Global Motorcycle Suspension System Market

Market Size in USD Million

CAGR :

%

USD

860.68 Million

USD

1,382.18 Million

2024

2032

USD

860.68 Million

USD

1,382.18 Million

2024

2032

| 2025 –2032 | |

| USD 860.68 Million | |

| USD 1,382.18 Million | |

|

|

|

|

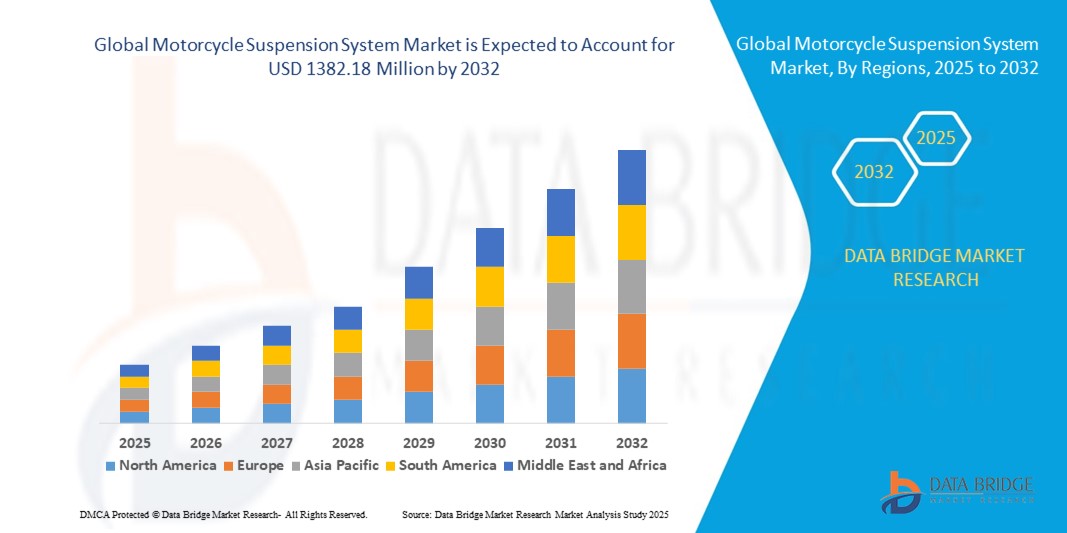

What is the Global Motorcycle Suspension System Market Size and Growth Rate?

- The global motorcycle suspension system market size was valued at USD 860.68 million in 2024 and is expected to reach USD 1382.18 million by 2032, at a CAGR of 6.10% during the forecast period

- Constant advancements in suspension technology, including the development of adaptive suspension systems, electronic suspension control, and innovative materials, are driving the market. These improvements enhance rider experience, safety, and performance.

- There's a rising emphasis on providing superior comfort and safety to riders. Manufacturers have an opportunity to develop and market suspension systems that enhance performance and prioritize rider comfort and safety, addressing a significant market need

What are the Major Takeaways of Motorcycle Suspension System Market?

- Constant advancements in suspension technology, including the development of adaptive suspension systems, electronic suspension control, and innovative materials, are driving the market. These improvements enhance rider experience, safety, and performance

- With an increasing demand for high-performance motorcycles, there's a parallel demand for advanced suspension systems capable of handling diverse terrains and providing superior comfort and control. This demand fuels the growth of the suspension system market

- North America dominated the motorcycle suspension system market with the largest revenue share of 42.12% in 2024, driven by rising adoption of decentralized applications (dApps), blockchain infrastructure, and AI-driven Motorcycle Suspension System solutions

- North America is projected to grow at the fastest CAGR of 8.7% from 2025 to 2032, fueled by the rising popularity of cruisers, touring bikes, and electric motorcycles in the U.S. and Canada

- The Telescopic Fork segment dominated the market with the largest revenue share of 46.3% in 2024, driven by its widespread adoption in commuter motorcycles due to cost-effectiveness, simplicity, and ease of maintenance

Report Scope and Motorcycle Suspension System Market Segmentation

|

Attributes |

Motorcycle Suspension System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Motorcycle Suspension System Market?

Integration of Advanced Electronic Suspension and AI-Driven Performance Optimization

- A significant and accelerating trend in the global motorcycle suspension system market is the adoption of electronic suspension systems integrated with artificial intelligence (AI) to enhance ride comfort, safety, and performance. These systems enable real-time adjustments based on road conditions, load, and riding style, offering a highly personalized riding experience

- For instance, BMW Motorrad and KTM are incorporating semi-active suspension systems that automatically adapt damping settings using AI algorithms, while Showa and KYB Corporation are developing smart suspensions that integrate sensors for predictive performance tuning

- AI integration in motorcycle suspension systems allows predictive maintenance, dynamic load balancing, and optimized handling. This provides riders with improved stability, reduced fatigue, and enhanced overall control, especially for high-performance and adventure motorcycles

- The seamless fusion of electronic control units, AI, and IoT connectivity fosters a smarter riding ecosystem where suspension interacts with braking systems, tire pressure monitors, and navigation data to deliver an adaptive, safe, and efficient ride

- This trend is fundamentally reshaping consumer expectations for motorcycle performance. Consequently, companies such as ZF Friedrichshafen AG and Continental AG are investing in AI-enabled suspension platforms that offer cloud-based data analytics and over-the-air (OTA) updates to ensure consistent advancements in technology

- The rising demand for intelligent and adaptive motorcycle suspension systems is rapidly expanding across premium motorcycles, electric bikes, and performance segments, as consumers increasingly prioritize safety, customization, and connected features

What are the Key Drivers of Motorcycle Suspension System Market?

- The growing demand for premium motorcycles and the rising focus on rider safety and comfort are significant drivers fueling the expansion of the motorcycle suspension system market

- For instance, in February 2024, KYB Corporation introduced an advanced electronically controlled suspension system for sports bikes, aiming to enhance cornering stability and reduce manual adjustments, thus accelerating innovation in the sector

- As consumers seek superior riding experiences, motorcycle suspension systems provide better handling, reduced vibration, and improved load-carrying capacity, positioning them as essential components for performance, touring, and off-road motorcycles

- Furthermore, the shift towards electric motorcycles and government regulations promoting road safety are driving manufacturers to integrate lightweight and energy-efficient suspension technologies. Companies such as Showa and Endurance Technologies are focusing on high-performance suspensions tailored for electric two-wheelers

- The ability to integrate AI-powered control systems, support customized damping profiles, and enhance durability is propelling Motorcycle Suspension System adoption across diverse segments, setting the stage for consistent market growth

Which Factor is challenging the Growth of the Motorcycle Suspension System Market?

- High costs associated with advanced electronic suspension systems and complex maintenance requirements are significant barriers to widespread adoption. These challenges particularly affect price-sensitive markets such as developing regions

- For instance, smart suspension technologies by BMW and WP Suspension significantly improve performance but come with premium pricing, limiting accessibility for entry-level motorcycles

- Addressing these challenges requires cost-efficient manufacturing techniques, modular designs, and training for service professionals to handle advanced technologies. Companies such as Gabriel India Limited are exploring localized production to reduce costs while maintaining quality

- Another challenge is technological integration—ensuring compatibility between suspension systems and other electronic components such as ABS and traction control can complicate design and development

- Overcoming these hurdles through economies of scale, collaboration between OEMs and suppliers, and R&D in lightweight materials will be crucial for the Motorcycle Suspension System market to achieve wider adoption and long-term sustainability

How is the Motorcycle Suspension System Market Segmented?

The market is segmented on the basis of product type, sales channel, technology, and motorcycle type.

- By Product Type

On the basis of product type, the motorcycle suspension system market is segmented into Front Suspension, Telescopic Fork, Rear Suspension, Dual Shocks, Mono Shocks, and Others. The Telescopic Fork segment dominated the market with the largest revenue share of 46.3% in 2024, driven by its widespread adoption in commuter motorcycles due to cost-effectiveness, simplicity, and ease of maintenance. Telescopic forks are preferred for their versatility across standard and entry-level motorcycles, making them the most commonly used suspension system globally.

The Mono Shocks segment is anticipated to witness the fastest CAGR of 22.6% from 2025 to 2032, fueled by rising demand in sports and premium motorcycles. Mono shocks offer improved stability, better handling, and enhanced ride quality, making them popular in high-performance and adventure bikes.

- By Sales Channel

On the basis of sales channel, the motorcycle suspension system market is segmented into OEM and Aftermarket. The OEM segment captured the largest market revenue share of 71.4% in 2024, driven by the increasing production of motorcycles integrated with advanced suspension systems as standard features. OEMs are focusing on offering technologically advanced and lightweight suspension solutions to meet rising safety and comfort expectations.

The Aftermarket segment is projected to grow at the fastest CAGR of 21.2% from 2025 to 2032, supported by the growing trend of customization and performance upgrades among motorcycle enthusiasts, as well as replacement demand due to wear and tear.

- By Technology

On the basis of technology, the motorcycle suspension system market is segmented into Passive and Active/Semi-active. The Passive segment dominated the market with the largest revenue share of 68.9% in 2024, driven by its affordability, durability, and extensive use in mass-market motorcycles. Passive suspension systems continue to hold dominance due to their low maintenance requirements and cost-effectiveness, particularly in developing markets.

The Active/Semi-active segment is expected to register the fastest CAGR of 24.1% from 2025 to 2032, fueled by increasing integration of electronic control units (ECUs) and AI-driven technologies in premium and electric motorcycles to deliver adaptive and personalized ride experiences.

- By Motorcycle Type

On the basis of motorcycle type, the motorcycle suspension system market is segmented into Standard, Cruiser, Sports, Scooter, Mopeds, and Others. The Standard motorcycle segment accounted for the largest revenue share of 39.7% in 2024, attributed to high production volumes and widespread usage in commuter and utility applications, particularly in emerging economies. Standard motorcycles typically feature simpler suspension setups, making them more accessible to a broad consumer base.

The Sports motorcycle segment is anticipated to grow at the fastest CAGR of 23.5% from 2025 to 2032, driven by increasing demand for performance-oriented bikes with advanced suspension systems that offer superior handling, stability, and safety at high speeds.

Which Region Holds the Largest Share of the Motorcycle Suspension System Market?

- Asia-Pacific dominated the motorcycle suspension system market with the largest revenue share of 41.8% in 2024, driven by rising motorcycle production, growing urbanization, and increasing consumer demand for comfortable and performance-oriented bikes

- Consumers in the region highly value affordability, durability, and advanced suspension technologies, especially in markets such as India, China, and Southeast Asia, where two-wheelers are a primary mode of transportation

- This growth is further supported by expanding manufacturing facilities, rising disposable incomes, and government initiatives promoting electric and premium motorcycles, positioning Asia-Pacific as the global leader in Motorcycle Suspension System adoption

China Motorcycle Suspension System Market Insight

The China Motorcycle Suspension System market accounted for 48% of the Asia-Pacific share in 2024, driven by its position as the world’s largest motorcycle producer and consumer. Growing demand for electric two-wheelers, combined with advancements in mono shocks and semi-active suspension technologies, is accelerating growth. In addition, domestic manufacturers are innovating lightweight and cost-efficient solutions, making China a hub for both mass-market and premium motorcycle suspension systems.

India Motorcycle Suspension System Market Insight

The India Motorcycle Suspension System market is gaining traction due to high sales of commuter and budget motorcycles, which dominate the country’s automotive landscape. The rising popularity of sports bikes and premium motorcycles among younger consumers is boosting demand for mono shocks and telescopic forks. Government support for local manufacturing under “Make in India” and the shift toward electric scooters are further shaping market expansion.

Japan Motorcycle Suspension System Market Insight

The Japan Motorcycle Suspension System market is driven by strong demand for advanced suspension technologies in premium bikes and sports motorcycles. Japanese manufacturers such as SHOWA and KYB are pioneering semi-active and electronically controlled suspension systems, catering to global OEMs. Japan’s emphasis on performance, safety, and technological innovation ensures its continued leadership in high-end motorcycle suspension development.

Which Region is the Fastest Growing Region in the Motorcycle Suspension System Market?

North America is projected to grow at the fastest CAGR of 8.7% from 2025 to 2032, fueled by the rising popularity of cruisers, touring bikes, and electric motorcycles in the U.S. and Canada. Increasing consumer preference for customized suspension solutions and the integration of AI-powered and semi-active suspension technologies in premium motorcycles are driving regional growth. A robust presence of leading motorcycle brands, coupled with higher disposable incomes and growing recreational riding culture, positions North America as a key growth engine for advanced Motorcycle Suspension Systems.

U.S. Motorcycle Suspension System Market Insight

The U.S. Motorcycle Suspension System market dominated North American share in 2024, driven by rising demand for cruisers and touring bikes featuring advanced suspension systems. Increasing adoption of aftermarket upgrades, along with innovations in active and semi-active technologies, is fueling growth. The U.S. market also benefits from a strong culture of customization and premium motorcycle ownership.

Canada Motorcycle Suspension System Market Insight

The Canada Motorcycle Suspension System market is expanding steadily, supported by the growing adoption of adventure and off-road motorcycles. Rising interest in outdoor recreational activities and cross-country touring is increasing demand for durable and performance-oriented suspension solutions, particularly in mono shocks and dual shocks segments.

Which are the Top Companies in Motorcycle Suspension System Market?

The motorcycle suspension system industry is primarily led by well-established companies, including:

- Bajaj Auto (India)

- Gabriel India Limited (India)

- Marzocchi Moto (Italy)

- FTR Suspension (U.S.)

- ZF Friedrichshafen AG (Germany)

- Endurance Technologies Limited (India)

- SHOWA CORPORATION (Japan)

- Continental (Germany)

- KYB Corporation (Japan)

- Duro Shox Pvt Ltd (India)

- Bayerische Motoren Werke AG (BMW) (Germany)

- Dah Ken Industrial Co. Ltd. (Taiwan)

- BMW Group (Germany)

- WP Suspension GmbH (Germany)

- Arnott LLC (U.S.)

- Nitron Racing Shocks (U.K.)

What are the Recent Developments in Global Motorcycle Suspension System Market?

- In February 2025, Endurance Technologies Limited secured significant new orders from major OEMs including TVS, Hero MotoCorp, and Suzuki. The company received INR 72 crore worth of orders from TVS for inverted front forks and rear mono shocks, and INR 175 crore from Hero MotoCorp for various suspension components. In addition, Suzuki placed orders for a new front fork scooter, with SOPs scheduled to begin in FY25, reinforcing Endurance’s strong position in the two-wheeler suspension market

- In February 2025, Gabriel India Limited entered into a Technical Assistance Agreement with Netherlands-based TracTive Suspension BV. This collaboration grants Gabriel exclusive rights to manufacture, sell, and distribute TracTive’s advanced suspension adjustment technologies in India. The partnership will enhance Gabriel’s capabilities in application engineering and local manufacturing while bringing electronically adjustable suspension systems to the Indian market, marking a strategic step towards premium product development

- In December 2023, KYB Corporation introduced an electronically controlled suspension system designed specifically for electric two-wheelers. This innovative technology provides real-time adjustments based on road conditions and rider preferences, significantly improving ride comfort and performance. Following its launch, KYB experienced a 20% increase in demand for these systems, highlighting the growing acceptance and need for advanced suspension solutions in the electric mobility segment

- In August 2023, WP Suspension GmbH unveiled its WP Xact Pro components for the 2023 KTM motocross lineup. Featuring Cone Valve Technology, the new suspension allows riders to make quick adjustments for varying track conditions, enhancing performance and adaptability. The launch resulted in a 25% surge in orders from professional racing teams and enthusiasts, emphasizing the importance of high-performance suspension systems in competitive motorsport environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Motorcycle Suspension System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Motorcycle Suspension System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Motorcycle Suspension System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.