Global Orthopedic Extremity Devices Market

Market Size in USD Billion

CAGR :

%

USD

66.58 Billion

USD

109.36 Billion

2024

2032

USD

66.58 Billion

USD

109.36 Billion

2024

2032

| 2025 –2032 | |

| USD 66.58 Billion | |

| USD 109.36 Billion | |

|

|

|

|

Orthopedic Extremity Devices Market Size

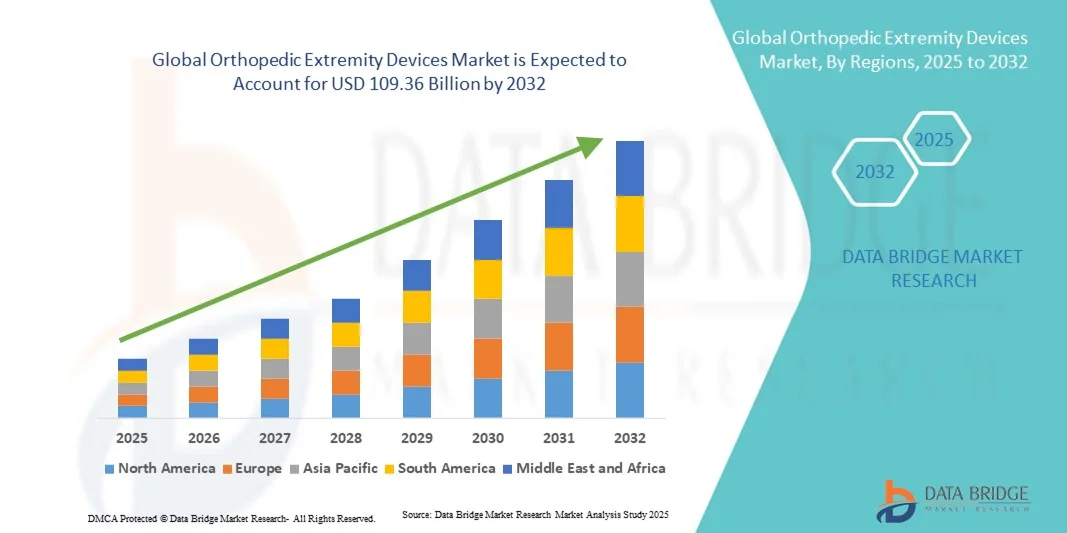

- The global orthopedic extremity devices market size was valued at USD 66.58 billion in 2024 and is expected to reach USD 109.36 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely driven by the rising prevalence of musculoskeletal disorders, osteoarthritis, and traumatic injuries, coupled with the increasing demand for advanced reconstructive and fixation solutions for upper and lower extremities

- Furthermore, technological advancements in 3D printing, biomaterials, and minimally invasive orthopedic surgeries are enhancing product performance and patient recovery outcomes, thereby accelerating the adoption of orthopedic extremity devices and significantly boosting the industry’s overall growth

Orthopedic Extremity Devices Market Analysis

- Orthopedic extremity devices, encompassing implants and fixation systems for the upper and lower limbs, have become crucial in restoring mobility, stability, and function in patients with fractures, deformities, or degenerative joint conditions across both hospital and outpatient care settings due to advancements in design, materials, and surgical technique

- The growing demand for orthopedic extremity devices is primarily fueled by the increasing incidence of osteoarthritis, osteoporosis, sports injuries, and road accidents, coupled with a rising elderly population seeking improved quality of life through joint reconstruction and limb restoration

- North America dominated the orthopedic extremity devices market with the largest revenue share of 41.8% in 2024, attributed to the strong presence of leading medical device manufacturers, well-established healthcare infrastructure, and high procedure volumes, with the U.S. witnessing robust adoption of innovative implants and patient-specific 3D-printed solutions

- Asia-Pacific is expected to be the fastest-growing region in the orthopedic extremity devices market during the forecast period, driven by improving healthcare access, increasing healthcare expenditure, and growing awareness about advanced orthopedic treatment options

- The upper extremity devices segment dominated the market with a share of 45.6% in 2024, owing to rising cases of shoulder, elbow, and wrist injuries and technological advancements in joint replacement and fixation systems that enhance recovery and long-term outcomes

Report Scope and Orthopedic Extremity Devices Market Segmentation

|

Attributes |

Orthopedic Extremity Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Orthopedic Extremity Devices Market Trends

Technological Advancements Driving Personalized and Minimally Invasive Solutions

- A significant and accelerating trend in the global orthopedic extremity devices market is the integration of advanced technologies such as 3D printing, robotics, and computer-assisted surgery to enhance precision, customization, and patient recovery outcomes. This evolution is transforming treatment approaches across upper and lower extremity procedures

- For instance, Stryker’s Mako SmartRobotics system combines real-time 3D imaging and robotic-assisted arm technology, enabling surgeons to perform highly accurate joint replacement surgeries with improved alignment and reduced recovery times. Similarly, Zimmer Biomet’s Persona IQ smart knee integrates sensors to remotely monitor post-surgery mobility and patient outcomes

- The use of additive manufacturing allows for the production of patient-specific implants and fixation systems designed to match individual anatomical structures, thereby improving fit, comfort, and long-term performance. For instance, companies such as LimaCorporate and Materialise are pioneering customized titanium implants using advanced 3D printing technologies

- The rise in demand for minimally invasive and personalized orthopedic procedures has led to greater adoption of digital planning tools, navigation systems, and sensor-enabled implants that enhance surgical efficiency and patient satisfaction

- This trend towards technologically advanced, personalized, and data-driven orthopedic solutions is reshaping the extremity devices landscape. Consequently, major manufacturers are expanding R&D in robotic-assisted extremity surgery and AI-driven outcome analytics to meet the growing demand for precision-based care

Orthopedic Extremity Devices Market Dynamics

Driver

Rising Prevalence of Musculoskeletal Disorders and Trauma Injuries

- The growing global burden of musculoskeletal conditions such as osteoarthritis, osteoporosis, and fractures, coupled with a rise in sports-related and road accident injuries, is significantly driving the demand for orthopedic extremity devices

- For instance, in February 2024, Johnson & Johnson MedTech launched its next-generation fixation system aimed at improving bone healing outcomes in upper extremity trauma cases, underscoring the industry's focus on advanced reconstructive solutions

- As the geriatric population expands and awareness of limb preservation surgeries increases, there is a heightened need for efficient, durable, and anatomically designed implants and fixation devices

- Furthermore, technological progress in biomaterials, including bioresorbable and titanium-based implants, is offering improved biocompatibility and patient recovery, strengthening overall market adoption

- The shift toward value-based healthcare and early rehabilitation is encouraging hospitals and orthopedic centers to invest in innovative extremity devices that minimize hospital stay and optimize clinical efficiency. The continuous evolution of product design and material strength is further driving procedural growth globally

Restraint/Challenge

High Cost and Regulatory Barriers Hindering Rapid Adoption

- The high cost associated with technologically advanced orthopedic extremity devices and robotic-assisted surgeries poses a major challenge to their adoption, especially in developing and cost-sensitive healthcare markets

- For instance, premium extremity implants and robotic systems can significantly raise procedural expenses, limiting accessibility for patients without comprehensive insurance coverage or in regions with low healthcare spending

- In addition, stringent regulatory requirements for product approval and post-market surveillance increase development timelines and costs for manufacturers, delaying new product introductions in key regions

- Addressing these cost and compliance challenges through localized manufacturing, clinical validation, and transparent approval processes is essential for broader market expansion. Leading players such as Smith+Nephew and DePuy Synthes are focusing on regulatory harmonization and cost-optimized production to enhance affordability

- While gradual technological cost reductions are underway, reimbursement limitations and complex clinical data requirements continue to restrict rapid market penetration, particularly for small and mid-sized orthopedic firms

- Overcoming these barriers through streamlined approval frameworks, targeted pricing strategies, and increased collaboration between regulators and manufacturers will be vital to sustain long-term growth in the orthopedic extremity devices market

Orthopedic Extremity Devices Market Scope

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the global orthopedic extremity devices market is segmented into upper extremity devices, lower extremity devices, spine orthopedics devices, arthroscopic devices, orthobiologics, and braces and support devices. The upper extremity devices segment dominated the market with the largest revenue of 45.6% share in 2024, attributed to the increasing prevalence of shoulder, elbow, and wrist disorders and the growing number of trauma cases resulting from sports and road injuries. The segment’s growth is further supported by advancements in implant materials and fixation systems that provide improved strength and biocompatibility. Manufacturers such as Stryker and Zimmer Biomet are continuously innovating in shoulder arthroplasty and fracture fixation technologies, enhancing functional outcomes and recovery rates. In addition, the rising elderly population and increased awareness of joint reconstruction procedures are boosting demand for upper extremity implants globally.

The lower extremity devices segment is anticipated to witness the fastest growth rate during the forecast period, driven by the surge in hip, knee, ankle, and foot reconstructive procedures. Increasing cases of osteoarthritis, osteoporosis, and lower limb fractures are propelling the need for durable and anatomically designed implants. Moreover, technological advancements in 3D-printed and patient-specific prosthetics are enabling surgeons to achieve greater precision and patient satisfaction. The adoption of robotic-assisted knee and ankle surgeries and the introduction of bioresorbable fixation materials are also accelerating the growth of this segment across both developed and emerging markets.

- By Application

On the basis of application, the orthopedic extremity devices market is segmented into hip, knee, spine, dental, craniomaxillofacial, sports injuries, extremities, and trauma. The extremities segment dominated the market in 2024, primarily due to the high incidence of upper and lower limb injuries and the growing number of reconstructive surgeries worldwide. Extremity implants and fixation devices are increasingly preferred for their ability to restore limb function and mobility following fractures or degenerative joint conditions. The segment benefits from ongoing product innovation, such as modular plating systems and anatomically contoured implants, which improve surgical outcomes and reduce recovery times. In addition, increased investment in extremity-focused R&D by leading orthopedic device manufacturers continues to strengthen this segment’s market leadership.

The sports injuries segment is projected to exhibit the fastest growth during the forecast period, driven by the global rise in sports participation and the corresponding increase in musculoskeletal injuries. The demand for advanced arthroscopic and fixation devices that support minimally invasive repair of ligaments, tendons, and joints is escalating. For instance, the growing adoption of bioabsorbable screws and anchors in ligament reconstruction surgeries is enhancing recovery and reducing complications. Furthermore, the trend toward early mobility and rapid rehabilitation among athletes is encouraging the use of innovative orthopedic implants and biologic solutions designed for faster healing and improved joint stability.

- By End-User

On the basis of end-user, the orthopedic extremity devices market is segmented into hospitals, ambulatory surgical centers (ASCs), and specialty orthopedic centers. The hospitals segment dominated the market with the largest share in 2024, owing to the high volume of orthopedic surgeries performed in these settings and the availability of advanced surgical infrastructure. Hospitals are equipped with modern imaging, robotic systems, and experienced orthopedic specialists capable of handling complex extremity reconstructions and trauma cases. In addition, the rising incidence of road traffic accidents and trauma-related injuries continues to drive hospital-based orthopedic procedures. The presence of multispecialty departments and post-operative rehabilitation facilities further enhances hospitals’ dominance in the orthopedic extremity devices market.

The ambulatory surgical centers (ASCs) segment is expected to register the fastest growth rate during the forecast period due to the increasing shift toward outpatient orthopedic procedures. ASCs offer cost-effective, efficient, and patient-friendly environments for extremity surgeries such as hand, wrist, ankle, and foot repairs. The adoption of minimally invasive techniques and faster recovery protocols is fueling the demand for extremity devices in these centers. Moreover, technological advancements in portable surgical equipment and same-day discharge models are expanding the accessibility of orthopedic care, especially in developed regions such as North America and Europe. This trend aligns with healthcare providers’ focus on reducing hospital stays and improving procedural efficiency.

Orthopedic Extremity Devices Market Regional Analysis

- North America dominated the orthopedic extremity devices market with the largest revenue share of 41.8% in 2024, attributed to the strong presence of leading medical device manufacturers, well-established healthcare infrastructure, and high procedure volumes, with the U.S. witnessing robust adoption of innovative implants and patient-specific 3D-printed solutions

- Patients and healthcare providers in the region increasingly prefer innovative implants, robotic-assisted surgeries, and patient-specific 3D-printed devices that enhance precision and recovery outcomes

- This widespread adoption is further supported by strong healthcare infrastructure, favorable reimbursement policies, and the presence of major market players such as Stryker, Zimmer Biomet, and DePuy Synthes, positioning North America as the leading hub for orthopedic extremity device innovation and utilization

U.S. Orthopedic Extremity Devices Market Insight

The U.S. orthopedic extremity devices market captured the largest revenue share of 82% in 2024 within North America, fueled by the high prevalence of musculoskeletal disorders and an aging population requiring reconstructive and trauma-related surgeries. The country’s advanced healthcare infrastructure and widespread access to orthopedic specialists support significant procedure volumes. The growing adoption of robotic-assisted and 3D-printed extremity implants, coupled with strong reimbursement systems, continues to drive market expansion. Moreover, leading manufacturers such as Stryker, Zimmer Biomet, and DePuy Synthes are introducing technologically advanced solutions tailored to U.S. clinical needs, further strengthening market leadership.

Europe Orthopedic Extremity Devices Market Insight

The Europe orthopedic extremity devices market is projected to grow at a substantial CAGR during the forecast period, driven by the increasing prevalence of degenerative bone diseases, trauma injuries, and the rising geriatric population. The region’s focus on improving orthopedic care standards and early rehabilitation is promoting the use of advanced implants and fixation systems. In addition, stringent quality standards and supportive reimbursement policies are fostering innovation in minimally invasive and patient-specific extremity devices. The demand is particularly strong in orthopedic centers and rehabilitation clinics across Germany, France, and the U.K., where adoption of robotic-assisted procedures is steadily increasing.

U.K. Orthopedic Extremity Devices Market Insight

The U.K. orthopedic extremity devices market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a growing elderly population and a rise in musculoskeletal conditions. Increasing awareness of early joint reconstruction and sports injury management is boosting the adoption of extremity implants and braces. Furthermore, the National Health Service’s (NHS) focus on reducing surgical waiting times is driving hospitals to adopt efficient and minimally invasive orthopedic solutions. Domestic and international manufacturers are also expanding their distribution networks to meet the growing demand for technologically advanced and affordable extremity devices.

Germany Orthopedic Extremity Devices Market Insight

The Germany orthopedic extremity devices market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong emphasis on medical innovation and advanced surgical techniques. Germany’s robust healthcare infrastructure and focus on precision medicine support the widespread adoption of next-generation implants and fixation systems. The increasing use of digital surgical planning tools and robotic-assisted extremity surgeries is transforming orthopedic care delivery. Moreover, German consumers and healthcare providers are prioritizing biocompatible, high-performance materials that align with the country’s strict medical device quality standards.

Asia-Pacific Orthopedic Extremity Devices Market Insight

The Asia-Pacific orthopedic extremity devices market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, driven by rising healthcare expenditure, rapid urbanization, and an increasing burden of trauma and degenerative bone conditions. Countries such as China, Japan, and India are experiencing higher surgical procedure volumes and growing awareness of advanced orthopedic care. Government initiatives promoting healthcare modernization and local manufacturing are further stimulating regional growth. In addition, the expansion of orthopedic specialty hospitals and the introduction of cost-effective implants are making advanced extremity care more accessible to a wider population base.

Japan Orthopedic Extremity Devices Market Insight

The Japan orthopedic extremity devices market is gaining momentum due to the country’s aging population, strong focus on precision healthcare, and advanced technological ecosystem. The increasing incidence of osteoporosis and joint degeneration among older adults is driving demand for high-quality reconstructive implants and fixation systems. Japanese hospitals are early adopters of robotic and image-guided orthopedic procedures, enhancing surgical accuracy and recovery outcomes. Moreover, the nation’s commitment to integrating digital technologies into healthcare is promoting the adoption of sensor-enabled and patient-specific extremity devices.

India Orthopedic Extremity Devices Market Insight

The India orthopedic extremity devices market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the rising prevalence of trauma cases, growing healthcare investments, and expanding middle-class access to orthopedic care. The country’s increasing number of road accidents and sports injuries is accelerating demand for affordable and durable implants. Furthermore, the government’s push toward healthcare infrastructure development and the rise of domestic medical device manufacturing are enhancing market competitiveness. India’s adoption of cost-effective, high-performance extremity solutions across both private and public healthcare sectors continues to propel market growth significantly.

Orthopedic Extremity Devices Market Share

The Orthopedic Extremity Devices industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Smith+Nephew (U.K.)

- Arthrex, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Orthofix Medical Inc. (U.S.)

- Medtronic (Ireland)

- NuVasive, Inc. (U.S.)

- B. Braun SE (Germany)

- Medacta International (Switzerland)

- LimaCorporate S.p.A. (Italy)

- Exactech, Inc. (U.S.)

- Össur hf. (Iceland)

- MicroPort Orthopedics (China)

- DJO Global, Inc. (U.S.)

- Globus Medical, Inc. (U.S.)

- Paragon Medical (U.S.)

- Surgalign Holdings, Inc. (U.S.)

What are the Recent Developments in Global Orthopedic Extremity Devices Market?

- In October 2025, Zimmer Biomet Holdings, Inc. announced the launch of two new devices the Gorilla Pilon Fusion Plating System and the Phantom TTC Trauma Nail through its acquisition of Paragon 28, Inc., significantly strengthening its lower extremity and trauma portfolios. These innovative implants are engineered to provide advanced solutions for complex hindfoot and ankle reconstructions, addressing conditions such as post-traumatic arthritis and deformities

- In September 2025, Poly Medicure Limited completed the acquisition of Citieffe SRL, an Italy-based company specializing in trauma and extremities solutions, for approximately €31 million. This acquisition gives Poly Medicure a direct presence in the European orthopedic implant market and strengthens its product offerings in trauma and extremity fixation devices

- In April 2025, Tyber Medical, Intech, and Resolve Surgical Technologies merged to form a new global CDMO+ platform, dedicated to providing next-generation musculoskeletal device solutions, including orthopedic extremity implants and instruments. The collaboration aims to accelerate innovation in the contract design and manufacturing of implants, focusing on speed-to-market, quality, and scalability for OEM partners

- In March 2025, Johnson & Johnson MedTech showcased its latest digital orthopaedics innovations at the AAOS 2025 Annual Meeting, emphasizing advancements across joint reconstruction, trauma, spine, and extremities. The company highlighted integrated digital surgery platforms, AI-driven preoperative planning, and smart implants designed to improve precision, surgical outcomes, and patient recovery

- In August 2022, OSSIO, Inc. launched the U.S. commercial use of its OSSIOfiber® Suture Anchors, designed for soft-tissue-to-bone fixation in multiple anatomical sites including the shoulder, foot/ankle, knee, hand/wrist, and elbow. The OSSIOfiber® Suture Anchors are made from a proprietary bio-integrative material that gradually becomes part of the native bone, eliminating the need for permanent metal implants or later removal surgeries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.