Global Narcolepsy Treatment Market

Market Size in USD Billion

CAGR :

%

USD

3.48 Billion

USD

7.73 Billion

2024

2032

USD

3.48 Billion

USD

7.73 Billion

2024

2032

| 2025 –2032 | |

| USD 3.48 Billion | |

| USD 7.73 Billion | |

|

|

|

|

Narcolepsy Treatment Market Size

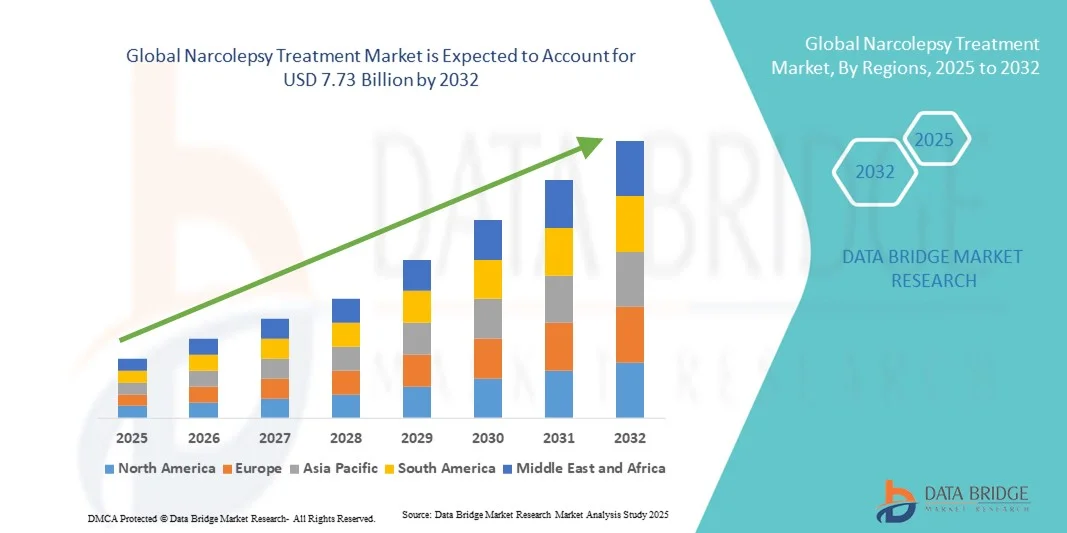

- The global narcolepsy treatment market size was valued at USD 3.48 billion in 2024 and is expected to reach USD 7.73 billion by 2032, at a CAGR of 10.50% during the forecast period

- The market growth is primarily driven by increasing awareness of sleep disorders, advancements in pharmacological therapies, and the rising prevalence of narcolepsy across both developed and emerging regions

- In addition, growing patient preference for effective, safe, and convenient treatment options, along with ongoing research and development in novel therapies, is establishing advanced medications and therapeutic solutions as the standard of care. These combined factors are accelerating the adoption of narcolepsy treatments, thereby significantly propelling the market’s growth

Narcolepsy Treatment Market Analysis

- Narcolepsy treatments, encompassing pharmacological therapies such as stimulants, wakefulness-promoting agents, and sodium oxybate, are increasingly critical for managing excessive daytime sleepiness and cataplexy, significantly improving patients’ quality of life and daily functioning

- The rising demand for narcolepsy treatments is primarily driven by growing awareness of sleep disorders, increased diagnosis rates, and a shift toward personalized and effective therapeutic regimens

- North America dominated the narcolepsy treatment market with the largest revenue share of 37.7% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, early adoption of novel therapies, and a strong pipeline of pharmaceutical innovations, particularly in the U.S., where major drug launches and clinical trials are enhancing treatment accessibility

- Asia-Pacific is expected to be the fastest growing region in the narcolepsy treatment market during the forecast period due to rising healthcare awareness, improving diagnostic capabilities, and expanding access to prescription medications

- Stimulants segment dominated the narcolepsy treatment market with a market share of 42.7% in 2024, driven by their effectiveness in managing excessive daytime sleepiness and wide physician preference as a first-line therapy

Report Scope and Narcolepsy Treatment Market Segmentation

|

Attributes |

Narcolepsy Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Narcolepsy Treatment Market Trends

Adoption of Digital Therapeutics and Remote Monitoring

- A notable and accelerating trend in the global narcolepsy treatment market is the integration of digital therapeutics and remote monitoring platforms, enhancing patient adherence and individualized treatment management

- For instance, the SomnoWake app allows patients to track sleep patterns, medication schedules, and daytime alertness, enabling clinicians to adjust treatment plans based on real-time data

- Digital tools enable predictive analytics for symptom management, sending alerts if patients show signs of excessive daytime sleepiness or irregular sleep cycles. Instance: some Orexin-based therapy trials use wearable devices to monitor sleep-wake patterns and optimize dosing schedules

- Integration with telemedicine platforms allows centralized management of therapy, letting patients and healthcare providers coordinate treatments, access health records, and track symptom improvement from a single interface

- This trend towards technology-enabled, data-driven care is reshaping expectations for narcolepsy management, leading pharmaceutical companies such as Jazz Pharmaceuticals to invest in companion digital platforms for therapies

- The demand for solutions that combine pharmacological treatment with digital monitoring is increasing across both hospitals and home-care settings, as patients and clinicians increasingly prioritize convenience and personalized care

Narcolepsy Treatment Market Dynamics

Driver

Rising Prevalence and Awareness of Sleep Disorders

- The increasing prevalence of narcolepsy and growing awareness about sleep disorders among patients and healthcare providers is a significant driver for higher treatment demand

- For instance, in March 2024, Axsome Therapeutics launched a public education initiative on narcolepsy awareness, highlighting the importance of timely diagnosis and adherence to therapy

- As patients become more aware of the debilitating effects of untreated narcolepsy, therapies offering effective symptom management, such as stimulants and sodium oxybate, are gaining traction

- Furthermore, early diagnosis through sleep clinics and expanded insurance coverage are increasing patient access to treatments, making pharmacological management more widespread

- The introduction of selective histamine H3-receptor antagonists and novel stimulant medications exemplifies this progress, offering improved symptom management for individuals affected by narcolepsy. These advancements provide more effective treatment options and cater to diverse patient needs, enabling tailored approaches to symptom control.

- The convenience of oral and once-nightly dosing, along with the availability of combination therapies and monitoring support, are key factors propelling narcolepsy treatment adoption in both urban and semi-urban healthcare settings

Restraint/Challenge

Side Effects and Regulatory Compliance Hurdles

- Concerns surrounding adverse effects of narcolepsy medications, including cardiovascular and gastrointestinal complications, pose a challenge to broader market adoption

- For instance, high-profile reports of side effects associated with stimulant therapy have made some patients hesitant to initiate or continue treatment

- Addressing these safety concerns through post-marketing surveillance, risk mitigation strategies, and physician education is crucial for building patient trust. Instance: Jazz Pharmaceuticals and Avadel Pharmaceuticals provide extensive patient counseling and safety monitoring programs to mitigate risks

- In addition, stringent regulatory requirements for new drug approvals, clinical trials, and labeling can delay product launches, impacting market entry timelines

- While newer therapies with improved safety profiles are emerging, concerns over side effects, coupled with regulatory complexities, can hinder adoption, especially in emerging markets where monitoring infrastructure is limited

- The high cost of many narcolepsy treatment medications presents a significant barrier to patient access and adherence to treatment regimens. For individuals without sufficient insurance coverage, the financial burden can be overwhelming, leading to delays in seeking necessary medical care

Narcolepsy Treatment Market Scope

The market is segmented on the basis of type, drugs, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the narcolepsy treatment market is segmented into Type 1 Narcolepsy and Type 2 Narcolepsy. The Type 1 Narcolepsy segment dominated the market with the largest revenue share in 2024, driven by the higher prevalence of narcolepsy with cataplexy globally. Patients with Type 1 often require more consistent and intensive treatment, including sodium oxybate or stimulants, which contributes to higher market revenue. Clinicians prioritize Type 1 treatment due to the severe daytime sleepiness and cataplexy symptoms that significantly impact quality of life. In addition, ongoing research and product launches are largely focused on therapies for Type 1, enhancing market dominance. The integration of digital monitoring and telemedicine for Type 1 patients further supports consistent medication adherence. The availability of combination therapies and personalized treatment plans also bolsters the segment’s market position.

The Type 2 Narcolepsy segment is expected to witness the fastest growth from 2025 to 2032, owing to increasing awareness, improved diagnostic capabilities, and rising recognition of narcolepsy without cataplexy. As sleep disorder diagnosis becomes more widespread, patients previously undiagnosed are now accessing treatment. Advancements in pharmacological options and non-stimulant therapies tailored for Type 2 patients are expanding adoption. The growing emphasis on early intervention and patient education is accelerating market growth. Telehealth platforms targeting Type 2 narcolepsy patients are further facilitating treatment uptake.

- By Drugs

On the basis of drugs, the narcolepsy treatment market is segmented into selective histamine H3-receptor antagonists, stimulants, serotonin reuptake inhibitors, tricyclic antidepressants, central nervous system depressants, and others. The Stimulants segment dominated the market in 2024 with a market share of 42.7% due to their widespread use as a first-line therapy for managing excessive daytime sleepiness. Stimulants are highly effective, well-established, and supported by extensive clinical data, making them a preferred choice for physicians. Patients experience rapid symptom relief, which encourages consistent usage. The broad availability of generic formulations contributes to accessibility and affordability. Stimulants are compatible with digital adherence tools, enhancing treatment compliance. Their established presence in hospitals and clinics further solidifies market dominance.

The Selective Histamine H3-Receptor Antagonist segment is expected to witness the fastest growth from 2025 to 2032, driven by the introduction of novel therapies targeting underlying narcolepsy pathophysiology. New drug launches focusing on wakefulness-promoting mechanisms are gaining physician acceptance. Clinical trials demonstrating efficacy with minimal side effects are attracting patient preference. Pharmaceutical companies are investing in marketing and awareness campaigns to expand adoption. The segment benefits from increasing research collaborations and regulatory approvals in major markets. Digital therapeutics integration further supports growth by monitoring patient response to these newer agents.

- By Route of Administration

On the basis of route of administration, the narcolepsy treatment market is segmented into oral and injectable therapies. The Oral segment dominated the market in 2024, attributed to patient preference for convenience, ease of self-administration, and non-invasive treatment. Oral medications allow flexible dosing schedules and are widely prescribed by clinicians, making them highly accessible. Patients with chronic narcolepsy prefer oral drugs for long-term management. The availability of generic oral formulations supports affordability and adoption. Integration with digital adherence apps enhances patient compliance. The segment also benefits from strong presence in both hospital and homecare settings.

The Injectable segment is expected to witness the fastest growth from 2025 to 2032 due to the increasing adoption of sodium oxybate for severe narcolepsy with cataplexy. Injectable therapies offer precise dosing and rapid therapeutic effects. Growth is fueled by improved formulations that enhance patient convenience and reduce side effects. Awareness campaigns by manufacturers educate patients and physicians about efficacy. The segment also benefits from hospital-based treatment programs and specialized sleep clinics. Expansion of homecare infusion services is further boosting adoption.

- By End-Users

On the basis of end-users, the narcolepsy treatment market is segmented into hospitals, homecare, specialty clinics, and others. The Hospitals segment dominated in 2024 due to the availability of specialized sleep centers, infrastructure for drug administration, and access to trained healthcare professionals. Hospitals provide comprehensive diagnosis and treatment, including pharmacotherapy and patient monitoring, ensuring better clinical outcomes. High patient footfall and partnerships with pharmaceutical companies strengthen revenue contribution. Hospitals also serve as key hubs for clinical trials, supporting the launch of new therapies. Integration with hospital electronic health record (EHR) systems enhances treatment adherence. Hospitals’ centralized procurement ensures consistent availability of therapies.

The Homecare segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing patient preference for at-home management, telemedicine follow-ups, and convenient drug delivery. Homecare allows patients to adhere to therapy without frequent hospital visits. The growth of wearable and digital monitoring devices supports remote management. Rising awareness among caregivers enhances adoption in residential settings. Homecare services reduce treatment costs compared to hospital visits. Improved delivery logistics and pharmaceutical support programs are accelerating segment growth.

- By Distribution Channel

On the basis of distribution channel, the narcolepsy treatment market is segmented into hospital pharmacies, retail pharmacies, and others. The Hospital Pharmacies segment dominated the market in 2024, as hospitals are the primary point for dispensing specialized narcolepsy therapies requiring clinical oversight. Hospital pharmacies ensure accurate dosing, patient counseling, and availability of high-cost or controlled drugs. The integration with hospital treatment programs strengthens market presence. Collaboration with manufacturers for patient assistance programs supports adherence. Hospitals’ ability to provide comprehensive care, including monitoring and follow-up, enhances revenue. Exclusive partnerships with pharmaceutical companies further consolidate dominance.

The Retail Pharmacies segment is expected to witness the fastest growth from 2025 to 2032 due to increasing availability of oral narcolepsy medications and growing patient preference for convenient, local access. Retail pharmacies provide easy access, flexible operating hours, and home delivery options. Expansion of pharmacy chains in urban and semi-urban regions is boosting adoption. Awareness campaigns and over-the-counter support for ancillary medications support growth. Integration with e-pharmacy platforms further accelerates convenience and accessibility. Growing insurance coverage for retail pharmacy purchases is also driving uptake.

Narcolepsy Treatment Market Regional Analysis

- North America dominated the narcolepsy treatment market with the largest revenue share of 37.7% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, early adoption of novel therapies, and a strong pipeline of pharmaceutical innovations, particularly in the U.S., where major drug launches and clinical trials are enhancing treatment accessibility

- Patients and healthcare providers in the region highly value the availability of innovative therapies, established treatment protocols, and integration of digital monitoring tools that enhance adherence and clinical outcomes

- This widespread adoption is further supported by high healthcare expenditure, strong insurance coverage, and the presence of leading pharmaceutical companies conducting research and launching novel therapies, establishing North America as the largest market for narcolepsy treatments

U.S. Narcolepsy Treatment Market Insight

The U.S. narcolepsy treatment market captured the largest revenue share of 38% in 2024 within North America, fueled by the widespread availability of innovative therapies and advanced healthcare infrastructure. Patients are increasingly prioritizing effective symptom management through pharmacological treatments and digital adherence tools. The growing adoption of telemedicine, combined with strong insurance coverage and access to specialized sleep clinics, further propels the market. Moreover, the presence of leading pharmaceutical companies conducting clinical trials and launching novel therapies is significantly contributing to market expansion.

Europe Narcolepsy Treatment Market Insight

The Europe narcolepsy treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of sleep disorders and the rising need for effective management options. The expansion of sleep clinics, coupled with government initiatives promoting early diagnosis, is fostering market growth. European patients are also drawn to therapies that improve daytime functioning and quality of life. The region is witnessing growth across hospitals, specialty clinics, and homecare settings, with advanced pharmacological treatments being incorporated into both new and ongoing therapeutic protocols.

U.K. Narcolepsy Treatment Market Insight

The U.K. narcolepsy treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing diagnosis rates and a growing focus on patient-centered care. In addition, rising concerns about sleep quality and daytime functioning are encouraging patients and healthcare providers to adopt approved therapies. The U.K.’s strong healthcare infrastructure and robust pharmaceutical distribution network are expected to continue stimulating market growth.

Germany Narcolepsy Treatment Market Insight

The Germany narcolepsy treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of sleep disorders and the demand for advanced, clinically proven therapies. Germany’s emphasis on healthcare innovation and access to specialist sleep centers promotes treatment adoption, particularly in hospitals and specialty clinics. Integration with digital health solutions and monitoring tools is becoming increasingly prevalent, with a strong preference for safe, effective, and evidence-based treatments aligning with local healthcare standards.

Asia-Pacific Narcolepsy Treatment Market Insight

The Asia-Pacific narcolepsy treatment market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising diagnosis rates, urbanization, and growing healthcare spending in countries such as China, Japan, and India. The region’s expanding awareness of sleep disorders, supported by government health initiatives and telemedicine adoption, is driving the uptake of narcolepsy therapies. Furthermore, increasing accessibility and affordability of approved treatments are expanding the patient base across hospitals, specialty clinics, and homecare settings.

Japan Narcolepsy Treatment Market Insight

The Japan narcolepsy treatment market is gaining momentum due to the country’s advanced healthcare infrastructure, high awareness of sleep disorders, and focus on patient convenience. The Japanese market places significant emphasis on improving quality of life for narcolepsy patients, with adoption driven by specialized sleep clinics and digital adherence platforms. Integration with telemedicine and remote monitoring solutions is fueling growth, particularly among aging populations who require ongoing therapy management.

India Narcolepsy Treatment Market Insight

The India narcolepsy treatment market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s growing healthcare access, rising awareness of sleep disorders, and expanding middle class. India is witnessing increased adoption of narcolepsy treatments across hospitals, specialty clinics, and homecare settings. Government initiatives promoting sleep health, the availability of affordable pharmacological therapies, and growing telemedicine adoption are key factors propelling market growth in India.

Narcolepsy Treatment Market Share

The Narcolepsy Treatment industry is primarily led by well-established companies, including:

- Avadel (Ireland)

- Takeda Pharmaceutical Company Limited (Japan)

- Amneal Pharmaceuticals LLC (U.S.)

- Harmony Biosciences Holdings, Inc. (U.S.)

- Jazz Pharmaceuticals, Inc. (Ireland)

- Eisai Co., Ltd. (Japan)

- UCB S.A. (Belgium)

- Bioprojet (France)

- Neurocrine Biosciences, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Biogen Inc. (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- AstraZeneca (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Lilly USA, LLC (U.S.)

- AbbVie Inc. (U.S.)

What are the Recent Developments in Global Narcolepsy Treatment Market?

- In September 2025, Takeda presented data from two global Phase 3 double-blind, placebo-controlled studies of oveporexton (TAK-861), a potential first-in-class investigational oral orexin receptor 2 (OX2R)-selective agonist in narcolepsy type 1. The studies highlighted statistically significant and clinically meaningful improvement in narcolepsy type 1 symptoms, demonstrating the potential for a new era of care

- In September 2025, Amneal Pharmaceuticals received U.S. FDA approval for its sodium oxybate oral solution, expanding its affordable medicines portfolio and broadening patient access. This approval provides an additional treatment option for patients with narcolepsy, enhancing accessibility to essential therapies

- In October 2024, the U.S. FDA approved Avadel Pharmaceuticals' LUMRYZ (sodium oxybate) for the treatment of cataplexy or excessive daytime sleepiness in pediatric patients aged 7 years and older with narcolepsy. This approval provides a once-at-bedtime treatment option, reducing the burden on families and caregivers of pediatric patients with narcolepsy who must wake up at night to administer a second dose

- In October 2024, Centessa Pharmaceuticals announced promising results for its narcolepsy treatment, ORX750, which showed effectiveness in restoring normal wakefulness in a study involving sleep-deprived healthy volunteers. Testing two doses, the higher 2.5-milligram dose reduced the time it took recipients to fall asleep significantly compared to placebo

- In June 2024, the U.S. FDA approved Wakix (pitolisant) for the treatment of excessive daytime sleepiness in pediatric patients aged ≥6 years with narcolepsy. This approval marks a significant development for children suffering from narcolepsy, providing a new therapeutic option for managing this chronic sleep disorder

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.