Global Oyster Mushroom Cultivation Market

Market Size in USD Billion

CAGR :

%

USD

2.84 Billion

USD

4.48 Billion

2024

2032

USD

2.84 Billion

USD

4.48 Billion

2024

2032

| 2025 –2032 | |

| USD 2.84 Billion | |

| USD 4.48 Billion | |

|

|

|

|

What is the Global Oyster Mushroom Cultivation Market Size and Growth Rate?

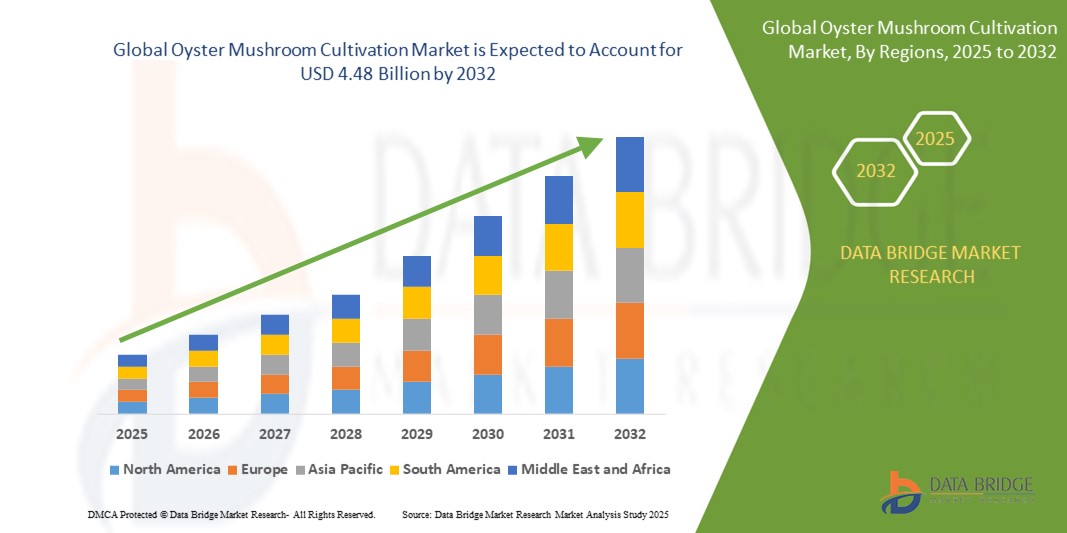

- The global oyster mushroom cultivation market size was valued at USD 2.84 billion in 2024 and is expected to reach USD 4.48 billion by 2032, at a CAGR of 5.20% during the forecast period

- Market expansion is primarily driven by increasing awareness of plant-based diets, a growing demand for sustainable protein sources, and the relatively low cost and simplicity of oyster mushroom farming

- In addition, oyster mushrooms are gaining traction in the functional food and nutraceutical sectors due to their nutritional benefits, boosting cultivation across both commercial farms and small-scale producers

What are the Major Takeaways of Oyster Mushroom Cultivation Market?

- Oyster mushroom cultivation is emerging as a scalable and eco-friendly solution in the global food system, favored for its fast growth cycle, minimal resource needs, and high nutritional content, including protein, fiber, and antioxidants

- The market’s momentum is reinforced by rising adoption among urban farmers, food service providers, and processed food manufacturers looking for cost-effective and sustainable ingredients

- Increasing investments in controlled-environment agriculture (CEA) and vertical farming innovations are expected to further enhance productivity and support year-round oyster mushroom supply

- Asia-Pacific dominated the oyster mushroom cultivation market with the largest revenue share of 41.7% in 2024, driven by the region's long-standing mushroom cultivation traditions, favorable agro-climatic conditions, and growing demand for plant-based nutrition

- North America oyster mushroom cultivation market is poised to grow at the fastest CAGR of 13.1% during the forecast period of 2025 to 2032, fueled by increasing interest in functional foods, plant-based diets, and sustainable agriculture

- The Phase II – Spawning segment dominated the oyster mushroom cultivation market with the largest revenue share of 34.6% in 2024, as this is the most critical stage where the mushroom mycelium colonizes the substrate, directly influencing overall yield and quality

Report Scope and Oyster Mushroom Cultivation Market Segmentation

|

Attributes |

Oyster Mushroom Cultivation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oyster Mushroom Cultivation Market?

“Technology-Driven Precision Farming and Climate Control”

- A key trend gaining momentum in the oyster mushroom cultivation market is the integration of IoT sensors, AI-based monitoring, and automated climate control systems to optimize growing conditions. These technologies allow precise management of humidity, temperature, CO₂ levels, and substrate moisture critical factors for consistent yield and quality

- For instance, Indian startup Fasal has introduced IoT-based climate monitoring tools tailored for mushroom farms, enabling growers to receive real-time alerts and automated environment adjustments. Similarly, Grocycle in the U.K. is experimenting with AI-led systems to predict growth cycles and optimize harvest schedules

- Advanced systems powered by AI and machine learning help forecast contamination risks, improve efficiency in spawn utilization, and reduce manual labor. These innovations are particularly useful for commercial-scale growers aiming to meet year-round demand while maintaining sustainability standards

- With rising input costs and labor shortages, automated cultivation is increasingly appealing. Systems equipped with remote monitoring, data analytics, and decision-support dashboards offer farmers better control and reduce crop failures

- As urban agriculture and vertical farming models expand, especially in Europe and Asia-Pacific, smart technologies will become more central to operations. Companies such as Mycotech Lab in Indonesia are also leveraging AI to track mycelium growth for circular economy applications

- The shift toward climate-resilient, data-driven cultivation methods is redefining operational practices in the oyster mushroom industry, especially among tech-forward smallholders and emerging commercial farms across APAC and Europe

What are the Key Drivers of Oyster Mushroom Cultivation Market?

- Rising consumer preference for organic, plant-based, and high-protein foods is a primary driver for oyster mushroom cultivation globally. The mushrooms' nutritional benefits, including high fiber, antioxidants, and immunity-boosting compounds, align with health-conscious dietary trends

- For instance, in March 2024, South Mill Champs expanded its Pennsylvania facility to increase oyster mushroom production, citing growing demand in food service and retail sectors. The facility utilizes energy-efficient HVAC and humidification controls to support sustainable production

- Government support through subsidies and training programs is further driving adoption, especially in countries such as India, China, and Kenya. Programs promoting low-input, high-return crops are positioning oyster mushrooms as a preferred agribusiness for small farmers

- In addition, oyster mushrooms require minimal space and low capital investment, making them ideal for urban, peri-urban, and backyard farming setups. This affordability contributes to growing interest in developing nations

- Increased demand from pharmaceutical and nutraceutical sectors, where oyster mushrooms are used for developing natural supplements and extracts, also contributes to market expansion

- These factors combined are fostering a robust ecosystem that supports both small-scale growers and industrial producers, enhancing the overall scalability of the oyster mushroom cultivation industry

Which Factor is challenging the Growth of the Oyster Mushroom Cultivation Market?

- Perishability and short shelf life remain major challenges in the oyster mushroom cultivation market. Without proper cold chain logistics and storage infrastructure, the mushrooms quickly lose moisture, texture, and market value especially in warmer climates

- For instance, a 2023 report by the Indian Council of Agricultural Research (ICAR) noted post-harvest losses of up to 30% in oyster mushroom production due to inadequate cold storage and inefficient transportation methods in rural areas

- These issues hinder market penetration in remote and underdeveloped regions, where access to refrigerated transport and packaging technology is limited. The result is reduced income for farmers and inconsistent product availability in retail markets

- Another constraint is the lack of technical knowledge among new growers regarding spawn selection, substrate preparation, and contamination control. Without proper training, first-time cultivators often face failed crops or low yield, deterring long-term investment

- In addition, inconsistent demand forecasting and limited contract farming opportunities reduce market stability. As a perishable commodity, oversupply can also lead to glut and price crashes

- Addressing these challenges will require stronger supply chain investments, capacity building, and the development of dehydrated or value-added mushroom products to increase shelf life and revenue opportunities for growers

How is the Oyster Mushroom Cultivation Market Segmented?

The market is segmented on the basis of phase, application, and form.

• By Phase

On the basis of phase, the oyster mushroom cultivation market is segmented into Phase I – Composting, Phase II – Spawning, Phase III – Casing, Phase IV – Pinning, and Phase V – Harvesting. The Phase II – Spawning segment dominated the Oyster Mushroom Cultivation market with the largest revenue share of 34.6% in 2024, as this is the most critical stage where the mushroom mycelium colonizes the substrate, directly influencing overall yield and quality. Producers often invest in high-quality spawn and optimized environmental conditions during this stage to ensure strong fungal growth and minimize contamination risks.

The Phase IV – Pinning segment is expected to witness the fastest CAGR from 2025 to 2032, driven by innovations in climate control and humidity regulation technologies. Precise pinning management leads to better fruit body formation, encouraging producers to adopt automated pinning chambers and smart sensors that ensure optimal initiation of fruiting bodies.

• By Form

On the basis of form, the oyster mushroom cultivation market is segmented into Fresh Mushroom, Frozen Mushroom, Dried Mushroom, and Canned Mushroom. The Fresh Mushroom segment held the largest market revenue share of 46.2% in 2024, attributed to its strong consumer preference due to taste, texture, and nutritional value. Fresh oyster mushrooms are widely available in local markets and supermarkets, particularly in Asia-Pacific and North America, and they command premium pricing due to their perishability and short shelf life.

The Dried Mushroom segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by growing demand for longer shelf life, international exports, and use in health supplements. Dried oyster mushrooms are easy to store and rehydrate, making them ideal for both the foodservice industry and home use in soups, sauces, and specialty cuisines.

• By Application

On the basis of application, the oyster mushroom cultivation market is segmented into Food Processing Industry, Retail Outlets, Food Services, and Others. The Food Services segment accounted for the largest market revenue share of 39.8% in 2024, due to the increased consumption of oyster mushrooms in restaurants, quick-service eateries, and institutional catering. Their culinary versatility, low calorie count, and umami flavor make them a preferred choice for vegetarian and vegan menus worldwide.

The Retail Outlets segment is expected to witness the fastest CAGR from 2025 to 2032, as consumer demand for fresh and packaged mushrooms continues to rise. Supermarkets, online grocery platforms, and health food stores are expanding their shelf space for exotic and functional mushrooms, especially in urban and health-conscious markets.

Which Region Holds the Largest Share of the Oyster Mushroom Cultivation Market?

- Asia-Pacific dominated the oyster mushroom cultivation market with the largest revenue share of 41.7% in 2024, driven by the region's long-standing mushroom cultivation traditions, favorable agro-climatic conditions, and growing demand for plant-based nutrition

- Countries such as China, India, and Indonesia lead in production and consumption, supported by government schemes promoting mushroom farming as a means of rural employment and sustainable agriculture

- High domestic consumption, low production costs, and rising exports are reinforcing Asia-Pacific’s position as the leading region in the Oyster Mushroom Cultivation market

China Oyster Mushroom Cultivation Market Insight

The China oyster mushroom cultivation market captured the largest revenue share of 64.2% in 2024 within Asia-Pacific, driven by its status as the world’s largest producer and consumer of mushrooms. Government support for agritech modernization, alongside a high-volume export focus, is driving scale and efficiency. The country’s vast rural labor force, increasing demand for health foods, and expansion of mushroom cooperatives continue to support market dominance.

India Oyster Mushroom Cultivation Market Insight

The India oyster mushroom cultivation market is projected to witness significant growth during the forecast period due to increasing awareness of mushrooms' nutritional and medicinal benefits. Initiatives such as “Doubling Farmers’ Income” and support for agri-entrepreneurship are encouraging small-scale cultivation across states. The market is also being fueled by rising vegetarian and vegan populations and a growing demand for affordable protein-rich foods.

Indonesia Oyster Mushroom Cultivation Market Insight

The Indonesia oyster mushroom cultivation market is expected to grow steadily owing to increasing urban demand, supportive government initiatives, and a strong focus on SME-based cultivation. Regional training centers and mushroom-focused cooperatives are helping local farmers improve productivity. Furthermore, increased adoption of packaged mushrooms in urban supermarkets is further driving market expansion.

Which Region is the Fastest Growing Region in the Oyster Mushroom Cultivation Market?

North America oyster mushroom cultivation market is poised to grow at the fastest CAGR of 13.1% during the forecast period of 2025 to 2032, fueled by increasing interest in functional foods, plant-based diets, and sustainable agriculture. Consumers are drawn to oyster mushrooms for their health benefits, including immunity-boosting and cholesterol-lowering properties. The market is also gaining from urban farming initiatives, growth in organic food retail, and rising adoption of climate-controlled indoor cultivation systems in the U.S. and Canada.

U.S. Oyster Mushroom Cultivation Market Insight

The U.S. oyster mushroom cultivation market captured the largest revenue share of 79.3% in 2024 within North America, driven by growing demand for gourmet and organic produce in urban centers. The rising trend of indoor vertical farming and restaurant demand for specialty mushrooms are key drivers. Startups and farmers are increasingly investing in automated cultivation systems and high-yield spawn varieties to meet demand.

Canada Oyster Mushroom Cultivation Market Insight

The Canada oyster mushroom cultivation market is expected to grow significantly due to the increasing popularity of meat alternatives and sustainable food production. Government funding for agri-tech innovation and a strong cooperative farming network are boosting small- and medium-scale mushroom growers. Demand is also rising through health food stores, farm-to-table restaurants, and online organic produce delivery services.

Which are the Top Companies in Oyster Mushroom Cultivation Market?

The oyster mushroom cultivation industry is primarily led by well-established companies, including:

- Monaghan Group (Ireland)

- WALSH MUSHROOMS GROUP (Ireland)

- Mycelia (Belgium)

- South Mill Mushrooms Sales (U.S.)

- Smithy Mushrooms Ltd. (U.K.)

- Rheinische Pilz Zentrale GmbH (Germany)

- Italspwan (Italy)

- Mushroom SAS (Italy)

- Hirano Mushroom LLC (Kosovo)

- Fujishukin Co. Ltd. (Japan)

What are the Recent Developments in Global Oyster Mushroom Cultivation Market?

- In March 2025, MyForest Foods, a spinoff of Ecovative specializing in mushroom-based meat alternatives such as MyBacon, scaled up its operations at its Green Island, New York facility. The company now cultivates around 20,000 pounds of oyster mushroom mycelium weekly, which is used to produce its signature bacon alternative. This expansion is set to generate approximately 160 new jobs over the next five years and includes innovations such as climate-controlled vertical farming and custom harvesting tools. This move strengthens MyForest Foods' position as a leading innovator in the alternative protein and functional fungi market

- In January 2024, MycoTechnology expanded its oyster mushroom cultivation capabilities to address increasing global demand for sustainable, plant-based protein ingredients in the food sector. The upgraded facilities are part of the company's strategic efforts to diversify mushroom applications and enhance supply for its growing client base. This development underscores the industry's rising focus on functional foods and clean-label protein sources

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OYSTER MUSHROOM CULTIVATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OYSTER MUSHROOM CULTIVATION MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION ANALYSIS

5.2 IMPORT-EXPORT ANALYSIS

5.3 UPCOMING CULTIVATION TECHNOLOGIES

5.4 SUPPLY CHAIN ANALYSIS

5.5 VALUE CHAIN ANALYSIS

5.6 PRODUCTION COST ANALYSIS

5.7 MUSHROOM STORAGE AND HANDLING

6 REGULATORY FRAMEWORK

7 IMPACT ANALYSIS OF COVID-19

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 PRICE IMPACT

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2020-2029, (USD MILLION), (TONS)

8.1 OVERVIEW

8.2 PEARL OYSTER

8.2.1 ASP (USD)

8.2.2 VALUE (USD MILLION)

8.2.3 VOLUME (TONS)

8.3 BLUE OYSTER

8.4 PHOENIX OYSTER

8.5 GLODEN OYSTER

8.6 PINK OYSTER

8.7 KING OYSTER

9 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2020-2029, (USD MILLION)

9.1 OVERVIEW

9.2 PADDY

9.3 WHEAT

9.4 RAGI

9.5 MAIZE

9.6 SAWDUST

9.7 SUGARCANE BAGASSE

9.8 MILLETS

9.9 COTTON

9.1 CITRONELLA

9.11 JUTE

9.12 COTTON WASTE

9.13 DEHULLED CORNCOBS

9.14 PEA NUT SHELLS

9.15 DRIED GRASSES

9.16 SUNFLOWER STALKS

9.17 TEA LEAF WASTE

9.18 DISCARDED PAPER WASTE

9.19 OTHERS

10 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2020-2029, (USD MILLION)

10.1 OVERVIEW

10.2 STEAM PASTEURIZATION

10.2.1 BY SUBSTRATE TYPE

10.2.1.1. PADDY

10.2.1.2. WHEAT

10.2.1.3. RAGI

10.2.1.4. MAIZE

10.2.1.5. SAWDUST

10.2.1.6. SUGARCANE BAGASSE

10.2.1.7. MILLETS

10.2.1.8. COTTON

10.2.1.9. CITRONELLA

10.2.1.10. JUTE

10.2.1.11. COTTON WASTE

10.2.1.12. DEHULLED CORNCOBS

10.2.1.13. PEA NUT SHELLS

10.2.1.14. DRIED GRASSES

10.2.1.15. SUNFLOWER STALKS

10.2.1.16. TEA LEAF WASTE

10.2.1.17. DISCARDED PAPER WASTE

10.2.1.18. OTHERS

10.3 HOT WATER TREATMENT

10.3.1 BY SUBSTRATE TYPE

10.3.1.1. PADDY

10.3.1.2. WHEAT

10.3.1.3. RAGI

10.3.1.4. MAIZE

10.3.1.5. SAWDUST

10.3.1.6. SUGARCANE BAGASSE

10.3.1.7. MILLETS

10.3.1.8. COTTON

10.3.1.9. CITRONELLA

10.3.1.10. JUTE

10.3.1.11. COTTON WASTE

10.3.1.12. DEHULLED CORNCOBS

10.3.1.13. PEA NUT SHELLS

10.3.1.14. DRIED GRASSES

10.3.1.15. SUNFLOWER STALKS

10.3.1.16. TEA LEAF WASTE

10.3.1.17. DISCARDED PAPER WASTE

10.3.1.18. OTHERS

10.4 STERILIZATION TECHNIQUE

10.4.1 BY SUBSTRATE TYPE

10.4.1.1. PADDY

10.4.1.2. WHEAT

10.4.1.3. RAGI

10.4.1.4. MAIZE

10.4.1.5. SAWDUST

10.4.1.6. SUGARCANE BAGASSE

10.4.1.7. MILLETS

10.4.1.8. COTTON

10.4.1.9. CITRONELLA

10.4.1.10. JUTE

10.4.1.11. COTTON WASTE

10.4.1.12. DEHULLED CORNCOBS

10.4.1.13. PEA NUT SHELLS

10.4.1.14. DRIED GRASSES

10.4.1.15. SUNFLOWER STALKS

10.4.1.16. TEA LEAF WASTE

10.4.1.17. DISCARDED PAPER WASTE

10.4.1.18. OTHERS

10.5 FERMENTATION OR COMPOSTING

10.5.1 BY SUBSTRATE TYPE

10.5.1.1. PADDY

10.5.1.2. WHEAT

10.5.1.3. RAGI

10.5.1.4. MAIZE

10.5.1.5. SAWDUST

10.5.1.6. SUGARCANE BAGASSE

10.5.1.7. MILLETS

10.5.1.8. COTTON

10.5.1.9. CITRONELLA

10.5.1.10. JUTE

10.5.1.11. COTTON WASTE

10.5.1.12. DEHULLED CORNCOBS

10.5.1.13. PEA NUT SHELLS

10.5.1.14. DRIED GRASSES

10.5.1.15. SUNFLOWER STALKS

10.5.1.16. TEA LEAF WASTE

10.5.1.17. DISCARDED PAPER WASTE

10.5.1.18. OTHERS

10.6 CHEMICAL STERILIZATION

10.6.1 BY SUBSTRATE TYPE

10.6.1.1. PADDY

10.6.1.2. WHEAT

10.6.1.3. RAGI

10.6.1.4. MAIZE

10.6.1.5. SAWDUST

10.6.1.6. SUGARCANE BAGASSE

10.6.1.7. MILLETS

10.6.1.8. COTTON

10.6.1.9. CITRONELLA

10.6.1.10. JUTE

10.6.1.11. COTTON WASTE

10.6.1.12. DEHULLED CORNCOBS

10.6.1.13. PEA NUT SHELLS

10.6.1.14. DRIED GRASSES

10.6.1.15. SUNFLOWER STALKS

10.6.1.16. TEA LEAF WASTE

10.6.1.17. DISCARDED PAPER WASTE

10.6.1.18. OTHERS

10.7 OTHERS

11 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2020-2029, (USD MILLION)

11.1 OVERVIEW

11.2 PHASE I- COMPOSTING

11.3 PHASE II- SPAWNING

11.4 PHASE III- CASING

11.5 PHASE IV- PINNING

11.6 PHASE V- HARVESTING

12 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2020-2029, (USD MILLION)

12.1 OVERVIEW

12.2 ORGANIC

12.3 CONVENTIONAL

13 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, BY END-USER, 2020-2029, (USD MILLION)

13.1 OVERVIEW

13.2 WHOLESALE TRADERS

13.3 HYPERMARKETS/SUPERMARKETS

13.4 CONVEINIENCE STORES

13.5 GROCERY STORES

13.6 SPECIALTY STORES

13.7 HOUSEHOLDS

13.8 OTHERS

14 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, BY COUNTRY, 2020-2029, (USD MILLION)

14.1 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 U.K.

14.3.3 ITALY

14.3.4 FRANCE

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 SWITZERLAND

14.3.8 TURKEY

14.3.9 BELGIUM

14.3.10 NETHERLANDS

14.3.11 DENMARK

14.3.12 SWEDEN

14.3.13 POLAND

14.3.14 NORWAY

14.3.15 FINLAND

14.3.16 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 JAPAN

14.4.2 CHINA

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 SINGAPORE

14.4.6 THAILAND

14.4.7 INDONESIA

14.4.8 MALAYSIA

14.4.9 PHILIPPINES

14.4.10 AUSTRALIA

14.4.11 NEW ZEALAND

14.4.12 VIETNAM

14.4.13 TAIWAN

14.4.14 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 EGYPT

14.6.3 BAHRAIN

14.6.4 UNITED ARAB EMIRATES

14.6.5 KUWAIT

14.6.6 OMAN

14.6.7 QATAR

14.6.8 SAUDI ARABIA

14.6.9 REST OF MEA

15 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS & PARTNERSHIP

15.8 REGULATORY CHANGES

16 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, SWOT & DBMR ANALYSIS

17 GLOBAL OYSTER MUSHROOM CULTIVATION MARKET, COMPANY PROFILE

17.1 WALSH MUSHROOMS GROUP

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 MYCELIA NV

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SOUTH MILL MUSHROOMS SALES

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 SMITHY MUSHROOMS

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 JIATIAN MUSHROOM

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 WHOLE EARTH HARVEST

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 MYCOTERRAFARM

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 PHILLIPS MUSHROOM FARMS

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 TEKOA FARMS

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 OSTROM MUSHROOM FARMS

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 ELLIJAY MUSHROOMS

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 MUSHROOM KING FARM.

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 SHARONDALE LLC

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 GREEN BOX MUSHROOMS

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 FARMING FUNGI, LLC

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.