Global Organic Soy Protein Market

Market Size in USD Billion

CAGR :

%

USD

803.50 Billion

USD

2,840.82 Billion

2024

2032

USD

803.50 Billion

USD

2,840.82 Billion

2024

2032

| 2025 –2032 | |

| USD 803.50 Billion | |

| USD 2,840.82 Billion | |

|

|

|

|

Organic Soy Protein Market Size

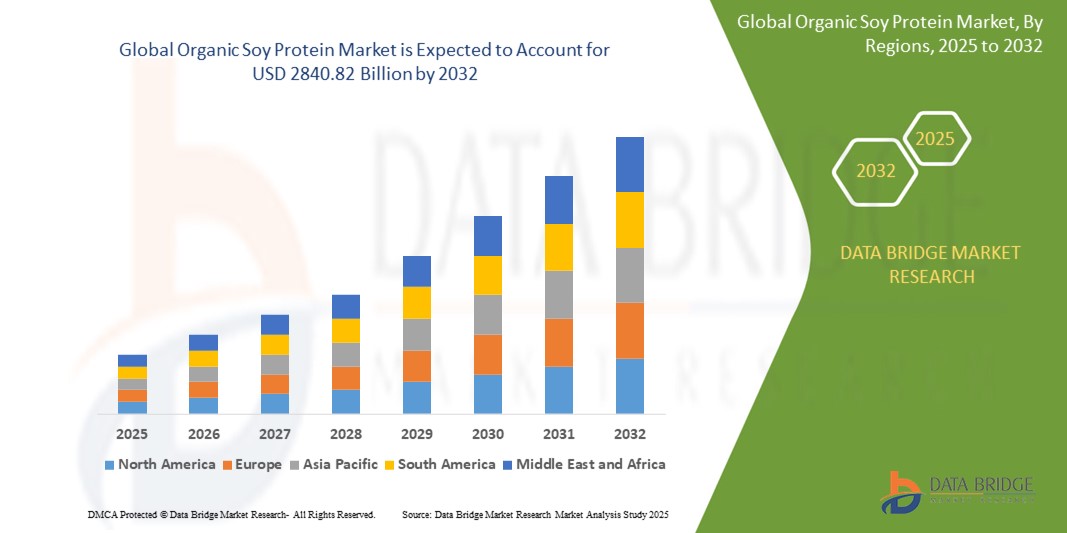

- The global organic soy protein market size was valued at USD 803.50 billion in 2024 and is expected to reach USD 2840.82 billion by 2032, at a CAGR of 17.10% during the forecast period

- The market growth is largely fuelled by the increasing consumer shift toward plant-based nutrition, rising demand for clean-label food products, and growing awareness about the health and environmental benefits of organic soy protein

- The market growth is also supported by expanding applications in functional foods, dietary supplements, and infant nutrition, along with favorable government policies promoting organic farming and non-GMO ingredients

Organic Soy Protein Market Analysis

- The organic soy protein market is experiencing steady growth as consumers increasingly choose plant-based protein sources over animal-derived options for health and ethical reasons

- This shift is encouraging food manufacturers to expand their product portfolios with organic soy-based alternatives across various categories

- North America dominated the organic soy protein market with the largest revenue share in 2024, driven by rising demand for plant-based nutrition and clean-label food products

- Asia-Pacific region is expected to witness the highest growth rate in the global organic soy protein market, driven by rising health awareness, rapid urbanization, and increasing demand for plant-based dietary products across emerging economies such as China, India, and Southeast Asia

- The concentrates segment held the largest market revenue share in 2024, owing to its wide usage in functional foods and beverages due to its balanced nutritional profile and cost-effectiveness. It is commonly incorporated into dairy alternatives and meat substitute products to enhance protein content without altering taste significantly. The increasing preference for clean-label and plant-based nutrition is also boosting the demand for soy protein concentrates across various food categories

Report Scope and Organic Soy Protein Market Segmentation

|

Attributes |

Organic Soy Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Plant-Based Protein in Emerging Markets with Rising Health Awareness • Expansion of Organic Soy Protein Applications in Sports Nutrition and Functional Beverages |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Soy Protein Market Trends

“Rising Demand for Clean-Label and Functional Plant-Based Products”

- Clean-label ingredients are now a top priority for health-conscious consumers who prefer organic, non-GMO, and additive-free products, as seen in brands such as Orgain launching soy-based vegan protein shakes targeting clean eating habits

- Manufacturers are innovating with soy-based offerings that deliver added nutritional value and wellness support, including formulations aimed at muscle recovery and heart health

- Organic soy protein is gaining traction in functional snacks such as high-protein energy bars, with instance such as GoMacro incorporating soy protein for a plant-based energy boost

- Protein powders using soy protein isolate are increasingly popular among fitness enthusiasts due to their complete amino acid profile and plant-based appeal

- Companies are actively promoting organic soy protein with digestive and immunity-enhancing claims, helping products stand out in competitive wellness and health food segments

Organic Soy Protein Market Dynamics

Driver

“Surge in Plant-Based Nutrition and Clean Eating Trends”

- Growing global interest in vegetarian, vegan, and flexitarian diets is pushing demand for organic soy protein as a healthier and ethical alternative to animal-based proteins

- Organic soy protein is gaining popularity due to its complete amino acid profile, making it ideal for fitness enthusiasts, athletes, and individuals with chronic health concerns

- Clean-label demand is increasing, with consumers seeking non-GMO, additive-free, and sustainably sourced soy products; for instance, Garden of Life offers certified organic soy protein shakes that align with these preferences

- Major brands are expanding their product ranges to include soy-based protein powders, meat substitutes, and ready-to-drink options to capture the growing market

- Influencers, wellness campaigns, and platforms such as Instagram and YouTube are playing a vital role in promoting plant-based lifestyles, encouraging wider adoption of organic soy protein across all age groups

Restraint/Challenge

“Allergen Concerns and Consumer Perceptions”

- Soy is a recognized allergen, and even organic soy protein can pose risks for sensitive individuals, leading many brands to diversify with alternatives such as pea or hemp protein

- Misconceptions about soy’s phytoestrogen content, such as fears of hormonal imbalance or thyroid issues, discourage consumers despite evidence supporting its safety in moderation

- In some markets, distrust stemming from genetically modified soy cultivation negatively affects the perception of all soy products, including certified organic variants

- Taste and texture concerns, such as a beany aftertaste in protein powders or bars, create challenges in product formulation and consumer satisfaction; companies are working on improved flavor profiles to address this

- Variability in global regulations and labeling standards makes it difficult for international brands to maintain consistency and transparency, increasing the complexity of product marketing and compliance

Organic Soy Protein Market Scope

The market is segmented on the basis of type, product form, and application.

• By Type

On the basis of type, the organic soy protein market is segmented into concentrates, isolates, and flour. The concentrates segment held the largest market revenue share in 2024, owing to its wide usage in functional foods and beverages due to its balanced nutritional profile and cost-effectiveness. It is commonly incorporated into dairy alternatives and meat substitute products to enhance protein content without altering taste significantly. The increasing preference for clean-label and plant-based nutrition is also boosting the demand for soy protein concentrates across various food categories.

The isolates segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high protein content and rapid absorption, making it a preferred choice in sports nutrition and health supplements. Fitness enthusiasts and individuals with dietary restrictions are increasingly adopting soy protein isolate for muscle building and weight management. In addition, its neutral flavor and smooth texture make it suitable for protein powders and ready-to-drink shakes.

• By Product Form

On the basis of product form, the organic soy protein market is segmented into liquid and dry. The dry segment dominated the market with the largest revenue share in 2024, attributed to its extended shelf life, ease of transport, and widespread use in powdered supplements and dry mixes. Dry soy protein is favored by manufacturers for its stability and formulation flexibility in a variety of applications including bakery, cereals, and snacks.

The liquid segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for ready-to-use health drinks and nutritional beverages. Its convenience and quick assimilation make it appealing for on-the-go consumers and those looking for meal replacements. The liquid form also enables easier incorporation into dairy alternatives and liquid meal solutions.

• By Application

On the basis of application, the organic soy protein market is segmented into bakery and confectionery, infant formula, meat alternatives, dairy alternatives, and functional foods. The meat alternatives segment accounted for the largest revenue share in 2024, supported by a global shift toward plant-based diets and sustainability-focused consumption patterns. Soy protein offers an excellent textural and nutritional substitute for meat, making it ideal for burgers, sausages, and plant-based patties.

The functional foods segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health awareness and demand for foods that provide additional benefits such as immunity support and digestive health. Organic soy protein is increasingly used in fortified cereals, bars, and beverages tailored to health-conscious consumers seeking high-protein, nutrient-rich options.

Organic Soy Protein Market Regional Analysis

• North America dominated the organic soy protein market with the largest revenue share in 2024, driven by rising demand for plant-based nutrition and clean-label food products

• Consumers in the region are highly inclined toward protein-enriched diets that support wellness goals, leading to increased adoption of soy protein in functional foods and beverages

• A growing base of health-conscious individuals, coupled with widespread retail availability of organic soy-based products, continues to support market expansion in both the U.S. and Canada

U.S. Organic Soy Protein Market Insight

The U.S. organic soy protein market captured the largest revenue share within North America in 2024, supported by the country’s advanced food processing sector and rising consumer shift toward sustainable, high-protein alternatives. The market benefits from a strong presence of key manufacturers and growing usage of organic soy protein in nutritional supplements, snacks, and ready-to-eat meals. Increased health awareness and the popularity of plant-forward diets among millennials and Gen Z consumers further propel the U.S. market

Europe Organic Soy Protein Market Insight

The Europe organic soy protein market is expected to witness the fastest growth rate from 2025 to 2032, attributed to stringent food safety regulations and a high level of consumer awareness regarding organic certifications. Demand is rising for soy-based meat alternatives and dairy substitutes, particularly in Germany, France, and the U.K. The region also shows increasing adoption of organic soy protein in functional foods and infant nutrition segments, driven by ongoing sustainability and wellness trends

U.K. Organic Soy Protein Market Insight

The U.K. organic soy protein market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong vegan and vegetarian movements and increasing interest in high-protein food solutions. The rising popularity of flexitarian diets and eco-conscious consumption patterns is prompting food manufacturers to incorporate soy protein in bakery items, dairy alternatives, and plant-based meat products. Consumers in the U.K. are also showing preference for clean-label products with transparent sourcing and organic ingredients

Germany Organic Soy Protein Market Insight

The Germany organic soy protein market is expected to witness the fastest growth rate from 2025 to 2032, due to the country's strong focus on organic agriculture and high demand for natural protein-rich foods. Germany is a key market for organic dairy alternatives, especially soy-based yogurts and beverages. The country’s commitment to sustainability and plant-based diets, along with innovation in organic soy protein formulations, is fostering growth across both retail and foodservice sectors

Asia-Pacific Organic Soy Protein Market Insight

The Asia-Pacific organic soy protein market is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding health awareness, rapid urbanization, and increased consumption of functional foods. Countries such as China, Japan, and India are witnessing a surge in plant-based product launches. Rising incomes, supportive government food safety initiatives, and an expanding middle-class population are collectively boosting demand for organic soy protein across the region

Japan Organic Soy Protein Market Insight

The Japan organic soy protein market is expected to witness the fastest growth rate from 2025 to 2032, due to the country's long-standing consumption of soy products and increasing interest in Western-style plant-based diets. The demand for soy-based snacks, beverages, and health supplements is on the rise, supported by a growing aging population seeking functional food options. The integration of traditional soy usage with modern organic formulations is helping brands capture a broader health-conscious audience

China Organic Soy Protein Market Insight

The China organic soy protein market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by a large consumer base and increasing focus on high-quality protein sources. The government’s push for food safety and organic farming practices has supported domestic production. Organic soy protein is widely used in meal replacements, infant formulas, and fortified drinks, aligning with growing consumer demand for clean, nutritious, and affordable plant-based options.

Organic Soy Protein Market Share

The Organic Soy Protein industry is primarily led by well-established companies, including:

- ADM (U.S.)

- DuPont (U.S.)

- Cargill Incorporated (U.S.)

- CHS Inc. (U.S.)

- Kerry Group (Ireland)

- Wilmar International Ltd (Singapore)

- The Nisshin OilliO Group, Ltd. (Japan)

- Ruchi Soya (India)

- Ag Processing Inc (U.S.)

- Devansoy Inc. (U.S.)

- American Soy Products (U.S.)

- Smithfield Foods, Inc. (U.S.)

- Impossible Foods Inc. (U.S.)

- Batory Foods (U.S.)

- Kellogg NA Co. (U.S.)

- Doves Farm Foods Ltd. (U.K.)

Latest Developments in Global Organic Soy Protein Market

- In September 2022, Archer Daniels Midland (ADM) inaugurated a new extrusion plant in Serbia. This facility enhances ADM's capacity to produce non-GMO textured soy protein, aligning with the rising demand for meat alternatives in the EMEA region. The investment aims to support and expand the company’s presence in the growing meat alternatives market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Soy Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Soy Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Soy Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.