Global Non Peptide Drugs Of Angiotensin Ii Receptor Antagonist Market

Market Size in USD Billion

CAGR :

%

USD

211.19 Billion

USD

423.91 Billion

2024

2032

USD

211.19 Billion

USD

423.91 Billion

2024

2032

| 2025 –2032 | |

| USD 211.19 Billion | |

| USD 423.91 Billion | |

|

|

|

|

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Size

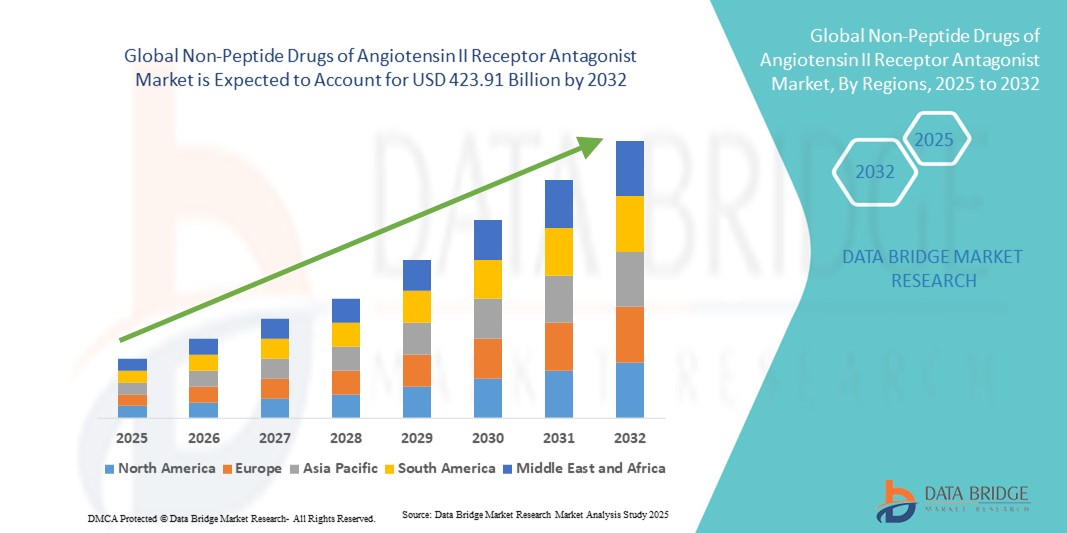

- The global non-peptide drugs of angiotensin II receptor antagonist market size was valued at USD 211.19 billion in 2024 and is expected to reach USD 423.91 billion by 2032, at a CAGR of 9.10% during the forecast period

- The market growth is largely fueled by the rising burden of hypertension, heart failure, and chronic kidney disease, coupled with increasing physician preference for angiotensin receptor blockers (ARBs) due to their efficacy, favorable safety profile, and lower incidence of side effects compared to other antihypertensive classes

- Furthermore, expanding availability of generics, growing patient demand for cost-effective and convenient long-term oral therapies, and supportive government initiatives for cardiovascular disease management are positioning non-peptide ARBs as a critical therapy option worldwide. These converging factors are accelerating the adoption of these drugs, thereby significantly boosting the industry’s growth

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Analysis

- Non-peptide drugs of angiotensin II receptor antagonists (ARBs), widely prescribed for the management of hypertension, heart failure, and chronic kidney disease, are increasingly vital components of cardiovascular care due to their proven efficacy, tolerability, and ability to reduce the risk of stroke and other cardiovascular events

- The escalating demand for ARBs is primarily fueled by the growing global prevalence of hypertension, the rising geriatric population, and physician preference for therapies with favorable side-effect profiles compared to ACE inhibitors, driving steady adoption across both developed and emerging healthcare markets

- North America dominated the non-peptide drugs of angiotensin II receptor antagonist market with the largest revenue share of 38.5% in 2024, characterized by high disease prevalence, advanced healthcare infrastructure, and the strong presence of leading pharmaceutical manufacturers, with the U.S. experiencing robust uptake driven by widespread generic availability and guideline-directed usage

- Asia-Pacific is expected to be the fastest growing region in the non-peptide drugs of angiotensin II receptor antagonist market during the forecast period due to increasing urbanization, lifestyle changes, rising disposable incomes, and expanding access to cardiovascular treatment in countries such as China and India

- The losartan segment dominated the non-peptide drugs of angiotensin II receptor antagonist market with a share of 37% in 2024, supported by its early introduction, widespread generic penetration, and broad clinical acceptance as a first-line therapy for hypertension management

Report Scope and Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Segmentation

|

Attributes |

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Trends

Rising Shift Toward Combination Therapies and Generics

- A significant and accelerating trend in the global non-peptide ARB market is the increasing adoption of fixed-dose combination (FDC) therapies that pair ARBs with other antihypertensives such as diuretics or calcium channel blockers. This approach is enhancing treatment efficacy and improving patient compliance, particularly among populations with resistant or multi-factorial hypertension

- For instance, telmisartan-based FDCs are being widely used in Europe and Asia, offering improved blood pressure control compared to monotherapy. Similarly, valsartan and amlodipine combinations have become standard in several treatment guidelines, underscoring the growing shift towards dual and triple therapy options

- The generic wave is another key trend reshaping the market, with widespread availability of cost-effective ARBs such as losartan, valsartan, and candesartan enabling broader patient access in both developed and developing markets. Companies are increasingly focusing on lifecycle management strategies, including extended-release formulations and branded generics, to maintain competitive positioning

- This trend toward combination therapies and cost-effective generics is transforming treatment strategies for cardiovascular disease, expanding accessibility while maintaining efficacy. Consequently, manufacturers such as Novartis and Teva are actively investing in next-generation ARB formulations and affordable generic lines to meet evolving healthcare demands

- The demand for affordable, patient-friendly, and highly effective ARB-based therapies is rapidly growing worldwide, as healthcare systems seek to reduce the burden of hypertension and cardiovascular disease through both innovation and cost containment

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Dynamics

Driver

Growing Burden of Hypertension and Cardiovascular Diseases

- The rising prevalence of hypertension, heart failure, and chronic kidney disease globally is a significant driver of demand for ARBs, as these conditions remain among the leading causes of morbidity and mortality worldwide

- For instance, in March 2024, the World Health Organization highlighted that over 1.2 billion adults globally are affected by hypertension, with only about one in five having it under control underscoring the urgent need for effective, well-tolerated therapies such as ARBs

- ARBs are increasingly preferred by physicians for their strong efficacy, lower incidence of cough and angioedema compared to ACE inhibitors, and proven role in reducing cardiovascular events, driving consistent prescribing patterns

- Furthermore, the availability of affordable generics and supportive government initiatives aimed at reducing cardiovascular disease burden are accelerating ARB adoption in both developed and emerging markets. The growing shift towards evidence-based guidelines recommending ARBs as first-line therapy in certain patient groups is reinforcing their clinical importance

- The convenience of once-daily oral dosing and strong patient adherence levels further strengthen ARBs’ role in long-term hypertension and cardiovascular management, making them a cornerstone therapy in global cardiovascular care

Restraint/Challenge

Patent Expiry, Generic Competition, and Regulatory Pressures

- The widespread availability of generic ARBs following patent expirations has significantly reduced profit margins for branded products, posing a major challenge for multinational pharmaceutical companies. This has intensified price competition, particularly in markets with strict cost-containment policies

- For instance, the loss of market exclusivity for valsartan and losartan led to a surge in generic competition, reducing the revenue streams of originator companies such as Novartis and Merck. In addition, safety recalls related to impurities (e.g., nitrosamine contamination in some valsartan generics in recent years) have raised regulatory scrutiny, creating further challenges for manufacturers

- Addressing these concerns requires stringent quality control, continuous monitoring of supply chains, and compliance with evolving global regulatory standards to maintain consumer and physician trust

- Another restraint is the relatively high saturation of the ARB class in comparison to newer antihypertensive agents and biologics, which may limit innovation-driven differentiation in the market

- Overcoming these challenges through investment in fixed-dose combinations, next-generation formulations, and strategic pricing models will be critical for sustained growth in the global ARB market

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Scope

The market is segmented on the basis of type, application, dosage, route of administration, and distribution channel,

- By Type

On the basis of type, the non-peptide drugs of angiotensin II receptor antagonist market is segmented into afatinib, trastuzumab, olmesartan medoxomil, valsartan, irbesartan, telmisartan, losartan, eprosartan, candesartan cilexetil, and allisartan isoproxil. Losartan dominated the market in 2024 with the largest revenue share of 37%, owing to its position as the first ARB introduced and its widespread acceptance as a standard therapy for hypertension. Its extensive clinical evidence, proven safety profile, and generic availability across multiple geographies have cemented its leadership in this market. Affordability and broad inclusion in hypertension treatment guidelines ensure that Losartan remains the preferred ARB in both primary care and hospital settings. Physicians also rely on its versatility, as it is used not only in hypertension but also in heart failure and diabetic nephropathy. The strong market penetration of generic Losartan continues to drive consistent patient access, making it the cornerstone of this therapeutic class.

Olmesartan is expected to record the fastest CAGR during the forecast period due to its potent antihypertensive action and long-lasting blood pressure control. The drug is increasingly favored in patients with moderate-to-severe hypertension, offering superior efficacy compared to some other ARBs. Its growing adoption in Asia-Pacific and European markets is being driven by clinical evidence of improved cardiovascular protection. In addition, the rising use of fixed-dose combinations with diuretics and calcium channel blockers is enhancing Olmesartan’s commercial growth. With healthcare systems emphasizing effective control of resistant hypertension, Olmesartan’s strong clinical positioning is expected to accelerate its uptake further.

- By Application

On the basis of application, the non-peptide drugs of angiotensin II receptor antagonist market is segmented into squamous cell carcinoma of nsclc, adenocarcinoma of nsclc, large cell carcinoma of nsclc, left ventricular hypertrophy, congestive heart failure, atherosclerosis, high blood pressure, and others. High blood pressure accounted for the largest market share in 2024, reflecting the massive global prevalence of hypertension affecting over one billion individuals. ARBs such as Losartan, Valsartan, and Telmisartan are widely recommended by treatment guidelines due to their efficacy and tolerability compared to ACE inhibitors. The chronic nature of hypertension ensures that patients require long-term therapy, leading to steady prescription demand. Governments and health organizations are also increasing awareness campaigns to improve hypertension diagnosis and treatment, further boosting ARB use. With aging populations and lifestyle risk factors on the rise, this segment is expected to maintain its dominance throughout the forecast period.

The CHF segment is projected to grow at the fastest rate during forecast period, fueled by ARBs’ proven role in improving survival outcomes and reducing hospital readmissions. Drugs such as Valsartan, used in combination with sacubitril (ARNI therapy), have shown remarkable results in managing heart failure with reduced ejection fraction (HFrEF). The rising prevalence of heart failure among aging populations, particularly in North America, Europe, and Asia, is driving demand for ARB-based therapies. Physicians are increasingly prescribing ARBs for patients intolerant to ACE inhibitors, giving ARBs a significant clinical advantage. Furthermore, ongoing research into ARBs’ benefits in heart failure management is expected to accelerate adoption in this high-growth segment.

- By Dosage

On the basis of dosage, the non-peptide drugs of angiotensin II receptor antagonist market is segmented into tablet and others. Tablets represented the largest revenue share in 2024, as oral solid dosage forms are the standard for ARBs globally. Their convenience, affordability, and ability to deliver consistent dosing make tablets the most widely prescribed format for hypertension management. The availability of high-volume generics in tablet form ensures affordability across both developed and developing countries. Tablets also offer flexibility in dosing and are easily combined into fixed-dose formulations, which further enhances patient adherence. Given the chronic nature of hypertension and cardiovascular diseases, tablets remain the most practical and accessible dosage form for patients and healthcare providers asuch as.

The “Others” category, which includes extended-release and orally disintegrating tablets, is expected to grow at the fastest pace during the forecast period. These novel formulations are being developed to improve compliance, particularly among elderly patients and those with swallowing difficulties. Extended-release versions provide longer-lasting effects, reducing pill burden and improving treatment adherence. Pharmaceutical companies are investing in such innovations to differentiate products in a crowded generic-driven market. As treatment personalization becomes a focus, these novel formulations are expected to gain traction, especially in markets prioritizing patient-centric care.

- By Route of Administration

On the basis of route of administration, the non-peptide drugs of angiotensin II receptor antagonist market is segmented into oral and other. Oral administration held the majority share in 2024, as nearly all ARBs are formulated for once-daily oral dosing, making them convenient and cost-effective. This mode of delivery ensures strong patient compliance and is the standard practice across global treatment protocols. The widespread manufacturing of oral formulations supports a reliable supply chain and low production costs, reinforcing its dominance. Oral ARBs are particularly important for long-term therapy in chronic conditions such as hypertension and heart failure. The ease of integration into fixed-dose combinations further supports oral formulations’ central role in therapy. Given these factors, oral administration is expected to remain the leading segment throughout the forecast period.

Although small in share, the “Other” segment is anticipated to grow faster during forecast period, as novel delivery methods, such as parenteral and transdermal ARBs, are researched for specific use cases. Intravenous formulations, for example, may be useful in acute care or hospital settings for hypertensive emergencies. Transdermal approaches are being studied to enhance compliance in patients with pill fatigue or multiple comorbidities. While still in early development, such innovations could carve out niche applications and create incremental market opportunities. As R&D advances, this segment could see higher adoption in the long term.

- By Distribution Channel

On the basis of distribution channel, the non-peptide drugs of angiotensin II receptor antagonist market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Retail pharmacies held the largest revenue share in 2024, driven by the chronic nature of hypertension requiring continuous refills and patient interaction with local pharmacists. The wide accessibility of generics through retail outlets, coupled with pharmacist guidance, supports adherence and trust in ARB therapy. In developing regions, retail pharmacies remain the primary point of access for cardiovascular medicines. The convenience of in-person consultations and the ability to obtain multiple medications in one visit further reinforce retail dominance. With ARBs being prescribed across all age groups, retail distribution continues to play a critical role in ensuring widespread availability.

Online pharmacies are projected to grow at the fastest CAGR from 2025 to 2032, driven by the rising digitalization of healthcare and patient preference for doorstep delivery. Post-pandemic, consumers have increasingly shifted to e-pharmacies for convenience, affordability, and access to discounted generic ARBs. Regulatory recognition of online pharmacies in regions such as India, China, and parts of Europe is accelerating this trend. Younger and tech-savvy populations are particularly inclined toward digital health platforms, further boosting growth. As telemedicine expands, integration with online pharmacies will make this channel even more important for chronic disease management.

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Regional Analysis

- North America dominated the non-peptide drugs of angiotensin II receptor antagonist market with the largest revenue share of 38.5% in 2024, characterized by high disease prevalence, advanced healthcare infrastructure, and the strong presence of leading pharmaceutical manufacturers

- Physicians in the region frequently follow guideline-directed use of ARBs for hypertension, heart failure, and renal protection, while wide availability of generics and strong payer coverage improve affordability and longstanding patient adherence

- This dominance is further supported by active clinical research, a large base of diagnosed patients due to widespread screening, and the presence of major pharmaceutical manufacturers and robust distribution channels, making North America a leading revenue market for ARBs in both outpatient and inpatient settings

U.S. Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Insight

The U.S. non-peptide drugs of angiotensin II receptor antagonist market captured the largest revenue share of 82% in 2024 within North America, fueled by the high prevalence of hypertension and cardiovascular disease and the widespread use of guideline-directed medical therapy. Physicians frequently prescribe ARBs such as Losartan, Valsartan, and Irbesartan due to their proven safety and tolerability compared to ACE inhibitors. The availability of cost-effective generics, combined with strong insurance coverage and reimbursement policies, is further driving large-scale adoption. Moreover, robust clinical research and innovation in fixed-dose combinations continue to strengthen the U.S. market’s dominance in ARB therapy.

Europe Non-Peptide ARB Market Insight

The Europe non-peptide drugs of angiotensin II receptor antagonist market is projected to expand at a substantial CAGR throughout the forecast period, supported by a rising burden of hypertension and stringent cardiovascular treatment guidelines. Increasing patient preference for ARBs over ACE inhibitors, particularly due to fewer side effects, is boosting prescriptions. Urbanization, aging demographics, and rising healthcare expenditures are fostering greater reliance on chronic cardiovascular therapies. Furthermore, strong adoption of generic ARBs across European markets is expanding patient access, while research into combination therapies is expected to enhance treatment outcomes and market growth.

U.K. Non-Peptide ARB Market Insight

The U.K. non-peptide drugs of angiotensin II receptor antagonist market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing rates of hypertension and cardiovascular complications linked to aging and lifestyle changes. Physicians continue to favor ARBs as a cornerstone therapy due to their strong efficacy and better tolerance profiles compared to ACE inhibitors. National Health Service (NHS) initiatives focusing on hypertension management and cardiovascular risk reduction are further supporting widespread adoption. In addition, the U.K.’s well-developed retail and online pharmacy infrastructure makes ARBs easily accessible to patients, reinforcing market growth.

Germany Non-Peptide ARB Market Insight

The Germany non-peptide drugs of angiotensin II receptor antagonist market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s advanced healthcare system and emphasis on high-quality cardiovascular care. German clinicians place significant importance on effective, evidence-based hypertension therapies, which has strengthened ARB adoption. The market also benefits from strong generic penetration and well-structured reimbursement frameworks that ensure affordability. Increasing research collaborations in cardiovascular therapeutics, alongside rising demand for sustainable and patient-friendly drug delivery solutions, are further propelling the ARB market in Germany.

Asia-Pacific Non-Peptide ARB Market Insight

The Asia-Pacific non-peptide drugs of angiotensin II receptor antagonist market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising urbanization, aging populations, and an increasing burden of hypertension across China, India, and Japan. Government-led initiatives to improve cardiovascular disease screening and treatment are expanding patient access to ARBs. The region’s growing pharmaceutical manufacturing base is also reducing costs and improving availability of generics, supporting broader adoption. With greater emphasis on preventive healthcare and chronic disease management, ARBs are gaining traction as a frontline therapeutic option across APAC.

Japan Non-Peptide ARB Market Insight

The Japan non-peptide drugs of angiotensin II receptor antagonist market is gaining momentum due to the country’s advanced medical infrastructure, high disease awareness, and strong preference for innovative cardiovascular solutions. Japanese physicians frequently prescribe ARBs owing to their proven efficacy and tolerability, especially among elderly patients. The integration of ARBs into combination therapies with calcium channel blockers is particularly common, offering enhanced treatment compliance. Furthermore, Japan’s rapidly aging population is fueling rising demand for long-term cardiovascular therapies, positioning ARBs as a critical component of national healthcare strategies.

India Non-Peptide ARB Market Insight

The India non-peptide drugs of angiotensin II receptor antagonist market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by the country’s rising hypertension prevalence, rapid urbanization, and growing middle-class population. Increasing availability of affordable generics is making ARBs more accessible, particularly through widespread retail and online pharmacy channels. Government programs promoting awareness and screening for cardiovascular diseases are expanding the patient pool requiring long-term therapy. Domestic pharmaceutical manufacturers are also actively producing ARB generics, strengthening India’s position as a key market and export hub for cost-effective cardiovascular drugs.

Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market Share

The Non-Peptide Drugs of Angiotensin II Receptor Antagonist industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- AstraZeneca (U.K.)

- Sanofi (France)

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (U.S.)

- Sandoz Group AG (Switzerland)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Limited (India)

- Dr. Reddy's Laboratories Ltd. (India)

- Lupin Limited (India)

- Zydus Lifesciences Limited (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Torrent Pharmaceuticals Ltd. (India)

- Daiichi Sankyo Company, Limited (Japan)

What are the Recent Developments in Global Non-Peptide Drugs of Angiotensin II Receptor Antagonist Market?

- In April 2025, CSL Vifor and Travere Therapeutics announced the conversion of sparsentan’s conditional approval into standard marketing authorization in the EU for treating IgAN, based on Phase III PROTECT study data marking a significant regulatory milestone and enabling full commercialization across EU member states plus Iceland, Liechtenstein, and Norway

- In March 2025, SCIENTURE secured U.S. FDA approval for Arbli (losartan potassium oral suspension, SCN-102) the first ready-to-use, liquid formulation of losartan, indicated for hypertension, stroke risk reduction (with LVH), and diabetic nephropathy targeting a commercial launch in Q3 2025

- In September 2024, Travere Therapeutics (via partner Ligand Pharmaceuticals) received full U.S. FDA approval for FILSPARI (sparsentan) to slow kidney function decline in adults with primary IgA nephropathy (IgAN), marking its transition from accelerated to traditional approval

- In January 2024, Travere Therapeutics partnered with Renalys Pharma through an exclusive licensing agreement to develop and commercialize sparsentan (a dual endothelin and angiotensin II receptor antagonist) in Japan, South Korea, Taiwan, and several Southeast Asian countries. Renalys is expected to initiate registrational clinical studies in Q2 2024 to support potential regulatory approval of sparsentan in Japan

- In February 2023, the U.S. FDA granted accelerated approval to FILSPARI (sparsentan), a dual endothelin and angiotensin II receptor antagonist, for reducing proteinuria in adults with primary IgA nephropathy (IgAN). This marked a significant therapeutic advancement extending beyond conventional ARBs into renal disease modulation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.