Global Peek Interbody Devices Market

Market Size in USD Million

CAGR :

%

USD

893.74 Million

USD

1,582.14 Million

2024

2032

USD

893.74 Million

USD

1,582.14 Million

2024

2032

| 2025 –2032 | |

| USD 893.74 Million | |

| USD 1,582.14 Million | |

|

|

|

|

PEEK Interbody Devices Market Size

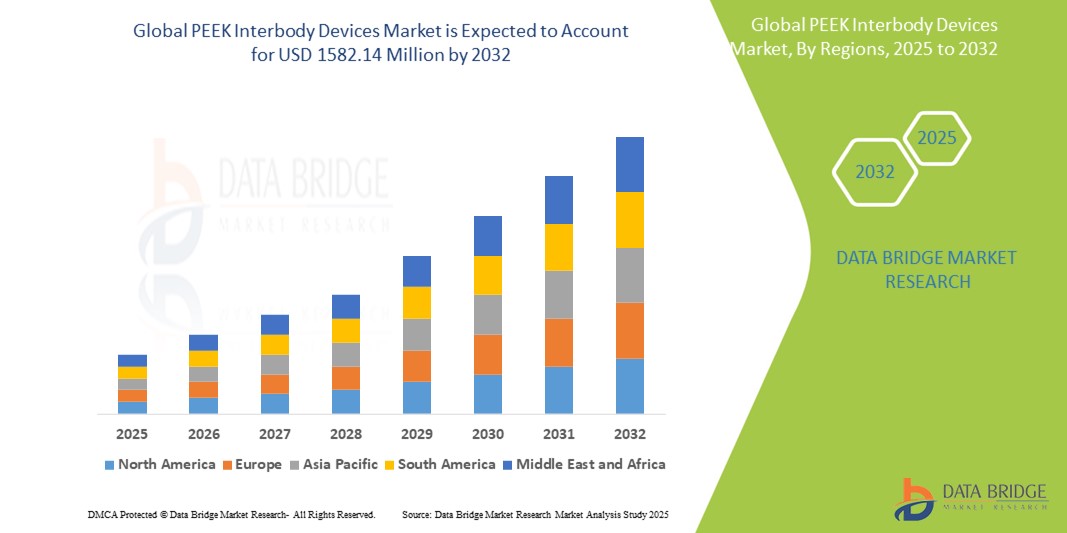

- The global PEEK interbody devices market size was valued at USD 893.74 million in 2024 and is expected to reach USD 1582.14 million by 2032, at a CAGR of 8.10% during the forecast period

- This growth is driven by factors such as the increasing prevalence of spinal disorders, rising adoption of minimally invasive surgeries, advancements in PEEK material technology, and growing healthcare infrastructure, particularly in emerging markets

PEEK Interbody Devices Market Analysis

- PEEK interbody devices are crucial tools used in spinal surgeries, specifically in spinal fusion procedures. These devices provide superior biomechanical properties, ensuring better load distribution and long-term stability of the spine

- The demand for PEEK interbody devices is driven by the increasing prevalence of spinal disorders, the growing elderly population, and advancements in minimally invasive spine surgery techniques

- North America is expected to dominate the PEEK interbody devices market with a market share of 41.5%, due to advanced healthcare infrastructure, early adoption of innovative spinal implants, and a strong presence of major medical device companies

- Asia-Pacific is expected to be the fastest growing region in the PEEK interbody devices market with a market share of 22.2%, during the forecast period due to rapid expansion of healthcare infrastructure, growing awareness about spinal health, and an increasing volume of spinal surgeries

- Interbody fusion devices segment is expected to dominate the market with a market share of 65.5% due to its widespread use in spinal fusion surgeries, where it offers superior biomechanical strength and biocompatibility

Report Scope and PEEK Interbody Devices Market Segmentation

|

Attributes |

PEEK Interbody Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

PEEK Interbody Devices Market Trends

“Advancements in PEEK Material Technology & Minimally Invasive Spine Surgery”

- One prominent trend in the evolution of PEEK interbody devices is the increasing integration of advanced PEEK material technologies and minimally invasive surgical techniques

- These innovations enhance surgical outcomes by providing better biomechanical properties, long-term stability, and compatibility with minimally invasive approaches, allowing for faster recovery times and less trauma to surrounding tissues

- For instance, 3D-printed PEEK interbody devices are gaining traction, offering customized solutions for patients, improving device fit and performance, and allowing for more precise spinal fusion. In addition, enhanced imaging technologies, such as fluoroscopy and CT-guided surgery, are being integrated with PEEK devices to improve real-time visualization during surgery

- These advancements are transforming spine surgery by enabling more precise, patient-specific interventions, improving clinical outcomes, reducing complications, and driving the demand for next-generation PEEK interbody devices in spinal fusion procedures

PEEK Interbody Devices Market Dynamics

Driver

“Rising Prevalence of Spinal Disorders and Demand for Minimally Invasive Surgery”

- The growing incidence of spinal disorders such as degenerative disc disease, herniated discs, and spinal stenosis is a major driver behind the increasing demand for PEEK interbody devices

- As the global population ages, the prevalence of these conditions continues to rise, with elderly individuals being more susceptible to spine-related ailments that often necessitate surgical intervention

- The demand for minimally invasive spine surgeries (MISS) is also surging, as these procedures involve shorter recovery times, less tissue damage, and reduced post-operative complications—areas where PEEK devices excel due to their biocompatibility and strength

For instance,

- According to the World Health Organization (WHO), low back pain is one of the leading causes of disability worldwide, with a significant portion of the aging population experiencing chronic spinal issues requiring surgical solutions such as spinal fusion

- As spinal disorders become more widespread, especially among the aging demographic, the adoption of PEEK interbody devices is increasing, offering improved clinical outcomes and playing a vital role in the success of spinal fusion surgeries

Opportunity

“Personalized Implants and 3D Printing Technology in Spine Surgery”

- The integration of 3D printing technology with PEEK interbody devices presents a significant opportunity to develop customized, patient-specific spinal implants, improving surgical fit, stability, and outcomes

- These personalized implants can be tailored to individual anatomical structures, enhancing fusion rates, reducing the risk of implant rejection, and promoting faster post-operative recovery

- In addition, advanced manufacturing technologies allow for the creation of porous PEEK implants that better mimic natural bone structure, supporting osteointegration and long-term spinal health

For instance,

- In recent years, companies have begun investing in 3D-printed PEEK devices for spinal fusion, such as those incorporating lattice structures that promote bone in-growth while maintaining the material’s radiolucency and mechanical strength. This technological evolution enables more precise, minimally invasive, and patient-tailored surgical approaches

- The ability to customize interbody fusion devices using 3D printing opens the door to next-generation spinal implants, creating opportunities for improved patient outcomes, reduced complication rates, and enhanced surgical precision in treating complex spinal pathologies

Restraint/Challenge

“High Cost of PEEK Implants and Limited Access in Developing Regions”

- The high manufacturing and material costs associated with PEEK interbody devices pose a significant challenge for market expansion, particularly in cost-sensitive and developing regions where healthcare budgets are constrained

- PEEK, being a premium biomaterial known for its excellent biomechanical and radiolucent properties, is more expensive compared to traditional materials such as titanium or stainless steel, increasing the overall cost of spinal fusion procedures

For instance,

- In lower-income markets, hospitals and surgical centers may opt for more affordable alternatives, limiting the adoption of PEEK-based implants. In addition, reimbursement policies in many countries do not adequately cover the higher cost of PEEK implants, further affecting their accessibility and market penetration

- Consequently, the high price point of PEEK interbody devices can restrict their use to high-end hospitals and private practices, leading to disparities in treatment access and slowing the widespread adoption of these advanced implants in global spine surgery

PEEK Interbody Devices Market Scope

The market is segmented on the basis of product type and end user

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By End User |

|

In 2025, interbody fusion devices is projected to dominate the market with a largest share in product type segment

The interbody fusion devices segment is expected to dominate the PEEK interbody devices market with the largest share of 65.5% in 2025 due to its widespread use in spinal fusion surgeries, where it offers superior biomechanical strength and biocompatibility. These devices facilitate better spinal stability, promote bone in-growth, and are compatible with minimally invasive techniques. In addition, their radiolucency allows for clearer post-operative imaging, enhancing clinical outcomes

The hospitals is expected to account for the largest share during the forecast period in end user market

In 2025, the hospital segment is expected to dominate the market with the largest market share of 48.9% due to its high patient inflow, availability of advanced surgical infrastructure, and presence of skilled healthcare professionals. Hospitals are more likely to adopt cutting-edge technologies such as PEEK implants for complex spinal procedures. In addition, their capability to handle a higher volume of spinal surgeries contributes significantly to segment growth.

PEEK Interbody Devices Market Regional Analysis

“North America Holds the Largest Share in the PEEK Interbody Devices Market”

- North America dominates the PEEK Interbody Devices market with a market share of estimated 41.5%, driven, by advanced healthcare infrastructure, early adoption of innovative spinal implants, and a strong presence of major medical device companies

- U.S. holds a significant share, due to a high volume of spinal fusion procedures, a large aging population, and growing demand for minimally invasive spine surgeries

- The Supportive reimbursement policies, continuous R&D investment, and access to skilled spine surgeons further contribute to the region’s dominance in adopting PEEK-based interbody devices

- In addition, the growing incidence of spine-related disorders such as degenerative disc disease and herniated discs is fueling the demand for next-generation biomaterials such as PEEK in spinal surgery

“Asia-Pacific is Projected to Register the Highest CAGR in the PEEK Interbody Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the PEEK Interbody Devices market with a market share of 22.2%, driven by rapid expansion of healthcare infrastructure, growing awareness about spinal health, and an increasing volume of spinal surgeries

- Countries such as China, India, and Japan are emerging as key markets due to a rising geriatric population, which is more prone to spinal degeneration and related disorders requiring surgical intervention

- Japan leads in the adoption of high-end spinal implants, supported by its strong emphasis on precision surgery and advanced medical technologies

- India is projected to register the highest CAGR in the region, fueled by government healthcare reforms, increased access to surgical care, and rising adoption of advanced spinal implants, including PEEK devices, in both public and private hospitals

PEEK Interbody Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Stryker (U.S.)

- NuVasive, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Globus Medical (U.S.)

- DePuy Synthes (U.S.)

- Alphatec Spine (U.S.)

- B. Braun SE (Germany)

- Orthofix Medical Inc. (U.S.)

- LDR Holding Corporation (U.S.)

- SpineArt (Switzerland)

- Mazor Robotics (Israel)

- Invibio (UK)

- Raymedica (U.S.)

- K2M (U.S.)

- Finceramica (Italy)

- Biomet (U.S.)

- Exactech (U.S.)

- Japan Medical Materials (Japan)

- Curiteva (U.S.)

Latest Developments in Global PEEK Interbody Devices Market

- In April 2025, Curiteva announced that it had surpassed 5,000 levels treated with its novel Inspire Cervical 3D Printed Trabecular PEEK implants. The Inspire platform utilizes a fully interconnected porous PEEK architecture designed to enhance osseointegration and radiographic assessment, representing a significant advancement in biomaterials for spinal implants

- In February 2025, Medtronic plc, a global leader in spine technologies, announced the acquisition of Nanovis’ nano-surface technology assets, aimed at enhancing the performance of its PEEK interbody fusion devices. The integration of this nanotechnology is designed to improve osseointegration and fixation in spinal implants, offering a competitive edge in advanced spinal surgeries

- In December 2024, NuVasive Inc. received FDA 510(k) clearance for expanded indications of its Modulus TLIF-A Interbody System, a 3D-printed porous PEEK implant. The system is optimized for TLIF procedures, offering improved endplate engagement and bone in-growth due to its advanced architecture. This clearance enhances its applicability across a broader range of spinal conditions

- In October 2024, Stryker Corporation expanded its spinal implant offerings by introducing the Pangea Plating System, which supports enhanced fixation in trauma-related spinal conditions. While not exclusively PEEK, it complements Stryker’s interbody product ecosystem, including textured and hybrid PEEK devices used in spinal reconstruction

- In August 2024, Zimmer Biomet Holdings, Inc. unveiled new products and innovations at the AAOS 2024 Annual Meeting, including upgrades to its interbody fusion portfolio. The company emphasized continued investment in PEEK-based interbody systems such as the TruFuse platform, which supports customizable spinal fusion solutions across diverse patient anatomies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.