Global Nootropics Market

Market Size in USD Billion

CAGR :

%

USD

16.07 Billion

USD

45.37 Billion

2024

2032

USD

16.07 Billion

USD

45.37 Billion

2024

2032

| 2025 –2032 | |

| USD 16.07 Billion | |

| USD 45.37 Billion | |

|

|

|

|

What is the Global Nootropics Market Size and Growth Rate?

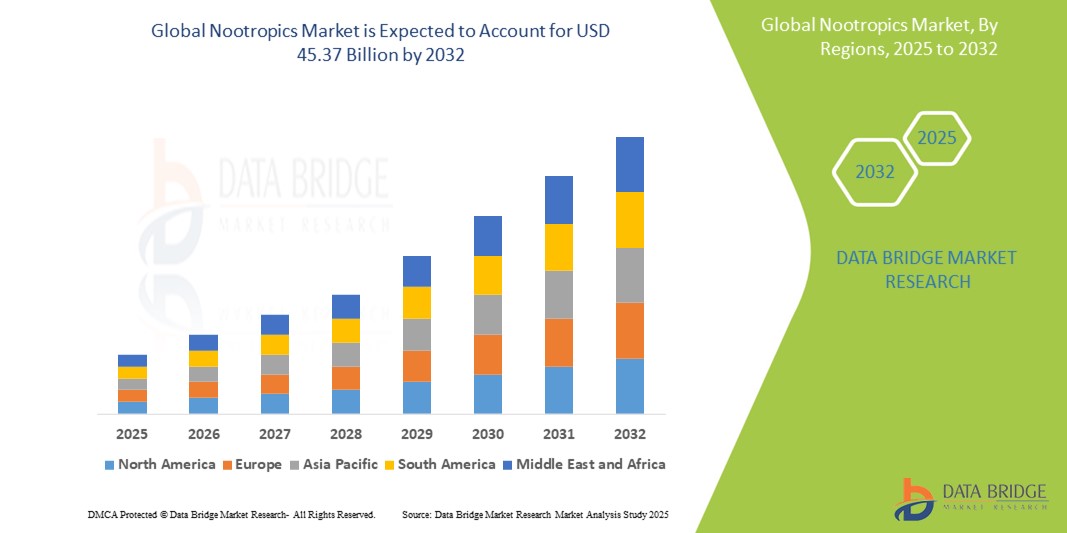

- The global nootropics market size was valued at USD 16.07 billion in 2024 and is expected to reach USD 45.37 billion by 2032, at a CAGR of 13.85% during the forecast period

- The nootropics market has experienced significant growth, driven by the increasing awareness of cognitive enhancement and mental wellness among consumers. Recent developments in this sector include the introduction of innovative formulations that combine traditional nootropic ingredients such as caffeine and L-theanine with newer compounds such as adaptogens and herbal extracts

- For instance, the emergence of products that feature ingredients such as rhodiola rosea and ashwagandha reflects a growing trend towards natural and plant-based nootropics, appealing to health-conscious consumers seeking holistic approaches to cognitive enhancement

What are the Major Takeaways of Nootropics Market?

- Advancements in research have led to a better understanding of how specific compounds can influence brain function, paving the way for more targeted and effective products. The rise of remote work and online learning has further fueled demand for nootropic supplements, as individuals seek to improve focus, memory, and overall cognitive performance in competitive environments

- Moreover, strategic collaborations, such as the recent partnership between Jones Soda and Wesana Health to launch a nootropic supplement, highlight the market's potential and the growing interest from diverse industries

- North America dominated the nootropics market with the largest revenue share of 42.01% in 2024, driven by increasing consumer awareness around cognitive health, lifestyle enhancement, and mental performance optimization

- Asia-Pacific nootropics market is poised to grow at the fastest CAGR of 16.35% from 2025 to 2032, driven by increasing urbanization, rising health consciousness, and expanding middle-class populations across countries such as China, India, and Japan

- The Over-the-counter (OTC) segment dominated the nootropics market with the largest revenue share of 41.6% in 2024, driven by the growing consumer preference for self-medication, easy accessibility, and the wide variety of OTC cognitive enhancers available online and in retail pharmacies

Report Scope and Nootropics Market Segmentation

|

Attributes |

Nootropics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nootropics Market?

“Personalized Cognitive Enhancement through AI and Adaptive Formulations”

- A prominent and accelerating trend in the global nootropics market is the integration of artificial intelligence (AI) with customized supplement regimens. AI-enabled platforms are analyzing user health data, lifestyle patterns, and cognitive goals to formulate tailored nootropic stacks for enhanced focus, memory, and mental clarity

- For instance, Neurohacker Collective uses AI-driven algorithms to personalize its Qualia Mind formulation recommendations based on user inputs such as sleep, mood, and productivity goals. Similarly, Feed Smart Drinks incorporates machine learning to suggest personalized nootropic beverages for students and professionals

- These innovations are reshaping consumer expectations, shifting demand from generic cognitive enhancers to intelligent, bio-individualized solutions. Nootropic brands are developing systems that dynamically adjust ingredients based on user feedback and performance metrics

- This AI-powered personalization is increasingly paired with wearables and mobile apps, which help track cognitive states and optimize dosage timing. Companies such as Nootrobox (now HVMN) offer guided programs that use biometric feedback to refine intake schedules for maximum mental performance

- As consumers prioritize efficacy, safety, and real-time adaptation, personalized and tech-integrated nootropic systems are setting new standards for cognitive enhancement. The convergence of data science and neuroscience is expected to drive the next wave of innovation in this space

What are the Key Drivers of Nootropics Market?

- Rising mental health awareness, increased work-related cognitive stress, and growing consumer interest in brain-boosting supplements are major growth drivers for the nootropics market. Professionals, students, and aging populations asuch as are turning to these products to improve productivity, focus, and memory

- For instance, in March 2024, Mind Lab Pro announced a global campaign highlighting the science-backed cognitive benefits of its all-in-one nootropic formula, aimed at young professionals and older adults seeking sustained mental energy

- Furthermore, the growing biohacking movement and interest in natural nootropics such as L-theanine, Bacopa Monnieri, and Rhodiola Rosea are expanding the market beyond synthetic compounds. Consumers are seeking clean-label, plant-based formulations backed by clinical research

- The increasing availability of nootropics through e-commerce, subscription models, and wellness retailers is also making these products more accessible. Platforms such as Amazon, Thorne, and GNC are experiencing rising demand for daily cognitive enhancers

- As personalization and functional wellness gain traction, nootropics are becoming essential components of holistic health routines, further fueling their adoption across diverse demographics and regions

Which Factor is challenging the Growth of the Nootropics Market?

- A major challenge hindering the growth of the nootropics market is regulatory ambiguity and safety concerns. Due to varying international regulations and a lack of standardization, consumers may question the efficacy, legitimacy, or potential side effects of certain nootropic products

- For instance, regulatory bodies such as the FDA in the U.S. and EFSA in Europe often classify nootropics as dietary supplements, limiting their oversight and raising issues about unverified claims or undeclared ingredients. In 2023, several online nootropic brands received warnings for mislabeling ingredients and making unsupported cognitive benefit claims

- In addition, the lack of long-term clinical studies for newer synthetic nootropics raises questions around potential health risks, especially with prolonged or unsupervised use. Consumers are increasingly demanding transparency regarding sourcing, formulation processes, and third-party testing

- Another barrier is price sensitivity, as premium nootropic stacks or personalized regimens can be costly. This is especially significant in emerging markets where health supplement adoption is still nascent. Products such as Qualia Mind or Alpha Brain come with price tags that may deter budget-conscious consumers

- Addressing these challenges through clear regulatory frameworks, scientific validation, consumer education, and affordable pricing strategies will be key to building credibility and expanding the nootropics market sustainably

How is the Nootropics Market Segmented?

The market is segmented on the basis of type, indication, dosage form, route of administration, end user, and distribution channel.

• By Type

On the basis of type, the nootropics market is segmented into Over-the-counter (OTC), Prescription, Natural, Homemade, and Others. The Over-the-counter (OTC) segment dominated the Nootropics market with the largest revenue share of 41.6% in 2024, driven by the growing consumer preference for self-medication, easy accessibility, and the wide variety of OTC cognitive enhancers available online and in retail pharmacies. Consumers often opt for OTC nootropics due to their perceived safety, lack of prescription requirements, and the growing popularity of wellness-focused daily supplements.

The Natural segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by increasing awareness about plant-based health solutions, rising demand for clean-label products, and consumer skepticism toward synthetic ingredients. Natural nootropics such as Bacopa Monnieri, Rhodiola Rosea, and Ginkgo Biloba are gaining traction among health-conscious users seeking sustainable cognitive support.

• By Indication

On the basis of indication, the market is segmented into Productivity and Study, Socializing, Exercise and Health, Wellbeing, and Others. The Productivity and Study segment accounted for the largest market revenue share of 36.9% in 2024, primarily driven by the demand from students, professionals, and entrepreneurs seeking enhanced concentration, memory, and mental clarity. This segment is supported by strong demand in urban regions and tech-driven communities.

The Wellbeing segment is expected to witness the fastest CAGR from 2025 to 2032, as consumers shift focus toward holistic cognitive wellness, mental balance, and stress management. This growth is driven by lifestyle changes, rising stress levels, and the trend toward preventive health practices.

• By Dosage Form

On the basis of dosage form, the market is segmented into Tablets, Capsules, Injections, and Others. The Capsules segment held the largest market revenue share of 38.2% in 2024, due to high user preference for ease of swallowing, precise dosing, and longer shelf life. Capsules are widely used by manufacturers to deliver herbal and synthetic nootropics in a convenient, consumer-friendly format.

The Injections segment is anticipated to witness the fastest CAGR from 2025 to 2032, mainly in clinical and specialized use cases, especially for immediate cognitive enhancement or neuroprotective applications under medical supervision.

• By Route of Administration

On the basis of route of administration, the nootropics market is segmented into Oral, Parenteral, and Others. The Oral segment dominated the market with the largest share of 76.5% in 2024, driven by convenience, better patient compliance, and the vast range of oral nootropics in the form of pills, capsules, and powders. Oral administration remains the most popular method due to minimal invasiveness and accessibility.

The Parenteral segment is expected to grow at the fastest rate, primarily used in hospital or clinical settings where rapid action is needed, especially in cases of neurodegeneration or acute cognitive disorders.

• By End-Users

On the basis of end-users, the market is segmented into Hospitals, Specialty Clinics, Homecare, and Others. The Homecare segment held the largest market revenue share of 44.8% in 2024, as a result of the increasing preference for self-use cognitive enhancers at home. The rise of online consultations and direct-to-consumer product models support this trend.

The Specialty Clinics segment is projected to register the fastest CAGR from 2025 to 2032, especially with the rising number of neurotherapy centers and personalized cognitive health clinics offering tailored nootropic interventions.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others. The Online Pharmacy segment dominated the market with the highest revenue share of 39.1% in 2024, fueled by increasing e-commerce adoption, digital health trends, and convenience of doorstep delivery. Online channels also offer access to a wider range of international and niche nootropic brands.

The Retail Pharmacy segment is expected to witness the fastest CAGR during the forecast period, supported by the growing availability of cognitive enhancers in physical stores and the trust consumers place in pharmacist recommendations.

Which Region Holds the Largest Share of the Nootropics Market?

- North America dominated the nootropics market with the largest revenue share of 42.01% in 2024, driven by increasing consumer awareness around cognitive health, lifestyle enhancement, and mental performance optimization

- Consumers in this region actively seek over-the-counter and natural cognitive enhancers to boost productivity, manage stress, and support brain health. This strong demand is further supported by high disposable incomes, a wellness-driven population, and growing penetration of e-commerce and digital health platforms that offer easy access to Nootropic products

- The increasing prevalence of mental fatigue and focus-related concerns, especially among students and professionals, is positioning Nootropics as a mainstream lifestyle supplement across the U.S. and Canada

U.S. Nootropics Market Insight

The U.S. nootropics market captured the largest revenue share within North America in 2024, fueled by the country’s high consumption of dietary supplements and increasing adoption of brain health-focused regimens. The rising popularity of biohacking communities, college students, and tech professionals seeking productivity enhancements is a key growth factor. U.S. consumers are particularly inclined toward natural and OTC Nootropics, supported by strong online sales channels, wellness influencers, and proactive mental wellness initiatives. Furthermore, major players and startups are launching innovative, clinically tested products tailored for memory, focus, and mood enhancement, further solidifying the U.S. market's leading position.

Europe Nootropics Market Insight

The Europe nootropics market is projected to grow at a robust CAGR over the forecast period, supported by increasing awareness of mental wellness and preventive health measures. European consumers are embracing Nootropics for their perceived ability to combat burnout, mental fatigue, and age-related cognitive decline. The market is witnessing growing demand across working professionals, students, and the elderly population. Regulatory support for nutraceuticals, coupled with the region’s preference for natural, plant-based supplements, is further aiding adoption. Expanding distribution through pharmacies and health stores, along with strong penetration of online health platforms, supports sustained market growth.

U.K. Nootropics Market Insight

The U.K. nootropics market is anticipated to register significant CAGR during the forecast period, driven by increasing stress levels, productivity pressures, and rising demand for mental clarity among students and office workers. Consumers are gravitating toward clean-label and vegan Nootropics, while subscription-based and personalized supplement offerings are gaining popularity. The U.K.’s strong online retail infrastructure, coupled with proactive interest in health and wellness trends, is expected to support long-term market expansion.

Germany Nootropics Market Insight

The Germany nootropics market is expected to witness steady CAGR during the forecast period, backed by strong consumer trust in scientifically formulated supplements and a high preference for natural ingredients. German consumers are highly conscious of product quality and transparency, driving demand for clinically backed Nootropics with traceable ingredients. The country’s well-established healthcare system, emphasis on preventive health, and innovation-driven supplement brands are playing a key role in fostering Nootropics adoption across age groups.

Which Region is the Fastest Growing Region in the Nootropics Market?

Asia-Pacific nootropics market is poised to grow at the fastest CAGR of 16.35% from 2025 to 2032, driven by increasing urbanization, rising health consciousness, and expanding middle-class populations across countries such as China, India, and Japan. The region’s rapid adoption of cognitive supplements is fueled by the academic and professional performance culture, growing internet penetration, and social media influence on wellness trends. Government support for nutraceuticals and rising demand for affordable, locally produced Nootropics are further expanding the market’s reach across diverse income segments.

Japan Nootropics Market Insight

The Japan nootropics market is gaining momentum due to its tech-savvy population and strong emphasis on cognitive health, particularly among the elderly. With a growing aging demographic, there is increasing demand for memory-enhancing and neuroprotective supplements that support daily functioning. Consumers prefer scientifically validated, high-quality products, and local manufacturers are actively innovating with herbal-based and amino acid formulations tailored to Japanese preferences.

China Nootropics Market Insight

The China nootropics market accounted for the largest revenue share within Asia-Pacific in 2024, supported by a booming wellness industry and rapid expansion of smart healthcare solutions. China’s rising middle class is driving demand for focus-enhancing and mood-boosting supplements, particularly among students and young professionals. Strong domestic production capabilities, a growing e-commerce landscape, and the government's push toward healthy lifestyles contribute to the widespread adoption of both traditional and modern Nootropic formulations.

Which are the Top Companies in Nootropics Market?

The nootropics industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Reckitt Benckiser Group PLC (UK)

- Onnit Labs, Inc. (U.S.)

- Mental Mojo, LLC (U.S.)

- NooCube (U.K.)

- Vitablend (Netherlands)

- TruBrain (U.S.)

- Zhou Nutrition (U.S.)

What are the Recent Developments in Global Nootropics Market?

- In May 2023, Nature's Way introduced its newest nootropic gummy, created to support brain health and tap into the rapidly growing market for cognitive products. This offering is intended to help adults improve their short-term memory, focus, and concentration. It is currently available at retailers such as Kroger, Meijer, Giant Company, and various natural food stores

- In September 2022, Neuriva, a cognitive health supplement brand owned by Reckitt, teamed up with chef and food enthusiast Alton Brown to advocate for a holistic approach to brain health. This collaboration aimed to encourage consumers to recognize the importance of brain health as an essential part of their overall wellness. The partnership highlighted Neuriva’s product range, which includes Neuriva Plus as well as newly launched items such as Neuriva Sleep and Neuriva Brain + Energy

- In August 2022, Nu, a provider of nootropic products based in the UK, unveiled a new line of nootropic snack bars. These bars are made from Norwegian black oats and are enriched with vital brain nutrients, including choline, phosphatidylserine, and omega-3 fatty acids. They are available in an assortment of flavors, such as maple and pecan, salted caramel, raisin and almond, and apple and cinnamon

- In 2022, Jones Soda introduced a groundbreaking nootropic supplement developed in partnership with Mike Tyson and Wesana Health. This innovative product aims to enhance cognitive function and mental clarity, setting itself apart as a unique offering in the supplement market. By combining Tyson's star power with Wesana Health's expertise in mental wellness, Jones Soda is tapping into the growing demand for brain-boosting supplements

- In October 2021, the Australian start-up Savvy Beverage announced the release of an instant coffee and soda beverage infused with nootropic ingredients aimed at enhancing cognitive function. This product line extends their existing range of functional coffee pods, which are compatible with Nespresso machines, offering consumers convenient options for boosting mental performance while on the move

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

introduction

OBJECTIVES OF THE STUDY

MARKET DEFINITION

OVERVIEW of Global Nootropics Market

currency and pricing

LIMITATION

MARKETS COVERED

MARKET SEGMENTATION

KEY TAKEAWAYS

ARRIVING AT THE Global Nootropics Market size

VENDOR POSITIONING GRID

TECHNOLOGY LIFE LINE CURVE

TRIPOD DATA VALIDATION MODEL

MARKET GUIDE

MULTIVARIATE MODELLING

TOP TO BOTTOM ANALYSIS

CHALLENGE MATRIX

APPLICATION COVERAGE GRID

STANDARDS OF MEASUREMENT

VENDOR SHARE ANALYSIS

DATA POINTS FROM KEY PRIMARY INTERVIEWS

DATA POINTS FROM KEY SECONDARY DATABASES

Global Nootropics Market: RESEARCH SNAPSHOT

ASSUMPTIONS

MARKET OVERVIEW

drivers

Restraints

Opportunities

Challenges

EXECUTIVE SUMMARY

premium insights

PESTEL analysis

Porter’s five forces model

Case studies successful ventures leveraging nootropics

food

apparel

others

Nootropics brand and revenue analysis

industry insights

Micro and Macro Economic Factors

Penetration and Growth Prospect Mapping

KEY PRICING STRATEGIES

INTERVIEWS WITH specialist

Analyis and Recommendation

Intellectual Property (IP) Portfolio

Patent Quality and Strength

Patent Families

Licensing and Collaborations

Competitive Landscape

IP Strategy and Management

other

Cost Analysis Breakdown

Technonlogy Roadmap

innovation tracker and Strategic Analysis

Major Deals And Strategic Alliances Analysis

Joint Ventures

Mergers and Acquisitions

Licensing and Partnership

Technology Collaborations

Strategic Divestments

Number of Products in Development

Stage of Development

Timelines and Milestones

Innovation Strategies and Methodologies

Risk Assessment and Mitigation

mergers and acquisitions

Future Outlook

epidemiology

INCIDENCE OF ALL BY GENDER

TREATMENT RATE

MORTALITY RATE

DRUG ADHERENCE AND THERAPY SWITCH MODEL

PATient TREATMENT SUCCESS RATES

Regulatory Compliance

Regulatory Authorities

Regulatory Classifications

Class I

Class II

Class III

Regulatory Submissions

International Harmonization

Compliance and Quality Management Systems

Regulatory Challenges and Strategies

pipeline analysis

CLINICAL TRIALS AND PHASE ANALYSIS

DRUG THERAPY PIPELINE

PHASE III CANDIDATES

PHASE II CANDIDATES

PHASE I CANDIDATES

OTHERS (PRE-CLINICAL AND RESEARCH)

global clinical trial market FOR Nootropics Market

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

Distribution of Products and Projects by Phase for Nootropics Market

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

distribution of projects by Therapeutic Area and Phase for Nootropics Market

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

Distribution of Projects by Scientific Approach and Phase for Nootropics Market

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

1 TOP ENTITIES BASED ON R&D GLANCE FOR NOOTROPICS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

Reimbursement Framework

Opputunity map analysis

Value chain analysis

Healthcare Economy

Healthcare expenditure

Capital expenditure

CAPEX Trends

CAPEX Allocation

Funding Sources

Industry Benchmarks

GDP ration in Overall GDP

healthcare system structure

government policies

economic development

Global Nootropics Market, BY type

(NOTE: MARKET VALUE, MARKET VOLUME AND ASP WILL BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS)

overview

OVER THE COUNTER

Natural supplements

FOOD-DERIVED SUPPLEMENTS

OMEGA-3 FATTY ACIDS

VITAMINS

CAFFEINE

L-THEANINE

CREATINE

NICOTINE

CDP-CHOLINE

OTHERS

PLANT-DERIVED SUPPLEMENTS

GINKGO BILOBA

PANAX GINSENG

ASHWAGANDHA

RHODIOLA ROSEA

BACOPA MONNIERI

OTHERS

SYNTHETIC SUPPLEMENTS

RACETAMS

PIRACETAM

PRAMIRACETAM

PHENYLPIRACETAM

ANIRACETAM

OXIRACETAM

OTHERS

NOOPEPT

OTHERS

PRESCRIPTION

MODAFINIL

ADDERALL

METHYPHENIDATE

MEMANTINE

AMPHETAMINE

OTHERS

OTHERS

Global Nootropics Market, BY DOSAGE FOrM

(NOTE: MARKET VALUE, MARKET VOLUME AND ASP WILL BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF EQUIPMENT)

overview

oral

TABLET

CAPSULES

powder

others

parenteral/INJECTIONS

intraveneous

subcutaneous

others

OTHERS

Global Nootropics Market, BY application

OVERVIEW

pharmaceuticals

mood enhancement

Mood & Depression

Attention & Focus

Anti-aging

Sleep

Anxiety

plateforms

supplements

fitness and wellness

others

food/functional foods

appreals

others

Global Nootropics Market, BY indication

OVERVIEW

NARCOLEPSY

OVER THE COUNTER

NATURAL SUPPLEMENTS

FOOD-DERIVED SUPPLEMENTS

OMEGA-3 FATTY ACIDS

VITAMINS

CAFFEINE

L-THEANINE

CREATINE

NICOTINE

CDP-CHOLINE

OTHERS

PLANT-DERIVED SUPPLEMENTS

GINKGO BILOBA

PANAX GINSENG

ASHWAGANDHA

RHODIOLA ROSEA

BACOPA MONNIERI

OTHERS

SYNTHETIC SUPPLEMENTS

RACETAMS

PIRACETAM

PRAMIRACETAM

PHENYLPIRACETAM

ANIRACETAM

OXIRACETAM

OTHERS

NOOPEPT

OTHERS

PRESCRIPTION

MODAFINIL

ADDERALL

METHYPHENIDATE

MEMANTINE

AMPHETAMINE

OTHERS

OTHERS

DEMENTIA

OVER THE COUNTER

NATURAL SUPPLEMENTS

FOOD-DERIVED SUPPLEMENTS

OMEGA-3 FATTY ACIDS

VITAMINS

CAFFEINE

L-THEANINE

CREATINE

NICOTINE

CDP-CHOLINE

OTHERS

PLANT-DERIVED SUPPLEMENTS

GINKGO BILOBA

PANAX GINSENG

ASHWAGANDHA

RHODIOLA ROSEA

BACOPA MONNIERI

OTHERS

SYNTHETIC SUPPLEMENTS

RACETAMS

PIRACETAM

PRAMIRACETAM

PHENYLPIRACETAM

ANIRACETAM

OXIRACETAM

OTHERS

NOOPEPT

OTHERS

PRESCRIPTION

MODAFINIL

ADDERALL

METHYPHENIDATE

MEMANTINE

AMPHETAMINE

OTHERS

OTHERS

ATTENTION DEFICIT DISORDER

OVER THE COUNTER

NATURAL SUPPLEMENTS

FOOD-DERIVED SUPPLEMENTS

OMEGA-3 FATTY ACIDS

VITAMINS

CAFFEINE

L-THEANINE

CREATINE

NICOTINE

CDP-CHOLINE

OTHERS

PLANT-DERIVED SUPPLEMENTS

GINKGO BILOBA

PANAX GINSENG

ASHWAGANDHA

RHODIOLA ROSEA

BACOPA MONNIERI

OTHERS

SYNTHETIC SUPPLEMENTS

RACETAMS

PIRACETAM

PRAMIRACETAM

PHENYLPIRACETAM

ANIRACETAM

OXIRACETAM

OTHERS

NOOPEPT

OTHERS

PRESCRIPTION

MODAFINIL

ADDERALL

METHYPHENIDATE

MEMANTINE

AMPHETAMINE

OTHERS

OTHERS

ALZHEIMER’S

OVER THE COUNTER

NATURAL SUPPLEMENTS

FOOD-DERIVED SUPPLEMENTS

OMEGA-3 FATTY ACIDS

VITAMINS

CAFFEINE

L-THEANINE

CREATINE

NICOTINE

CDP-CHOLINE

OTHERS

PLANT-DERIVED SUPPLEMENTS

GINKGO BILOBA

PANAX GINSENG

ASHWAGANDHA

RHODIOLA ROSEA

BACOPA MONNIERI

OTHERS

SYNTHETIC SUPPLEMENTS

RACETAMS

PIRACETAM

PRAMIRACETAM

PHENYLPIRACETAM

ANIRACETAM

OXIRACETAM

OTHERS

NOOPEPT

OTHERS

PRESCRIPTION

MODAFINIL

ADDERALL

METHYPHENIDATE

MEMANTINE

AMPHETAMINE

OTHERS

OTHERS

OTHERS

Global Nootropics Market, BY End User

overview

Hospitals

by type

PUBLIC

PRIVATE

BY LEVEL

TIER 1

TIER 2

TIER 3

Specialty Clinics

PUBLIC

PRIVATE

Home HEALTHcare

rehabilitation centers

others

Global Nootropics Market, BY DISTRIBUTION CHANNEL

overview

direct tender

retail SALES

OFFLINE

HOSPITAL PHARMACY

RETAIL PHARMACY

OTHERS

ONLINE1

E-STORES

COMPANY WEBSITE

OTHERS

OTHERS

Global Nootropics Market, by GEOGRAPHY

GLOBAL NOOTROPICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

U.S.

JAPAN

CHINA

Europe

GERMANY

FRANCE

U.K.

ITALY

SPAIN

RUSSIA

TURKEY

BELGIUM

NETHERLANDS

SWITZERLAND

REST OF EUROPE

KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

Global Nootropics Market, COMPANY landscape

company share analysis: u.s.

company share analysis: japan

company share analysis: china

company share analysis: eUROPE

MERGERS & ACQUISITIONS

NEW PRODUCT DEVELOPMENT & APPROVALS

EXPANSIONS

REGULATORY CHANGES

PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

Global Nootropics Market, company profile

Pfizer Inc.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Taj Pharma Group

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Aurobindo Pharma USA

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Lupin Pharmaceuticals, Inc.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

vitaris inc.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Natco Pharma Limited

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Watsons (CK Hutchison Holdings)

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Alembic Pharmaceuticals Limited

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Cadila Healthcare Ltd

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Orbion Pharmaceuticals Private Limited

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Avet Pharmaceuticals Inc.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

AdvaCare Pharma

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Jackson Laboratories Pvt Ltd

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Shanghai Ryan Pharma Co., Ltd

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Wellona Pharma

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

SiNi Pharma Pvt. Ltd.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

teva pharmaceutical industries Ltd.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT DEVELOPEMENTS

APOTEX INC

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT DEVELOPEMENTS

Somafina

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT DEVELOPEMENTS

reckitt benckiser group

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT DEVELOPEMENTS

Superior Supplement Manufacturing

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT DEVELOPEMENTS

NUTRA GROUP LLC,

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Divine Design Manufacturing

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Double Wood Supplements

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

SFI Health Australia

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Myland

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Sabinsa

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Gaia Herbs

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Purelife bioscience Co., Ltd.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Kemin Industries, Inc.

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

Onnit Labs, Inc

COMPANY OVERVIEW

revenue analysis

GEOGRAPHIC PRESENCE

PRODUCT PORTFOLIO

RECENT developments

RELATED REPORTS

Conclusion

QUESTIONNAIRE

ABOUT DATA BRIDGE MARKET RESEARCh

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.