Global Organic Poultry Feed Market

Market Size in USD Million

CAGR :

%

USD

812.20 Million

USD

1,181.82 Million

2024

2032

USD

812.20 Million

USD

1,181.82 Million

2024

2032

| 2025 –2032 | |

| USD 812.20 Million | |

| USD 1,181.82 Million | |

|

|

|

|

What is the Global Organic Poultry Feed Market Size and Growth Rate?

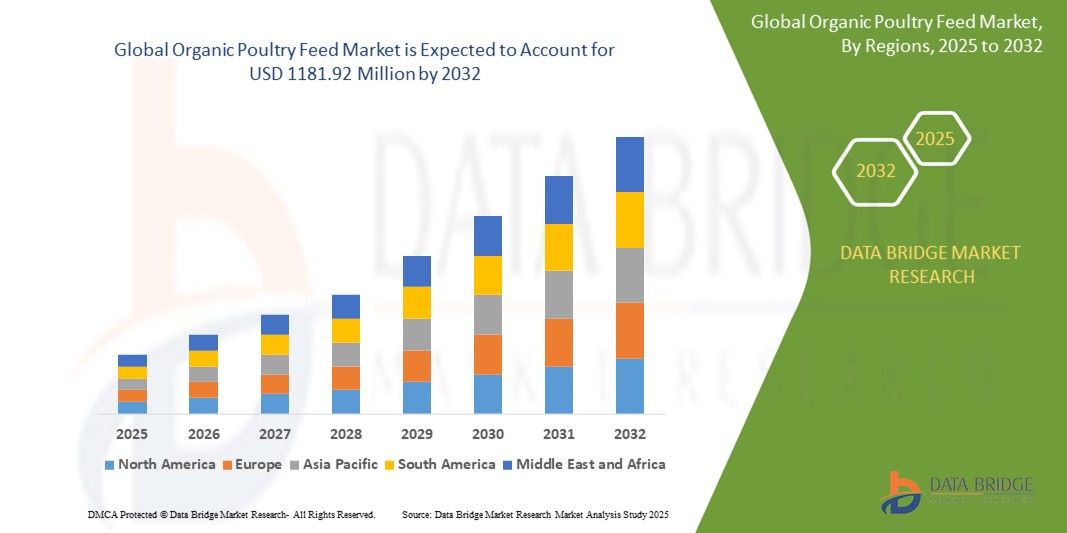

- The global organic poultry feed market size was valued at USD 812.20 million in 2024 and is expected to reach USD 1181.82 million by 2032, at a CAGR of 4.80% during the forecast period

- The global organic poultry feed market is experiencing a surge fueled by increasing consumer demand for healthier, sustainable options. Regulatory standards emphasizing organic farming practices further boost market growth, instilling consumer confidence

- However, challenges loom, notably the higher production costs associated with organic poultry feed and the limited availability of organic feed ingredients, impacting consistent production. Despite these hurdles, opportunities arise through expanding retail channels and the global proliferation of organic farming

What are the Major Takeaways of Organic Poultry Feed Market?

- Increasing consumer awareness and preferences for organic and sustainable food products have been a significant driver for the global organic poultry feed market. Consumers are seeking healthier options, free from synthetic additives and genetically modified organisms, driving demand for organic poultry products

- North America dominated the organic poultry feed market with the largest revenue share of 37.01% in 2024, driven by the rising demand for organic, antibiotic-free poultry products and increasing consumer awareness regarding animal welfare and sustainable farming practices

- Asia-Pacific organic poultry feed market is poised to grow at the fastest CAGR of 14.56% during the forecast period from 2025 to 2032, driven by rapid urbanization, rising incomes, and growing consumer awareness of food safety and organic products in countries such as China, India, and Japan

- The Broilers segment dominated the organic poultry feed market with the largest market revenue share of 48.6% in 2024, driven by the rising global demand for organic poultry meat, particularly in North America and Europe

Report Scope and Organic Poultry Feed Market Segmentation

|

Attributes |

Organic Poultry Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Organic Poultry Feed Market?

“Rising Demand for Sustainable and Functional Nutrition”

- A significant and accelerating trend in the global organic poultry feed market is the increasing emphasis on sustainable, functional, and health-focused nutrition for poultry. As consumers demand organic, antibiotic-free, and ethically raised poultry products, the feed industry is rapidly evolving to meet these expectations

- For instance, leading manufacturers such as Cargill and Nutreco are investing heavily in the development of organic feed formulations enriched with probiotics, essential oils, and plant-based additives to promote animal health naturally and reduce dependency on synthetic additives or antibiotics

- These innovative feed solutions aim to enhance immunity, growth performance, and feed conversion efficiency, ensuring that poultry raised on organic farms meets the highest welfare and quality standards. For instance, Alltech’s organic mineral programs focus on improving nutrient absorption and overall flock health, aligning with organic farming principles

- The trend also reflects broader sustainability goals, with organic poultry feed often incorporating non-GMO grains, locally sourced ingredients, and regenerative agriculture practices to minimize environmental impact

- Companies such as De Heus Animal Nutrition and ForFarmers are introducing certified organic feed lines that align with these values, supporting the growing demand for traceable, eco-friendly poultry products

- This shift towards nutrient-dense, functional organic feeds is reshaping industry expectations and positioning organic poultry as a premium, health-conscious choice in both developed and emerging markets

What are the Key Drivers of Organic Poultry Feed Market?

- The rising consumer preference for organic, chemical-free poultry products, driven by health concerns, animal welfare awareness, and environmental considerations, is a major factor fueling the growth of the organic poultry feed market

- For instance, in January 2024, Chr. Hansen Holding A/S launched an organic probiotic additive designed specifically for poultry, supporting gut health and reducing the need for antibiotics, marking a significant advancement in organic feed technology

- Growing regulatory support for organic farming practices, including government subsidies and stricter labeling standards, is encouraging more poultry producers to transition towards certified organic operations, thereby boosting feed demand

- In addition, heightened awareness regarding antibiotic resistance and consumer demand for cleaner, traceable food chains are accelerating the shift towards organic poultry production, with feed suppliers developing specialized solutions to meet organic certification requirements

- The expansion of organic retail markets, particularly in North America, Europe, and parts of Asia-Pacific, coupled with premium pricing for organic poultry, creates strong economic incentives for farmers to adopt organic feed solutions

Which Factor is challenging the Growth of the Organic Poultry Feed Market?

- The high production cost and limited raw material availability of certified organic feed ingredients present a significant challenge to market expansion, especially in developing regions where conventional feed remains more affordable and accessible

- For instance, fluctuations in the supply of organic grains, coupled with stricter sourcing standards, often result in higher prices for organic poultry feed compared to conventional alternatives, limiting adoption among cost-sensitive farmers

- Organic feed formulations must comply with rigorous certification standards, which can increase production complexity and operational costs for feed manufacturers, creating barriers for smaller players or new market entrants

- Furthermore, the relative scarcity of certified organic land for crop cultivation constrains the raw material pipeline, particularly for key ingredients such as organic soy, maize, and oilseeds, which are essential for high-performance poultry diets

- While large producers such as BASF SE and DSM are innovating to develop more efficient organic feed additives, bridging the gap between cost and performance remains an ongoing challenge. Overcoming these limitations through expanded organic agriculture, supply chain optimization, and ingredient innovation is crucial for ensuring the sustained growth of the organic poultry feed market

How is the Organic Poultry Feed Market Segmented?

The market is segmented on the basis of animal type, ingredients, supplements, additives, and distribution channel.

- By Animal Type

On the basis of animal type, the organic poultry feed market is segmented into Broilers, Layers, Turkeys, and Others. The Broilers segment dominated the Organic Poultry Feed market with the largest market revenue share of 48.6% in 2024, driven by the rising global demand for organic poultry meat, particularly in North America and Europe. Broiler producers are increasingly adopting organic feed to meet consumer preferences for antibiotic-free and naturally raised poultry, with organic certification boosting the market value of the end product.

The Layers segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the surging demand for organic eggs across retail and foodservice industries. Organic feed for layers enhances egg quality, promotes animal welfare, and aligns with stringent organic farming standards, making it a crucial component for certified organic egg production.

- By Ingredients

On the basis of ingredients, the organic poultry feed market is segmented into Cereals & Grains, Oilseeds, Pulses, and Others. The Cereals & Grains segment held the largest market revenue share in 2024, supported by the widespread use of organic maize, wheat, and barley as primary energy sources in poultry diets. Cereals & grains provide essential carbohydrates and are preferred by producers for their availability and nutritional benefits.

The Oilseeds segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising inclusion of organic soybean meal and other oilseed products, valued for their high protein content essential for poultry growth and productivity. The shift towards protein-rich feed formulations to meet performance standards is boosting oilseed demand.

- By Supplement

On the basis of supplement, the organic poultry feed market is segmented into Vitamins, Amino Acids, Antibiotics, Enzymes, Anti-Oxidants, Acidifiers, Probiotics & Prebiotics, and Other Supplements. The Probiotics & Prebiotics segment dominated the market with the largest revenue share of 28.3% in 2024, owing to their role in enhancing gut health, immunity, and nutrient absorption, particularly under organic farming conditions where antibiotic use is restricted.

The Enzymes segment is projected to witness the fastest CAGR from 2025 to 2032, as organic poultry producers seek to improve feed efficiency and optimize nutrient utilization through enzyme supplementation, which reduces feed costs and supports sustainable production.

- By Additives

On the basis of additives, the organic poultry feed market is segmented into Amino Acids, Enzymes, Vitamins, Minerals, and Phytogenics. The Vitamins segment accounted for the largest market revenue share in 2024, driven by their essential role in maintaining poultry health, enhancing growth rates, and improving egg production, especially in organically raised flocks.

The Phytogenics segment is anticipated to grow at the fastest rate from 2025 to 2032, reflecting increased adoption of plant-based additives such as essential oils and herbal extracts to naturally promote poultry performance, immunity, and disease resistance in line with organic farming principles.

- By Distribution Channel

On the basis of distribution channel, the organic poultry feed market is segmented into Supermarkets/Hypermarkets, Specialty Stores, and Online. The Supermarkets/Hypermarkets segment dominated the market with the largest revenue share of 41.7% in 2024, attributed to their wide product availability, competitive pricing, and consumer preference for purchasing certified organic feed from trusted, established retail chains.

The Online segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing trend of e-commerce, offering convenience, product variety, and doorstep delivery. Online platforms enable small-scale organic farmers and backyard poultry keepers to access premium feed products, expanding market reach.

Which Region Holds the Largest Share of the Organic Poultry Feed Maret?

- North America dominated the organic poultry feed market with the largest revenue share of 37.01% in 2024, driven by the rising demand for organic, antibiotic-free poultry products and increasing consumer awareness regarding animal welfare and sustainable farming practices

- The region benefits from a well-established organic farming infrastructure, favorable regulatory environment, and strong consumer demand for premium, health-focused food products, including organic poultry raised on certified feed

- The U.S. and Canada are witnessing steady expansion in organic poultry production, with feed manufacturers introducing innovative, nutrient-rich organic formulations to meet the growing demand for high-quality poultry products

U.S. Organic Poultry Feed Market Insight

U.S. organic poultry feed market captured the largest revenue share in 2024 within North America, fueled by the country's leadership in organic agriculture and the strong consumer preference for naturally raised poultry. The growing popularity of organic chicken and eggs, supported by retail giants and foodservice providers offering certified organic options, is driving feed demand. Moreover, regulatory support for organic labeling, coupled with rising health consciousness, continues to propel the Organic Poultry Feed industry in the U.S.

Europe Organic Poultry Feed Market Insight

The Europe organic poultry feed market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent organic farming regulations, growing consumer demand for ethically sourced food, and heightened awareness of environmental sustainability. Countries such as Germany, France, and the U.K. are at the forefront of organic poultry production, supported by government initiatives promoting sustainable agriculture. The region is experiencing increased adoption of organic poultry feed across both small-scale farms and large commercial operations, contributing to market growth.

U.K. Organic Poultry Feed Market Insight

The U.K. organic poultry feed market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising demand for organic meat and eggs, as well as consumer preference for higher welfare standards in poultry production. The country's robust retail infrastructure and growing availability of certified organic products, both in supermarkets and through direct farm sales, are accelerating the adoption of organic poultry feed. In addition, sustainability-conscious consumers continue to drive market momentum.

Germany Organic Poultry Feed Market Insight

The Germany organic poultry feed market is expected to expand at a considerable CAGR during the forecast period, supported by strong consumer interest in organic food, animal welfare, and environmentally friendly farming practices. Germany's mature organic market, combined with increasing innovation in organic feed formulations focusing on animal health and performance, is encouraging broader adoption among poultry producers. Furthermore, the country's emphasis on reducing antibiotic use in livestock reinforces demand for high-quality organic feed solutions.

Which Region is the Fastest Growing Region in the Organic Poultry Feed Market?

Asia-Pacific organic poultry feed market is poised to grow at the fastest CAGR of 14.56% during the forecast period from 2025 to 2032, driven by rapid urbanization, rising incomes, and growing consumer awareness of food safety and organic products in countries such as China, India, and Japan. The region’s expanding organic poultry sector, coupled with government policies supporting organic agriculture, is accelerating demand for certified feed. Moreover, increasing middle-class populations and changing dietary preferences towards healthier protein sources are fueling market growth.

Japan Organic Poultry Feed Market Insight

The Japan organic poultry feed market is gaining momentum due to the country's emphasis on food quality, health, and sustainability. Rising demand for organic poultry, supported by strict food safety regulations and consumer preference for clean-label products, is driving the adoption of organic feed. In addition, Japan's aging farming workforce and focus on technological innovation are encouraging the development of efficient, high-performance organic feed solutions to support domestic poultry production.

China Organic Poultry Feed Market Insight

The China organic poultry feed market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid urbanization, expanding disposable incomes, and growing consumer demand for safe, organic food products. The government’s emphasis on food safety and environmental sustainability, alongside the increasing popularity of organic meat and eggs, is driving significant investments in organic poultry production and feed development. Domestic feed manufacturers are introducing cost-effective, nutrient-rich organic feed options to meet the rising market demand.

Which are the Top Companies in Organic Poultry Feed Market?

The organic poultry feed industry is primarily led by well-established companies, including:

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (U.S.)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Cargill, Incorporated (U.S.)

- Nutreco (Netherlands)

- ForFarmers (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch and Peck Feeds (U.S.)

What are the Recent Developments in Global Organic Poultry Feed Market?

- In October 2021, Cargill introduced its Nutrena NatureWise poultry feeds enriched with essential oils, representing a significant advancement in the global organic poultry feed sector. The product line aims to improve the overall health, productivity, and well-being of backyard chickens by enhancing egg weight, size, and production, while offering better feed palatability and a fresher coop environment. This initiative highlights the growing industry trend toward natural, wellness-focused feed solutions

- In May 2021, Charoen Pokphand Group announced a strategic collaboration with Plug and Play, the world’s leading innovation platform for industry accelerators, based in Silicon Valley. Through this partnership, C.P. Group intends to drive innovation across its business operations, support sustainable enterprise development, and create positive impacts on global communities. This move reflects the company's long-term commitment to sustainability and innovation-driven growth

- In February 2021, Kemin Industries expanded its portfolio by launching KemTRACE® Chromium-OR, an organic-compliant chromium propionate feed additive designed for swine, cattle, broiler, and horse diets. The supplement supports improved immunity, growth, reproduction, and overall maintenance of animals, while meeting organic farming standards. This product introduction emphasizes Kemin’s dedication to enhancing animal nutrition through compliant and effective solutions

- In January 2020, MileFour, a U.S.-based e-commerce company, launched a subscription-based organic chicken feed service targeting the growing backyard poultry segment. The service simplifies feed purchasing by offering convenient home delivery of high-quality organic poultry feed. This innovation reflects the increasing demand for hassle-free, reliable feed options among small-scale poultry owners

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.