Global Point Of Care Poc Drugs Of Abuse Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.53 Billion

USD

2.20 Billion

2025

2033

USD

1.53 Billion

USD

2.20 Billion

2025

2033

| 2026 –2033 | |

| USD 1.53 Billion | |

| USD 2.20 Billion | |

|

|

|

|

Point of Care (POC) Drugs of Abuse Testing Market Size

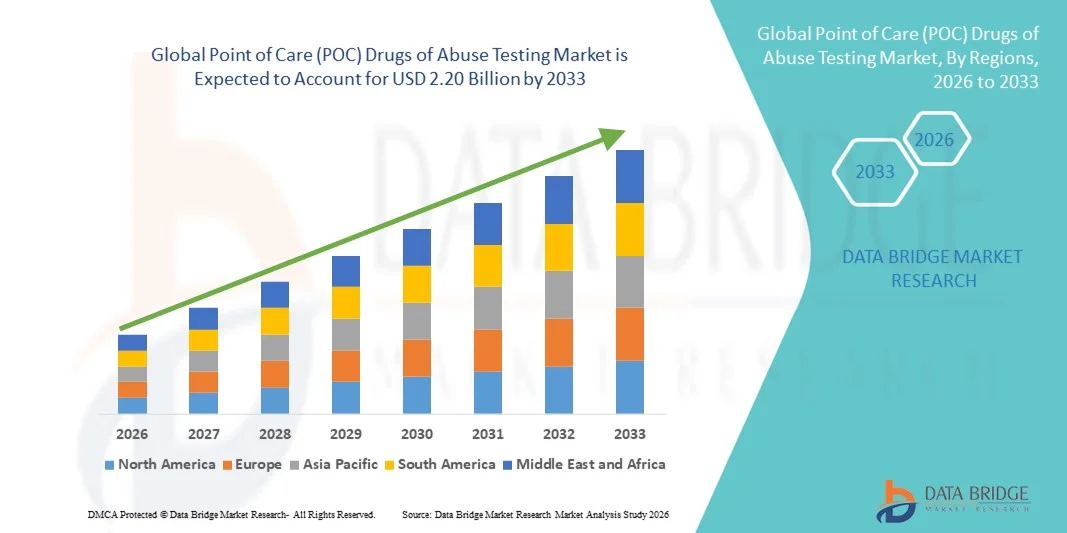

- The global Point of Care (POC) drugs of abuse testing market size was valued at USD 1.53 billion in 2025 and is expected to reach USD 2.20 billion by 2033, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of substance abuse and the technological progress in rapid diagnostic and screening devices, leading to greater adoption of on-site testing across workplaces, healthcare, and law enforcement settings

- Furthermore, rising demand for quick, reliable, and non-invasive drug screening solutions, along with stricter regulatory and workplace safety policies, is establishing POC drug testing as a preferred detection approach. These converging factors are accelerating the uptake of POC drugs of abuse testing solutions, thereby significantly boosting the industry’s growth

Point of Care (POC) Drugs of Abuse Testing Market Analysis

- Point of care (POC) drugs of abuse tests, which enable rapid on-site detection of illicit and prescription drug misuse through urine, saliva, or other biological samples, are increasingly vital tools in workplace screening, clinical diagnostics, and law enforcement due to their speed, portability, and ease of use

- The escalating demand for POC drugs of abuse testing is primarily fueled by the rising prevalence of substance abuse worldwide, stricter workplace and road-safety regulations, and a growing emphasis on early detection and monitoring of drug misuse

- North America dominated the POC drugs of abuse testing market with the largest revenue share of 43.5% in 2025, characterized by strong regulatory frameworks, high awareness regarding substance abuse, and widespread workplace drug screening programs, with the U.S. experiencing substantial adoption across employers, hospitals, and forensic settings

- Asia-Pacific is expected to be the fastest growing region in the POC drugs of abuse testing market during the forecast period due to increasing public health initiatives, expanding healthcare infrastructure, and rising awareness about drug-related harms

- Urine segment dominated the market with a market share of 47.3% in 2025, driven by its non-invasive nature, high acceptance in workplace and clinical applications, and broad detection window for multiple drug classes

Report Scope and Point of Care (POC) Drugs of Abuse Testing Market Segmentation

|

Attributes |

Point of Care (POC) Drugs of Abuse Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Point of Care (POC) Drugs of Abuse Testing Market Trends

Shift Toward Rapid, Non-Invasive and Digitalized Screening Solutions

- A significant and accelerating trend in the global POC drugs of abuse testing market is the increasing shift toward rapid, non-invasive testing methods such as oral fluid and saliva-based tests, combined with digital readers and data connectivity. This fusion of technologies is significantly enhancing testing convenience and operational efficiency

- For instance, several manufacturers now offer oral fluid POC devices that deliver results within minutes and can electronically transmit results to monitoring systems, while compact cup-based urine tests remain widely used for on-site screening programs

- Technological integration in POC drug testing enables features such as automated result interpretation, reduced human error, and secure digital record keeping. For instance, some modern POC analyzers utilize smart readers to improve accuracy and provide flagged alerts when presumptive positives are detected. Furthermore, rapid testing capabilities offer users the ease of immediate decision-making in critical settings

- The seamless integration of POC testing devices with electronic health records and workplace management systems facilitates centralized oversight of testing programs. Through a single interface, administrators can manage drug screening data alongside occupational health records and compliance documentation, creating a more unified monitoring environment

- This trend toward more efficient, connected, and user-friendly drug testing systems is fundamentally reshaping user expectations for screening programs. Consequently, companies such as Abbott and Roche are developing advanced rapid test solutions with improved sensitivity and digital compatibility for decentralized settings

- The demand for POC drug testing solutions that offer speed, accuracy, and digital integration is growing rapidly across workplaces, criminal justice systems, and healthcare facilities, as organizations increasingly prioritize safety and regulatory compliance

- Rising interest in multiplex testing panels capable of detecting multiple drug classes simultaneously is improving testing efficiency and reducing the need for multiple separate assays

Point of Care (POC) Drugs of Abuse Testing Market Dynamics

Driver

Growing Need Due to Rising Substance Abuse and Workplace Safety Requirements

- The increasing prevalence of drug misuse worldwide, coupled with stricter workplace safety and zero-tolerance policies, is a significant driver for the heightened demand for POC drugs of abuse testing

- For instance, in 2025 several employers and transportation authorities expanded mandatory on-site drug screening programs to improve occupational and public safety, supporting higher adoption of rapid testing solutions

- As organizations become more aware of the operational and legal risks linked to substance abuse, POC tests offer advantages such as quick detection, on-site screening, and immediate preliminary results, providing a practical alternative to laboratory testing

- Furthermore, the growing emphasis on drug monitoring in emergency care, rehabilitation programs, and roadside testing is making POC devices an integral component of modern screening frameworks, offering flexible and decentralized testing options

- The convenience of instant results, minimal training requirements, and the ability to conduct frequent random testing are key factors propelling the adoption of POC drug testing in both public and private sectors. The trend toward decentralized healthcare delivery further contributes to market growth

- Government initiatives aimed at controlling drug-impaired driving and substance abuse are increasing the deployment of roadside and community-based screening programs

- The expansion of occupational health policies in high-risk industries such as mining, aviation, and construction is further stimulating routine POC drug screening adoption

Restraint/Challenge

Accuracy Concerns and Regulatory Compliance Hurdles

- Concerns surrounding the accuracy limitations of some rapid screening devices, including risks of false positives or false negatives, pose a significant challenge to broader market acceptance. As POC tests are preliminary in nature, confirmatory laboratory testing is often required

- For instance, reports of discordant rapid test results in certain screening scenarios have made some organizations cautious about relying solely on on-site testing solutions

- Addressing these reliability concerns through improved assay sensitivity, quality controls, and regulatory compliance is crucial for building user confidence. Companies such as Siemens Healthineers and Abbott emphasize validation data and quality assurance in their product positioning. Additionally, the cost of repeated testing and confirmatory procedures can be a burden for some programs

- While device performance is gradually improving, the perceived limitations of rapid tests can still hinder full trust, especially in legal or forensic contexts where high accuracy is essential

- Overcoming these challenges through technological refinement, clearer regulatory frameworks, and user education on proper test interpretation will be vital for sustained market growth

- Variability in drug detection windows across different sample types can create interpretation challenges and potential disputes in workplace or legal settings

- Stringent regulatory approval processes and differing regional guidelines can delay product launches and increase compliance costs for manufacturers

Point of Care (POC) Drugs of Abuse Testing Market Scope

The market is segmented on the basis of drug type, products, prescription, sample type, testing type, application, end user, and distribution channel.

- By Drug Type

On the basis of drug type, the POC drugs of abuse testing market is segmented into amphetamines, opiates, cannabinoids, cocaine, barbiturates, benzodiazepines, methadone, phencyclidine, tricyclic antidepressants, and others. The cannabinoids segment dominated the market with the largest market revenue share in 2025, driven by the high global prevalence of cannabis use and its mandatory inclusion in workplace and forensic testing panels. POC kits for THC detection are widely available and frequently used in both residential and institutional settings. Employers and law enforcement agencies prioritize cannabinoid screening to maintain compliance and ensure safety. The broad detection window in urine and saliva tests further strengthens adoption. Legalization trends in several regions have increased structured monitoring programs. Multi-drug panels commonly include cannabinoids, supporting high sales volume and recurring usage.

The amphetamines segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising misuse of stimulants and synthetic drugs globally. Methamphetamine and prescription stimulant abuse is increasing screening demand in workplaces and forensic settings. Roadside and emergency testing programs increasingly target amphetamines. Technological improvements have enhanced detection sensitivity in rapid POC kits. Multi-drug panels often emphasize amphetamine detection. Growing public health initiatives focused on stimulant abuse support rapid segment expansion.

- By Products

On the basis of products, the POC drugs of abuse testing market is segmented into devices and consumables and accessories. The consumables and accessories segment dominated the market with the largest revenue share in 2025, driven by recurring usage in every test cycle. Single-use cartridges, cups, and strips ensure hygiene and regulatory compliance. High testing frequency in workplaces, hospitals, and law enforcement agencies results in repeat procurement. Bulk procurement by institutions strengthens market demand. Consumables reduce cross-contamination and operational complexity. Their cost-effectiveness makes them ideal for large-scale screening programs across multiple end users.

The devices segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the adoption of digital analyzers and smart readers. Digital devices reduce human interpretation errors and provide automated results. Connectivity features allow data storage, reporting, and compliance tracking. Portable analyzers enable decentralized testing in field settings. Technological upgrades drive replacement and new adoption. Integration with digital systems increases efficiency and supports professional user requirements.

- By Prescription

On the basis of prescription, the POC drugs of abuse testing market is segmented into over-the-counter testing and prescription-based testing. The prescription-based testing segment dominated the market in 2025, driven by hospitals, clinics, and forensic applications. Regulatory frameworks favor controlled and supervised testing. Professional oversight ensures accuracy and reliability. Confirmatory testing pathways align with prescription-based protocols. Institutional and insurance-backed programs support routine adoption. High clinical trust sustains the dominance of prescription-based testing in professional settings.

The over-the-counter testing segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing home-based screening demand. Parents and caregivers adopt OTC kits for privacy and convenience. E-commerce platforms and pharmacies improve accessibility. Affordable pricing supports consumer adoption. Awareness about early detection of drug misuse encourages self-monitoring. Discreet and convenient home testing further drives segment expansion. Rising awareness about early detection of drug misuse supports growth. Self-monitoring and discreet testing increase market penetration

- By Sample Type

On the basis of sample type, the POC drugs of abuse testing market is segmented into urine, saliva, blood, hair, breath, and others. The urine segment dominated the market with the largest revenue share of 47.3% in 2025, driven by its reliability and regulatory acceptance. Urine testing offers a broad detection window for multiple drugs. It is cost-effective for large-scale workplace programs. Multi-drug POC panels are widely available in urine format. Regulatory and institutional preference reinforces its adoption. Established accuracy and reproducibility make urine testing the standard choice for most end users.

The saliva segment is expected to witness the fastest growth from 2026 to 2033, driven by its non-invasive and convenient nature. Saliva testing reduces the risk of sample tampering. Rapid results support roadside and emergency testing programs. No specialized facilities are required for testing. Law enforcement adoption is increasing due to ease of use. User comfort and privacy further drive growth and market penetration. Law enforcement adoption of saliva-based tests is increasing. Ease of collection and user comfort drive higher adoption rates

- By Testing Type

On the basis of testing type, the POC drugs of abuse testing market is segmented into random testing, post-incident testing, and abstinence testing. The random testing segment dominated the market in 2025, driven by its deterrence effect and widespread workplace adoption. Many employers mandate random checks to ensure compliance. It reduces predictable misuse and enhances occupational safety. Large organizations rely on random testing for ongoing monitoring. Frequent testing supports continuous regulatory compliance. Safety and productivity objectives drive consistent demand across sectors.

The post-incident testing segment is expected to witness the fastest growth from 2026 to 2033, fueled by workplace safety and liability concerns. Employers perform testing immediately after accidents or incidents. Rapid results enable timely decision-making. High-risk industries such as construction, mining, and aviation rely heavily on post-incident testing. Insurance and legal frameworks encourage adoption. Safety compliance initiatives further drive segment expansion. High-risk industries such as construction, mining, and aviation rely heavily on post-incident testing. Safety compliance initiatives further drive growth in this segment.

- By Application

On the basis of application, the POC drugs of abuse testing market is segmented into medical screening, workplace screening, law enforcement and criminal justice, pain management, substance abuse treatment and rehabilitation, parental or home drug testing, sports and athletics testing, drug screening in schools and educational institutions, and others. The workplace screening segment dominated the market in 2025, driven by strict employer policies and regulatory compliance. Safety-sensitive industries conduct frequent and routine testing. Pre-employment and random checks are common. Corporate compliance programs support large-scale adoption. Testing ensures productivity and reduces legal risks. Government and legal frameworks reinforce workplace screening dominance.

The law enforcement and criminal justice segment is expected to witness the fastest growth from 2026 to 2033, fueled by expansion of roadside and forensic screening programs. Drug-impaired driving regulations drive demand. Portable POC kits allow field deployment. Policy enforcement increases procurement. Public safety concerns sustain growth. Government initiatives and campaigns further boost adoption. Public safety campaigns sustain market expansion. Government programs and funding support segment growth.

- By End User

On the basis of end user, the POC drugs of abuse testing market is segmented into healthcare facilities, employers, government institutes, and others. The employers segment dominated the market in 2025, driven by large-scale workforce screening programs. Occupational safety regulations mandate testing. High employee volumes sustain adoption. Pre-employment, random, and post-incident testing drive recurring usage. Corporate compliance policies reinforce demand. Industry-specific regulations ensure continued market dominance.

The government institutes segment is expected to witness the fastest growth from 2026 to 2033, fueled by public safety initiatives and anti-drug campaigns. Border control, transportation, and law enforcement agencies increasingly deploy POC kits. National and state-level programs expand testing coverage. Policy enforcement increases procurement. Government funding supports large-scale adoption. Awareness and regulatory initiatives sustain market growth. Funding for public health and safety initiatives supports growth. Awareness campaigns and regulatory mandates further boost adoption rates.

- By Distribution Channel

On the basis of distribution channel, the POC drugs of abuse testing market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market in 2025, driven by bulk procurement by hospitals, agencies, and government bodies. Large contracts reduce per-unit costs. Institutional buyers prefer tenders for reliability and supply consistency. Stable supply agreements support ongoing operations. Government purchases drive significant volume. Long-term contracts reinforce segment dominance.

The retail sales segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising home-testing demand. Pharmacies and online stores expand product reach. E-commerce improves accessibility and discretion. Rising consumer awareness supports adoption. OTC availability encourages self-testing. Expansion of home-based and parental testing drives retail growth. OTC product availability encourages self-testing. Expansion of home-based and parental testing drives retail growth.

Point of Care (POC) Drugs of Abuse Testing Market Regional Analysis

- North America dominated the POC drugs of abuse testing market with the largest revenue share of 43.5% in 2025, characterized by strong regulatory frameworks, high awareness regarding substance abuse, and widespread workplace drug screening programs

- Organizations in the region highly value rapid, accurate, and reliable POC testing solutions that allow immediate detection of illicit and prescription drug misuse, supporting safety in workplaces, law enforcement, and healthcare facilities

- This strong adoption is further supported by stringent government regulations, well-established testing protocols, awareness about substance abuse, and significant investment in occupational safety, establishing POC drugs of abuse testing as a preferred solution for employers, healthcare providers, and law enforcement agencies

U.S. Point of Care (POC) Drugs of Abuse Testing Market Insight

The U.S. Point-of-Care (POC) drugs of abuse testing market captured the largest revenue share of 82% in 2025 within North America, fueled by the widespread implementation of workplace drug policies and substance abuse monitoring programs. Organizations are increasingly prioritizing rapid, accurate, and on-site testing solutions to ensure employee safety and regulatory compliance. The growing adoption of portable analyzers, multi-drug panels, and digital reporting systems further propels market growth. Additionally, the integration of Point-of-Care (POC) Drugs of Abuse Testing with healthcare and occupational safety programs is significantly contributing to the market’s expansion. Strong government regulations and awareness campaigns regarding drug misuse reinforce the region’s leading position.

Europe Point-of-Care (POC) Drugs of Abuse Testing Market Insight

The Europe Point-of-Care (POC) drugs of abuse testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent workplace safety regulations and increasing monitoring requirements in healthcare and law enforcement sectors. Rising urbanization and the adoption of connected diagnostic devices are fostering market growth. European organizations are drawn to the convenience, accuracy, and efficiency of rapid Point-of-Care (POC) Drugs of Abuse Testing. The market is witnessing strong adoption across hospitals, rehabilitation centers, and corporate environments. Multi-drug testing panels and portable analyzers are increasingly used in routine screening programs.

U.K. Point-of-Care (POC) Drugs of Abuse Testing Market Insight

The U.K. Point-of-Care (POC) drugs of abuse testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the growing need for workplace safety and compliance with regulatory guidelines. Concerns regarding substance abuse and workplace accidents are encouraging both employers and healthcare providers to adopt rapid on-site testing. The U.K.’s robust healthcare infrastructure and e-commerce platforms support easier accessibility of Point-of-Care (POC) Drugs of Abuse Testing kits. Employers increasingly incorporate multi-drug testing as part of occupational safety programs. The trend of self-monitoring and parental drug testing also contributes to market growth. Digital reporting features in modern POC kits further enhance adoption.

Germany Point-of-Care (POC) Drugs of Abuse Testing Market Insight

The Germany Point-of-Care (POC) drugs of abuse testing market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of substance abuse and a strong emphasis on occupational safety. Germany’s well-developed healthcare infrastructure and regulatory frameworks support Point-of-Care (POC) Drugs of Abuse Testing adoption in workplaces, hospitals, and law enforcement agencies. Technologically advanced and reliable POC testing solutions are preferred for multi-drug detection. Employers and government institutions are increasingly implementing on-site testing programs. The integration of digital reporting and automated analyzers enhances operational efficiency. Demand for accurate and fast screening in both residential and commercial applications is increasing.

Asia-Pacific Point-of-Care (POC) Drugs of Abuse Testing Market Insight

The Asia-Pacific Point-of-Care (POC) drugs of abuse testing market is poised to grow at the fastest CAGR of 23% during 2026 to 2033, driven by increasing urbanization, rising workplace safety awareness, and growing healthcare infrastructure in countries such as China, Japan, and India. Rising substance abuse monitoring initiatives and government programs promoting public safety are fueling market adoption. The region is witnessing an increasing preference for portable and rapid Point-of-Care (POC) Drugs of Abuse Testing solutions. Growth is supported by expanding corporate and healthcare testing programs. Multi-drug panels and digital analyzers are being adopted widely across industries. The affordability and accessibility of POC test kits further support market expansion in APAC.

Japan Point-of-Care (POC) Drugs of Abuse Testing Market Insight

The Japan Point-of-Care (POC) drugs of abuse testing market is gaining momentum due to rising awareness about workplace safety, strict regulatory compliance, and the demand for convenient testing solutions. Adoption is driven by hospitals, law enforcement agencies, and corporate programs implementing rapid multi-drug testing. Integration with digital data management systems is enhancing testing efficiency. Portable and easy-to-use analyzers are increasingly popular in remote or decentralized testing environments. The focus on employee and public safety further promotes growth. Japan’s aging workforce increases demand for non-invasive, user-friendly screening solutions in both healthcare and occupational settings.

India Point-of-Care (POC) Drugs of Abuse Testing Market Insight

The India Point-of-Care (POC) drugs of abuse testing market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rising substance abuse awareness, strict workplace compliance regulations, and the expansion of healthcare and rehabilitation infrastructure. India is emerging as a key market for rapid and portable Point-of-Care (POC) Drugs of Abuse Testing solutions across workplaces, hospitals, and law enforcement. Government initiatives and public safety campaigns are driving adoption. Affordable and accessible POC test kits, combined with increasing corporate and parental monitoring programs, support growth. Expansion of urban workplaces and corporate compliance requirements further boost market penetration. Rising awareness of non-invasive and user-friendly testing methods also contributes to market growth.

Point of Care (POC) Drugs of Abuse Testing Market Share

The Point of Care (POC) Drugs of Abuse Testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Danaher (U.S.)

- OraSure Technologies, Inc. (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Alfa Scientific Designs Inc. (U.S.)

- Premier Biotech, Inc. (U.S.)

- Securetec Detektions-Systeme AG (Germany)

- MP Biomedicals, LLC (U.S.)

- ARK Diagnostics, Inc. (U.S.)

- Wondfo Biotech Co., Ltd. (China)

- Ameditech, Inc. (U.S.)

- Chembio Diagnostic Systems, Inc. (U.S.)

- Medtox Scientific, Inc. (U.S.)

- Randox Laboratories Ltd. (U.K.)

- Omega Laboratories, Inc. (U.S.)

What are the Recent Developments in Global Point of Care (POC) Drugs of Abuse Testing Market?

- In January 2025, the U.S. Department of Health and Human Services updated the Mandatory Guidelines for Federal Workplace Drug Testing Programs to include fentanyl and norfentanyl in urine and oral fluid drug testing panels, reflecting evolving testing priorities at the federal level

- In August 2024, Carolina Liquid Chemistries Corp. and Medline Industries announced a distribution agreement to offer the first ever FDA‑cleared point‑of‑care fentanyl urine screening kit (Fentanyl Urine Detect) on the portable RYAN analyzer, delivering rapid qualitative results and expanding access across clinical and POC sites in the U.S.

- In October 2023, the U.S. Food and Drug Administration cleared the first over‑the‑counter urine test cassette for preliminary detection of fentanyl, providing individuals a 5‑minute screening option with follow‑up confirmation, marking a key milestone in accessible public health testing

- In October 2023, the U.S. Food and Drug Administration cleared the first over‑the‑counter urine test for fentanyl, enabling a five‑minute preliminary screening that individuals can use at point‑of‑care settings, potentially reducing delays in identifying opioid exposure

- In July 2023, Shenzhen Superbio Technology Co., Ltd. received FDA clearance for the first point‑of‑care instrument intended for the qualitative detection of fentanyl in human urine, marketed as RYAN™, enabling results in under 6 minutes and significantly expanding rapid POC screening for opioids outside traditional lab settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.