Global Plasma Fractionational Market

Market Size in USD Billion

CAGR :

%

USD

31.16 Billion

USD

51.57 Billion

2024

2032

USD

31.16 Billion

USD

51.57 Billion

2024

2032

| 2025 –2032 | |

| USD 31.16 Billion | |

| USD 51.57 Billion | |

|

|

|

|

Plasma Fractionation Market Size

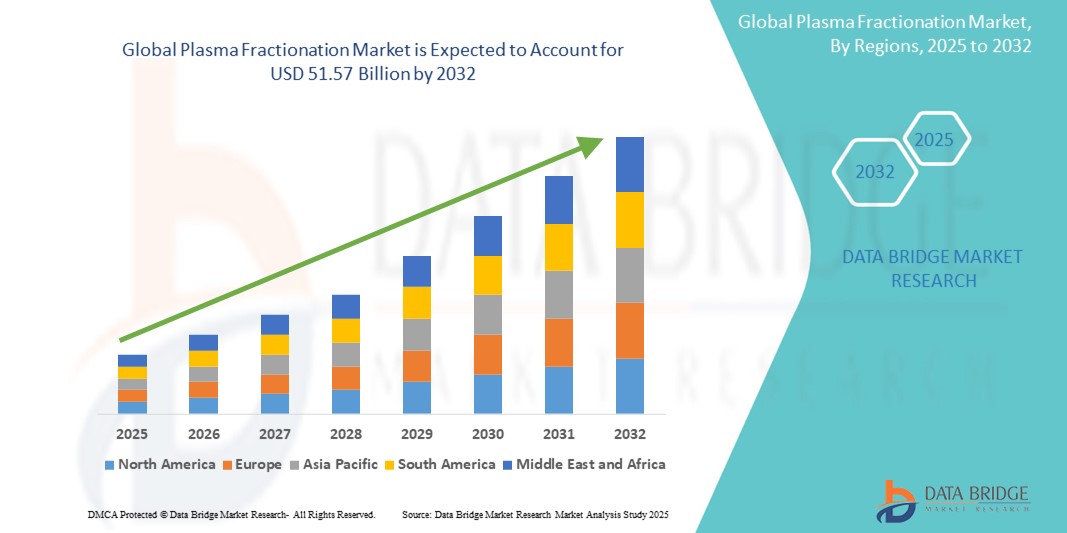

- The global plasma fractionation market size was valued at USD 31.16 billion in 2024 and is expected to reach USD 51.57 billion by 2032, at a CAGR of 6.50% during the forecast period

- This growth is driven by factors such as the increasing elderly population susceptible to chronic and rare diseases, rising demand for plasma-derived therapies such as immunoglobulins and alpha-1-antitrypsin, and the expansion of plasma collection facilities worldwide

Plasma Fractionation Market Analysis

- Plasma fractionation involves the separation of plasma into its component proteins, which are then used to treat a variety of conditions such as immune deficiencies, bleeding disorders, and pulmonary diseases

- The growth of this market is primarily driven by the increasing prevalence of rare and chronic diseases, rising demand for immunoglobulins and albumin, and advancements in fractionation technologies

- North America is expected to dominate the plasma fractionations market with a market share of 54.1%, due by a well-established plasma collection infrastructure, high healthcare spending, and robust demand for immunoglobulins and albumin

- Asia-Pacific is expected to be the fastest growing region in the Plasma Fractionation market with a market share of 22.5%, during the forecast period due to increasing healthcare investments, rising awareness of plasma-derived therapies, and growing patient populations with chronic and rare diseases

- Immunoglobulins segment is expected to dominate the market with a market share of 63.7% due to its widespread use in treating primary and secondary immunodeficiency disorders, autoimmune diseases, and neurological conditions

Report Scope and Plasma Fractionation Market Segmentation

|

Attributes |

Plasma Fractionation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plasma Fractionation Market Trends

“Technological Advancements in Plasma Fractionation and Automation in Downstream Processing”

- One major trend shaping the plasma fractionation market is the growing adoption of advanced separation technologies and automation in downstream processing for increased efficiency and product yield

- Innovations such as continuous flow centrifugation, membrane filtration, and enhanced chromatography techniques are enabling faster, more scalable, and purer fractionation of plasma proteins

- For instance, the integration of automated ion-exchange chromatography systems allows for consistent, high-purity separation of immunoglobulins and albumin, reducing manual errors and processing time

- These technological advancements are optimizing plasma-derived product manufacturing, enhancing product safety, and boosting the global supply of critical therapeutics, thereby accelerating market growth

Plasma Fractionation Market Dynamics

Driver

“Rising Prevalence of Chronic and Rare Diseases Driving Demand for Plasma-Derived Therapies”

- The growing incidence of chronic illnesses such as immune deficiencies, hemophilia, and alpha-1 antitrypsin deficiency is significantly boosting the demand for plasma-derived therapies, thereby fueling market growth

- With aging populations and increasing awareness of rare disease diagnosis and treatment, the need for specialized therapeutics derived from plasma components is rapidly expanding

- Plasma fractionation enables the extraction of life-saving proteins such as immunoglobulins, clotting factors, and albumin—essential for managing critical conditions and improving patient survival

For instance,

- According to the World Federation of Hemophilia 2023 report, over 1.3 million people worldwide are living with bleeding disorders, many of whom rely on plasma-derived clotting factors for regular treatment

- As the global burden of chronic and rare diseases rises, so too does the demand for advanced plasma fractionation processes to meet the growing need for effective and safe therapeutic solutions

Opportunity

“Emergence of AI and Automation in Plasma Processing and Quality Control”

- The integration of artificial intelligence and automation technologies in plasma fractionation presents a significant opportunity to improve operational efficiency, product consistency, and safety in manufacturing processes

- AI-driven systems can optimize fractionation parameters, monitor batch quality in real time, and predict equipment maintenance needs, thereby reducing errors and operational downtime

- In addition, AI-enabled data analytics platforms can accelerate research and development of novel plasma-derived therapies by identifying patterns and optimizing formulation processes

For instance,

- According to a 2024 report by BioProcess International, several biopharmaceutical companies are leveraging AI to monitor chromatographic separations and forecast deviations in product quality, enabling faster decision-making and reducing batch failures

- As demand for plasma-derived products increases globally, the use of AI and automation in plasma processing facilities can enhance scalability, regulatory compliance, and cost-effectiveness—offering a transformative opportunity for industry growth

Restraint/Challenge

“High Infrastructure and Operational Costs Limiting Market Expansion”

- The plasma fractionation process requires highly specialized infrastructure, including advanced facilities for plasma collection, storage, and fractionation—making the initial setup and operational costs prohibitively high

- Building and maintaining GMP-compliant fractionation plants, along with the need for stringent regulatory adherence and cold chain logistics, can involve investments of hundreds of millions of dollars

- These high costs create barriers for new entrants and limit the expansion of fractionation capacity, particularly in low- and middle-income countries where healthcare budgets are constrained

For instance,

- According to a 2023 industry report by Plasma Protein Therapeutics Association (PPTA), establishing a plasma fractionation facility with a modest processing capacity can cost over USD 300 million, and require 5–7 years to become operational, due to complex regulatory approvals and quality control demands

- Consequently, the high financial and logistical burdens restrict market access, discourage innovation from smaller players, and contribute to regional disparities in the availability of plasma-derived therapies

Plasma Fractionation Market Scope

The market is segmented on the basis of product type, application, processing technology, mode, end user, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By Processing Technology |

|

|

By Mode |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the immunoglobulins is projected to dominate the market with a largest share in product type segment

The immunoglobulins segment is expected to dominate the plasma fractionation market with the largest share of 63.7% in 2025 due to its widespread use in treating primary and secondary immunodeficiency disorders, autoimmune diseases, and neurological conditions. The growing geriatric population, increasing incidence of chronic illnesses, and rising off-label use of immunoglobulins further contribute to this demand. In addition, continuous innovation in intravenous (IVIG) and subcutaneous (SCIG) formulations enhances therapeutic efficacy and patient compliance.

The ion- exchange chromatography is expected to account for the largest share during the forecast period in processing technology market

In 2025, ion- exchange chromatography segment is expected to dominate the market with the largest market share of 34.2% due to its high efficiency, scalability, and ability to selectively separate plasma proteins with high purity. Its cost-effectiveness and strong binding capacity make it a preferred method in large-scale plasma fractionation. In addition, advancements in resin technology and automation have further improved its performance and adoption in biopharmaceutical manufacturing.

Plasma Fractionation Market Regional Analysis

“North America Holds the Largest Share in the Plasma Fractionation Market”

- North America dominates the plasma fractionation market with a market share of estimated 54.1%, driven, by a well-established plasma collection infrastructure, high healthcare spending, and robust demand for immunoglobulins and albumin

- U.S. holds a market share of 74.8%, due to the presence of leading plasma fractionation companies, frequent approvals of plasma-derived therapies, and strong regulatory frameworks ensuring safety and quality

- The favorable reimbursement policies, high awareness of rare diseases, and government support for biologics manufacturing further contribute to the region's dominance

- The growing number of plasma donation centers and increasing prevalence of immunodeficiency and bleeding disorders continue to drive the demand for plasma-derived products across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Plasma Fractionation Market”

- Asia-Pacific is expected to witness the highest growth rate in the plasma fractionation market with a market share of 22.5%, driven by increasing healthcare investments, rising awareness of plasma-derived therapies, and growing patient populations with chronic and rare diseases

- Countries such as China, India, Japan, and South Korea are emerging as key contributors due to rising demand for immunoglobulins, expanding plasma collection networks, and government initiatives to promote self-sufficiency in plasma-derived product manufacturing

- Japan remains a prominent market with advanced healthcare technology and high utilization of plasma products for immunological and neurological disorders

- India is projected to register the highest CAGR of 10.9% in the plasma fractionation market, driven by rapidly growing population, increased healthcare funding, a rise in diagnostic capabilities, and growing collaborations with global biopharmaceutical firms to build domestic plasma fractionation capacity

Plasma Fractionation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Grifols, S.A. (Spain)

- Takeda Pharmaceutical Company Limited (Japan)

- Octapharma Inc. (Switzerland)

- CSL Plasma LLC (U.S.)

- Japan Blood Products Organization (Japan)

- China Biologic Products Holdings, Inc. (China)

- LFB (France)

- GC Corp. (South Korea)

- Shanghai RAAS Blood Products Co., Ltd. (China)

- Baxter (U.S.)

- Bio Products Laboratory Ltd. (U.K.)

- Pall Corporation (U.S.)

- KabaFusion (U.S.)

- Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd. (China)

- Bharat Serums (India)

- SK Plasma (South Korea)

- Kedrion S.p.A (Italy)

- Sanquin (Netherlands)

- Biotest AG (Germany)

- Merck KGaA (Germany)

- ADMA Biologics, Inc. (U.S.)

- Boccard (France)

- Intas Pharmaceuticals Ltd. (India)

Latest Developments in Global Plasma Fractionation Market

- In April 2025, CSL announced plans to seek regulatory approval from Chinese authorities to export albumin from its new USD 900 million plasma fractionation facility in Broadmeadows, Melbourne. This move aims to enhance global supply chain resilience and meet the growing demand for plasma-derived therapies in China

- In September 2022, CSL Behring K.K. obtained manufacturing and marketing authorization from Japan's Ministry of Health, Labour and Welfare for Berinert S.C. Injection 2000. This lyophilized human C1-esterase inhibitor concentrate is designed for subcutaneous injection to prevent acute hereditary angioedema (HAE) attacks. The approval marks a significant advancement in plasma-derived therapeutics for HAE patients in Japan

- In September 2022, CSL Behring K.K. received regulatory approval from Japan’s Ministry of Health, Labour and Welfare for Berinert S.C. Injection 2000, a lyophilized human C1-esterase inhibitor designed for subcutaneous administration. This approval represents a key advancement in plasma-derived therapeutics for the prevention of acute hereditary angioedema (HAE) attacks, expanding treatment options in the Japanese market

- In October 2022, Grifols inaugurated a new albumin purification and filling facility in Dublin, Ireland, strengthening its global manufacturing and supply capabilities. This expansion significantly boosts the company’s capacity to produce albumin—an essential plasma-derived product—supporting the growing global demand for plasma fractionation therapies

- In May 2022, Terumo Blood and Cell Technologies opened a new USD 250 million, 170,000-square-foot manufacturing facility in Douglas County, Colorado. The plant is dedicated to producing single-use collection sets for the FDA-approved Rika Plasma Donation System, aiming to bolster plasma collection capabilities and meet the increasing demand for source plasma in the plasma fractionation market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.