Global Ashwagandha Market

Market Size in USD Million

CAGR :

%

USD

59.75 Million

USD

143.87 Million

2024

2032

USD

59.75 Million

USD

143.87 Million

2024

2032

| 2025 –2032 | |

| USD 59.75 Million | |

| USD 143.87 Million | |

|

|

|

|

Ashwagandha Market Size

- The global ashwagandha market was valued at USD 59.75 million in 2024 and is expected to reach USD 143.87 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.61%, primarily driven by increasing consumer preference for natural supplements

- This growth is driven by rising awareness of stress management and mental wellness and growing adoption of ayurvedic medicine in global healthcare

Ashwagandha Market Analysis

-

Ashwagandha has gained significant popularity due to increasing consumer demand for natural health supplements, rising awareness of stress management, and the growing adoption of ayurvedic medicine. Its adaptogenic properties play a crucial role in supporting mental wellness, enhancing immune health, and improving physical endurance

- The market is primarily driven by expanding applications in nutraceuticals, increasing investments in organic farming, and advancements in extraction technology. In addition, growing research validating ashwagandha’s therapeutic benefits is further accelerating market expansion

- For instance, in India and China, the demand for ashwagandha-based formulations is increasing due to growing awareness of its role in stress relief and immune support, contributing to sustained market expansion

- Globally, ashwagandha remains a key player in the herbal supplement industry, with innovations such as standardized extracts, functional food formulations, and clinical research-backed products driving industry transformation and supporting the shift toward holistic wellness

Report Scope and Ashwagandha Market Segmentation

|

Attributes |

Ashwagandha Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ashwagandha Market Trends

“Growing Popularity of Ashwagandha in Functional Foods and Beverages”

-

The increasing consumer preference for functional foods and beverages is driving demand for ashwagandha, known for its adaptogenic and stress-relief properties

- Food and beverage companies are incorporating ashwagandha extracts into products such as herbal teas, energy drinks, and gummies to cater to health-conscious consumers

- The rising focus on holistic wellness and natural ingredients is accelerating the adoption of ashwagandha-infused products across global markets

For instance

- In August 2024, Organic India, USA, launched Ashwagandha Organic Gummies, reflecting the growing demand for convenient, plant-based supplements

- In April 2024, Tranquilo 500mg Root Ashwagandha Drink was introduced in the U.K., tapping into the expanding market for stress-relief beverages

- In October 2021, Gaia Herbs launched Ashwagandha Gummies, designed to enhance resilience to stress and promote mental well-being

- As the functional food and beverage industry continues to grow, the incorporation of ashwagandha in innovative product formats will expand, meeting consumer demand for natural wellness solutions

Ashwagandha Market Dynamics

Driver

“Rising Consumer Awareness Driving Demand for Ashwagandha”

- The increasing awareness of holistic wellness and natural stress management solutions is a major driver of the ashwagandha market

- Consumers are actively seeking herbal supplements to support mental well-being, enhance immune health, and improve physical endurance through scientifically backed natural remedies

- Governments and healthcare organizations are promoting the use of ayurvedic medicine and plant-based therapies to reduce reliance on synthetic drugs and encourage preventive healthcare

For instance

- In May 2024, the World Health Organization (WHO) emphasized the benefits of Ashwagandha in traditional medicine, highlighting its role in stress relief and cognitive health

- In January 2024, the Indian Ministry of AYUSH launched awareness campaigns to promote herbal adaptogens, including Ashwagandha, for better mental and physical health

- In September 2023, the U.S. National Institutes of Health (NIH) published a study validating the effectiveness of Ashwagandha extracts in reducing anxiety and improving sleep quality

- As consumer interest in natural wellness continues to grow, the demand for ashwagandha is expected to increase significantly, reinforcing its position as a leading herbal supplement in the nutraceutical and functional food industries

Opportunity

“Rising Demand for Ashwagandha in Sports Nutrition and Performance Enhancement”

- The increasing focus on fitness and athletic performance is creating a significant opportunity for ashwagandha, known for its ability to enhance strength, endurance, and muscle recovery

- Athletes and fitness enthusiasts are incorporating ashwagandha supplements into their regimens due to its scientifically proven benefits in reducing cortisol levels, improving energy levels, and promoting muscle growth

- Sports nutrition brands are developing ashwagandha-infused protein powders, pre-workout supplements, and recovery formulas to meet the growing demand for natural performance boosters

For instance,

- In March 2024, Nutriventia launched Prolanza, a sustained-release ashwagandha supplement, targeting endurance athletes and fitness professionals

- In September 2023, GNC introduced ashwagandha-enhanced protein blends, designed to support muscle recovery and stress management

- In June 2022, Optimum Nutrition added ashwagandha extract to its Gold Standard Pre-Workout series, reinforcing its position in the sports nutrition market

- As consumer interest in natural performance enhancers grows, ashwagandha will continue to gain traction in the sports nutrition and fitness supplement industries, driving market expansion

Restraint/Challenge

“Supply Chain Disruptions and Raw Material Sourcing Constraints”

- The increasing global demand for ashwagandha has put pressure on raw material availability, leading to supply chain challenges and fluctuating production costs.

- Variability in climatic conditions, soil quality, and harvesting cycles affects the yield and consistency of ashwagandha root extracts, impacting supply stability.

- Dependence on India as the primary cultivation hub for ashwagandha creates logistical challenges, including export restrictions, transportation delays, and price volatility.

For instance,

- In March 2024, the Indian government imposed temporary export restrictions on ashwagandha raw materials, leading to supply shortages in the U.S. and European markets.

- In October 2023, adverse weather conditions in major ashwagandha-producing regions in India resulted in a 20% decline in crop yield, increasing raw material costs.

- In June 2022, global shipping disruptions and rising fuel costs led to higher transportation expenses for ashwagandha exporters, impacting product pricing.

- To mitigate these challenges, companies need to invest in alternative sourcing locations, enhance supply chain resilience, and explore sustainable cultivation practices to ensure long-term stability in the ashwagandha market.

Ashwagandha Market Scope

The market is segmented on the basis of type, product type, withanolides content, category, form, function, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product Type |

|

|

By Withanolides Content |

|

|

By Category |

|

|

By Form |

|

|

By Function |

|

|

By Application |

|

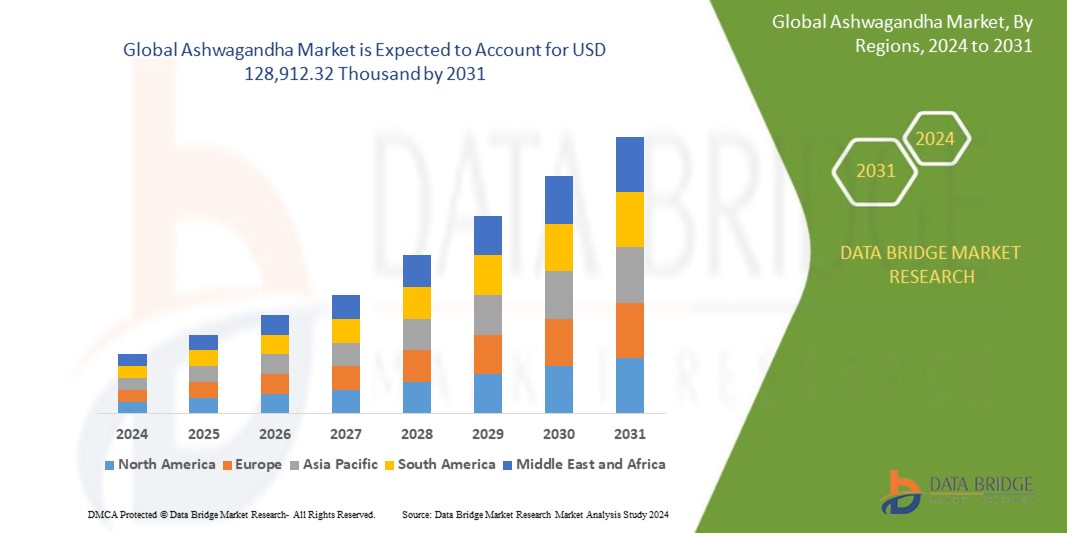

Ashwagandha Market Regional Analysis

“North America is the Dominant Region in the Ashwagandha Market”

- North America leads the global ashwagandha market, driven by increasing demand for herbal supplements, growing consumer preference for ayurvedic medicine, and expanding nutraceutical applications

- The U.S. and Canada dominate the region due to rising health-conscious populations, a well-established dietary supplement industry, and increasing investments in organic farming

- Supportive regulatory frameworks, advancements in extraction technology, and growing awareness about stress-relief and immunity-boosting properties have further strengthened market growth

- In addition, the presence of major herbal product manufacturers, expanding e-commerce distribution, and increasing consumer spending on natural health products contribute to the region’s market dominance

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the ashwagandha market, driven by increasing demand for herbal supplements, growing consumer preference for Ayurvedic remedies, and rising awareness of natural immunity boosters

- India and China are emerging as key markets due to strong government support for traditional medicine, increasing cultivation of medicinal herbs, and expanding exports of botanical extracts

- India leads the region in ashwagandha production, with significant investments in organic farming and the rising adoption of good agricultural practices (GAP) to ensure high-quality yields

- China is witnessing strong market growth due to increasing research in adaptogenic herbs, rising demand for functional beverages, and growing consumer trust in plant-based therapeutics

- Expanding e-commerce platforms, strategic collaborations between herbal product manufacturers, and rising global demand for stress-relief solutions further contribute to Asia-Pacific’s market expansion

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- KSM66 Ashwagandha (U.S.)

- Sami-Sabinsa Group (India)

- Dabur (India)

- Himalaya Wellness Company (India)

- iHerb, LLC (U.S.)

- Zandu Care (India)

- Patanjali Ayurved Limited (India)

- Herbochem (India)

- Apex International (India)

- Kerry Group plc (Ireland)

- KAIRALI AYURVEDIC PRODUCTS PRIVATE LIMITED (India)

- Bioprex Labs (India)

- Natreon Inc. (U.S.)

- Medikonda Nutrients (India)

- Carrubba, Inc (U.S.)

- Organic India Pvt. Ltd. (India)

- Zoic Pharmaceuticals (India)

- Creative Enzymes (U.S.)

- Aunutra Industries Inc. (U.S.)

Latest Developments in Global Ashwagandha Market

- In August 2024, Organic India, USA, introduced Organic Fiber Gummies and Ashwagandha Organic Gummies, marking its first entry into the gummy supplement market. This launch reflects the increasing consumer preference for convenient, low-sugar supplements and highlights the growing trend of incorporating ashwagandha into functional foods and dietary products

- In May 2024, Herbochem launched +91 ASHWAGANDHA ingredients, designed for use in capsules, tablets, gummies, and other supplement formats, expanding formulation possibilities in the Ashwagandha market

- In April 2024, The "Tranquilo" 500mg Root Ashwagandha Drink was launched in the UK, targeting health-conscious consumers looking for natural relaxation solutions. This product aligns with the increasing demand for stress-relief beverages and holistic wellness products

- In September 2022, Nutriventia launched Prolanza, a sustained-release ashwagandha supplement offering enhanced absorption and prolonged therapeutic effects. Supported by clinical studies, Prolanza demonstrated 12 times higher bioavailability of key phytoactives such as withanolides compared to conventional extracts, making it a more effective choice for long-lasting stress relief

- In August 2022, Swanson launched Passion Fruit Orange Ashwagandha Gummies with Vitamin D, formulated to support stress management. This strategic product expansion strengthened the company’s market presence and diversified its supplement offerings

- In October 2021, Gaia Herbs launched a new line of botanical gummies, including Ashwagandha Gummies, Sleep Gummies, and Relax Gummies. The Ashwagandha Gummies were specifically designed to help reduce stress and enhance the body's resilience by leveraging the adaptogenic benefits of ashwagandha

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.