Global Platform Based Master Card Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

3.12 Billion

2024

2032

USD

1.30 Billion

USD

3.12 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 3.12 Billion | |

|

|

|

|

Platform Based Master Card Market Analysis

The platform-based mastercard market is experiencing significant growth as digital payment solutions become more prevalent globally. mastercard's platform-based approach leverages technology to facilitate secure, seamless, and efficient payment transactions across various industries. These platforms integrate advanced technologies such as artificial intelligence, blockchain, and biometric authentication to enhance the security and speed of transactions. The rise of e-commerce, mobile payments, and contactless payments is further fueling market expansion. mastercard's continuous innovation in creating flexible, scalable solutions that cater to businesses of all sizes is driving adoption, especially in emerging markets. Recent developments in the market include collaborations with fintech companies and the integration of mastercard payment systems into diverse platforms, enabling customers to access services more efficiently. As the demand for digital payments grows, the platform-based mastercard market is poised for sustained growth, offering opportunities for further advancements in payment technologies and services.

Platform Based Master Card Market Size

The global platform based master card market size was valued at USD 1.30 billion in 2024 and is projected to reach USD 3.12 billion by 2032, with a CAGR of 11.50% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Platform Based Master Card Market Trends

“Integration of Mastercard Payment Systems”

The platform-based mastercard market is rapidly evolving, driven by innovation in digital payment technologies. mastercard continues to expand its offerings with secure, flexible platforms that integrate advanced technologies such as artificial intelligence and blockchain. One key trend is the rise of contactless payments, which has gained significant traction globally due to the convenience and speed it offers consumers. This shift towards contactless transactions is reshaping the payment landscape, making it essential for businesses to adopt mastercard's platform-based solutions. In addition, the integration of mastercard payment systems into various online platforms and mobile applications is expanding its reach. With increasing adoption across e-commerce, fintech, and other sectors, the platform-based mastercard market is poised for continued growth.

Report Scope and Platform Based Master Card Market Segmentation

|

Attributes |

Platform Based Master Card Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Fiserv, Inc. (U.S.), Adyen (Netherlands), Amazon Inc. (U.S.), Stripe, Inc. (U.S.), GMO Internet Group (Japan), Verizon (U.S.), Verifone (U.S.), Visa (U.S.), CCBill, LLC. (U.S.), SecurePay (Australia), PayPal Payments Private Limited (U.S.), NASPERS (South Africa), Worldpay LLC (U.K.), Wirecard (Germany), American Express (U.S.), Discover Bank, Member FDIC (U.S.), Citigroup (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Platform Based Master Card Market Definition

Platform-based mastercard refers to mastercard’s payment solutions that utilize digital platforms to enable secure, efficient, and flexible payment transactions. These platforms integrate various technologies such as artificial intelligence, blockchain, and biometric authentication to enhance the security, speed, and user experience of financial transactions. Unlike traditional card payment methods, platform-based mastercard solutions enable seamless integration with e-commerce websites, mobile apps, and point-of-sale systems, facilitating both online and offline payments.

Platform Based Master Card Market Dynamics

Drivers

- Rising Demand for Contactless Payments

The growing popularity of contactless payments is a key driver for the platform-based mastercard market. Consumers increasingly favor contactless payment methods due to their speed, convenience, and enhanced security. These payments allow for quick transactions without the need for physical contact, making them ideal for both small and large purchases. As demand for contactless solutions rises, platform-based mastercard offerings are well-positioned to meet this need by providing secure, seamless, and efficient payment infrastructure. This trend is driving the adoption of mastercard’s platform-based solutions across various sectors, further boosting the growth of the digital payments market.

- Increased Digital Payment Adoption

The shift toward digital payment methods is rapidly accelerating, driven by consumer preferences for convenience and the growing reliance on online transactions. As more businesses adopt e-commerce models, they seek secure, efficient, and flexible payment solutions to cater to this demand. Platform-based mastercard offerings are perfectly positioned to address this need, providing robust security features, scalability, and ease of integration across various platforms. This growing demand for digital payments, combined with the increasing need for flexible payment solutions, is driving the adoption of platform-based mastercard systems, further fueling the growth of the digital payment landscape.

Opportunities

- Integration with Fintech and Mobile Wallets

The rise of fintech startups and mobile wallets offers a significant growth opportunity for mastercard to expand its platform-based solutions. As consumers increasingly turn to digital wallets and innovative fintech services for their payment needs, mastercard can integrate its secure, scalable payment systems into these platforms, providing a seamless payment experience across multiple devices and channels. By doing so, mastercard can tap into a rapidly growing market segment, ensuring that its solutions cater to the evolving needs of consumers and businesses alike. This integration will further strengthen mastercard’s position as a leading player in the digital payments ecosystem.

- Innovations in Cross-Border Payments

As global trade and international travel expand, the demand for efficient and secure cross-border payment solutions is growing. Platform-based mastercard solutions are uniquely positioned to address this need by offering enhanced security features and lower transaction costs compared to traditional payment methods. These solutions enable seamless international transactions, which are essential for businesses and consumers who require fast and reliable payment options. By integrating advanced technologies such as blockchain and AI, platform-based mastercard systems can further streamline cross-border payments, creating a significant opportunity for growth in the global financial services market.

Restraints/Challenges

- Competition from Alternative Payment Solutions

The emergence of alternative payment solutions, including cryptocurrencies, digital wallets, and other fintech innovations, poses a significant challenge to the platform-based mastercard market. These alternatives offer consumers new ways to make transactions, often promising lower fees, faster processing, and enhanced privacy. As a result, Mastercard faces growing competition from these alternatives, which could potentially disrupt traditional payment systems. To maintain its market position, Mastercard must continue to innovate, adapting its platform-based solutions to meet changing consumer preferences and staying ahead of emerging technologies. Failing to do so could impact its dominance in the digital payments market.

- Dependence on Internet Connectivity

Platform-based payment solutions depend significantly on reliable internet access and connectivity to function effectively. In regions with underdeveloped or unreliable internet infrastructure, the adoption of these solutions can be slow, limiting their reach and market penetration. For businesses and consumers in areas with limited connectivity, the reliance on internet-based systems may present challenges, such as slow transaction speeds or the inability to process payments at all. These infrastructure limitations can restrict the growth of platform-based mastercard solutions, making it a key restraint to expanding the market, especially in developing or rural regions with poor internet access.

Platform Based Master Card Market Scope

The market is segmented on the basis of application, technology, and card type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Micro and Small Enterprises

- Large Enterprises

- Mid-Size Enterprises

Technology

- Embossing

- Magnetic Stripe

- Smart Card

- Payment Cloud

- Proximity Card

- Re-Programmable Magnetic Stripe Card

- Others

Card Type

- Credit Card

- Debit Card

- Prepaid Card

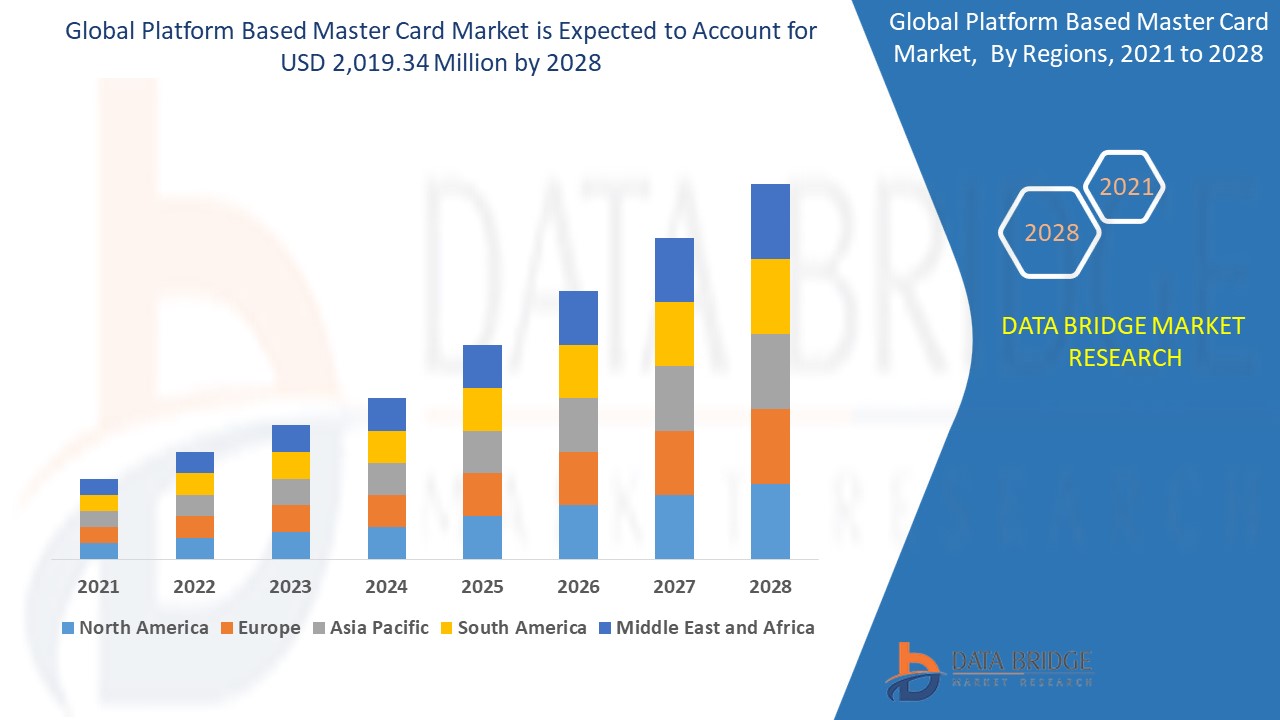

Platform Based Master Card Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, application, technology, and card type as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to lead the platform-based mastercard market, driven by the growing adoption of smartphones and their integration into daily consumer activities. In addition, the increasing demand for online payment solutions in the region further fuels market growth. These factors position North America as a dominant player in the market.

The Asia-Pacific region is anticipated to experience significant growth in the platform-based mastercard market during the 2025-2032 forecast period. This growth is driven by the rising consumer preference for cashless and cardless payment options. In addition, the widespread penetration of smartphones across the region further supports the adoption of digital payment solutions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Platform Based Master Card Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Platform Based Master Card Market Leaders Operating in the Market Are:

- Fiserv, Inc. (U.S.)

- Adyen (Netherlands)

- Amazon Inc. (U.S.)

- Stripe, Inc. (U.S.)

- GMO Internet Group (Japan)

- Verizon (U.S.)

- Verifone (U.S.)

- Visa (U.S.)

- CCBill, LLC. (U.S.)

- SecurePay (Australia)

- PayPal Payments Private Limited (U.S.)

- NASPERS (South Africa)

- Worldpay LLC (U.K.)

- Wirecard (Germany)

- American Express (U.S.)

- Discover Bank, Member FDIC (U.S.)

- Citigroup (U.S.)

Latest Developments in Platform Based Master Card Market

- In February 2024, American Express and Delta Air Lines introduced enhanced Delta SkyMiles® American Express Cards designed to enrich the travel experience. These upgraded cards aim to offer added benefits and everyday value to both consumers and business owners. The collaboration focuses on providing a more rewarding and flexible payment solution for frequent travelers

- In January 2024, Bank of America launched CashPro Insights, a new digital application designed to analyze data through the CashPro platform. This tool aims to provide businesses with deeper financial insights and better decision-making capabilities. By leveraging advanced data analytics, CashPro Insights enhances financial management for companies using the platform

- In February 2024, Barclays announced its acquisition of Tesco's retail banking unit. This move is aimed at strengthening Barclays' position in the retail banking sector. The acquisition will enhance Barclays' customer base and expand its service offerings in the UK market

- In 2020, Zuora, Inc. formed a partnership with SB Payment Service Corp., a Softbank Group company, to enable Japanese businesses across various industries to process credit card payments securely. This collaboration aimed to offer a seamless and convenient subscription-based payment solution. The partnership supports the growing demand for flexible payment methods in Japan's expanding digital economy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.