Global Ocular Bromfenac Market

Market Size in USD Million

CAGR :

%

USD

36.83 Million

USD

63.32 Million

2024

2032

USD

36.83 Million

USD

63.32 Million

2024

2032

| 2025 –2032 | |

| USD 36.83 Million | |

| USD 63.32 Million | |

|

|

|

|

Ocular Bromfenac Market Size

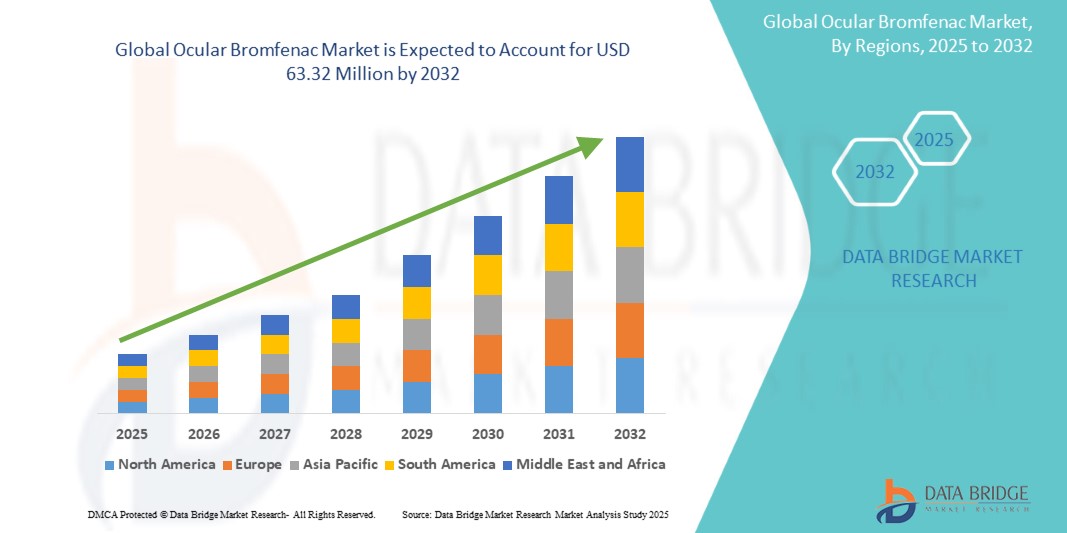

- The global ocular bromfenac market size was valued at USD 36.83 million in 2024 and is expected to reach USD 63.32 million by 2032, at a CAGR of 7.01% during the forecast period

- The market growth is largely driven by the rising number of cataract surgeries worldwide, along with increasing demand for effective post-operative inflammation and pain management solutions

- Furthermore, growing availability of advanced formulations such as preservative-free and once-daily bromfenac eye drops, coupled with the expansion of generic competition and improved ophthalmic care infrastructure, is fueling adoption. These converging factors are significantly boosting the uptake of ocular bromfenac globally, thereby accelerating the industry’s growth

Ocular Bromfenac Market Analysis

- Ocular bromfenac, a topical NSAID for managing postoperative ocular inflammation and pain (primarily after cataract surgery), has become an essential therapy across both developed and emerging healthcare systems due to its efficacy, safety, and availability in multiple strengths

- The escalating demand for ocular bromfenac is fueled by the growing global cataract surgery volume, increasing geriatric population, and strong adoption of once-daily and preservative-free formulations that improve compliance and treatment outcomes

- North America dominated the ocular bromfenac market with the largest revenue share of 39.1% in 2024, supported by high surgical volumes, favorable reimbursement frameworks, and strong penetration of both branded and generic products in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the ocular bromfenac market during the forecast period, driven by rapidly aging populations, expanding cataract surgery programs, and increasing access to affordable generics in markets such as Japan, China, and India

- The 0.09% concentration segment dominated the ocular bromfenac market with the largest market share of 44.7% in 2024, favored for its proven efficacy, broad clinical adoption, and widespread availability across both branded and generic formulations globally

Report Scope and Ocular Bromfenac Market Segmentation

|

Attributes |

Ocular Bromfenac Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Bromfenac Market Trends

Shift Toward Preservative-Free and Once-Daily Formulation

- A significant and accelerating trend in the global ocular bromfenac market is the transition toward preservative-free, once-daily, and advanced vehicle-based formulations that enhance patient compliance and ocular surface safety. This evolution is reshaping prescribing habits among ophthalmologists and driving product differentiation

- For instance, preservative-free single-dose vials are being increasingly adopted in Europe and Japan to reduce ocular surface toxicity risks in elderly patients undergoing cataract surgery. Similarly, DuraSite-based mucoadhesive formulations extend drug residence time, allowing effective once-daily dosing compared to traditional twice-daily drops

- These innovations improve patient adherence by simplifying dosing schedules while minimizing side effects, a critical factor in aging populations undergoing multiple eye procedures. Once-daily therapies are particularly favored in North America and Asia-Pacific where compliance challenges are more pronounced among elderly patients

- The broadening pipeline of next-generation bromfenac formulations is also aimed at securing extended market exclusivity and offsetting generic erosion. Companies are investing in R&D for preservative-free packaging technologies, improved dropper designs, and combination therapies to reinforce their competitive position

- This shift toward safer, more convenient delivery is fundamentally reshaping expectations for post-operative ocular care. Consequently, pharmaceutical companies are prioritizing preservative-free launches and enhanced delivery systems to meet rising demand and strengthen their global market share

- The demand for advanced bromfenac formulations is growing rapidly across both mature and emerging markets, as patients and clinicians increasingly prioritize safety, convenience, and treatment adherence alongside clinical efficacy

Ocular Bromfenac Market Dynamics

Driver

Rising Cataract Surgery Volume and Post-Operative Care Demand

- The rising prevalence of cataracts, coupled with the expansion of surgical capacity worldwide, is a significant driver of ocular bromfenac demand. As the global population ages, the volume of cataract procedures is increasing steadily, directly fueling the need for effective anti-inflammatory and pain management therapies

- For instance, WHO estimates indicate over 30 million cataract surgeries annually worldwide, with the number projected to rise significantly by 2030, particularly in Asia-Pacific and Latin America. Bromfenac, with its proven clinical efficacy, is well-positioned as a standard of care for post-surgical inflammation management

- In North America, high reimbursement coverage supports widespread adoption of branded and generic bromfenac formulations, while in Asia-Pacific, public health initiatives are expanding access to cost-effective generics. These dynamics create dual growth pathways across premium and value-driven markets

- Furthermore, increasing surgeon preference for once-daily regimens enhances patient compliance, reducing post-surgical complications and improving outcomes. This reinforces bromfenac’s role as a cornerstone therapy in ophthalmic post-operative care, driving its market growth trajectory globally

- The expanding presence of cost-effective generic bromfenac formulations is another major driver of market growth, particularly in emerging economies where affordability is critical to adoption. The availability of generics ensures that bromfenac therapy is accessible to a wider patient base, supporting higher treatment penetration

Restraint/Challenge

Generic Erosion and Regulatory Barriers

- The widespread availability of generics, particularly in markets such as India, Japan, and parts of Europe, poses a significant challenge to premium branded bromfenac sales. Price erosion pressures are limiting revenue growth for established players, making differentiation through innovation critical

- For instance, after the expiration of exclusivity for key branded products in the U.S., multiple generic bromfenac formulations entered the market, sharply lowering average selling prices and squeezing margins. This trend is expected to intensify as more generics gain approval globally

- Regulatory hurdles also present barriers, as ophthalmic NSAIDs must demonstrate safety and efficacy in sensitive ocular tissues. Variations in approval timelines across regions delay product launches and complicate global expansion strategies for companies

- In addition, safety concerns regarding NSAID-related corneal complications in high-risk patients may restrict broader use in certain populations. Physicians often weigh these risks against benefits, which can limit adoption in cases outside of standard cataract care

- Overcoming these challenges requires investment in next-generation preservative-free formulations, robust clinical evidence to support broader indications, and competitive pricing strategies. Companies that can balance innovation with affordability will be best positioned to sustain growth amid intensifying generic competition

Ocular Bromfenac Market Scope

The market is segmented on the basis of strength, indication, brand status, end user, and distribution channel.

- By Strength

On the basis of strength, the ocular bromfenac market is segmented into 0.07%, 0.075%, 0.09%, and 0.1%. The 0.09% segment dominated the market with the largest share of 44.7% in 2024, driven by its wide clinical acceptance and extensive availability in both branded and generic formulations. It is considered the standard concentration for effective post-operative ocular inflammation and pain management, making it the most prescribed option globally. Its strong track record in safety and efficacy, coupled with broad inclusion in treatment guidelines, has reinforced its dominance. In addition, availability across multiple distribution channels from hospital pharmacies to retail outlets—further supports its widespread use. Physicians often prefer this strength due to its consistent patient outcomes, which helps sustain its market leadership.

The 0.07% segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of once-daily dosing regimens that improve compliance, particularly in elderly cataract patients. This lower-strength formulation is gaining traction in North America and Europe, where physicians are prioritizing safety and tolerability without compromising efficacy. Its appeal is further enhanced by ongoing clinical studies highlighting improved patient adherence and ocular surface compatibility. As a result, 0.07% bromfenac is becoming the formulation of choice for patients with higher sensitivity to preservatives or dosing frequency, supporting its rapid growth trajectory.

- By Indication

On the basis of indication, the ocular bromfenac market is segmented into post-operative ocular inflammation & pain after cataract surgery and other ocular inflammation indications. The post-operative ocular inflammation & pain after cataract surgery segment dominated the market in 2024, supported by the global surge in cataract surgeries, which is estimated to exceed 30 million procedures annually worldwide. Bromfenac is widely prescribed in this indication due to its ability to reduce inflammation, minimize pain, and support quicker recovery. Hospitals and surgical centers consistently integrate bromfenac into their standard post-surgical protocols, cementing this indication as the largest revenue driver. Moreover, strong reimbursement coverage in developed regions ensures high adoption, making this segment the cornerstone of market growth.

The other ocular inflammation indications segment is projected to witness the fastest growth during the forecast period, as bromfenac is increasingly explored beyond cataract surgery in conditions such as post-refractive surgery inflammation and uveitis management. Although off-label use is region-specific, growing clinical evidence is supporting expanded adoption. Emerging markets with rising ophthalmic surgical volumes are beginning to prescribe bromfenac more broadly, driving incremental demand. This segment benefits from physician interest in NSAIDs as steroid-sparing agents, positioning it as a promising growth avenue for the industry.

- By Brand Status

On the basis of brand status, the ocular bromfenac market is segmented into branded formulations and generic formulations. The generic formulations segment dominated the market in 2024, reflecting the widespread availability of cost-effective versions following patent expirations of branded products. Generics are especially prevalent in Asia-Pacific, Latin America, and parts of Europe, where affordability is a key determinant of patient access. The competitive pricing of generics has accelerated their adoption in public healthcare systems, making them the largest revenue contributor globally. In addition, large-scale distribution through hospital tenders and retail pharmacies has solidified their dominant position in the marketplace.

The branded formulations segment is expected to record the fastest growth rate during the forecast period, driven by innovation in preservative-free and once-daily delivery technologies that enhance product differentiation. Companies are investing heavily in advanced packaging systems and mucoadhesive vehicles to extend exclusivity and capture premium market share. These branded innovations appeal strongly to physicians and patients in developed regions, where safety, tolerability, and convenience are prioritized over cost. As demand for high-quality, next-generation formulations grows, branded products are poised to expand rapidly despite generic competition.

- By End User

On the basis of end user, the ocular bromfenac market is segmented into hospitals & hospital pharmacies, ambulatory surgical centers (ASCs), ophthalmology clinics, and retail pharmacies. The hospitals & hospital pharmacies segment dominated the market in 2024, owing to their central role in managing cataract surgeries and post-operative care. Hospitals remain the primary setting for bromfenac prescriptions, as most cataract procedures are performed within these facilities. Centralized procurement processes and reimbursement frameworks in developed markets further strengthen the dominance of hospital-based distribution. In addition, physicians often prefer prescribing bromfenac through hospital pharmacies for immediate post-surgical availability, ensuring seamless continuity of care.

The ambulatory surgical centers (ASCs) segment is projected to witness the fastest growth during the forecast period, reflecting the global trend toward outpatient cataract surgeries. ASCs offer faster patient turnaround and lower costs compared to hospitals, driving their popularity in both developed and emerging economies. As ASCs expand, they are increasingly procuring bromfenac to manage post-operative inflammation efficiently. The shift toward minimally invasive and day-care procedures will continue to fuel demand in this segment, positioning ASCs as the fastest-growing end-user group for ocular bromfenac.

- By Distribution Channel

On the basis of distribution channel, the ocular bromfenac market is segmented into hospital pharmacies, retail pharmacies, and online / e-pharmacies. The hospital pharmacies segment dominated the market in 2024, supported by their integration into surgical workflows and immediate access following cataract operations. Hospital pharmacies ensure that patients receive bromfenac as part of their discharge medication, making them the most reliable and consistent channel. In addition, strong procurement contracts and bulk purchasing practices allow hospital pharmacies to distribute both branded and generic formulations efficiently. Their direct association with post-surgical care protocols has firmly positioned them as the leading revenue contributor.

The online / e-pharmacies segment is anticipated to grow at the fastest rate during the forecast period, driven by increasing digitalization in healthcare and patient preference for convenient drug delivery. In developed markets, online channels offer home delivery of both branded and generic bromfenac, improving access for elderly patients with limited mobility. In emerging economies, the expansion of regulated e-pharmacy platforms is opening new pathways for distribution. The combination of convenience, affordability, and accessibility is fueling rapid adoption of online channels, making them the fastest-growing distribution pathway.

Ocular Bromfenac Market Regional Analysis

- North America dominated the ocular bromfenac market with the largest revenue share of 39.1% in 2024, supported by high surgical volumes, favorable reimbursement frameworks, and strong penetration of both branded and generic products in the U.S. and Canada

- The region benefits from advanced healthcare infrastructure, high awareness among patients regarding post-operative eye care, and strong presence of leading pharmaceutical manufacturers

- Moreover, rising geriatric population prone to age-related eye disorders and increasing adoption of branded formulations such as BromSite and Prolensa further strengthen regional dominance. Regulatory approvals by the U.S. FDA and strong investments in R&D for ocular NSAIDs continue to boost market expansion

U.S. Ocular Bromfenac Market Insight

The U.S. ocular bromfenac market captured the largest revenue share of 82% in 2024 within North America, supported by the high number of cataract surgeries performed annually and the widespread adoption of branded formulations such as Prolensa and BromSite. Strong awareness about post-operative ocular inflammation management and the presence of established pharmaceutical players drive demand. Moreover, favorable reimbursement frameworks and continuous FDA approvals of ophthalmic NSAIDs further reinforce market strength. Growing preference for convenient once-daily and preservative-free solutions is shaping consumer choice, while R&D in novel delivery systems continues to support market expansion.

Europe Ocular Bromfenac Market Insight

The Europe ocular bromfenac market is projected to expand at a robust CAGR throughout the forecast period, primarily driven by rising cataract incidence due to an aging population and improved surgical access. The adoption of branded ophthalmic NSAIDs remains significant, with increasing availability of generics boosting affordability. European healthcare systems emphasize standardized post-operative eye care, encouraging wider drug use across hospitals and ophthalmology clinics. Furthermore, regulatory support and awareness initiatives on ocular health are expected to accelerate adoption across key countries, particularly in Western Europe.

U.K. Ocular Bromfenac Market Insight

The U.K. ocular bromfenac market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by rising cataract procedures and growing attention to improved patient recovery outcomes. The country’s advanced healthcare infrastructure supports adoption in both hospitals and ambulatory surgical centers. Moreover, increasing awareness campaigns on age-related eye disorders and patient preference for effective NSAID-based therapies foster growth. The availability of generic versions alongside branded drugs also strengthens adoption across both private and NHS-supported treatment pathways.

Germany Ocular Bromfenac Market Insight

The Germany ocular bromfenac market is expected to expand at a considerable CAGR, supported by the country’s emphasis on innovation and precision in healthcare treatments. Rising cataract surgeries and patient demand for effective inflammation management drive market demand. German consumers and providers also favor preservative-free ophthalmic drugs, aligning with a growing trend toward safety and tolerability. In addition, the presence of strong distribution networks and robust regulatory frameworks helps accelerate drug adoption, particularly across hospital pharmacies and specialized ophthalmology clinics.

Asia-Pacific Ocular Bromfenac Market Insight

The Asia-Pacific ocular bromfenac market is poised to grow at the fastest CAGR of 8.5% during 2025 to 2032, driven by the rising aging population, increasing surgical volumes, and growing awareness of advanced post-operative eye care solutions. Countries such as China, Japan, and India are emerging as high-demand markets due to rapid improvements in healthcare access and expanding middle-class populations. Government healthcare initiatives and the rising adoption of generics further fuel affordability and uptake. Expanding pharmaceutical manufacturing capacity in APAC also boosts regional supply and availability.

Japan Ocular Bromfenac Market Insight

The Japan ocular bromfenac market is gaining momentum due to its highly developed healthcare system, rising geriatric population, and early adoption of advanced ophthalmic therapies. High prevalence of cataract surgeries and preference for preservative-free solutions foster demand. Japanese consumers place strong emphasis on treatment efficacy and safety, accelerating uptake of branded formulations. Moreover, integration of ocular NSAIDs into comprehensive ophthalmic care pathways and continuous investment by domestic pharmaceutical companies are expected to sustain growth.

India Ocular Bromfenac Market Insight

The India ocular bromfenac market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid urbanization, rising cataract burden, and expanding access to ophthalmic care. India has one of the highest numbers of cataract surgeries globally, fueling demand for affordable post-operative inflammation management solutions. The presence of strong domestic generic manufacturers ensures cost-effective drug availability across hospital and retail pharmacies. Government-led healthcare initiatives and expanding private healthcare infrastructure are also accelerating adoption, particularly in tier-2 and tier-3 cities.

Ocular Bromfenac Market Share

The ocular bromfenac industry is primarily led by well-established companies, including:

- Bausch + Lomb. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Lupin (India)

- Alembic Pharmaceuticals Limited (India)

- Amneal Pharmaceuticals LLC (U.S.)

- Apotex Inc. (Canada)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Senju Pharmaceutical Co., Ltd. (Japan)

- Viatris Inc. (U.S.)

- Alcon Inc. (Switzerland)

- Zydus Lifesciences Limited (India)

- Intas Pharmaceuticals Ltd. (India)

- Dr. Reddy's Laboratories Ltd. (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Piramal Pharma Limited (India)

- Sandoz International GmbH (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Cipla Ltd. (India)

- Macleods Pharmaceuticals Ltd (India)

- Alembic Pharmaceuticals Limited (U.S.)

What are the Recent Developments in Global Ocular Bromfenac Market?

- In July 2024, Alembic Pharmaceuticals Ltd has received final approval from the US health regulator for its generic Bromfenac ophthalmic solution, which is indicated for the treatment of postoperative inflammation and pain in patients who have undergone cataract surgery

- In February 2024, Global pharma major Lupin Limited (Lupin) announced that it has received approval from the United States Food and Drug Administration (U.S. FDA) for its Abbreviated New Drug Application for Bromfenac Ophthalmic Solution, 0.075%, to market a generic equivalent of BromSite Ophthalmic Solution, 0.075%, of Sun Pharmaceutical Industries Limited. Lupin is the exclusive first-to-file for this product

- In January 2024, Global pharma major Lupin Limited (Lupin) announced the launch of Bromfenac Ophthalmic Solution, 0.07%, after having received an approval from the United States Food and Drug Administration (U.S. FDA). Lupin is the exclusive first-to-file for this product and is eligible for 180-day exclusivity

- In August 2023, the FDA approved Lupin’s ANDA for bromfenac ophthalmic solution, 0.09%, making it a generic equivalent of Bausch + Lomb’s Bromday. The product was added to the FDA’s Orange Book

- In May 2021 study published in Scientific Reports, researchers found that topical bromfenac significantly decreased VEGF and MCP-1 levels in the aqueous humour of pseudophakic eyes following phacoemulsification, suggesting potential longer-term anti-inflammatory benefits beyond the immediate post-op period

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.