Global Platinum Automotive Catalyst Market

Market Size in USD Billion

CAGR :

%

USD

11.21 Billion

USD

21.84 Billion

2024

2032

USD

11.21 Billion

USD

21.84 Billion

2024

2032

| 2025 –2032 | |

| USD 11.21 Billion | |

| USD 21.84 Billion | |

|

|

|

|

Platinum Automotive Catalyst Market Size

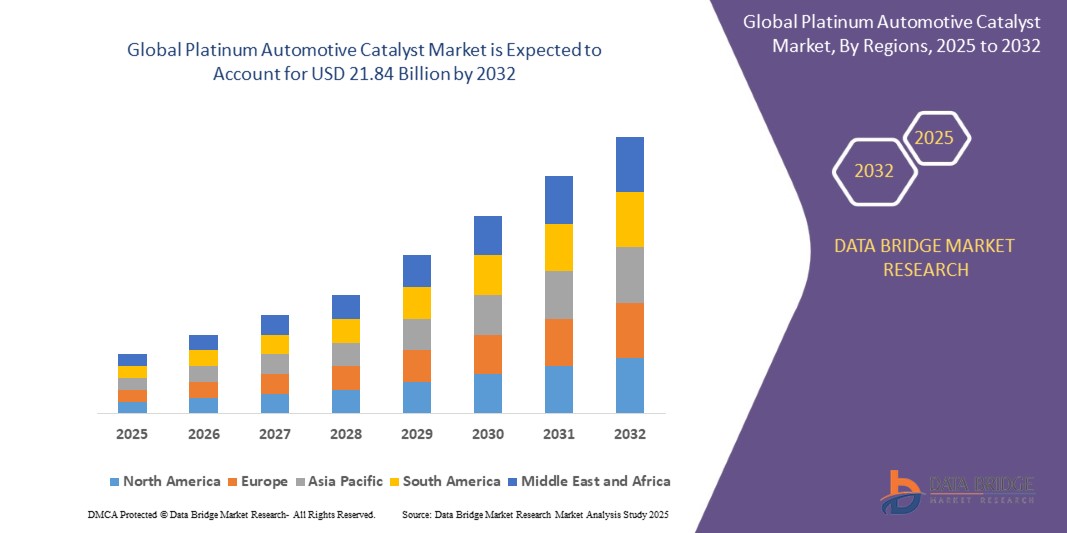

- The Global Platinum Automotive Catalyst Market size was valued at USD 11.21 Billion in 2024 and is expected to reach USD 21.84 billion by 2032, at a CAGR of 5.40 % during the forecast period

- The Platinum Automotive Catalyst Market is experiencing steady growth, primarily driven by stringent environmental regulations and increasing demand for vehicles with lower emissions. As governments worldwide enforce stricter emission norms to combat air pollution, automakers are adopting platinum-based catalysts for their superior efficiency in reducing harmful exhaust gases such as nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons.

- Furthermore, the rising consumer preference for eco-friendly and fuel-efficient vehicles is encouraging manufacturers to integrate advanced platinum catalysts that enhance engine performance while minimizing environmental impact. Innovations focusing on improved catalyst durability, reduced platinum loading, and enhanced conversion rates are attracting significant investments from key industry players. Additionally, the growing shift toward hybrid and electric vehicles, along with expanding automotive production in emerging economies, is fueling market demand

Platinum Automotive Catalyst Market Analysis

- Platinum automotive catalysts are critical components used in vehicle exhaust systems to reduce harmful emissions such as nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons. These catalysts help meet stringent environmental regulations by enabling cleaner combustion and improved air quality

- The demand for platinum automotive catalysts is primarily driven by tightening emission standards globally, increasing consumer awareness of environmental sustainability, and the automotive industry's shift towards greener technologies. Additionally, growing production of passenger and commercial vehicles continues to boost catalyst consumption

- Asia-Pacific is expected to dominate the Platinum Automotive Catalyst Market with a market share of approximately 39.37%, supported by a rapidly expanding automotive industry, favorable government policies promoting cleaner vehicles, and rising demand for emission control technologies in countries such as China, India, and Japan

- North America is projected to be the fastest-growing region in the market, fueled by stringent emission regulations, increasing vehicle electrification trends, and growing investments in advanced catalyst technologies. High consumer purchasing power and focus on sustainability further enhance regional growth prospects

- The passenger vehicle segment is anticipated to hold the largest market share, driven by increasing production volumes and consumer preference for vehicles compliant with environmental norms. Among catalyst types, three-way catalysts (TWCs) are expected to lead the market owing to their effectiveness in controlling multiple pollutants simultaneously and compatibility with gasoline engines

Report Scope and Platinum Automotive Catalyst Market Segmentation

|

Attributes |

Platinum Automotive Catalyst Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Platinum Automotive Catalyst Market Trends

“Innovation in Catalyst Efficiency and Sustainability”

- The market is witnessing a growing focus on advanced catalyst technologies that improve emission reduction efficiency while lowering platinum usage to reduce overall costs.

- Manufacturers are increasingly investing in research on durable and high-performance catalysts that can withstand extreme engine conditions and support hybrid and electric vehicle powertrains.

- Innovation is being driven by regulatory pressures worldwide, especially the adoption of Euro 7 and equivalent emission standards, pushing for catalysts that meet stricter pollutant limits.

- For instance, in early 2025, Johnson Matthey announced the launch of a next-generation platinum catalyst featuring enhanced NOx conversion and reduced precious metal loading, aimed at improving sustainability without compromising performance.

- This trend is steering collaborations between automotive OEMs, catalyst manufacturers, and material scientists to develop tailored solutions that align with the evolving landscape of clean mobility and environmental compliance.

Platinum Automotive Catalyst Market Dynamics

Driver

“Rising Environmental Regulations and Emission Standards”

- The Platinum Automotive Catalyst Market is primarily driven by increasingly stringent environmental regulations and emission standards across the globe. Governments are enforcing tougher norms like Euro 7 in Europe, China VI in China, and similar regulations in North America to reduce vehicular pollution and improve air quality

- For example, these regulations mandate lower permissible levels of nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons, compelling automakers to adopt advanced platinum-based catalysts for effective exhaust gas treatment. This regulatory push significantly increases demand for high-performance catalytic converters

- Growing public awareness about the adverse health impacts of air pollution is encouraging consumers and manufacturers alike to prioritize cleaner vehicle technologies, further boosting the market for platinum catalysts

- Additionally, the global shift towards hybrid and electric vehicles, which often require specialized emission control solutions, is expanding opportunities for innovative catalyst designs that enhance fuel efficiency and reduce environmental impact

- These regulatory and consumer-driven factors are motivating automakers and catalyst manufacturers to invest heavily in R&D, leading to continuous technological advancements and improved catalyst performance, thereby driving sustained market growth

Restraint/Challenge

“High Cost of Platinum and Volatility in Raw Material Prices”

- The Platinum Automotive Catalyst Market faces significant restraints due to the high cost and price volatility of platinum, which is a key raw material used in catalyst production. Fluctuating prices of this precious metal impact the overall cost of automotive catalysts, making them expensive for manufacturers and ultimately affecting vehicle prices.

- For example, sudden spikes in platinum prices driven by geopolitical tensions, supply-demand imbalances, or mining disruptions can lead to increased production costs, thereby limiting the adoption of platinum-based catalysts, especially in price-sensitive markets.

- Additionally, the limited availability and geographic concentration of platinum mining, primarily in South Africa and Russia, pose supply chain risks that can disrupt manufacturing schedules and product availability.

- Regulatory complexities and evolving emission standards require frequent catalyst reformulations, adding to R&D and compliance costs that further strain profit margins.

- In emerging markets, cost sensitivity among consumers and automakers can delay the transition to advanced platinum catalysts, especially when lower-cost alternatives or less stringent regulatory enforcement exist.

- Addressing these restraints requires innovation in catalyst design to reduce platinum loading, alternative material research, strategic sourcing, and closer collaboration between manufacturers, suppliers, and regulators to stabilize supply and control costs

Platinum Automotive Catalyst Market Scope

- By Fuel Type

On the basis of fuel type, the Platinum Automotive Catalyst Market is segmented into Gasoline, Diesel, Hybrid Fuels, and Hydrogen Fuel Cell

The Gasoline segment dominates the market with the largest revenue share of 52.3% in 2024, driven by the widespread use of gasoline-powered vehicles globally and the critical role of platinum catalysts in reducing emissions from these engines. Gasoline catalysts are preferred due to their high efficiency in converting harmful gases such as CO, NOx, and hydrocarbons into less harmful substances, aligning with stringent emission regulations. The segment’s growth is further supported by ongoing innovations aimed at improving catalyst durability and performance under varying operating conditions

- By Emission Content

On the basis of emission content, the Platinum Automotive Catalyst Market is segmented into Ammonia (NH3), Nitrogen Oxides (NOx), Carbon Monoxide (CO), and Others.

The Nitrogen Oxides (NOx) segment dominates the market with the largest revenue share of 55.8% in 2024, driven by the critical need to control NOx emissions, which are major contributors to air pollution and smog formation. Regulatory mandates worldwide focus heavily on reducing NOx levels from vehicle exhausts, making platinum-based catalysts highly effective in converting these harmful gases into harmless nitrogen and oxygen

- By Catalyst Type

On the basis of catalyst type, the Platinum Automotive Catalyst Market is segmented into Two-way, Three-way, and Diesel Oxidation catalysts.

The Three-way catalyst segment dominates the market with the largest revenue share of 61.4% in 2024, driven by its superior ability to simultaneously reduce nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons from gasoline engine exhausts. This catalyst type is widely adopted due to its high efficiency in meeting stringent emission standards such as Euro 6 and EPA Tier 3

- By Vehicle Type

On the basis of vehicle type, the Platinum Automotive Catalyst Market is segmented into Motor Bikes, Passenger Vehicles, Commercial Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles.

The Passenger Vehicle segment dominates the market with the largest revenue share of 57.8% in 2024, driven by the high volume production and sales of passenger cars worldwide. This segment benefits from stringent emission regulations targeting private vehicles, encouraging widespread adoption of platinum-based catalytic converters to meet environmental standards

- By Distribution Channel

On the basis of distribution channel, the Platinum Automotive Catalyst Market is segmented into OEM and Aftermarket.

The OEM segment dominates the market with the largest revenue share of 65.2% in 2024, driven by the integration of platinum-based catalysts directly into new vehicles during manufacturing

Platinum Automotive Catalyst Market Regional Analysis

- North America dominates the Platinum Automotive Catalyst Market with the largest revenue share of 37.8% in 2024, driven by stringent emission regulations, advanced automotive manufacturing infrastructure, and increasing demand for cleaner mobility solutions. The U.S. leads the regional market, supported by strong government mandates on vehicle emissions and significant investments in catalyst technology innovation. Consumer preference for environmentally compliant vehicles and growing adoption of hybrid and electric vehicles further propel market growth

U.S. Platinum Automotive Catalyst Market Insight

The U.S. Platinum Automotive Catalyst Market captured a significant revenue share of 82% in North America in 2024, fueled by regulatory pressures such as EPA Tier 3 standards and California’s stringent CARB regulations. Strong collaborations between automotive OEMs and catalyst manufacturers, alongside rising investments in R&D for platinum load reduction, are key growth drivers. The shift towards clean energy vehicles is also accelerating demand for advanced catalyst solutions

Europe Platinum Automotive Catalyst Market Insight

Europe is expected to witness steady growth in the Platinum Automotive Catalyst Market over the forecast period, supported by aggressive implementation of Euro 6 and upcoming Euro 7 emission standards. Countries such as Germany, the U.K., and France lead the regional market with robust automotive sectors focusing on sustainability and emission control innovations. Increasing demand for premium vehicles and government incentives for green mobility contribute to market expansion

U.K. Platinum Automotive Catalyst Market Insight

The U.K. Platinum Automotive Catalyst Market is anticipated to grow at a notable CAGR, driven by government initiatives promoting electric and hybrid vehicles, as well as consumer demand for environmentally friendly technologies. Regulatory frameworks encouraging lower vehicle emissions are fostering catalyst adoption across new vehicle production

Germany Platinum Automotive Catalyst Market Insight

Germany’s market is poised for considerable growth, buoyed by its strong automotive manufacturing base and emphasis on reducing environmental footprint. The country’s focus on clean mobility solutions, including hydrogen fuel cell and hybrid vehicles, is increasing demand for specialized platinum catalysts with high durability and performance

Asia-Pacific Platinum Automotive Catalyst Market Insight

Asia-Pacific is projected to register the fastest CAGR of 23.1% from 2025 to 2032, driven by rapid urbanization, rising vehicle ownership, and tightening emission standards in key markets such as China, India, Japan, and South Korea. Local governments are increasingly adopting regulations similar to Euro standards, pushing automakers to incorporate advanced catalytic converters

Japan Platinum Automotive Catalyst Market Insight

Japan’s Platinum Automotive Catalyst Market is gaining momentum due to technological advancements in catalyst materials and a strong focus on fuel efficiency and emission reduction. The country’s automotive industry prioritizes high-quality and reliable catalyst solutions that meet strict environmental norms

China Platinum Automotive Catalyst Market Insight

China’s Platinum Automotive Catalyst Market is growing rapidly, supported by growing environmental concerns, rising disposable incomes, and government policies promoting green technologies. The expansion of vehicle production and adoption of hybrid and electric vehicles are key factors fueling demand. E-commerce and digital sales channels are also accelerating product availability and consumer access

Platinum Automotive Catalyst Market Share

The smart lock industry is primarily led by well-established companies, including:

- Johnson Matthey (U.K.)

- BASF SE (Germany)

- Umicore (Belgium)

- Tenneco Inc. (U.S.)

- Heraeus Holding GmbH (Germany)

- Clariant AG (Switzerland)

- Denso Corporation (Japan)

- BASF Catalysts LLC (U.S.)

- Corning Incorporated (U.S.)

- Faurecia S.A. (France)

- NGK Insulators, Ltd. (Japan)

- Platinum Group Metals Ltd. (South Africa)

- Cataler Corporation (Japan)

- Saint-Gobain S.A. (France)

- Johnson Controls International plc (Ireland)

Latest Developments in Global Platinum Automotive Catalyst Market

- In March 2025, Johnson Matthey launched its next-generation platinum catalyst featuring enhanced NOx conversion efficiency and reduced precious metal loading. This innovation aims to improve sustainability and lower costs while meeting stricter Euro 7 emission standards, reinforcing Johnson Matthey’s leadership in advanced catalyst technology

- In January 2025, BASF introduced a new line of durable platinum-based catalysts designed specifically for hybrid and hydrogen fuel cell vehicles. These catalysts offer improved thermal stability and longer service life, addressing the evolving needs of clean mobility applications globally

- In November 2024, Umicore announced a strategic partnership with a leading automotive OEM to develop customized catalyst solutions for electric and hybrid powertrains. This collaboration focuses on optimizing catalyst performance under variable driving conditions while reducing platinum usage to enhance cost efficiency

- In July 2024, Tenneco unveiled a series of lightweight and compact three-way catalysts engineered for passenger vehicles to meet increasingly stringent emission norms without compromising vehicle performance or fuel efficiency. The launch supports the company’s goal to innovate sustainable emission control technologies

- In May 2024, Clariant expanded its catalyst materials portfolio by introducing a new class of platinum alloys designed to improve catalyst durability and reduce degradation under extreme engine temperatures. This development is expected to boost demand in commercial vehicle segments requiring high-performance emission controls

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.