Global Oral Proteins And Peptides Market

Market Size in USD Billion

CAGR :

%

USD

1.21 Billion

USD

2.61 Billion

2024

2032

USD

1.21 Billion

USD

2.61 Billion

2024

2032

| 2025 –2032 | |

| USD 1.21 Billion | |

| USD 2.61 Billion | |

|

|

|

|

Oral Proteins and Peptides Market Size

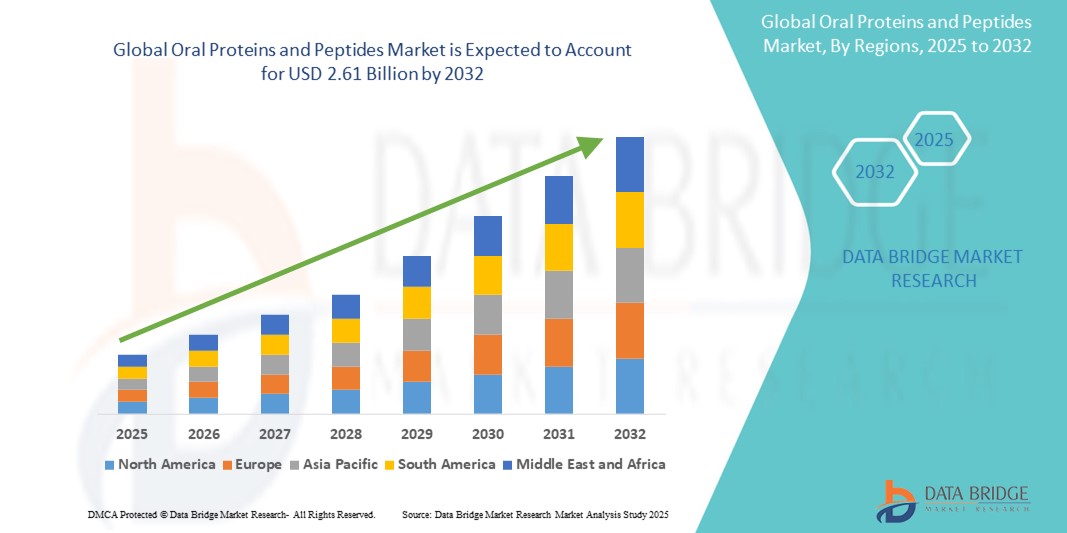

- The global oral proteins and peptides market size was valued at USD 1.21 billion in 2024 and is expected to reach USD 2.61 billion by 2032, at a CAGR of 10.12% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases such as diabetes and cancer, coupled with the growing interest in non-invasive drug delivery methods that improve patient compliance and therapeutic outcomes

- In addition, advancements in drug formulation technologies and protective delivery systems are enabling the effective oral administration of traditionally injectable proteins and peptides. These converging factors are fostering significant momentum in the adoption of oral biologics, thereby accelerating the expansion of the oral proteins and peptides industry

Oral Proteins and Peptides Market Analysis

- Oral proteins and peptides, designed for non-invasive delivery of biologics through the gastrointestinal tract, are emerging as transformative solutions in drug administration due to their potential to enhance patient adherence and eliminate the need for injections in chronic disease management

- The growing demand for oral biologics is primarily driven by increasing incidences of chronic conditions such as diabetes, hormonal disorders, and gastrointestinal diseases, coupled with technological advances in drug formulation, including enzyme inhibitors and permeation enhancers that improve bioavailability

- North America dominated the oral proteins and peptides market with the largest revenue share of 39.5% in 2024, owing to strong R&D investments, a well-established biopharmaceutical industry, and early adoption of novel drug delivery platforms, particularly in the U.S., where regulatory support and clinical trial advancements are accelerating product development

- Asia-Pacific is expected to be the fastest growing region in the oral proteins and peptides market during the forecast period due to increasing healthcare expenditure, expanding patient population, and rising awareness of advanced therapeutics

- The insulin segment dominated the oral proteins and peptides market with a market share of 46.1% in 2024, driven by the surging global diabetes burden and intensive efforts to develop patient-friendly oral insulin formulations

Report Scope and Oral Proteins and Peptides Market Segmentation

|

Attributes |

Oral Proteins and Peptides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oral Proteins and Peptides Market Trends

“Advances in Drug Delivery Technologies for Oral Biologics”

- A notable and accelerating trend in the global oral proteins and peptides market is the rapid advancement in drug delivery technologies, particularly those enabling the protection and effective absorption of biologics in the gastrointestinal tract. These innovations are making oral delivery a viable alternative to traditional injections

- For instance, Oramed Pharmaceuticals is advancing its oral insulin candidate using a protective coating and enzyme inhibitors to prevent degradation in the stomach and enhance intestinal absorption. Similarly, Rani Therapeutics has developed a robotic pill that delivers biologics by injecting them directly into the intestinal wall after sensing optimal conditions

- These cutting-edge technologies enable therapeutic proteins and peptides to bypass enzymatic breakdown and low permeability challenges in the gut, improving bioavailability and therapeutic efficacy. Such innovations are opening doors to oral alternatives for chronic diseases that require frequent dosing, including diabetes and osteoporosis

- The growing number of collaborations between biotech firms and pharmaceutical companies to co-develop and commercialize oral biologics reflects rising industry confidence. For instance, Novo Nordisk’s oral semaglutide (Rybelsus) marked a breakthrough in GLP-1 therapies, offering a precedent for further development of peptide drugs in oral form

- These innovations are reshaping patient expectations, favoring user-friendly alternatives that improve adherence and quality of life. Consequently, companies are accelerating research into oral formulations of other peptides, such as parathyroid hormone, growth hormone, and calcitonin

- The demand for effective and patient-compliant oral peptide therapies is rapidly growing, fueled by a global shift towards less invasive treatments and enhanced chronic disease management across both developed and emerging markets

Oral Proteins and Peptides Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases and Demand for Non-Invasive Therapies”

- The rising global burden of chronic diseases such as diabetes, osteoporosis, and endocrine disorders is a significant driver for the growing demand for oral proteins and peptides. Patients increasingly seek non-invasive alternatives to improve compliance and reduce injection-related discomfort

- For instance, the global diabetic population is pushing pharmaceutical companies to develop oral insulin solutions. Oramed Pharmaceuticals and Novo Nordisk are among the frontrunners exploring such options with promising clinical progress in recent years

- Oral delivery also reduces the risk of needle-stick injuries and improves the quality of life for patients requiring long-term therapy. As regulatory bodies show increased support for innovation in biologics, market players are investing heavily in formulation science and novel delivery platforms

- The convenience of oral dosing, better patient adherence, and rising awareness about advanced therapies are compelling factors accelerating the adoption of oral biologics. Healthcare systems also view oral therapies as cost-effective solutions by potentially reducing hospital visits and injection-related complications

Restraint/Challenge

“Low Bioavailability and Formulation Complexity”

- One of the major challenges restraining the growth of the oral proteins and peptides market is the low bioavailability of these molecules due to enzymatic degradation and poor permeability in the gastrointestinal tract. Unsuch as small molecules, proteins and peptides are highly susceptible to breakdown in the stomach and intestines

- For instance, early clinical trials for many oral biologics often face setbacks due to suboptimal absorption or inconsistent therapeutic effects, delaying product development and increasing costs

- To address this, companies must invest in sophisticated formulation strategies, including enteric coatings, enzyme inhibitors, and absorption enhancers, which increase R&D complexity and regulatory scrutiny. Moreover, achieving commercial-scale production of such complex formulations adds to operational costs

- While successful cases such as Rybelsus have proven market potential, replicating similar efficacy across other protein classes remains challenging. Educating prescribers and patients on the efficacy of these novel delivery systems is also crucial

- Overcoming these challenges through innovation in drug delivery, robust clinical validation, and strategic partnerships will be essential to unlocking the full potential of oral proteins and peptides in mainstream therapeutics

Oral Proteins and Peptides Market Scope

The market is segmented on the basis of drug type, application, product type, and end user.

- By Drug Type

On the basis of drug type, the oral proteins and peptides market is segmented into linaclotide, plecanatide, calcitonin, insulin, and octreotide. The insulin segment dominated the market with the largest market revenue share of 46.1% in 2024, owing to the growing global burden of diabetes and the increasing need for non-invasive alternatives to injectable insulin. Oral insulin formulations such as Oramed’s ORMD-0801 and Novo Nordisk’s Rybelsus have demonstrated significant potential in improving patient compliance and reducing injection-associated challenges. This segment continues to attract strong investment and innovation, especially in regions with high diabetes prevalence.

The linaclotide segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its widespread use in treating irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC). Its proven efficacy, once-daily oral dosing, and expanding regulatory approvals across global markets are contributing to its growing adoption.

- By Application

On the basis of application, the oral proteins and peptides market is segmented into gastric and digestive disorders, bone diseases, diabetes, and hormonal disorders. The diabetes segment accounted for the largest market share in 2024, driven by the increasing diabetic population and the unmet need for convenient oral insulin therapies. The focus on reducing injection-related complications and improving long-term glycemic control is leading to a strong push for the commercialization of oral diabetic biologics.

The gastric and digestive disorders segment is projected to grow at the fastest CAGR during the forecast period, fueled by rising awareness and diagnosis of functional gastrointestinal disorders. Drugs such as linaclotide and plecanatide are gaining traction for their role in improving digestive health without invasive procedures, further stimulating market expansion.

- By Product Type

On the basis of product type, the oral proteins and peptides market is segmented into low molecular weight iron dextran, ferric gluconate, iron sucrose, and ferric carboxyl maltose. The ferric carboxyl maltose segment dominated the market in 2024 due to its superior pharmacokinetic profile, reduced dosing frequency, and greater efficacy in treating iron deficiency-related anemia in chronic conditions. Its high stability and patient-friendly administration are driving its uptake, particularly in hospital and clinical settings.

The iron sucrose segment is anticipated to register a fastest growth through 2032, supported by its widespread use, favorable safety profile, and increasing inclusion in oral peptide combination therapies aimed at improving nutrient absorption and therapeutic outcomes.

- By End User

On the basis of end user, the oral proteins and peptides market is segmented into hospitals, pharmaceutical companies, and others. The hospital segment held the largest market revenue share in 2024, driven by the high volume of patients receiving chronic care and clinical trials for oral peptide-based therapeutics. Hospitals play a critical role in the adoption of novel delivery systems due to their access to advanced treatment protocols and support from healthcare professionals.

The pharmaceutical companies segment is projected to witness the fastest growth during the forecast period, fueled by increased R&D investments, strategic partnerships, and a focus on advancing oral biologics pipelines. The growing number of licensing agreements and innovation-led collaborations is further propelling this segment forward.

Oral Proteins and Peptides Market Regional Analysis

- North America dominated the oral proteins and peptides market with the largest revenue share of 39.5% in 2024, owing to strong R&D investments, a well-established biopharmaceutical industry, and early adoption of novel drug delivery platforms, particularly in the U.S., where regulatory support and clinical trial advancements are accelerating product development

- The region's healthcare systems are increasingly embracing non-invasive therapies to enhance patient adherence and reduce the costs associated with injectable biologics. This shift is reinforced by a supportive regulatory environment and rapid advancements in clinical research

- The high prevalence of conditions such as diabetes, digestive disorders, and osteoporosis, coupled with rising awareness about the benefits of oral biologics, continues to propel the regional demand. A technologically advanced R&D infrastructure and collaboration between academic institutions and pharmaceutical firms further strengthen North America’s leadership in this evolving market

U.S. Oral Proteins and Peptides Market Insight

The U.S. oral proteins and peptides market captured the largest revenue share of 82% in 2024 within North America, driven by a strong focus on patient-centric therapies and rapid biotechnological advancements. The country's well-established pharmaceutical infrastructure, combined with high R&D investment and supportive FDA pathways for innovative delivery systems, is fueling the adoption of oral biologics. The growing burden of chronic conditions such as diabetes and gastrointestinal disorders, along with increasing consumer preference for non-invasive treatment options, continues to propel demand for oral formulations, particularly in insulin and GLP-1 segments.

Europe Oral Proteins and Peptides Market Insight

The Europe oral proteins and peptides market is projected to expand at a substantial CAGR throughout the forecast period, supported by robust clinical research, aging populations, and rising demand for needle-free treatment solutions. Increasing regulatory approvals and adoption of advanced drug delivery platforms are driving market growth across key countries. The region’s focus on chronic disease management, especially diabetes and osteoporosis, along with government incentives for innovation in biopharmaceuticals, is accelerating the uptake of oral peptide therapies in both outpatient and clinical care settings.

U.K. Oral Proteins and Peptides Market Insight

The U.K. oral proteins and peptides market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by a progressive healthcare system, supportive regulatory environment, and strong public-private research collaborations. The increasing prevalence of digestive and metabolic disorders is creating a favorable landscape for oral biologics. The U.K.'s leadership in biotechnology innovation and focus on improving patient adherence through convenient drug formats continue to support long-term market expansion.

Germany Oral Proteins and Peptides Market Insight

The Germany oral proteins and peptides market is expected to expand at a considerable CAGR during the forecast period, driven by rising investments in pharmaceutical R&D and a strong emphasis on advanced drug delivery technologies. Germany’s aging population and rising incidence of chronic illnesses are contributing to growing demand for non-invasive, easily administrable therapies. In addition, a growing biosimilars market and increasing awareness among healthcare providers are supporting the adoption of oral peptides across clinical settings.

Asia-Pacific Oral Proteins and Peptides Market Insight

The Asia-Pacific oral proteins and peptides market is poised to grow at the fastest CAGR of 25.2% during the forecast period of 2025 to 2032, supported by rising healthcare expenditure, government initiatives in drug innovation, and expanding access to modern therapeutics. Countries such as China, Japan, and India are experiencing a surge in chronic disease cases, prompting increased demand for effective, patient-friendly treatment solutions. Local pharmaceutical companies are also increasingly collaborating with global firms to develop and commercialize oral biologics, accelerating regional market growth.

Japan Oral Proteins and Peptides Market Insight

The Japan oral proteins and peptides market is gaining momentum due to its advanced pharmaceutical sector, strong focus on patient comfort, and high prevalence of chronic diseases such as type 2 diabetes and gastrointestinal disorders. Japanese consumers and healthcare providers value innovative, non-invasive treatments, driving increased interest in oral formulations. Furthermore, robust regulatory support and technological integration with diagnostic systems and home healthcare are fostering long-term adoption of oral peptide therapies.

India Oral Proteins and Peptides Market Insight

The India oral proteins and peptides market accounted for the largest market revenue share in Asia Pacific in 2024, supported by a growing middle class, rising chronic disease burden, and a rapidly evolving pharmaceutical manufacturing base. India is emerging as a critical player in the global development and production of cost-effective oral peptide formulations. Government-led health initiatives and strong clinical trial activity across metabolic and hormonal disorders are boosting domestic consumption and export potential, making India a key growth engine for this market.

Oral Proteins and Peptides Market Share

The oral proteins and peptides industry is primarily led by well-established companies, including:

- Biocon (India)

- Diabetology Ltd. (U.K.)

- Novo Nordisk A/S (Denmark)

- Tarsa Therapeutics, Inc. (U.S.)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Theriva Biologics (U.S.)

- Hovione (Portugal)

- Novartis AG (Switzerland)

- Zydus Group (India)

- Johnson & Johnson Services, Inc. (U.S.)

- Abbott (U.S.)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- AbbVie Inc. (U.S.)

- Abeona Therapeutics Inc. (U.S.)

- Amgen Inc. (U.S.)

- Bayer AG (Germany)

What are the Recent Developments in Global Oral Proteins and Peptides Market?

- In April 2023, Oramed Pharmaceuticals Inc. announced positive top-line results from its Phase 2 clinical trial of ORMD-0801, its proprietary oral insulin candidate. The trial demonstrated meaningful reductions in fasting glucose and HbA1c levels among type 2 diabetes patients, showcasing the drug's potential as a non-invasive alternative to injectable insulin. This advancement reinforces Oramed’s commitment to transforming diabetes care through oral delivery of protein-based therapeutics and supports its continued leadership in this innovative segment

- In March 2023, Novo Nordisk reported expanded global availability of Rybelsus, the first oral GLP-1 receptor agonist for type 2 diabetes. Following regulatory approvals in Latin America and parts of Asia, the company increased its production capacity to meet growing global demand. This expansion illustrates Novo Nordisk’s strategic emphasis on accessibility and the scaling of oral peptide therapies to improve patient adherence and outcomes worldwide

- In March 2023, Rani Therapeutics unveiled advancements in its RaniPill platform, a robotic pill designed for oral delivery of biologics including peptides and antibodies. The company successfully completed a preclinical trial for octreotide, demonstrating controlled delivery and effective absorption. The development highlights Rani’s innovative approach to overcoming bioavailability challenges associated with oral protein administration and positions it at the forefront of next-generation drug delivery technologies

- In February 2023, Entera Bio Ltd. announced a research collaboration with a top-tier global pharmaceutical company to co-develop an oral parathyroid hormone (PTH) therapy for osteoporosis. The partnership leverages Entera’s proprietary technology platform for enhancing the bioavailability of large molecules via the oral route. This collaboration underscores the growing interest of major players in oral peptide development and reflects the therapeutic potential of such treatments for chronic bone-related conditions

- In January 2023, Protagonist Therapeutics achieved a clinical milestone with the initiation of a Phase 2 trial for PTG-300, an oral hepcidin mimetic targeting rare blood disorders such as polycythemia vera. This development represents a significant step in broadening the clinical utility of orally administered peptides in hematologic diseases and exemplifies the expanding scope of the oral peptide market beyond metabolic and gastrointestinal applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.