Global Ocular Implants Market

Market Size in USD Billion

CAGR :

%

USD

11.55 Billion

USD

18.32 Billion

2025

2033

USD

11.55 Billion

USD

18.32 Billion

2025

2033

| 2026 –2033 | |

| USD 11.55 Billion | |

| USD 18.32 Billion | |

|

|

|

|

Ocular Implants Market Size

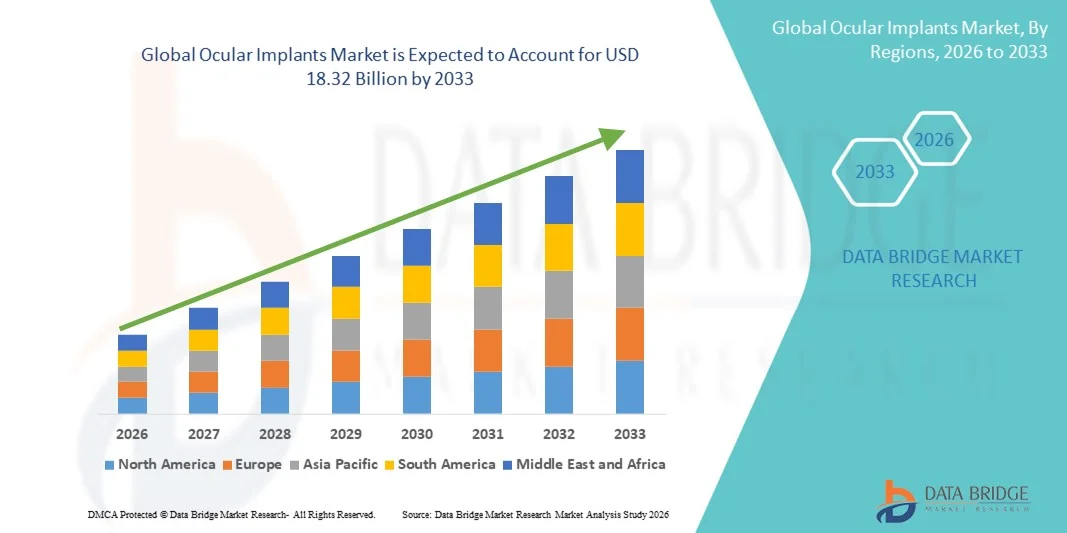

- The global ocular implants market size was valued at USD 11.55 billion in 2025 and is expected to reach USD 18.32 billion by 2033, at a CAGR of 5.94% during the forecast period

- The market growth is primarily driven by the rising prevalence of ophthalmic disorders, increasing geriatric population, and continuous advancements in implant materials and surgical techniques, supporting improved visual outcomes

- Furthermore, growing demand for minimally invasive eye surgeries, higher adoption of premium intraocular lenses, and expanding access to ophthalmic care are positioning ocular implants as essential solutions in modern eye treatment. These combined factors are significantly accelerating the growth of the global ocular implants market

Ocular Implants Market Analysis

- Ocular implants, including intraocular lenses, glaucoma implants, and orbital implants, are increasingly critical components of modern ophthalmic care in both hospital and specialty eye clinic settings due to their role in vision restoration, disease management, and improved patient quality of life

- The rising demand for ocular implants is primarily driven by the increasing prevalence of cataracts, glaucoma, and retinal disorders, along with a growing aging population and higher awareness of advanced ophthalmic treatment options

- North America dominated the ocular implants market with the largest revenue share of 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of premium ophthalmic devices, and a strong presence of leading implant manufacturers, with the U.S. accounting for the majority of regional demand due to high surgical volumes and favorable reimbursement frameworks

- Asia-Pacific is expected to be the fastest-growing region in the ocular implants market during the forecast period due to expanding access to eye care services, rising medical tourism, increasing cataract surgery volumes, and growing investments in ophthalmic healthcare infrastructure

- Intraocular lenses segment dominated the ocular implants market with a market share of 64.8% in 2025, driven by the high global incidence of cataract surgeries and continuous advancements in lens materials, toric and multifocal designs, and premium lens adoption

Report Scope and Ocular Implants Market Segmentation

|

Attributes |

Ocular Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Ocular Implants Market Trends

Rising Adoption of Premium and Advanced Implant Technologies

- A significant and accelerating trend in the global ocular implants market is the increasing adoption of premium and technologically advanced implants, particularly multifocal, toric, and extended-depth-of-focus intraocular lenses, aimed at improving post-surgical visual outcomes

- For instance, Alcon’s AcrySof IQ PanOptix trifocal intraocular lens has seen strong global uptake due to its ability to provide enhanced near, intermediate, and distance vision, reducing dependence on spectacles after cataract surgery

- Continuous advancements in biomaterials and implant design are enabling better biocompatibility, durability, and optical performance, leading to reduced complication rates and improved patient satisfaction across ophthalmic procedures

- The growing preference for minimally invasive ophthalmic surgeries is further supporting the demand for next-generation ocular implants that are easier to implant and compatible with advanced surgical techniques

- The integration of digital diagnostics and surgical planning tools with ocular implant selection is facilitating more personalized treatment approaches, allowing surgeons to optimize implant choice based on individual patient anatomy and lifestyle needs

- This shift toward high-performance, patient-centric ocular implants is reshaping clinical expectations and encouraging manufacturers to focus on innovation-driven product portfolios across global markets

- Growing collaborations between implant manufacturers and ophthalmology clinics are accelerating product trials and real-world validation of advanced ocular implant technologies

Ocular Implants Market Dynamics

Driver

Growing Burden of Ophthalmic Disorders and Aging Population

- The increasing global prevalence of cataracts, glaucoma, and other vision-impairing disorders, combined with a rapidly aging population, is a major driver fueling demand for ocular implants

- For instance, according to global ophthalmic health estimates, cataract remains the leading cause of blindness worldwide, directly driving high and sustained volumes of intraocular lens implantation procedures

- Advancements in ophthalmic surgical techniques and improved access to eye care services are enabling higher surgical success rates, encouraging patients to opt for implant-based vision correction

- Rising awareness regarding early diagnosis and timely treatment of eye disorders is further supporting the uptake of ocular implants in both developed and emerging healthcare markets

- In addition, favorable reimbursement policies and government-supported vision care initiatives in several countries are contributing to the steady growth of the ocular implants market

- Increasing investments in ophthalmic infrastructure and expansion of specialized eye hospitals are boosting procedural volumes across both public and private healthcare settings

- Growing medical tourism for eye surgeries, particularly in Asia-Pacific and Latin America, is further accelerating global demand for cost-effective ocular implant solutions

Restraint/Challenge

High Cost of Advanced Implants and Regulatory Stringency

- The high cost associated with premium ocular implants and advanced surgical procedures poses a significant challenge to market expansion, particularly in price-sensitive and developing regions

- For instance, premium multifocal and toric intraocular lenses are often not fully reimbursed, limiting their adoption among cost-conscious patients despite clinical benefits

- Stringent regulatory approval processes for implantable ophthalmic devices increase development timelines and compliance costs for manufacturers, potentially delaying product launches

- Concerns related to post-surgical complications, such as implant dislocation or infection, can also create hesitation among patients considering implant-based treatments

- Addressing these challenges through cost-effective product development, streamlined regulatory pathways, and enhanced surgeon training will be essential for sustaining long-term growth in the global ocular implants market

- Limited availability of skilled ophthalmic surgeons in low-income regions restricts access to implant-based procedures, slowing market penetration

- Variability in reimbursement policies across countries creates uncertainty for manufacturers and healthcare providers, impacting the adoption rate of advanced ocular implant technologies

Ocular Implants Market Scope

The market is segmented on the basis of type, application, material, and end user.

- By Type

On the basis of type, the global ocular implants market is segmented into intraocular lenses, ocular prosthesis, glaucoma implants, corneal implants, orbital implants, and others. The intraocular lenses (IOLs) segment dominated the market with the largest revenue share of 64.8% in 2025, driven by the consistently high number of cataract surgeries performed globally. Cataract remains one of the leading causes of vision impairment, particularly among the aging population, ensuring sustained demand for IOL implantation. Technological advancements such as toric, multifocal, and extended-depth-of-focus lenses have further strengthened this segment’s dominance. Increasing patient preference for premium lenses that reduce dependence on spectacles also contributes to revenue growth. Expanding cataract surgery programs in emerging economies are improving accessibility and procedural volumes. In addition, strong clinical familiarity and long-term safety data support widespread adoption of intraocular lenses.

The glaucoma implants segment is expected to witness the fastest growth during the forecast period due to the rising global prevalence of glaucoma and the need for effective long-term intraocular pressure management. Increasing adoption of minimally invasive glaucoma surgery (MIGS) is significantly boosting demand for implant-based solutions. These implants offer reduced surgical risk and faster recovery compared to conventional glaucoma surgeries. Growing awareness regarding early glaucoma intervention is encouraging timely surgical treatment. Continuous innovation in implant design is improving clinical outcomes and surgeon confidence. Expanding screening programs in both developed and emerging regions are further accelerating growth in this segment.

- By Application

On the basis of application, the market is segmented into glaucoma surgery, oculoplasty, drug delivery, age-related macular degeneration, aesthetic purpose, and others. The glaucoma surgery segment dominated the market in 2025 due to the chronic and progressive nature of the disease, which often requires surgical intervention when medication fails. Rising diagnosis rates, particularly among elderly populations, are increasing the number of glaucoma procedures worldwide. Implant-based surgical approaches provide sustained pressure reduction, making them a preferred option for advanced cases. Improved surgical techniques and better post-operative outcomes are further driving adoption. Hospitals and specialty clinics continue to expand glaucoma treatment capabilities. Long-term disease management needs ensure consistent demand within this segment.

The drug delivery segment is anticipated to be the fastest-growing application during the forecast period, driven by increasing demand for sustained-release ocular therapies. These implants reduce the frequency of intravitreal injections, improving patient compliance and treatment convenience. Rising prevalence of chronic retinal disorders is supporting the need for long-acting drug delivery solutions. Ongoing clinical research is expanding the range of drugs delivered via ocular implants. Favorable clinical outcomes are encouraging broader adoption among ophthalmologists. Increasing regulatory approvals for novel drug-eluting implants are further strengthening growth prospects.

- By Material

On the basis of material, the ocular implants market is segmented into non-integrated implants and integrated implants. The non-integrated implants segment held the largest market share in 2025, primarily due to their extensive historical usage and proven clinical reliability. These implants are widely used across standard ophthalmic procedures and are generally more cost-effective. Their simpler design and manufacturing processes make them accessible in both developed and developing healthcare systems. Surgeons are highly familiar with non-integrated implant handling and implantation techniques. Broad availability across multiple implant categories supports their continued dominance. Cost sensitivity in emerging markets further reinforces demand for this segment.

The integrated implants segment is expected to grow at the fastest rate over the forecast period, driven by advancements in biomaterials and surface engineering. These implants promote better tissue integration, improving stability and long-term outcomes. Reduced risk of infection and implant migration enhances their clinical appeal. Growing preference for advanced solutions in complex ophthalmic cases is supporting adoption. Increasing investments in R&D are accelerating product innovation. Expanding use in premium surgical settings is further driving segment growth.

- By End User

On the basis of end user, the market is segmented into eye specialty clinics, eye institutes, ambulatory surgical centers, specialty clinics, hospitals, and others. The hospitals segment dominated the ocular implants market in 2025 due to the high volume of complex ophthalmic surgeries performed in hospital settings. Hospitals offer advanced diagnostic and surgical infrastructure required for implant-based procedures. Availability of multidisciplinary care and post-operative management supports better patient outcomes. High patient inflow and referral rates contribute to larger procedural volumes. Favorable reimbursement structures in hospital settings further support dominance. Teaching and research activities also promote adoption of advanced ocular implants.

The ambulatory surgical centers segment is projected to be the fastest-growing end-user segment during the forecast period. These centers offer cost-effective surgical solutions with shorter recovery times. Increasing preference for outpatient eye surgeries is shifting procedure volumes away from hospitals. Advancements in minimally invasive ophthalmic techniques support safe same-day procedures. Patients benefit from reduced waiting times and lower treatment costs. Growing investments in specialized ambulatory eye care facilities are accelerating adoption. Favorable regulatory support for outpatient surgeries further enhances growth potential.

Ocular Implants Market Regional Analysis

- North America dominated the ocular implants market with the largest revenue share of 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of premium ophthalmic devices, and a strong presence of leading implant manufacturers, with the U.S. accounting for the majority of regional demand due to high surgical volumes and favorable reimbursement frameworks

- Patients and healthcare providers in the region place significant value on advanced ocular implant technologies that offer improved visual outcomes, reduced complication rates, and compatibility with minimally invasive surgical techniques

- This widespread adoption is further supported by high healthcare expenditure, favorable reimbursement policies, a strong presence of leading ophthalmic device manufacturers, and continuous technological innovation, positioning ocular implants as a preferred solution across hospitals and specialty eye clinics

U.S. Ocular Implants Market Insight

The U.S. ocular implants market captured the largest revenue share within North America in 2025, driven by a high prevalence of age-related eye disorders and strong adoption of advanced ophthalmic surgical procedures. Patients increasingly prioritize improved visual outcomes through premium intraocular lenses and minimally invasive implant-based treatments. The presence of leading ophthalmic device manufacturers, coupled with favorable reimbursement policies, supports widespread adoption. Moreover, continuous technological innovation and high procedural volumes across hospitals and specialty eye clinics are significantly contributing to market expansion.

Europe Ocular Implants Market Insight

The Europe ocular implants market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by an aging population and increasing incidence of cataract and glaucoma cases. Rising awareness regarding early diagnosis and treatment of ophthalmic disorders is supporting higher surgical volumes. European healthcare systems emphasize quality care and clinical outcomes, encouraging the adoption of advanced implant technologies. The region is witnessing strong demand across public hospitals and private eye clinics, with ocular implants increasingly used in both routine and complex ophthalmic procedures.

U.K. Ocular Implants Market Insight

The U.K. ocular implants market is anticipated to grow at a notable CAGR during the forecast period, driven by increasing cataract surgery volumes and advancements in ophthalmic treatment protocols. Growing patient preference for premium intraocular lenses that enhance post-surgical vision is supporting market growth. In addition, the U.K.’s well-established public healthcare system, combined with expanding private eye care services, is facilitating access to implant-based procedures. Continuous investments in ophthalmic infrastructure are expected to further stimulate market demand.

Germany Ocular Implants Market Insight

The Germany ocular implants market is expected to expand at a considerable CAGR over the forecast period, fueled by strong healthcare infrastructure and high adoption of advanced medical technologies. The country’s focus on precision medicine and high clinical standards promotes the use of innovative ocular implant solutions. Increasing demand for minimally invasive eye surgeries and premium implants is supporting growth. Germany’s aging population and high awareness of eye health are further driving procedural volumes across hospitals and specialized eye centers.

Asia-Pacific Ocular Implants Market Insight

The Asia-Pacific ocular implants market is poised to grow at the fastest CAGR during the forecast period, driven by a large patient pool, rising prevalence of vision impairment, and improving access to ophthalmic care. Rapid urbanization and growing healthcare expenditure in countries such as China, India, and Japan are supporting market expansion. Government-led eye care programs and increasing medical tourism are further accelerating adoption. In addition, expanding local manufacturing capabilities are improving affordability and availability of ocular implants across the region.

Japan Ocular Implants Market Insight

The Japan ocular implants market is gaining momentum due to the country’s rapidly aging population and high demand for advanced vision correction solutions. Japan places strong emphasis on clinical precision and patient safety, driving adoption of high-quality intraocular and glaucoma implants. Increasing use of minimally invasive surgical techniques is supporting procedural growth. Integration of advanced diagnostics with implant-based treatments is further enhancing clinical outcomes and market development.

India Ocular Implants Market Insight

The India ocular implants market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to high cataract prevalence, expanding middle-class population, and growing awareness of eye health. India conducts one of the highest volumes of cataract surgeries globally, driving strong demand for intraocular lenses. Government-supported vision care initiatives and increasing penetration of private eye hospitals are improving access to implant-based treatments. The presence of cost-effective domestic manufacturers is further supporting widespread adoption across urban and semi-urban regions.

Ocular Implants Market Share

The Ocular Implants industry is primarily led by well-established companies, including:

- STAAR SURGICAL ALL RIGHTS RESERVED (U.S.)

- HOYA Medical (Japan)

- SAV IOL SA (Switzerland)

- FCI Ophthalmics (U.S.)

- Alcon Vision LLC (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Clearly Ophtec (Netherlands)

- Lenstec, Inc. (U.S.)

- Glaukos Corporation (U.S.)

- Carl Zeiss Meditec AG (Germany)

- Bausch + Lomb Corporation (Canada)

- Rayner Intraocular Lenses Limited (U.K.)

- PhysIOL SA (Belgium)

- Morcher GmbH (Germany)

- SIFI S.p.A. (Italy)

- Ophtec BV (Netherlands)

- HumanOptics Holding AG (Germany)

- OSD Medical GmbH (Germany)

- Second Sight Medical Products Inc. (U.S.)

- Aurolab Ltd. (India)

What are the Recent Developments in Global Ocular Implants Market?

- In May 2025, the FDA further expanded Susvimo’s indications by approving it for diabetic retinopathy making it the first and only continuous delivery ocular implant system with up to nine-month refill intervals for vision preservation in DR patients, broadening clinical use

- In April 2025, Alcon introduced its Clareon PanOptix Pro trifocal intraocular lens (IOL) in the United States a premium presbyopia-correcting IOL designed to improve near, intermediate, and distance vision after cataract surgery, enhancing patient visual outcomes with a preloaded delivery system

- In April 2025, SpyGlass Pharma announced the successful first‑in‑human clinical trial results for its innovative intraocular lens (IOL) that also delivers sustained glaucoma‑reducing therapy after cataract surgery all 23 treated patients showed significant reductions in intraocular pressure and remained off topical medications through 18 months, marking a major step toward a combined vision correction and glaucoma implant solution that could transform standard surgical practice

- In February 2025, the U.S. Food and Drug Administration (FDA) approved Susvimo® (ranibizumab) a refillable ocular implant delivering continuous drug treatment for diabetic macular edema, offering patients a substantially reduced treatment burden compared to regular intra-vitreal injections. This approval expands the use of Susvimo beyond AMD and marks a major advancement in sustained-delivery ocular implants

- In June 2024, ANI Pharmaceuticals completed its acquisition of Alimera Sciences, Inc., a company focused on ophthalmic products including implants and drug therapies. This consolidation strengthens ANI’s position in the ocular implant and vision health segment by adding marketed treatments used in retinal disease care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.