Global Mobile Broadband Modem Market

Market Size in USD Billion

CAGR :

%

USD

24.28 Billion

USD

48.75 Billion

2024

2032

USD

24.28 Billion

USD

48.75 Billion

2024

2032

| 2025 –2032 | |

| USD 24.28 Billion | |

| USD 48.75 Billion | |

|

|

|

|

Mobile Broadband Modem Market Size

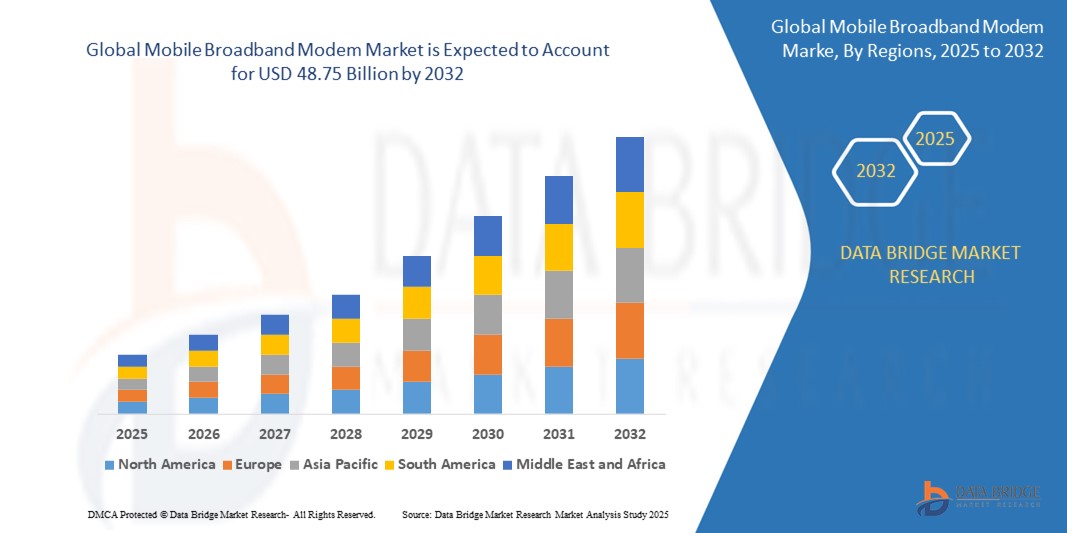

- The global mobile broadband modem market size was valued at USD 24.28 billion in 2024 and is expected to reach USD 48.75 billion by 2032, at a CAGR of 9.10% during the forecast period

- This growth is driven by increasing global internet penetration

Mobile Broadband Modem Market Analysis

- Mobile broadband modems are revolutionizing internet connectivity by offering faster speeds, lower latency, and improved reliability compared to traditional broadband solutions, enabling seamless communication and enhanced performance in applications such as streaming, gaming, and remote work

- The increasing demand for mobile broadband modems is driven by the rapid expansion of 5G networks, the growing need for high-speed internet across urban and rural areas, and the rising adoption of smart devices such as smartphones, laptops, and IoT devices, all of which rely on advanced broadband solutions for optimal performance

- North America is expected to dominate the mobile broadband modem market with the largest market share of 37.26%, driven by high internet penetration, widespread mobile device usage, and the growing need for fast and stable broadband connectivity across residential and commercial sectors

- Asia-Pacific is expected to witness the fastest growth in the mobile broadband modem market, driven by rapid urbanization, expanding mobile subscriber base, and increased adoption of 4G and 5G technologies

- The 4G segment is expected to dominate the market with the largest market share of 72.45% in 2025 due to the widespread adoption of 4G in smartphones, tablets, and other mobile devices, offering reliable and high-speed connectivity that supports a wide range of applications, from streaming high-definition videos to online gaming and business communications

Report Scope and Mobile Broadband Modem Market Segmentation

|

Attributes |

Mobile Broadband Modem Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Mobile Broadband Modem Market Trends

“Increasing Adoption of 5G Technology”

- A significant trend in the mobile broadband modem market is the increased integration of 5G technology, which enables modems to support higher data speeds, lower latency, and enhanced connectivity, making them ideal for emerging applications such as autonomous vehicles, smart cities, and industrial IoT

- 5G mobile broadband modems offer benefits such as faster download speeds, improved network efficiency, and enhanced reliability, driving demand in both consumer and enterprise sectors

- Manufacturers are focusing on enhancing 5G modem designs to ensure compatibility with future networks, improved energy efficiency, and reduced size to meet the requirements of mobile devices and IoT applications

- For instance, in June 2024, Qualcomm introduced a new 5G Mobile Broadband Modem chipset capable of delivering multi-gigabit speeds, with reduced power consumption for devices in both consumer and industrial applications

- The widespread adoption of 5G networks and the continuous push for smart infrastructure are expected to drive further innovation in the mobile broadband modem market

Mobile Broadband Modem Market Dynamics

Driver

“Rising Demand for Remote Work and Online Services”

- The increasing reliance on remote work, e-learning, and virtual meetings is a major driver for the mobile broadband modem market, as individuals and businesses seek reliable and fast internet connections

- Consumers and companies alike are demanding mobile broadband modems that can support high-speed, uninterrupted video conferencing, streaming, and cloud services, all of which are essential in the modern digital workspace

- The rise in cloud-based applications, collaboration tools, and high-definition content streaming is fueling the market for advanced broadband modems

- For instance, in 2023, Zoom Video Communications partnered with a leading modem manufacturer to develop a low-latency broadband modem tailored for virtual meetings and high-quality video calls

- This trend of growing online service usage and remote work continues to push the demand for high-performance broadband modems, particularly in areas requiring high upload speeds

Opportunity

“Expansion of Mobile Broadband Modem Use in the IoT Sector”

- A key opportunity for the mobile broadband modem market is the growing integration of modems in IoT devices, as the number of connected devices continues to rise globally

- Mobile Broadband Modems are becoming essential for smart home devices, wearables, and industrial IoT systems, where reliable, fast connectivity is required to enable real-time data exchange and automation

- The expansion of smart cities, connected health devices, and smart agriculture applications offers a substantial growth opportunity for mobile broadband modems

- For instance, in 2024, Ericsson launched a new IoT-focused broadband modem designed to connect multiple sensors and smart devices for industrial automation, enabling seamless connectivity in manufacturing environmentS

- The rapid expansion of the IoT ecosystem is expected to drive significant demand for mobile broadband modems, offering manufacturers and investors a lucrative opportunity in this emerging sector

Restraint/Challenge

“High Manufacturing Costs”

- A significant challenge in the mobile broadband modem market is the high production costs associated with developing advanced modems, especially those supporting 5G, IoT, and high-speed applications

- The cost of research and development, advanced semiconductor materials, and compliance with various regional regulations adds to the price of mobile broadband modems, which may limit their affordability for certain market segments

- As the demand for high-performance, feature-rich modems grows, manufacturers must find ways to reduce production costs while maintaining high quality and ensuring market competitiveness

- For instance, in 2023, a leading modem manufacturer faced challenges in reducing production costs for 5G mobile broadband modems, which led to delays in product availability for budget-conscious consumers

- Addressing these cost-related challenges will be crucial for widespread adoption of next-generation modems across both developed and developing markets

Mobile Broadband Modem Market Scope

The market is segmented on the basis of component, technology, end use, type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Technology |

|

|

By End Use |

|

|

By Type |

|

|

By Application |

|

In 2025, the 5G is projected to dominate the market with a largest share in technology segment

The 5G segment is expected to dominate the mobile broadband modem market with the largest market share of 72.45% in 2025 due to the widespread adoption of 5G in smartphones, tablets, and other mobile devices, offering reliable and high-speed connectivity that supports a wide range of applications, from streaming high-definition videos to online gaming and business communications.

The standalone is expected to account for the largest share during the forecast period in type segment

In 2025, the standalone segment is expected to dominate the market with the largest market share of 63.14% due to USB dongles and portable Wi-Fi hotspots, are favored for their portability, ease of use, and ability to provide reliable internet access without relying on smartphones or integrated routers.

Mobile Broadband Modem Market Regional Analysis

“North America Holds the Largest Share in the Mobile Broadband Modem Market”

- North America is expected to dominate the global mobile broadband modem market with the largest market share of 37.26%, driven by high internet penetration, widespread mobile device usage, and the growing need for fast and stable broadband connectivity across residential and commercial sectors

- The U.S. dominates regional growth, fueled by robust telecom infrastructure, the presence of leading modem and network equipment manufacturers, and strong adoption in industries such as remote work, online education, digital healthcare, and entertainment streaming

- Continuous advancements in 5G modem integration, increasing use of IoT-connected devices, and government initiatives aimed at bridging the digital divide in rural areas are further accelerating the growth of the mobile broadband modem market in North America

“Asia-Pacific is projected to register the Highest CAGR in the Mobile Broadband Modem Market”

- Asia-Pacific is expected to witness the fastest growth in the global mobile broadband modem market, driven by rapid urbanization, expanding mobile subscriber base, and increased adoption of 4G and 5G technologies

- Key countries such as China, India, Japan, and South Korea are leading the region’s expansion, supported by strong government initiatives to enhance telecom infrastructure and promote digital inclusion

- The region’s large population, growing demand for remote connectivity, and rising adoption of smartphones, tablets, and IoT devices are key growth enablers across both developed and emerging markets

Mobile Broadband Modem Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Digi International Inc. (U.S.)

- D-Link (India) Limited (Taiwan)

- Baima Global Leader in Industrial IoT (China)

- Cisco Systems, Inc. (U.S.)

- Belkin (U.S.)

- LANTRONIX, INC. (U.S.)

- Bentek Systems (Canada)

- Shenzhen Wlink Technology Co., Ltd. (China)

- Airgain (U.S.)

- Sierra Wireless (Canada)

- Huawei Technologies Co., Ltd. (China)

- NETGEAR (U.S.)

- Moxa Inc. (Taiwan)

- Peplink (U.S.)

- InHand Networks (U.S.)

- Campbell Scientific, Inc. (U.S.)

- Jinan USR IOT Technology Limited (China)

- Qualcomm Technologies, Inc. (U.S.)

- TP-Link Corporation Limited (China)

- Advantech Co., Ltd. (Taiwan)

- Multi-Tech Systems, Inc. (U.S.)

- Robustel (China)

- Motorola Mobility LLC (U.S.)

- Red Lion (U.S.)

- Bivocom (China)

Latest Developments in Global Mobile Broadband Modem Market

- In March 2025, Qualcomm redefined mobile broadband with the launch of the Qualcomm Dragonwing Fixed Wireless Access Gen 4 Elite, the world's first 5G-Advanced FWA platform. It features on-device AI-enhanced traffic classification, 40 TOPS edge AI integration, and surpasses downlink speeds of up to 12.5 Gbps. This innovation is expected to significantly enhance mobile broadband performance

- In July 2024, OptConnect, a leader in managed wireless solutions, announced the launch of ema:USB, the first smart USB modem. The ema:USB allows customers to integrate cellular connectivity into their hardware without the delays and complexities of traditional solutions, making it an ideal tool for seamless connectivity in various applications

- In February 2024, TCL unveiled the TCL LINKKEY IK511 at MWC 2024, one of the world's first 3GPP R17 5G RedCap USB dongles powered by the Snapdragon X35 5G Modem-RF System from Qualcomm Technologies. This launch marks a key step in advancing portable 5G technology for enhanced connectivity

- In September 2024, Mobile operator Three UK introduced a 5G Outdoor Hub for their Three Home Broadband service, a mobile router that can be self-installed on the outside of homes, providing consumers with easy access to high-speed internet. This innovative solution enables better service accessibility for households across the U.K.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.