals, helping to mitigate the risk of diseases and nutritional deficiencies. They ensure proper nourishment during critical stages of growth, thereby supporting overall livestock health and productivity in the animal husbandry sector

What are the Major Takeaways of Milk Replacers Market?

- Advancements in nutrition science have led to the creation of milk replacers that closely mimic the nutritional composition of natural milk, enhancing their efficacy in supporting the growth and health of young animals. Improvements in processing technologies have allowed for better preservation of nutrients and extended shelf life, increasing the convenience and accessibility of milk replacers for farmers

- Moreover, advancements in packaging techniques ensure product quality and safety, further fueling market growth. Technological progress continues to drive innovation and efficiency in the milk replacers industry, meeting the evolving demands of livestock farming.

- Europe dominated the milk replacers market with the largest revenue share of 41.2% in 2024, driven by strict regulations on animal welfare, sustainable farming practices, and the ban on antibiotic growth promoters (AGPs) across the region

- Asia-Pacific milk replacers market is projected to grow at the fastest CAGR of 12.4% from 2025 to 2032, fueled by rapid urbanization, rising incomes, and increasing demand for safe, sustainable animal protein

- The Non-Medicated segment dominated the milk replacers market with the largest market revenue share of 64.2% in 2024, attributed to its wide adoption for routine animal nutrition without the complexities of pharmaceutical regulations

Report Scope and Milk Replacers Market Segmentation

|

Attributes |

Milk Replacers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Milk Replacers Market?

“Integration of Functional Additives for Enhanced Immunity and Growth Performance”

- A dominant trend shaping the global milk replacers market is the integration of functional additives such as probiotics, prebiotics, enzymes, and immune-stimulants into milk replacer formulations to optimize animal health, growth rates, and survivability, particularly in calves, lambs, piglets, and kids

- These fortified formulations aim to enhance early-stage nutrition, strengthen immunity, and reduce the risk of common infections, thereby improving productivity and reducing veterinary interventions

- For instance, in 2024, FrieslandCampina Ingredients introduced its NutriOptim range, incorporating immune-modulating bioactive compounds that support gut health, immune development, and nutrient utilization in young animals

- The inclusion of omega-3 fatty acids, essential vitamins, nucleotides, and plant-based antioxidants is becoming more prevalent, offering a holistic approach to neonatal nutrition beyond basic energy and protein needs

- Leading manufacturers such as Lactalis Ingredients and Nutreco are heavily investing in R&D to create specialized milk replacers that align with evolving demands for animal welfare, disease prevention, and improved weaning outcomes

- With increased awareness of the economic benefits linked to better calf survival rates, earlier weaning, and enhanced feed efficiency, the adoption of functional, scientifically enhanced milk replacers is accelerating across both developed and emerging markets

What are the Key Drivers of Milk Replacers Market?

- The rising demand for high-performance young animal nutrition solutions driven by global growth in dairy and meat production is a primary factor boosting the Milk Replacers market. Producers are increasingly recognizing the role of milk replacers in improving early-life nutrition and overall productivity

- For instance, in 2023, VanDrie Group expanded its milk replacer portfolio to include formulations enriched with digestive enzymes and health-promoting additives aimed at improving calf health and reducing mortality rates

- The need for disease prevention, reduced antibiotic usage, and enhanced biosecurity on farms is accelerating the use of milk replacers that incorporate functional health components, especially in regions grappling with animal disease outbreaks

- Advancements in processing technologies and ingredient innovation, such as the use of highly digestible whey proteins and encapsulated nutrients, are further driving market growth by improving product efficacy and palatability

- In addition, heightened economic pressure to improve feed conversion, optimize growth rates, and shorten production cycles is prompting livestock producers to adopt reliable milk replacers as part of their nutritional strategies

Which Factor is challenging the Growth of the Milk Replacers Market?

- A significant challenge limiting the widespread adoption of milk replacers is the fluctuating cost and availability of high-quality dairy-based raw materials, especially whey protein concentrates and skimmed milk powder, which are essential ingredients in premium milk replacer formulations

- For instance, in 2023, global supply chain disruptions and rising dairy prices impacted manufacturers such as Nukamel, leading to price volatility and supply constraints in the milk replacer sector, affecting market stability

- Price-sensitive livestock producers, particularly in developing countries, often opt for lower-cost, conventional feeding options due to the higher upfront costs associated with fortified or specialized milk replacers, which restricts market penetration

- Furthermore, knowledge gaps and inconsistent adoption of proper feeding protocols can lead to suboptimal results, discouraging long-term usage among some producers

- To address these barriers, industry players are focusing on cost-efficient formulations, improving farmer education, and establishing strategic partnerships with suppliers to ensure consistent raw material availability and affordability

How is the Milk Replacers Market Segmented?

The market is segmented on the basis of type, form, livestock, source, and distribution channel.

- By Type

On the basis of type, the milk replacers market is segmented into Medicated and Non-Medicated. The Non-Medicated segment dominated the Milk Replacers market with the largest market revenue share of 64.2% in 2024, attributed to its wide adoption for routine animal nutrition without the complexities of pharmaceutical regulations. Non-medicated milk replacers are preferred for their cost-effectiveness and ability to meet nutritional needs in young animals across various species.

The Medicated segment is expected to register the fastest growth rate from 2025 to 2032, driven by increasing incidences of neonatal diseases and the growing use of therapeutic milk replacers to support animal health, especially during critical early-life stages.

- By Form

On the basis of form, the milk replacers market is segmented into Liquid and Powder. The Powder segment accounted for the largest market revenue share of 71.6% in 2024, due to its extended shelf life, ease of storage, and convenience in transportation. Powdered milk replacers are highly compatible with various feeding systems, making them ideal for both small-scale and commercial livestock operations.

The Liquid segment is projected to witness the fastest CAGR from 2025 to 2032, supported by increasing adoption in on-farm liquid feeding programs, ease of administration, and improved digestibility in young animals.

- By Livestock

On the basis of livestock, the milk replacers market is segmented into Calves, Piglets, Kittens, Puppies, Foals, and Lambs. The Calves segment dominated the market with the largest revenue share of 46.9% in 2024, fueled by the global emphasis on improving calf survival rates, early growth, and productivity in the dairy and beef industries. High-quality milk replacers are essential in calf-rearing programs to enhance immunity, digestion, and overall performance.

The Piglets segment is expected to register the fastest growth rate from 2025 to 2032, driven by increased demand for improved weaning strategies, gut health management, and enhanced growth rates in swine production.

- By Source

On the basis of source, the milk replacers market is segmented into Milk-Based, Non-Milk Based, and Blended. The Milk-Based segment dominated the market with the largest revenue share of 58.3% in 2024, due to its superior digestibility, high nutrient content, and ability to closely mimic natural milk, making it ideal for young animal nutrition.

The Blended segment is projected to witness the fastest growth from 2025 to 2032, supported by the development of cost-effective formulations that combine milk-derived ingredients with plant-based or alternative protein sources to balance nutrition and affordability.

- By Distribution Channel

On the basis of distribution channel, the milk replacers market is segmented into Online Retailing, Supermarket, Hypermarket, Convenience Stores, and Others. The Supermarket segment dominated the market with the largest revenue share of 34.7% in 2024, driven by widespread availability, convenience, and consumer preference for in-store purchases, especially in urban and semi-urban areas.

The Online Retailing segment is expected to record the fastest growth from 2025 to 2032, fueled by the rising penetration of e-commerce, direct-to-farm delivery models, and increasing consumer preference for convenient, doorstep access to animal nutrition products.

Which Region Holds the Largest Share of the Milk Replacers Market?

- Europe dominated the milk replacers market with the largest revenue share of 41.2% in 2024, driven by strict regulations on animal welfare, sustainable farming practices, and the ban on antibiotic growth promoters (AGPs) across the region

- European livestock producers are increasingly adopting high-quality milk replacers to improve early-stage nutrition, calf survival rates, and overall productivity while aligning with consumer demand for natural, residue-free meat and dairy products

- The region's leadership in animal nutrition research, innovation in functional milk replacer formulations, and strong emphasis on food safety further strengthen Europe's dominance in the global market

U.K. Milk Replacers Market Insight

U.K. milk replacers market accounted for a significant share within Europe in 2024, supported by the growing focus on sustainable livestock production, animal welfare, and compliance with stringent food safety standards. British producers are adopting advanced milk replacers to enhance immunity, reduce disease incidence, and meet the rising demand for high-quality, antibiotic-free animal products. The country’s innovation-driven animal health sector is further accelerating the development and integration of functional milk replacers.

Germany Milk Replacers Market Insight

Germany milk replacers market is expected to grow steadily, fueled by the country’s advanced livestock sector and strong commitment to reducing antibiotic dependency. German producers are increasingly using milk replacers to support early growth, improve feed efficiency, and comply with strict environmental and animal welfare regulations. The demand for premium, sustainable animal products and Germany's leadership in agricultural innovation contribute to market expansion.

France Milk Replacers Market Insight

France milk replacers market is witnessing consistent growth, driven by the nation’s emphasis on animal welfare, sustainable farming, and the reduction of antibiotic usage in young animal nutrition. French livestock producers are integrating high-performance milk replacers to enhance calf health, growth rates, and productivity, aligning with evolving consumer preferences for safe, traceable, and high-quality animal products.

Which Region is the Fastest Growing Region in the Milk Replacers Market?

Asia-Pacific milk replacers market is projected to grow at the fastest CAGR of 12.4% from 2025 to 2032, fueled by rapid urbanization, rising incomes, and increasing demand for safe, sustainable animal protein. Governments across major countries such as China, India, and Japan are promoting modern livestock practices, stricter biosecurity, and reduced antibiotic use, driving widespread adoption of milk replacers. The region's expanding livestock population, growing aquaculture sector, and heightened awareness of animal nutrition and early-life health are further accelerating market growth.

China Milk Replacers Market Insight

The China milk replacers market captured the largest revenue share within Asia-Pacific in 2024, driven by the country's vast livestock sector, rising middle-class population, and heightened focus on food safety. Stricter regulations limiting antibiotic use and growing demand for sustainable animal protein are boosting milk replacer adoption across calves, piglets, and aquaculture production. Domestic and global players are investing heavily in localized, high-performance milk replacer solutions to meet China’s evolving agricultural needs.

India Milk Replacers Market Insight

The India milk replacers market is witnessing rapid growth, supported by the expanding dairy and livestock industries and government efforts to enhance animal productivity. Indian producers are increasingly adopting milk replacers to improve calf nutrition, reduce mortality rates, and support sustainable farming practices. The rising demand for high-quality, antibiotic-free animal products and greater awareness of early-life animal health are driving market growth in the country.

Japan Milk Replacers Market Insight

The Japan milk replacers market is experiencing steady momentum, fueled by high standards for food quality, safety, and animal welfare. Japanese livestock and aquaculture producers are integrating advanced milk replacers to enhance gut health, immunity, and disease resistance, particularly in premium meat, dairy, and seafood production. Ongoing innovation in nutritional formulations and Japan's proactive stance on reducing antibiotic reliance are contributing to market expansion.

Which are the Top Companies in Milk Replacers Market?

The milk replacers industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- ADM Animal Nutrition (Archer Daniels Midland Company) (U.S.)

- CHS Inc. (U.S.)

- Land O'Lakes, Inc. (U.S.)

- Glanbia plc (Ireland)

- Lactalis Ingredients (France)

- VanDrie Group (Netherlands)

- FrieslandCampina Ingredients (Netherlands)

- Nutreco (Netherlands)

- Alltech Store (U.S.)

- Nukamel (Netherlands)

- BEWITAL agri GmbH & Co. KG (Germany)

- Manna Pro Products LLC. (U.S.)

- Pet-Ag Inc. (U.S.)

- Liprovit BV (Netherlands)

- HiPro Feeds (Canada)

- PBS Animal Health (U.S.)

- Kent Nutrition Group (U.S.)

What are the Recent Developments in Global Milk Replacers Market?

- In February 2024, Trouw Nutrition introduced its next-generation milk replacer range under the Sprayfo Delta brand, integrating gut health modulators and micro-encapsulated fats to enhance energy absorption and feed efficiency in pre-weaning calves, specifically designed for high-performance dairy farms using automated calf feeding systems, reinforcing its position in advanced calf nutrition solutions

- In July 2023, Cargill launched a prototype plant-based calf milk replacer at the World Dairy Expo, formulated with soy protein isolates, probiotics, and fermented amino acid complexes to offer a sustainable, cost-effective alternative to conventional milk-based products, particularly for developing markets, reflecting the company's focus on sustainable livestock nutrition

- In November 2022, Archer Daniels Midland Company inaugurated a new research laboratory in Switzerland, aimed at advancing science-based feed additive development to meet evolving demands in the livestock and pet food sectors, marking a significant step toward enhancing its R&D capabilities

- In March 2022, Opalia, a Canadian food-tech company, unveiled its animal-free milk derived from mammary cells, having successfully replaced fetal bovine serum with a cost-efficient, non-animal growth substrate, reinforcing its commitment to sustainable, ethical dairy alternatives

- In October 2021, BASF SE rolled out the trinamiX mobile Near Infrared (NIR) spectroscopy solution for the feed industry, streamlining real-time, on-site analysis of animal feed and ingredients without the need for lab testing, thereby accelerating decision-making and improving efficiency across the value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.