Global Mobile Operator Telecom Service Assurance Market

Market Size in USD Billion

CAGR :

%

USD

9.70 Billion

USD

20.04 Billion

2025

2033

USD

9.70 Billion

USD

20.04 Billion

2025

2033

| 2026 –2033 | |

| USD 9.70 Billion | |

| USD 20.04 Billion | |

|

|

|

|

What is the Global Mobile Operator Telecom Service Assurance Market Size and Growth Rate?

- The global mobile operator telecom service assurance market size was valued at USD 9.70 billion in 2025 and is expected to reach USD 20.04 billion by 2033, at a CAGR of 9.50% during the forecast period

- Assurance of service, telecommunications is widely defined as the application of the Communications Provider's policies and procedures (CSP) to ensure that the services provided by the networks meet the pre-defined quality level of service for a good subscriber experience. However, there is an earthquake change in the Telecom world of Service Assurance and the sector is changing

What are the Major Takeaways of Mobile Operator Telecom Service Assurance Market?

- The adoption of telecom service assurance decreases the cost of maintenance, improves and consistent service quality, enhances customer quality of experience is a driving factor for the mobile operator telecom service assurance market

- The increasing mobile subscriber base and new mobile internet subscribers across the globe is also a driver for the mobile operator telecom service assurance market. The launch of VoWi-Fi services to improves indoor coverage and provides a cost-efficient roaming solution is an opportunity for the mobile operator telecom service assurance market

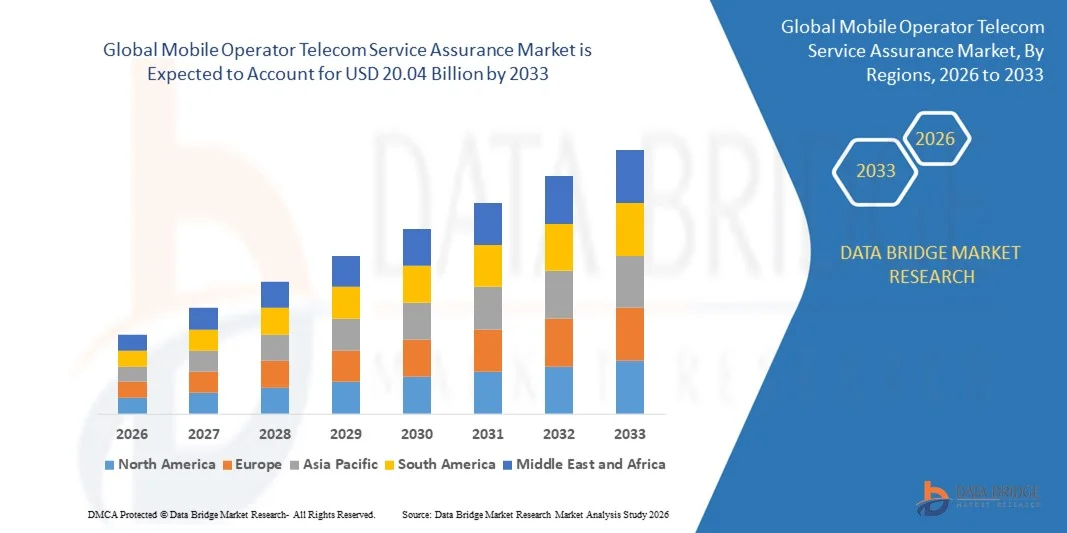

- North America dominated the mobile operator telecom service assurance market with the largest revenue share of 41.2% in 2025, driven by the presence of major telecom operators, advanced network infrastructure, and high adoption of digital service assurance solutions in the U.S. and Canada

- Asia-Pacific is projected to witness the fastest growth with a CAGR of 10.2% during 2026–2033, fueled by rapid 5G deployment, increasing mobile subscriber base, and digital transformation initiatives in countries such as China, India, Japan, and South Korea

- The Products segment dominated the market with the largest revenue share of 48.6% in 2025, owing to the widespread adoption of network monitoring hardware, sensors, and analytics platforms that ensure reliable service delivery across mobile and fixed networks

Report Scope and Mobile Operator Telecom Service Assurance Market Segmentation

|

Attributes |

Mobile Operator Telecom Service Assurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Mobile Operator Telecom Service Assurance Market?

Increasing Adoption of Advanced Network Monitoring and Analytics for Service Reliability

- The mobile operator telecom service assurance market is witnessing a major shift toward real-time network monitoring, predictive analytics, and AI-driven service management, fueled by rising mobile data traffic, 5G deployment, and customer demand for uninterrupted connectivity. Operators are investing in software platforms, sensors, and automated fault detection tools to optimize performance and reduce downtime

- For instance, IBM Corporation and Nokia have expanded their service assurance solutions with AI-based analytics and end-to-end monitoring, enabling faster issue resolution and enhanced QoS for telecom operators globally

- The demand for cloud-based and virtualized assurance solutions is increasing, allowing operators to scale monitoring capabilities, improve network efficiency, and reduce CAPEX

- Integration of IoT, network slicing, and SDN/NFV technologies is transforming service assurance, supporting automated fault prediction and predictive maintenance

- Sustainability initiatives in telecom, such as energy-efficient monitoring tools and eco-friendly hardware, are gaining traction

- As mobile operators prioritize reliability, efficiency, and customer experience, the adoption of advanced service assurance solutions is expected to remain a key trend shaping global market growth

What are the Key Drivers of Mobile Operator Telecom Service Assurance Market?

- Rapid deployment of 5G networks, increasing mobile broadband subscribers, and growing enterprise connectivity requirements are driving the demand for advanced service assurance solutions

- For instance, in 2025, Spirent Communications expanded its telecom service assurance portfolio with cloud-native monitoring platforms to support 5G and edge deployments

- Rising focus on network reliability, SLA compliance, and proactive fault management is pushing telecom operators to adopt predictive analytics and automated monitoring systems

- Technological advancements, including AI/ML analytics, network virtualization, and real-time performance dashboards, enhance visibility, fault detection, and service quality

- Growing adoption of IoT, cloud computing, and network slicing across telecom infrastructure is fueling demand for scalable and flexible service assurance solutions

- As operators expand digital services, 5G deployments, and managed network offerings, the Mobile Operator Telecom Service Assurance market is set to experience steady growth supported by technological innovation and regulatory compliance

Which Factor is Challenging the Growth of the Mobile Operator Telecom Service Assurance Market?

- High implementation costs, complex integration with legacy networks, and interoperability challenges remain significant barriers to adoption

- For instance, during 2024–2025, operators in North America and Europe faced delays integrating AI-based assurance platforms with multi-vendor network equipment, affecting deployment timelines and ROI

- Intense competition among global and regional vendors has resulted in pricing pressures and increased focus on cost-efficient, flexible solutions without compromising performance.

- Strict regulatory requirements and data privacy standards across regions add complexity to deployment and operation of monitoring tools

- Rapid evolution of network technologies, such as 6G trials, network virtualization, and cloud-native infrastructure, requires continuous upgrades and investments, posing challenges for operators

- To address these hurdles, market players are focusing on cloud-based deployment, AI-driven automation, and modular service assurance solutions to enhance scalability, compliance, and service reliability

How is the Mobile Operator Telecom Service Assurance Market Segmented?

The market is segmented on the basis of solution, operator type, deployment mode, and organization size.

- By Solution

On the basis of solution, the mobile operator telecom service assurance market is segmented into Products and Services. The Products segment dominated the market with the largest revenue share of 48.6% in 2025, owing to the widespread adoption of network monitoring hardware, sensors, and analytics platforms that ensure reliable service delivery across mobile and fixed networks. These products provide operators with real-time visibility, fault detection, and predictive maintenance capabilities, supporting high-quality service assurance.

The Services segment is expected to register the fastest CAGR from 2026 to 2033, driven by the growing demand for managed service assurance, cloud-based monitoring, and consulting services that help operators optimize network performance and meet SLA commitments. Rising outsourcing of network management and advanced support solutions in emerging markets continues to propel the adoption of service-based assurance offerings globally.

- By Operator Type

On the basis of operator type, the market is segmented into Mobile Operators and Fixed Operators. The Mobile Operator segment dominated the market with a revenue share of 52.3% in 2025, attributed to the rapid deployment of 4G/5G networks, increasing smartphone penetration, and the need for continuous service monitoring to maintain QoS and customer satisfaction.

The Fixed Operator segment is anticipated to grow at the fastest CAGR from 2026 to 2033, supported by rising broadband expansion, fiber-to-the-home (FTTH) deployments, and enterprise connectivity services. Service assurance adoption among fixed operators is increasing due to the critical need for low-latency, reliable connections in residential and corporate networks, ensuring uninterrupted performance and reduced downtime.

- By Deployment Mode

On the basis of deployment mode, the mobile operator telecom service assurance market is segmented into On-Premises and Cloud solutions. The On-Premises segment dominated the market with a share of 55.1% in 2025, driven by operators’ preference for in-house control, high data security, and integration with legacy network infrastructure.

The Cloud segment is expected to register the fastest CAGR from 2026 to 2033, fueled by increasing adoption of virtualization, NFV/SDN networks, and scalable, subscription-based assurance solutions. Cloud-based platforms offer flexibility, remote management, and real-time analytics, enabling operators to efficiently monitor and optimize large-scale network operations across multiple regions.

- By Organization Size

On the basis of organization size, the market is segmented into Large Enterprises and SMEs. The Large Enterprises segment dominated the market with a revenue share of 57.4% in 2025, due to their extensive network infrastructure, high subscriber base, and stringent SLA requirements that necessitate advanced service assurance solutions.

The SME segment is anticipated to register the fastest CAGR from 2026 to 2033, driven by growing adoption of managed service assurance, cloud-based monitoring, and cost-effective solutions that allow smaller operators to improve service quality without heavy upfront investment. Increasing focus on digital transformation and network reliability among SMEs is further accelerating market growth in this segment.

Which Region Holds the Largest Share of the Mobile Operator Telecom Service Assurance Market?

- North America dominated the mobile operator telecom service assurance market with the largest revenue share of 41.2% in 2025, driven by the presence of major telecom operators, advanced network infrastructure, and high adoption of digital service assurance solutions in the U.S. and Canada

- The region benefits from extensive 5G rollout, network modernization projects, and a strong focus on customer experience management. Telecom operators are investing in predictive monitoring, AI-driven analytics, and end-to-end service assurance platforms to improve uptime and reduce operational costs

- The combination of advanced IT infrastructure, regulatory compliance, and a large base of enterprise clients is supporting sustained growth. Continuous innovation in cloud-based monitoring, network automation, and integration with AI/ML analytics further strengthens North America’s leadership in the global mobile operator telecom service assurance market

U.S. Mobile Operator Telecom Service Assurance Market Insight

The U.S. is the largest contributor in North America, supported by widespread deployment of 5G networks, enterprise network solutions, and advanced telecom analytics platforms. Key players such as IBM Corporation (U.S.), Nokia (Finland/U.S. operations), and Spirent Communications (U.K./U.S.) are focusing on AI-based service assurance, real-time fault detection, and predictive maintenance to enhance network reliability. Rising demand for managed services and cloud-based solutions is driving further investments.

Canada Mobile Operator Telecom Service Assurance Market Insight

Canada contributes steadily to the regional Mobile Operator Telecom Service Assurance market, driven by telecom infrastructure modernization and expanding enterprise adoption of monitoring and network analytics solutions. Telecom operators are increasingly leveraging predictive assurance and automated fault management to improve service quality and operational efficiency. Government initiatives supporting broadband expansion and smart city projects further enhance demand.

Asia-Pacific Mobile Operator Telecom Service Assurance Market Insight

Asia-Pacific is projected to witness the fastest growth with a CAGR of 10.2% during 2026–2033, fueled by rapid 5G deployment, increasing mobile subscriber base, and digital transformation initiatives in countries such as China, India, Japan, and South Korea. Telecom operators are investing heavily in AI-powered service assurance, cloud-based monitoring, and predictive analytics platforms to enhance customer experience and reduce network downtime. Growing investments in IoT, smart cities, and enterprise networking solutions are further boosting market adoption.

China Mobile Operator Telecom Service Assurance Market Insight

China is the largest contributor in Asia-Pacific, supported by large-scale 5G rollouts, smart city initiatives, and a strong telecom operator ecosystem. Investments in AI-driven monitoring, automated fault detection, and real-time service assurance platforms are reinforcing China’s position in the regional and global market. Operators are focusing on AI and machine learning for predictive network management and fault prevention, strengthening India’s contribution to Asia-Pacific growth

Europe Mobile Operator Telecom Service Assurance Market Insight

Europe holds a significant share of the global mobile operator telecom service assurance market, driven by demand for advanced service assurance solutions among telecom operators in Germany, the U.K., France, and Italy. The region emphasizes AI-based monitoring, predictive analytics, and integration with enterprise IT systems to optimize service quality. Regulatory compliance, including GDPR, is encouraging operators to adopt secure, automated service assurance solutions, while sustainability initiatives and digital transformation programs continue to support market expansion.

Germany Mobile Operator Telecom Service Assurance Market Insight

Germany leads Europe’s market, supported by advanced 5G networks, enterprise IT integration, and telecom operators’ focus on predictive fault management and network analytics. Continuous innovation in cloud-native service assurance solutions reinforces Germany’s leadership in Europe.

U.K. Mobile Operator Telecom Service Assurance Market Insight

The U.K. market is expanding steadily, driven by 5G adoption, smart city initiatives, and increased enterprise networking demand. Telecom operators are focusing on AI-powered fault detection, predictive analytics, and cloud-based service assurance platforms, strengthening the U.K.’s share in the European mobile operator telecom service assurance market.

Which are the Top Companies in Mobile Operator Telecom Service Assurance Market?

The mobile operator telecom service assurance industry is primarily led by well-established companies, including:

- TEOCO (U.S.)

- Spirent Communications (U.K.)

- Nokia (Finland)

- NETSCOUT (U.S.)

- NEC (Japan)

- MYCOM OSI (U.K.)

- Intracom Telecom (Greece)

- IBM Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Hewlett Packard Enterprise Development LP (U.S.)

- EXFO Inc. (Canada)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Comarch SA (Poland)

- Amdocs (U.S.)

- Accenture (Ireland)

- Broadcom (U.S.)

- ZTE Corporation (China)

- VIAVI Solutions Inc. (U.S.)

- Tata Consultancy Services Limited (India)

- Oracle Corporation (U.S.)

- CA Technologies (U.S.)

What are the Recent Developments in Global Mobile Operator Telecom Service Assurance Market?

- In October 2024, CloudFabrix announced the launch of its GenAI-driven Telco Service Assurance and Unified Network Observability solution at Gitex 2024 in Dubai, enhancing fault management, performance monitoring, and operational insights for next-generation telco networks, thereby improving network reliability and efficiency

- In September 2024, AVSystem introduced its Customer Experience Management (CEM) Platform, a WiFi service assurance solution for Communication Service Providers (CSPs), featuring AI-based diagnostics, intervention analytics, and self-management tools, which enhances customer satisfaction and operational effectiveness across WiFi networks

- In June 2024, Prodapt launched TechCo Toolkit, an integration with ServiceNow designed to assist Communication Service Providers (CSPs) in optimizing network service assurance workflows, thereby improving operational coordination and support for connected industry applications

- In February 2024, DISH Wireless implemented VMware Telco Cloud Service Assurance across the Boost Wireless Network in a pilot production environment, enabling real-time network monitoring, assurance, and automation, which provided an improved 5G network experience for subscribers

- In February 2024, ServiceNow, in collaboration with NVIDIA, introduced telco-specific generative AI solutions to enhance service experiences, offering service assurance teams streamlined, accurate, and timely explanations of network issues, thereby improving incident resolution and customer satisfaction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.