Global Photovoltaic Market

Market Size in USD Billion

CAGR :

%

USD

104.71 Billion

USD

193.82 Billion

2024

2032

USD

104.71 Billion

USD

193.82 Billion

2024

2032

| 2025 –2032 | |

| USD 104.71 Billion | |

| USD 193.82 Billion | |

|

|

|

|

What is the Global Photovoltaic Market Size and Growth Rate?

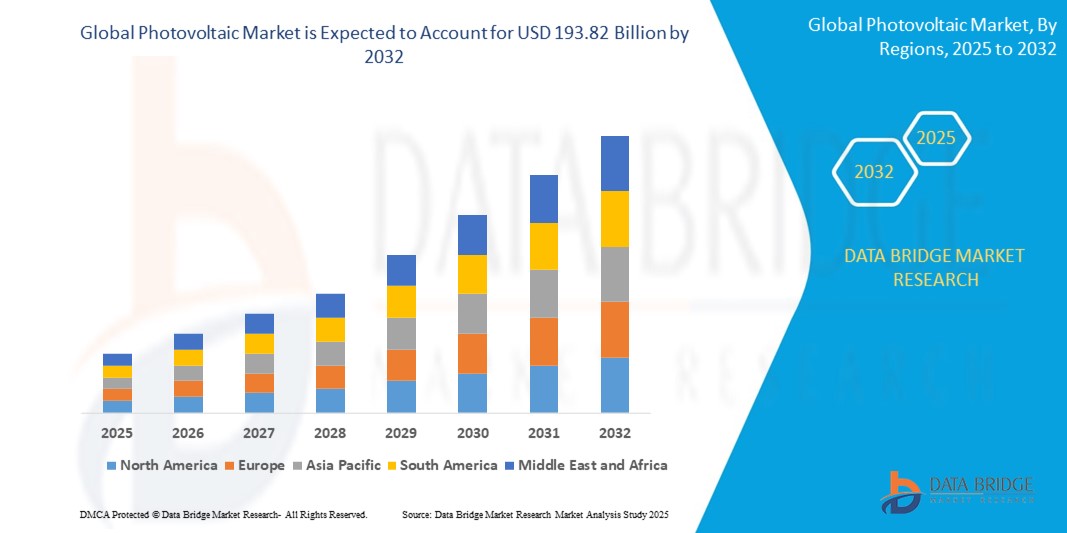

- The global Photovoltaic market size was valued at USD 104.71 billion in 2024 and is expected to reach USD 193.82 billion by 2032, at a CAGR of 8.00% during the forecast period

- The photovoltaic market is witnessing significant growth driven by technological advancements and innovative methods. One such advancement is the development of bifacial solar panels, which capture sunlight from both sides, enhancing energy efficiency by up to 30%

- In addition, perovskite solar cells are emerging as a game-changer due to their high efficiency and lower production costs compared to traditional silicon-based cells. The integration of artificial intelligence (AI) and machine learning (ML) in optimizing energy production and predictive maintenance is also gaining traction, improving system reliability and performance

What are the Major Takeaways of Photovoltaic Market?

- The usage of photovoltaic systems is expanding beyond traditional applications, including integration into building materials (Building Integrated Photovoltaics, or BIPV) and the rise of agrivoltaics, where solar panels are used in conjunction with agricultural activities. These advancements are increasing the adoption of photovoltaic technologies but are also making solar energy more accessible and affordable, driving substantial market growth and supporting global sustainability goals

- Asia-Pacific dominated the Photovoltaic market with the largest revenue share of 44.23% in 2024, driven by increasing solar capacity installations, favorable government policies, and the rapid expansion of renewable infrastructure across countries such as China, India, and Japan

- North America is projected to grow at the fastest CAGR of 11.8% from 2025 to 2032, driven by surging solar adoption across residential and commercial segments, especially in the U.S. and Canada

- The Modules segment dominated the market with the largest revenue share of 54.6% in 2024, driven by rising solar energy installations across residential, commercial, and utility sectors

Report Scope and Photovoltaic Market Segmentation

|

Attributes |

Photovoltaic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Photovoltaic Market?

“AI-Powered Energy Optimization and Smart Grid Integration”

- A major trend reshaping the photovoltaic market is the increasing integration of artificial intelligence (AI) and smart grid technologies to optimize energy efficiency and grid connectivity. AI-enabled photovoltaic systems can now predict energy generation based on weather data, consumption patterns, and automate performance adjustments in real-time

- Companies are leveraging machine learning algorithms to enhance solar panel efficiency, detect faults early, and extend equipment lifespan. AI also plays a critical role in managing distributed energy resources (DERs), enabling seamless two-way energy flows between producers and consumers

- For instance, Huawei Technologies Co., Ltd. has developed AI-powered FusionSolar Smart PV solutions that use intelligent string diagnosis and smart tracking algorithms to boost power output by up to 30%. Similarly, Sungrow integrates AI in its smart inverters for real-time monitoring and automated fault detection

- In addition, smart grid integration enables photovoltaic systems to coordinate with utility grids, allowing users to sell excess power back to the grid (net metering) and stabilize grid voltage. This is increasingly essential as global renewable adoption scales

- As the energy sector transitions toward decentralization, AI-driven photovoltaics enhance grid resilience, reduce operational costs, and support decarbonization goals. This is driving demand for smarter, self-optimizing PV systems across both residential and utility-scale sectors

- The convergence of AI, IoT, and photovoltaics is accelerating the emergence of next-generation solar ecosystems, fundamentally changing how solar energy is produced, consumed, and managed

What are the Key Drivers of Photovoltaic Market?

- The growing global focus on clean energy and decarbonization targets is a primary driver propelling the expansion of the photovoltaic market. As governments and corporations commit to net-zero emissions, solar power has emerged as a central pillar of global energy strategies

- For instance, in March 2024, the U.S. Department of Energy (DOE) announced over $250 million in funding for solar R&D and community-based photovoltaic projects, reinforcing national solar adoption goals. Such initiatives are echoing across Europe, China, and India as well

- Declining solar panel costs, improved module efficiency, and favorable policies such as feed-in tariffs, investment tax credits, and solar subsidies are also fueling adoption across residential, commercial, and industrial sectors

- Moreover, energy security concerns stemming from geopolitical conflicts and fossil fuel price volatility are pushing countries toward domestic solar infrastructure to reduce reliance on imports

- Consumer awareness regarding environmental sustainability, combined with rising electricity costs, is encouraging households and businesses to adopt rooftop photovoltaics and off-grid solar systems, particularly in regions with unreliable power supply

- Technological advancements, including bifacial panels, PERC technology, and thin-film solar cells, are also expanding use cases and improving performance under diverse climatic conditions

Which Factor is challenging the Growth of the Photovoltaic Market?

- A key challenge in the photovoltaic market is grid integration complexity and the intermittency of solar power. Since solar energy is weather-dependent, inconsistent generation can disrupt grid stability, especially during peak demand or cloudy conditions

- For instance, several regions in California and Australia have experienced grid strain due to high solar penetration without adequate storage or demand-side management systems in place, leading to curtailment or power outages

- Another concern is the lack of recycling infrastructure for decommissioned solar panels. As early-generation panels near the end of their 25–30-year life cycle, the industry faces a looming waste management challenge that may impact environmental credibility

- In addition, initial setup costs—while declining—still remain a barrier for many consumers, especially in developing countries with limited access to financing or incentives. The installation of large-scale PV plants also often faces land acquisition hurdles and regulatory delays

- Ensuring long-term durability in extreme weather conditions, improving energy storage capabilities, and developing global standards for panel recycling and disposal are essential for overcoming these growth limitations

- Addressing these challenges will require collaborative policy support, technological innovation, and supply chain localization to make solar energy truly accessible, affordable, and sustainable on a global scale

How is the Photovoltaic Market Segmented?

The market is segmented on the basis of component, system, material, cell type, installation type, and application.

- By Component

On the basis of component, the Photovoltaic market is segmented into Modules, Inverters, and Balance of System (BOS). The Modules segment dominated the market with the largest revenue share of 54.6% in 2024, driven by rising solar energy installations across residential, commercial, and utility sectors. Modules are the core generating unit in any photovoltaic system, and continued innovation in panel efficiency and cost reduction has expanded their deployment globally.

The Inverters segment is projected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for smart inverters that support grid stability and offer real-time performance analytics. Inverters are crucial in converting DC to AC and integrating solar energy into utility networks, making them indispensable for modern PV systems.

- By System

On the basis of system, the Photovoltaic market is segmented into High Concentration Photovoltaic (HCPV) and Low Concentration Photovoltaic (LCPV). The Low Concentration Photovoltaic (LCPV) segment held the largest market share of 68.9% in 2024, owing to its simpler design, lower cost, and broader application across various regions without requiring advanced cooling or solar tracking systems. LCPV is widely adopted in large-scale solar farms and rooftop installations in sun-abundant regions.

The High Concentration Photovoltaic (HCPV) segment is anticipated to witness the fastest CAGR during the forecast period due to its higher efficiency levels and potential for energy generation in high direct normal irradiance (DNI) areas. Technological improvements in multi-junction cells and tracking systems are boosting HCPV adoption.

- By Material

On the basis of material, the Photovoltaic market is segmented into Silicon and Compounds. The Silicon segment dominated the market with the largest revenue share of 81.2% in 2024, owing to its widespread usage in crystalline silicon-based PV modules, which offer high efficiency, stability, and scalability. Silicon continues to be the industry standard for PV cells due to its cost-effectiveness and mature manufacturing process.

The Compounds segment, which includes materials such as cadmium telluride (CdTe) and gallium arsenide (GaAs), is expected to witness the fastest growth from 2025 to 2032, driven by demand for flexible, lightweight, and high-performance modules in specialty and portable applications.

- By Cell Type

On the basis of cell type, the Photovoltaic market is segmented into Full-Cell PV Modules and Half-Cell PV Modules. The Full-Cell PV Modules segment held the largest market share of 59.3% in 2024, due to its established presence and cost-efficiency for standard residential and utility-scale installations. Full-cell modules are widely used in conventional PV installations due to their proven reliability.

However, the Half-Cell PV Modules segment is projected to witness the highest growth rate from 2025 to 2032, owing to better shade tolerance, reduced resistive losses, and higher output efficiency. As manufacturers increasingly transition to half-cell technology, this segment is rapidly gaining momentum in new installations.

- By Installation Type

On the basis of installation type, the Photovoltaic market is segmented into Ground Mounted, Building-Integrated Photovoltaics (BIPV), and Floating PV. The Ground Mounted segment accounted for the largest market share of 63.8% in 2024, owing to large-scale solar farms and commercial installations across open terrains. Ground-mounted systems offer ease of maintenance, optimal panel positioning, and scalability, making them the preferred choice for utility-scale applications.

The Floating PV segment is expected to register the fastest CAGR from 2025 to 2032, driven by rising land scarcity, particularly in densely populated regions. Floating PV systems provide dual use of water bodies and help reduce water evaporation while improving panel efficiency through natural cooling.

- By Application

On the basis of application, the Photovoltaic market is segmented into Residential, Commercial and Industrial, and Utilities. The Utilities segment dominated the market with the largest revenue share of 49.5% in 2024, driven by large-scale solar energy projects, government-backed clean energy targets, and favorable feed-in tariffs across several countries. The cost-efficiency of utility-scale projects and their role in replacing fossil fuels in national grids continues to fuel demand.

The Residential segment is projected to experience the highest growth during the forecast period due to increasing rooftop installations, government subsidies, and energy independence goals of homeowners. Advancements in storage solutions and the integration of home energy management systems are further accelerating residential adoption.

Which Region Holds the Largest Share of the Photovoltaic Market?

- Asia-Pacific dominated the Photovoltaic market with the largest revenue share of 44.23% in 2024, driven by increasing solar capacity installations, favorable government policies, and the rapid expansion of renewable infrastructure across countries such as China, India, and Japan

- The region benefits from abundant sunlight, rising electricity demand, and aggressive carbon neutrality targets, leading to significant investment in solar energy technologies, including both utility-scale and rooftop PV systems

- Furthermore, the availability of low-cost solar components, local manufacturing ecosystems, and ongoing R&D in panel efficiency solidify Asia-Pacific’s leadership in the global photovoltaic landscape

China Photovoltaic Market Insight

The China Photovoltaic market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s ambitious renewable energy targets, industrial manufacturing capacity, and robust investment in solar farms. China’s leadership in polysilicon production and innovation in solar module technologies continues to accelerate large-scale deployments. Government incentives, along with the shift toward distributed generation, further promote residential and commercial PV adoption across urban and rural areas.

Japan Photovoltaic Market Insight

The Japan Photovoltaic market is witnessing steady growth due to limited fossil fuel resources, high electricity costs, and a national push for clean energy. The country’s feed-in tariff (FiT) programs, solar building regulations, and the rise of zero-energy buildings (ZEBs) are key drivers. Moreover, Japan’s strong engineering focus supports adoption of high-efficiency PV modules, particularly in urban rooftops and commercial applications.

India Photovoltaic Market Insight

The India Photovoltaic market is expanding rapidly, supported by initiatives such as the National Solar Mission and increasing electrification of rural areas. Falling solar panel prices, supportive net metering policies, and rising energy demand across residential and industrial sectors are fueling installations. India’s utility-scale PV projects and solar parks are among the largest globally, offering long-term growth potential.

Which Region is the Fastest Growing in the Photovoltaic Market?

North America is projected to grow at the fastest CAGR of 11.8% from 2025 to 2032, driven by surging solar adoption across residential and commercial segments, especially in the U.S. and Canada. Supportive federal tax incentives, falling costs of solar panels, and state-level renewable energy targets are accelerating photovoltaic deployment in homes, businesses, and utilities. In addition, growing consumer interest in energy independence, resilience through battery storage, and grid decarbonization plans position North America as a high-growth PV market.

U.S. Photovoltaic Market Insight

The U.S. Photovoltaic market captured the largest revenue share within North America in 2024, fueled by the Inflation Reduction Act (IRA), which provides long-term incentives for solar and storage. Residential solar continues to thrive due to rising electricity bills, power outages, and demand for sustainable energy. Corporates and utilities are also investing heavily in PV to meet ESG goals and clean energy mandates.

Canada Photovoltaic Market Insight

The Canada Photovoltaic market is gaining traction as provinces roll out clean energy strategies, carbon pricing, and net-zero commitments. Solar PV is increasingly used in off-grid applications, commercial rooftops, and community solar projects, particularly in Ontario, Alberta, and British Columbia. The growing focus on decarbonizing remote and indigenous communities further supports market growth.

Which are the Top Companies in Photovoltaic Market?

The Photovoltaic industry is primarily led by well-established companies, including:

- JA Solar Technology Co., Ltd. (China)

- Schneider Electric (France)

- Siemens (Germany)

- Mitsubishi Electric Corporation (Japan)

- General Electric Company (U.S.)

- OMRON Corporation (Japan)

- SMA Solar Technology AG (Germany)

- Delta Energy Systems (Germany)

- Enphase Energy (U.S.)

- SolarEdge (Israel)

- Huawei Technologies Co., Ltd. (China)

- Shenzhen Kstar Science & Technology Co., Ltd. (China)

- ENF Ltd. (U.K.)

- SUNGROW (China)

- Trina Solar (China)

- LONGi (China)

- Canadian Solar (Canada)

- Qcells (South Korea)

- SHARP CORPORATION (Japan)

- LG Electronics (South Korea)

What are the Recent Developments in Global Photovoltaic Market?

- In September 2023, First Solar Inc., a renewable energy technology company, announced that Longroad Energy had expanded its solar panel order by an additional 2 gigawatts (GW), increasing its total purchase volume to around 8 GW. The panels, based on advanced thin-film solar modules, are scheduled for delivery between 2027 and 2029. Longroad, which has developed or acquired 4.3 GW of renewable energy projects in the U.S., also sold a 108-megawatt solar project in Virginia to Dominion Energy. This move strengthens First Solar's long-term manufacturing demand and reaffirms Longroad's commitment to domestic clean energy sourcing

- In May 2023, SJVN Ltd., a government-owned entity, secured a 100 MW solar power project valued at approximately USD 73.24 million from Rajasthan Urja Vikas Nigam Ltd. The project was awarded through a competitive tariff bidding process and an e-Reverse Auction (e-RA), with SJVN Green Energy Ltd. (SGEL), its wholly-owned subsidiary, leading the effort. This win highlights SGEL’s growing influence in India’s solar infrastructure development

- In November 2022, European Energy, a Denmark-based solar project developer, began preparations for constructing a 128.5 MW solar park near Helsingborg in southern Sweden. The park is expected to generate 175 GWh of electricity annually, with operations set to commence in 2024. This project underscores Europe's aggressive transition to sustainable power sources

- In March 2022, Canadian Solar began large-scale production of its new 54-cell format module, featuring 182 mm solar cells. The new design is tailored for residential, commercial, and industrial rooftop installations and aims to enhance efficiency and performance across multiple segments. This product launch demonstrates Canadian Solar’s innovation in high-performance solar modules

- In October 2021, SunPower Corp., a top solar technology and energy solutions provider, acquired Blue Raven Solar, one of the fastest-growing residential solar firms in the U.S. The acquisition is set to broaden SunPower’s market presence into underserved regions, especially in the Northwest and Mid-Atlantic. This strategic expansion is expected to accelerate SunPower’s residential solar adoption and customer outreach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Photovoltaic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Photovoltaic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Photovoltaic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.