Global Mold Inhibitors Market

Market Size in USD Billion

CAGR :

%

USD

1.45 Billion

USD

2.22 Billion

2024

2032

USD

1.45 Billion

USD

2.22 Billion

2024

2032

| 2025 –2032 | |

| USD 1.45 Billion | |

| USD 2.22 Billion | |

|

|

|

|

Mold Inhibitors Market Size

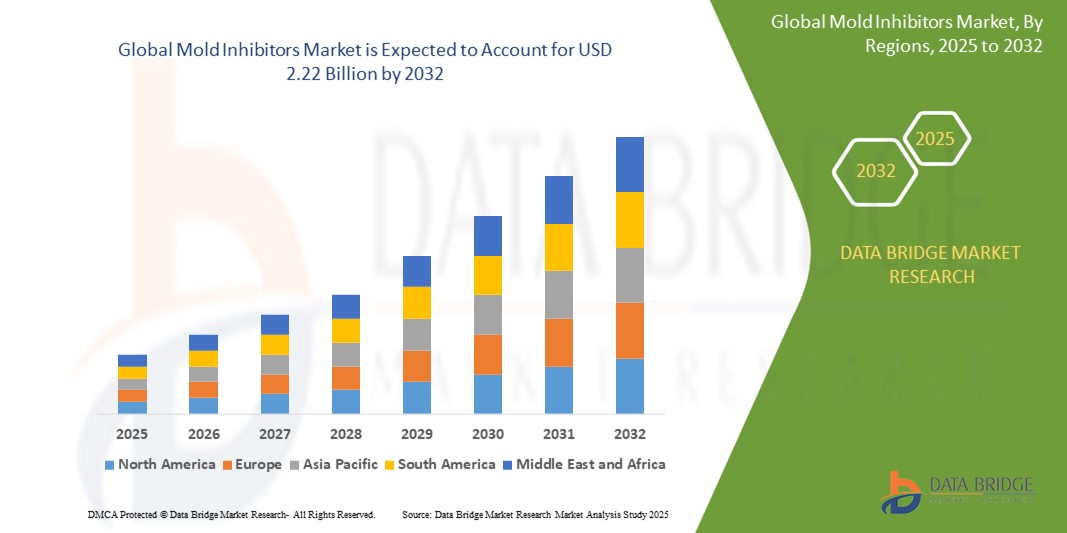

- The global Mold Inhibitors market size was valued at USD 1.45 billion in 2024 and is expected to reach USD 2.22 billion by 2032, at a CAGR of 5.5% during the forecast period

- This growth is driven by factors such as the increasing consumer demand for clean-label products, heightened awareness of health and wellness, advancements in packaging technologies, stringent food safety regulations, and the rising preference for natural and sustainable ingredients

Mold Inhibitors Market Analysis

- Mold inhibitors are the compounds that are used to tackle the fungal growth in food items, beverages, medicines, cosmetics and other products.

- These are the additives that minimize the mold contamination and restrict the mold growth. Mold inhibitors also add to the shelf life of products. These products are both natural and synthetic in nature and these need not be added in large quantities to the products.

- Asia-Pacific is expected to dominate the Mold Inhibitors market by 35% due to rapid urbanization, increased food production, and heightened awareness of food safety

- Asia-Pacific expected to be the fastest growing region in the mold Inhibitors market during the forecast period due to population growth, urbanization, and increased food production are driving this expansion

- Microorganisms segment is expected to dominate the market with a market share of 42.5% due to good yeast is largely used for baking and confectionary products. This helps in keeping the food fresh and prevent it from rancidity. Microorganisms such as yeast help in absorbing minerals and vitamins from the food. It also helps in keeping digestive system healthy and in balance

Report Scope and Mold Inhibitors Market Segmentation

|

Attributes |

Mold Inhibitors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mold Inhibitors Market Trends

“Rise of Clean-Label and Natural Mold Inhibitors”

- There is a growing consumer preference for food products with minimal and recognizable ingredients. This trend is driving the adoption of clean-label mold inhibitors, which are derived from natural sources and free from synthetic additives

- Innovations such as high-pressure processing (HPP) and pulsed electric fields (PEF) are being integrated with clean-label practices. These methods extend shelf life without the need for chemical preservatives, appealing to health-conscious consumers

- There is a growing trend toward sourcing ingredients ethically and sustainably. Consumers are increasingly mindful of not only what is in their food but also the environmental and social impact of their food choices, driving demand for responsibly sourced mold inhibitors

- Brands are enhancing transparency about what’s in their products and how they are made. This trend is leading to more detailed labeling and marketing strategies that highlight the natural and clean aspects of mold inhibitors

- Clean-label mold inhibitors are finding new applications beyond food, in sectors such as cosmetics and pharmaceuticals, where there is a parallel demand for natural and non-toxic ingredients. This diversification is opening new markets and opportunities for growth

Mold Inhibitors Market Dynamics

Driver

“Increasing Consumer Awareness and Regulatory Standards”

- Consumers are becoming more aware of the health risks associated with synthetic preservatives, leading to a preference for natural alternatives. This shift is driving the demand for mold inhibitors derived from natural sources

- Governments and regulatory bodies are implementing stricter food safety standards, necessitating the use of effective mold inhibitors in food products. Compliance with these regulations is driving manufacturers to adopt mold inhibitors that ensure product safety and quality

- Consumers expect longer shelf life for food products without compromising on quality. Mold inhibitors play a crucial role in extending the shelf life of products, meeting consumer expectations and regulatory requirements

- There is an increasing preference among consumers for products with minimal and recognizable ingredients. This shift is prompting manufacturers to adopt natural mold inhibitors that align with clean-label trends, thereby enhancing product appeal and meeting consumer expectations

- The expansion of the processed and packaged food industry is driving the demand for effective mold inhibitors to ensure product safety and quality. Manufacturers are adopting mold inhibitors to meet the growing demand for convenient and safe food products

Opportunity

“Expansion into Emerging Markets”

- Emerging markets are witnessing an increase in disposable incomes, leading to a higher demand for premium food products. This trend presents an opportunity for manufacturers to introduce mold inhibitors in these markets to meet the growing demand for quality and safe food products

- Urbanization and changing lifestyles in emerging markets are driving the demand for processed and packaged foods. This shift presents an opportunity for manufacturers to introduce mold inhibitors to ensure the safety and quality of these products

- As consumers in emerging markets become more aware of food safety and quality, the demand for mold inhibitors is expected to rise. Manufacturers can capitalize on this trend by introducing effective mold inhibitors to meet consumer expectations

- Governments in emerging markets are implementing regulations to enhance food safety standards. This regulatory support creates an opportunity for manufacturers to introduce mold inhibitors that comply with these standards, ensuring product safety and quality.

- The growth of food processing industries in emerging markets is driving the demand for mold inhibitors to ensure the safety and quality of food products. Manufacturers can leverage this growth by introducing effective mold inhibitors tailored to the needs of these industries.

Restraint/Challenge

“Technical Limitations and Regulatory Compliance”

- Natural mold inhibitors may exhibit varying levels of efficacy depending on the type of food product. For instance, an inhibitor effective in bakery products may not perform similarly in dairy or meat products due to differences in moisture content and pH levels

- The use of natural mold inhibitors can sometimes affect the taste, texture, or appearance of food products. This sensory impact may lead to consumer dissatisfaction and pose challenges for manufacturers in maintaining product quality

- Natural mold inhibitors can be sensitive to environmental factors such as light, heat, and oxygen, leading to reduced stability and effectiveness over time. This instability can limit their shelf life and pose challenges for manufacturers in ensuring consistent product quality

- Navigating the complex regulatory requirements for clean-label mold inhibitors can be challenging for manufacturers. Obtaining certifications and ensuring compliance with various standards can be time-consuming and resource-intensive

- The production of natural mold inhibitors often involves more complex processes and higher raw material costs compared to synthetic alternatives. These increased costs can impact the pricing and profitability of products incorporating natural mold

Mold Inhibitors Market Scope

The market is segmented on the basis source, type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Type |

|

|

By Application |

|

In 2025, the micro-organisms surgery is projected to dominate the market with a largest share in source segment

The micro-organisms segment is expected to dominate the Mold Inhibitors market with the largest share of 42.5% in 2025 due to good yeast is largely used for baking and confectionary products. This helps in keeping the food fresh and prevent it from rancidity. Microorganisms such as yeast help in absorbing minerals and vitamins from the food. It also helps in keeping digestive system healthy and in balance. The right amount of yeast in human body helps in building immune system. This is driving the demand for microorganisms segment in the mold inhibitors market.

The natamycin is expected to account for the largest share during the forecast period in type market

In 2025, the natamycin segment is expected to dominate the market with the largest market share of 22.5% due to its widely used in the food industry, pharmaceutical industry, and animal feed industry. The increase in demand from various applications related to the food & beverages, pharma and animal feed is increasing the demand for mold inhibitors such as calcium aluminosilicates and propyl gallate.

Mold Inhibitors Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Mold Inhibitors Market”

- The Asia-Pacific region held the largest share of the global mold inhibitors market in 2023, accounting for 35% of the revenue

- This dominance is attributed to rapid urbanization, increased food production, and heightened awareness of food safety

- China is the leading market within the Asia-Pacific region, driven by its substantial food processing industry and stringent food safety regulations

- India is identified as the fastest-growing market in the Asia-Pacific region. This growth is fueled by increasing disposable incomes, a burgeoning food processing sector, and rising consumer demand for safe and quality food products

- The country's focus on technological innovation and high standards in food safety contribute to this upward trend

- Countries such as Thailand and Vietnam are witnessing increased adoption of mold inhibitors due to supportive government regulations and growing awareness of food safety, further bolstering the market in Southeast Asia

“Asia-Pacific is Projected to Register the Highest CAGR in the Mold Inhibitors Market”

- Factors such as population growth, urbanization, and increased food production are driving this expansion

- This surge is attributed to the country's expanding food processing industry and increasing consumer awareness of food safety

- Japan's focus on technological advancements in food safety is contributing to its rapid market growth

- Southeast Asian countries are implementing regulations and initiatives to enhance food safety, leading to increased adoption of mold inhibitors. This regulatory support is accelerating market growth in the region

- Emerging economies in the Asia-Pacific region, such as Indonesia and the Philippines, are witnessing a rise in demand for mold inhibitors due to economic development and improved standards of living, presenting significant growth opportunities

Mold Inhibitors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hawkins Watts Limited (New Zealand)

- Kemin Industries, Inc. (U.S.)

- Niacet (U.S.)

- Pacific Coast Chemical Co. (U.S.)

- ANGUS Chemical Company (U.S.)

- Eastman Chemical Company (U.S.)

- DSM (Netherlands)

- Watson Inc. (U.S.)

- Bentoli (U.S.)

- Corbion (Netherlands)

- Ravago Chemicals (Luxembourg)

Latest Developments in Global Mold Inhibitors Market

- In October 2024, Kemin Industries unveiled Shield V, a unique mold inhibitor combining the preservation properties of buffered vinegar with a botanical extract that is a source of sorbic acid. This blend effectively slows mold development, ensuring product freshness over time

- In July 2024, BDF Natural Ingredients introduced a natural mold inhibitor derived from fermented wheat flour, specifically designed for bakery products. This innovative solution offers an alternative to synthetic preservatives, aligning with the growing demand for clean-label ingredients in the food industry

- In July 2024, MILLBIO launched X-Tra Guard, a clean-label, all-natural solution utilizing gluten-free rowan berry extract as a potassium sorbate alternative. This product enhances shelf life without compromising flavor or texture, catering to the clean-label trend in food preservation

- In July 2023, BioVeritas LLC, a U.S.-based bio-based ingredients company, launched a clean-label mold inhibitor derived from vegetable oil extracts using upcycling and fermentation processes. This product offers a realistic solution for the bakery industry to replace calcium propionate, maintaining similar sensory qualities while adhering to clean-label guidelines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mold Inhibitors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mold Inhibitors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mold Inhibitors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.