Global Percutaneous Nephroscope Market

Market Size in USD Billion

CAGR :

%

USD

5.80 Billion

USD

9.19 Billion

2024

2032

USD

5.80 Billion

USD

9.19 Billion

2024

2032

| 2025 –2032 | |

| USD 5.80 Billion | |

| USD 9.19 Billion | |

|

|

|

|

Percutaneous Nephroscope Market Size

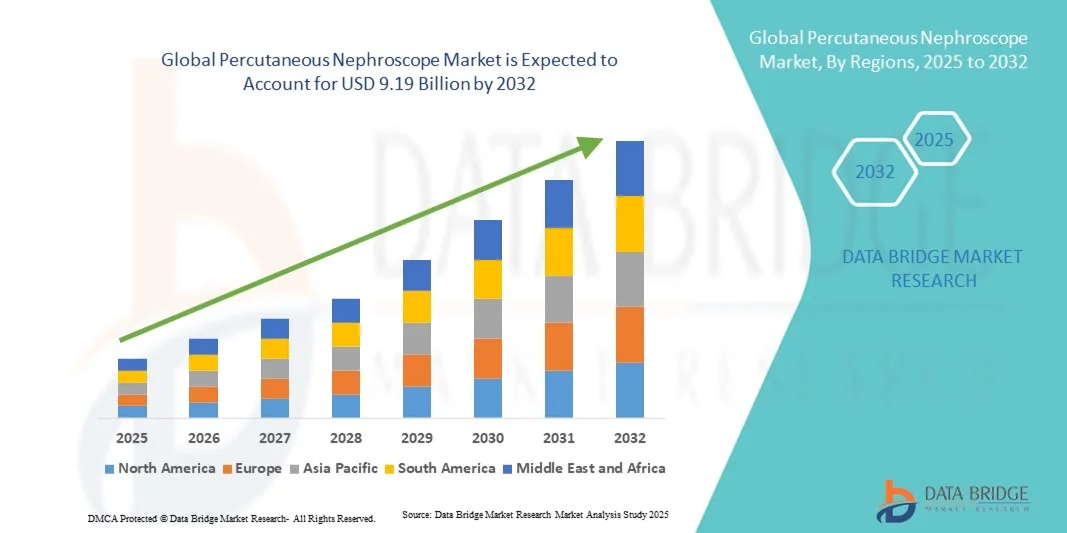

- The global percutaneous nephroscope market size was valued at USD 5.80 billion in 2024 and is expected to reach USD 9.19 billion by 2032, at a CAGR of 5.92% during the forecast period

- The market growth is largely fueled by the growing adoption of minimally invasive urological procedures and technological advances in nephroscope devices

- Furthermore, rising incidence of kidney stones and other urological disorders, increasing healthcare infrastructure investment globally, and preference for less invasive surgical tools are establishing percutaneous nephroscopes as the modern access and treatment tool of choice. These converging factors are accelerating the uptake of nephroscope solutions, thereby significantly boosting the industry’s growth

Percutaneous Nephroscope Market Analysis

- Percutaneous nephroscopes, offering minimally invasive access for kidney stone removal and other urological procedures, are increasingly vital components of modern urology surgeries in both hospitals and specialty clinics due to their enhanced precision, reduced recovery time, and integration with advanced imaging systems

- The escalating demand for percutaneous nephroscopes is primarily fueled by the rising prevalence of kidney stones and other renal disorders, growing adoption of minimally invasive procedures, and a preference for reduced surgical complications and faster patient recovery

- North America dominated the percutaneous nephroscope market with the largest revenue share of 38.5% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative surgical devices, and a strong presence of key industry players, with the U.S. experiencing substantial growth in nephroscope procedures, driven by technological innovations and rising awareness among urologists

- Asia-Pacific is expected to be the fastest growing region in the percutaneous nephroscope market during the forecast period due to increasing healthcare infrastructure, rising patient awareness, and growing prevalence of kidney-related disorders

- Rigid nephroscope segment dominated the percutaneous nephroscope market with a market share of 45.3% in 2024, driven by its established reliability, widespread adoption in standard procedures, and compatibility with existing surgical setups

Report Scope and Percutaneous Nephroscope Market Segmentation

|

Attributes |

Percutaneous Nephroscope Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Percutaneous Nephroscope Market Trends

Advancements in Imaging and Flexible Scope Technology

- A significant and accelerating trend in the global percutaneous nephroscope market is the integration of high-definition imaging and flexible scope technology, enhancing procedural precision and safety in urological surgeries

- For instance, flexible digital nephroscopes from Olympus and Richard Wolf allow surgeons to navigate complex renal anatomies, reducing tissue damage and improving stone removal efficiency

- Integration of advanced imaging enables real-time visualization during procedures, facilitating accurate stone localization and minimizing operative complications

- The seamless incorporation of flexible scopes with digital recording and irrigation systems allows centralized procedural control and post-operative evaluation, improving workflow efficiency

- This trend toward minimally invasive, precise, and technologically advanced nephroscope systems is reshaping surgical standards and prompting companies such as Boston Scientific to develop innovative devices with enhanced maneuverability

- The demand for nephroscopes with advanced visualization and flexible functionalities is rising rapidly across hospitals and specialty clinics, as surgeons prioritize patient safety and reduced recovery times. For instance, integration with laser fibers and lithotripsy probes is increasing procedural efficiency and enabling complete stone clearance in a single session

- The growing emphasis on outpatient and day-care urology procedures is encouraging adoption of compact and user-friendly nephroscope devices in both developed and emerging markets

Percutaneous Nephroscope Market Dynamics

Driver

Rising Prevalence of Kidney Stones and Minimally Invasive Procedures

- The increasing incidence of kidney stones and renal disorders, coupled with growing preference for minimally invasive surgeries, is a major driver for percutaneous nephroscope adoption

- For instance, Boston Scientific in 2024 launched new flexible digital nephroscopes with improved imaging and ergonomics, aimed at enhancing procedural outcomes in PCNL

- As patients and healthcare providers seek safer alternatives to open surgery, nephroscopes offer reduced complications, shorter hospital stays, and faster recovery

- The rising popularity of outpatient surgery centers for urological interventions is further expanding nephroscope adoption globally

- Ease of handling, integration with advanced imaging systems, and precise maneuverability are key factors propelling usage in hospitals and specialty clinics

- Technological advancements and growing awareness among urologists are driving continued investment in flexible and rigid nephroscope devices. For instance, government healthcare initiatives promoting minimally invasive procedures in emerging economies are boosting adoption rates significantly

- Collaborations between device manufacturers and hospitals for training and demonstration programs are enhancing confidence and accelerating market penetration

Restraint/Challenge

High Equipment Cost and Training Requirements

- The high procurement and maintenance costs of advanced nephroscope systems can hinder adoption, particularly in emerging and budget-sensitive markets

- For instance, Karl Storz flexible nephroscopes require specialized surgical training, limiting broader utilization in smaller clinics or low-resource settings

- The complexity of minimally invasive procedures demands skilled surgeons, which can slow market penetration in certain regions

- Despite clinical advantages, cost and training barriers may restrict adoption in areas with limited procedural volume or reimbursement policies

- Maintenance, sterilization, and accessory costs add to the overall investment, making hospitals cautious about large-scale deployment

- Overcoming these challenges through cost-effective devices, modular solutions, and comprehensive surgeon training programs is crucial for sustained market growth. For instance, lack of standardized training protocols in emerging markets can lead to procedural errors and slow device adoption

- Concerns over limited reimbursement and insurance coverage for advanced nephroscopy procedures may deter hospitals from investing in premium devices

Percutaneous Nephroscope Market Scope

The market is segmented on the basis of type, treatment instruments, application, and end user.

- By Type

On the basis of type, the percutaneous nephroscope market is segmented into rigid nephroscope and flexible nephroscope. The rigid nephroscope segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its established reliability, ease of use, and compatibility with standard percutaneous nephrolithotomy (PCNL) procedures. Hospitals and specialty clinics prefer rigid nephroscopes for their durability and precision in stone removal procedures. These devices provide excellent visualization and allow surgeons to use conventional treatment instruments, making them the preferred choice for established urology centers. Rigid nephroscopes also benefit from lower maintenance costs and familiarity among trained urologists, which ensures high adoption in regions with well-established surgical infrastructures. The segment’s dominance is reinforced by ongoing product refinements such as improved optics and ergonomic designs that enhance procedural efficiency.

The flexible nephroscope segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its capability to navigate complex renal anatomies and reach hard-to-access calyces with minimal tissue disruption. Flexible nephroscopes are increasingly adopted in outpatient and minimally invasive surgery settings due to their precision and patient-friendly approach. Technological advancements such as digital imaging, enhanced maneuverability, and smaller diameters are expanding their clinical applications. The growth is also supported by the rising incidence of complex kidney stones and a growing preference for personalized surgical approaches that reduce recovery time. Flexible devices are increasingly integrated with advanced irrigation and imaging systems, further driving adoption across both developed and emerging healthcare markets.

- By Treatment Instruments

On the basis of treatment instruments, the market is segmented into bioscopy forceps, stone removal forceps, lithotripsy probes, and laser fibers. The stone removal forceps segment dominated the market in 2024, owing to its widespread use in PCNL procedures for efficient extraction of kidney stones. Stone removal forceps are compatible with both rigid and flexible nephroscopes, providing surgeons with precise control to handle various stone sizes and compositions. Their reliability, ease of sterilization, and ability to be used repeatedly in multiple procedures contribute to sustained demand. Hospitals and specialty clinics particularly favor this instrument due to its role in improving procedural success rates and reducing operative time. In addition, innovations such as ergonomic designs and enhanced grip mechanisms are driving continued adoption in clinical settings. Stone removal forceps remain a standard instrument in most percutaneous nephroscope kits, ensuring their dominance in the market.

The laser fibers segment is expected to witness the fastest growth over the forecast period, driven by the increasing preference for minimally invasive lithotripsy techniques. Laser fibers enable precise fragmentation of stones with reduced collateral tissue damage, making them suitable for complex procedures and smaller stone fragments. The growth is also fueled by technological advancements in fiber durability, energy delivery, and integration with flexible nephroscopes. Rising awareness among urologists about the efficiency of laser-assisted stone removal, coupled with the expanding use of outpatient surgical centers, is accelerating demand. Laser fibers offer the advantage of reduced recovery time and lower complication rates, contributing to their rapid adoption globally.

- By Application

On the basis of application, the market is segmented into surgery and diagnostics. The surgery segment dominated the market in 2024 due to the widespread utilization of percutaneous nephroscopes in minimally invasive procedures for kidney stone removal and other urological interventions. Surgical applications benefit from high precision, reduced patient recovery time, and integration with advanced imaging systems. Hospitals and specialty clinics prefer surgical nephroscope applications for their ability to improve procedural success and reduce complication rates. Technological advancements such as high-definition optics, digital recording, and enhanced irrigation systems further strengthen the adoption of surgical procedures. The demand is particularly strong in regions with high prevalence of kidney stones and well-developed healthcare infrastructure. Integration with flexible and rigid nephroscopes ensures that surgical procedures remain the primary revenue-generating application for the market.

The diagnostics segment is anticipated to witness the fastest growth during the forecast period, fueled by rising use of nephroscopes for minimally invasive diagnostic procedures such as renal biopsy and evaluation of anatomical anomalies. Diagnostics applications benefit from flexible, high-resolution scopes that allow precise visualization of renal structures without extensive incisions. Increasing focus on early detection and minimally invasive evaluation of kidney-related disorders is driving adoption. Growth in diagnostic applications is supported by technological advancements in imaging, improved maneuverability, and integration with digital reporting systems. The segment’s expansion is also boosted by growing awareness among clinicians and patients about safer, outpatient-friendly diagnostic alternatives.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others. The hospitals segment dominated the market in 2024, due to well-established infrastructure, availability of trained urologists, and high procedural volume for kidney stone treatments and related surgeries. Hospitals can invest in both rigid and flexible nephroscope systems, along with the required treatment instruments, making them the largest revenue contributors. The adoption is driven by ongoing upgrades in surgical equipment, increasing prevalence of renal disorders, and availability of specialized urology departments. Hospitals also provide training and procedural standardization, which enhances confidence in using advanced nephroscope systems. Moreover, hospitals can integrate nephroscope procedures with broader patient care services, ensuring higher utilization and continued market dominance.

The ambulatory surgical centers segment is expected to witness the fastest growth over the forecast period, driven by the trend toward outpatient minimally invasive procedures. Rising preference for day-care surgeries, lower treatment costs, and faster patient recovery are key factors supporting growth. Advanced flexible nephroscopes and laser fibers enable procedures to be performed efficiently in outpatient settings. Expanding awareness among patients about outpatient surgery benefits, coupled with increasing investment in modern ambulatory centers, is accelerating adoption. This segment benefits from the convenience, cost-effectiveness, and shorter procedure-to-discharge timelines, making it the fastest-growing end-user category globally.

Percutaneous Nephroscope Market Regional Analysis

- North America dominated the percutaneous nephroscope market with the largest revenue share of 38.5% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative surgical devices, and a strong presence of key industry players

- Hospitals and specialty clinics in the region highly value percutaneous nephroscopes for their precision, reduced recovery times, and compatibility with advanced imaging and flexible scope technologies

- This adoption is further supported by the presence of key market players, ongoing technological innovations, well-trained urologists, and government initiatives promoting minimally invasive surgeries. The U.S., in particular, sees substantial growth in percutaneous nephroscope procedures due to rising patient awareness and increased procedural volumes

U.S. Percutaneous Nephroscope Market Insight

The U.S. percutaneous nephroscope market captured the largest revenue share 2024 within North America, fueled by the widespread adoption of minimally invasive urological procedures and advanced healthcare infrastructure. Hospitals and specialty clinics increasingly prioritize percutaneous nephroscopy for kidney stone removal and other renal interventions due to its precision, reduced recovery time, and lower complication rates. The presence of key market players such as Boston Scientific and Karl Storz, along with ongoing technological innovations in rigid and flexible nephroscopes, is significantly contributing to the market’s expansion. In addition, the rising prevalence of kidney stones and renal disorders, coupled with strong reimbursement policies for minimally invasive procedures, further propels adoption.

Europe Percutaneous Nephroscope Market Insight

The Europe percutaneous nephroscope market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of minimally invasive urology procedures and advanced diagnostic techniques. Healthcare facilities in Germany, France, and the U.K. are increasingly incorporating both rigid and flexible nephroscope systems into hospitals and specialty clinics. The growth is also supported by government initiatives promoting early intervention for kidney-related disorders and the rising prevalence of renal calculi in aging populations. Moreover, the integration of advanced imaging systems and laser-assisted lithotripsy with nephroscope devices is encouraging wider adoption across surgical and outpatient settings.

U.K. Percutaneous Nephroscope Market Insight

The U.K. percutaneous nephroscope market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of minimally invasive surgeries and heightened focus on patient safety and recovery. Hospitals and ambulatory surgical centers are adopting nephroscopes for both standard PCNL procedures and complex stone removal cases. The U.K.’s robust healthcare infrastructure, alongside rising government-backed screening and awareness programs for kidney stone disorders, is expected to continue to stimulate market growth.

Germany Percutaneous Nephroscope Market Insight

The Germany percutaneous nephroscope market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong focus on advanced surgical technologies and the rising prevalence of kidney stone disorders. German healthcare providers emphasize precision, safety, and efficiency in urological surgeries, promoting the adoption of both rigid and flexible nephroscopes. Integration of high-definition imaging, laser fibers, and minimally invasive instrumentation is increasingly prevalent in surgical procedures, aligning with Germany’s emphasis on clinical innovation and patient-centric healthcare solutions.

Asia-Pacific Percutaneous Nephroscope Market Insight

The Asia-Pacific percutaneous nephroscope market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising incidence of kidney stones, expanding healthcare infrastructure, and increasing awareness of minimally invasive procedures. Countries such as China, Japan, and India are experiencing rapid adoption of advanced nephroscope systems in hospitals, specialty clinics, and ambulatory surgical centers. The growth is further supported by government initiatives promoting early diagnosis, outpatient surgical procedures, and modern healthcare technologies. Moreover, increased local manufacturing and improved affordability of nephroscope devices are enhancing accessibility to a wider patient population in the region.

Japan Percutaneous Nephroscope Market Insight

The Japan percutaneous nephroscope market is gaining momentum due to the country’s advanced healthcare ecosystem, technological expertise, and increasing demand for minimally invasive surgeries. Japanese hospitals and specialty clinics focus on high-precision nephroscopy for kidney stone removal and renal diagnostics. Integration with digital imaging, flexible scopes, and laser-assisted lithotripsy is driving adoption. In addition, Japan’s aging population is such asly to boost demand for safer, less invasive surgical procedures, including outpatient interventions, further fueling market growth.

India Percutaneous Nephroscope Market Insight

The India percutaneous nephroscope market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly growing healthcare infrastructure, rising prevalence of kidney stone disorders, and increased patient awareness of minimally invasive treatments. Hospitals, ambulatory surgical centers, and specialty clinics are increasingly investing in both rigid and flexible nephroscope systems. The push towards modernized surgical facilities, combined with the availability of cost-effective devices and strong domestic distribution networks, are key factors propelling market expansion. Government initiatives supporting early diagnosis and outpatient surgeries are further contributing to the rapid adoption of nephroscope technologies in India.

Percutaneous Nephroscope Market Share

The Percutaneous Nephroscope industry is primarily led by well-established companies, including:

- Olympus Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- Richard Wolf GmbH (Germany)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- CONMED Corporation (U.S.)

- B. Braun SE (Germany)

- Medtronic (Ireland.)

- Teleflex Incorporated (U.S.)

- Smith & Nephew (U.K.)

- FUJIFILM Holdings Corporation (Japan)

- Coloplast Group (Denmark)

- Schölly Fiberoptic GmbH (Germany)

- Maxer Endoscopy GmbH (Germany)

- Hangzhou Endotop Medi Tech Co., Ltd. (China)

- Versa Consulting, Inc. (Netherlands)

- HealthWare (Italy)

- Blazejewski Medi Tech GmbH (Germany)

- Ackermann Instrumente (Germany)

What are the Recent Developments in Global Percutaneous Nephroscope Market?

- In September 2025, First PCNL procedures using Mendaera’s Focalist system are reported at the 2025 World Conference on Endourology and Uro‑Technology (WCET) in Phoenix, showing real‑world use of the new access technology in PCNL. This marks launch/early adoption of a new robotic access device specifically for PCNL, shifting toward more advanced instrumentation in nephroscope‑/tract access

- In July 2025, Mendaera receives FDA 510(k) clearance for its “Focalist” handheld robotic system for ultrasound‑guided needle placement, initial focus on urology procedures including Percutaneous Nephrolithotomy (PCNL). This clearance represents an important milestone for PCNL access technology, enabling more precise instrument placement via robotic control and ultrasound imaging

- In July 2024, A peer‑reviewed study describes the development of a novel digital flexible nephroscope specifically for PCNL, which in 3D‑printed and ex‑vivo porcine kidney models showed improved access to calyces versus rigid scopes. This technical development signals growing innovation in nephroscope design beyond the standard rigid instruments, relevant for advanced PCNL work

- In May 2023, In a review article on kidney‑stone management, the authors describe use of a 12 Fr nephroscope within the Karl Storz MIP M system highlighting the system’s use of the “vacuum cleaner effect” and smaller‑calibre nephroscopy as part of mini‑PCNL workflows. This reflects the trend of miniaturisation in nephroscopes and PCNL instrumentation smaller access tracts, optimized visualization, and enhanced efficiency of stone removal

- In July 2021, The second generation of the MIP system from Karl Storz is described in a brochure as being launched with updated sheaths, nephroscopes and vacuum‑suction‑irrigation features for PCNL. This earlier launch underpins the shift to smaller diameters and enhanced nephroscope‑sheath systems in PCNL.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.