Global Nucleic Acid Electrophoresis Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

2.69 Billion

2025

2033

USD

1.60 Billion

USD

2.69 Billion

2025

2033

| 2026 –2033 | |

| USD 1.60 Billion | |

| USD 2.69 Billion | |

|

|

|

|

Nucleic Acid Electrophoresis Market Size

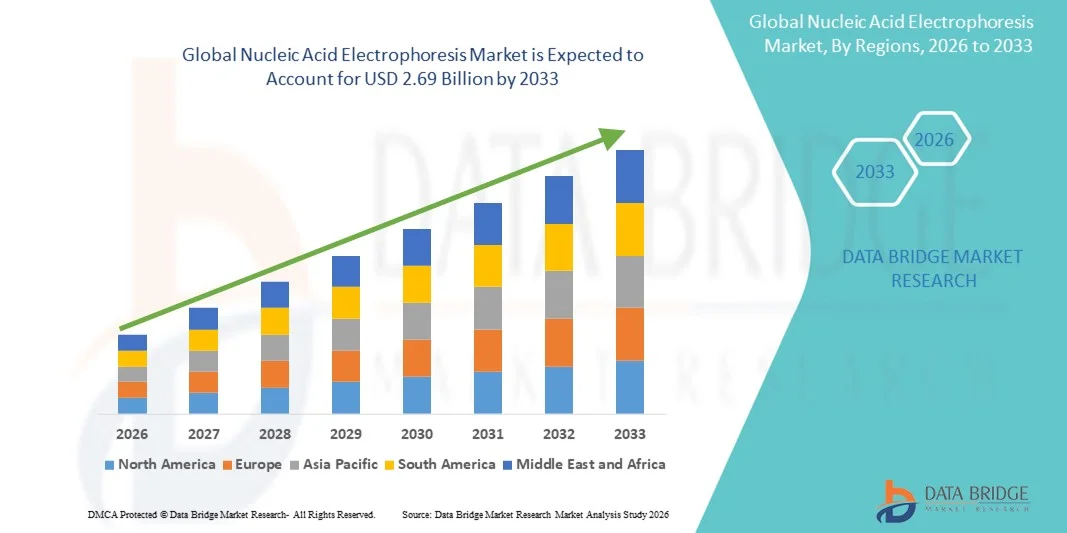

- The global nucleic acid electrophoresis market size was valued at USD 1.60 billion in 2025 and is expected to reach USD 2.69 billion by 2033, at a CAGR of 6.73% during the forecast period

- The market growth is largely driven by the increasing use of nucleic acid electrophoresis in molecular biology research, clinical diagnostics, and genetic testing, supported by technological advancements in gel and capillary electrophoresis systems

- Furthermore, rising demand for precise, rapid, and high-throughput DNA and RNA analysis in research institutions, biotechnology companies, and diagnostic laboratories is positioning nucleic acid electrophoresis as a critical tool in modern life sciences. These factors are accelerating the adoption of electrophoresis solutions, thereby significantly driving the market expansion

Nucleic Acid Electrophoresis Market Analysis

- Nucleic acid electrophoresis, enabling the separation and analysis of DNA and RNA molecules based on size and charge, is an essential technique in molecular biology, clinical diagnostics, and genetic research, valued for its precision, reproducibility, and compatibility with advanced analytical systems

- The increasing demand for nucleic acid electrophoresis is primarily driven by the growth of molecular diagnostics, rising prevalence of genetic disorders, and expanding research activities in genomics and proteomics, coupled with technological advancements in gel and capillary electrophoresis platforms

- North America dominated the nucleic acid electrophoresis market with the largest revenue share of 38.7% in 2025, attributed to well-established research infrastructure, high R&D expenditure, and the presence of leading life sciences companies, with the U.S. witnessing significant adoption in academic institutions, biotech firms, and diagnostic laboratories

- Asia-Pacific is expected to be the fastest-growing region in the nucleic acid electrophoresis market during the forecast period due to increasing investments in biotechnology research, growing number of clinical laboratories, and rising focus on genetic testing and precision medicine

- Nucleic acid electrophoresis apparatus segment dominated the market with a share of 44.6% in 2025, driven by its essential role in DNA and RNA analysis, compatibility with various experimental setups, and integration with gel documentation and software systems for enhanced accuracy

Report Scope and Nucleic Acid Electrophoresis Market Segmentation

|

Attributes |

Nucleic Acid Electrophoresis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Nucleic Acid Electrophoresis Market Trends

Advancements in Automated and High-Throughput Systems

- A significant and accelerating trend in the global nucleic acid electrophoresis market is the adoption of automated and high-throughput electrophoresis platforms, enhancing workflow efficiency, accuracy, and reproducibility in DNA and RNA analysis

- For instance, the QIAxcel Advanced System by QIAGEN offers fully automated capillary electrophoresis for high-throughput applications, allowing multiple samples to be analyzed simultaneously with minimal manual intervention

- Integration with digital imaging and software platforms enables real-time data analysis, improved quantification, and better visualization of nucleic acid samples, reducing human error and increasing laboratory productivity

- The trend toward automation and high-throughput electrophoresis is reshaping expectations in research and clinical laboratories, driving demand for systems that combine speed, precision, and user-friendly operation

- Companies such as Agilent Technologies are developing next-generation automated electrophoresis systems that streamline sample preparation, electrophoretic separation, and data reporting, enabling more efficient workflows

- The demand for automated, high-throughput, and integrated electrophoresis platforms is growing rapidly across academic, pharmaceutical, and diagnostic laboratories as research complexity and sample volume increase

- Increasing integration of electrophoresis systems with AI-based data analytics and cloud platforms is enabling predictive insights, error reduction, and more streamlined laboratory management

- Rising focus on personalized medicine and precision genomics is driving adoption of electrophoresis for complex nucleic acid profiling, biomarker discovery, and targeted therapeutic research

Nucleic Acid Electrophoresis Market Dynamics

Driver

Increasing Adoption in Molecular Diagnostics and Genomics Research

- The expanding use of nucleic acid electrophoresis in molecular diagnostics, genomics, and proteomics research is a major driver for the heightened demand for electrophoresis systems

- For instance, in March 2025, Thermo Fisher Scientific introduced enhanced electrophoresis reagents and apparatus for high-precision genetic testing, aiming to support growing clinical and research applications

- Rising prevalence of genetic disorders, infectious diseases, and cancer is driving laboratories to adopt electrophoresis for DNA/RNA analysis, mutation detection, and biomarker studies

- Growing government and private funding for genomics and personalized medicine is fueling research activities, increasing the reliance on electrophoresis techniques in laboratories worldwide

- The convenience of automated workflows, integration with data analysis software, and compatibility with high-throughput screening are key factors propelling adoption in research and clinical settings

- Expansion of biotechnology and pharmaceutical R&D in emerging markets is creating new opportunities for electrophoresis adoption across previously untapped regions

- Increasing collaborations between academic institutions and industry for genomic research are accelerating the deployment of advanced electrophoresis technologies

Restraint/Challenge

High Costs and Technical Complexity

- Concerns relatively high cost of advanced electrophoresis systems and reagents, along with the technical expertise required for operation, pose significant challenges to broader market penetration

- For instance, some automated capillary electrophoresis platforms, while highly efficient, involve substantial initial investment, limiting adoption in smaller laboratories or developing regions

- Variability in protocols and the need for trained personnel to interpret complex electrophoresis results can also hinder adoption in clinical and research labs with limited expertise

- Addressing these challenges through cost-effective systems, user-friendly interfaces, and comprehensive training programs is critical to expand market reach and ensure widespread adoption

- While prices of basic gel electrophoresis equipment are decreasing, advanced systems with integrated software and high-throughput capabilities still carry a premium, which may restrict uptake

- Overcoming technical and financial barriers through innovative, affordable, and easy-to-use electrophoresis solutions will be vital for sustained growth in the global market

- Limited standardization across different electrophoresis platforms and reagent systems may create compatibility issues, slowing adoption in multi-vendor laboratory setups

- Regulatory and compliance requirements for clinical applications of nucleic acid electrophoresis add complexity and can delay deployment in diagnostic and hospital laboratories

Nucleic Acid Electrophoresis Market Scope

The market is segmented on the basis of product type, application, and end-user.

- By Product Type

On the basis of product type, the market is segmented into nucleic acid electrophoresis reagents, nucleic acid electrophoresis apparatus, horizontal gel electrophoresis, vertical electrophoresis, gel documentation systems, and software. The nucleic acid electrophoresis apparatus segment dominated the market with the largest revenue share of 44.6% in 2025, owing to its essential role in DNA and RNA analysis across research and diagnostic laboratories. Apparatus systems are highly valued for their precision, reproducibility, and ability to integrate with other laboratory instruments and software platforms. Their versatility in accommodating various sample types and gel formats makes them a preferred choice for molecular biology workflows. In addition, apparatus systems often feature automation and high-throughput capabilities, catering to the growing demand for efficient laboratory operations. Leading market players are continuously innovating electrophoresis apparatus to include enhanced features such as real-time monitoring and integrated safety mechanisms, further strengthening market dominance. The widespread use in academic, clinical, and industrial research labs ensures steady revenue growth for this segment.

The gel documentation systems segment is expected to witness the fastest growth during the forecast period, driven by the increasing need for precise imaging, quantification, and documentation of nucleic acid samples. Gel documentation systems enable researchers to capture high-resolution images of electrophoresed gels, facilitating accurate analysis and record-keeping. Their integration with advanced software allows for real-time data processing, densitometry, and comparative analysis across experiments. The rising adoption of automated electrophoresis workflows further propels demand for gel documentation solutions, as they streamline downstream analysis. In addition, increasing focus on reproducibility, data integrity, and compliance in research and clinical studies is supporting growth. Companies offering compact, user-friendly, and cloud-enabled gel documentation platforms are witnessing strong adoption in both developed and emerging markets.

- By Application

On the basis of application, the nucleic acid electrophoresis market is segmented into diagnostics, research, and quality control & process validation. The research segment dominated the market in 2025 with the largest share, driven by extensive use in academic institutions, pharmaceutical R&D, and biotechnology labs for DNA/RNA separation, mutation detection, and genetic profiling. Research applications benefit from the high versatility and adaptability of electrophoresis techniques across various nucleic acid studies. Moreover, the growing focus on genomics, proteomics, and molecular biology research continues to fuel adoption in this segment. Advanced research laboratories prefer automated and high-throughput electrophoresis systems to improve efficiency and accuracy. Key players also focus on offering specialized reagents and apparatus tailored for complex experimental workflows.

The diagnostics segment is anticipated to witness the fastest growth from 2026 to 2033, driven by rising demand for molecular diagnostics, genetic testing, and early disease detection. Diagnostic laboratories increasingly rely on electrophoresis for analyzing clinical samples, detecting genetic disorders, and validating biomarkers. Regulatory emphasis on accuracy, reproducibility, and compliance enhances adoption in hospitals and diagnostic centers. In addition, integration of electrophoresis systems with software for data analysis and reporting supports faster diagnostic workflows. Rising prevalence of infectious diseases, cancer, and hereditary disorders globally is also boosting demand for electrophoresis in diagnostics. Companies offering compact, automated, and easy-to-use electrophoresis solutions for clinical applications are witnessing rapid market uptake.

- By End-User

On the basis of end-user, the market is segmented into academic & research institutes, pharmaceutical & biotechnology companies, forensic laboratories, and hospitals & diagnostics. The academic & research institutes segment dominated the market in 2025, driven by extensive use of nucleic acid electrophoresis in molecular biology courses, laboratory research, and experimental studies. These institutions prefer versatile and reliable electrophoresis systems for teaching, training, and experimental reproducibility. Continuous funding for scientific research, development of genomics programs, and collaborative studies across universities also contribute to steady demand. Furthermore, academic labs frequently adopt automated electrophoresis systems to handle high sample volumes efficiently. Key players provide customized solutions to meet the diverse experimental needs of research institutions, further reinforcing market dominance.

The pharmaceutical & biotechnology companies segment is expected to witness the fastest growth during the forecast period due to increasing R&D activities in drug discovery, biomarker identification, and personalized medicine. Electrophoresis systems are widely used in pharmaceutical labs for nucleic acid analysis, quality control, and process validation. The adoption of high-throughput, automated, and software-integrated electrophoresis platforms enables faster drug development cycles and improved data accuracy. Growing investment in genomics and proteomics research is driving demand for sophisticated electrophoresis solutions. Companies offering integrated electrophoresis and analysis platforms tailored to pharmaceutical workflows are experiencing rapid market uptake. Rising focus on precision medicine and molecular diagnostics further accelerates adoption in biotech and pharma sectors.

Nucleic Acid Electrophoresis Market Regional Analysis

- North America dominated the nucleic acid electrophoresis market with the largest revenue share of 38.7% in 2025, attributed to well-established research infrastructure, high R&D expenditure, and the presence of leading life sciences companies, with the U.S. witnessing significant adoption in academic institutions, biotech firms, and diagnostic laboratories

- Laboratories and academic institutions in the region extensively use electrophoresis for DNA and RNA analysis, genetic testing, and molecular diagnostics, benefiting from advanced instrumentation and software integration

- This widespread adoption is further supported by substantial government and private funding for genomics, personalized medicine, and biotechnology research, establishing nucleic acid electrophoresis as a critical tool in both academic and industrial settings

U.S. Nucleic Acid Electrophoresis Market Insight

The U.S. nucleic acid electrophoresis market captured the largest revenue share of 82% in 2025 within North America, fueled by the country’s well-established research infrastructure and high investment in biotechnology and molecular diagnostics. Laboratories extensively employ electrophoresis for DNA/RNA analysis, genetic testing, and clinical diagnostics. The growing demand for high-throughput and automated systems, combined with the integration of advanced imaging and analysis software, further propels market growth. Moreover, the increasing focus on personalized medicine, genomics research, and government-backed funding for scientific initiatives is significantly contributing to the market’s expansion.

Europe Nucleic Acid Electrophoresis Market Insight

The Europe nucleic acid electrophoresis market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong R&D activities in genomics, proteomics, and molecular biology research. Increasing investment in clinical diagnostics, coupled with stringent regulatory standards for accuracy and reproducibility, is fostering the adoption of electrophoresis systems. European research institutions and pharmaceutical companies are leveraging automated and high-throughput electrophoresis platforms for enhanced productivity. The market growth is also supported by government initiatives promoting biotechnology innovation and collaborations between academia and industry.

U.K. Nucleic Acid Electrophoresis Market Insight

The U.K. nucleic acid electrophoresis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for advanced molecular diagnostics and genetic research. In addition, the increasing prevalence of genetic disorders and infectious diseases is encouraging laboratories to adopt precise and reliable nucleic acid analysis techniques. The U.K.’s strong academic and biotech research infrastructure, alongside well-established clinical laboratories, is expected to continue to stimulate market growth. Furthermore, the integration of electrophoresis systems with digital imaging and analysis software supports faster, more accurate research workflows.

Germany Nucleic Acid Electrophoresis Market Insight

The Germany nucleic acid electrophoresis market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of molecular diagnostics and the demand for technologically advanced laboratory solutions. Germany’s emphasis on research innovation and sustainable laboratory practices promotes adoption, particularly in academic, pharmaceutical, and industrial research labs. The use of automated electrophoresis systems integrated with data analysis tools is becoming increasingly prevalent, aligning with local preferences for accuracy, reproducibility, and efficiency in molecular biology workflows.

Asia-Pacific Nucleic Acid Electrophoresis Market Insight

The Asia-Pacific nucleic acid electrophoresis market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by increasing investment in biotechnology, genomics, and molecular research in countries such as China, Japan, and India. The growing number of academic institutions, diagnostic laboratories, and pharmaceutical R&D centers is driving demand for high-throughput and automated electrophoresis platforms. Furthermore, government initiatives promoting research infrastructure and digitalization of laboratories are enhancing adoption. Rising focus on personalized medicine and emerging biotech hubs is also expanding accessibility and usage of electrophoresis systems across the region.

Japan Nucleic Acid Electrophoresis Market Insight

The Japan nucleic acid electrophoresis market is gaining momentum due to the country’s advanced research infrastructure, strong focus on genomics and precision medicine, and high technological adoption. Japanese laboratories prioritize automation, high-throughput systems, and integrated software for efficient DNA and RNA analysis. The increasing number of academic and industrial research collaborations is driving demand for sophisticated electrophoresis solutions. In addition, the aging population and rising healthcare requirements encourage adoption of electrophoresis-based diagnostics and molecular testing across clinical and research facilities.

India Nucleic Acid Electrophoresis Market Insight

The India nucleic acid electrophoresis market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid growth in biotechnology research, expanding diagnostic laboratories, and increasing R&D in pharmaceuticals. India is emerging as a key hub for molecular biology research, with high adoption of automated and cost-effective electrophoresis systems in academic, commercial, and clinical labs. Government initiatives promoting biotech innovation, the rise of smart laboratories, and the availability of affordable electrophoresis solutions are key factors propelling market growth. Moreover, collaborations with global life sciences companies are further accelerating adoption across the country.

Nucleic Acid Electrophoresis Market Share

The Nucleic Acid Electrophoresis industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- QIAGEN (Netherlands)

- Lonza (Switzerland)

- Cytiva (U.S.)

- Harvard Bioscience, Inc. (U.S.)

- Cleaver Scientific Ltd. (U.K.)

- Analytik Jena AG (Germany)

- Sebia Group (France)

- Labnet International, Inc. (U.S.)

- ATTO Corporation (Japan)

- VWR International, LLC (U.S.)

- PerkinElmer (U.S.)

- Shimadzu Corporation (Japan)

- Danaher (U.S.)

- SERVA Electrophoresis GmbH (Germany)

- Promega Corporation (U.S.)

- Merck KGaA (Germany)

What are the Recent Developments in Global Nucleic Acid Electrophoresis Market?

- In May 2025, Thermo Fisher Scientific introduced the Applied Biosystems™ SeqStudio Flex Dx genetic analyzer, an IVDR‑compliant capillary electrophoresis system designed for Sanger sequencing and fragment analysis in genomic testing with advanced automation and diagnostic use modes

- In April 2025, miniPCR bio™ launched the redesigned blueGel™ Electrophoresis System, offering 25% faster run times, enhanced LED illumination, improved imaging capabilities, and USB‑C power compatibility, aimed at both educational and research laboratories to improve DNA electrophoresis efficiency and visibility

- In September 2024, Thermo Fisher Scientific unveiled the Applied Biosystems™ InnoviGene™ Suite, a browser‑based software platform to automate and optimize capillary electrophoresis data analysis for biopharmaceutical and research workflows, featuring AI‑based base calling and 21 CFR Part 11 compliance capabilities

- In December 2023, TransGen Biotech introduced a multi‑purpose horizontal electrophoresis system, the TSE‑N unit, coupled with a gel imaging system and robust agarose gels designed to enhance nucleic acid separation performance in life sciences research settings

- In September 2023, Advanced Electrophoresis Solutions Ltd (Canada) appointed Medispec as its exclusive distributor partner in India, expanding the reach of electrophoresis equipment and consumables across a broader geographic market and strengthening adoption in the Indian life sciences sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.