Global Polyvinyl Chloride Pvc Film For Medical Market

Market Size in USD Billion

CAGR :

%

USD

2.88 Billion

USD

4.03 Billion

2025

2033

USD

2.88 Billion

USD

4.03 Billion

2025

2033

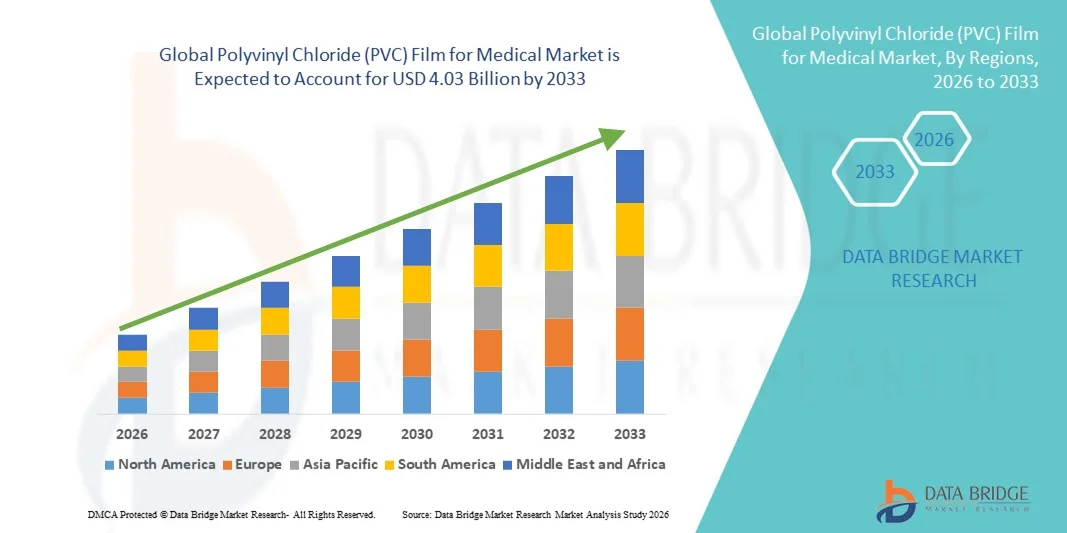

| 2026 –2033 | |

| USD 2.88 Billion | |

| USD 4.03 Billion | |

|

|

|

|

Polyvinyl Chloride (PVC) Film for Medical Market Size

- The global Polyvinyl Chloride (PVC) film for medical market size was valued at USD 2.88 billion in 2025 and is expected to reach USD 4.03 billion by 2033, at a CAGR of 4.32% during the forecast period

- The market growth is largely fueled by the increasing use of PVC films in medical applications such as sterile packaging, tubing, bags, and devices, driven by the rise in healthcare spending and the need for safe, durable materials that meet stringent regulatory standards

- Furthermore, growing global demand for cost‑effective, flexible, and high‑barrier medical films in hospitals, clinics, and pharmaceutical settings is establishing PVC as a preferred material for medical packaging solutions. These converging factors are accelerating the uptake of PVC film in medical applications, thereby significantly boosting the industry’s growth

Polyvinyl Chloride (PVC) Film for Medical Market Analysis

- PVC films, used extensively in medical applications such as blood and IV bags, medical accessories, and healthcare launderable barrier products, are increasingly vital components of modern healthcare and pharmaceutical operations due to their durability, flexibility, and compliance with stringent regulatory standards

- The escalating demand for PVC films is primarily fueled by the rising global healthcare expenditure, increasing production of pharmaceutical products, and the growing need for cost-effective, high-barrier, and safe packaging solutions in hospitals, clinics, and diagnostic laboratories

- North America dominated the PVC film for medical market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of medical innovations, and a strong presence of key manufacturers, with the U.S. experiencing substantial growth in the use of PVC films for medical packaging and devices, driven by technological advancements and stringent quality standards

- Asia-Pacific is expected to be the fastest growing region in the PVC film for medical market during the forecast period due to increasing healthcare infrastructure investments, growing pharmaceutical production, and rising demand for disposable medical products

- Polymeric Flexible PVC Films segment dominated the PVC film for medical market with a market share of 46.2% in 2025, driven by its extensive use in bags, accessories, and launderable barrier products, along with superior flexibility, durability, and compatibility with medical sterilization processes

Report Scope and Polyvinyl Chloride (PVC) Film for Medical Market Segmentation

|

Attributes |

Polyvinyl Chloride (PVC) Film for Medical Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Polyvinyl Chloride (PVC) Film for Medical Market Trends

Advancements in Sterile and Barrier Packaging Solutions

- A significant and accelerating trend in the global PVC film for medical market is the development of advanced sterile and barrier packaging solutions that enhance product safety, shelf life, and usability in hospitals and pharmaceutical environments

- For instance, polymeric flexible PVC films with multi-layer coatings are being designed to provide superior microbial barrier performance while maintaining transparency and flexibility for medical bags and accessories

- Innovations in PVC film allow for improved sterilization compatibility, such as gamma irradiation and ethylene oxide treatments, enabling safer packaging of sensitive medical products. Furthermore, barrier films are now being engineered to resist moisture, oxygen, and chemical exposure, ensuring drug and blood product integrity

- The integration of PVC films with automation-friendly packaging machinery facilitates high-speed production of bags, tubing, and launderable barrier products, streamlining hospital and pharmaceutical workflows

- This trend toward more functional, durable, and compliant PVC films is fundamentally reshaping user expectations for medical packaging. Consequently, companies are increasingly offering multi-functional films with enhanced barrier properties and sterilization resilience

- The demand for advanced PVC films that provide both safety and operational efficiency is growing rapidly across hospitals, clinics, and pharmaceutical manufacturers, as the focus on infection prevention and product integrity intensifies

- Collaborations between PVC film manufacturers and medical device producers to develop tailor-made films for specialized applications, such as neonatal care bags or dialysis tubing, are also accelerating innovation adoption

Polyvinyl Chloride (PVC) Film for Medical Market Dynamics

Driver

Increasing Demand Due to Rising Healthcare Expenditure and Medical Device Growth

- The growing healthcare spending globally, along with the expansion of medical device and pharmaceutical production, is a key driver for the heightened adoption of PVC films in medical applications

- For instance, in March 2025, a major U.S. medical packaging firm announced expansion of its polymeric PVC film lines to meet surging demand for IV and blood bags in hospitals. Such strategic moves by key players are expected to drive market growth in the forecast period

- As healthcare facilities seek safe, durable, and cost-effective packaging solutions, PVC films provide superior barrier properties and compliance with regulatory standards, offering a compelling alternative to traditional packaging materials

- Furthermore, the rising demand for disposable medical products and launderable barrier solutions is making PVC films an essential material for hospital and pharmaceutical operations, supporting infection prevention and operational efficiency

- Ease of use, compatibility with sterilization methods, and adaptability across a wide range of medical products are key factors propelling the adoption of PVC films. The trend towards large-scale automated packaging and standardized material specifications further contributes to market growth

- Increasing global awareness about hospital-acquired infections and blood-borne pathogen control is prompting medical facilities to adopt PVC film-based sterile packaging, further boosting demand

- Technological advancements in film extrusion and coating techniques are enabling manufacturers to produce PVC films with enhanced durability, clarity, and flexibility, opening up new medical applications and increasing market uptake

Restraint/Challenge

Regulatory Compliance and Environmental Concerns

- Strict regulatory requirements regarding biocompatibility, toxicity, and sterilization standards pose a significant challenge to broader adoption of PVC films in medical applications. PVC films must meet rigorous testing before approval, which can slow product launches

- For instance, delays in regulatory approvals for new PVC film formulations have made some manufacturers cautious in expanding production capacities

- Addressing these regulatory hurdles through comprehensive testing, compliance documentation, and proactive engagement with authorities is crucial for market expansion. In addition, concerns over PVC waste management and environmental impact can limit adoption in regions with stringent sustainability mandates

- While innovations in recyclable or low-chlorine PVC films are emerging, the perception of PVC as environmentally challenging still influences procurement decisions in hospitals and pharmaceutical firms

- Overcoming these challenges through eco-friendly product development, regulatory compliance support, and transparent safety communication will be vital for sustained market growth

- Price volatility of PVC raw materials and rising production costs can affect profit margins for manufacturers and slow adoption in cost-sensitive markets

- Limited awareness in emerging regions about advanced PVC film benefits and safe usage practices may delay market penetration despite growing healthcare infrastructure

Polyvinyl Chloride (PVC) Film for Medical Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the PVC film for medical market is segmented into polymeric flexible pvc films, monomeric flexible PVC films, rigid PVC films, and others. Polymeric Flexible PVC Films segment dominated the market with the largest revenue share of 46.2% in 2025, driven by its extensive use in blood and IV bags, medical accessories, and launderable barrier products. These films are highly valued for their superior flexibility, tensile strength, and compatibility with sterilization processes such as gamma irradiation and ethylene oxide treatment. Hospitals and pharmaceutical manufacturers prefer polymeric flexible PVC films for packaging critical medical products due to their durability and ability to maintain product integrity. Furthermore, these films allow for transparent monitoring of fluids, enabling healthcare professionals to track levels and detect contamination easily. Their ease of heat-sealing and automated production compatibility also enhances operational efficiency in large-scale packaging facilities. The growing focus on infection control and disposable medical products reinforces the preference for polymeric flexible PVC films over other types.

Monomeric Flexible PVC Films segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption in emerging markets and cost-sensitive applications. These films offer adequate flexibility and barrier properties at a lower production cost, making them suitable for accessories, tubing, and short-term medical packaging applications. Their relatively lighter weight and ease of handling support transportation and storage efficiency for hospitals and clinics. Monomeric films are also being enhanced with antimicrobial coatings and multi-layer structures, expanding their applicability in infection prevention settings. The increasing focus on affordable healthcare solutions in Asia-Pacific and Latin America is expected to accelerate the adoption of monomeric flexible PVC films. In addition, growing pharmaceutical production and disposable device usage are contributing to strong demand in both hospital and outpatient care segments.

- By Application

On the basis of application, the PVC film for medical market is segmented into bags, accessories, healthcare launderable barrier products, and others. Bags segment dominated the market with a revenue share of 41.8% in 2025, driven primarily by its use in blood storage, IV fluid delivery, and infusion therapy. PVC films provide high barrier protection, flexibility, and chemical resistance, ensuring safe storage and transportation of sensitive medical fluids. The transparency of PVC bags allows for visual inspection of fluids, while compatibility with sterilization techniques guarantees hygiene standards. Hospitals and blood banks rely on PVC film bags for their durability, cost-effectiveness, and ease of integration with automated filling and sealing equipment. The widespread adoption of disposable medical bags to reduce contamination risk further supports this segment's dominance. In addition, regulatory approval and standardized specifications for medical bags enhance their reliability and trust among healthcare providers.

Accessories segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for tubing, connectors, and infusion set components in hospitals and home healthcare setups. PVC films used in medical accessories provide the flexibility, transparency, and biocompatibility required for safe and effective fluid delivery. The growing adoption of home infusion therapy and portable medical devices increases the need for lightweight and reliable PVC-based accessories. Technological improvements such as antimicrobial coatings and enhanced barrier layers also expand the functionality of accessories, supporting higher adoption. Cost efficiency and compatibility with automated production lines further drive growth in this segment. The rising healthcare infrastructure in Asia-Pacific and Latin America is anticipated to further accelerate the use of PVC films in accessories.

Polyvinyl Chloride (PVC) Film for Medical Market Regional Analysis

- North America dominated the PVC film for medical market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of medical innovations, and a strong presence of key manufacturers

- Hospitals, clinics, and pharmaceutical manufacturers in the region highly value the durability, sterilization compatibility, and barrier performance offered by polymeric flexible PVC films used in blood and IV bags, medical accessories, and launderable barrier products

- This widespread adoption is further supported by rising healthcare expenditure, strong focus on infection prevention, and the availability of skilled medical and technical personnel, establishing PVC films as a preferred material for safe and efficient medical packaging and disposable products

The United States Polyvinyl Chloride (PVC) Film for Medical Market Insight

The United States (U.S.) PVC film for medical market captured the largest revenue share of 82% in 2025 within North America, fueled by advanced healthcare infrastructure, high adoption of polymeric flexible PVC films, and stringent regulatory standards. Hospitals and pharmaceutical manufacturers are increasingly prioritizing safe, durable, and sterilization-compatible PVC films for blood and IV bags, medical accessories, and launderable barrier products. The growing preference for automated packaging systems and disposable medical products, combined with robust demand for high-barrier, infection-preventing films, further propels the market. Moreover, continuous innovation in polymeric PVC films, including multi-layer and antimicrobial coatings, is significantly contributing to the market’s expansion.

Europe Polyvinyl Chloride (PVC) Film for Medical Market Insight

The Europe PVC film for medical market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict medical device and packaging regulations, and the rising demand for safe, sterile medical packaging solutions. Increasing urbanization and growing healthcare infrastructure across countries such as Germany, France, and Italy are fostering the adoption of PVC films. European hospitals and clinics also value the durability, flexibility, and chemical resistance of PVC films for applications including IV and blood bags, tubing, and launderable barrier products. The region is experiencing strong growth across hospitals, clinics, and pharmaceutical manufacturing, with PVC films being incorporated into both new facilities and renovation projects.

United Kingdom Polyvinyl Chloride (PVC) Film for Medical Market Insight

The United Kingdom (U.K.) PVC film for medical market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for disposable medical products and infection-preventing packaging solutions. In addition, healthcare regulations emphasizing sterilization, biocompatibility, and patient safety are encouraging hospitals and clinics to adopt high-quality PVC films. The U.K.’s strong pharmaceutical and medical device industry, alongside a technologically advanced healthcare infrastructure, is expected to continue stimulating market growth.

Germany Polyvinyl Chloride (PVC) Film for Medical Market Insight

The Germany PVC film for medical market is expected to expand at a considerable CAGR during the forecast period, fueled by the growing emphasis on patient safety, sterilization standards, and the adoption of eco-friendly, high-performance medical films. Germany’s well-developed healthcare system, combined with its focus on medical innovation and regulatory compliance, promotes the use of polymeric and monomeric flexible PVC films. The integration of PVC films into hospital and pharmaceutical workflows for blood bags, IV bags, and launderable barrier products is also becoming increasingly prevalent, with a strong preference for durable and high-barrier materials aligning with local standards.

Asia-Pacific (APAC) Polyvinyl Chloride (PVC) Film for Medical Market Insight

The Asia-Pacific (APAC) PVC film for medical market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by expanding healthcare infrastructure, increasing pharmaceutical manufacturing, and rising disposable incomes in countries such as China, India, and Japan. The region’s growing inclination towards disposable medical products, supported by government healthcare initiatives, is driving the adoption of PVC films. Furthermore, as APAC emerges as a manufacturing hub for medical packaging solutions, the affordability and accessibility of PVC films are expanding to a wider healthcare and pharmaceutical base.

Japan Polyvinyl Chloride (PVC) Film for Medical Market Insight

The Japan PVC film for medical market is gaining momentum due to the country’s advanced healthcare system, emphasis on infection prevention, and high adoption of sterilization-compatible PVC films. Hospitals and clinics prioritize films for IV and blood bags, medical accessories, and launderable barrier products, enhancing patient safety and operational efficiency. Integration of PVC films with automated packaging systems and multi-layer barrier technologies is fueling growth. Moreover, Japan’s aging population and increasing home healthcare needs are likely to spur demand for reliable, easy-to-use, and high-quality PVC films in both hospitals and home care settings.

India Polyvinyl Chloride (PVC) Film for Medical Market Insight

The India PVC film for medical market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rapid urbanization, and rising demand for disposable medical products. India stands as one of the largest markets for blood bags, IV bags, and medical accessories, with PVC films increasingly used in hospitals, clinics, and pharmaceutical facilities. The push towards smart hospitals, availability of cost-effective PVC films, and strong domestic manufacturers are key factors propelling the market in India. Government initiatives to expand healthcare access and improve patient safety further accelerate PVC film adoption.

Polyvinyl Chloride (PVC) Film for Medical Market Share

The Polyvinyl Chloride (PVC) Film for Medical industry is primarily led by well-established companies, including:

- Formosa Plastics Corporation (Taiwan)

- Shin Etsu Chemical Co Ltd (Japan)

- BASF SE (Germany)

- Klöckner Pentaplast Group (U.K.)

- Tekni Plex, Inc. (U.S.)

- C.I. TAKIRON CORPORATION (Japan)

- Nanya Plastics Corporation (China)

- Dunmore (U.S.)

- Wiicare (U.S.)

- Occidental Petroleum Corporation (U.S.)

- Bilcare Limited (India)

- Presco (U.S.)

- Achilles (U.K.)

- Plastatech Engineering Ltd. (U.S.)

- Caprihans India Limited (India)

- Ercros (Spain)

- INOVYN (U.K.)

- Vinnolit GmbH & Co. KG (Germany)

- Adams Plastics, LP (U.S.)

- Grafix Plastics (U.S.)

What are the Recent Developments in Global Polyvinyl Chloride (PVC) Film for Medical Market?

- In April 2025, SDZL announced innovations in its medical‑grade PVC films, including antimicrobial formulations showcased at MedTech Asia that achieved enhanced bacterial filtration efficiency when used with IV bags and other medical packaging products, exceeding key healthcare regulatory standards

- In April 2025, Dr. Sheikh Akbar Ali of ACG World emphasized the ongoing importance of PVC films in pharmaceutical blister packaging, noting that PVC remains dominant for its barrier performance and protective properties for sensitive drugs, and further improvements in laminated and coated PVC formats are underway

- In March 2024, RENOLIT SE introduced a new phthalate‑free medical‑grade PVC film specifically engineered for dialysis bags and blood storage, offering improved transparency and reduced extractables to meet stringent hospital and healthcare sterilization requirements

- In July 2022, Perlen Packaging entered an exclusive collaboration with Brazil‑based Cipatex to expand local production of mono PVC pharmaceutical films, supporting regional supply of high‑clarity and barrier‑grade PVC films used in medical and blister packaging applications

- In July 2022, the Perlen Packaging division announced upgrades at its Anápolis site to modernize PVC film coating capabilities for PVdC‑coated barrier films used in pharmaceutical blister packs, aiming to secure dependable regional supply chains and enhance performance for medical packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.