Global Pressure Guidewires Market

Market Size in USD Million

CAGR :

%

USD

621.91 Million

USD

1,299.56 Million

2025

2033

USD

621.91 Million

USD

1,299.56 Million

2025

2033

| 2026 –2033 | |

| USD 621.91 Million | |

| USD 1,299.56 Million | |

|

|

|

|

Pressure Guidewires Market Size

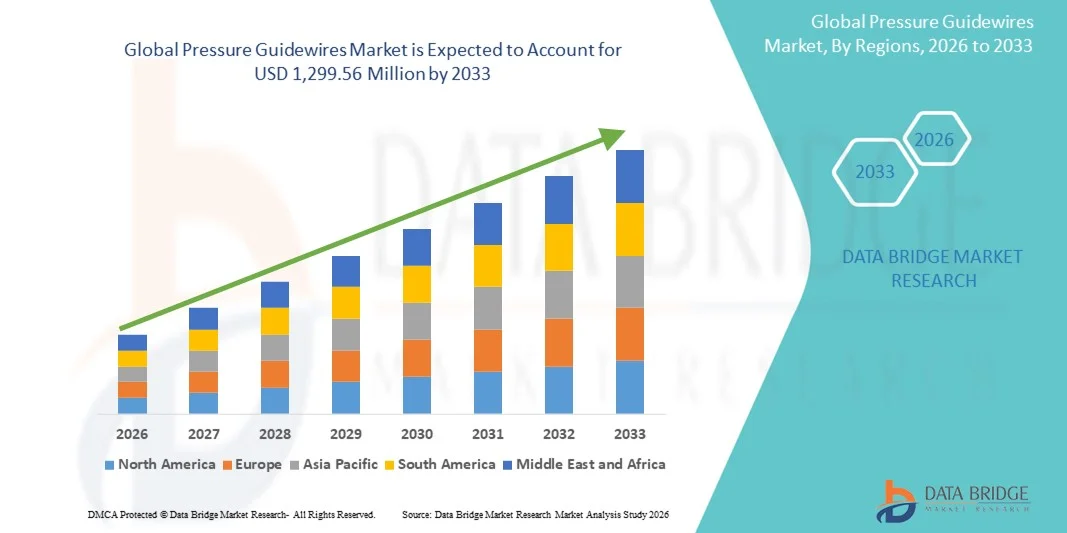

- The global pressure guidewires market size was valued at USD 621.91 million in 2025 and is expected to reach USD 1,299.56 million by 2033, at a CAGR of 9.65% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular disease (CVD), rising adoption of minimally‑invasive interventional cardiology procedures and technological advances in sensor‑enabled guidewires for accurate intravascular pressure measurement

- Furthermore, expanding healthcare infrastructure globally growing clinician preference for advanced diagnostic tools to reduce unnecessary stenting and improve patient outcomes, and product innovations are establishing pressure guidewires as a key component in interventional procedures

Pressure Guidewires Market Analysis

- Pressure guidewires, used for measuring intravascular pressure during cardiovascular procedures, are increasingly vital components in interventional cardiology due to their ability to optimize stenting decisions, improve patient outcomes, and integrate with advanced imaging and diagnostic systems

- The escalating demand for pressure guidewires is primarily fueled by the rising prevalence of cardiovascular diseases, growing adoption of minimally invasive procedures, and increasing clinician preference for physiology-based diagnostics such as fractional flow reserve (FFR) and instantaneous wave-free ratio (iFR)

- North America dominated the pressure guidewires market with the largest revenue share of 39% in 2025, driven by advanced healthcare infrastructure, well-established reimbursement policies, high adoption of FFR/iFR techniques, and a strong presence of key industry players, with the U.S. experiencing substantial growth in interventional cardiology procedures, particularly in hospitals and specialized cardiac centers

- Asia-Pacific is expected to be the fastest growing region in the pressure guidewires market during the forecast period due to increasing cardiovascular disease burden, expanding cardiac care infrastructure, rising disposable incomes, and growing awareness of minimally invasive diagnostic procedures

- Flexible tipped guidewires dominated the pressure guidewires market with a market share of 52.8% in 2025, driven by their enhanced navigability through tortuous vessels and superior performance in complex coronary anatomies

Report Scope and Pressure Guidewires Market Segmentation

|

Attributes |

Pressure Guidewires Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Pressure Guidewires Market Trends

Integration with Advanced Imaging and Digital Platforms

- A significant and accelerating trend in the global pressure guidewires market is the integration of guidewires with advanced imaging systems, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), as well as digital diagnostic platforms for real-time procedural guidance

- For instance, the Philips Volcano OptoWire combines pressure measurement with OCT imaging, enabling clinicians to simultaneously assess coronary physiology and anatomy for optimized stenting decisions

- Digital integration allows automated data collection, real-time analytics, and improved procedural precision, reducing operator dependency and supporting better clinical outcomes

- These integrated systems facilitate seamless workflow in cardiac catheterization labs, enabling physicians to manage both pressure measurement and imaging assessments through a unified platform, enhancing efficiency and patient care

- This trend towards multifunctional, data-driven, and technologically sophisticated guidewires is fundamentally reshaping clinical expectations in interventional cardiology

- The demand for pressure guidewires with advanced imaging and digital connectivity is growing rapidly across hospitals and specialized cardiac centers, as clinicians prioritize procedural accuracy and workflow optimization

- Increasing focus on telemedicine and remote procedural monitoring is driving integration of pressure guidewires with cloud-based analytics, enabling off-site expert consultations during interventions

- Continuous innovation in guidewire sensor technology, such as miniaturized solid-state and fiber-optic sensors, is improving measurement accuracy and expanding the scope of clinical applications

Pressure Guidewires Market Dynamics

Driver

Rising Cardiovascular Disease Prevalence and Minimally Invasive Procedure Adoption

- The increasing prevalence of cardiovascular diseases worldwide, coupled with the rising adoption of minimally invasive interventional procedures, is a significant driver for the heightened demand for pressure guidewires

- For instance, in March 2025, Abbott introduced an upgraded FFR guidewire system designed to enhance diagnostic precision in complex coronary lesions, supporting better treatment planning

- As clinicians seek accurate tools to assess coronary physiology and optimize stent placement, pressure guidewires offer real-time pressure measurement, improved patient outcomes, and reduced unnecessary interventions

- Furthermore, the growing focus on evidence-based cardiology and physiological assessment of coronary lesions is making pressure guidewires an integral tool in catheterization labs, providing reliable guidance for percutaneous coronary interventions (PCI)

- The convenience of combining pressure measurement with other diagnostic procedures, streamlined workflow, and improved safety profile are key factors propelling the adoption of pressure guidewires in hospitals, ambulatory surgical centers, and independent catheterization labs

- Increasing demand for personalized cardiac care and precision interventions is encouraging hospitals to adopt pressure guidewires to tailor treatments to individual patient physiology

- Strategic partnerships and collaborations between guidewire manufacturers and cardiac imaging companies are driving wider adoption and innovation in integrated diagnostic solutions

Restraint/Challenge

High Device Cost and Limited Adoption in Emerging Markets

- The relatively high cost of advanced pressure guidewires, including FFR and optical fiber-based devices, poses a significant challenge to wider adoption, particularly in emerging markets with constrained healthcare budgets

- For instance, small- to mid-sized hospitals in developing regions may delay adoption due to budget limitations, despite clinical benefits, limiting market penetration in these areas

- Addressing affordability issues through cost-effective models and bundled solutions is crucial for expanding adoption and market growth

- Furthermore, limited clinician training and familiarity with sophisticated pressure measurement technologies can hinder uptake in smaller centers, requiring targeted education and procedural training programs

- Overcoming these challenges through cost reduction, clinician training initiatives, and simplified device handling will be vital for sustained expansion of the pressure guidewires market

- Regulatory approval processes and stringent compliance requirements across different countries can delay product launches, affecting market growth momentum

- Cybersecurity concerns for digitally integrated guidewires and data management platforms may pose barriers to adoption in hospitals emphasizing patient data protection and IT compliance

Pressure Guidewires Market Scope

The market is segmented on the basis of product type, technology type, and end user.

- By Product Type

On the basis of product type, the pressure guidewires market is segmented into flat tipped and flexible tipped guidewires. The flexible tipped guidewires segment dominated the market with the largest market revenue share of 52.8% in 2025, driven by their enhanced navigability through tortuous vessels and superior performance in complex coronary anatomies. Flexible tipped guidewires are widely preferred by clinicians for percutaneous coronary interventions (PCI) because they reduce vessel trauma and improve procedural success rates. Hospitals and specialized cardiac centers often choose flexible tipped guidewires for their reliability, especially in challenging lesions or bifurcated arteries. The segment also benefits from ongoing technological advancements that improve tactile feedback, torque control, and radiopacity, making them safer and easier to handle during interventions. Furthermore, flexible tipped guidewires are compatible with various pressure measurement systems and imaging technologies, supporting integrated diagnostic procedures. The high adoption of these guidewires in North America and Europe, where complex interventions are common, further reinforces their market dominance.

The flat tipped guidewires segment is expected to witness the fastest growth at a CAGR of 9.1% from 2026 to 2033, driven by increasing use in emerging markets and routine diagnostic procedures. Flat tipped guidewires offer a simpler design that is cost-effective and easier to manufacture, making them appealing for hospitals with budget constraints. They are particularly suitable for standard lesions and routine FFR/iFR measurements, facilitating widespread adoption in small- to mid-sized hospitals and ambulatory surgical centers. Manufacturers are introducing innovations in flat tipped guidewires, such as improved sensor integration and polymer coatings, enhancing safety and maneuverability. Growth in percutaneous coronary interventions across Asia-Pacific and Latin America is further accelerating demand for flat tipped guidewires. Clinicians are increasingly using them in combination with imaging platforms for guided interventions, expanding their clinical applications. The growing awareness of minimally invasive cardiac procedures in emerging regions also contributes to the segment’s rapid adoption.

- By Technology Type

On the basis of technology type, the market is segmented into pressure wire and optical fibre guidewires. The pressure wire segment dominated the market with the largest revenue share of 58.4% in 2025, driven by its widespread use in physiology-based diagnostics such as fractional flow reserve (FFR) and instantaneous wave-free ratio (iFR). Pressure wire guidewires provide accurate real-time pressure measurements across coronary lesions, enabling clinicians to make informed stenting decisions and reduce unnecessary interventions. The segment benefits from the increasing number of catheterization procedures globally and the established adoption in North America and Europe. Hospitals and specialized cardiac centers prefer pressure wire guidewires due to their compatibility with standard FFR consoles and well-established clinical protocols. Ongoing improvements in sensor sensitivity, guidewire flexibility, and wireless connectivity further strengthen the segment’s position. In addition, pressure wire guidewires are often bundled with training and service packages, increasing clinician confidence and driving adoption.

The optical fibre guidewires segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, propelled by technological innovation and integration with advanced imaging systems. Optical fibre guidewires enable simultaneous pressure measurement and intravascular imaging, providing a more comprehensive assessment of coronary lesions. They are increasingly adopted in complex interventions and by early-adopting hospitals and cardiac centers seeking precision-guided PCI. The high demand for minimally invasive procedures in Asia-Pacific and growing awareness among interventional cardiologists contribute to their rapid growth. Continuous development in miniaturized fibre-optic sensors and improved data analytics platforms is expanding the clinical applications of optical fibre guidewires. The segment also benefits from partnerships between medical device manufacturers and imaging technology companies to deliver integrated diagnostic solutions.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, and independent catheterization labs. The hospitals segment dominated the market with the largest revenue share of 64.7% in 2025, owing to the higher volume of complex cardiac procedures performed in hospital settings. Hospitals are equipped with advanced cath labs and specialized staff, making them ideal for adopting both pressure wire and optical fibre guidewires. The dominance is reinforced by the presence of large healthcare infrastructure, well-established reimbursement policies, and high procedure volumes in North America and Europe. Hospitals also benefit from purchasing agreements with manufacturers and bundled services that include training, which encourages adoption. The segment’s growth is further supported by increasing prevalence of cardiovascular diseases requiring interventional procedures and continuous upgrades in hospital cardiac care facilities.

The ambulatory surgical centers segment is expected to witness the fastest growth at a CAGR of 11.0% from 2026 to 2033, driven by the rising number of outpatient cardiac procedures and cost-effective minimally invasive interventions. These centers offer reduced procedural costs, shorter hospital stays, and more flexible scheduling, encouraging adoption of pressure guidewires for routine diagnostics and PCI. The segment’s growth is supported by increasing investments in outpatient cardiac care infrastructure in Asia-Pacific and Latin America. Manufacturers are targeting ambulatory centers with compact, easy-to-use guidewire systems suitable for high-volume but less complex procedures. Enhanced clinician training programs and simplified devices further drive the adoption of guidewires in these facilities. The growing preference for outpatient interventions for patient convenience and cost efficiency accelerates this segment’s rapid expansion.

Pressure Guidewires Market Regional Analysis

- North America dominated the pressure guidewires market with the largest revenue share of 39% in 2025, driven by advanced healthcare infrastructure, well-established reimbursement policies, high adoption of FFR/iFR techniques, and a strong presence of key industry players

- Hospitals and specialized cardiac centers in the region prioritize pressure guidewires for accurate intravascular pressure measurement, optimized stenting decisions, and improved patient outcomes, supporting widespread clinical adoption

- This dominance is further reinforced by favorable reimbursement policies, high procedure volumes, and continuous innovations in guidewire technology, including flexible tips and pressure wire systems

U.S. Pressure Guidewires Market Insight

The U.S. pressure guidewires market captured the largest revenue share of 42% in 2025 within North America, fueled by the high prevalence of cardiovascular diseases and the advanced adoption of physiology-based diagnostics such as FFR and iFR. Hospitals and specialized cardiac centers prioritize pressure guidewires for accurate intravascular pressure measurement, optimized stenting decisions, and improved patient outcomes. The growing trend of minimally invasive interventions, combined with ongoing technological advancements in flexible tipped and pressure wire systems, further propels the market. In addition, integration with advanced imaging platforms and digital diagnostic tools enhances procedural precision and workflow efficiency, driving broader adoption. Government healthcare initiatives and favorable reimbursement policies also support market expansion in the U.S.

Europe Pressure Guidewires Market Insight

The Europe pressure guidewires market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing prevalence of cardiovascular diseases and the rising adoption of minimally invasive interventions. Hospitals and cardiac centers are investing in advanced diagnostic tools, including optical fibre and pressure wire guidewires, to improve procedural accuracy and patient outcomes. Urbanization, improved healthcare infrastructure, and government initiatives promoting cardiovascular health are fostering adoption. The market growth is also supported by strong research collaborations, clinical trials, and continuous innovations in sensor technologies for pressure measurement. Europe’s regulatory emphasis on high-quality medical devices ensures the adoption of safe and effective pressure guidewires across the region.

U.K. Pressure Guidewires Market Insight

The U.K. pressure guidewires market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising number of percutaneous coronary interventions (PCI) and increasing awareness of evidence-based cardiac care. Hospitals and independent catheterization labs are adopting pressure guidewires to improve diagnostic precision and optimize stent placement. The country’s focus on advanced healthcare infrastructure and clinician training programs encourages adoption of pressure wire and optical fibre guidewires. In addition, collaborations between medical device companies and hospitals to implement advanced pressure measurement solutions are boosting market growth. Increasing patient preference for minimally invasive procedures and technological advancements in guidewire design further support market expansion.

Germany Pressure Guidewires Market Insight

The Germany pressure guidewires market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of cardiovascular health and demand for advanced, high-precision interventional tools. Hospitals and cardiac centers prefer optical fibre and flexible tipped guidewires for complex procedures, including multivessel interventions. Germany’s well-established healthcare infrastructure and emphasis on innovation promote adoption of technologically advanced guidewires. Integration with imaging modalities and digital diagnostic platforms enhances procedural efficiency and clinical decision-making. The market also benefits from robust regulatory standards ensuring high-quality devices, fostering clinician confidence and wider adoption in both public and private healthcare facilities.

Asia-Pacific Pressure Guidewires Market Insight

The Asia-Pacific pressure guidewires market is poised to grow at the fastest CAGR of 11% during the forecast period of 2026 to 2033, driven by the increasing burden of cardiovascular diseases, rising disposable incomes, and expanding healthcare infrastructure in countries such as China, Japan, and India. Hospitals and ambulatory surgical centers are adopting pressure wire and optical fibre guidewires to improve interventional outcomes and reduce procedural risks. Government initiatives promoting minimally invasive cardiac procedures and investment in advanced cardiac care facilities are accelerating market growth. Technological advancements, local manufacturing of guidewires, and cost-effective solutions are enhancing accessibility and adoption across the region. The growing number of outpatient cardiac interventions and rising awareness among clinicians further propel the market.

Japan Pressure Guidewires Market Insight

The Japan pressure guidewires market is gaining momentum due to the country’s advanced healthcare system, high awareness of cardiovascular health, and preference for precision-guided interventions. Hospitals and catheterization labs are increasingly using flexible tipped and optical fibre guidewires for complex coronary procedures to improve diagnostic accuracy and patient outcomes. The integration of guidewires with imaging and digital diagnostic platforms enhances procedural efficiency and clinician confidence. In addition, the aging population in Japan is driving demand for minimally invasive, safe, and effective cardiac interventions. Technological innovation, government support for cardiovascular health programs, and continuous training of interventional cardiologists are key factors fueling market growth.

India Pressure Guidewires Market Insight

The India pressure guidewires market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding healthcare infrastructure, and increasing prevalence of cardiovascular diseases. Hospitals and ambulatory centers are adopting pressure wire and optical fibre guidewires to improve procedural precision and optimize stenting outcomes. The push towards modern cardiac care facilities, coupled with government initiatives for minimally invasive procedures and evidence-based cardiology, is propelling market adoption. Local manufacturing and availability of cost-effective guidewires enhance accessibility across hospitals and smaller clinics. Rising awareness among clinicians, combined with increasing outpatient cardiac procedures, is contributing to rapid market growth in India.

Pressure Guidewires Market Share

The Pressure Guidewires industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Haemonetics Corporation (U.S.)

- Opsens (Canada)

- Arrotek Ltd (U.K.)

- Terumo Corporation (Japan)

- Lepu Medical Technology Co., Ltd. (China)

- Medis Medical Imaging Systems (Netherlands)

- Insight Lifetech Co., Ltd. (China)

- Acist Medical Systems, Inc. (U.S.)

- Biotronik (Germany)

- Kossel Medtech GmbH (Germany)

- OrbusNeich Medical Group Holdings Ltd (Hong Kong)

- Merit Medical Systems (U.S.)

- Microport Scientific Corporation (China)

- Cordis Corporation (U.S.)

- Cook (U.S.)

- Meril Life Sciences Pvt. Ltd. (India)

What are the Recent Developments in Global Pressure Guidewires Market?

- In July 2024, Haemonetics Corporation announced CE Mark certification for its SavvyWire® Pre‑Shaped Pressure Guidewire the world’s first sensor‑guided “3‑in‑1” solution for transcatheter aortic valve implantation (TAVI) procedures, which provides predictable wire performance, hemodynamic measurement and left‑ventricular pacing capabilities in one device

- In September 2022, OpSens announced FDA 510(k) clearance for its “SavvyWire™”, a novel guidewire designed for transcatheter aortic valve replacement (TAVR) procedures that also provides continuous hemodynamic pressure monitoring. The SavvyWire is positioned as a three‑in‑one solution: valve delivery, pressure measurement and pacing support

- In August 2021, Abbott Laboratories secured U.S. Food and Drug Administration (FDA) clearance for its “Ultreon™ 1.0 Software”, an AI‑powered optical coherence tomography (OCT) imaging platform that integrates with its PressureWire X guidewire. This development signals growing convergence of imaging, physiology and AI in the cath lab: the software enables physicians to combine OCT imaging and pressure measurement for a more comprehensive assessment of coronary lesions, thereby enhancing procedural precision and decision support

- In April 2021, OpSens signed an agreement with Cathmedical Cardiovascular S.A. (Spain) to integrate its OptoWire’s dPR and FFR algorithms into Cathmedical’s “Picasso” haemodynamic system. This integration enables smoother workflow for interventional cardiologists in Spain by combining the guidewire’s physiology data directly into a next‑generation cath lab system, thus reducing procedural friction and improving diagnostic decision‑making

- In February 2021, OpSens Inc. announced that its “OptoWire III” fibre‑optic pressure guidewire received CE Mark approval for the EMEA region. This approval allows the device to be marketed across the European Union, Middle East and Africa, underpinning the company’s strategy to expand its clinical presence in interventional cardiology using optical sensor technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.