Global Patient Engagement Solution Market

Market Size in USD Billion

CAGR :

%

USD

25.77 Billion

USD

71.23 Billion

2024

2032

USD

25.77 Billion

USD

71.23 Billion

2024

2032

| 2025 –2032 | |

| USD 25.77 Billion | |

| USD 71.23 Billion | |

|

|

|

|

Patient Engagement Solutions Market Size

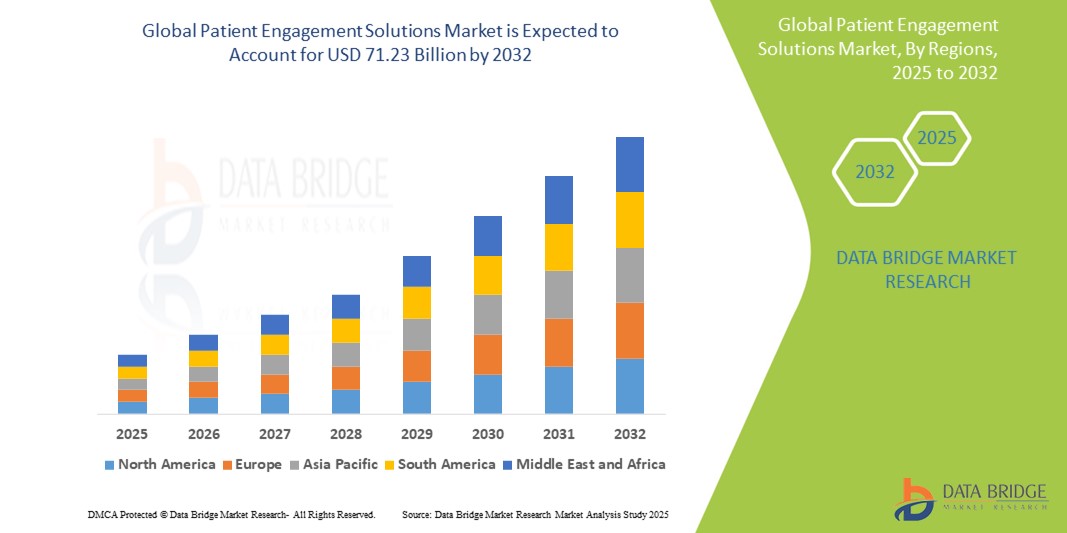

- The global patient engagement solutions market size was valued at USD 25.77 billion in 2024 and is expected to reach USD 71.23 billion by 2032, at a CAGR of 13.55% during the forecast period

- The market growth is largely driven by the increasing emphasis on patient-centric care, advancements in digital health technologies, and the rising use of mobile health apps, telehealth platforms, and electronic health records to improve communication between patients and healthcare providers

- In addition, growing demand for remote monitoring tools and personalized care experiences is positioning patient engagement solutions as essential for improving treatment adherence and health outcomes. These developments are propelling the widespread adoption of these solutions across various healthcare settings, thereby significantly boosting the industry's growth

Patient Engagement Solutions Market Analysis

- Patient engagement solutions, encompassing digital tools and platforms that facilitate communication between patients and healthcare providers, are becoming critical in modern healthcare systems due to their ability to enhance patient satisfaction, treatment adherence, and health outcomes through personalized and proactive care

- The growing demand for patient engagement solutions is primarily driven by the increasing adoption of telehealth services, the expansion of mobile health applications, and the integration of electronic health records (EHRs), all aimed at improving access to healthcare and promoting patient self-management

- North America dominated the patient engagement solutions market with the largest revenue share of 42.2% in 2024, characterized by advanced healthcare infrastructure, favorable government initiatives promoting digital health, and the high prevalence of chronic diseases that necessitate continuous patient-provider interaction

- Asia-Pacific is expected to be the fastest growing region in the patient engagement solutions market during the forecast period due to rising healthcare digitization efforts, increasing healthcare awareness, and expanding mobile and internet penetration

- Web-based segment dominated the patient engagement solutions market with a market share of 46.8% in 2024, attributed to their ease of deployment, broad accessibility, and scalability across diverse healthcare environments

Report Scope and Patient Engagement Solutions Market Segmentation

|

Attributes |

Patient Engagement Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Patient Engagement Solutions Market Trends

“Personalized Care Through AI and Omnichannel Platforms”

- A significant and accelerating trend in the global patient engagement solutions market is the integration of artificial intelligence (AI) and omnichannel communication platforms to deliver personalized, timely, and patient-centric care experiences across diverse healthcare settings

- For instance, solutions such as IBM Watson Health and Microsoft Cloud for Healthcare leverage AI to provide predictive analytics, patient risk stratification, and automated reminders, thereby supporting clinicians in offering tailored interventions and improving adherence to treatment plans

- AI-driven engagement tools are increasingly capable of understanding patient behavior, preferences, and historical data to offer intelligent recommendations, schedule follow-ups, and deliver relevant health content. For instance, Conversa Health uses conversational AI to create automated health check-ins and care pathways, enhancing the patient experience through contextual interactions

- Omnichannel platforms incorporating mobile apps, SMS, patient portals, emails, and telehealth enable seamless communication across touchpoints, giving patients greater flexibility in how they access care and information. These solutions also ensure continuity of care and engagement regardless of the patient’s location or device

- This convergence of AI and omnichannel delivery is transforming patient expectations, shifting healthcare towards a more proactive and participatory model. Companies such as GetWellNetwork and WELL Health are leading this transformation by offering dynamic engagement platforms that support multilingual content, real-time messaging, and AI-assisted triage

- The demand for AI-powered, personalized engagement solutions is growing rapidly as healthcare providers and systems strive to improve outcomes, boost operational efficiency, and meet the rising expectations of digitally connected patients

Patient Engagement Solutions Market Dynamics

Driver

“Rising Demand for Personalized, Accessible, and Proactive Healthcare”

- The growing emphasis on patient-centered care, along with the global shift towards digital health transformation, is a significant driver behind the rising adoption of patient engagement solutions

- For instance, in March 2024, Allscripts Healthcare Solutions, Inc. announced enhancements to its FollowMyHealth platform, incorporating AI-driven insights and personalized care plans to improve patient-provider communication and engagement. Such developments are expected to boost market growth in the forecast period

- As healthcare providers face increasing pressure to improve outcomes, reduce hospital readmissions, and enhance patient satisfaction, engagement platforms offer real-time access to health information, appointment scheduling, medication reminders, and teleconsultation features that empower patients to take an active role in their health

- Furthermore, the rise of value-based care models and regulatory initiatives encouraging digital health integration are making patient engagement tools a core requirement in modern healthcare infrastructure

- The convenience of anytime access to medical records, personalized health content, and virtual support through apps or web portals is propelling the demand for these solutions. In addition, the proliferation of smartphones, growing health literacy, and the increasing comfort with remote care services are further contributing to the widespread adoption of patient engagement solutions across hospitals, clinics, and home care settings

Restraint/Challenge

“Data Privacy Concerns and Regulatory Compliance Hurdle”

- Concerns surrounding data privacy and stringent regulatory compliance present significant challenges to the broader adoption of patient engagement solutions. As these platforms collect and store sensitive personal health information (PHI), they are subject to strict data protection laws, including HIPAA in the U.S. and GDPR in Europe

- For instance, reported breaches in digital health systems have raised alarm among patients and healthcare providers, leading to cautious adoption of new engagement technologies

- Addressing these concerns requires robust data encryption, secure authentication, and adherence to evolving regulatory frameworks. Companies such as GetWellNetwork and MyChart emphasize their HIPAA-compliant infrastructure and privacy safeguards to reassure healthcare providers and users

- In addition, the complexity and cost of implementing secure, interoperable engagement solutions can be a barrier, particularly for smaller clinics and providers in resource-limited settings. Integration challenges with legacy electronic health record (EHR) systems and the need for IT training further complicate deployment

- While digital literacy and telehealth familiarity are improving, disparities in technology access and varying levels of trust in digital platforms can limit engagement among certain patient populations

Patient Engagement Solutions Market Scope

The market is segmented on the basis of component, functionality, delivery mode, application, therapeutic area, and end user.

- By Component

On the basis of component, the patient engagement solutions market is segmented into hardware, software, and services. The software segment dominated the market with the largest revenue share in 2024, attributed to its integral role in facilitating communication, remote monitoring, and data analysis. Increasing adoption of EHR-integrated platforms, mobile health applications, and patient portals drives the demand for robust software solutions that offer real-time insights and user-friendly interfaces.

The services segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the increasing need for implementation support, consulting, and post-deployment maintenance services. Service providers play a crucial role in customizing solutions to meet regulatory requirements and improving user engagement through training and support.

- By Delivery Mode

On the basis of delivery mode, the patient engagement solutions market is segmented into on-premise solutions, cloud-based solutions, and web-based solutions. The web-based segment held the largest share of 46.8% in 2024, due to its accessibility, ease of deployment, and cost-effectiveness. These solutions offer cross-platform compatibility, making them a preferred choice for healthcare providers across varying scales.

The cloud-based segment is anticipated to register the fastest CAGR from 2025 to 2032, fueled by increased scalability, real-time updates, and the shift toward interoperable digital health infrastructure.

- By Functionality

On the basis of functionality, the patient engagement solutions market is segmented into communication, health tracking & insights, billing & payments, administrative, patient education, and others. The communication segment accounted for the largest market share in 2024, owing to the growing demand for secure and efficient channels between patients and providers through telehealth, in-app messaging, and virtual consultations.

The health tracking & insights segment is expected to grow at the fastest rate during the forecast period, as the focus on preventive care and personalized treatment plans increases. These tools support chronic disease management and improve decision-making through real-time data analytics.

- By Application

On the basis of application, the patient engagement solutions market is segmented into health management, home health management, social and behavioral management, and financial health management. The health management segment led the market in 2024, driven by the rising demand for solutions that improve clinical outcomes and manage chronic conditions through remote monitoring and personalized health plans.

The home health management segment is expected to grow rapidly during the forecast period, supported by the aging population and increased preference for remote care delivery models, especially post-pandemic.

- By Therapeutic Area

On the basis of therapeutic area, the patient engagement solutions market is segmented into chronic diseases, women’s health, fitness, and others. The chronic diseases segment dominated in 2024, due to the global rise in conditions such as diabetes, cardiovascular diseases, and respiratory disorders, which require continuous monitoring and patient involvement.

The fitness segment is forecasted to grow at a robust pace from 2025 to 2032, boosted by consumer interest in wellness, wearable integration, and proactive health tracking features.

- By End User

On the basis of end user, the patient engagement solutions market is segmented into providers, payers, patients, and others. The providers segment held the largest share in 2024, with hospitals and clinics actively adopting patient engagement platforms to improve operational efficiency and meet value-based care objectives.

The patients segment is expected to see the fastest growth from 2025 to 2032, as patients increasingly adopt self-management tools and mobile apps for greater control over their healthcare journeys. Rising digital health literacy and the proliferation of smartphones further support this trend.

Patient Engagement Solutions Market Regional Analysis

- North America dominated the patient engagement solutions market with the largest revenue share of 42.2% in 2024, driven by advanced healthcare infrastructure, favorable government initiatives promoting digital health, and the high prevalence of chronic diseases that necessitate continuous patient-provider interaction

- Patients and providers in the region increasingly prioritize personalized care, remote monitoring, and seamless communication, which are effectively supported by robust engagement platforms and mobile health technologies

- This widespread adoption is further fueled by favorable reimbursement policies, high digital literacy, and the presence of major health IT companies, establishing patient engagement solutions as essential tools across hospitals, clinics, and home care settings in the region

U.S. Patient Engagement Solutions Market Insight

The U.S. patient engagement solutions market captured the largest revenue share of 79% in 2024 within North America, driven by advanced digital infrastructure, strong regulatory backing for telehealth, and growing adoption of value-based care models. Patients and providers asuch as are increasingly embracing solutions that enhance care coordination, remote monitoring, and personalized communication. The surge in chronic disease prevalence, combined with the rising popularity of mobile health applications and EHR-integrated engagement tools, continues to fuel market growth. In addition, the U.S. healthcare system’s focus on patient empowerment and outcome-based reimbursements is reinforcing the need for comprehensive engagement platforms.

Europe Patient Engagement Solutions Market Insight

The Europe patient engagement solutions market is projected to grow at a substantial CAGR throughout the forecast period, supported by expanding eHealth initiatives, aging populations, and increased focus on chronic disease management. Governments across the region are prioritizing digital transformation in healthcare through strategic investments and supportive legislation. European patients are showing growing acceptance of digital health platforms that offer multilingual interfaces, secure data access, and tailored care content. The integration of patient engagement tools across public and private health systems is promoting preventive care, boosting adherence, and enhancing healthcare experience

U.K. Patient Engagement Solutions Market Insight

The U.K. patient engagement solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the National Health Service’s (NHS) digital health roadmap and rising patient expectations for remote access and personalized care. Increased investments in AI-powered tools and EHR connectivity, along with efforts to streamline communication between patients and clinicians, are propelling market adoption. The growing popularity of mobile health applications and self-management platforms is enhancing care continuity, especially for long-term conditions such as diabetes and cardiovascular diseases.

Germany Patient Engagement Solutions Market Insight

The Germany patient engagement solutions market is expected to expand at a considerable CAGR during the forecast period, fueled by the Digital Healthcare Act and rising demand for interoperable, patient-focused digital tools. Germany’s strong emphasis on data privacy, combined with a highly regulated healthcare environment, is encouraging the development of secure, compliant engagement platforms. Increased use of wearables, telemedicine, and digital prescriptions is fostering greater patient involvement and real-time health tracking. The country’s robust insurance framework and advanced medical infrastructure further support widespread solution deployment.

Asia-Pacific Patient Engagement Solutions Market Insight

The Asia-Pacific patient engagement solutions market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid healthcare digitization, rising chronic disease burden, and increasing smartphone and internet penetration. Countries such as China, Japan, and India are experiencing a surge in telehealth adoption and mobile health app usage, supported by government-led digital health programs. The region’s growing middle class and expanding healthcare infrastructure are encouraging providers to implement scalable engagement solutions to improve care delivery and patient outcomes.

Japan Patient Engagement Solutions Market Insight

The Japan patient engagement solutions market is gaining momentum due to the nation’s tech-savvy population, aging demographic, and government efforts to digitize healthcare. With a high demand for remote care and home-based management of chronic illnesses, Japan is witnessing increased adoption of AI-driven, user-friendly platforms tailored to senior patients. Integration of engagement tools with IoT-enabled health devices, electronic medical records, and automated care coordination systems is fueling steady market expansion.

India Patient Engagement Solutions Market Insight

The India patient engagement solutions market is projected to grow significantly during the forecast period, driven by the government’s Ayushman Bharat Digital Mission (ABDM), rising chronic disease prevalence, and growing health awareness. Increased smartphone usage and expanding rural internet connectivity are making digital health platforms more accessible to a broader population. Indian healthcare providers are increasingly adopting patient portals, teleconsultation apps, and multilingual engagement tools to enhance reach and affordability. As healthcare providers aim to improve patient satisfaction and operational efficiency, the demand for scalable and localized engagement solutions is accelerating.

Patient Engagement Solutions Market Share

The patient engagement solutions industry is primarily led by well-established companies, including:

- GetWellNetwork, Inc. (U.S.)

- Veradigm LLC (U.S.)

- Oracle (U.S.)

- Epic Systems Corporation (U.S.)

- MCKESSON CORPORATION (U.S.)

- Medical Information Technology, Inc. (U.S.)

- Lumeon Inc. (U.S.)

- athenahealth, Inc. (U.S.)

- IQVIA (U.S.)

- Zebra Technologies Corporation (U.S.)

- eClinicalWorks, LLC (U.S.)

- WELL Health Technologies Corp. (Canada)

- Orion Health Group Limited (New Zealand)

- Mytonomy Inc. (U.S.)

- Zocdoc, Inc. (U.S.)

- Solutionreach, Inc. (U.S.)

- Nuance Communications, Inc. (U.S.)

- HealthTap, Inc. (U.S.)

- Medallia, Inc. (U.S.)

What are the Recent Developments in Global Patient Engagement Solutions Market?

- In April 2023, Get Well Network, a leading provider of digital patient engagement solutions, launched its new AI-powered GetWell Loop+ platform. This enhanced version offers intelligent care navigation, real-time symptom tracking, and personalized content delivery to support patients throughout their care journey. The platform is designed to boost adherence, improve clinical outcomes, and reduce hospital readmissions. This development underscores the company's commitment to advancing patient-centric care through innovative digital technologies

- In March 2023, Oracle Health announced the integration of its patient engagement suite with the Oracle Cerner electronic health record (EHR) system. This strategic move aims to create a seamless care experience by enabling patients to access their health data, receive personalized health reminders, and communicate with care teams through a unified interface. The initiative reinforces Oracle Health’s goal of fostering connectivity and improving patient-provider communication across health systems

- In March 2023, WELL Health Technologies partnered with Hamilton Health Sciences in Canada to deploy its omnichannel patient communication platform. The solution enables automated appointment reminders, two-way texting, and multilingual support, enhancing accessibility and convenience for diverse patient populations. This partnership demonstrates the growing importance of communication tools that promote inclusivity and patient satisfaction in large healthcare networks

- In February 2023, Lumeon, a digital health company, introduced its Care Journey Orchestration platform to support personalized care pathways for chronic disease management. The solution leverages data-driven insights to automate engagement workflows and deliver timely interventions, improving care coordination and operational efficiency. Lumeon’s innovation highlights the industry's shift towards proactive, patient-centered care delivery models

- In January 2023, Mytonomy, a cloud-based patient education platform, expanded its video-based engagement suite to include behavioral health and oncology care. The new content modules are designed to educate and empower patients through microlearning and culturally relevant videos, delivered via mobile and web platforms. This expansion reflects the growing demand for tailored digital education that enhances health literacy and supports informed decision-making

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.