Global Orthopaedic Imaging Equipment Market

Market Size in USD Billion

CAGR :

%

USD

11.56 Billion

USD

17.98 Billion

2024

2032

USD

11.56 Billion

USD

17.98 Billion

2024

2032

| 2025 –2032 | |

| USD 11.56 Billion | |

| USD 17.98 Billion | |

|

|

|

|

Orthopaedic Imaging Equipment Market Size

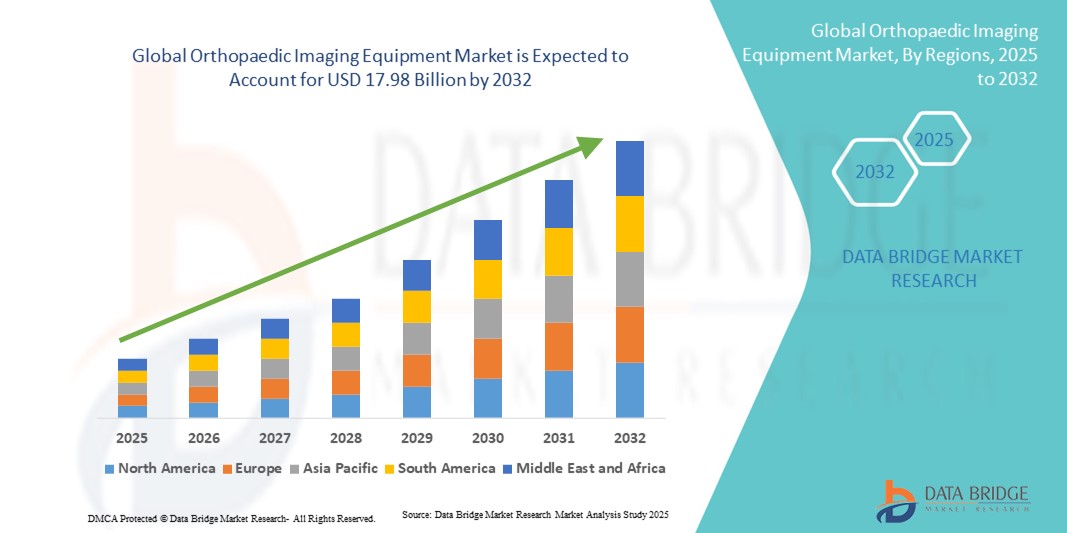

- The global orthopaedic imaging equipment market size was valued at USD 11.56 billion in 2024 and is expected to reach USD 17.98 billion by 2032, at a CAGR of 5.67% during the forecast period

- The market growth is largely driven by rising prevalence of musculoskeletal disorders, increasing geriatric population, and technological advancements in imaging modalities such as digital X-ray, CT, and MRI systems, enhancing diagnostic accuracy and workflow efficiency

- Furthermore, growing investments in healthcare infrastructure, rising demand for minimally invasive surgeries, and increased awareness of early diagnosis for orthopaedic conditions are promoting adoption of advanced imaging equipment in hospitals and diagnostic centers. These converging factors are accelerating market penetration, thereby significantly boosting the industry's growth

Orthopaedic Imaging Equipment Market Analysis

- Orthopaedic imaging equipment, including X-ray, CT, and MRI systems, provides critical diagnostic support for musculoskeletal conditions and is increasingly essential in hospitals, diagnostic centers, and outpatient clinics due to its ability to deliver accurate imaging, enhance surgical planning, and improve patient outcomes

- The rising demand for orthopaedic imaging equipment is primarily driven by increasing prevalence of musculoskeletal disorders, growing geriatric population, and advancements in imaging technologies, including 3D imaging, AI-assisted diagnostics, and portable imaging solutions

- North America dominated the orthopaedic imaging equipment market with the largest revenue share of 39.2% in 2024, supported by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key market players, with the U.S. witnessing significant adoption of digital imaging systems in hospitals and outpatient facilities, bolstered by innovations in AI-assisted image analysis and minimally invasive surgical planning

- Asia-Pacific is expected to be the fastest growing region in the orthopaedic imaging equipment market during the forecast period due to rising healthcare investments, increasing number of orthopaedic procedures, and expanding diagnostic centers in emerging economies such as China and India

- X-ray systems segment dominated the orthopaedic imaging equipment market with a market share of 42% in 2024, driven by its cost-effectiveness, wide availability, and reliability for diagnosing fractures, joint disorders, and other musculoskeletal conditions

Report Scope and Orthopaedic Imaging Equipment Market Segmentation

|

Attributes |

Orthopaedic Imaging Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orthopaedic Imaging Equipment Market Trends

Advancements Through AI and 3D Imaging Integration

- A significant and accelerating trend in the global orthopaedic imaging equipment market is the increasing integration of artificial intelligence (AI) and advanced 3D imaging technologies into diagnostic systems. This combination is enhancing diagnostic accuracy, surgical planning, and patient outcomes

- For instance, some AI-enabled MRI and CT systems can automatically detect fractures or joint abnormalities, providing radiologists with prioritized insights for faster diagnosis. Similarly, 3D digital X-ray systems allow surgeons to visualize complex musculoskeletal structures more precisely before performing minimally invasive procedures

- AI integration enables predictive analytics for musculoskeletal disorders, optimizing imaging protocols and suggesting potential treatment pathways. For example, certain software solutions can analyze bone density trends over time and provide early alerts for risk of fractures or osteoporosis. Furthermore, 3D imaging facilitates accurate preoperative planning, reducing operative time and improving postoperative recovery

- The seamless integration of orthopaedic imaging equipment with hospital PACS (Picture Archiving and Communication System) and surgical navigation platforms allows centralized management of patient data, imaging results, and treatment plans, creating a streamlined and efficient workflow

- This trend toward intelligent, precise, and interconnected imaging systems is reshaping expectations for orthopaedic diagnostics and surgical planning. Consequently, companies such as GE Healthcare and Siemens Healthineers are developing AI-enabled imaging solutions with advanced 3D reconstruction, automated fracture detection, and enhanced image clarity

- The demand for orthopaedic imaging systems offering AI-assisted diagnostics and 3D visualization is growing rapidly across hospitals, outpatient centers, and specialty clinics, as healthcare providers increasingly prioritize accuracy, efficiency, and improved patient outcomes

Orthopaedic Imaging Equipment Market Dynamics

Driver

Increasing Demand Due to Rising Musculoskeletal Disorders and Technological Advancements

- The rising prevalence of musculoskeletal disorders, coupled with technological advancements in imaging modalities, is a significant driver for the heightened demand for orthopaedic imaging equipment

- For instance, in March 2024, Siemens Healthineers launched a new AI-powered X-ray system designed to improve fracture detection and workflow efficiency in orthopedic clinics. Such innovations by key companies are expected to drive market growth in the forecast period

- As the global population ages and the incidence of joint and bone-related conditions rises, orthopaedic imaging equipment offers advanced features such as high-resolution imaging, real-time analysis, and 3D reconstruction, providing superior diagnostic capabilities compared to conventional imaging

- Furthermore, increasing investments in healthcare infrastructure and the rising number of orthopaedic procedures worldwide are expanding the adoption of advanced imaging systems in hospitals and diagnostic centers

- High demand for minimally invasive surgeries and the adoption of integrated imaging solutions for surgical planning and postoperative monitoring are also propelling the market growth

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The high capital investment required for advanced orthopaedic imaging equipment, including MRI, CT, and digital X-ray systems, poses a significant barrier to widespread adoption, particularly in developing regions

- For instance, the cost of AI-enabled imaging systems with 3D capabilities can be prohibitive for smaller hospitals or diagnostic centers, limiting access to advanced technology.

- In addition, strict regulatory requirements, such as FDA and CE approvals for medical imaging devices, add complexity and delay market entry, making compliance a critical challenge for manufacturers

- While prices for certain imaging systems are gradually decreasing, premium features such as AI-assisted diagnostics, high-resolution 3D imaging, and automated analysis still command a higher cost, which can hinder adoption among budget-conscious healthcare providers

- Overcoming these challenges through cost-effective product development, regulatory support, and training programs for healthcare providers will be vital for sustained market growth

Orthopaedic Imaging Equipment Market Scope

The market is segmented on the basis of product, systems, indication, application, and end user.

- By Product

On the basis of product, the orthopaedic imaging equipment market is segmented into drill guides, guide tubs, implant holders, custom clamps, distracters, and screwdrivers. The implant holders segment dominated the market in 2024 due to their critical role in ensuring precise positioning of implants during orthopaedic procedures. Surgeons prioritize high-quality implant holders for their stability, reliability, and compatibility with a wide range of implants. The strong adoption of joint replacement surgeries, particularly knee and hip procedures, drives demand for durable and ergonomically designed implant holders. In addition, implant holders integrated with advanced imaging systems improve surgical accuracy and reduce intraoperative complications. Hospitals and specialty clinics increasingly rely on these tools to streamline procedures, making them a consistent revenue generator for manufacturers.

The custom clamps segment is expected to witness the fastest growth rate during the forecast period, fueled by increasing demand for patient-specific orthopaedic solutions. Custom clamps offer tailored support for complex surgeries, such as spinal reconstructions and craniomaxillofacial procedures. Rising adoption of minimally invasive surgeries and personalized orthopaedic implants further accelerates the need for custom clamps. Advancements in material science, such as lightweight titanium and carbon composites, enhance their appeal among surgeons seeking precision and ease of handling. Growing awareness among healthcare providers regarding procedure-specific tools is further propelling adoption. Manufacturers focusing on customizable and modular solutions are such asly to capture a significant portion of this growing segment.

- By Systems

On the basis of systems, the orthopaedic imaging equipment market is segmented into X-ray systems, CT scanners, MRI systems, EOS imaging systems, ultrasound, and nuclear imaging systems. The X-ray systems segment dominated the market in 2024 with a market share of 42%, driven by their cost-effectiveness, widespread availability, and reliability for diagnosing fractures, joint disorders, and acute musculoskeletal injuries. Digital X-ray systems provide high-resolution imaging and real-time diagnostic capabilities, supporting faster clinical decision-making in hospitals and radiology centers. X-ray systems are particularly valuable in emergency care settings due to their speed and ease of use. Continuous improvements in image quality, integration with PACS systems, and compatibility with advanced orthopaedic tools maintain their dominance. The segment’s strong presence in both developed and emerging markets ensures a consistent revenue base. Moreover, hospitals prefer X-ray systems for their relatively low maintenance costs compared to CT and MRI systems.

The EOS imaging systems segment is expected to witness the fastest growth during forecast period, due to rising demand for low-dose, full-body imaging for scoliosis, spine, and lower limb assessments. EOS systems provide highly accurate 3D reconstruction while minimizing radiation exposure, making them attractive in pediatric and chronic disorder cases. Growing awareness about radiation safety and the benefits of 3D postural analysis drives adoption in hospitals and specialty clinics. The increasing number of spinal surgeries and orthopedic corrective procedures further fuels demand. EOS systems’ ability to integrate with surgical planning software enhances their utility for complex procedures. Providers are increasingly investing in EOS systems to improve patient outcomes and workflow efficiency.

- By Indication

On the basis of indication, the orthopaedic imaging equipment market is segmented into acute injuries and chronic disorders, and osteoarthritis. The acute injuries segment dominated the market in 2024, driven by the high incidence of fractures, sports injuries, and trauma cases requiring immediate imaging for diagnosis and treatment planning. Orthopaedic imaging equipment allows rapid assessment, helping surgeons make informed decisions for interventions such as fracture fixation or joint realignment. Emergency care facilities prioritize systems that deliver fast, high-resolution imaging to reduce patient waiting times. Acute injury imaging requires precise, reliable tools to prevent misdiagnosis and ensure timely treatment. Hospitals and radiology centers continuously invest in imaging solutions for trauma cases. Advanced X-ray, CT, and MRI systems have enhanced capabilities for real-time assessment of complex injuries.

The osteoarthritis segment is expected to witness the fastest growth during forecast period, due to the rising geriatric population and increasing prevalence of degenerative joint diseases. Early diagnosis and continuous monitoring of osteoarthritis through MRI and CT scans enhance treatment strategies and patient quality of life. Orthopaedic clinics and hospitals are increasingly adopting imaging solutions to track disease progression. Advanced imaging helps in personalized therapy planning and post-operative evaluation. Growing awareness about joint health and preventive care further accelerates adoption. AI-assisted diagnostics for osteoarthritis are expected to enhance early detection rates, driving growth.

- By Application

On the basis of application, the orthopaedic imaging equipment market is segmented into hip, knee, spine, craniomaxillofacial, dental, sports injuries, and trauma orthopaedic devices. The knee orthopaedic devices segment dominated the market in 2024, supported by the high prevalence of knee osteoarthritis, ligament injuries, and increasing knee replacement surgeries. Imaging equipment such as MRI and digital X-ray systems is essential for accurate diagnosis, preoperative planning, and postoperative assessment. Minimally invasive knee procedures further boost the demand for advanced imaging. Hospitals rely on high-resolution imaging to optimize surgical outcomes and reduce complications. Knee imaging systems are widely adopted in both orthopedic specialty clinics and general hospitals. Continuous innovations in imaging and knee implant technology strengthen this segment’s dominance.

The spine orthopaedic devices segment is expected to witness the fastest growth during forecast period, due to increasing spinal surgeries, including scoliosis correction, spinal fusion, and disc replacement procedures. Advanced imaging systems, including 3D X-ray and CT scanners, enable precise visualization of complex spinal structures. Hospitals and outpatient centers are adopting EOS and CT solutions to minimize surgical risks. Rising incidence of spinal disorders and technological advancements in spinal implant navigation systems drive adoption. Surgeons increasingly rely on imaging to guide minimally invasive spinal procedures. Awareness of spine health and corrective surgery benefits among patients further supports growth in this segment.

- By End User

On the basis of end user, the orthopaedic imaging equipment market is segmented into hospitals, radiology centers, emergency care facilities, and ambulatory surgical centers. The hospitals segment dominated the market in 2024 due to comprehensive imaging infrastructure, skilled radiologists, and the ability to perform a wide range of orthopaedic procedures. Hospitals prefer advanced imaging systems for multi-departmental use, supporting diagnostics, surgical planning, and postoperative monitoring. They invest heavily in equipment with high throughput and versatility to serve diverse patient needs. Integration with PACS and electronic health record systems further enhances operational efficiency. The segment benefits from continuous upgrades and replacement cycles for older imaging systems. Hospitals in developed markets are early adopters of AI-enabled imaging solutions, maintaining dominance.

The ambulatory surgical centers segment is expected to witness the fastest growth during forecast period, due to increasing outpatient orthopaedic procedures and demand for cost-effective imaging solutions. Smaller facilities are adopting portable and AI-enabled imaging systems to improve workflow efficiency and patient throughput. Rising focus on minimally invasive surgeries supports adoption of advanced imaging tools. Outpatient centers require compact, versatile systems that provide accurate diagnostics with minimal space and operational costs. Increasing awareness about outpatient treatment benefits drives adoption of modern imaging equipment. Manufacturers are targeting these centers with modular and affordable solutions to capture this fast-growing segment.

Orthopaedic Imaging Equipment Market Regional Analysis

- North America dominated the orthopaedic imaging equipment market with the largest revenue share of 39.2% in 2024, supported by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key market players

- The region benefits from a technologically advanced medical ecosystem where hospitals and diagnostic centers increasingly adopt AI-enabled imaging systems, 3D X-ray, and digital CT/MRI solutions for orthopaedic diagnostics and surgical planning

- Widespread awareness about musculoskeletal health, rising prevalence of fractures, osteoarthritis, and sports injuries, along with a growing geriatric population, further support strong demand for orthopaedic imaging solutions

U.S. Orthopaedic Imaging Equipment Market Insight

The U.S. orthopaedic imaging equipment market captured the largest revenue share of 42% in North America in 2024, driven by advanced healthcare infrastructure, high adoption of digital imaging systems, and a strong focus on musculoskeletal health. Hospitals and specialty clinics are increasingly investing in AI-enabled MRI, CT, and X-ray systems to improve diagnostic accuracy and surgical planning. Rising incidence of fractures, osteoarthritis, sports injuries, and trauma cases further fuels market demand. The preference for minimally invasive procedures and integration of imaging systems with surgical navigation platforms supports rapid adoption. In addition, a well-established insurance ecosystem and high healthcare expenditure enable hospitals to procure advanced imaging equipment. These factors collectively position the U.S. as a dominant market for orthopaedic imaging solutions.

Europe Orthopaedic Imaging Equipment Market Insight

The Europe orthopaedic imaging equipment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing prevalence of musculoskeletal disorders and rising demand for advanced imaging solutions. Stringent healthcare regulations and growing emphasis on early diagnosis of orthopaedic conditions encourage the adoption of MRI, CT, and digital X-ray systems. Countries such as France, Italy, and Spain are witnessing significant growth in hospitals, radiology centers, and outpatient facilities. The integration of imaging equipment with hospital PACS systems and surgical planning software enhances workflow efficiency. Furthermore, rising investments in healthcare infrastructure and technological advancements in imaging modalities strengthen market expansion across the region.

U.K. Orthopaedic Imaging Equipment Market Insight

The U.K. orthopaedic imaging equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of digital imaging systems and AI-assisted diagnostics. Growing geriatric population and rising prevalence of joint disorders, sports injuries, and trauma cases boost the demand for orthopaedic imaging. Hospitals and outpatient centers are focusing on advanced imaging for precise preoperative planning and postoperative evaluation. Government initiatives to improve healthcare infrastructure and adoption of connected medical devices further stimulate growth. In addition, the robust healthcare R&D ecosystem in the U.K. facilitates continuous technological innovations, supporting market expansion.

Germany Orthopaedic Imaging Equipment Market Insight

The Germany orthopaedic imaging equipment market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of musculoskeletal health and technological advancements in imaging systems. Hospitals and diagnostic centers prefer AI-enabled MRI and CT solutions for accurate detection of fractures, osteoarthritis, and spine disorders. The country’s strong focus on innovation, digitalization, and healthcare quality drives adoption of sophisticated imaging solutions. Integration with surgical navigation systems and low-dose 3D imaging modalities such as EOS systems enhances clinical outcomes. Rising demand for minimally invasive surgeries and patient-specific orthopaedic solutions further supports market growth in Germany.

Asia-Pacific Orthopaedic Imaging Equipment Market Insight

The Asia-Pacific orthopaedic imaging equipment market is poised to grow at the fastest CAGR of 22% during the forecast period, driven by rapid urbanization, rising disposable incomes, and increasing healthcare investments in countries such as China, Japan, and India. Growing prevalence of musculoskeletal disorders, expanding hospital networks, and rising awareness about early diagnosis boost adoption of advanced imaging systems. Technological advancements, government initiatives promoting healthcare modernization, and increasing surgical procedures contribute to market expansion. Furthermore, APAC emerging as a manufacturing hub for imaging equipment enhances affordability and accessibility, widening the consumer base across hospitals and diagnostic centers.

Japan Orthopaedic Imaging Equipment Market Insight

The Japan orthopaedic imaging equipment market is gaining momentum due to the country’s high-tech healthcare infrastructure, aging population, and demand for precise diagnostics. Hospitals and specialty clinics increasingly adopt AI-assisted MRI, CT, and digital X-ray systems for fracture detection, spine disorders, and osteoarthritis management. The integration of imaging equipment with connected healthcare devices and surgical navigation platforms supports improved clinical outcomes. Growing focus on minimally invasive procedures and rehabilitation planning further drives demand. In addition, Japan’s technological orientation and patient safety awareness promote adoption of advanced imaging systems.

India Orthopaedic Imaging Equipment Market Insight

The India orthopaedic imaging equipment market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rising healthcare infrastructure, increasing hospital capacity, and high rates of musculoskeletal disorders. Hospitals, diagnostic centers, and outpatient facilities are adopting cost-effective and AI-enabled imaging solutions for accurate diagnosis and treatment planning. The government’s push for healthcare modernization and smart hospital initiatives supports market growth. Rapid urbanization, expanding middle-class population, and increasing awareness of joint health are key factors boosting adoption. Moreover, the availability of affordable imaging solutions and local manufacturing hubs enhance accessibility and affordability in the Indian market.

Orthopaedic Imaging Equipment Market Share

The Orthopaedic Imaging Equipment industry is primarily led by well-established companies, including:

- Globus Medical, (U.S.)

- Zimmer Biomet (U.S.)

- Ziehm Imaging GmbH (Germany)

- CONMED Corporation (U.S.)

- EOS imaging (France)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Siemens Healthineers AG (Germany)

- Esaote S.p.A. (Italy)

- Planmed Oy (Finland)

- Adaptix Ltd (U.K.)

- Shimadzu Corporation (Japan)

- Xilloc Medical B.V. (Netherlands)

- MicroPort Orthopedics Inc. (U.S.)

- AmRAD (U.S.)

- Imperial Imaging (U.S.)

- Medtronic (Ireland)

- Stryker (U.S.)

- Smith & Nephew (U.K.)

- Orthofix Medical Inc. (U.S.)

- Arthrex, Inc. (U.S.)

What are the Recent Developments in Global Orthopaedic Imaging Equipment Market?

- In January 2025, Siemens Healthineers showcased its latest innovations at the AOCR 2025 conference, including the MAGNETOM Flow MRI. This 1.5T MRI platform incorporates Dry Cool technology, which reduces the liquid helium requirement from 1,500 liters to just 0.7 liters. This innovation addresses sustainability in healthcare and leverages a deep learning algorithm, Deep Resolve, to significantly shorten scan times while maintaining image quality and resolution

- In March 2024, Siemens Healthineers introduced its MAGNETOM Flow, a 1.5T MRI platform that features Dry Cool technology. This innovation reduces the liquid helium required from up to 1,500 liters to just 0.7 liters, making the system virtually helium-free. This significant development addresses sustainability in healthcare and makes MRI technology more accessible and cost-effective by eliminating the need for a quench pipe and reducing energy consumption

- In July 2023, Konica Minolta Healthcare Americas, Inc. introduced the PocketPro H2, a new wireless handheld ultrasound device. This device is specifically optimized for musculoskeletal (MSK) applications, including needle guidance and pain management. The PocketPro H2 is a development in the trend toward portable and accessible imaging solutions, making high-quality ultrasound imaging more readily available for orthopedic and related procedures

- In June 2023, GE HealthCare announced the FDA clearance and launch of its Sonic DL, a deep learning-based technology for magnetic resonance imaging (MRI). This technology is designed to significantly accelerate image acquisition, enabling new imaging paradigms such as a high-quality cardiac MRI in a single heartbeat. This breakthrough expands GE HealthCare's portfolio of AI-enabled solutions, improving diagnostic efficiency and potentially reducing patient wait times for scans

- In November 2021, Medacta International S.A. received FDA clearance for its NextAR Spine Platform. This augmented reality surgical guidance system is designed to provide surgeons with a "surgical GPS," overlaying imaging data directly onto the patient's anatomy to guide procedures with high precision. This development is part of a broader trend of integrating advanced navigation and imaging technologies to improve the accuracy and outcomes of complex orthopedic and spine surgeries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.