Global Organic Chocolate And Confectionery Market

Market Size in USD Billion

CAGR :

%

USD

1.39 Billion

USD

1.83 Billion

2024

2032

USD

1.39 Billion

USD

1.83 Billion

2024

2032

| 2025 –2032 | |

| USD 1.39 Billion | |

| USD 1.83 Billion | |

|

|

|

|

Organic Chocolate and Confectionery Market Size

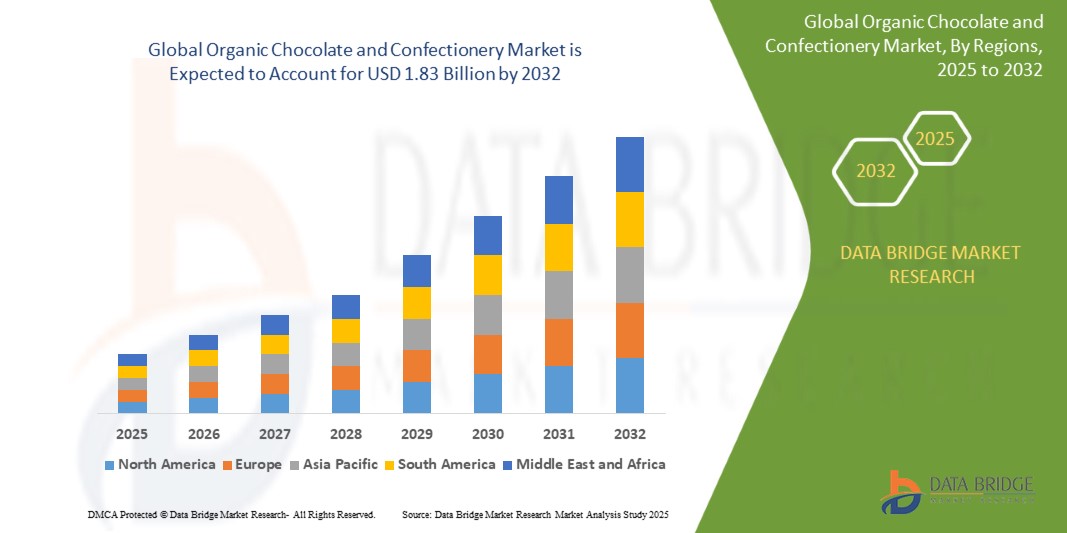

- The global organic chocolate and confectionery market size was valued at USD 1.39 billion in 2024 and is expected to reach USD 1.83 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by increasing consumer awareness surrounding health, wellness, and clean-label products, driving demand for organic chocolate and confectionery items that are free from artificial additives, GMOs, and synthetic pesticides

- Furthermore, rising interest in ethical consumption, sustainable sourcing, and premium indulgence is establishing organic chocolates as a preferred choice among health-conscious and environmentally aware consumers. These converging factors are accelerating the expansion of the organic confectionery segment, thereby significantly boosting the industry's growth

Organic Chocolate and Confectionery Market Analysis

- Organic chocolates and confections are produced using certified organic ingredients that avoid synthetic fertilizers, chemical processing, and genetically modified organisms. These products are positioned as healthier and more sustainable alternatives to conventional treats, appealing to consumers seeking both indulgence and nutritional value

- The escalating demand for organic chocolate is primarily driven by rising disposable incomes, shifting dietary preferences, growing retail availability, and increased product innovation in flavors, textures, and formats across global markets

- North America dominated the organic chocolate and confectionery market with a share of 36.6% in 2024, due to increasing consumer awareness of health, sustainability, and ethical sourcing in food choices

- Asia-Pacific is expected to be the fastest growing region in the organic chocolate and confectionery market with a share of during the forecast period due to rising urbanization, increasing disposable incomes, and growing consumer exposure to global health and wellness trends

- Premium segment dominated the market with a market share of 47.4% in 2024, due to rising consumer preference for high-quality, ethically sourced, and artisanal chocolate products that align with health, sustainability, and indulgence trends. Premium offerings often emphasize organic certifications, bean-to-bar transparency, and unique flavor profiles, which appeal to affluent and health-conscious consumers seeking elevated chocolate experiences

Report Scope and Organic Chocolate and Confectionery Market Segmentation

|

Attributes |

Organic Chocolate and Confectionery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Chocolate and Confectionery Market Trends

“Increasing Health Consciousness”

- The organic chocolate and confectionery market is expanding rapidly as consumers become more health-conscious and seek out indulgent treats with clean-label, all-natural ingredients. Shoppers are actively avoiding artificial sweeteners, preservatives, GMOs, and synthetic additives in favor of products that emphasize purity and transparency

- For instance, such as Alter Eco, Green & Black’s, and Theo Chocolate have experienced significant growth in sales due to their focus on organic, fair-trade certified, and minimally processed ingredients. These brands cater to a rising base of consumers who prioritize wellness even in confectionery consumption

- Consumer demand is shifting toward dark chocolate, vegan formulations, and sugar-free organic candies, perceived as healthier yet satisfying alternatives to traditional sweets

- Growing interest in functional ingredients—such as superfoods, plant-based proteins, and adaptogens—is shaping innovation in organic confectionery, with brands introducing products that combine indulgence with health benefits

- Digital platforms, health influencers, and wellness blogs are playing a major role in elevating the visibility of organic chocolate and sweets, especially among Millennials and Gen Z consumers

- Packaging sustainability is also trending, with organic brands increasingly adopting compostable, plastic-free, or recyclable materials to appeal to environmentally conscious buyers

Organic Chocolate and Confectionery Market Dynamics

Driver

“Rising Organic Food Trends”

- Rising global demand for organic food products is directly driving momentum in the organic chocolate and confectionery category, reflecting broader consumer shifts toward clean eating, ethical sourcing, and sustainability

- For instance, Endangered Species Chocolate and Hu Kitchen have capitalized on these trends by offering a wide range of organic chocolates free from refined sugar, dairy, and emulsifiers—positioned as both premium and health-focused treats

- The influence of farm-to-table and ethical consumerism movements has made organic certifications a market necessity, encouraging innovation in organic supply chains, especially for cacao, dairy substitutes, and natural sweeteners

- Retail shelves and e-commerce platforms are dedicating more space to organic confections, with many supermarkets and health-food chains curating organic-only candy sections or private-label organic chocolate lines

- The market is expanding beyond traditional chocolates into organic gummies, caramels, protein bars, and seasonal products, offering diverse options to health-minded consumers

Restraint/Challenge

“Higher Production Costs”

- Producing organic chocolate and confectionery involves higher input and certification costs due to the use of premium, ethically sourced, and chemical-free ingredients, along with strict adherence to organic farming standards

- For instance, companies such as Theo Chocolate and Taza Chocolate often pay higher procurement fees for organic, fair-trade cacao and face costlier production due to the small-batch, non-industrial nature of their operations

- Limited organic supply chains, lower crop yields, and dependency on specific regions (e.g., Latin America and West Africa for cacao) contribute to cost pressures and seasonal fluctuations in pricing

- Organic certification and compliance also increase technical costs related to audits, labeling, and traceability, deterring smaller players and slowing broader market accessibility

- Consequently, organic chocolates and candies are often priced at a premium, which may restrict adoption in price-sensitive markets or among cost-conscious consumers despite their growing interest

Organic Chocolate and Confectionery Market Scope

The market is segmented on the basis of product, type, distribution channel, and category.

• By Product

On the basis of product, the organic chocolate and confectionery market is segmented into boxed, moulded bars, chips and bites, and truffles and cups. The moulded bars segment dominated the largest market revenue share in 2024, owing to their high consumer preference for portion-controlled formats and ease of portability. These bars are often perceived as a convenient, healthier indulgence compared to conventional snacks, with many brands emphasizing clean-label ingredients and ethical sourcing. Their extensive availability across both premium and everyday product lines also supports broader market penetration, especially among health-conscious and eco-aware consumers.

The chips and bites segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for snackable and resealable confectionery formats. This growth is supported by increasing consumer interest in on-the-go and functional snacking options that combine indulgence with organic certifications. The versatility of chocolate chips and bites, especially in baking, snacking, and gifting, contributes to expanding product innovation and wider adoption.

• By Type

On the basis of type, the market is segmented into dark, white, milk, and others. The dark chocolate segment captured the largest revenue share in 2024, primarily due to its perceived health benefits and high cocoa content, which align with rising consumer demand for low-sugar, antioxidant-rich indulgences. Dark chocolate also appeals strongly to ethically motivated buyers who prioritize Fairtrade and organic certifications, further enhancing its market dominance.

The milk chocolate segment is expected to register the fastest CAGR from 2025 to 2032, as brands focus on reformulating traditional milk chocolates using organic dairy and plant-based alternatives. The smoother taste profile of milk chocolate continues to attract a broad demographic, including younger consumers and families, while the incorporation of organic ingredients helps cater to health and sustainability trends.

• By Distribution Channel

On the basis of distribution channel, the market is categorized into store-based and non-store based. The store-based segment held the largest revenue share in 2024, driven by the trust and sensory experience consumers associate with physical retail purchases, especially in premium confectionery. Specialty organic stores, supermarkets, and gourmet outlets allow brands to showcase the quality and story behind their products, reinforcing brand loyalty and impulse purchases.

The non-store based segment is projected to experience the fastest growth rate from 2025 to 2032, supported by the accelerating shift toward e-commerce and direct-to-consumer platforms. The convenience of online shopping, paired with increasing digital marketing efforts and subscription models, is making organic chocolate more accessible across urban and semi-urban regions. Online channels also enable smaller, niche brands to scale rapidly and tap into a broader customer base.

• By Category

On the basis of category, the market is segmented into premium, seasonal, and every day. The premium segment dominated the market revenue share of 47.4% in 2024, driven by rising consumer preference for high-quality, ethically sourced, and artisanal chocolate products that align with health, sustainability, and indulgence trends. Premium offerings often emphasize organic certifications, bean-to-bar transparency, and unique flavor profiles, which appeal to affluent and health-conscious consumers seeking elevated chocolate experiences.

The seasonal segment is expected to witness the fastest growth from 2025 to 2032, fueled by heightened consumer demand during festivals and celebrations. Organic seasonal confections are gaining popularity for gifting due to their perceived quality and health-conscious appeal. Brand innovations around festive themes, limited-time flavors, and eco-friendly presentation further boost segment growth, particularly in North America and Europe.

Organic Chocolate and Confectionery Market Regional Analysis

- North America dominated the organic chocolate and confectionery market with the largest revenue share of 36.6% in 2024, driven by increasing consumer awareness of health, sustainability, and ethical sourcing in food choices

- Consumers in the region are drawn to organic chocolates that are free from artificial ingredients, non-GMO, and certified by USDA Organic, with rising demand for plant-based and clean-label confections

- The strong retail infrastructure, high per capita confectionery consumption, and willingness to pay a premium for quality products contribute to widespread adoption across various age groups

U.S. Organic Chocolate and Confectionery Market Insight

The U.S. accounted for the largest share within the North American market in 2024, fueled by a strong preference for high-quality, ethically sourced chocolate products. Consumers in the U.S. are increasingly leaning toward premium and functional chocolate products that support health, such as dark chocolates rich in antioxidants or confections with added nutrients. The presence of a wide variety of organic product offerings across grocery chains, natural food stores, and e-commerce platforms has enabled broader market accessibility. Seasonal demand for premium gifting, along with the growing influence of social media and celebrity endorsements for clean eating, continues to push demand higher in both urban and suburban markets.

Europe Organic Chocolate and Confectionery Market Insight

The Europe market is expected to expand steadily over the forecast period, driven by strong demand for ethical, sustainable, and premium food products. European consumers are highly receptive to organic certification and Fairtrade labeling, with many showing a clear preference for chocolate brands that provide traceability and environmental responsibility. Countries across Western Europe, in particular, are witnessing rising demand for low-sugar, dairy-free, and vegan chocolate options, driven by lifestyle shifts and rising food sensitivities. Growth is also supported by innovation in flavors and packaging, as well as increasing availability in both specialty and mainstream retail outlets. Regulatory frameworks that promote organic farming and sustainability further reinforce consumer confidence and brand value in the region.

U.K. Organic Chocolate and Confectionery Market Insight

The U.K. market is projected to grow at a significant pace, driven by a rising inclination toward health-conscious eating and increased awareness around ethical consumption. Consumers in the U.K. are actively seeking chocolates that reflect clean ingredient profiles, ethical cocoa sourcing, and eco-friendly packaging. The organic chocolate trend is especially strong among younger consumers and urban populations who prioritize transparency and quality. The country's well-developed e-commerce infrastructure and retail partnerships have enabled quick market penetration for niche and premium organic chocolate brands. Demand continues to grow during festive seasons and special occasions, where premium organic chocolates are preferred for gifting.

Germany Organic Chocolate and Confectionery Market Insight

Germany is expected to remain a key market in Europe for organic chocolate and confectionery due to its deeply rooted organic food culture and consumer focus on environmental and health values. German consumers place a high priority on the origin, purity, and ethical credentials of food products. Organic chocolates that feature recyclable packaging, single-origin cocoa, and minimal processing are particularly popular. The country’s strong support for organic farming practices and eco-conscious retailing has created a favorable environment for both domestic and international organic confectionery brands. With growing innovation in product formats and flavors, the German market continues to expand across both the premium and everyday consumption segments.

Asia-Pacific Organic Chocolate and Confectionery Market Insight

Asia-Pacific is poised to grow at the fastest CAGR between 2025 and 2032, fueled by rising urbanization, increasing disposable incomes, and growing consumer exposure to global health and wellness trends. Consumers across China, Japan, India, and Southeast Asia are showing growing interest in organic and clean-label food products, especially within urban and digitally connected populations. As western eating habits gain popularity, premium and organic chocolate products are entering both traditional retail and online platforms at a rapid pace. The influence of food influencers, social media, and wellness-focused marketing is also playing a crucial role in shaping consumer preferences. Local manufacturers are increasingly exploring organic certifications and sustainable sourcing practices to tap into this expanding opportunity.

Japan Organic Chocolate and Confectionery Market Insight

The Japan market is gaining momentum due to its focus on quality, safety, and functionality in food products. Consumers in Japan favor high-end, health-enhancing confections such as organic dark chocolate with added antioxidants or unique flavor infusions. The aging population is particularly drawn to products that offer both indulgence and wellness benefits, creating opportunities for functional organic confections. The minimalist design, premium packaging, and limited-edition nature of many imported and domestic organic chocolate products align well with Japanese consumer preferences. Moreover, the growing smart retail ecosystem and strong culture of seasonal and gift-based purchases are helping boost market traction across the country.

China Organic Chocolate and Confectionery Market Insight

China held the largest revenue share within Asia-Pacific in 2024, supported by its large consumer base, expanding middle class, and growing demand for high-quality food products. Chinese consumers are increasingly turning toward organic and premium chocolate products as part of a broader shift toward healthier, safer, and more transparent food choices. The market is further driven by the popularity of online shopping festivals and increasing penetration of premium and imported brands through cross-border e-commerce. As awareness around food safety, sustainability, and health grows, domestic brands are also entering the organic chocolate segment, making these products more accessible and affordable to a broader demographic.

Organic Chocolate and Confectionery Market Share

The organic chocolate and confectionery industry is primarily led by well-established companies, including:

- Artisan Confections (U.S.)

- Green & Black's (U.K.)

- Taza Chocolate (U.S.)

- nibbed (U.S.)

- PASCHA CHOCOLATE CO (U.S.)

- Theo Chocolate, Inc. (U.S.)

- Rococo Chocolates London Limited (U.K.)

- Born Organic (Australia)

- Original Beans (Netherlands)

- DOISY AND DAM (U.K.)

- Lake Champlain Chocolates (U.S.)

- Love Cocoa (U.K.)

- Daylesford Organic Limited. (U.K.)

- K'UL CHOCOLATE (U.S.)

- Seed & Bean (U.K.)

- Alter Eco Foods (U.S.)

- Equal Exchange (U.S.)

Latest Developments in Global Organic Chocolate and Confectionery Market

- In April 2025, organic snacking brand Biona introduced a new line of chocolate-covered fruit and nut snacks, expanding its footprint in the organic indulgence category. This product launch reflects the growing consumer demand for clean-label, better-for-you confectionery options. By combining organic certification with familiar snacking formats, Biona aims to capture health-conscious consumers seeking functional yet indulgent treats, thereby supporting the market’s shift toward premium, natural, and on-the-go chocolate-based offerings

- In October 2024, Nurture Brands announced the acquisition of its plant-based chocolate brand Doisy & Dam by Food Thoughts, a company known for its fair-trade cocoa offerings. This strategic move is expected to strengthen Food Thoughts’ position in the ethical and organic confectionery market by broadening its product range beyond baking ingredients into ready-to-eat snacking. With Doisy & Dam’s presence across major U.K. retailers, the acquisition is likely to enhance product accessibility and brand visibility, accelerating growth in the sustainable plant-based chocolate segment

- In January 2023, NUTSLA launched the DT Organic Dark Chocolate bar, a vegan and paleo-friendly option made with up to six simple, organic ingredients and no added sugar. Available in Almond Crunch, Cashew Butter, and Peanut Butter flavors, these bars cater to health-conscious consumers looking for pure, straightforward indulgence

- In August 2022, Hu Kitchen, renowned for its vegan chocolates, expanded its product line by introducing dairy milk chocolates sourced from grass-fed cows. This new range emphasizes a “grass-fed” label, showcasing Hu Kitchen’s commitment to high-quality, ethical dairy ingredients while maintaining its reputation as a leading vegan chocolate brand

- In September 2022, Theobroma Chocolat, an established Canadian company known for organic chocolate, unveiled Yummy Zero Sugar—a plant-based, sugar-free organic chocolate. This innovative product reflects Theobroma’s commitment to social manufacturing and sustainable practices, offering consumers a healthier alternative while staying true to its organic and ethical roots

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Chocolate And Confectionery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Chocolate And Confectionery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Chocolate And Confectionery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.