Global Orthodontic Headgear Market

Market Size in USD Billion

CAGR :

%

USD

1.09 Billion

USD

1.59 Billion

2025

2033

USD

1.09 Billion

USD

1.59 Billion

2025

2033

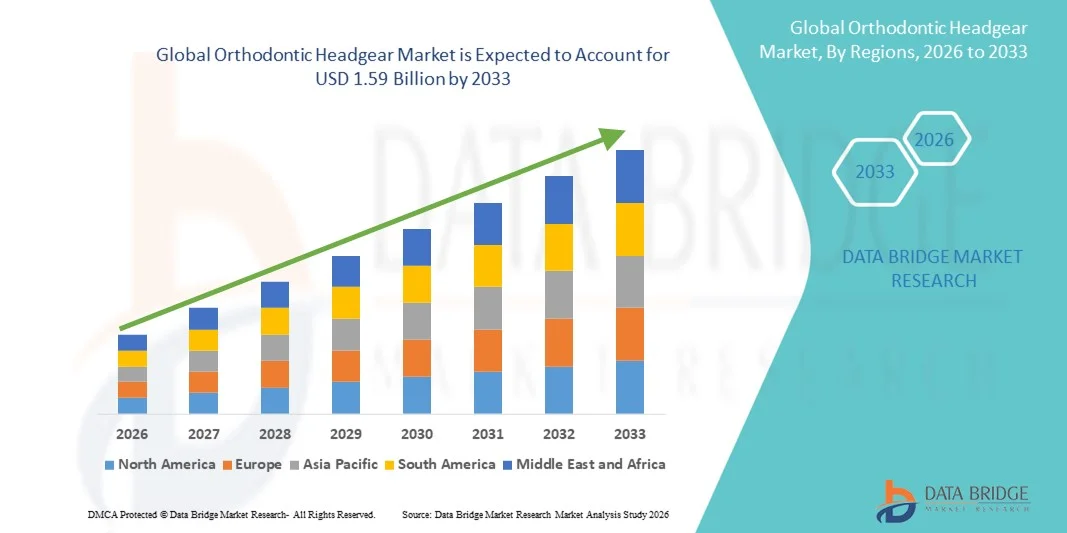

| 2026 –2033 | |

| USD 1.09 Billion | |

| USD 1.59 Billion | |

|

|

|

|

Orthodontic Headgear Market Size

- The global orthodontic headgear market size was valued at USD 1.09 billion in 2025 and is expected to reach USD 1.59 billion by 2033, at a CAGR of 4.87% during the forecast period

- The market growth is largely fueled by the rising prevalence of malocclusions and dental disorders, increased awareness about orthodontic treatments, and ongoing technological advancements in headgear design and materials that improve patient comfort and treatment outcomes

- Furthermore, growing consumer demand for effective, non‑invasive, and clinically proven orthodontic solutions especially for correcting jaw alignment and tooth positioning in children and adolescents is establishing orthodontic headgear as a vital appliance in corrective dentistry. These converging factors are accelerating market uptake globally, thereby significantly boosting the industry’s growth

Orthodontic Headgear Market Analysis

- Orthodontic headgear, providing external force to correct jaw alignment and tooth positioning, is increasingly vital in modern orthodontic treatments in both pediatric and adolescent patients due to its clinical effectiveness, customizable designs, and compatibility with braces and other dental appliances

- The escalating demand for orthodontic headgear is primarily fueled by the rising prevalence of malocclusions, increasing awareness about dental health, and a growing preference for non-invasive yet effective orthodontic solutions

- North America dominated the orthodontic headgear market with the largest revenue share of 39.1% in 2025, characterized by high awareness of orthodontic treatments, strong healthcare infrastructure, and the presence of key industry players, with the U.S. experiencing substantial growth driven by innovations in headgear design, comfort, and compliance-monitoring features

- Asia-Pacific is expected to be the fastest-growing region in the orthodontic headgear market during the forecast period due to increasing dental awareness, urbanization, and rising disposable incomes enabling access to orthodontic care

- Cervical pull segment dominated the orthodontic headgear market with a market share of 45.7% in 2025, driven by its proven effectiveness in correcting Class II malocclusions and ease of integration with existing orthodontic appliances

Report Scope and Orthodontic Headgear Market Segmentation

|

Attributes |

Orthodontic Headgear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Orthodontic Headgear Market Trends

Advancements in Comfort and Compliance Monitoring

- A significant and accelerating trend in the global orthodontic headgear market is the development of more comfortable, patient-friendly designs using lightweight materials and ergonomic fittings, improving wear compliance and overall treatment outcomes

- For instance, cervical and high-pull headgears are now being produced with cushioned straps and adjustable components, allowing patients to wear them for longer durations without discomfort

- Integration of smart compliance monitors in headgear is enabling real-time tracking of wear time and patient adherence, providing orthodontists with actionable insights to optimize treatment plans

- For instance, certain modern headgear models include Bluetooth-enabled sensors that log usage data and send reminders to patients, enhancing treatment efficiency

- These innovations are redefining patient expectations, making orthodontic headgear not only clinically effective but also comfortable, wearable, and digitally connected

- The demand for headgear that balances treatment effectiveness with patient comfort and digital monitoring is rising across pediatric and adolescent orthodontic practices globally

- Growing collaborations between orthodontic device manufacturers and dental clinics to provide bundled treatment solutions are promoting wider adoption of headgear

- Increasing use of virtual treatment planning and tele-orthodontics is enabling orthodontists to remotely monitor headgear usage and make adjustments, further improving compliance and treatment outcomes

Orthodontic Headgear Market Dynamics

Driver

Increasing Prevalence of Malocclusions and Awareness of Orthodontic Care

- The growing incidence of malocclusions, jaw misalignment, and dental crowding among children and adolescents, coupled with rising awareness of orthodontic care, is a key driver for the heightened adoption of orthodontic headgear

- For instance, in March 2025, an orthodontic association report highlighted increasing cases of Class II malocclusions in North America, prompting more practitioners to recommend headgear as an essential corrective device

- As parents and patients become more informed about long-term dental health, headgear is preferred for its non-invasive, effective role in guiding jaw growth and aligning teeth

- Furthermore, the trend of integrating headgear with braces or aligners provides a comprehensive orthodontic treatment solution, encouraging higher adoption rates

- The convenience of adjustable and customizable designs, coupled with the ability to monitor compliance digitally, is further propelling headgear usage in clinics worldwide

- Rising investments in orthodontic education and awareness campaigns by dental associations are increasing early adoption of corrective devices such as headgear

- Technological advancements in materials and design that reduce treatment time and enhance comfort are attracting more patients to use headgear consistently

Restraint/Challenge

Patient Compliance and Social Acceptance Issues

- Concerns regarding discomfort, aesthetic appearance, and social stigma associated with wearing headgear pose significant challenges to broader market adoption, particularly among self-conscious adolescents

- For instance, studies in 2024 reported that some patients discontinued treatment due to discomfort or embarrassment in social settings, limiting the effectiveness of orthodontic headgear

- Addressing these concerns through ergonomic designs, less visible options, and educational campaigns to improve patient understanding is critical to market growth

- In addition, the requirement for consistent daily wear to achieve desired outcomes can be difficult to enforce, creating reliance on patient cooperation for treatment success

- While newer headgear models with improved comfort and digital compliance monitoring are mitigating some issues, overcoming social perception and adherence challenges remains crucial for sustained adoption

- Limited insurance coverage and out-of-pocket expenses for headgear can restrict access for price-sensitive patients, especially in developing regions

- Variability in orthodontist recommendations and treatment protocols can create confusion among patients and parents, potentially affecting compliance and overall adoption rates

Orthodontic Headgear Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the orthodontic headgear market is segmented into cervical pull, high-pull headgear, reverse-pull (facemask), and others. The Cervical Pull segment dominated the market with the largest market revenue share of 45.7% in 2025, driven by its proven effectiveness in correcting Class II malocclusions. Orthodontists often recommend cervical pull headgear for its ability to guide lower jaw growth while being compatible with braces. Its adjustable straps and standardized design allow for easier fitting across a wide age range, enhancing patient compliance. The segment benefits from a high level of clinical adoption in North America and Europe due to long-established orthodontic protocols. Cervical pull headgear is preferred in pediatric and adolescent orthodontics because it delivers reliable results within predictable treatment timelines. The segment’s dominance is also supported by continuous innovations in comfort, lightweight materials, and compliance-monitoring features.

The High-Pull Headgear segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its increasing adoption for treating vertical growth discrepancies and open bites. High-pull headgear offers superior control over maxillary molar movement, making it suitable for complex orthodontic cases requiring vertical dimension correction. Advancements in ergonomics, cushioned straps, and digital wear sensors are increasing patient comfort and compliance, driving faster adoption. Its rising popularity in Asia-Pacific is attributed to increasing awareness of advanced orthodontic treatments among adolescents. Dental clinics are integrating high-pull headgear with modern braces and aligners to provide comprehensive treatment solutions. The segment’s growth is further propelled by education initiatives and tele-orthodontics, enabling better monitoring of treatment progress.

- By End User

On the basis of end user, the orthodontic headgear market is segmented into hospitals, dental clinics, and others. The Dental Clinics segment dominated the market in 2025, accounting for the largest share, as these clinics are primary providers of specialized orthodontic care. Dental clinics offer personalized treatment plans, including the prescription and adjustment of headgear, ensuring precise correction of malocclusions. Orthodontists in clinics benefit from direct patient monitoring, which improves adherence and treatment success. Clinics also lead in introducing advanced headgear designs with smart compliance monitoring, enhancing patient satisfaction. High patient inflow in urban areas contributes to dental clinics maintaining a dominant position. Partnerships with headgear manufacturers for training and bundled treatment packages further strengthen the segment’s leadership.

The Hospitals segment is expected to witness the fastest growth from 2026 to 2033, driven by expanding pediatric and adolescent orthodontic departments and increasing hospital-based dental care services in emerging regions. Hospitals provide integrated treatment solutions, often combining orthodontic care with other pediatric or maxillofacial interventions. Rising investments in hospital dental infrastructure and awareness campaigns are boosting demand for headgear. Technological integration, such as tele-monitoring for patient compliance, is more commonly adopted in hospital setups. Hospitals in Asia-Pacific and Latin America are increasingly recommending headgear as part of standardized orthodontic protocols, fueling growth. The segment benefits from both public and private hospital expansions focusing on comprehensive dental care services.

Orthodontic Headgear Market Regional Analysis

- North America dominated the orthodontic headgear market with the largest revenue share of 39.1% in 2025, characterized by high awareness of orthodontic treatments, strong healthcare infrastructure, and the presence of key industry players

- Patients and parents in the region highly value the clinical effectiveness, comfort, and customizable designs of modern headgear, as well as the ability to monitor compliance digitally for better treatment outcomes

- This widespread adoption is further supported by advanced healthcare facilities, a well-trained orthodontist network, and strong investments in pediatric and adolescent dental care, establishing orthodontic headgear as a preferred corrective appliance in both private clinics and hospital-based orthodontic departments

U.S. Orthodontic Headgear Market Insight

The U.S. orthodontic headgear market captured the largest revenue share of 82% in North America in 2025, fueled by a high prevalence of malocclusions among children and adolescents and widespread awareness of corrective orthodontic care. Patients and parents increasingly prioritize clinically effective and comfortable headgear solutions that ensure predictable treatment outcomes. The growing adoption of digital compliance monitoring and ergonomic designs further propels the market. In addition, the integration of headgear with modern braces and aligners is enhancing treatment efficiency and patient adherence. The presence of well-established orthodontic clinics and ongoing innovations by key manufacturers contribute significantly to market growth. Moreover, educational initiatives and early orthodontic interventions are supporting the consistent uptake of headgear appliances.

Europe Orthodontic Headgear Market Insight

The Europe orthodontic headgear market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of dental health, rising prevalence of malocclusions, and established orthodontic treatment infrastructure. Urbanization and rising disposable incomes are fostering higher adoption of orthodontic appliances. European consumers value the combination of effectiveness, comfort, and aesthetic design offered by modern headgear. The market is experiencing growth across private dental clinics, hospital-based orthodontic departments, and academic dental centers. Moreover, the integration of digital compliance monitoring tools in headgear is enhancing treatment precision and patient adherence. Rising healthcare investments and orthodontic education programs are further stimulating demand.

U.K. Orthodontic Headgear Market Insight

The U.K. orthodontic headgear market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of pediatric dental care and a focus on early orthodontic intervention. Concerns regarding malocclusions and long-term dental health are motivating parents to choose corrective appliances such as headgear. The integration of comfortable and discreet designs is improving patient compliance and acceptance. In addition, the U.K.’s advanced dental infrastructure and strong presence of specialized orthodontic clinics support market growth. Tele-orthodontics and digital wear-time monitoring are becoming more common, further enhancing treatment effectiveness. The combination of rising healthcare expenditure and educational campaigns on orthodontic health continues to boost adoption.

Germany Orthodontic Headgear Market Insight

The Germany orthodontic headgear market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of orthodontic care, technological advancements in headgear design, and the increasing prevalence of malocclusions. German consumers prioritize precision, comfort, and aesthetic considerations when selecting headgear appliances. Well-developed healthcare infrastructure, coupled with high standards in orthodontic practice, promotes adoption in both clinics and hospital settings. Integration with braces and aligners, along with digital compliance monitoring, is enhancing treatment outcomes. Furthermore, Germany’s emphasis on preventive care and education regarding oral health is driving early adoption among children and adolescents. Continuous product innovations focusing on lightweight, ergonomic designs further strengthen market growth.

Asia-Pacific Orthodontic Headgear Market Insight

The Asia-Pacific orthodontic headgear market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing awareness of orthodontic treatment among children and adolescents. Countries such as China, Japan, and India are witnessing strong adoption of headgear due to the expansion of private dental clinics and hospital-based orthodontic services. Government initiatives promoting oral health education and early intervention programs are further encouraging uptake. Technological advancements in comfort, customization, and compliance monitoring are enhancing patient adherence. In addition, rising investments in orthodontic training and infrastructure are supporting the market’s rapid growth. The affordability of modern headgear options compared to traditional braces also contributes to wider adoption across the region.

Japan Orthodontic Headgear Market Insight

The Japan orthodontic headgear market is gaining momentum due to the country’s focus on advanced orthodontic care, rising urbanization, and an emphasis on pediatric and adolescent dental health. Japanese patients and parents value high-quality, comfortable, and discreet headgear designs that integrate effectively with braces and aligners. The increasing use of digital compliance monitoring systems allows orthodontists to track patient wear time and adjust treatment plans accurately. Growing awareness campaigns on oral health and orthodontic care further fuel demand. Moreover, Japan’s aging population is encouraging the development of user-friendly headgear for adolescent patients, enhancing treatment adherence. Continuous innovation in ergonomics and material technology supports market expansion.

India Orthodontic Headgear Market Insight

The India orthodontic headgear market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising dental awareness, increasing prevalence of malocclusions, and expanding access to orthodontic care. India is witnessing strong adoption of headgear in private dental clinics, hospitals, and school-based orthodontic programs. Urbanization, growth of the middle-class population, and affordability of modern headgear designs are key factors driving the market. Government and private initiatives promoting early orthodontic interventions are supporting demand. Technological advancements, such as ergonomic designs and digital compliance monitoring, are further enhancing patient adherence. The presence of domestic manufacturers producing cost-effective headgear solutions is also contributing to widespread adoption across the country.

Orthodontic Headgear Market Share

The Orthodontic Headgear industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Ormco Corporation (U.S.)

- Henry Schein Orthodontics (U.S.)

- Great Lakes Dental Technologies, LTD. (U.S.)

- Align Technology, Inc. (U.S.)

- American Orthodontics (U.S.)

- G&H Orthodontics (U.S.)

- Dentsply Sirona Inc. (U.S.)

- TP Orthodontics, Inc. (U.S.)

- Rocky Mountain Orthodontics, Inc. (U.S.)

- DB Orthodontics (U.K.)

- Dentaurum GmbH & Co. KG (Germany)

- Adenta GmbH (Germany)

- FORESTADENT Bernhard Foerster GmbH (Germany)

- Ortho Kinetics Corporation (U.S.)

- SmileDirectClub, Inc. (U.S.)

- ClearCorrect (U.S.)

- GC Orthodontics (Japan)

- Patterson Companies, Inc. (U.S.)

What are the Recent Developments in Global Orthodontic Headgear Market?

- In February 2025, Smile Doctors reported continued rapid expansion of its orthodontic services network. Smile Doctors the largest U.S. orthodontic support organization announced strong year‑over‑year growth with new practice openings and partnerships, supporting broader access to comprehensive orthodontic care, which may correlate with increased prescription and usage of appliances such as headgear in complex cases as clinics scale

- In November 2024, Biolux Technology secured investment to accelerate innovation in orthodontic treatment optimization. Biolux announced a USD 4.5 M investment to expand its digital platform OrthoPulse® for real‑time monitoring and treatment optimization an instance of technological advances that could influence how orthodontists monitor compliance and results when using headgear and other appliances

- In November 2024, Smartee Denti‑Technology launched Disney‑licensed clear aligner packages to enhance patient engagement. Smartee unveiled Disney‑branded clear aligners featuring Mickey Mouse and Iron Man themes, aimed at increasing treatment adoption and compliance among younger patients—a trend that may impact headgear usage patterns as clinicians balance aligner popularity with traditional extraoral appliances for severe malocclusions

- In February 2024, uLab Systems received Townie Choice Awards for its clear aligner products and support services. uLab’s uSmile™ clear aligners and uAssist™ treatment planning service were awarded by orthodontists for excellence, highlighting the growing adoption of digital orthodontic solutions that can impact traditional appliance use and clinical workflows, including those connected to headgear integration and alternatives

- In January 2023, Ormco launched the Ultima Hook, the first repositionable hook designed specifically for use with the Ultima wire system, which improves efficiency and patient comfort in orthodontic treatments involving extraoral anchorage tools such as headgear and auxiliaries. The repositionable feature (up to three uses) supports clinicians in precise force application and simplifies adjustments during treatment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.