Global Premium Wine Market

Market Size in USD Billion

CAGR :

%

USD

46.09 Billion

USD

69.99 Billion

2024

2032

USD

46.09 Billion

USD

69.99 Billion

2024

2032

| 2025 –2032 | |

| USD 46.09 Billion | |

| USD 69.99 Billion | |

|

|

|

|

Premium Wine Market Size

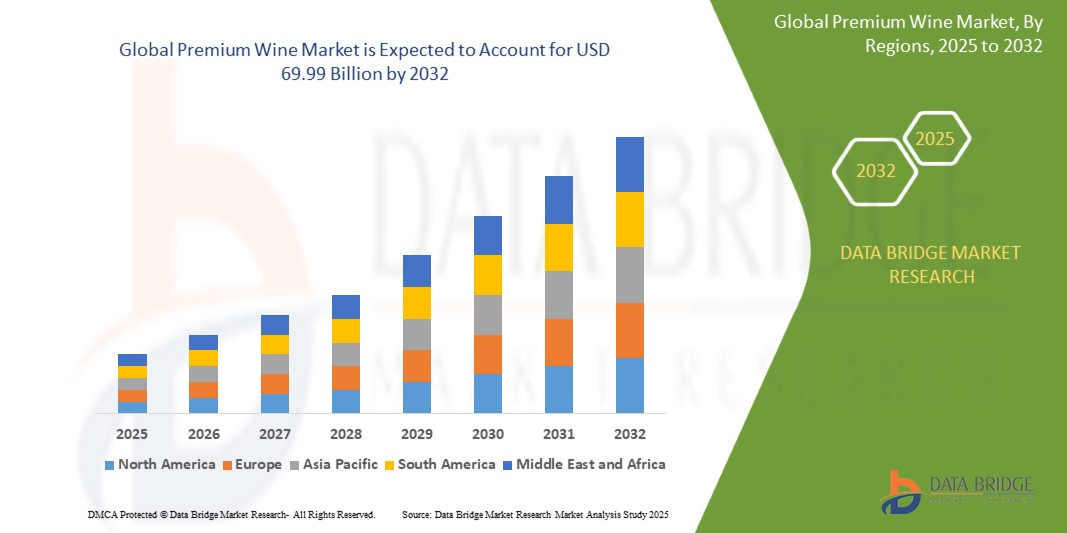

- The global premium wine market was valued at USD 46.09 billion in 2024 and is expected to reach USD 69.99 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.36%, primarily driven by the evolving consumer preferences and increasing demand for high-quality, artisanal wines

- This growth is driven by factors such as the rising disposable income, expansion of online wine retail, and growing wine tourism culture across key regions including North America and Europe

Premium Wine Market Analysis

- Premium wines are high-quality wines typically produced using superior grape varieties, traditional fermentation methods, and extended aging processes. These wines are often positioned in the luxury segment and are sought after for their craftsmanship, regional authenticity, and flavor complexity

- The demand for premium wine is significantly driven by the rising global preference for quality over quantity, particularly among millennials and Gen Z consumers. The shift toward experiential consumption and connoisseurship has increased demand in urban centers and emerging markets

- The Europe region stands out as one of the dominant regions for premium wine, driven by its deep-rooted wine culture, world-renowned vineyards, and strong regulatory standards for quality and origin labelling

- For instance, France and Italy continue to lead global exports of premium wine, while countries such as the U.S., China, and Australia are witnessing a steady rise in consumption and local premium production

- Globally, premium wines are becoming a key focus area for wineries looking to enhance brand reputation and profitability. They play a pivotal role in the premiumization trend seen across the alcoholic beverage industry, supported by boutique wineries, sustainable production practices, and expanding e-commerce channels

Report Scope and Premium Wine Market Segmentation

|

Attributes |

Premium Wine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Premium Wine Market Trends

“Increasing Focus on Sustainable and Organic Wine Production”

- One prominent trend in the global premium wine market is the growing focus on sustainable and organic wine production

- Consumers are becoming more environmentally conscious, leading to an increased demand for wines made through sustainable practices that minimize environmental impact

- For instance, many wineries are adopting organic farming techniques, reducing the use of pesticides and fertilizers, and focusing on eco-friendly packaging. This shift appeals to the health-conscious and environmentally aware consumer base

- Sustainable production practices also involve water conservation, waste reduction, and the use of renewable energy sources, enhancing the overall environmental footprint of the wine industry

- As these practices gain traction, wineries that emphasize sustainability are seeing a rise in consumer loyalty and premium pricing, thereby strengthening their position in the market

- This trend is reshaping the premium wine industry, attracting a new wave of conscious consumers and increasing the demand for eco-friendly wines in the market

Premium Wine Market Dynamics

Driver

“Rising Demand for Premium Wine Due to Increased Consumer Spending Power”

- The increasing disposable income and consumer spending power globally is significantly contributing to the rising demand for premium wines

- As economies continue to grow, particularly in emerging markets, a larger segment of the population has access to higher disposable incomes, which allows them to indulge in premium and luxury products, including high-quality wines

- This trend is most prominent in regions such as Asia-Pacific, particularly China and India, where the growing middle class is showing a strong inclination toward luxury goods and fine dining experiences

- Premium wine is seen as a status symbol and is increasingly becoming a part of social gatherings, celebrations, and upscale dining experiences, thus increasing its demand

- In addition, the rise of wine tourism and wine-related experiences further amplifies consumer interest in exploring premium wine offerings

For instance,

- In May 2023, according to the IWSR Drinks Market Analysis, the global premium wine market saw a 15% year-on-year growth, driven by increasing consumer spending in regions like the U.S. and China. The report highlighted that higher-income consumers are shifting toward premium offerings, with particular growth in wines priced above USD 20 per bottle

- As consumers continue to seek premium experiences and products, the global premium wine market is expected to grow at an accelerated pace, driven by increasing wealth and an evolving consumer mindset

Opportunity

“Growing Popularity of Wine Subscription Services and Direct-to-Consumer Channels”

- The increasing trend of wine subscription services and direct-to-consumer (DTC) channels is creating new opportunities for growth in the premium wine market

- Consumers are increasingly seeking convenience and personalized experiences when purchasing wine, which has led to the rise of subscription-based models that deliver curated selections of premium wines directly to consumers' doorsteps

- DTC channels allow wineries to establish direct relationships with customers, bypassing traditional retail intermediaries and enhancing the customer experience with exclusive access to high-quality wines

- In addition, the rise of e-commerce and digital platforms enables wine brands to expand their reach, targeting global consumers and offering personalized recommendations based on individual preferences

For instance,

- In April 2023, California-based winery Winc launched a subscription service aimed at delivering premium wines directly to consumers. The platform allows users to customize their selections based on taste preferences and provides access to exclusive, high-quality wines not typically available in retail outlets

- This growing preference for subscription-based models and direct-to-consumer services presents an opportunity for premium wine brands to tap into a broader, digitally savvy consumer base, further driving market expansion

Restraint/Challenge

“High Production and Distribution Costs Impeding Market Growth”

- The high production and distribution costs associated with premium wine pose a significant challenge for market expansion, particularly in emerging markets

- Premium wines often require higher-quality raw materials, specialized cultivation methods, and aging processes, all of which contribute to their elevated production costs

- In addition to production, the costs of logistics, storage, and international distribution can add significant financial burdens, particularly when dealing with wines that require temperature-controlled environments during transport

- These factors lead to higher prices for consumers, which can deter price-sensitive buyers, especially in regions where premium wine is still considered a luxury product

For instance,

- In February 2023, the International Wine and Spirits Record (IWSR) reported that rising shipping and logistics costs have significantly impacted the global premium wine market. The increase in container shipping fees, coupled with challenges in supply chain logistics, has led to higher prices for premium wines, especially those exported from Europe to the U.S. and Asia

- These financial barriers, combined with the challenges of scaling production to meet global demand, present significant obstacles for the growth and affordability of premium wine products, particularly in regions where the wine culture is still developing

Premium Wine Market Scope

The market is segmented on the basis wine colour, product type, product category, flavour ,ageing barrel type, aging years, by price range, distribution channel, packaging type and consumer segment

|

segmentation |

sub-segmentation |

|

By Wine Colour |

|

|

By Product Type |

|

|

By Product Category

|

|

|

By Flavour |

|

|

By Aging Years |

|

|

By Ageing Barrel Type

|

|

|

By Price Range |

|

|

By Distribution Channel |

|

|

By Packaging Type |

|

|

By Consumer Segment |

|

Premium Wine Market Regional Analysis

“North America is the Dominant Region in the Premium Wine Market”

- North America is the dominant region in the premium wine market, driven by strong consumer demand, a well-established wine culture, and the presence of key market players in the region

- The U.S. holds a significant share of the market due to a growing interest in high-quality wines, increased disposable incomes, and a rising preference for premium and luxury wine products

- The high rate of wine consumption, particularly among millennials and affluent consumers, along with a strong wine tourism industry, further propels the growth of premium wine sales across the region

- In addition, the expansion of direct-to-consumer (DTC) channels and e-commerce platforms has made premium wines more accessible to a larger consumer base in the U.S., fueling market growth

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the premium wine market, driven by increasing disposable incomes, a growing middle class, and rising interest in wine culture

- Countries such as China, India, and Japan are emerging as key markets due to the expanding consumer base with a preference for premium and luxury products, coupled with a strong interest in wine consumption, particularly among younger demographics

- Japan, with its developed wine market and increasing adoption of wine appreciation and fine dining culture, is playing a critical role in the growth of the premium wine segment in Asia-Pacific. The country's high-income consumers are increasingly inclined towards high-quality, imported wines

- China and India, with their large populations and evolving wine markets, are witnessing significant investments in the premium wine sector. The growing presence of international wine brands and the increasing number of wine retailers and wine tourism opportunities are further fueling market growth

Premium Wine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Vina Concha Y Toro (Chile)

- Treasury Wine Estates (Australia)

- Mount Mary Vineyard (Australia)

- Vins Grands Crus (France)

- Sula Vineyards (India)

- Moss Wood (Australia)

- Leeuwin Estate (Australia)

- E. & J. Gallo Winery (U.S.)

- Constellation Brands, Inc. (U.S.)

- Castel Freres (France)

- The Wine Group (U.S.)

- Accolade Wines (U.K.)

- Pernod Ricard (France)

- Rockford (Australia)

- Henschke Cellars (Australia)

- Gioconda (Australia)

- Cullen Wines (Australia)

- Bass Philip (Australia)

- Changyu Pioneer Wine Company (China)

- Casella (Australia)

- Chateau Cheval Blanc (France)

- Miguel Torres S.A. (Spain)

- Fetzer (U.S.)

- GRUPO PENFLOR (Argentina)

Latest Developments in Global Premium Wine Market

- In November 2023, Wine Intelligence reported that the premium wine market in China grew by 20% year-on-year, driven by increasing demand for higher-end wines, particularly those from regions such as Bordeaux and Napa Valley. The rising popularity of wine among younger, affluent consumers is accelerating this growth

- In December 2022, Sula Vineyards, one of India’s largest wine producers, expanded its premium wine offerings to meet the growing demand for quality wines in the country. The company reported a 15% increase in sales of premium wines, particularly in urban areas with a rising middle class

- In 2022, Japan’s Suntory Holdings launched a premium wine collection sourced from both domestic and international vineyards to cater to the growing demand for luxury wines among Japanese consumers. This strategic move capitalized on the growing trend of wine appreciation in Japan

- In June 2022, Pernod Ricard introduced a digital label system designed to enhance consumer awareness about product content and promote responsible drinking. This initiative addresses the growing demand for transparency regarding product ingredients and health information. Following a European pilot program launched in July 2022, the system is set to be implemented globally across all brands in the Group's portfolio by 2024

- In August 2022, E. & J. Gallo Winery revealed its partnership as the official Wine Sponsor of the National Football League (NFL). This collaboration marked a significant milestone for the company, enabling it to expand its global presence and connect with a broader audience. The multi-year agreement includes local team activations, player appearances, and a presence at premier NFL events, such as the Super Bowl. By aligning with America's most popular sport, Gallo aims to enhance its brand visibility and engage NFL fans through innovative marketing strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Premium Wine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Premium Wine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Premium Wine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.