Global Oral Care Products And Other Dental Consumables Market

Market Size in USD Billion

CAGR :

%

USD

62.58 Billion

USD

100.51 Billion

2024

2032

USD

62.58 Billion

USD

100.51 Billion

2024

2032

| 2025 –2032 | |

| USD 62.58 Billion | |

| USD 100.51 Billion | |

|

|

|

|

Oral Care Products and Other Dental Consumables Market Size

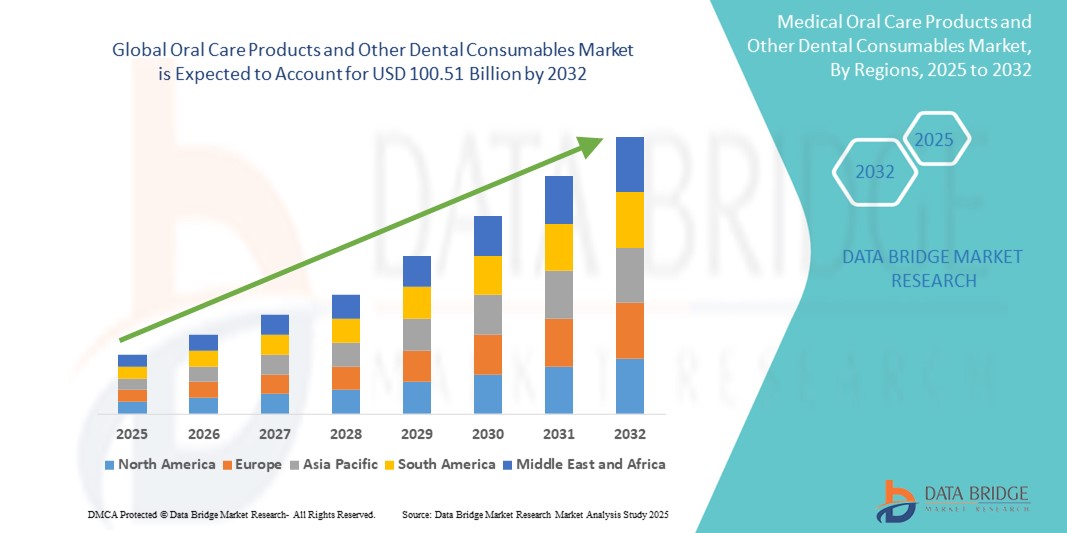

- The global oral care products and other dental consumables market size was valued at USD 62.58 billion in 2024 and is expected to reach USD 100.51 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by increasing awareness regarding oral hygiene and the rising prevalence of dental disorders, which is driving the demand for advanced oral care products and dental consumables across both developed and developing regions. This shift is further supported by the growing geriatric population and an increasing focus on preventive dental care

- Furthermore, rising consumer demand for innovative, effective, and aesthetically oriented dental solutions is establishing oral care products and other dental consumables as essential components of daily healthcare routines. These converging factors are accelerating the uptake of products such as whitening toothpaste, mouthwashes, interdental brushes, dental prosthetics, and orthodontic supplies, thereby significantly boosting the industry's growth across dental clinics, hospitals, and retail pharmacies

Oral Care Products and Other Dental Consumables Market Analysis

- Oral care products and other dental consumables, such as dental fillings, whitening agents, fluoride varnishes, and periodontal dressings, are increasingly vital components of modern dental treatment and preventive care strategies in both clinical and at-home settings due to their broad applicability, ease of use, and continual innovation in formulations and delivery systems

- The escalating demand for oral care products and other dental consumables is primarily fuelled by increasing awareness of oral hygiene and its link to overall health, a rising prevalence of dental disorders, technological advancements in dental care, and a growing geriatric population with higher dental care needs

- North America dominated the oral care products and other dental consumables market with a revenue share of 31.1% in 2024. This dominance is characterized by advanced dental infrastructure, high healthcare spending, and substantial investments in research and development, with the U.S. experiencing substantial growth driven by innovations and rising demand for preventive and cosmetic dentistry

- Asia-Pacific is expected to be the fastest growing region with a CAGR of 9.2% in the oral care products and other dental consumables market during the forecast period. This growth is attributed to increasing urbanization, rising disposable incomes, expanding dental care facilities, growing public awareness regarding oral hygiene, and increased investment in research and development across countries such as China and India

- The dental restoration products segment dominated the largest market revenue share of 57.3% in 2024, driven by the rising demand for aesthetic and functional restorations, particularly among aging populations. These products—including crowns, bridges, implants, and inlays/onlays—are widely adopted in restorative and cosmetic dentistry due to their effectiveness in replacing missing teeth and enhancing oral function. The increasing number of dental clinics and growing awareness of dental aesthetics further reinforce the segment's leading position

Report Scope and Oral Care Products and Other Dental Consumables Market Segmentation

|

Attributes |

Oral Care Products and Other Dental Consumables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oral Care Products and Other Dental Consumables Market Trends

“Rising Demand for Preventive and Cosmetic Dental Solutions”

- A significant and accelerating trend in the global oral care products and other dental consumables market is the rising consumer preference for preventive and cosmetic dental care. This is being driven by growing awareness of oral hygiene, increased aesthetic expectations, and the influence of social media on appearance-related concerns

- For instance, demand for products such as whitening strips, fluoride toothpaste, interdental brushes, and natural ingredient-based oral care items has surged, particularly in urban areas and among younger demographics. This shift from treatment-focused to prevention-focused care is transforming the oral care landscape

- In addition, the growing middle-class population in emerging markets is contributing to an increased adoption of professional dental treatments, fueling the consumption of consumables such as impression materials, polishing agents, and fluoride varnishes in dental clinics

- The increased frequency of routine dental visits is also driving up the demand for products such as prophylaxis pastes, pit and fissure sealants, and disposable dental accessories, which are essential for maintaining clinical hygiene and improving patient experience

- Moreover, expanding dental tourism, especially in countries such as India, Thailand, and Mexico, is further propelling the use of consumables by increasing the volume of procedures such as tooth restoration, orthodontics, and prosthodontics

- The trend toward minimally invasive dentistry and patient-friendly solutions has encouraged manufacturers to innovate in material science, leading to the development of biocompatible, fast-setting, and easy-to-apply dental consumables

Oral Care Products and Other Dental Consumables Market Dynamics

Driver

“Growing Need Due to Rising Oral Health Awareness and Preventive Care”

- The increasing global prevalence of dental disorders such as caries, gingivitis, and periodontitis, coupled with heightened public awareness about oral hygiene, is a major driver for the growth of the oral care products and other dental consumables market. Consumers are increasingly seeking preventive solutions to avoid costly dental procedures, driving demand for a wide range of daily-use products

- For instance, in April 2024, several oral care manufacturers introduced fluoride-free and natural ingredient-based dental products to cater to the rising demand for safer and more eco-conscious alternatives. Such product diversification strategies by key companies are expected to further accelerate market growth over the forecast period

- As individuals become more informed about the long-term impact of oral health on systemic well-being, there is a noticeable shift toward routine dental checkups and home-based care. This growing consumer trend is boosting the sales of toothbrushes, toothpaste, mouthwashes, and floss, along with professional consumables such as polishing pastes, sealants, and impression materials

- Furthermore, the surge in cosmetic dentistry procedures such as teeth whitening, veneers, and orthodontics is making dental consumables a crucial part of aesthetic enhancement. The availability of convenient, over-the-counter whitening kits and specialized products is further driving adoption among consumers who seek improved appearance and self-confidence

- The ease of access to oral care products through online channels, expanding retail pharmacies, and increasing government and NGO-led oral health campaigns is contributing to stronger product penetration globally. The growing trend of do-it-yourself (DIY) dental kits and subscription-based oral care plans also supports market expansion

Restraint/Challenge

“Limited Affordability in Developing Regions and Regulatory Hurdles”

- One of the significant restraints to the broader adoption of Oral Care Products and Other Dental Consumables, particularly in low- and middle-income countries, is the limited affordability of high-end dental solutions. Premium consumables and cosmetic dental care products often remain out of reach for a large portion of the population, restraining potential growth

- In addition, stringent regulatory frameworks and long product approval cycles in regions such as the U.S. and Europe can delay the launch of innovative dental products. Companies often face challenges in meeting diverse regulatory standards for safety, efficacy, and labeling across multiple markets

- For instance, delays in approvals for fluoride concentration limits or organic certification for natural products can hinder time-to-market and increase costs for manufacturers. Moreover, the lack of dental insurance coverage in several countries continues to pose a financial burden on patients, leading to lower spending on non-essential oral care consumables

- Addressing these challenges through strategic pricing, public-private partnerships, and education campaigns focused on preventive oral care is essential. Expanding low-cost product lines and leveraging digital platforms for awareness and distribution can help overcome barriers and support sustainable market growth

Oral Care Products and Other Dental Consumables Market Scope

The market is segmented on the basis of product and distribution channel.

• By Product

On the basis of product, the oral care products and other dental consumables market is segmented into dental restoration products and dental restoration materials.

The dental restoration products segment dominated the market with the largest revenue share of 57.3% in 2024, driven by the rising demand for aesthetic and functional restorations, especially in aging populations. These products, including crowns, bridges, implants, and inlays/onlays, are widely adopted in restorative and cosmetic dentistry due to their ability to replace missing teeth and improve oral function. The growing number of dental clinics and increasing awareness about dental aesthetics further support the dominance of this segment.

The dental restoration materials segment is anticipated to witness the fastest CAGR of 7.9% from 2025 to 2032, fueled by continuous innovation in composite resins, ceramics, and amalgam alternatives. These materials are essential for procedures such as fillings, bonding, and veneer applications, offering improved strength, durability, and biocompatibility. The increasing preference for minimally invasive techniques and tooth-colored materials is accelerating demand in both developed and emerging markets.

• By Distribution Channel

On the basis of distribution channel, the oral care products and other dental consumables market is segmented into consumer stores market, dental dispensaries market, retail pharmacies market, and online distribution market.

The consumer stores market segment accounted for the largest market share of 38.5% in 2024, driven by the widespread availability of over-the-counter dental products such as toothbrushes, toothpaste, and mouthwashes. Convenience, ease of access, and attractive promotions in supermarkets, hypermarkets, and convenience stores make this channel a preferred choice for daily-use oral care products.

The online distribution market is expected to grow at the fastest CAGR of 9.2% during the forecast period (2025–2032). E-commerce platforms offer a wide variety of dental consumables and oral care products with the added benefit of home delivery, discounts, and subscription models. The growing adoption of digital shopping, increased internet penetration, and availability of customer reviews are encouraging consumers to purchase dental products online, especially in urban and tech-savvy regions.

Oral Care Products and Other Dental Consumables Market Regional Analysis

- North America dominated the oral care products and other dental consumables market with the largest revenue share of 31.1% in 2024, driven by rising dental awareness, a well-established healthcare infrastructure, and increased demand for cosmetic dentistry

- Consumers in the region prioritize oral aesthetics and hygiene, which, along with high dental expenditure and frequent dental visits, supports market expansion

- In addition, the presence of major industry players and strong insurance coverage in countries such as the U.S. and Canada further contributes to this dominance

U.S. Oral Care Products and Other Dental Consumables Market Insight

The U.S. oral care products and other dental consumables market accounted for 78.1% of North America's market share in 2024, fueled by high per capita dental spending and growing demand for dental aesthetics, implants, and whitening solutions. A large aging population, increasing prevalence of periodontal diseases, and the widespread use of professional dental services drive growth. The strong presence of dental chains, private clinics, and innovative product launches also bolster the U.S. market outlook.

Europe Oral Care Products and Other Dental Consumables Market Insight

The Europe oral care products and other dental consumables market is projected to witness a CAGR of 6.7% from 2025 to 2032, supported by growing awareness of preventive oral care, rising dental tourism (especially in countries such as Hungary and Poland), and government initiatives promoting oral hygiene. Strong public health policies and reimbursement systems in countries such as Germany, France, and the U.K. enhance access to oral care products and dental procedures.

U.K. Oral Care Products and Other Dental Consumables Market Insight

The U.K. oral care products and other dental consumables market market is anticipated to grow at a CAGR of 6.4% during the forecast period, driven by increasing demand for cosmetic dentistry and heightened awareness of oral hygiene. Innovations in whitening, aligners, and implant products, along with growing retail sales through e-commerce channels, contribute to steady market expansion.

Germany Oral Care Products and Other Dental Consumables Market Insight

Germany oral care products and other dental consumables market is expected to register a CAGR of 6.8% through 2032, due to its strong dental infrastructure, insurance coverage, and growing demand for high-end consumables such as restorative materials and preventive care products. The country also has a large base of practicing dentists, supporting product consumption.

Asia-Pacific Oral Care Products and Other Dental Consumables Market Insight

Asia-Pacific oral care products and other dental consumables market is poised to grow at the fastest CAGR of 9.2% from 2025 to 2032, driven by increasing disposable incomes, growing urban populations, and heightened awareness about oral hygiene in countries such as China, Japan, and India. Rapid expansion of dental clinics, medical tourism, and supportive government initiatives are driving regional demand.

Japan Oral Care Products and Other Dental Consumables Market Insight

Japan oral care products and other dental consumables market is witnessing strong demand for premium dental consumables, fueled by an aging population, advanced healthcare system, and cultural emphasis on oral aesthetics. The market is anticipated to grow at a CAGR of 7.8% as consumers increasingly seek cosmetic and restorative dental solutions.

China Oral Care Products and Other Dental Consumables Market Insight

China oral care products and other dental consumables market held the largest market share in Asia-Pacific in 2024 at 38.3%, driven by rapid urbanization, increasing healthcare spending, and government efforts to expand dental coverage. Growth in e-commerce channels and strong domestic manufacturing capabilities also make China a highly dynamic market for dental consumables.

Oral Care Products and Other Dental Consumables Market Share

The oral care products and other dental consumables industry is primarily led by well-established companies, including:

- Institut Straumann AG (Switzerland)

- Envista (U.S.)

- Dentsply Sirona (U.S.)

- 3M (U.S.)

- Zimmer Biomet (U.S.)

- Henry Schein, Inc. (U.S.)

- KURARAY CO., LTD. (Japan)

- Geistlich Pharma AG (Switzerland)

- Ivoclar Vivadent (Liechtenstein)

- GC Corporation (Japan)

- Mitsui Chemicals Inc. (Japan)

- KeystoneDentalGroup (U.S.)

- BEGO GmbH and Co. KG (Germany)

- Young Innovations, Inc. (U.S.)

- Septodont Holding (France)

- Align Technology, Inc. (U.S.)

- Ultradent Products, Inc. (U.S.)

- COLTENE Group (Switzerland)

- Brasseler USA (U.S.)

- NAKANISHI INC. (Japan)

- OSSTEM IMPLANT CO., LTD. (South Korea)

- DB Orthodontics Limited (UK)

- J. MORITA CORP (Japan)

- THE YOSHIDA DENTAL MFG. CO., LTD (Japan)

- VOCO GmbH (Germany)

Latest Developments in Global Oral Care Products and Other Dental Consumables Market

- In September 2023, TePe, a leading oral health brand, announced the launch of a new dental floss made entirely from 100% recycled plastic water bottles. Each 150-metre floss roll repurposes the equivalent of two 0.5-litre plastic bottles, helping to divert waste from landfills. The product features a coating of vegetable wax and avocado oil, is packaged in a fully recyclable outer carton, and is free from PFAS ‘forever chemicals’. This launch follows the company’s earlier release of the TePe Choice toothbrush, which features a reusable wooden handle. The initiative reinforces TePe’s commitment to sustainable oral care and aligns with consumer trends, as research shows 89% of consumers prefer brands that prioritize sustainability

- In December 2023, Young Innovations, a leading global dental products supplier, announced the acquisition of Salvin Dental Specialties, a North Carolina-based company specializing in regenerative biomaterials, surgical instruments, and equipment for implant dentistry. The acquisition strengthens Young Innovations’ position as the largest implant-agnostic dental supplier in the industry. Salvin’s leadership team, including CEO William Simmons and President Greg Slayton, will continue to lead operations, while founder Bob Salvin will serve as an advisor. The move underscores Young Innovations’ commitment to expanding its presence in the oral surgery market and supporting the continued growth of Salvin’s brand, team, and customer base

- In October 2024, Haleon, a global leader in consumer health, announced a £130 million investment in a new Global Oral Health Innovation Centre in Weybridge, Surrey. Set to open in 2027, the 90,000 sq. ft. facility will house 450 employees and feature digitally enabled research labs, consumer behavior research spaces, and sustainable design targeting a ‘BREEAM Outstanding’ rating. The initiative reflects Haleon’s commitment to continuous innovation in its oral health brands such as Sensodyne, Polident/Poligrip, Aquafresh, and Corsodyl, while reinforcing the UK’s role as a global hub for life sciences and R&D

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.